THE EFFECT OF GOVERNMENT POLICY AND STRATEGIC HUMAN RESOURCE COMPETENCY ON ORGANIZATIONAL PERFORMANCE IN OPTIMIZATION OF TAX REVENUE FOR E-COMMERS ENTREPRENEURS IN GOOD CORPORATE GOVERNANCE mediated COVID-19 PANDEMIC

Nahruddien Akbar 1![]() , Yuzwar Z Basri 2, Kusnadi 3

, Yuzwar Z Basri 2, Kusnadi 3

1,2,3 Faculty

of Economics, University Trisakti Jakarta, Indonesia

|

|

ABSTRACT |

||

|

The purpose of this study is to support potential tax revenue for e-commerce-based entrepreneurs, the Directorate General of Taxes must carry out comprehensive reforms in modernizing taxation to improve services to taxpayers, and every tax officer has good tax knowledge by receiving education and training from various sources. sources and have a business understanding and knowledge of the needs of taxpayers in relation to tax obligations The research design and method used in this research is hypothesis testing. This research is a quantitative non-experimental, using a questionnaire given to 135 respondents. This research was conducted at the Tax Service Office and Online-Based Digital Company – E-commerce. Data analysis used SPSS and PLS.3.29 software with the multivariate Structural Equation Model (SEM) analysis method. The results of

this study indicate that: The influence of Government Policy, Strategic Human

Resource Competency on Good Corporate Governance is positive and significant.

The effect of Good Corporate Governance on Organizational Performance is

positive and significant. The influence of Good Corporate Governance is

mediating Government Policy, Strategic Human Resource Competency on

Organizational Performance is positive and significant. It means that the

higher/positive mediation of Good Corporate Governance on Government Policy,

Strategic Human Resource Competency, the higher/positive Organizational

Performance. Theoretical implications: Good Corporate Governance as a

mediating against Government Policy, Strategic Human Resource Competency is

able to improve Organizational Performance, by improving Good Corporate

Governance through increasing its dimensions will be able to improve the

Organizational Performance of the Tax Service Office. |

|||

|

Received 19 May 2022 Accepted 28 June 2022 Published 13 July 2022 Corresponding Author Nahruddien

Akbar, DOI 10.29121/granthaalayah.v10.i6.2022.4681 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2022 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Government Policy, Strategic Human

Resource Competency, Good Corporate Governance, Organizational Performance |

|||

1. INTRODUCTION

In the current state of the COVID-19 pandemic, people who are accustomed to conducting conventional transactions will switch to online transactions, which can result in the number of conventional business actors decreasing. If this happens, the government will experience a decrease in the results of taxing conventional businesses, which will automatically affect the tax revenue target of conventional business actors.

Facing such conditions, the Government, in this case the Directorate General of Taxes - Ministry of Finance, continues to explore potential tax revenues in the midst of the COVID-19 pandemic, one of which is the plan to tax domestic and foreign e-commers-based entrepreneurs. In order to support the potential for tax revenue for e-commerce-based entrepreneurs, the Directorate General of Taxes must carry out comprehensive reforms in modernizing taxation to improve services to taxpayers, and every tax officer has good tax knowledge by receiving education and training from various sources and has a business understanding. as well as knowledge of the needs of taxpayers in relation to tax obligations. Andhika and Johan (2019) Munthe and Syauqi (2020)

In addition, tax officials and officers must be open in serving taxation so that there is no abuse of authority and position that can lead to acts of corruption, collusion and nepotism with taxpayers that can harm the state. Some tax officials and employees are not open in serving taxation, this has an impact on taxpayers' losses and losses for the state.

The development of the internet today has made it easier for all businesspeople to transact without the need to meet in person. This convenience is due to the existence of a container in the form of an application that provides digital transaction facilities. The e-commerce platform has efficiently connected customers to access information about marketed products. According to data from the Association of Internet Service Providers in Indonesia (AAJII), there are a number of internet users up to around 171 million or around 64.8% in 2019 (BPPSDM 2019). In 2020 the number of internet users in Indonesia is 196.7 million as of the second quarter of 2020. This condition can be an opportunity for start-ups. Kusnandar (2021a)

This trading system provides many benefits for the perpetrators. In addition, it raises the challenge of being able to improve the efficiency of life and its quality (Sri 2018). Technology will make everything easier, but on the other hand, dependence on computers and smartphones is getting higher too. In 2014, Euro monitor confirmed that Indonesia's digital trade turnover had reached approximately US$1.1 billion. This is supported by BPS census data which also states that around a period of 10 years this business has increased by 17 percent Kusnandar (2021b) The results of Jayani's Economy SEA research, (2020) also state that in Indonesia the development of digital business has reached Rp. 391 trillion. Where this figure is the largest number for the Southeast Asia region to reach 49% of its contribution.

