ARIMA MODEL FOR FORECASTING THE BITCOIN EXCHANGE RATE AGAINST THE USD

Vasantha Vinayakamoorthi 1![]()

![]() ,

Saravanamutthu Jeyarajah 2

,

Saravanamutthu Jeyarajah 2![]()

![]() , Jeyapraba Suresh 2

, Jeyapraba Suresh 2![]()

![]() ,

Niroshanth Sathasivam 3

,

Niroshanth Sathasivam 3![]()

![]()

1 Lecturer, Department of Economics,

Eastern University Sri Lanka, Eastern Province, Sri Lanka

2 Senior Lecturer, Department of

Economics, Eastern University Sri Lanka, Eastern Province, Sri Lanka

3 Department of Software Technology, University of Vocational Technology, Sri Lanka

|

|

ABSTRACT |

||

|

This study

analysis forecasting the bitcoin exchange rate against the USD. The dataset

selected for this study starts from January 2015 to June 2022. This study's

methodology uses autoregressive integrated moving average forecasting (ARIMA).

The overall outcomes of this study were gathered from the statistical

software Minitab 21.1. The Box Jenkins approaches are also used to predict

the best model. To determine the ARIMA model parameter, this study did

autocorrelation function (ACF) and partial autocorrelation function (PACF)

analyses. According to the Box-Cox transformation method, log transformation

was selected. The outcome demonstrates that the seasonal with the regular

difference in the Bitcoin exchange rate against the USD is a stationary data

series. The forecasting model used in this study is ARIMA (1,1,0) (2,1,1)12.

This predicted model is identified through the Mean squared error by

comparing the other guessing ARIMA models. After the prediction, 5 Month

bitcoin exchange rate against the USD. Investors will be able to estimate the

bitcoin exchange rate against the USD with the use of this information, but

volatility must also be properly watched. This will aid investors in making

better investment decisions and increase profits. In future studies, better

consider another exchange rate of BTC and software experts will develop such

type of software based on ARIMA models for prediction. |

|||

|

Received 02 September 2022 Accepted 03 October 2022 Published 19 October 2022 Corresponding Author Vasantha

Vinayakamoorthi, vasanthav@esn.ac.lk DOI 10.29121/IJOEST.v6.i5.2022.400 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2022 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: BTC (Bitcoin), ARIMA, Forecasting |

|||

1. INTRODUCTION

Currently, the most popular digital currency is bitcoin. Bitcoin's recognition as a valuable investment asset is on the rise. A peer-to-peer, completely decentralized cryptocurrency system called BTC was created to enable online users to perform transactions using virtual money known as bitcoins. It is decentralized because it is neither governed nor managed by a single organization Ayaz et al. (2020).

A prediction method is required to assist its customers in forecasting the price in the future in order to deal with the unpredictable changes in the price of bitcoin Wirawan et al. (2019). It has received a lot of attention recently in a variety of domains, such as computer science, economics, and finance. If we had the ability to sell our assets ahead of a price crash and then buy them again when prices fell. In order to anticipate the price of Bitcoin in the future, we employed a time series forecasting method called ARIMA. The results were quite intriguing.

There is a need to research ways to comprehend Bitcoin's price changes given that it is growing in popularity while yet remaining unpredictable and little understood. Making accurate daily predictions can boost day traders' profits and, as a result, improve the market's efficiency. Performance can be significantly impacted by the model selection for predicting Chen et al. (2019).

Most of the related studies find the ARIMA model before the pandemic of covid. Very few studies consider the forecasting concept through the ARIMA model. Current two years also, the BTC exchange rate dramatically increased to the top. At the same time, it faced a decreased pattern nowadays. Many countries consider cryptocurrency for their economic development. So, we want to identify the shootable model for forecasting to predict the exchange rate of BTC. This study finds out 2 objectives. The first one is to identify the best ARIMA model for forecasting. The Second object is to predict the next 5-month bitcoin exchange rate against the USD.

2. LITERATURE REVIEW

Wirawan et al. (2019) Investigate the Short-term prediction of Bitcoin price using the ARIMA method. The Autoregressive Integrated Moving Average (ARIMA) approach is used to make predictions and may produce short-term predictions with a high degree of accuracy. Use of Mean Absolute Percentage Error to Analyze Prediction Results (MAPE). According to the findings, ARIMA (4,1,4) models produced predictions with the minimum MAPE, 0.87 for the following one-day projection and 5.98 for the following seven days. As a result, it is possible to anticipate Bitcoin prices for the next one to seven days using the ARIMA (4,1,4) model.

