FINANCIAL DECISION FACTORS FOR WOMEN MSME IN TANGERANG: AN ANALYSIS USING STRUCTURAL EQUATION MODELING

Ignatius Roni Setyawan 1![]()

![]() , Ishak

Ramli 2

, Ishak

Ramli 2![]() , Indra Listyarti 3

, Indra Listyarti 3![]()

1, 2 Faculty of Economics & Business, Universitas Tarumanagara, Jl. Tanjung Duren Utara 1, Jakarta, Indonesia

3 Faculty of Economics & Business, Universitas Hayam Wuruk Perbanas, Jl. Nginden Semolo 34-36, Surabaya, Indonesia

|

|

ABSTRACT |

||

|

Although

Tangerang is an urban area, there are still many women MSME who do not still

very understand about the financial products. When they are faced with

financial products other than savings, they are still afraid and hesitant to

use it. Even they should use them to accelerate their business. It interests

us to test their financial literacy level through structural modeling. We

build a financial decision-making model with two antecedents, namely

financial literacy, and financial inclusion and one mediator, namely

financial intention. Based on the SMART PLS results of 150 respondents, all

indicators have passed the inner and outer model and others. This study finds

that financial intentions can mediated effectively the literacy and financial

inclusion as antecedents with to financial decisions as consequent. Thus,

finally from this research, it can be concluded that for women MSME in

Tangerang were more financially literate than just the previous studies facts. |

|||

|

Received 20 May 2022 Accepted 22 June 2022 Published 18 July 2022 Corresponding Author Ignatius

Roni Setyawan, ign.s@fe.untar.ac.id DOI 10.29121/granthaalayah.v10.i7.2022.4678 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2022 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Literacy, Inclusion, Financial Intentions

& Decisions, Women Msme, Tangerang |

|||

1. INTRODUCTION

In various economic crises, it is undeniable that the role of MSMEs is the pillar of the national economy. As one of the economic pillars whose existence is still needed during the COVID-19 pandemic, which has not shown any signs of ending, the role of MSMEs in Indonesia is very reliable. In addition, responding to the phenomenon of the increasingly incessant movement of empowering women in the world to become more resilient, being one of the pillars of the family economy makes the role of women increasingly equal to that of men. In relation to MSMEs in Indonesia, the position of women as strategic MSME actors is no less dominant than male MSME actors, so the alignments of the regulator towards women MSME actors need to be further developed. Women who are MSME actors need to be given the right to develop business and financially so that they can contribute more to the national economy. Various studies at home and abroad have proven the resilience of this MSME female actor.

In the context of women's entrepreneurship, the support that needs to be intensified is the expertise of women in managing aspects of financial management as an important part of business management. Because as we all know, the financial management aspect which includes managing funding sources and executing various projects will be a determining factor for women's success as businesspeople. In particular, for MSMEs that still have basic weaknesses, namely the difficulty of getting funding quickly and lack of knowledge in executing various projects, it should get attention from regulators to solve the problem of meeting funds, considering the actual business potential of MSMEs which are actually very good and can become export commodities.

With the growing development of women's empowerment of MSMEs in Indonesia in terms of business and finance, the movement to further educate women entrepreneurs of MSMEs so that they can make good financial decisions should continue to be encouraged. Experience from the study of women's empowerment in entrepreneurship and finance by Lusardi (2019) states that better financial decision making will be shown by the extent to which women have financial literacy. Financial literacy in question is the basic ability to recognize various kinds of financial products other than as an investment instrument as well as a source of funding. Expertise in managing various types of funding efficiently to get maximum results from project execution will be a sign as to whether this person can be said to be financially literate or not. However, it must be acknowledged that the financial literacy of the majority of MSME actors, both men and women in Indonesia, must be acknowledged as still low. This, of course, will be contradictory to the financial penetration and inclusion efforts that have been intensified by the regulator. This low financial literacy can be shown by the lack of understanding of MSME actors, especially women in recognizing various financial products as a source of funding and there are still many who prefer shortcuts to quickly realize projects with non-regular loans, both conventional ones such as ten kulak and tukang ijon as well as modern ones, namely online loans through fintech. As a result of the shackles of MSME actors with a funding system through non-regular loans, MSME actors are burdened with debt interest expenses which of course will periodically drain their business net profit.

