QUALITATIVE CHARACTERISTICS AS A RELIABLE TOOL FOR ASSESSING THE QUALITY OF ACCOUNTING INFORMATION: AN OVERVIEW STUDY

Abstract

The accounting information contained in the financial reports is considered to be of a quality if it possesses a set of characteristics. Professional organizations have been concerned with the issuance of standards and the determination of characteristics related to the quality of accounting information. This paper aims to clarify the dependability on the qualitative characteristics of accounting information as an indicator of the quality of accounting information. The historical approach is used for the purpose of this study. The paper revealed that the qualitative characteristics of accounting information are a dependable indicator of the quality of accounting information and useful for decision-making.

Keywords

Qualitative Characteristics, Accounting Information Quality, Iasb, Fasb, Financial Reporting

INTRODUCTION

Many researchers have conducted extensive assessments on various facts surrounding the quality of accounting information. Accounting standards convergence, accounting standards harmonization, growth in disclosure requirements, economic crises, and other factors have produced an excessive focus on financial reporting. Furthermore, the emergence of accounting scandals in the early 21st century in the USA conspiracy by large audit firms being one of the main causes of this scandals have led to weaknesses in the quality of accounting information and lack of confidence in them. The products of accounting are financial reporting whose main objective is to supply useful information to interested parties. Based on that, this information should have qualitative characteristics to be useful for decision making (Obaidat, 2007). Another word, the qualitative characteristics of the information determinethe quality attributes that information should have. These characteristics are basic criteria for judging the efficiency, effectiveness, and quality of such information in achieving the desired objectives in the performance of its role in rationalization and decision-making (Salar, Timi, & G, 2006).

Therefore, it is essential to provide high-quality accounting information to influence users in making investment decisions, prediction, and to enhance market efficiency. The higher the quality of accounting information, the more vital is the benefits to be obtained by investors and users of the accounting information. Moreover, accounting information quality is a broad concept that does refer to the financial information included in financial reports that are useful for making decisions. Providing perfect methods for evaluating the quality of accounting information is another global demand. The ultimate objective of professional organizations is to generate high-quality standards in order to provide useful financial reports. In 2010, the joint venture between FASB and IASB developed a conceptual framework for financial reporting, which presented the qualitative characteristics of useful financial information (Alorabi & Qashi, ). The qualitative characteristics were divided into fundamental and enhanced characteristics. Fundamental characteristics were represented in relevance and faithful representation, while the enhanced characteristics were represented at comparability, verifiability, timeliness, and understandability.

This paper tries to answer the following question: Is the qualitative characteristics of accounting information a reliable tool for measuring the quality of accounting information? To answer the questions mentioned, the paper is divided into the following a review of the literature, theoretical framework, research methodology, discussion, and conclusion.

REVIEW OF LITERATURE

The decision-making process is an important step in business continuity, in order to make the right decisions, relevance and reliable information must be available in timeliness that can be compared with other sectors and understandability by its users. Several studies have discussed the characteristics of accounting information such as (Beest, Braam, & Boelens, 2009), (L. & Harbin: School Of Management, Harbin Institute Of Technology, P.R.China., 2007), (Obaidat, 2007), (Kallob & Buhaisi, 2013), (Kythreotis, 2014), (Tsoncheva, 2014), (Yurisandi & Puspitasari, 2015), (Junior, Caldeira, & Torrent, 2017), (Nobes & Stadler, 2015), (Mbobo & Ekpo, 2016), (AL-Shatnawi, 2017), (Al-dmour, Abbod, & Al-dmour, 2017), (Mbawuni, 2019).

(Jonas & Blanchet, 2000) developed a generally acceptable framework between management, auditors and audit committees to assess the quality of financial reports. The study found that FASB concept data represents the most advanced idea to date of the objectives and characteristics of good financial reporting.

(Obaidat, 2007) examined whether there is an existing gap regarding the importance of accounting information qualitative characteristics from a perspective of the investors` and external auditors` as they represent the independent part responsible for the financial reports. A study disclosed that there was an existing gap in terms of the qualitative characteristics of accounting information between the investors and external auditors.

(L. et al., 2007) conducted study aimed to try to determine the qualitative characteristics of accounting information and evaluate it based on a study of international accounting standards. The study concluded that reliability was the most representative of quality while comparing and relativity of accounting information is good.

In the light of assessing the quality of financial reports (Beest et al., 2009)

developed and tested a compound measurement tool to assess the quality of financial reports

through examining the fundamental and enhanced qualitative characteristics as specified in the Exposure Draft (IASB & FASB). The results showed that the measurement tool used in this study is a valid and reliable approach to assessing the quality of financial reports.