However, the potential for taxation in Indonesia from the type of e-commerce business to date has not been carried out effectively, because the existing tax policy has not been able to become a tool for taxing tax subjects from e-commerce market players, this is due to e-commerce system transactions. -Commerce is difficult to know (invisible trader). In this case, regulation is one of the tools used to carry out the taxation process, but the instruments needed to tax e-commerce cannot use the same instrument to tax conventional businesses, even though the existing regulations consider the two objects to be the same. Therefore, the Directorate General of Taxes must deregulate or improve regulations without having to cause inequality and injustice among business actors. From some of the problems faced above, it can be ascertained that this will lead to ineffectiveness and even the inability of the Directorate General of Taxes to explore tax potential among e-Commerce business actors Hadya (2019)

According to Hidayah (2021) stated that the potential for digital development greatly affects the online shopping model carried out by the millennial generation. The millennial generation prefers to look for price lists that can be compared, discounts, features to be considered in determining product purchases Saragih (2020) The development of the internet has significantly impacted the development of online business. With the ease of internet access, online shops have sprung up or more commonly called online shops. With the increasing number of internet users, it certainly affects the increase in the number of trades, which in turn raises problems in the financial sector, namely, how to apply taxes for this business Zuraya (2020)

The regulation of online trade or e-commerce policies has been carried out in 2013 through the regulation of the Director General of Taxes number 62 of 2013. However, the circular letter has not comprehensively regulated online trade transactions. In the end, the regulations regarding Value Added Tax (PPN) and Income Tax (PPh) have not been implemented. Next, after the rapid growth of e-commerce transactions, the government issued regulation 210/PMK.010/2018 djpb.kemenkeu (2019)

This regulation states that digital businesses are required to comply with the rules regarding income tax and value added tax. However, on March 29, 2019, through the website Kemenkeu.go.id, the Minister of Finance Sri Mulyani cancelled regulation number 210 of 2018 and then issued PMK 32 PMK.010/2019. Thus, businesspeople who have a turnover of up to IDR 4,800,000,000 are subject to a rate of half a percent (0.5%) on their turnover.

Several previous research results indicate that there is a positive impact or development of digital transactions on state tax revenues. One of them was carried out by Pangesti who showed the impact of e-commerce on state tax revenues Pangesti (2017). However, there are still some obstacles in e-commerce, namely not many taxpayers in depositing their tax obligations. Next is a study conducted by Lestari which examines the benefits of using internet facilities in business. The results show that a competitive company is a company that is ready to apply its technological capabilities in its business system Suharsono and Indaryani (2020)

E-commerce is one of the media to increase sales and turnover and maintain the level of business competition. Digital transactions are highly developed in Indonesia Bhatti et al. (2020) So far, many actors offer goods using the internet. The value of e-commerce transactions is very high and can reach the maximum. Of course, it will be a loss for the government not to take advantage of this opportunity. The government needs to make regulations as other countries have harmonized to collect taxes on this transaction.

Another study examines the behaviour of online businesspeople in recording their online transactions. Other results of research prove that the e-commerce variable and the level of compliance of business actors have a positive influence on tax revenue Bhatti et al. (2020) E-commerce is related to the level of taxpayer compliance. Then the e-commerce variable has a high level of influence on tax payments mediated compliance variable. To get e-commerce taxes, the government needs to be active and concerned with the growth of this business. By exploring the potential of e-commerce taxes, of course, it will be very beneficial for development and realize justice for all businesspeople in any form. Koe and Sakir (2020)

The phenomenon that occurs in this case is the limited comprehensive research in the field of taxation related to the influence of Government Policy and Strategy Human Resource Competency Potential taxes that will be received from digital business types, especially e-commerce on tax revenues. Based on the results of previous research studies, it is concluded that the development of technology that uses digital in transactions has a fairly large and significant impact on state tax revenues. To capture the potential revenue from digital trade, more serious and organized regulatory efforts from the government are needed.