Dhinakaran et al. (2022) demonstrate, through an analysis of the price time series over a three-year period, the benefits of the conventional Autoregressive Integrative Moving Average (ARIMA) model in predicting the future value of cryptocurrencies. On the one hand, empirical studies demonstrate that the behaviour of the time series is essentially unchanged; on the other hand, when used for short-term prediction, this straightforward method is largely effective in sub-periods. A further investigation in cryptocurrency price prediction using an ARIMA model trained over the entire dataset is discussed below.

Bakar and Rosbi (2017) examined ARIMA Model for Forecasting Cryptocurrency Exchange Rate. The parameter of the ARIMA model was determined by this study's examination of the autocorrelation function (ACF) and partial autocorrelation function (PACF). As a result, the first variation in the price of a bitcoin is a stationary data series. ARIMA was used as the forecasting model in this investigation (2, 1, 2). The informational Akaike criterion is 13.7805. This model is regarded as having good fitness. Ex-post forecasting has a mean absolute percentage error of 5.36 percentage based on the error analysis between the predicted value and actual data. The results of this study will help forecast the price of bitcoin in an environment with high volatility.

Based on a time series analysis method known as the autoregressive integrated moving average (ARIMA) model, Vidyulatha et al. (2020) research is conducted on five and a half years' worth of bitcoin data from 2015 to 2020. Additionally, the linear regression (LR) model, an existing machine learning approach, is also contrasted. The suggested ARIMA model outperformed the LR model in terms of short-term volatility in weighted bitcoin costs, according to extensive prediction findings.

To forecast Bitcoin's log returns, Kim et al. (2022) used linear and nonlinear error-correcting models (ECMs) (BTC). In terms of RMSE, MAE, and MAPE, the linear ECM outperforms the neural network and autoregressive models at predicting BTC. We can comprehend how other coins affect BTC by using a linear ECM. In addition, we tested fourteen cryptocurrencies for Granger causality.

3. RESEARCH METHODOLOGY

3.1. DATA SELECTION

From January 2015 through June 2022, monthly data for the exchange rate of bitcoin were chosen for this study. The information is gathered from https://www.investing.com.

3.2. BOX-JENKINS ARIMA MODEL

Forecasting is the process of speculating about what will happen in the future. Due to the uncertainty, a forecast's accuracy is just as crucial as the result it predicts. There are three classifications of widely used forecasting techniques.

Figure 1

|

Figure 1 Classification of Forecasting Techniques |

The Autoregressive Integrated Moving Average Model (also known as ARIMA) is a widely used statistical model for forecasting and analysing time data. The authors’ Box and Jenkins also propose a procedure for selecting, estimating, and verifying ARIMA models for a particular time series dataset.

The first step is to make the plot of the series. Then check whether the variance is stationary or not. If the variance is non-stationary, will apply the shootable transformation method and otherwise check whether the mean is stationary or not. if the mean is non-stationary, will apply the regular and seasonal differencing to the data. After making the stationary series, identify the model selection. Every time check whether the residual parameters value correlated or not. if is it ok the series is, next we want to check the significant level of parameters. If that model is adequate, we will check the diagnostic test to confirm the validity of the fitted model. Finally, we can forecast the particular data.

3.3. ACF and PACF

The correlation between observations of a time series that

are separated by k time units (![]() is measured by the autocorrelation function.

To find ARIMA models, combine the partial autocorrelation function with the

autocorrelation function. Check to see if any of the spikes at each lag are substantial.

The significance thresholds will be exceeded by a significant spike, proving

that the correlation for that lag isn't equal to zero.

is measured by the autocorrelation function.

To find ARIMA models, combine the partial autocorrelation function with the

autocorrelation function. Check to see if any of the spikes at each lag are substantial.

The significance thresholds will be exceeded by a significant spike, proving

that the correlation for that lag isn't equal to zero.

3.4. NORMALITY, BOX-COX TRANSFORMATION AND REGULAR AND SEASONAL DIFFERENCE

The data collection may follow a normal distribution if you do a straightforward computation called a Box-Cox Transformation. George Box and Sir David Cox, two British statisticians, are credited with creating the Box-Cox transformation.

To determine if the data follows a normal distribution or not, use the normality test. the null and alternative hypotheses are given below.

![]() Data

follow normal Distribution

Data

follow normal Distribution

![]() Data

does not follow a normal distribution

Data

does not follow a normal distribution

Then will do the step to transform the data using Box-Cox transformation. After that conclude or select the shoutable transformation method through the below criteria. Table 1

Table 1

|

Table

1 |

|

|

|

Transform Data |

|

-2 |

|

|

-1 |

|

|

-0.5 |

|

|

0 |

|

|

0.5 |

|

|

1 |

|

|

2 |

|

ARIMA models can also be used to model a variety of seasonal data. By incorporating additional seasonal components into the ARIMA models we have seen thus far, a seasonal ARIMA model is created. It reads as follows.