A good understanding of financial literacy in order to produce appropriate financial management decisions needs to be oriented specifically to MSME actors, especially women. Several studies also note the need for one type of factor that is parallel to financial literacy, namely financial inclusion, which is also related to financial decisions. If MSME actors already have high financial literacy, then financial inclusivity is more prominent considering that MSME actors are already familiar with a variety of financial products as a source of funding. This can be realized considering the proximity of MSME actors to various types of bank funding schemes. That way, MSME actors will also have no difficulty in making credit proposals.

Finally, related to this research, financial literacy as an important determinant of financial management decisions, in addition to other parallel determinants, namely financial inclusion, will also be linked to financial management decisions. What is new is that without financial intentions, MSME actors will find it difficult to realize good and appropriate financial management decisions. Financial intentions represent the pre-action behaviour of MSME actors before realizing their financial management decisions. Based on the theory of planned behaviour from Ajzen (2015) a good decision is a form of targeted action from individuals because of the intention or behaviour that becomes the basis of the argument for the actions that have been taken. And then the behavioural aspect in the form of a strong intention should be based on an attitude aspect that has a strong responsibility as well.

Thus, if Ajzen (2015) is able to manifest the relationship between attitudes, behaviour, and actions at the level of consumer purchasing decisions, this research will use the level of thinking, attitudes, behaviours, and actions of women entrepreneurs of SMEs to produce good and appropriate financial management decisions in the context of business development. related. This study intends to offer a model for determining the financial decisions of women entrepreneurs of SMEs which consists of 2 antecedents namely financial literacy and financial inclusion and 1 consequent namely financial management decisions, which in the end will depend on one important aspect, namely financial intention which in this case will function as a mediating variable. The target of women MSMEs to be researched is women who are MSME actors in the Tangerang area, taking into account the high variety of businesses from local MSMEs and the high potential for digital literacy skills of female MSME actors in Tangerang when compared to other regions in Indonesia.

2. RESEARCH CONCEPTUAL FRAMEWORK

The research model used to solve the problem of the relationship between financial literacy and financial as an antecedent of financial decisions as a consequence must of course be based on several similar previous studies. Several previous studies, such as Abel et al. (2018) Grohman et al. (2018) Hsb et al. (2020) Kayode et al. (2020) Lusardi and Mitchell (2014) Monga et al. (2019) and Remund (2010) have been able to map well various forms of interrelationships of financial literacy, financial inclusion, and financial decisions with each other, both as antecedents and consequents or even as mediating variables. Various types of units of analysis are also used, from the productive age group who already have a job and an established business to the young age group who still does not have a job and still depends on receiving income from their parents. In general, the results of these studies have been able to reach an agreement that a good financial decision will depend on the extent of mastery of the level of financial literacy and experience of financial inclusion experienced by each type of unit of analysis.

This means that if the level of financial literacy is high and is followed by maximum financial inclusion experience, the type of financial decision will be good and appropriate. Because considering that the type of unit of analysis used is the productive age group and the young age group in developed countries, the empirical fact that occurs is that it is almost always the exact type of financial decision that is taken with the reason that financial literacy is so high. The results of these various studies on the relationship between financial inclusion, financial literacy and financial decisions are certainly a strong motivator to prove the same thing in the case in Indonesia.

Based on the study of Suryani and Iramani (2015) which has similarities with the author's type of study, namely MSMEs, it is found that contrasts with various research results on the relationship between financial literacy and financial inclusion with financial decisions. Suryani and Iramani (2015) found the results of various types of financial decisions that were not good and appropriate from MSME actors in Indonesia. In addition, Suryani and Iramani (2015) also noted that the financial literacy of MSME actors is still low, even though the degree of financial inclusion is already so high thanks to the financial penetration activities carried out by the Financial Services Authority (OJK) since the last 5 years.