The novelty or novelty in this research is, in addition to the Strategic Human Resources Competency factor, in this study, Good Corporate Governance also wants to see its impact on Organizational performance. This is related to the findings from Padoli (2019) that Good Corporate Governance can create a new approach to continuous improvement that leads to an increase in Organizational Performance.

2. LITERATURE REFERENCES

This research tries to develop theories about Government Policy, which are policies developed by government agencies and officials, which state that they can be done or not done Tertychka (2021) Strategic human resources competency, which was carried out for the development of the Knight (2015) Mainga (2017) there are many opinions from experts who develop Strategic human resources competency, especially to carry out the full duties and responsibilities of each individual. Raut et al. (2020) Likewise with the theory of Good Corporate Governance Padoli (2019) because Good Corporate Governance requires an element of professionalism from government officials in providing public services. Professionalism here puts more emphasis on the ability, skills, and expertise of government officials in providing responsive, transparent, productive, and efficient public services.

Government Policy is a process of action of a policy by the government or the holder of power that has an impact on the wider community. So that the impact can bring good changes for the progress of an institution or organization. Government policies are policies developed by government agencies and officials, which state whether they can be done or not done Tertychka (2021) Before discussing good governance further, it should be noted that governance has a different understanding from government. Many assume that the two terms have the same meaning, namely when good governance is achieved, good governance will also be realized. Warsito Utomo explained that the difference is that in the nuances of a monolithic, centralized politics, government is a government that relies on an authority that shows management with the highest authority. The government or government or state becomes the sole agent that dominates all government and development activities. Whereas in governance, government rests on compatibility or harmony between various components or groups or forces that exist within the State. In good governance, there is a synergy between the three existing actors, namely the government itself (public), the community (community or civil society) and the private sector (private). Each actor knows clearly and precisely his purpose (purpose), role (role) and direction (direction).

In other words, governance is more directed to the understanding that power is no longer solely a government affair, but more emphasis is placed on the mechanisms, practices and procedures of the government and citizens to manage resources and seek and formulate problem solving for public problems. In this governance context, the government is positioned as one of the actors who is not always the determinant. It is even possible for non-governmental institutions to play a dominant role in this governance. According to the United Nations Development Program (UNDP)11, the term governance denotes a process that positions the people to regulate their economy, institutions, and social and political resources not only for development, but also to create cohesion, integration, and for the welfare of the people. Good governance which in Indonesian can be interpreted as good governance is the dream of many countries in the world, including Indonesia. But to make it happen is not an easy thing. Chavarría et al. (2020)

Strategy Human Resource Competency, Amir et al. (2019) stated that “strategy” is about making choices Kaliappen and Hilman (2017) It is a way of ensuring a sustainable competitive advantage by investing the necessary resources to develop key capabilities that lead to superior long-term performance. Furthermore, Amir et al. (2019) stated that according to Bettis et al. (2014) organizational strategy is sometimes defined normatively and sometimes descriptively. Amir et al. (2019) stated that organizations use strategies to deal with environmental changes when presenting a combination of solutions for various internal and external circumstances of the organization.

Good Corporate Governance, according to Padoli (2019) efforts to realize it require an element of professionalism from government officials in providing public services. Professionalism here puts more emphasis on the ability, skills, and expertise of government officials in providing responsive, transparent, productive, and efficient public services. Watimena (2020) in his research also said that managers in companies have a role in regulating or controlling debt levels, issued by companies, so that they can improve company performance, this is also the same with tax service leaders and staff.