![]()

Where,

p, P – AR Part

q, Q – MA Part

d, D – Integration

m – Number of observations per year

The seasonal lags of the PACF and ACF will show the seasonal component of an AR or MA model. An example of a representation of a random process is an autoregressive (AR) model. In time series data, it is used to describe some time-varying processes. According to the moving-average model, the output variable is linearly dependent on the present value as well as various previous values of a stochastic (Imperfectly predictable) factor.

3.5. MODEL SELECTION CRITERIA

Even while one model may occasionally be appropriate for any given collection of data, the accuracy of a forecasting model necessitates that a number of models are compared in order to determine which one yields the best results with the fewest errors. The mean squared error of all forecasts, or MSE, is the initial evaluation criterion.

![]()

Where,

![]() - The ith observed value

- The ith observed value

![]() - The corresponding predicted value

- The corresponding predicted value

n - The number of observations

4. RESULTS AND DISCUSSION

4.1. DATA DESCRIPTION

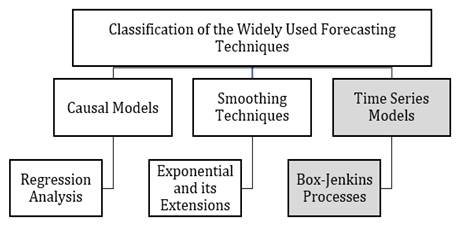

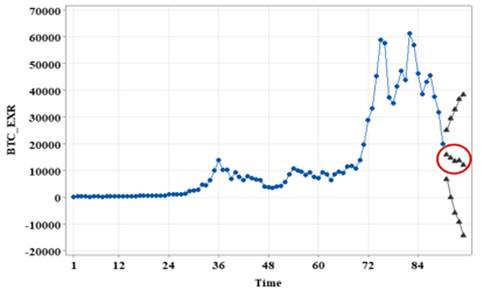

The Bitcoin exchange rate against the USD is shown in Figure 2. The chosen observational data span the period of time from January 2015 to June 2022. There have been 90 observations in total.

Figure 2

|

Figure 2 Bitcoin Exchange Rate Against USD (Monthly Data from Jan-2015 To Jun-2022) |

From January 2015 to August 2020 Bitcoin exchange rate against the USD slowly increased. In September 2020, the Bitcoin exchange rate against the USD dramatically increased up to March 2021. Increased demand from institutional and retail investors who viewed the virtual currency as a shelter and an inflation hedge has contributed to this growth. Then it decreased with fluctuated. The minimum and maximum values of the Bitcoin exchange rate against the USD are 217 and 61330. It is shown in Table 2.

Table 2

|

Table 2 Basic Statistics |

|||||

|

Variable |

N |

Mean |

Median |

Minimum |

Maximum |

|

BTC_EXR (Bitcoin exchange rate against USD) |

90 |

12946 |

6976 |

217 |

61330 |

4.2. STATIONARY TEST AT LEVEL FORM

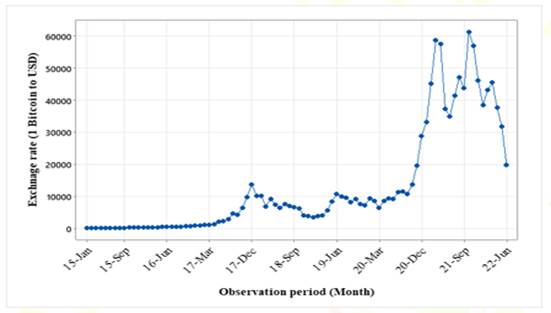

Figure 3

|

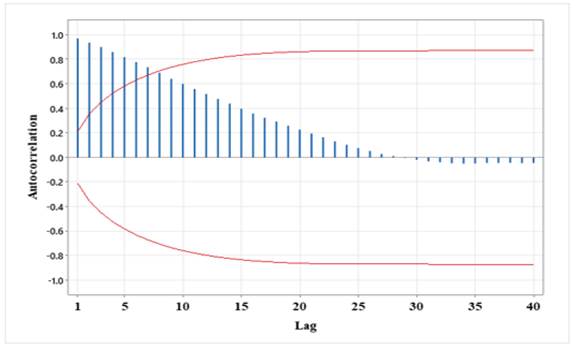

Figure 3 Autocorrelation Function (ACF) For BTC_EXR (With 5% Significance Limits for the Autocorrelations) |

According to the ACF, there is slow decay in autocorrelation analysis. Therefore, exchange rate data is non-stationary data. Otherwise, conclude it is non-stationary with mean and variance.

