EXAMINING THE IMPACT OF DEBT MATURITY TIME, EXPECTED RETURN AND VOLATILITY ON PROBABILITY OF DEFAULT IN CREDIT RISK MODELLING: THE CASE OF MERTON AND MKMV MODELS

1 Research Scholar, Department of Mathematics, Gujarat University, India

2 Department of Mathematics, Gujarat

University, India

|

|

ABSTRACT |

||

|

In order to

model default risk, this article examines the impact of debt maturity time,

volatility, and expected asset return on probability of default (PD). The

study compares the probability of default produced by the Merton and Moody's

KMV (MKMV) methodologies and add modifying time, volatility, and expected

return on assets to see how they affect the probabilities of default produced.

It utilizes the balance sheet from Apple Inc. (AAPL) recorded from 2019

September 29 to 2022 September 29 for the current and total liabilities and

asset values in order to calculate the Probability of Default. The process

begins by determining the distances to default (DD) for Merton and MKMV using

the balance sheet, and then use the DDs to determine the likelihood of

default (PD). Results indicates that, the MKMV approach compares favorably to

the Merton approach. |

|||

|

Received 04 December 2022 Accepted 03 January 2023 Published 18 January 2023 Corresponding Author George Jumbe, georgejumbe@yahoo.com DOI 10.29121/IJOEST.v7.i1.2023.442 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2023 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Default Risk,

Debt Maturity Time, Volatility, Merton Model, MKMV Model, Expected Return,

Distance to Default, Probability of Default |

|||

1. INTRODUCTION

Default risk, also known as default probability, is the likelihood that a borrower won't pay back the principal and interest owed on a debt security in whole and on time. One of the two elements of credit risk is default risk, along with loss severity. The chance of a default over a specific time horizon is described by the financial risk management term probability of default (PD). It offers a prediction of the probability that a borrower won't be able to pay back its debt. The PD is normally determined by performing a migration study of loans with similar ratings over a certain time period and calculating the proportion of defaulted loans. The PD is then assigned to the risk level and each risk level will only have one PD percentage Joseph (2021).

The PD can be used in a wide range of different credit analysis or risk management scenarios. It is influenced by the borrower's qualities as well as the overall state of the economy. In order to make up for the increased default risk, creditors (lenders) often demand a higher interest rate. Various credit evaluations and risk management frameworks make use of the PD especially in the determination of the economic or regulatory capital for a banking organization.

The PD is closely related to the expected loss, which is calculated as the sum of the Product Derivative (PD), Loss Given Default (LGD), and Exposure at Default (EAD). This study explore the effects of volatility, expected return, and debt maturity time on probability of default in credit risk using Merton and Moody's KMV model.

2. LITERATURE

Peresetsky et al. (2011) conducted an econometric analysis of Russian bank

failures from 1997 to 2003, concentrating on the degree to which information

from quarterly bank balance sheets that is made publicly available can be used

to anticipate defaults in the future. Their probability of default model was

built using binary choice models. The model produced a fair predictive power on

calculating the chance of default that Russian banks can utilize, despite the

low quality of the balance sheet data from Russia.

To calculate the implied likelihood of default from stock and option

market prices, Câmara et al. (2012) modified Merton (1976) ruin option pricing model. By examining all

international financial institutions having traded options in the US and

concentrating on the subprime mortgage crisis era, they tested their model. The

performance of the implied default probability produced by their methodology

was compared to the anticipated default frequencies based on the Moody's KMV

model. Their model's outcomes surpassed credit scores and agreed with those of

the KMV model.

A method for expressing credit risk was created by Valášková and Klieštik (2014) and uses either the probability of debtor default (businesses) or the difference between the asset value of the company and the default barrier expressed as a number of standard deviations. They demonstrate that the bond maturity is the key point in the Merton model and that defaults at this time occur when the market value of the asset is less than the bond's nominal value. In this situation, the company's financial resources won't be sufficient to pay off all of its debtors.

Based on Moody's KMV model, Voloshyn (2015) created a straightforward method for explicitly predicting a credit limit for a company. Their method allowed for the consideration of loan term to maturity, asset quality, balance sheet structure, and required degree of default probability. The proposed technique explained well-known intuitive phenomena like the lower the credit limit, the higher the level of confidence, and the lower the credit limit, as well as the lower the credit limit, the higher the volatility of return on assets. Their method allowed for the consideration of the possibility that a company might invest fresh debt in assets with a different quality than existing assets.