Organizational Performance, the factors that affect Performance, include: First; effectiveness and efficiency. If a certain goal can finally be achieved, it means that the activity is effective, but if the consequences are not sought, the activity is considered important from the results achieved so that it results in satisfaction even though it is effective, it is called inefficient. On the other hand, if the desired result is not important or trivial, then the activity is efficient. The second is the factor of authority (authority). Authority is the nature of a communication or order in a formal organization that is owned by a member of the organization to another member to carry out a work activity in accordance with his contribution Boukamcha (2019) While the third is discipline. Discipline is obedience to applicable laws and regulations. Employee discipline is the activity of the employee concerned in respecting the work agreement with the organization where he works. Fourth, namely initiative, related to thinking and creativity in forming ideas to plan something related to organizational goals Schuldt and Gomes (2020) Organizations that want to give birth to the benefits of their intellectual capital, then the role of human capital should be seen as a strategic resource, because only humans can create knowledge. Organizations should pay attention to the dimensions of knowledge and the differences in value creation activities related to human capital as a superior resource for the organization.

3. METHODOLOGY

The type of data used in this study is the type of subjective data. The type of subjective data is the type of data in the form of opinions or opinions from research respondents on the questionnaires that have been distributed. The data sources used are primary data sources where primary data is data obtained directly through distributing questionnaires to respondents.

In this research, the data collection method used is a field study method with a questionnaire distribution technique which is done by giving a set of questions or written statements to the respondents, as well as observations made directly to the research objects, especially those concerning the variables studied.

Questionnaires were distributed to respondents who are Leadership officials at the Directorate General of Taxes and Management and Leaders and Digital Companies that use E-commerce services.

The number of samples in this study that was successfully obtained would be respondents, using primary data and distributing questionnaires directly. Individuals who meet the requirements to be selected as respondents are those who meet the following criteria:

1) The current position in the organization where you are serving is the minimum as a policy maker.

2) Work experience in the Organization for a minimum of five years.

3) The current length of service is a minimum of two years.

4) 4Minimum education is Strata one or its equivalent.

The above criteria are made with the assumption that the respondent already has sufficient and relevant knowledge of the defense organization. In addition, it is also assumed that the respondent is sufficiently familiar with the object of research so that data related to the object of research can be obtained through the respondent. The criteria for determining the number of samples are based on considerations of the use of the analytical tools to be used. In this study, we will use a structural equation model or Structural Equation Modeling (SEM) as an analysis. A minimum sample size of 100 will be used as a benchmark referring to Wijayanto (2015) which states that a minimum sample size of 100 is sufficient to be used to estimate the model.

3.1. POPULATION AND SAMPLE

The population involved as objects in this research is the Inspectorate General of Taxes which involves Officials at the Tax Service Office as well as Directors and Leaders in Digital Companies related to Tax Digital Information Technology. There are approximately 150 officials who fall into the category of leadership and Echelon 1, Echelon II and Echelon III who can make decisions from each division or directorate, as well as Digital Company Directors. The sample in this study is random or probability, that is, where the selected population elements have the same opportunity to be selected. The method of collecting and determining the sample is used purpose sampling. The method used with certain criteria is in accordance with the needs in the study Hair et al. (2015)

From this amount, this research will take a sample of respondents from the category of leaders who can make decisions. The results of these respondents are planned to be processed using SMART PLS/SEM. Primary data collection in this study was carried out through a survey process. The survey was conducted using a questionnaire instrument. Questionnaires are the most commonly used data collection instrument in business research Cooper and Schindler (2014) The questionnaire made did not ask for the name of the respondent and the company where he worked to ensure that the respondent gave an objective answer. The cover letter also states that the data collected will be kept confidential and for academic purposes only, so to ensure its representation the probability sampling technique chosen is stratified random sampling.

The method that can be referenced to get the sample size is according to the Krejcie and Morgan Table

4. RESULT AND DISCUSSION

Based on Krejcie and Morgan's formulas and tables with a population of 150 to 200, the minimum sample size for the population is 108 to 132. The questionnaires were distributed to 150 respondents who are Decision Making Officers of the Directorate General of Taxes, especially in the Tax Service Office as well as Directors and Management decision makers. Decisions on Digital Companies. The number of samples in this study that were successfully obtained were 135 respondents, using primary data and direct distribution of questionnaires.

