A STUDY OF OPTION PRICING MODELS WITH DISTINCT INTEREST RATE1 Research

Scholar, Department of Mathematics, Gujarat University, Navrangpura,

Ahmedabad-380009 (Gujarat), India

2 Associate Professor, Department of Mathematics, Gujarat University, Navrangpura, Ahmedabad-380009, (Gujarat), India |

` |

||

|

|

|||

|

Received 19 March 2022 Accepted 19 April 2022 Published 05 May 2022 Corresponding Author Neha Sisodia, nsisodia011@gmail.com DOI 10.29121/IJOEST.v6.i2.2022.310 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2022 The

Author(s). This is an open access article distributed under the terms of the

Creative Commons Attribution License, which permits unrestricted use, distribution,

and reproduction in any medium, provided the original author and source are

credited.

|

ABSTRACT |

|

|

|

This paper analyses the effect of different interest

rates on two Option Pricing Models, Black-Scholes’, and Heston. Here, the

parameter interest rate is focused, and a comparison is done amongst the two

models. An error estimator, UMBRAE (Unscaled Mean Bounded Relative Absolute

Error) is calculated for pricing various European call options. The real

market data is collected from NSE (National Stock Exchange). Moneyness

(percentage difference of stock price and strike price) and Time-To-Maturity

are used as the base for comparison. All the mathematical calculation is done

in MATAB software. We observe that Black-Scholes’ model is preferred for

lower interest rates than Heston options pricing model and vice-versa. This

study is helpful in derivatives market. |

|

||

|

Keywords: European Call Option, Black-Scholes’ Model,

Heston Model, Moneyness, Time-To-Maturity, Interest Rate 1. INTRODUCTION

Financial markets are one of the most demanding and considered to be

quick source of income nowadays. It is the place where various securities are

traded like – stock market, bond market, derivatives market etc. The

derivative market is the market for financial instruments like – futures

contracts or options. The value of financial contract depends on an underlying

asset. Prices for derivatives derive from fluctuations in the underlying

asset. Options are a type of derivative product that allows investors to

contemplate against the volatility of an underlying stock. Options are of two types, Call and Put

option. Call option - the option holder purchases an asset at a specified

price on or before a specified time. Put option is vice versa of call option.

In this, option holders sell an asset at a specified price on or before a

specified time. It is again divided among two styles European and American.

European options are traded in both NSE and BSE in Indian stock market. They

can be exercised only at the time of expiration. Black-Scholes’ model is a

well-known basic option pricing model for determining the theoretical premium

value for a call or a put option with six parameters such as, volatility,

underlying stock price, type of option, strike price, time, and risk-free

interest rate.

Since 1960’s, large number of mathematicians are working on the

valuation of options. In 1973, Fischer Black and Myron Scholes Black and Scholes (1973) gave the theoretical closed form solution for

pricing |

|

||

European call options. With

several assumptions, this is more convenient and easiest model for calculation

of theoretical premium values. In 1993, Heston Heston

(1993) came up with a

stochastic volatility model which assumed that the asset variance ![]() ,

follows a mean reverting Cox-Ingersoll-Ross process. Stochastic volatility is

favourable with the practical market and also it removes excess kurtosis and

asymmetry of Black-Scholes’ model. Sisodia

and Gor (2021).

,

follows a mean reverting Cox-Ingersoll-Ross process. Stochastic volatility is

favourable with the practical market and also it removes excess kurtosis and

asymmetry of Black-Scholes’ model. Sisodia

and Gor (2021).

Interest rate is one of the important parameters in market fluctuations. It is the amount a lender charges a borrower and is a percentage of the principal- the amount loaned. The risk-free rate is used in both mathematical models Black-Scholes’ and Heston option pricing model. It is the zero risk investments, theoretical rate of return. However, a truly risk-free rate does not exist because even the safest investments carry a very small risk.