Sariev and Germano

(2020) developed an enhanced Bayesian regularization

method to train artificial neutral networks (ANNs) and contrasted it to the

traditional regularizations method used to train

feedforward networks, which uses the back-propagation technique. On three

separate data sets, they examined the categorization accuracy of various

network designs. Profitability, leverage, and liquidity were discovered to be

significant financial default driver groups.

Joseph (2021) calculated and calibrated the credit rating default probability using Bayesian statistics and Monte-Carlo simulations. They used their approach on banks and other financial institutions to address the problem of non-monotonicity that arises when default rates are calculated empirically. By assuming that the default rate parameter is a non-random variable that follows the Beta distribution, they were able to implement their strategy. They first calculated a posterior density of the default rate parameter using historical data, and then they used simulations to calculate an estimate of the actual default rate parameter. Their outcomes were found to be equivalent to those of other well-liked calibration techniques frequently employed in the literature. They take a long time, though, with their method. However, their approach consumes large amount of time to execute.

3. THE MERTON MODEL

Merton (1974) is based on the work of Black and Scholes (1973) on option pricing and offers a framework for valuing debt issued by a firm. The model assesses the structural credit risk of a company by modeling the company's equity as a call option on its assets. The model calculates the theoretical pricing of European put and call options without considering dividends paid out during the life of the option. The original Merton model is based on some simplifying assumptions about the structure of the typical firm’s finances. The event of default is determined by the market value of the firm’s assets in conjunction with the liability structure of the firm. When the value of the assets falls below a certain threshold (the default point), the firm is considered to be in default. A critical assumption is that the event of default can only take place at the maturity of the debt when the repayment is due. Other assumptions include as described in Tudela and Young (2005), include;

1) All options are European and are exercised only at the time of expiration.

2) No dividends are paid out.

3) Market movements are unpredictable (efficient markets).

4) No commissions are included.

5) Underlying stocks' volatility and risk-free rates are constant.

6) Returns on underlying stocks are normally distributed.

The firm issues two classes of securities: equity and

debt. The equity receives no dividends. The debt is a pure discount bond where

a payment of D is promised at date T. If at date T the firm’s asset value ![]() exceeds the promised

payment, D, the debtholders are paid the promised amount and the shareholders

receive the residual asset value, (

exceeds the promised

payment, D, the debtholders are paid the promised amount and the shareholders

receive the residual asset value, (![]() ). If the asset value is insufficient to meet the

debtholders’ claims the firm defaults, the debtholders receive a payment equal

to the asset value, and the shareholders get nothing. The equation connecting

between asset, equity and debt values is given by Majumder (2006):

). If the asset value is insufficient to meet the

debtholders’ claims the firm defaults, the debtholders receive a payment equal

to the asset value, and the shareholders get nothing. The equation connecting

between asset, equity and debt values is given by Majumder (2006):

![]() Equation 1

Equation 1

where ![]() is the total asset

value of the firm,

is the total asset

value of the firm, ![]() is the equity value of

the firm and

is the equity value of

the firm and ![]() is the total amount of the firm’s debt.

is the total amount of the firm’s debt.

All debts are mapped into a zero-coupon bond by selecting a

debt maturity ![]() . When

. When ![]() shareholders' stock still has value and the company's debt

holders are paid in full. If

shareholders' stock still has value and the company's debt

holders are paid in full. If ![]() , the business fails

on its debt. In this scenario, shareholders would receive nothing, and debt

holders would have priority claim to the remaining asset. The equity value at

time

, the business fails

on its debt. In this scenario, shareholders would receive nothing, and debt

holders would have priority claim to the remaining asset. The equity value at

time ![]() can be expressed as follows:

can be expressed as follows:

![]() Equation

2

Equation

2

This is the payout of a European

call option with a maturity of ![]() and a strike price of

and a strike price of ![]() written on an underlying asset

written on an underlying asset![]() . The returns on the firm’s assets are assumed to be

normally distributed and their behavior can be

described with the following Brownian motion Zieliński (2013):

. The returns on the firm’s assets are assumed to be

normally distributed and their behavior can be

described with the following Brownian motion Zieliński (2013):

![]() Equation

3

Equation

3

where ![]() is a standard Brownian motion,

is a standard Brownian motion, ![]() is the expected return

on assets which can be equal to the

risk-free interest rate and

is the expected return

on assets which can be equal to the

risk-free interest rate and![]() is the volatility of the firm’s assets (the standard

deviation of annualized rate of return).

is the volatility of the firm’s assets (the standard

deviation of annualized rate of return).