(Kallob et al., 2013) measured the quality of financial reports for the Palestinian banking sector by activating the qualitative characteristics of accounting information. The results showed that the reflection of the fundamental and enhanced qualitative characteristics in the financial reports was 66.1% and 70.8%, respectively.

(Kythreotis, 2014) created a quality financial statement based on the standards that were created by IASB. To achieve this objective, the basic qualitative characteristics (relevance and reliability) established by IAS committee were examined. The results revealed that there was an increase in relevance, while reliability appears to have remained unchanged.

(Tsoncheva, 2014) conducted a methodology for measuring and assessing the quality and usefulness of accounting information by determining the extent to which financial statements are consistent with the qualitative characteristics of accounting information issued by FASB and IASC in the conceptual framework, separately or totally. A study found that the qualitative characteristics identified in the conceptual framework (relevance, faithful representation, understandability, and comparability) can be used to measure the quality of accounting information.

(Yurisandi et al., 2015) assessed whether there has been an increase in the quality of financial reporting after the adoption of the IFRS utilizing the qualitative approach which was developed via the Nijmegen Centre for Economics (Nice) over the period 2009-2013 that represents the period before and after the adoption of the IFRS. The study concluded that the adoption of IFRS grown financial reporting quality. Especially, the results revealed that the qualitative characteristics as understandability, relevance, and comparability level have risen after adopting IFRS and the faithful representation level had a decreasing trend; while timeliness level had no changing in the period before and after IFRS adoption.

Similarly, (Junior et al., 2017) analyzed whether the adoption of IFRS has had an effect on the accounting information quality in brazil, the results revealed a positive impact of IFRS on the value relevance; and not found sufficient evidence toward timelines and conservatism

(Nobes et al., 2015) investigated the use of qualitative characteristics by company managers to assist them in making decisions by using publicly available data. The study found that comparability was more used, especially comparison regarding the type of industry, then that relevance, faithful representation, and understandability were important. In addition, there is a significant correlation between the use of qualitative characteristics and the scale of transparency of the country.

(Mbobo et al., 2016) clarified how the qualitative characteristics could be operationalized in the measurement of financial reporting quality in Nigeria. The results indicated that when focusing on the lower attributes of these key characteristics: relevance, faithful representation, comparability, understanding, verifiability, and timeliness the qualitative characteristics of financial reporting can be activated. In addition, the respondents realized that faithful representation and relevance have a greater potential of enhancing the financial reporting quality.

(AL-Shatnawi, 2017) found out the effect of the primary qualitative characteristics and secondary qualitative characteristics of the accounting information on the quality of the interim financial reports. A study revealed that both primary and secondary qualitative characteristics of the accounting information have a statistically significant effect on the quality of the interim financial reports.

(Al-dmour et al., 2017) applied empirical study on the reliability of the proposed relationship between the qualitative characteristics of financial reporting and performance of non-financial business via the moderating role of the characteristics of organizational demographics (type, experience, and size).A study found that all components of the quality of financial reporting (relevance, faithful representation, Understandability, comparability, and timeliness) are relevant in predicting financial and non-financial performance.

(Mbawuni, 2019) assessed the extent to which senior and middle management perceives the quality of accounting information for companies in Ghana. After adopting the IFRS, a five- dimensional survey was developed based on the NiCE quality scale. The results indicated that the upper and middle management, in general, perceives that the qualitative characteristics of companies are very good. In addition, there are differences in the respondents' perception of the quality of accounting information according to the characteristics of their work background.

Additionally, it was found that the evaluation of professional accountants working in upper and middle management was more important.

THEORETICAL FRAMEWORK

ACCOUNTING INFORMATION QUALITY

Quality refers to the credibility of the accounting information that is contained in the financial reports and the degree of its benefit to users. In order to achieve this, it must be free from distortion and misleading. Also, it must be prepared in light of a set of legal, directorial, professional, and technical standards in order to achieve the purpose of its use (Alsalim, Amin, & Youssef, 2018). Similarly, Information refers to data that has been properly processed to give full meaning to a user, enabling them to be used in ongoing and future decision-making processes (Mohammed, 2014). Information is defined as a collection of facts that have been organized and processed to provide meaning to users, and it useful in a decision-making activity (Fitriati & Mulyani, 2015). In the same context, Information quality is conceptualized as an intrinsic quality that information itself owns; regardless of situation and context. So, it is supposed that information quality can be evaluated based on an assessment of the information itself (Mai, 2013). Additionally,Gustavsson and Wänström (2009) via (Alshikhi & Abdullah, 2018) defined information quality as the ―ability to satisfy stated and implied needs of the information consumer‖. The customer refers to users.