Descriptive statistics is a process that can be carried out in research data in tabulated form so that it can be easily understood and interpreted. Descriptive statistical data analysis aims to analyse data by summarizing and describing numerical data regarding gender, age, status, income. Manurung (2018) That male respondents were 88 people (65.2%), and female respondents were 47 people (34.8%). These results indicate that there are more men who serve as leadership officers at the Directorate General of Taxes and Management and Leaders and Digital Companies that use E-commerce services compared to female respondents. That the age of 21-30 (23.7%) with 32 respondents indicating a career age that has just entered the stage of young leadership, many of whom come from millennials in the digital field, ages 31-40 (47.4%) indicate the stage of starting to reach maturity. leadership and echelon officials as many as 64 officials where at this age careers and positions enter very productive periods and are in the process of high enthusiasm in working, followed by the age of 41-50 (25.2%) with 34 people, aged entering a period of loyalty at work where the leaders and echelon officials are very experienced with their work. At the age of 51 years and above is the age that is very beginning to enter retirement at work because a long-standing career has been very developed and has reached the top position which shows that decision makers are very well established and at a very mature age to show quality work, especially as company leaders and employees. Echelon. Respondents in this study also have different levels of education.

The results of the reliability test to see the value of Cronbach's alpha and composite reliability. Terms for the value of all variables, the dimensions for Cronbach's alpha and composite reliability are 0.7. If the final results for Cronbach's alpha and composite reliability have reached a value of 0.7, then the test for the Inner model or the second stage of testing of all research variables can be continued, from the reliability test results in Table 1

Table 1

|

Table 1 Reliability Test Results |

|||

|

Variabel |

Dimensi |

Cronbachs

Alpha |

Composite

Reliability |

|

Government

Policy |

Transparency

Participation Accountability Coordination |

0.882 |

0.910 |

|

Strategic

Human Resource Competency |

Attitude

Knowledge Skills |

0.939 |

0.949 |

|

Good

Coorporate Governance |

Accountability

Responsibly Indepedency Fairness |

0.770 |

0.780 |

|

Organizational

Performance |

Future

Orientation, Profitabilitas, Diversity |

0.726 |

0.810 |

|

Source Processed data (2022) |

|||

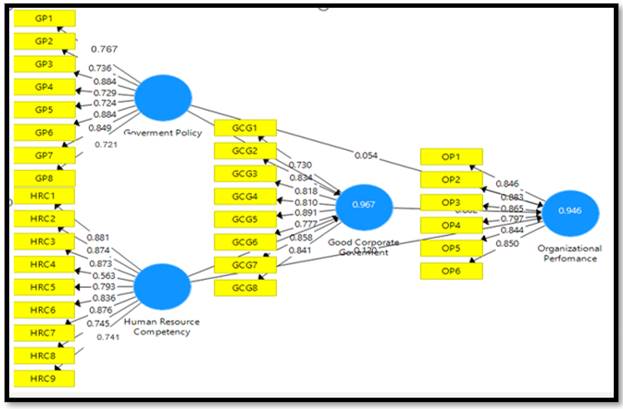

Structural model testing can be evaluated by looking at the R-square model for each endogenous latent variable as the predictive power of the model. The path coefficient value for endogenous variables was assessed for significance based on the T-statistic or P-Value value. If all these conditions have been met, the results of the PLS Bootstrapping will be obtained. The results of testing the structural model can be seen in Figure 1 below:

Figure 1

|

Figure 1 PLS Bootstrapping Results Display Source Processed

data (2022) |

The results of hypothesis testing of the influence of each variable are as follows:

H1. Government Policy has a T-Statistic value of 16,460 > 1.96 and a P-Value of 0.000 < 0.050. This figure shows that Government Policy has a significant positive effect on Organizational Performance.

H2. Strategic Human Resource Competency has a T-Statistic value of 1.976 > 1.96 and a P-Value of 0.000 < 0.050. This figure shows that Strategic Human Resource Competency has a significant positive effect on Organizational Performance.

H3. Good Corporate Governance has a T-Statistic value of 2.206 > 1.96 and a P-Value of 0.000 < 0.050. This figure shows that Good Corporate Governance has a significant positive effect on Organizational Performance.

H4. Government Policy has a T-Statistic value of 6992 > 1.96 and a P-Value of 0.000 < 0.05. This figure shows that Government Policy has a significant positive influence on Good Corporate Governance.

H5. Strategic Human Resource Competency has a T-Statistic value of 2.900 > 1.96 and a P-Value of 0.000 < 0.050. This figure shows that Strategic Human Resource Competency has a significant positive influence on Good Corporate Governance.