The firm’s asset value is assumed to obey lognormal diffusion

process with a constant volatility given by:

![]() Equation 4

Equation 4

where ![]() is initial value of

the assets specified at

is initial value of

the assets specified at ![]() and

and ![]() is the value of the

asset at time

is the value of the

asset at time ![]() . The expected value of the assets at the time

. The expected value of the assets at the time ![]() is given by:

is given by:

![]() Equation

5

Equation

5

![]() Equation 6

Equation 6

Using the

Black-Scholes assumptions, we get:

![]() Equation

7

Equation

7

for the call

option value, and

![]() Equation

8

Equation

8

for the put option.

where ![]() is the standard normal

cumulative distribution probability function, and

is the standard normal

cumulative distribution probability function, and

![]() Equation 9

Equation 9

![]() Equation

10

Equation

10

The value of the debt is determined by ![]() . The probability of the company's debt default under

risk-neutral conditions is

. The probability of the company's debt default under

risk-neutral conditions is ![]() . Here, the event that shareholders' call

option matures out-of-money is what triggers a credit default at time

. Here, the event that shareholders' call

option matures out-of-money is what triggers a credit default at time ![]() , with the following risk-neutral probability:

, with the following risk-neutral probability:

![]() Equation 11

Equation 11

Since equity is an option on form value,

the volatility of equity, denoted as ![]() , is also a function of

, is also a function of ![]() and

and

![]() . Using another geometric Brownian motion for equity

. Using another geometric Brownian motion for equity ![]() we can obtain

we can obtain ![]() and

and ![]() and use Ito's

Lemma to demonstrate that instantaneous volatilities satisfy:

and use Ito's

Lemma to demonstrate that instantaneous volatilities satisfy:

![]() Equation 12

Equation 12

using Black-Scholes equation, it can be

shown that ![]() , then (12) we becomes:

, then (12) we becomes:

![]() Equation 13

Equation 13

![]() Equation 14

Equation 14

where ![]() is essentially the

delta of equity with respect to firm value. The price of an equity

is essentially the

delta of equity with respect to firm value. The price of an equity ![]() and the volatility

and the volatility ![]() of its return are

observed in the equity market. Finally, (7) and (14), can be solved

simultaneously for

of its return are

observed in the equity market. Finally, (7) and (14), can be solved

simultaneously for ![]() and

and ![]() .

.

3.1. Distances to

Default (DD) by Merton Approach

Distance to default (DD) is the difference

in standard deviations between the debt threshold and the anticipated asset

value at maturity. It serves as the basis for assessing credit risk. It is a

standard index that evaluates a company's creditworthiness and enables

comparisons between different companies and over time. There are fewer

likelihood of defaults with the higher values of DDs because the corporation is

more likely to repay debts on schedule. The DD measures how far a company's

assets are from the obligations whose value would cause a default Chen et al. (2010). The

distance to default (DD) is computed using the following formula:

![]() Equation

15

Equation

15

3.2. Probability of Default (PD) by Merton Approach

The probability that the asset value will fall below the debt threshold at the end of the time horizon is known as the likelihood of default (PD) and is determined by:

![]() Equation 16

Equation 16

4. MOODY

KMV (MKMV) MODEL

Oldrich Vasicek, John

McQuown, and Stephen Kealhofer

founded and debuted KMV in 1989. In 2002, Moody's Corporation bought the model

and gave the name of MKMV model. The model has been continuously updated and

improved since the acquisition in 2002 by Moody's Corporation. The KMV

structural model, now known as Moody's KMV (MKMV), is similar

to the Merton model but makes more reasonable assumptions by including

novel ideas such the default point, multi-class liabilities, distance to

default, and expected default frequency Voloshyn (2015).