An error estimator UMBRAE (Unscaled Mean Bounded Relative Absolute Error) Chao et al. (2017) is used in the model. It helps in elimination of symmetric and bounded error that occurs in forecasting. Naive method is used as the benchmark for forecasting. The performance of Heston Model and Black-Scholes’ Model is observed for three different health companies. The comparison is done for the parameters like time-to-maturity and moneyness (The percentage difference of stock price and strike price) for European call option. Sisodia and Gor (2021)

In this paper, initially we discuss the basic terminologies, Black-Scholes’ model, Heston Model and then Methodology. At last, the result is discussed regarding comparison of the two models for real market Indian stock data.

1.1. LITERATURE REVIEW

It was in early 1960’s study of financial market started, many mathematicians like Ayres (1963), Samuelson (1965), Boness (1964), Baumol et al. (1966) etc.. worked on this concept. In Black and Scholes (1973) developed the formula which gives theoretical premium value for European call Options. This also works with corporate bonds and warrants. With large number of assumptions this formula is widely used all over stock market in India. Sisodia and Gor (2021)

Many other mathematicians worked on the modified Black-Scholes models. Recently, Singh and Gor (2020a) worked on the model where underlying at maturity, stock returns follow the Gumbel distribution Singh and Gor (2020a). Also, Singh and Gor (2020b) compared the basic B-S model to a new model in which stock returns follow truncated Gumbel distribution Singh and Gor (2020b). Chauhan and Gor (2020b) worked upon the modified truncated Black-Scholes model and compared the result Chauhan and Gor (2020b). Sisodia and Gor (2020) worked on the relevancy of option pricing model. They have used various error estimators for relevancy check Sisodia and Gor (2020). orked on the comparative study of oprion pricing models. They have compared the B-S Model and Heston model for various option of moneyness Sisodia and Gor (2020). worked on the effect of implied volatility on two option pricing models and compared the result Sisodia and Gor (2020). worked on the historical volatility and its effect on option pricing model and compared the result of error estimation Sisodia and Gor (2021).

It has been seen that modified B-S model gives better output than the original B-S model. In continuation to this, a stochastic volatility model was developed by Heston in 1993. He proposed a stochastic volatility model which gives a closed form solution for calculating theoretical premium value of European Call options. It assumes underlying stock price and volatility as stochastic quantity. The stochastic volatility models help in removing excess of skewness and kurtosis and asset variance follow a mean reverting CIR process. Sisodia and Gor (2021)

In the paper of Shinde and Takale (2012), basic terminologies of option pricing model are explained in a simplified manner. Zhang and Shu (2003), Yuang (2013), and Crisostomo (2014) derived the Heston characteristic function and graphically compared the B-S model and Heston option pricing formula on the basis of different parameters of moneyness and Time-To-Maturity.

In the paper of Santra and Chakrabarti (2017), Matlab software is introduced for all kind of mathematical calculation. An accuracy measure UMBRAE is used as provided in the paper of Chao et al. (2017). The two models are compared for real market data with this error estimator.

1.2. BASIC CONCEPTS AND THE MODELS Hull (2009), Sisodia

and Gor (2021)

1. Option: An option is defined as the

right, but not the obligation, to buy (call option) or sell (put option) a

specific asset by paying a strike price on or before a specific date.

·

Call option: An option which allows its holder the right

to buy the underlying asset at a strike price at some particular time in the

future.

·

Put option: An option which allows its holder the right

to sell the underlying asset at a strike price at some particular time in the

future.

2. Stochastic Process: Any variable whose value changes over time in an

uncertain way is said to follow a stochastic process.

3. Strike Price: The predetermined price of an

underlying asset is called strike price.

4. Stochastic Volatility: Volatility

is a measure for variation of price of a stock over time. Stochastic in this

sense refers to successive values of a random variable that are not

independent.

5. Expiration Date/ Time-to-maturity: The

date on which an option right expires and becomes worthless if not exercised.

In European options, an option cannot be exercised until the expiration date.

6. Moneyness: It is the relative position of

the current price of an underlying asset with respect to the strike price of a

derivative, most commonly a call/put option.

7. Geometric Brownian Motion: A

continuous time stochastic process in which the logarithm of the randomly

varying quantity follows a Brownian motion.