Accountancy is "the art of communicating financial information about a business entity to users such as shareholders and managers" (Elliott & Elliott, 2017). Accounting is called the language of business, it's an information and measurement system that identifies, records, and communicates relevant, reliable, and comparable information about an organization’s business activities to external and internal users for making better decisions (Wild, Shaw, & Chiappetta, 2014).Accounting information denotes the data collected, measured, summarized, tabulated and presented in the financial statements to enable its users to evaluate and make decisions (Dalal & Nouraddin, 2016). Accounting information is a set of data that is processed to obtain the final product is information; it’s done by the accounting processing. Accounting information must be characterized by a set of characteristics in order to be useful and can be used by external and internal users (Al-Gazwi & Alhiali, 2010).

The accounting information quality refers to the informativeness of reported numbers, the level of disclosure, and the degree of compliance to generally accepted accounting standards (Cascino, Pugliese, Mussolino, & Sansone, 2014). (Kukah, Amidu, & Abor, 2016) They mentioned the accounting information quality refers to the extent to which accounting information accurately reflects the current operating performance of a company and the usefulness of the current figures in predicting the future performance of the firm. As well, (Alsalim et al., 2018) said the quality of accounting information indicates those characteristics that should assign the useful accounting information that is useful for the preparation of financial reports, because of its role in evaluating the quality of information that results from the application of accounting methods. The quality of accounting information refers to the attributes which accounting information should own for satisfying their users' needs.

External users of accounting information are those who do not directly participate in the management and operation of the firm and have limited access to it, and they use the information to assist in the decision-making process. Includes shareholders (investors), customers, lenders, suppliers, regulators, brokers, lawyers, the press and others. Internal users of accounting information are those who participate directly in the management and operation of the firm's, and they use the information to help improve the efficiency and effectiveness of the performance, such as chief executive officer, chief audit executive, chief financial officer, Treasurer, and other executive and managerial-level staff (Alasbahi, 2016).

CONCEPTUAL FRAMEWORK & QUALITATIVE CHARACTERISTICS OF ACCOUNTING INFORMATION

IASB and FASB are working on a joint project to develop a common conceptual framework. Aim to build on and relate to an established body of concepts and objectives, provide a framework for solving new and arising practical problems, improve financial statement users' understanding of and confidence in financial reporting, and increase comparability among companies' financial statements.