4.3. NORMALITY TEST AND DATA TRANSFORMATION

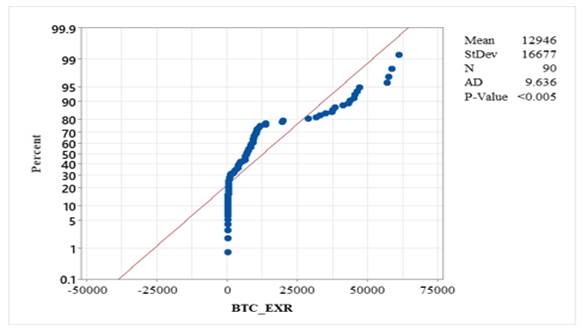

According to the Normality test Figure 4, the p-value (0.005) is less than the alpha value (0.05). Thus accept the alternative hypothesis. So, the data are not normally distributed.

Figure 4

|

Figure 4 Normality Test |

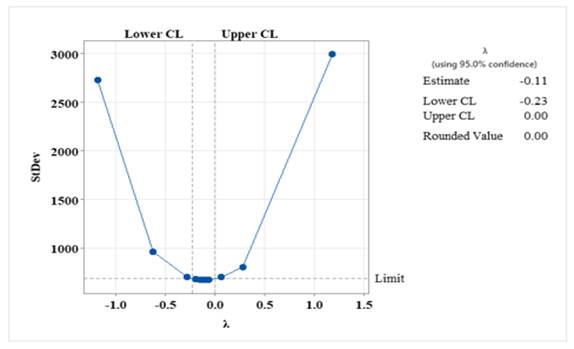

Then choose the shoutable transformation to the data. According to the Box-Cox Transformation method, the rounded value is 0. So, the shootable transformation is a log transformation. It was clearly shown in Figure 5.

Figure 5

|

Figure 5 Box-Cox Plot of BTC_EXR |

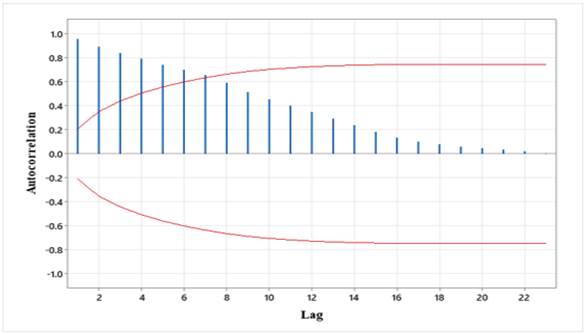

4.4. STATIONARY TEST AT LOG FORM

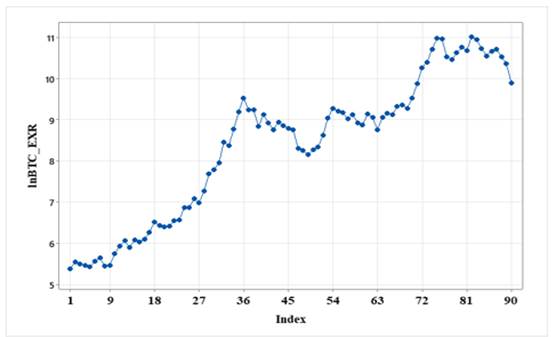

According to Figure 6 and Figure 7, we can conclude the data is non-stationary still with the mean. Because the initial spikes follow the decay.

Figure 6

|

Figure 6 Time Series Plot of ln BTC_EXR |

Figure 7

|

Figure 7 Autocorrelation Function (ACF) for ln BTC_EXR (with 5% significance limits for the autocorrelations) |

4.5. SEASONALITY ADJUSTMENT BY DIFFERENCING

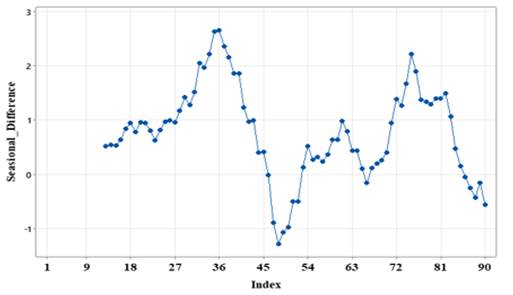

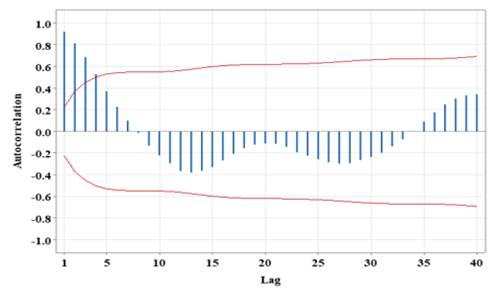

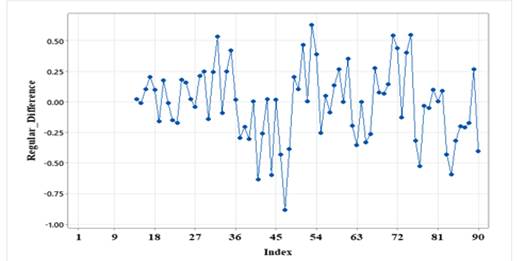

Stationery needs to be created for the series. Therefore, using the log function to modify the data, we must remove the trend and seasonality from the series to make it stationary. As seen in Figure 6, the results are unsatisfactory, thus we must apply seasonal and regular differencing, one of the most popular techniques for dealing with both trend and seasonality. Figure 8, Figure 9, Figure 10.