H6. Good Corporate Governance has a T-Statistic value of 1,966 > 1.96 and a P-Value of 0.000 < 0.050. This figure shows that Good Corporate Governance has a significant positive mediating effect on Government Policy on Organizational Performance.

H7. Good Corporate Governance has a T-Statistic value of 2.559 > 1.96 and a P-Value of 0.000 < 0.050. This figure shows that Good Corporate Governance has a significant positive mediating effect on Strategic Human Resource Competency on Organizational Performance.

5. CONCLUSION

The results of this study provide a conclusion that in general, Government Policy and Strategic Human Resource Competency are variables that affect Good Corporate Governance as a mediating variable. Likewise, Good Corporate Governance has a good influence on Organizational Performance, as well as on the Good Corporate Governance variable as a mediation on the Government Policy and Strategic Human Resource Competency variables. Human Resource Competency has a strong influence on the Organizational Performance of the Tax Service Office and also Digital Companies that use e-commerce services. The conclusions based on the research objectives are as follows:

1) Government Policy has a positive effect on Organizational Performance, illustrating that organizational policies at the Tax Service Office greatly affect the policies set by the government, this can affect all echelon officials in making decisions so that they are able to provide maximum policy in maintaining decision levels. Strategic steps taken can help improve organizational performance Tarifa-Fernández et al. (2019)

2) Strategic Human Resource Competency has a positive effect on Organizational Performance. This positive effect gives the conclusion that Strategic Human Resource Competency is able to demonstrate good competence on organizational performance, which is the goal of the State Tax Service Office in producing quality resources, as well as good capabilities so that the direction of of quality must meet the dimensions that are the reference for the quality of organizational performance, this is still the main task if the Tax Service Office wants to continue to be a quality institution. Wright et al. (2018)

3) Good Corporate Governance has a positive effect on Organizational Performance. This shows that collaboration with the government is a good influence for any performance management system, especially those applied to tax service offices and e-commerce companies Rahman et al. (2018) The expectation of each performance is able to be the best, that good corporate governance has a significant influence on organizational performance.

4) Government Policy has a positive effect on Good Corporate Governance. This means that the development of government policies in a very strong strategy will make the government's experience even better. Opinion Rahman et al. (2018) also says that Government Policy has an influence on Good Corporate Governance. Gangurde and Chavan (2016) The Tax Service Office and e-commerce companies can realize the objectives of the policy so as to provide maximum measurable organizational quality.

5) Strategic Human Research Competency, which has a positive effect on Good Corporate Governance, illustrates that Strategic Human Research Competency at the Tax Service Office can influence the results of the policies provided by the Government and related agencies, so that all echelon officials in making decisions are able to provide policies maximum in maintaining the level of problems and very influential on organizational performance Tarifa-Fernández et al. (2019)

6) Good Corporate Governance mediates or influences Government Policy on Organizational Performance, this shows that this illustrates that government policy affects organizational performance, then Good Corporate Governance as a mediation will further increase the positive influence of Government Policy on the performance of the Tax Service Office. Good Government Policy will bring good quality as well for an organization that maximally develops all aspects for organizational progress in the development of the e-commerce field. Dong et al. (2019)

7) Good Corporate Governance mediates or influences Strategic Human Research Competency; on Organizational Performance this shows that the existence of government policies that mediate Strategic Human Research Competency provided by the tax service office can increase the influence on the performance of organizational officials in understanding E-commerce. Good organizational performance will have a maximum impact on the progress of the Tax Service Office in each section, in taking a policy of readiness in synergy to create organizational performance.

Based on the results of the research conducted, the theoretical implications related to the development of competency theory, policies and organizational performance from Government Policy and Strategic Human Research Competency mediated by Good Corporate Governance on the Organizational Performance of the Tax Service Office are as follows:

1) Government Policy and Strategic Human Research Competency. The results of this study strengthen the positive and significant influence of Government Policy and Strategic Human Research Competency on Good Corporate Governance of the Tax Service Office in line with previous research. Zaremba et al. (2021)

2) Good Corporate Governance as a mediating for Government Policy and Strategic Human Research Competency is able to improve the performance of the Tax Service Office. Dong et al. (2019)

3) The results of the study conclude that the existence of Good Corporate Governance through increasing its dimensions will be able to improve organizational performance, can increase the trust and loyalty of related parties. Improvement and development of the quality of human resources must first, pay attention to policies and synergy. Development will give a good indication of the organization.