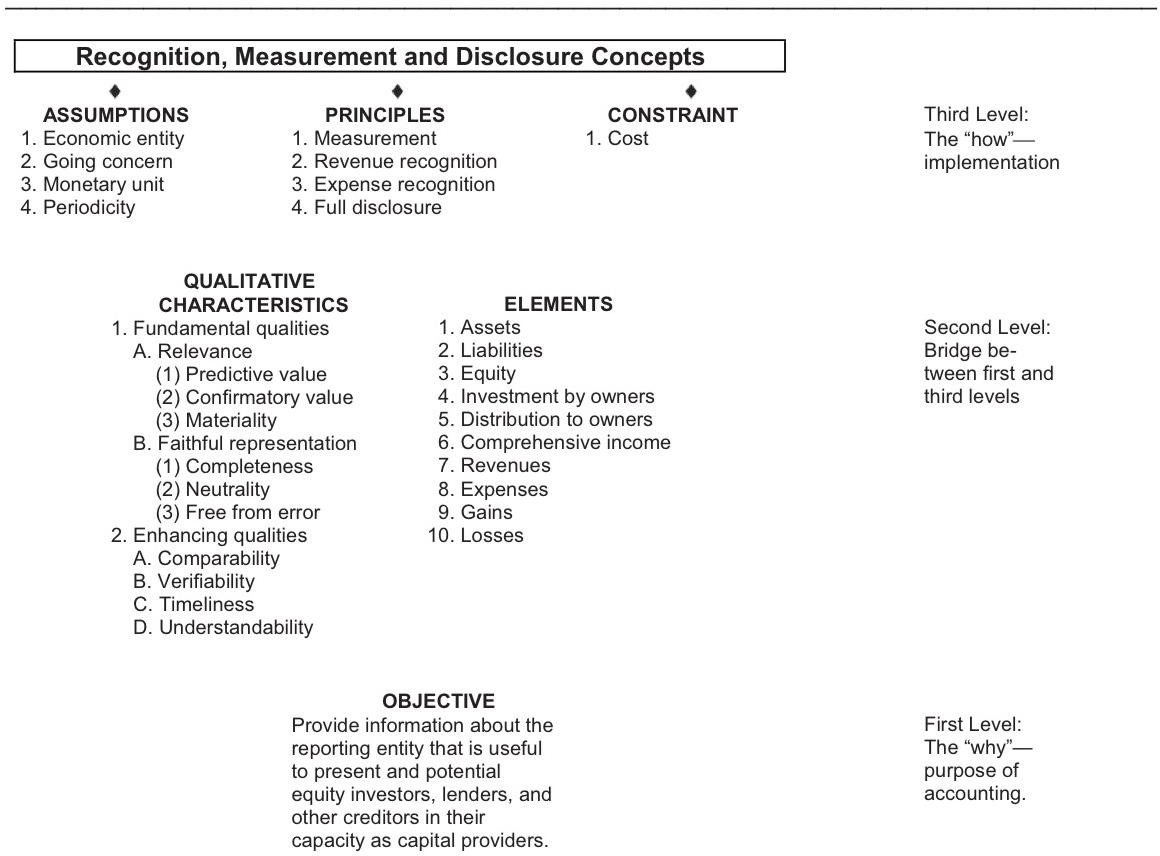

A conceptual framework contains three levels (Figure 1 ). The first level identifies the objective of financial reporting—that is, the purpose of financial reporting. The second level provides the qualitative characteristics that make accounting information useful and the elements of financial statement (assets, liabilities, revenues, expenses and so on). The third level identifies the recognition, measurement, and disclosure concepts used in establishing and applying financial accounting standards and the specific concepts to implement the objective. These concepts include assumptions, principles, and a constraint that describe the present reporting environment.

According to FASB and IASB (2010), qualitative characteristics are those attributes that make financial information useful. In other words, the qualitative characteristics of the accounting information imply the quality attributes that accounting information should have in order to be useful to its users'. Qualitative characteristics are considered as a bridge between the objective of financial reporting and the concepts of recognition, disclosure, and measurement.

Qualitative characteristics are either fundamental or enhancing characteristics, according to how they influence the decision-usefulness of information. Apart from classification, every qualitative characteristic contributes to the decision-usefulness of financial reporting information. However, providing useful financial information is limited by a constraint on financial reporting, cost should not exceed the benefits of a reporting practice.

The following is a brief description of the elements of fundamental and enhanced quality mentioned by (Kieso et al., 2013):

-

Relevance: capable of making a difference in a decision (because the information has predictive value, confirmatory value, or both).

-

Predictive value: helps investors to form their own expectations about the future.

-

Confirmatory value: relevant information with confirmatory value helps users to confirm or correct prior expectations.

-

Materiality: Is a company-specific aspect of relevance; information is material if omitting it or misstating it could influence decisions that users make on the basis of the reported financial information. Both the nature and/or magnitude of the item(s) to which the information relates must be considered; thus, the relative size and importance of an item must be evaluated. An immaterial item need not be separately disclosed.

-

Faithful representation: numbers and descriptions match what really existed or happened. Faithful representation is necessary because a user does not have the means to evaluate the factual content of the information. The information must be complete, neutral, and free of material error.

-

Completeness: all the information that is necessary for faithful representation is provided. An omission can cause the information to be false or misleading.

-

Neutrality: a company cannot select information to favor one set of interested parties over another. Information presented in financial statements must be unbiased.

-

Free from error refers to the information will be more accurate when it's free from error. The faithful representation does not indicate total freedom from error, because the most financial reporting measures involve estimates of different types that incorporate the management’s judgment. Like, determine depreciation expense and bad debt expense.

-

Comparability: information that is measured and reported in a similar manner for different companies is considered comparable and enables users to identify the real similarities and differences in economic events between companies. Consistency is a type of comparability and is present when a company applies the same accounting treatment to similar events, from period to period.

-

Verifiability: occurs when independent measurers using the same methods, obtain similar results. An example of direct verification is where two independent auditors count the inventory items on hand and arrive at the same physical quantity amount. An example of indirect verification is where two independent auditors compute the ending inventory value by using the FIFO method. Verification here may occur by checking the quantity and costs (inputs) and recalculating the ending inventory (the output).

-

Timeliness: having information available to decision-makers before it loses its capacity to influence decisions. Having relevant information available sooner can enhance its capacity to influence decisions.