4.1. Default Point

(DPT)

The Merton model assumes that all

liabilities are mapped to zero coupon bonds; instead, different classes of

liabilities, such as short-term or current liabilities (CL) and long-term or

total liabilities (LTL), are used in the MKMV model. The MKMV model allows for

pre-maturity default, which is activated anytime the asset value falls below a

predetermined level known as the default point (DPT). Typically, MKMV suggests that, a company's default point falls between its short-term

debt and half of its long-term debt Jumbe and Gor (2020).

![]() Equation 17

Equation 17

The key takeaway from this is that the

company will always have to put short-term obligations (debt)(CL) ahead of

long-term responsibilities (LTL). Additionally, default doesn't always happen

when a company's asset worth equals the book value of all of its liabilities. A

firm will, however, go into default when there is no longer any difference

between its assets and its default point.

4.2. Distance to Default (DD)

In

the MKMV model, the default point is a crucial component for calculating the

distance to default (DD). The DD, which is determined using the supplied

relation below, is the number of standard deviations the asset value is from

the default point.

![]() Equation 18

Equation 18

From

the Merton model, the 1-year probability of default is given as ![]()

where

![]() Equation 19

Equation 19

where ![]() is the expected return

on assets which can be equal to the risk-free interest rate. According to

empirical research, the quantity

is the expected return

on assets which can be equal to the risk-free interest rate. According to

empirical research, the quantity ![]() is very close to zero hence negligible. So, we

approximate (19) to the expression below:

is very close to zero hence negligible. So, we

approximate (19) to the expression below:

![]() Equation 20

Equation 20

Replacing the liability D

with the default point DPT in (20) we

obtain the DD in MKMV.

![]() Equation 21

Equation 21

![]() Equation

22

Equation

22

4.3. Expected Default Frequency (EDF)

The MKMV model uses the Expected Default Frequency (EDF), a

fundamental quantity, to determine the likelihood that a specific firm will go

out of business within a year. In contrast to the EDF calculated from empirical

data in the MKMV, the chance of default in the Merton model is estimated from a

normal distribution, and this does not adhere to the genuine probability. According

to Voloshyn (2015), a company's EDF is as follows:

![]() Equation 23

Equation 23

In the MKMV model, a declining empirical function ![]() takes the place of the normal distribution

function

takes the place of the normal distribution

function ![]() used by the Merton model. The function

used by the Merton model. The function ![]() converts a company's distance to default into

the percentage of companies with similar DD values in an extensive historical

database that have defaulted in the past. As a result, it follows that two

distinct businesses with the same DD will also have the same EDF. To make a

comparison, in order to obtain the EDF for more than a year, the liability D is

substituted with the default point DPT in (15);

converts a company's distance to default into

the percentage of companies with similar DD values in an extensive historical

database that have defaulted in the past. As a result, it follows that two

distinct businesses with the same DD will also have the same EDF. To make a

comparison, in order to obtain the EDF for more than a year, the liability D is

substituted with the default point DPT in (15);

![]() Equation

24

Equation

24

where

![]() Equation 25

Equation 25

5. DATA ANALYSIS AND DISCUSSION

The information

on Apple Inc.'s (AAPL) asset values (A), current liabilities (CL), and

long-term liabilities (LTL) documented from 2019 September 29 to 2022 September

29 is shown in Table 1.

Table 1

|

Table 1 Current Liabilities, Long Term Liabilities, Total Asset Values and Default Points |

||||

|

Time (T) |

9/29/2019 |

9/29/2020 |

9/29/2021 |

9/29/2022 |

|

Total Asset (A) |

338,516,000 |

323,888,000 |

351,002,000 |

352,755,000 |

|

Total debt (D) |

108,047,000 |

112,436,000 |

124,719,000 |

120,069,000 |

|

CL |

105,718,000 |

105,392,000 |

125,481,000 |

153,982,000 |

|

LTL |

142,310,000 |

153,157,000 |

162,431,000 |

148,101,000 |

|

DPT |

176,873,000 |

181,970,500 |

206,696,500 |

228,032,500 |

|

Source (Apple Inc.(AAPL) , https://finance.yahoo.com/quote/AAPL/balance-sheet?p=AAPL). |

||||

Table 2 shows the

calculated default probabilities (PDs and EDF) and distances to defaults (DDs)

based on information from Table 1. Combining

current liabilities (CL) with long-term liabilities (17) yields default points

(DPT) (LTL). In order to calculate the distances to default (DDs), (15) and

(25) are used, respectively. In order to determine the probability of default

(PDs), (16) and (24) are used, respectively. The table demonstrates that as the

number of years until debt maturity rises, the distances to default (DDs)

shorten. The table also demonstrates that as debt maturity durations in years

rise, so do the probabilities of default (PDs).