8. Black-Scholes Inputs:

Black-Scholes model uses following six

parameters in option pricing model.

· Underlying stock price

· Interest rate

· Time to expiration

· Strike price

· Volatility

Risk-Free Interest Rate is measured in percentage per year. In a particular trade it is the rate at which cash over the life of the option is deposited or borrowed. Call option value increases with the risk-free rate. Put option value decreases as the risk-free rate increases. Its sensitivity with option price is termed as RHO.

MIBOR (Mumbai interbank offer rate) is the rate at which a bank lends loan to another bank on short-term. For a continuous developed market of India, a reference rate is all required for its debt market, which evolved MIBOR. It is used in conjunction with forward rates and the Mumbai interbank bid (MIFOR and MIBID). NSE (2022)

1.3. THE BLACK-SCHOLES’ MODEL SANTRA

AND CHAKRABARTI (2017), SISODIA

AND GOR (2021)

This model has number of assumptions.

· Random walk.

· Interest rate remains constant.

· Stock pays no dividends.

· No transaction cost.

· Option can only be exercised upon expiration.

· Stock returns are normally distributed; thus, the volatility remain constant throughout.

In Black and Scholes (1973) proposed a European Call option pricing model which is based on Geometric Brownian motion.

![]()

![]() - asset price,

- asset price,

![]() -

drift (that is constant),

-

drift (that is constant),

![]() -

return volatility(constant) and

-

return volatility(constant) and

![]() - Brownian motion.

- Brownian motion.

Black and Scholes (1973) makes use of the risk neutral probability instead of true probability to compute option price.

The risk neutral dynamics on asset is given by.

![]()

Here, r is the risk-free rate and Geometric Brownian Motion is the solution to the above stochastic differential equation.

![]()

Geometric Brownian Motion (GBM) model is the lognormal of the above equation for stock prices.

![]()

Here, R.H.S. equation is a normal random variable whose

mean is ![]()

And variance is ![]()

The Black-Scholes Formula for European call price is,

![]()

Where, ![]() and

and ![]()

K

– strike price, ![]() – current stock price, t – time to expiration, r

– riskless interest rate (constant),

– current stock price, t – time to expiration, r

– riskless interest rate (constant), ![]() – volatility of stock (constant). Sisodia

and Gor (2020)

– volatility of stock (constant). Sisodia

and Gor (2020)

1.4. THE HESTON MODEL SISODIA

AND GOR (2021), YE (2013)

In Heston

(1993) developed a Stochastic Volatility

option pricing Model. Consider at time t

the underlying asset ![]() which obeys a diffusion process with

volatility being treated as a latent stochastic process of Feller as

proposed by Cox, Ingersoll, and Ross (CIR): Sisodia

and Gor (2020)

which obeys a diffusion process with

volatility being treated as a latent stochastic process of Feller as

proposed by Cox, Ingersoll, and Ross (CIR): Sisodia

and Gor (2020)

![]()

![]()

Here, ![]() and

and ![]() are two separate Brownian motion which are

correlated with a correlation coefficient

are two separate Brownian motion which are

correlated with a correlation coefficient ![]()

![]()

Here, ![]() - asset price, r - risk free rate,

- asset price, r - risk free rate, ![]() - variance at time t,

- variance at time t, ![]() is the long term mean variance, k >0 is variance mean-reversion

speed,

is the long term mean variance, k >0 is variance mean-reversion

speed, ![]() is the volatility of the variance.

is the volatility of the variance.

European call option price is given by.

![]()

Here, ![]() -

delta of the option and

-

delta of the option and ![]() - risk-neutral probability of exercise (i.e.,

when

- risk-neutral probability of exercise (i.e.,

when ![]()

Heston characteristic function for j=1, 2 is given as; Indian Institute of Management Calcutta (n.d.)

![]()

Were,

![]()

![]()

![]()

![]()

![]()

The required probabilities can be

obtained by inverting the characteristic functions Indian Institute of Management Calcutta (n.d.)

![]()

2.