-

Understandability: for information to be useful, there must be a connection (linkage) between users and the decisions they make. This link, understandability, is the quality of information that lets reasonably informed users see its significance. Understandability is enhanced when information is classified, characterized, and presented clearly and concisely.

|

Elements |

Definition |

|

Cost |

Overall constraint on the amount of information decision-makers will get. |

|

Relevance |

capable of making a difference in a decision |

|

Predictive value |

Information that can aid to predict the future |

|

Confirmatory value |

Confirms (or dis-confirms) user's expectations |

|

Materiality |

Degree of omission or misstatement of information on its users. |

|

Faithful Representation |

The ability to count on the information, it's referring to what happened. |

|

Completeness |

The degree to which information covers data about every relevant event or object |

|

Neutrality |

Reasonably free from bias |

|

Free from error |

Containing no mistakes; faultless |

|

Comparability |

Can be compared to a benchmark |

|

Verifiability |

It can be extracted independently from the same underlying data. |

|

Timeliness |

Availability before the point of need |

|

Undersandability |

presentation as a familiar form, and it makes sense to the user |

ROLE OF PROFESSIONAL BODIESIN FORMALIZATIONOF QUALITATIVE CHARACTERISTICS

The final goal of professional organizations is to produce high-quality standards in order to supply useful financial reports (Mohammed, 2017). Professional organizations were concerned with the issuance of standards and the determination of the characteristics related to the quality of accounting information, the most important of these organizations are but not limited: Governmental Accounting Standards Board (GASB), International Public Sector Accounting Standards Board (IPSASB), Australian Accounting Standards Board (AASB), Canadian Institute of Chartered Accountants (CICA), International Accounting Standards Committee (IASC), Accounting Standards Steering Committee -UK (ASSC), Financial Accounting Standard Board (FASB), and International Accounting Standards Board (IASB). From Table 2 , it noted that the characteristics of relevance, understandability, and comparability were accepted by most professional organizations, In addition, to faithful representation, reliability, timeliness, verifiability, and completeness less acceptance.

|

CHARACTERISTICS |

GASB |

IPSASB |

AASB |

CICA |

IASC |

ASSC |

CF joint project IASB – FASB |

|

Relevance |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

Understandability |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

Comparability |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

Timeliness |

✓ |

✓ |

– |

– |

– |

✓ |

✓ |

|

Consistency |

✓ |

– |

– |

– |

– |

– |

– |

|

Reliability |

✓ |

– |

✓ |

✓ |

✓ |

✓ |

– |

|

Faithful representation |

– |

✓ |

– |

– |

✓ |

– |

✓ |

|

Verifiability |

– |

✓ |

– |

– |

✓ |

– |

✓ |

|

Predictability Value |

– |

– |

– |

– |

✓ |

– |

– |

|

Confirmatory Value |

– |

– |

– |

– |

✓ |

– |

– |

|

Completeness |

– |

– |

– |

– |

✓ |

✓ |

– |

|

Objectivity |

– |

– |

– |

– |

– |

✓ |

– |

RESEARCH METHODOLOGY

The study adopted the secondary data and historical approach by reviewing the literature in some pioneered accounting journals, dissertations, and papers at both English and Arabic sourced, which related to the study topic.

DISCUSSION

This study aimed to discuss the level of reliance on qualitative characteristics as a method for measuring and evaluating the quality of the accounting information contained in the financial reports. The study showed that the most acceptable characteristics are relevance, reliability, faithful representation, understandability, comparability, timeliness. Similarly, the most acceptable characteristics by professional bodies as indicated are the relevance, understandability, and comparability, followed by reliability and faithful representation (the results of the Joint Venture, that issued by FASB and IASB in 2010, they amended the reliability to faithful representation), as well as the verifiability, timeliness, etc. In light of these indicators, it is clear that what the researchers have done is based mainly on what the professional organizations have done. Therefore, the availability of these characteristics in the information gives it quality. Hence, it can be assumed that the qualitative characteristics are an appropriate indicator of assessing the quality of information.

CONCLUSION

The qualitative characteristics are an appropriate indicator of assessing the quality of accounting information. There is no doubt that companies seek to produce high-quality financial reports that help their various users to appreciate the value of these economic units thereby making wise, efficient, and effective decisions. Professional organizations have played a prominent role in establishing and developing accounting standards to produce quality information and have created indicators to assess this quality through the availability of a set of qualitative characteristics in this information. This paper is of practical and valuable importance for educating managers, investors, and other users about the qualitative measures of the quality of accounting information based on the qualitative characteristics of the useful financial information described in the conceptual framework for financial reporting. The study recommends that experimental studies are needed to assess the availability of these characteristics in different sectors.