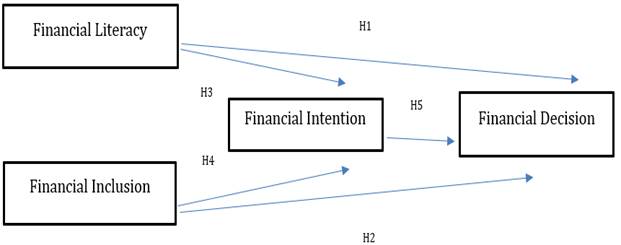

Thus, on the basis of differences in contrasting results regarding the level of financial literacy in the case of developed countries and in Indonesia, this study tries to propose a research model framework attached to Figure 1. The research model below is based on the views of Ajzen (2015) which explains the need to include intervention factors between financial literacy and financial inclusion to produce good and appropriate types of financial decisions. The model is described as a model of attitudes, behaviour, and actions. The intervention factor offered is financial intention, which refers to the results of the Lusardi study (2019) which states that for the case of developing countries and MSMEs, the financial intention factor can be a good substitute for low levels of financial literacy such as MSME actors. Based on Figure 1, the research model has 5 hypotheses to be tested with SEM.

Figure 1

|

Figure 1 Research Model (2022) |

In general, the working logic of the above model is that financial decisions as a consequence of the two antecedents of financial literacy and financial inclusion can be explained earlier without using financial intention as a mediating variable. In some cases of the productive age group who are already working and have an established business, the type of good and right financial decisions will be formed automatically through the high level of financial literacy and financial inclusion that has been experienced. A similar condition can also be experienced in the middle age group who have income from their parents who come from wealthy families. However, for the case of the MSME group, which generally live in developing countries, the close relationship between financial decisions and the 2 antecedents, namely financial literacy, and financial inclusion, needs to be facilitated by the work of financial intention as an effective mediator variable.

3. RESEARCH METHODS

Data collection activities have been carried out in a counter part with data collection activities for women entrepreneurs of SMEs in the Pacitan area. If data collection activities in Pacitan are carried out by utilizing the accessibility of the local PLUT KUKM, then for data collection activities in the Tangerang area get direct assistance from various associations of MSME actors in several culinary, clothing, and various handicraft industries. The heads of associations per industry were previously contacted by researchers and invited to do a brainstorming to get an initial understanding of the motivation and purpose of this research. In addition, they can also be the initial respondents in filling out the questionnaire to get a range of initial data profiles from the 4 constructs that have been formed in Figure 1.

To test H1 to H5 as shown in Figure 1, the SEM (Structural Equation Modeling) test analysis is carried out by using the SMART PLS software version 3. In order for the model in Figure 1 to be realized with SEM, each construct in Figure 1 is financial literacy, financial inclusion, financial intention, and financial decisions must be formulated very well for the indicators. Based on the results of the study Setyawan et al. (2020) then financial literacy, financial inclusion, financial intention, and financial decision each have 5, 4, 4 and 3 indicators. Furthermore, each indicator will be converted into a questionnaire statement item. Questionnaires were distributed to 150 women entrepreneurs of SMEs in the Tangerang area with a snowball sampling system, meaning that one respondent would recommend this research collection activity to other respondents on the basis of geographical proximity and kinship (kinship). Then the feasibility of SEM with Smart PLS must meet the inner and outer models before the bootstrapping process.

4. RESULT ANALYSIS AND DISCUSSION

In the descriptive statistical analysis section (not shown in full), the results are quite encouraging. This is because all constructs namely financial literacy, financial inclusion, financial intention, and financial decision have an average value above 4. In detail, the average value is 4.43; 4.31; 4.14 and 4.24 for the four constructs. This average result is also supported by a low standard deviation distribution value and if it is made in an estimate of the normality of the data, it is generally fulfilled on the grounds that the mean value is far above the standard deviation value. The resulting positive impact is the significance of the results on hypothesis testing through SEM analysis that can be realized. However, it should be noted that financial literacy, financial inclusion, financial intention, and financial decision are constructs because their form is in the form of a questionnaire item, namely primary data, not like the variables used in regression analysis in the case of secondary data. The main principle that is addressed in the normality analysis of the data is the readiness to enter the SEM feasibility stage.

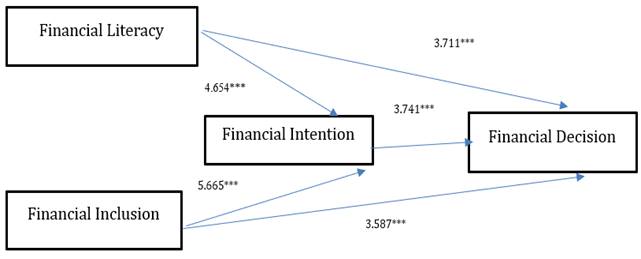

The results of the H1 to H5 tests can be explained in Figure 2 below, namely all the total effects from the SEM analysis of each t-test for H1, H2, H3, H4 and H5, namely 3,711; 3. 587; 4,554; 5,665 and 3,741 which turned out to be significant at the 1% level. If previously traced in the analysis of the inner model using AVE (Average Variance Extrated), the results are good, namely all indicators have an AVE value above 0.7. Then based on the analysis of the outer model using Cronbach alpha, the value is above 0.6. In addition to the Fornell-Larcker calculation and the Loading Factor from the SEM test in Figure 2, the results also meet the related criteria.