MATERIALS AND METHODS

Data: The live market data has been

gathered from NSE India website Indian Institute of Management Calcutta (n.d.). Five different companies are

considered randomly for calculation of European call option.

Aurobindo Pharma limited, Biocon limited,

Cipla limited, Zydus Cedilla Healthcare limited and Glenmark are considered for

the period from January 01 to January 31, 2021. February 25, 2021 is considered

as the maturity date.

Parameter

Sisodia and Gor (2021)

Moneyness - Percentage difference between the current

underlying price and the strike price:

·

Moneyness (%) = ![]()

The result has

been bifurcated in terms of moneyness option and maturity time.

· ITM (In the money) - In call options if the strike price is lower than the underlying stock price.

· ATM (At the money) - In call options when the strike price is similar to the underlying stock price.

· OTM (Out of the money) - In call options if the strike price is more than the underlying stock price.

·

An error estimator UMBRAE (Unscaled Mean Bounded

Relative Absolute Error) = ![]()

![]()

![]()

![]()

Where, ![]() is

observed price of the model,

is

observed price of the model, ![]() is the actual forecasted value of the market

and,

is the actual forecasted value of the market

and, ![]() is

the forecasted value of the market from Naive Method.

is

the forecasted value of the market from Naive Method.

· We have used MATLAB software to run the Black-Scholes model for calculation of European call option value.

· Risk –Free Interest rate: During the life of an option, the amount of money lends or borrowed at the particular rate is called Risk-Free Interest rate. Value of call option increases with increase in rate.

· Volatility: It is defined as the standard deviation of the continuously compounded return of the stock. Value of call option is high for the higher volatility.

· We have used MATLAB software to run the Heston model for calculation of European call option value.

· Initial Variance bounds of 0 and 1 have been considered.

· Long-term Variance bounds of 0 and 1 have been considered.

· Correlation: Correlation takes values from -1 to 1 between the stochastic processes.

· Volatility of Variance: It gives positive value. As the volatility of assets may increase in short term, a broad range of 0 to 5 has been considered.

·

Mean-Reversion Speed: This is dynamically set

with the help of a non-negative constraint (Feller, 1951). The constraint ![]() guarantees that the variance in CIR process is

always strictly positive.

guarantees that the variance in CIR process is

always strictly positive.

· Initial Variance = 0.28087

· Long-term Variance = 0.001001

· Volatility of Variance = 0.1

· Correlation Coefficient = 0.5

· Mean Reversion Speed = 2.931465

Interest rate is the supreme parameter in the overall study of the paper. To observe the effect of change of interest rate in option pricing models, two different rates have been considered, R1 = 10 % (arbitrary) and R2 = 3.47% (MIBOR- Mumbai Interbank offer Rate)

3. RESULTS AND DISCUSSIONS

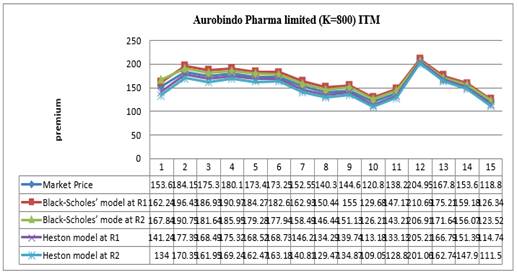

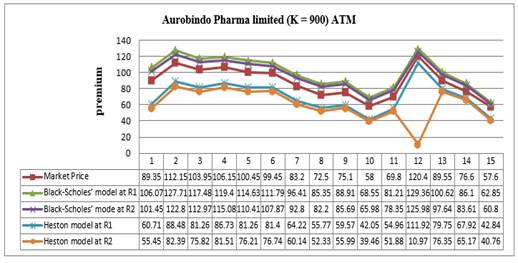

Randomly five different stocks have been chosen and its

theoretical premium value of European call option is computed for B-S model and

Heston model Sisodia

and Gor (2020). Two different interest rates i.e.,

R1 and R2 have considered for different option of

moneyness i.e. In-the-money (ITM), Out-of-the-money (OTM) and At-the-money

(ATM). Error estimation UMBRAE is evaluated and compared for both the models.