Table 2

|

Table 2 Effect

of Time on Distance to Default and Probability of Default from Table 1 ( |

||||||||||

|

Time (T) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|

|

2.3243 |

1.7637 |

1.5382 |

1.4171 |

1.3435 |

1.2959 |

1.2640 |

1.2425 |

1.2281 |

1.2188 |

|

|

0.0101 |

0.0389 |

0.0620 |

0.0782 |

0.0895 |

0.0975 |

0.1031 |

0.1070 |

0.1097 |

0.1114 |

|

|

2.2184 |

1.6888 |

1.4771 |

1.3642 |

1.2962 |

1.2527 |

1.2240 |

1.2050 |

1.1928 |

1.1853 |

|

|

0.0133 |

0.0456 |

0.0698 |

0.0863 |

0.0975 |

0.1052 |

0.1105 |

0.1141 |

0.1165 |

0.1179 |

|

|

1.7958 |

1.3900 |

1.2331 |

1.1529 |

1.1072 |

1.0801 |

1.0643 |

1.0556 |

1.0519 |

1.0517 |

|

|

0.0363 |

0.0823 |

0.1088 |

0.1245 |

0.1341 |

0.1400 |

0.1436 |

0.1455 |

0.1464 |

0.1464 |

|

|

1.2564 |

1.0086 |

0.9220 |

0.8832 |

0.8660 |

0.8599 |

0.8604 |

0.8649 |

0.8721 |

0.8811 |

|

|

0.1045 |

0.1566 |

0.1783 |

0.1886 |

0.1932 |

0.1949 |

0.1948 |

0.1935 |

0.1916 |

0.1891 |

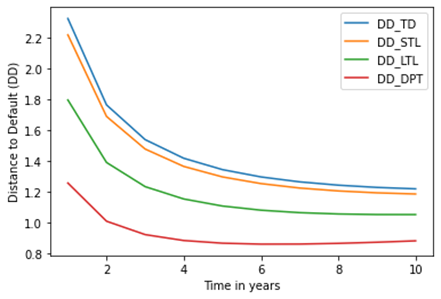

Figure 1 displays the

distances to default (DDs) plotted against the number of years until debt

maturity (T). The figure indicates that as loan maturity time lengthens, DDs

decrease. However, DDs generated using the firm's total debt (TD) are higher

than DDs generated using CL, LTL, and DPT. According to this result, businesses

that think about using current or short-term liabilities are more likely to

default. However, as investment duration increases, the firm's stability to

default declines; as a result, this study suggests that firms should think

about adopting short-term investments for their stability. The image likewise

depicts the DDS and PDs as having an inversely proportional connection. The PDs

rise when the DDs fall, and vice versa. This suggests that businesses with

larger DDs will experience a decreased likelihood of default. The odds of

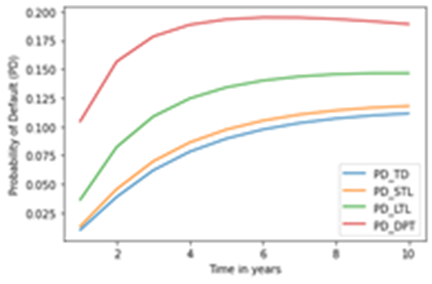

default are displayed against the dates of the debt maturities in Figure 2 The graph

demonstrates that the PDs produced by DPT are more than those produced by TD,

CL, and LTL. This result demonstrates that companies utilising DPT in their

investment schemes are much more likely to default than companies using TD, CL,

or LTL. The image also depicts the exponential rise in default probability

before they begin to fall at some point in the future.