Figure 8

|

Figure 8 Time Series Plot of Seasional Difference |

Figure 9

|

Figure 9 Autocorrelation Function (ACF) for Seasional_Difference (with 5% significance limits for the autocorrelations) |

Figure 10

|

Figure 10 Time Series Plot of Regular Difference |

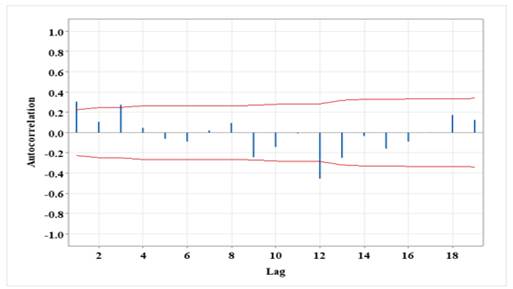

Visually, we can see time series have been made stationary at this point. The next step is to use ARIMA to create a model on the time series. We must first determine the values of the parameters p, q, and d before we can implement the ARIMA function.

4.6. PARAMETER ESTIMATION FOR ARIMA

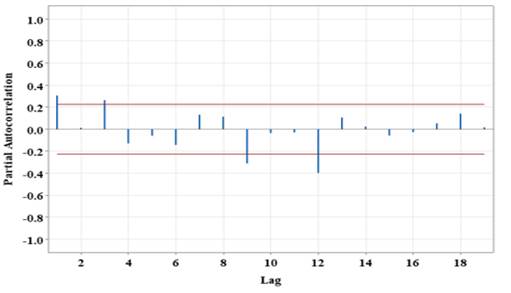

Two charts, the Autocorrelation Function (ACF) - Minitab. (N.D.) and the Partial Autocorrelation Function are used to calculate the values of "p" and "q." (PACF). Figure 11, Figure 12.

Figure 11

|

Figure 11 Autocorrelation Function (ACF) - Minitab. (N.D.) for Regular difference with a seasonal difference (with 5% significance limits for the autocorrelations) – MA part |

Figure 12

|

Figure 12 Partial Autocorrelation Function (ACF) for Regular difference with a seasonal difference (with 5% significance limits for the partial autocorrelations) – AR part |

We have used the ARIMA technique to model time series in

order to predict the Bitcoin exchange rate against the USD. The best models are

thought to have a lower MSE. To determine the best fit for our model, we experimented

with a variety of ARIMA combinations in an effort to attain a lower MSE value.

According to Table 2, The forecast model

implemented in this study is ARIMA ![]() .

Comparing other ARIMA models, our fitted model is lower MSE, and 5 significant

value is there. The fitted model predicted parameters’ (5 Parameters)

probability value is less than the alpha value (0.05). Thus, All the variables

are stationary. According to the

Ljung-Box chi-square statistics, 12,24,36,48 lags’ probability values are

greater than the alpha value (0.05). So, The Modified Box-Pierce test suggested

that there is no autocorrelation left in the residuals. This model is

considered a model with good fitness.

.

Comparing other ARIMA models, our fitted model is lower MSE, and 5 significant

value is there. The fitted model predicted parameters’ (5 Parameters)

probability value is less than the alpha value (0.05). Thus, All the variables

are stationary. According to the

Ljung-Box chi-square statistics, 12,24,36,48 lags’ probability values are

greater than the alpha value (0.05). So, The Modified Box-Pierce test suggested

that there is no autocorrelation left in the residuals. This model is

considered a model with good fitness.