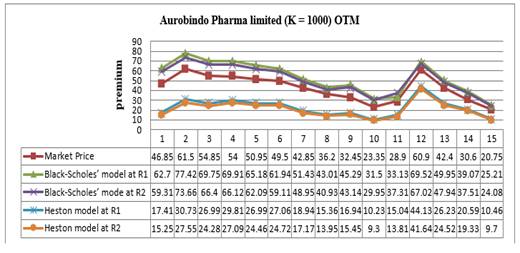

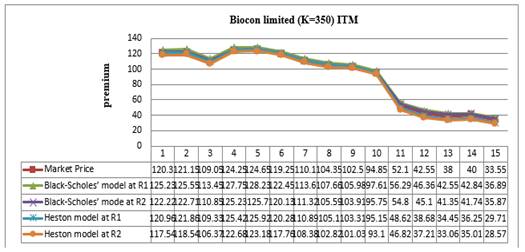

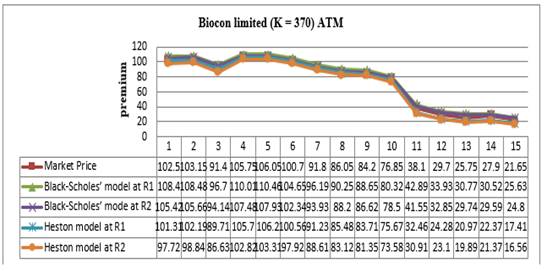

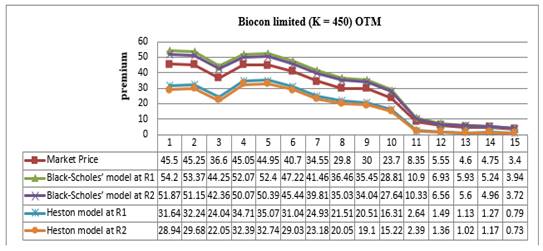

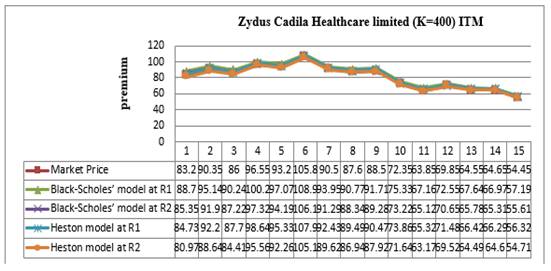

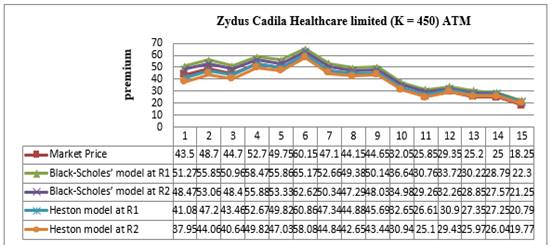

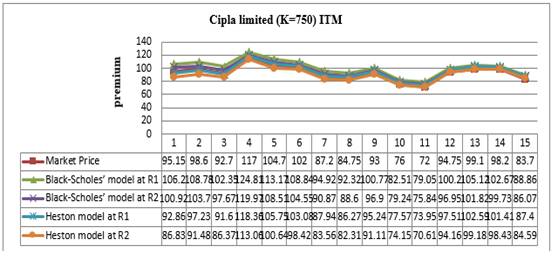

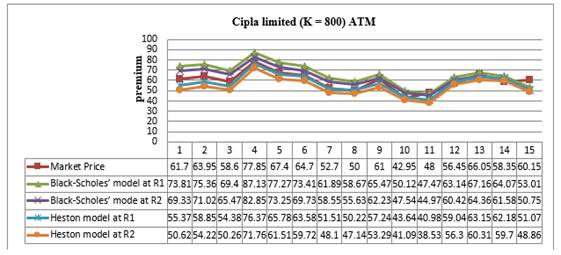

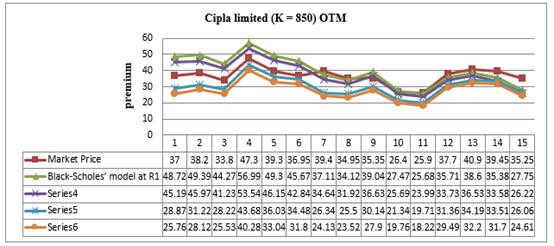

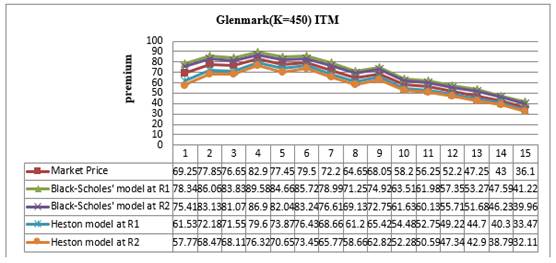

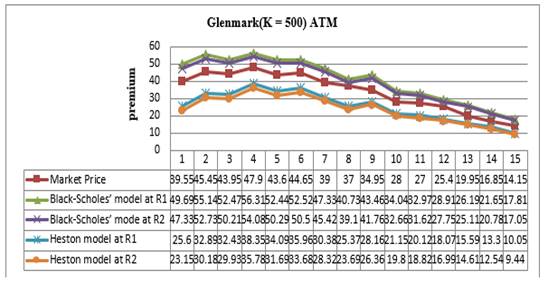

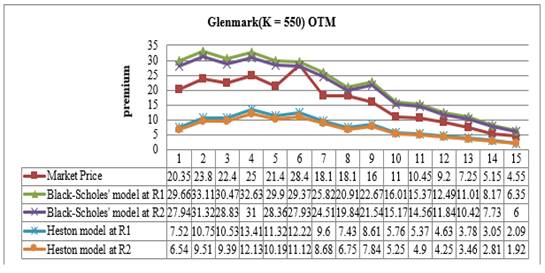

Above

graph’s shows that the model price’s at R1 are higher than at R2.

This indicates that higher the interest rate so is the premium value. Also, it

is seen that Black-Scholes’ model gives closer result at MIBOR i.e., R2

as compared to Heston model.

Further,

UMBRAE (Unscaled Mean Bounded Relative Absolute Error) is computed, and

comparison is done for various option of moneyness. Interest Rate is considered

as the principal parameter in both Black-Scholes’ and Heston Option pricing

model. Sisodia

and Gor (2021)

|

Table 1: Aurobindo

Pharma Limited |