The results of the SEM test in Figure 2 also provide information about the specific indirect effect between financial literacy and financial inclusion as an antecedent and financial decisions as a consequence. This analysis is actually used to test the effectiveness of financial intention as a mediating variable in order to test Ajzen (2015) opinion. The effectiveness of financial intention as a mediating variable can be done by analysing specific indirect effects which is one of the important menus in SMART PLS.

Figure 2

|

Figure 2 SEM Test Results with SMART PLS |

The analysis of specific indirect effects that was carried out for the results of the SEM test in Figure 2 got the results that for the specific indirect effect between financial literacy and financial decisions mediated by financial intention, the number was 0.136. Meanwhile, for specific indirect effects with financial intention mediators for financial inclusion and financial decisions, the figure is 0.165. Through these results, it can be found that financial intention mediation will work more strongly on financial inclusion compared to financial literacy. This result cannot be claimed to emphasize the low level of financial literacy among MSME actors. Therefore, financial literacy as an independent variable (antensendent) still has a t-test of 3,711 which is greater than financial inclusion as an independent variable (antensendent) which has a t-test of 3,587.

If a comparison is made with the results of Suryani and Iramani (2015) research, this research has given more value, namely the potential for new, more positive opinions, namely financial literacy for MSME actors, especially women, which is not as low as previously thought. Women who do MSMEs for research cases in Tangerang with higher digital literacy are certainly expected to be able to build a better level of financial literacy. Various proximity to access to financial services considering that geographically Tangerang is not far from Jakarta as the capital city can be an added value to strengthen financial literacy in order to produce better and more accurate financial decisions. Then, if it is added with a stronger financial intention factor, the level of financial literacy should increase and reach the expectations of similar studies in developed countries, namely Abel et al. (2018) Grohman et al. (2018) Lusardi and Mitchell (2014) Monga et al. (2019) and Remund (2010) In addition to the applicability of Ajzen (2015) attitude, behaviour, and action model for the topic of financial behaviour, it can be realized in the context of women entrepreneurs of MSMEs in Indonesia.

This study also has a fairly good result of the effectiveness of the use of indicators from 4 constructs in the SEM analysis model that is carried out. The amount used from financial literacy, financial inclusion, financial intention, and financial decision passed the screening test with a factor loading test. The number of indicators used for each construct of financial literacy, financial intention and financial decisions is 100%. As for the number of indicators used for the construct of financial inclusion, only 3 out of 4 means 75%. This finding also indicates that the validity and reliability of the indicators stated in the questionnaire items have been fully understood by the respondents, namely women entrepreneurs of SMEs in Tangerang. Another encouraging result is that the highest number of indicators, namely 5 for financial literacy, is actually all used. This also confirms the high level of digital literacy among women MSME actors in Tangerang in responding not only to product purchasing decisions but also to making sound and appropriate financial decisions. Women who are SMEs in Tangerang are not only good at using technology to identify various digital marketing products but are also able to do so in financial decisions.

5. CONCLUSION AND SUGGESTION

The results of the study are able to provide an answer, namely the formation of a model for determining financial decisions for women entrepreneurs of SMEs in Tangerang using SEM analysis. All constructs of the analysis model which consist of two antecedents, namely financial literacy, and financial inclusion and one consequence, namely financial decisions, have been able to carry out their roles well. This means that financial literacy and financial inclusion are indeed good determinants. In addition, through the SEM analysis model, it can also be shown the effectiveness of financial intention as a mediating variable as well as having proven the applicability of Ajzen's (2015)Ajzen (2015) attitude, behaviour and action model which shifted from consumer behaviour to financial behaviour.