4) This research provides an update on the development of the influence of Good Corporate Governance as well as Government Policy. Organizational Performance in the Tax Service Office that has quality.

In order to increase synergy and organizational performance, officials and echelons must pay attention to the following factors:

1) This study shows that government policy greatly influences organizational performance, so government policy through improving every dimension of government policy must be a priority to be able to maintain the organization, so as to be able to give the impression and trust and loyalty of the community.

2) Resource competence, in the process of involvement, is a picture that can be felt by the community or parties who cooperate, so that these various qualities must be a priority for improving and developing Tax Services in meeting quality performance, so as to be able to provide satisfaction to the community and have an impact on loyalty to future organization.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Amir, A. Sajriawati, S. Masisseng, A. N. A. & Lawi, Y. S. A. (2019). Strategy to Increase Competency of Human Resources on Good Manufacturing Practice (GMP) Of The Fishery Processing Group In Makassar City. Musamus Fisheries and Marine Journal, 2(1). https://doi.org/10.35724/mfmj.v2i1.1804

Andhika, R. & Johan, R. (2019). Pengaruh Pengetahuan Perpajakan Dan Sosialisasi E-Commerce Terhadap Tingkat Kepatuhan Wajib Pajak Dengan Peran Direktorat Jenderal Pajak Dalam Pelayanan Perpajakan Sebagai Variabel Moderating. Media Akuntansi Perpajakan.

Bettis, R. Gambardella, A. Helfat, C. & Mitchell, W. (2014). Editorial Quantitative Emperical Analsys in Strategic Management, 949-953. https://doi.org/10.1002/smj.2278

Bhatti, A. Akram, H. Basit, H. M. Khan, A. U. Mahwish, S. Naqvi, R. & Bilal, M. (2020). E-commerce trends during COVID-19 Pandemic. International Journal of Future Generation Communication and Networking.

Boukamcha, F. (2019). The effect of transformational leadership on corporate entrepreneurship in Tunisian SMEs. Leadership and Organization Development Journal, 40(3), 286-304. https://doi.org/10.1108/LODJ-07-2018-0262

Chavarría, J. H. Villalobos, L. D. & Grossman, F. B. (2020). Government policy in the aeronautical industry : A comparative analysis of Mexico, Brazil and Spain. In Perfiles Latinoamericanos. https://doi.org/10.18504/pl2855-010-2020

Cooper, D. R. & Schindler, P. S. (2014). Business Research Methods - Donald R. Cooper. In McGraw-Hill.

Dong, X. Chang, Y. Fan, X. (2019). Effects of the characteristics of online multimedia synergy on consumers' message acceptance and message response. Unit 07, 1-5.

djpb.kemenkeu (2019). Kemenkeu. Djpb.Kemenkeu.Go.Id.

Gangurde, S. R. & Chavan, A. A. (2016). Customer co-creation in hotel service innovation : An interpretive structural modeling and MICMAC analysis approach Abstract. Benchmarking : An International Journal, 23(7), 1751-1779. https://doi.org/10.1108/BIJ-09-2016-0145

Hadya, J. D. (2019). Berapa Pengguna Internet di Indonesia ? Proyeksi Pengguna Internet di Indonesia 2017-2023. Katadata.Co.Id.

Hair, J. F. Celsi, M. Money, A. H. Samouel, P. & Page, M. J. (2015). Essentials of business research methods (3rd ed.). Routledge. https://doi.org/10.4324/9781315704562

Hidayah, A. (2021). Tantangan Kaum Freelancer dan Pemerintah Indonesia di Era Perkembangan Teknologi Digital. RESIPROKAL : Jurnal Riset Sosiologi Progresif Aktual. https://doi.org/10.29303/resiprokal.v3i1.47

Hoffman. V. (2015). Strategic Management. 55.

Jayani, D. H. (2020). Berapa Pengguna Internet di Indonesia ? Databoks.