||||||

|

Model |

Error

estimation UMBRAE |

|||||

|

Call Option at R1 |

Call Option at R2 |

|||||

|

ITM

K=800 |

ATM

K=900 |

OTM

K=1000 |

ITM

K=800 |

ATM

K=900 |

OTM

K=1000 |

|

|

Black-Schole |

0.7 |

1 |

1 |

0.45 |

0.78 |

1 |

|

Heston |

0.41 |

1 |

1 |

0.69 |

1 |

1 |

According

to the above table, at R1 Heston model outperforms Black-Scholes’

model at ITM while other shows maximum error value 1. At R2

Black-Schole model outcompete Heston model at ITM and ATM options while OTM

options shows no difference.

|

Table 2: Biocon

Limited |

||||||

|

Model |

Error

estimation UMBRAE |

|||||

|

Call Option at R1 |

Call Option at R2 |

|||||

|

ITM

K=350 |

ATM

K=370 |

OTM

K=450 |

ITM

K=350 |

ATM

K=370 |

OTM

K=450 |

|

|

Black-Schole |

0.83 |

1 |

1 |

0.47 |

0.69 |

0.88 |

|

Heston |

0.37 |

0.28 |

1 |

0.57 |

0.86 |

1 |

According

to the above table, at R1 Heston model outcompete Black-Schole model

at ITM and ATM options. At R2 Black-Scholes model outcompete Heston

for all the three moneyness option.