Table 3

|

Table 3 Summary Table of ARIMA Combinations |

|||

|

ARIMA

Model |

Final

Estimates of Parameters (Significant values) |

MSE |

Ljung-Box

Chi-square Statistics (Significant lag) |

|

|

2 |

0.0614806 |

12,24,36,48 |

|

|

3 |

0.0455948 |

12,24,36,48 |

|

|

4 |

0.0449887 |

12,24,48 |

|

|

4 |

0.0414699 |

12,24,36,48 |

|

|

5 |

0.040462 |

12,24,36,48 |

Table 4

|

Table 4 Predicted model Parameters Estimation - |

|||

|

Type |

Coef |

SE Coef |

P-Value |

|

AR 1 |

0.265 |

0.121 |

0.032 |

|

SAR 12 |

-0.344 |

0.15 |

0.025 |

|

SAR 24 |

0.398 |

0.156 |

0.013 |

|

SMA 12 |

0.799 |

0.159 |

0 |

|

Constant |

-0.02178 |

0.0055 |

0 |

Table 5

|

Table 5 Modified Box-Pierce (Ljung-Box) Chi-Square Statistics |

||||

|

Lag |

12 |

24 |

36 |

48 |

|

Chi square |

5.67 |

19.49 |

30.63 |

48.30 |

|

DF |

7 |

19 |

31 |

43 |

|

P-Value |

0.579 |

0.426 |

0.485 |

0.267 |

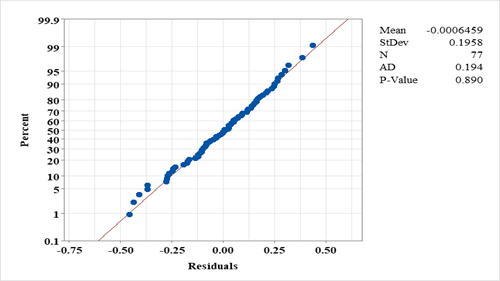

4.7. NORMALITY

TEST FOR RESIDUAL CHECKING TO ARIMA ![]()

According to the output of Normality test for residual, the probability value is 0.890. It was higher than the alpha value (0.05). S we accept the null hypothesis. Thus, we can say the residual series is Normally distributed in our fitted model. It was indicated in the Figure 13.

Figure 13

|

Figure 13 Normality Test for Residual |

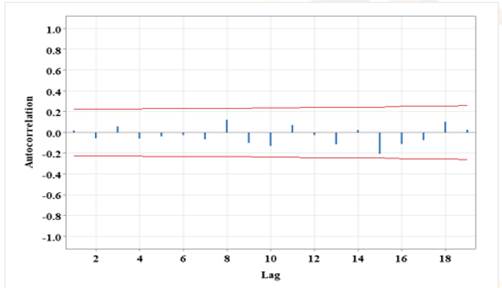

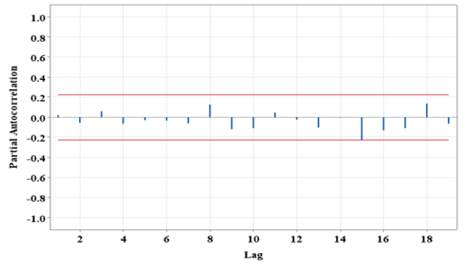

4.8. DIAGNOSTIC TEST

Figure 14

|

Figure 14 ACF for Residual (with 5% significance limits for the autocorrelations) |

Figure 15

|

Figure 15 PACF for Residual (with 5% significance limits for the partial autocorrelations) |

4.9. FORECASTING

Finally, we are going to predict the Bitcoin exchange rate

against the USD from July 2022 to November 2022. Figure 13 displays the plot for

the Bitcoin exchange rate against the USD over the next five months after an

ARIMA model ![]() was fitted to the time series data.

was fitted to the time series data.

Table 6

|

Table 6 Forecasting Values |

|||

|

Period |

Forecast |

95% Limits |

|

|

Lower |

Upper |

||

|

Jul-22 |

15834.6 |

6668.6 |

25000.7 |

|

Aug – 2022 |

14562.9 |

-303 |

29428.7 |

|

Sep – 2022 |

13347.9 |

-6014.6 |

32710.5 |

|

Oct – 2022 |

13635 |

-9466.7 |

36736.7 |

|

Nov-22 |

11968.3 |

-14372.3 |

38308.9 |

Figure 16

|

Figure 16 Plot of Forecasting Values (Jul – 2022 to Nov – 2022) |

5. CONCLUSION AND RECOMMENDATION

In this study, we have investigated the bitcoin exchange

rate against the USD prediction by using the ARIMA model (![]() .

Log transformed method was used to make the stationary with variance and also

apply the regular and seasonal difference to make the stationary with mean. In

the best adequate model, all parameters are stationary. The predicted model

also fitted well. This study only considers the bitcoin exchange rate against

the USD. In the cryptocurrency market, the lead coin is BTC. But also, there

are so many altcoins. So, except for the BTC, Investors or analysts need to

consider the forecasting area. A reliable forecasting model is produced by the

forecasting strategy employing the autoregressive integrated moving average

(ARIMA) method. Error diagnostics must be given extra consideration while forecasting

in high volatility environments. Investors will be able to forecast the future

bitcoin exchange rate against the USD with the aid of this information.