Kaliappen, N. & Hilman, H. (2017). Competitive strategies, market orientation types and innovation strategies : finding the strategic fit. World Journal of Entrepreneurship, Management and Sustainable Development, 13(3), 257-261. https://doi.org/10.1108/WJEMSD-11-2016-0048

Knight, J. (2015). Investing in human resource development : Strategic planning for success in academic libraries. Advances in Library Administration and Organization, 33, 1-42. https://doi.org/10.1108/S0732-067120150000033001

Koe, W. L. & Sakir, A. N. (2020). The motivation to adopt e-commerce among Malaysian entrepreneurs. Organizations and Markets in Emerging Economies. https://doi.org/10.15388/omee.2020.11.30

Kusnandar, V. B. (2021a). Penetrasi Internet Indonesia Urutan ke-15 di Asia pada. Databoks.

Kusnandar, V. B. (2021b). Pengguna Internet Indonesia Peringkat ke-3 Terbanyak di Asia. Databooks.Id.

Mainga, W. (2017). Examining project learning, project management competencies, and project efficiency in project-based firms (PBFs). International Journal of Managing Projects in Business. https://doi.org/10.1108/IJMPB-04-2016-0035

Manurung, H. (2018). The Impact of Global Culture toward Local Wisdom: A Study on Multiculturalism & Mass Media. 1-16.

Munthe, T. & Syauqi, R. S. (2020). E-COMMERCE UTILIZATION IN TAX RECEIPTS. International Proseding Taxation Faculty of Social Sciences University of Development Panca Budi.

Padoli, F. (2019). The Influence Good Coorporate Governance, Banking Risks Of Banking Performance On Private Bank Foreign Exchange. Journal of Economic, Public, and Accounting (JEPA). https://doi.org/10.31605/jepa.v1i2.312

Rahman, S. Islam, M. Z. Ahad Abdullah, A. D. & Sumardi, W. A. (2018). Empirical investigation of the relationship between organizational factors and organizational commitment in service organizations. Journal of Strategy and Management, 11(3), 418-431. https://doi.org/10.1108/JSMA-01-2018-0007

Raut, R. D. Gardas, B. Luthra, S. Narkhede, B. & Kumar, M. S. (2020). Analysing green human resource management indicators of automotive service sector. International Journal of Manpower, ahead-of-p(ahead-of-print). https://doi.org/10.1108/IJM-09-2019-0435

Saragih, M. G. (2020). Perkembangan Digital Marketing di Masa Pandemi Covid-19. In Merdeka Kreatif di Era Pandemi Covid-19.

Schuldt, K. S. & Gomes, G. (2020). Influence of organizational culture on the environments of innovation and organizational performance. Gestao e Producao. https://doi.org/10.1590/0104-530x4571-20

Suharsono, A. & Indaryani, A. S. (2020). Implementasi Knowledge Management Dalam Kemenkeu Corporate University. Jurnal Pengabdian Kepada Masyarakat Abdi Laksana.

Tarifa-Fernández, J. de-Burgos-Jimenez, J. & Cespedes-Lorente, J. (2019). Absorptive capacity as a confounder of the process of supply chain integration. Business Process Management Journal, 25(7), 1587-1611. https://doi.org/10.1108/BPMJ-12-2017-0340

Tertychka, V. (2021). Policy and Governance. Journal of Policy & Governance. https://doi.org/10.33002/jpg010100

Watimena, M. A. (2020). Implementasi Good Coorporate Governance, Good Governance dan Kepemimpinan Situasional Terhadap Kinerja Pegawai. PUBLIC POLICY, Jurnal Aplikasi Kebijakan Publik & Bisnis. https://doi.org/10.51135/PublicPolicy.v1.i2.p195-214

Wright, P. M. Nyberg, A. J. & Ployhart, R. E. (2018). A research revolution in SHRM : New challenges and new research directions. Research in Personnel and Human Resources Management, 36, 141-161. https://doi.org/10.1108/S0742-730120180000036004

Zaremba, A. Aharon, D. Y. Demir, E. Kizys, R. & Zawadka, D. (2021). COVID-19, government policy responses, and stock market liquidity around the world : A note. Research in International Business and Finance. https://doi.org/10.1016/j.ribaf.2020.101359

Zuraya, N. (2020). Tiga Dampak Besar Pandemi Covid-19 bagi Ekonomi RI. Repubilka.Co.Id.

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2022. All Rights Reserved.