|

Table 3: Zydus

Cedilla Healthcare Limited |

||||||

|

Model |

Error

estimation UMBRAE |

|||||

|

Call Option at R1 |

Call Option at R2 |

|||||

|

ITM

K=400 |

ATM

K=450 |

OTM

K=500 |

ITM

K=400 |

ATM

K=450 |

OTM

K=500 |

|

|

Black-Schole |

0.65 |

1 |

1 |

0.23 |

0.77 |

1 |

|

Heston |

0.41 |

0.31 |

1 |

0.41 |

0.48 |

1 |

According

to the above table, at R1 Heston model outcompete Black-Schole model

at ITM and ATM options. At R2 Black-Scholes’ model is better than

Heston model at ITM while vice-versa in ATM option.

|

Table 4: Cipla

Limited |

||||||

|

Model |

Error

estimation UMBRAE |

|||||

|

Call Option at R1 |

Call Option at R2 |

|||||

|

ITM

K=750 |

ATM

K=800 |

OTM

K=850 |

ITM

K=750 |

ATM

K=800 |

OTM

K=850 |

|

|

Black-Schole |

0.96 |

0.91 |

0.75 |

0.5 |

0.74 |

0.94 |

|

Heston |

0.63 |

0.51 |

1 |

0.63 |

1 |

1 |

According

to the above table, at R1 Heston model is better than Black-Scholes’

model in ITM and ATM options and vice-versa in OTM option. At R2

Black-Scholes’ model outcompete Heston model in all moneyness option.

|

Table 5: Glenmark |

||||||

|

Model |

Error

estimation UMBRAE |

|||||

|

Call Option at R1 |

Call Option at R2 |

|||||

|

ITM

K=450 |

ATM

K=500 |

OTM

K=550 |

ITM

K=450 |

ATM

K=500 |

OTM

K=550 |

|

|

Black-Schole |

1 |

1 |

1 |

0.93 |

1 |

1 |

|

Heston |

0.72 |

1 |

1 |

1 |

1 |

1 |

According to the above table, at R1 Heston model outperforms

Black-Scholes’ model in ITM option and vice-versa at R2. Rest all

other shows maximum error value 1.

4. CONCLUSIONS AND RECOMMENDATIONS

We conclude the following

from the above study.

R1 = 10% (Arbitrary):

·

Heston model is far better than

Black-Scholes’ model at In-the-money and At-the-money option for all cases.

·

Black-Scholes’ model is better than Heston

only in Cipla limited while; others have similar error value maximum 1 at Cut-off–the-money

option.

R2 = 3.47 (MIBOR):

·

Black-Scholes’ model proves to be better than

Heston model in all except Zydus Cedilla limited at At-the-money option.

·

Black-Scholes’ model performs better than

Heston model in all chosen companies’ data at In-the-money option.

·

Black-Scholes’ outcompete Heston model in the

case of Biocon and Cipla limited. Remaining all gives similar error value

indicating no such difference at Out-of-the-money option.

We have considered one-month different stock data from five different

companies for two different interest rates R1 and R2. We

have computed the error estimation for both the Black-Scholes’ model and Heston

model for various option of moneyness i.e. In-the money (ITM), out-of-the-money

(OTM) and At-the-money (ATM) Sisodia and

Gor (2021). The comparison is then

done in both the models. At last, we could conclude that, the Black-Scholes’

model is more reliable for interest rate at MIBOR while, Heston model must be

used for other higher rates. Because as the rate increases the higher the premium

value we get. Thus, the Black-Scholes’ model fails with the increasing interest

rates. This kind of

study is always useful to derivative market investors in both short term and long-term

options [18]. In future, we could work on the large number of data, compute

many more results, and forecast much accurately.

ACKNOWLEDGEMENT

This paper and research are possible with the exceptional support of my guide Dr. Ravi Gor. His knowledge and keen attention in the subject have been a positive inspiration for my work.

REFERENCES

American Institute for Economic Research. (2022). Website – http://www.economictimes.indiatimes.com/

Ayres, H. F. (1963). Risk aversion in the warrant markets.