.

Log transformed method was used to make the stationary with variance and also

apply the regular and seasonal difference to make the stationary with mean. In

the best adequate model, all parameters are stationary. The predicted model

also fitted well. This study only considers the bitcoin exchange rate against

the USD. In the cryptocurrency market, the lead coin is BTC. But also, there

are so many altcoins. So, except for the BTC, Investors or analysts need to

consider the forecasting area. A reliable forecasting model is produced by the

forecasting strategy employing the autoregressive integrated moving average

(ARIMA) method. Error diagnostics must be given extra consideration while forecasting

in high volatility environments. Investors will be able to forecast the future

bitcoin exchange rate against the USD with the aid of this information.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

No specific grant was given to this research by any funding organization in the public, private, or non-profit sectors.

REFERENCES

Autocorrelation Function (ACF) - Minitab. (N.D.). Autocorrelation Function (ACF) - Minitab, Support.Minitab.Com.

Ayaz, Z., Fiaidhi, J., Sabah, A., And Ansari, M. (2020).

Bitcoin Price Prediction Using ARIMA Model. https://doi.org/10.36227/techrxiv.12098067.v1.

BTC USD Bitfinex Historical Data - Investing.Com. (N.D.). Investing.Com.

Bakar, N. A. and Rosbi, S. (2017). Autoregressive Integrated Moving Average (ARIMA) Model for Forecasting Cryptocurrency Exchange Rate in High Volatility Environment : A New Insight of Bitcoin Transaction, International Journal of Advanced Engineering Research and Science, 4(11),130-137. https://dx.doi.org/10.22161/ijaers.4.11.20.

Chen, A.S., Chang,H. C., And Cheng, L.Y. (2019). Time-Varying Variance Scaling: Application of the Fractionally Integrated ARMA Model. The North American Journal of Economics and Finance, 47, 1–12. https://doi.org/10.1016/j.najef.2018.11.007.

Dhinakaran, K., Baby Shamini, P., Divya, J., Indhumathi, C. and Asha, R. (2022). "Cryptocurrency Exchange Rate Prediction Using ARIMA Model on Real Time Data," 2022 International Conference on Electronics and Renewable Systems (ICEARS), 914-917, https://doi.org/10.1109/ICEARS53579.2022.9751925.

Frost, J. (2021). Mean Squared Error (MSE) - Statistics by Jim. Statistics by Jim, Statisticsbyjim.Com.

Gertrude Chavez-Dreyfuss, T. W. (N.D.). Bitcoin Surges to All-Time Record as 2020 Rally Powers on, Reuters. U. S.

Hessing, T., and PV, R. (2014). Box Cox Transformation. Six Sigma Study Guide, Sixsigmastudyguide.Com.

Kim, J. M., Cho, C. and Jun, C. (2022). "Forecasting the Price of the Cryptocurrency Using Linear and Nonlinear Error Correction Model". Journal of Risk and Financial Management, 15(2), 74. https://doi.org/10.3390/jrfm15020074.

Seasonal ARIMA Models (2022). Forecasting : Principles and Practice (2nd Ed). (N.D.). 8.9 Seasonal ARIMA Models. Forecasting: Principles and Practice (2nd Ed), Otexts.Com.

Specify a Box-Cox Transformation for Individual Distribution Identification - Minitab. (N.D.). Specify a Box-Cox Transformation for Individual Distribution Identification - Minitab, Support.Minitab.Com.

Time-Critical Decision Modeling and Analysis. (N.D.). Home.Ubalt. Edu.

Tularam, G. A., and Saeed, T. (2016). Oil-Price Forecasting Based on Various Univariate Time-Series Models. American Journal of Operations Research, 6(3), 226–235. https://doi.org/10.4236/AJOR.2016.63023.

Vidyulatha, G., Mounika, M., And Arpitha,N.

(2020). Crypto Currency Prediction Model Using ARIMA, Turkish Journal of

Computer and Mathematics Education, 11(3), 1654 – 1660.

Wirawan, M., Widiyaningtyas, T. and Hasan, M. M. (2019)."Short

Term Prediction on Bitcoin Price Using ARIMA Method," 2019 International

Seminar on Application for Technology of Information And Communication (Isemantic),

2019, 260-265.

https://doi.org/10.1109/ISEMANTIC.2019.8884257.