Figure 1

|

Figure 1 Distances to Default vs Time |

Figure 2

|

Figure 2 Probability of Default vs Time |

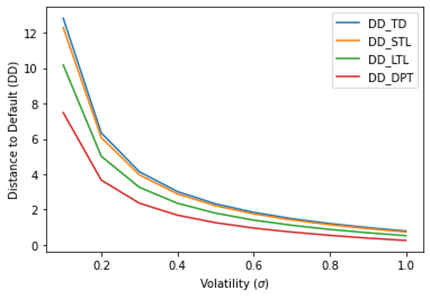

The impact of altering volatility (![]() ) on the DDs and PDs is seen in Table 3. The table

demonstrates a decline in DDs when volatility rises. This research suggests

that because volatility lowers a firm's stability to default, higher volatility

firms will default more frequently. The table also demonstrates an increase in

PDs as volatility rises, suggesting that businesses with high volatility have a

higher chance of defaulting.

) on the DDs and PDs is seen in Table 3. The table

demonstrates a decline in DDs when volatility rises. This research suggests

that because volatility lowers a firm's stability to default, higher volatility

firms will default more frequently. The table also demonstrates an increase in

PDs as volatility rises, suggesting that businesses with high volatility have a

higher chance of defaulting.

Table 3

|

Table 3 Effect

of Volatility on Distance to Default and Probability of Default from Table 1 ( |

||||||||||

|

|

0.1 |

0.2 |

0.3 |

0.4 |

0.5 |

0.6 |

0.7 |

0.8 |

0.9 |

1.0 |

|

|

12.8214 |

6.3357 |

4.1405 |

3.0178 |

2.3243 |

1.8452 |

1.4888 |

1.2089 |

0.9801 |

0.7871 |

|

|

12.2919 |

6.0709 |

3.9640 |

2.8855 |

2.2184 |

1.7570 |

1.4131 |

1.1427 |

0.9213 |

0.7342 |

|

|

10.1788 |

5.0144 |

3.2596 |

2.3572 |

1.7958 |

1.4048 |

1.1113 |

0.8786 |

0.6865 |

0.5229 |

|

|

7.4821 |

3.6661 |

2.3607 |

1.6830 |

1.2564 |

0.9553 |

0.7260 |

0.5415 |

0.3869 |

0.2532 |

|

|

0.0 |

1.1813e-10 |

1.7330e-05 |

1.2729e-03 |

1.0055e-02 |

3.2502e-02 |

6.8274e-02 |

1.1335e-01 |

1.6350e-01 |

2.1560e-01 |

|

|

0.0 |

6.3586e-10 |

3.6859e-05 |

1.9542e-03 |

1.3265e-02 |

3.9461e-02 |

7.8810e-02 |

1.2657e-01 |

1.7844e-01 |

2.3142e-01 |

|

|

0.0 |

2.6599e-07 |

5.5784e-04 |

9.2067e-03 |

3.6266e-02 |

8.0040e-02 |

1.3323e-01 |

1.8981e-01 |

2.4619e-01 |

3.0053e-01 |

|

|

3.6526e-14 |

1.2315e-04 |

9.1198e-03 |

4.6184e-02 |

1.0448e-01 |

1.6970e-01 |

2.3391e-01 |

2.9407e-01 |

3.4941e-01 |

4.0005e-01 |

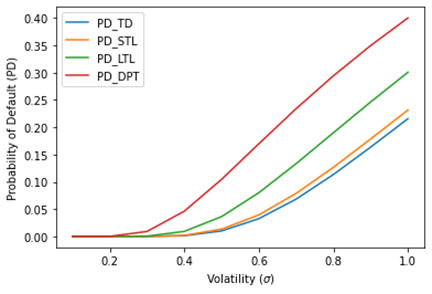

The decline of DDs versus volatilities is depicted in Figure 3 When

volatility rises, DDs also fall, and vice versa. The DDs decrease with

increasing volatilities. The exponential increase of the PDs versus volatilities

is depicted in Figure 4 With rising

volatilities, PDs grow exponentially, raising the risk of default.