Baumol, W. J., Malkiel, B. G., & Quandt, R. E. (1966). The valuation of convertible securities. The Quarterly Journal of Economics, 80(1), 48-59. https://doi.org/10.2307/1880578

Black F. and Scholes M. (1973). The Pricing of Options and Corporate Liabilities, Journal of Political Economy,81(3), 637-644. https://doi.org/10.1086/260062

Boness, A. J. (1964). Elements of a theory of stock-option value. Journal of Political Economy, 72(2), 163-175. https://doi.org/10.1086/258885

Chao C, Jamie T. and Jonathan M. (2017). A new accuracy measure based on bounded relative error for time series forecasting, Tianjin University, China, 12(3), 6-7. https://doi.org/10.1371/journal.pone.0174202

Chauhan, A, and Gor, R. (2020b), A Comparative Study of Modified Black-Scholes option pricing formula for selected Indian call options, IOSR Journal of Mathematics, 16(5), 16-22.

Crisostomo R. (2014), An Analysis of the Heston Stochastic Volatility Model : Implementation and Calibration using Matlab, 58, 6-14. https://doi.org/10.2139/ssrn.3400670

Executive Post Graduate Programme in Machine Learning & AI. (N.d.). Website -

Fleischmann, R. Posner, M. (2020). Meditation for Increased Mindfulness and Memory : An Analysis on the Impact of Meditation on Mindfulness and Working Memory Capacity in High School Students, Journal of Student Research. https://doi.org/10.47611/jsrhs.v9i2.1079

Heston S.L. (1993). A Closed-Form Solution for Options with Stochastic Volatility with Applications to Bond and Currency Options,The Review of Financial Studies, 6(2),327-343. https://doi.org/10.1093/rfs/6.2.327

Hull J. C. (2009). Options, Futures and other Derivatives, Pearson Publication, Toronto.

Indian Institute of Management Calcutta (n.d.). Website -

Jang, J.H. Yoon, J. Kim, J. Gu, J. Kim, H.Y. (2021). DeepOption : A Novel Option Pricing Framework Based on Deep Learning with Fused Distilled Data from Multiple Parametric Methods. https://doi.org/10.1016/j.inffus.2020.12.010

Samuelson, P. A. (1965). Rational theory of warrent prices. Indust. manag. Rev., 6, 13-31.

Santra A. and Chakrabarti, B. (2017). Comparison of Black-Scholes and Heston Models for Pricing Index Options, Indian Institute of Management, 796,2-6.

Shinde A.S. and Takale K.C. (2012). Study of Black-Scholes Model and its Applications, International Conference on Modelling, (38),270-279. https://doi.org/10.1016/j.proeng.2012.06.035

Singh, A. Gor, R. (2020a). Relevancy of pricing European put option based on Gumbel distribution in actual market, Alochana Chakra Journal, 9(6), 4339-4342.

Singh, A. Gor, R. (2020b). Relevancy of pricing European put option based on truncated Gumbel distribution in actual market, IOSR Journal of Mathematics, 16(5), 12-15.

Sisodia, N. and Gor, R. (2020). Effect of implied volatility on option prices using two option pricing models, NMIMS ManagementReview, 31-42.

Sisodia, N. and Gor, R. (2021). A Study on the effect of historical volatility using two option pricing models, IOSR Journal of Economics and Financce (IOSR-JEF), 12(1), 19-26.

Yates Education. (2009). Website - http://www.accaglobal.com/

Ye, Z. (2013). The Black-Scholes and Heston Models for Option Pricing, Waterloo University, 23-25.

Yuang Y. (2013). Valuing a European Options with the Heston Model, Rochester Institute of Technology,25-28.

Zhang, D. Han, Y. Ning, X. Liu, X. (2008). A Framework for Time Series Forecasts, ISECS International Colloquium on Computing, Communication, Control, and Management. https://doi.org/10.1109/CCCM.2008.316

Zhang, J.E. Shu, J. (2003). Pricing S&P 500 index options with Heston's model, IEEE International Conference on Computational Intelligence for Financial Engineering.

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2022. All Rights Reserved.