This study has limitations, namely not being able to calculate financial literacy scores using the indicator formulations from OJK (2017). This is because the formula for the OJK indicator is more appropriate for non-SME groups, both those with established jobs and businesses, as well as young people who come from wealthy families. The MSME community will find it difficult to adapt to the types of questions from the formulation of the OJK (2017) indicators which are very detailed in asking the demographic profile of the respondents. The MSME community still needs to be accompanied when filling out this section. In order to overcome this limitation, researchers can conduct a gathering with the MSME protectors and a partner bank so that in addition to data collection activities run smoothly, various statements about financial literacy can be explored more personally for each individual MSME actor.

Another limitation is that there has not been time to carry out a simulation analysis of the measurement of financial literacy of women MSME actors in Tangerang considering the problems of bureaucratization, time, and funds. To carry out this simulation, it is necessary to have a special permit from the local government at least at the sub-district level because later it will be related to the selection of participants as MSMEs who are ready to measure their financial literacy with various more appropriate instruments, namely OJK (2017)

ACKNOWLEDGMENTS

This research was funded by Direktorat Riset dan Pengabdian Masyarakat, Kementerian Pendidikan dan Kebudayaan, (Directorate of Research and Community Service, Ministry of Education & Culture), Indonesia. Grant Number: 069/E5/PG.02.00.PT/2022). The authors would also like to thank the Institute for Research and Community Service of Universitas Tarumanagara for facilitating the realization of this research grant.

REFERENCES

Abel, S. Mutandwa, L. and Roux, P. (2018). A Review of Determinants of Financial Inclusion. International Journal of Economics and Financial Issues. ISSN, 8(3), 1-8.

Ajzen, I. (2015). Consumer Attitudes and Behavior : The Theory of Planned Behavior Applied to Food Consumption Decision, Italian Review of Agricultural Economics, 70(2), 120-138.

Grohman, A. Kluhs, T. and Menkhoff, L. (2018). Does Financial Literacy Improve Financial Inclusion : Crosscountry, World Development, 111, 84-96. https://doi.org/10.1016/j.worlddev.2018.06.020

Hsb, S. M. Santosa, H. and Asfriyati, A. (2020). Relationship of Family Income and Family Support with Maternal Reference in Pregnant Women in Pantai Cermin BEmONC, Langkat District, 2019. Budapest International Research and Critics Institute-Journal (BIRCI-Journal), 3(1), 486-493. https://doi.org/10.33258/birci.v3i1.798

Kayode, G. M. et al. (2020). Training Ekiti Women for Economic Resilience at the Ekiti State Women Development Centre. Budapest International Research and Critics Institute Journal (BIRCI-Journal), 3(3), 2501-2512.

Lusardi, A. (2019). Financial Literacy and The Need for Financial Education : Evidence and Implications, Swiss Journal of Economics and Statistics. https://doi.org/10.1186/s41937-019-0027-5

Lusardi, A. and Mitchell, O. S. (2014). The Economic Important of Financial Literacy: Theory and Evidence, Journal of Economic Literature, 52(1), 5-44. https://doi.org/10.1257/jel.52.1.5

Monga, M. Dzvimbo, M. and Mashizha, T. M. (2019). The Dynamics of Gender : A Grassroots Perspective on Economic Resilience and Empowerment of the Tonga People in Kariba. Budapest International Research and Critics Institute-Journal (BIRCI Journal), 2(4), 115-124. https://doi.org/10.33258/birci.v2i4.565

OJK. (2017). National Survey of Financial Literacy and Inclusion 2016 & 2017, Department of Financial Literacy and Inclusion, Consumer Education and Protection, 1-60.

Remund, D. (2010). Financial Literacy Explicated : The Case or a Clearer Definition in an Increasingly Complex Economy. Journal of Consumer Affairs, 44(2), 276-295. https://doi.org/10.1111/j.1745-6606.2010.01169.x

Setyawan, R. Ramli, I. and Listyarti, I. (2020). Design Development of Financial Citizenship Model for Women in Indonesia, IOP Conf. Seties : Materials Sciences and Engineering. https://doi.org/10.1088/1757-899X/1007/1/012046

Suryani, T. Iramani, R. R. (2015). Development of Financial Inclusion Access (FILA) Model and Marketing Competence in Small and Medium Enterprises (SMEs) Human Resources as a Strategy to Increase Competitiveness in the Era of the ASEAN Economic Community.

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2022. All Rights Reserved.