APPENDICES

Appendix 1

|

Appendix 1 “APPENDIX A,” |

||

|

Month |

BTC_EXR |

lnBTC_EXR |

|

15-Jan |

217.4 |

5.3817 |

|

15-Feb |

255.7 |

5.544 |

|

15-Mar |

244.3 |

5.4984 |

|

15-Apr |

236.1 |

5.4643 |

|

15-May |

228.7 |

5.4324 |

|

15-Jun |

262.9 |

5.5718 |

|

15-Jul |

284.5 |

5.6507 |

|

15-Aug |

231.4 |

5.4441 |

|

15-Sep |

236.5 |

5.4659 |

|

15-Oct |

316 |

5.7557 |

|

15-Nov |

376.9 |

5.932 |

|

15-Dec |

429 |

6.0615 |

|

16-Jan |

365.5 |

5.9013 |

|

16-Feb |

439.2 |

6.085 |

|

16-Mar |

416 |

6.0307 |

|

16-Apr |

446.6 |

6.1017 |

|

16-May |

530.7 |

6.2742 |

|

16-Jun |

674.7 |

6.5143 |

|

16-Jul |

623.7 |

6.4357 |

|

16-Aug |

604.1 |

6.4037 |

|

16-Sep |

611.1 |

6.4153 |

|

16-Oct |

704.1 |

6.5569 |

|

16-Nov |

708.1 |

6.5626 |

|

16-Dec |

966.6 |

6.8738 |

|

17-Jan |

966.2 |

6.8734 |

|

17-Feb |

1189.1 |

7.081 |

|

17-Mar |

1081.7 |

6.9863 |

|

17-Apr |

1435.2 |

7.2691 |

|

17-May |

2191.8 |

7.6925 |

|

17-Jun |

2420.7 |

7.7918 |

|

17-Jul |

2856 |

7.9572 |

|

17-Aug |

4718.2 |

8.4592 |

|

17-Sep |

4367 |

8.3818 |

|

17-Oct |

6458.3 |

8.7731 |

|

17-Nov |

9907 |

9.201 |

|

17-Dec |

13800 |

9.5324 |

|

18-Jan |

10284 |

9.2383 |

|

18-Feb |

10315 |

9.2414 |

|

18-Mar |

6925.3 |

8.8429 |

|

18-Apr |

9240 |

9.1313 |

|

18-May |

7485.8 |

8.9208 |

|

18-Jun |

6391.5 |

8.7627 |

|

18-Jul |

7730.6 |

8.9529 |

|

18-Aug |

7025.9 |

8.8574 |

|

18-Sep |

6618.1 |

8.7976 |

|

18-Oct |

6368.4 |

8.7591 |

|

18-Nov |

4038.3 |

8.3036 |

|

18-Dec |

3830.5 |

8.2508 |

|

19-Jan |

3501.1 |

8.1608 |

|

19-Feb |

3894 |

8.2672 |

|

19-Mar |

4167.6 |

8.3351 |

|

19-Apr |

5599.5 |

8.6304 |

|

19-May |

8533.3 |

9.0517 |

|

19-Jun |

10745 |

9.2822 |

|

19-Jul |

10088 |

9.2191 |

|

19-Aug |

9623.9 |

9.172 |

|

19-Sep |

8331.1 |

9.0278 |

|

19-Oct |

9185.6 |

9.1254 |

|

19-Nov |

7599.9 |

8.9359 |

|

19-Dec |

7208.3 |

8.883 |

|

20-Jan |

9367.4 |

9.145 |

|

20-Feb |

8557.3 |

9.0545 |

|

20-Mar |

6427.7 |

8.7684 |

|

20-Apr |

8635.3 |

9.0636 |

|

20-May |

9452.1 |

9.154 |

|

20-Jun |

9150.6 |

9.1216 |

|

20-Jul |

11350 |

9.337 |

|

20-Aug |

11671 |

9.3649 |

|

20-Sep |

10794 |

9.2867 |

|

20-Oct |

13788 |

9.5316 |

|

20-Nov |

19686 |

9.8877 |

|

20-Dec |

28933 |

10.2727 |

|

21-Jan |

33141 |

10.4085 |

|

21-Feb |

45300 |

10.7211 |

|

21-Mar |

58796 |

10.9818 |

|

21-Apr |

57637 |

10.9619 |

|

21-May |

37305 |

10.5269 |

|

21-Jun |

35043.5 |

10.4643 |

|

21-Jul |

41409 |

10.6313 |

|

21-Aug |

47157 |

10.7612 |

|

21-Sep |

43830 |

10.6881 |

|

21-Oct |

61330 |

11.024 |

|

21-Nov |

56938 |

10.9497 |

|

21-Dec |

46218 |

10.7411 |

|

22-Jan |

38526 |

10.5591 |

|

22-Feb |

43202 |

10.6736 |

|

22-Mar |

45535 |

10.7262 |

|

22-Apr |

37662 |

10.5364 |

|

22-May |

31792 |

10.367 |

|

22-Jun |

19938 |

9.9004 |

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2022. All Rights Reserved.