Figure 3

|

Figure 3 Distances to Default vs Volatility |

Figure 4

|

Figure 4 Probability of Default vs Volatility |

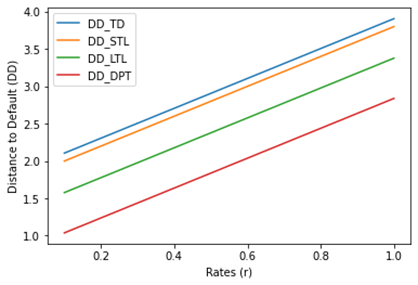

The impact of different interest rates (r) on the DDs

and PDs is shown in Figure 4. The table

displays the DDs and rates as a linear

relationship. With an increase in interest rates, the DDs rise. This indicates

that high interest rates lead to an increase in DDs, making it more likely that

the company will eventually default. Lower PDs are seen with higher DDs. The

table also demonstrates the decline in PDs in comparison to the rate increase.

High interest rates thereby lessen the likelihood of default (PD).

Table 4

|

Table 4 Effect of Rates on Distance to

Default and Probability of Default

from Table 1 ( |

||||||||||

|

Rate (r) |

0.1 |

0.2 |

0.3 |

0.4 |

0.5 |

0.6 |

0.7 |

0.8 |

0.9 |

1.0 |

|

|

15.7214 |

7.7857 |

5.1071 |

3.7428 |

2.9043 |

2.3286 |

1.9031 |

1.5714 |

1.3024 |

1.0771 |

|

|

15.1919 |

7.5209 |

4.9306 |

3.6105 |

2.7984 |

2.2403 |

1.8274 |

1.5052 |

1.2435 |

1.0242 |

|

|

13.0788 |

6.4644 |

4.2263 |

3.0822 |

2.3758 |

1.8881 |

1.5255 |

1.2411 |

1.0088 |

0.8129 |

|

|

10.3821 |

5.1161 |

3.3274 |

2.4080 |

1.8364 |

1.4387 |

1.1403 |

0.9040 |

0.7091 |

0.5432 |

|

|

1.7677e-02 |

1.060e-02 |

6.1350e-03 |

3.4223e-03 |

1.8405e-03 |

9.5371e-04 |

4.7610e-04 |

2.2892e-04 |

1.060e-04 |

4.7253e-05 |

|

|

2.2838e-02 |

1.3961e-02 |

8.2341e-03 |

4.6833e-03 |

2.5680e-03 |

1.3571e-03 |

6.9103e-04 |

3.3894e-04 |

1.6011e-04 |

7.2825e-05 |

|

|

0.0575 |

0.0379 |

0.0241 |

0.0148 |

0.0088 |

0.0050 |

0.0027 |

0.0015 |

0.0007 |

0.0004 |

|

|

0.1500 |

0.1081 |

0.0754 |

0.0509 |

0.0331 |

0.0209 |

0.0127 |

0.0074 |

0.0042 |

0.0023 |

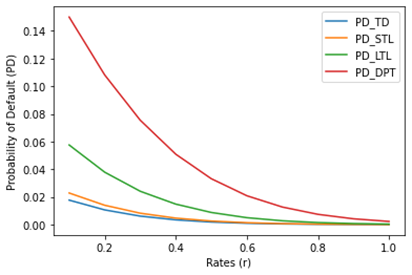

The linear relationship between DDs and rates is

depicted in Figure 5. As interest

rates rise, the DDs rise as well. Since asset values will be well outside of

the default threshold, an increase in DDs implies stability of the firm from

default. The inversely proportional link between the PDs and rates is shown in Figure 4 With rising

interest rates and vice versa, the PDs decline. This suggests that a high

interest rate lowers the risk of a default by the company.

Figure 5

|

Figure 5 Distances to Default vs Rates |

Figure 6

|

Figure 6 Probability of Default vs Rates |

6. CONCLUSION AND SUGGESTION FOR FUTURE RESEARCH

In this study, the effect of changes in interest rates, volatility, and debt maturity times on the likelihood of default was examined. The study examined the results of the Merton and MKMV strategies for determining the distances to default (DDs) and probability of defaults (PDs). The results show that DDs and PDs produced by the MKMV technique (sDPT) are significant when compared to those produced by the Merton approach in each scenario (sTD, sSTL and sLTL). The DDs appear to be contracting for longer maturities in Figure 1. This shows that as maturities get longer, the company's financial situation gets worse. The development of PDs for longer maturities is seen in Figure 2 This shows that businesses are very vulnerable to defaulting on loans with longer maturities. The decline of DDs versus volatilities is depicted in Figure 3 According to this, asset values converge to the default threshold value as volatilities rise, increasing the chance of default for greater volatilities. The development of the PDs against volatilities is depicted in Figure 4 The likelihood of default rises as volatilities rises. The linear relationship between DDs and rates is depicted in Figure 5. As interest rates rise, the DDs rise as well. Since asset values will be well outside of the default threshold, an increase in DDs implies stability of the firm from default. The inversely proportional link between the PDs and rates is shown in Figure 6. With rising interest rates and vice versa, the PDs decline. This suggests that a high interest rate lowers the risk of a default by the company. Future research will examine the impact of changes in interest rates, volatility, and debt maturity dates on credit ratings and credit quality.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Black, F., and Scholes, M. (1973). The Pricing of Options and Corporate Liabilities. Journal of Political Economy, 81(3), 637–654. https://doi.org/10.1086/260062

Chen, X., Wang, X., and Wu, D. D. (2010). Credit Risk Measurement and Early Warning of Smes: An Empirical Study of Listed Smes in China. Decision Support Systems, 49(3), 301–310. https://doi.org/10.1016/j.dss.2010.03.005

Câmara, A., Popova, I., and Simkins, B. (2012). A Comparative Study of The Probability of Default For Global Financial Firms. Journal of Banking and Finance, 36(3), 717–732. https://doi.org/10.1016/j.jbankfin.2011.02.019

Joseph, D. (2021). Estimating Credit Default Probabilities Using Stochastic Optimisation. Data Science In Finance and Economics, 1(3), 253–271.

Joseph, D. (2021). Predicting Credit Default Probabilities Using Bayesian Statistics and Monte Carlo Simulations.

Jumbe, G., and Gor, R. (2022). Estimation of Default Risk by Structural Models : Theory and Literature.

Majumder, D. (2006). Inefficient Markets and Credit Risk Modeling: Why Merton’s Model Failed. Journal of Policy Modeling, 28(3), 307–318. https://doi.org/10.1016/j.jpolmod.2005.10.006

Merton, R. C. (1974). On the Pricing of Corporate Debt: The Risk Structure of Interest Rates. Journal of Finance, 29(2), 449–470. https://doi.org/10.1111/j.1540-6261.1974.tb03058.x

Merton, R. C. (1976). Option Pricing When Underlying Stock Returns Are Discontinuous. Journal of Financial Economics, 3(1–2), 125–144. https://doi.org/10.1016/0304-405X(76)90022-2

Mišanková, M., Kočišová, K., and Adamko, P. (2014). Creditmetrics and Its Use For the Calculation of Credit Risk. In 2nd International Conference on Economics and Social Science (ICESS 2014), Information Engineering Research Institute, Advances In Education Research, 61.

Peresetsky, A. A., Karminsky, A. A., and Golovan, S. V. (2011). Probability of Default Models of Russian Banks. Economic Change and Restructuring, 44(4), 297–334. https://doi.org/10.1007/s10644-011-9103-2

Sariev, E., and Germano, G. (2020). Bayesian Regularized Artificial Neural Networks For the Estimation of the Probability of Default. Quantitative Finance, 20(2), 311–328. https://doi.org/10.1080/14697688.2019.1633014

Tudela, M., and Young, G. (2005). A Merton-Model Approach To Assessing the Default Risk of UK Public Companies. International Journal of Theoretical And Applied Finance, 08(6), 737–761. https://doi.org/10.1142/S0219024905003256

Valášková, K., and Klieštik, T. (2014). Assessing Credit Risk by Merton Model. In Proceedings of The ICMEBIS 2014 International Conference on Management, Education, Business, and Information Science. Edugait Press. Canada, 27–30.

Voloshyn, I. (2015). Usage of Moody’s KMV Model To Estimate A Credit Limit For A Firm. Available at SSRN 2553706. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2553706

Zieliński, T. (2013). Merton’s and KMV Models In Credit Risk Management. Studia Ekonomiczne, 127, 123–135.

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2023. All Rights Reserved.