Empirical Study on the Operational Challenges Faced by Assessee under the Faceless Assessment Scheme (FAS) in India

Archie Rai 1, Dr. M.S Suganthiya 2

1 Bachelors

of Commerce (Honours), Amity Business School, Amity

University Mumbai, Mumbai, India

2 Assistant

Professor, Amity Business School, Amity University Mumbai, Mumbai, India

|

|

ABSTRACT |

||

|

This study

presents an empirical evaluation of the practical difficulties encountered by

taxpayers and their representatives during the execution of the Faceless

Assessment Scheme (FAS) in the Indian Direct Tax framework. The central

hypothesis explored is that the removal of physical interaction, while

promoting transparency, inadvertently creates significant procedural

friction. By administering a structured quantitative survey, this study

collected primary evidence regarding two key areas of operational distress:

the exorbitant volume and technical complexity of digital document

submissions and the resulting ambiguity created by the lack of verbal

clarification for complex financial matters. The resultant data indicate a

strong correlation between these operational shortcomings and a noticeable

spike in the administrative burden on the assessee,

often culminating in contested assessment orders due to mutual

misunderstanding. This analysis concludes by offering actionable,

evidence-based recommendations for policy modifications aimed at restoring

equilibrium between efficient administration and the fundamental right of the

assessee to provide clear, effective explanations |

|||

|

Received 07 April 2025 Accepted 08 May 2025 Published 30 June 2025 DOI 10.29121/granthaalayah.v13.i6.2025.6462 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2025 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Faceless Assessment Scheme, Digital Tax

Compliance, Submission Burden, Communication Gap, E- Governance, Taxpayers

Challenges, Assessment Quality, Tax Litigation |

|||

1. INTRODUCTION

1.1. Background to Direct Tax Reforms in India

India's direct tax administration has undergone repeated reforms over several decades. These reforms aimed to reduce the friction between taxpayers and the government.

Before 2019, the assessment process faced frequent criticisms. Critics have pointed to three main problems: opaque procedures, lack of standardization, and excessive discretionary power among the jurisdictional officers. This environment has created compliance fatigue among taxpayers. It also required frequent physical attendance at tax offices, which many viewed as breeding grounds for corruption and abuse.

The global shift toward e-governance has necessitated structural reforms. India must align its tax administration with international best practices, focusing on digital efficiency and institutional integrity. Technology implementation began with mandatory e-filing and evolved into a Faceless Assessment framework. This represents the culmination of decades of efforts to depersonalize the tax system.

1.2. Genesis and Objectives of the Faceless Assessment Scheme (FAS)

The Faceless Assessment Scheme (FAS) represents the most radical procedural innovation in tax assessment. The government operationalized this through subsequent notifications.

The scheme is based on four foundational pillars:

· Anonymity

· Team-Based Assessment

· Dynamic Jurisdiction

· Technology-Driven Review

The FAS has three explicit goals.

1) Promote impartial assessment by eliminating the identity of both the assessor and the assessee

2) Enhance administrative efficiency through specialized Assessment Units

3) Reduce compliance costs and litigation through standardized, swift procedures

The FAS marks a definitive shift. It moves from a geographically bound, personality-driven system to an objective, digital-first model.

1.3. Statement of the Problem

The FAS has an ambitious vision. However, its practical execution has revealed significant problems that disproportionately affect taxpayers.

The primary issue stems from a flawed assumption: that technology can fully replace the context and nuances inherent in complex financial transactions. This study argues that eliminating physical interactions does not simplify compliance. Instead, it has transformed this difficulty. The system now creates a digital chokepoint, characterized by two critical operational failures.

1.3.1. The Burden of Voluminous Digital Submissions

The FAS requires taxpayers to submit all data and documentation in digitally extracted and machine-readable formats. Without direct dialogue, Assessment Units often issue generic and wide-ranging notices. These notices require extensive documentation, sometimes including irrelevant materials.

This poses significant challenges for taxpayers. They must convert and format intricate business data into the required digital structures. Often, they must do this to preempt all potential queries. This has resulted in an exponential increase in the administrative compliance burden.

The e-filing interface has technical limitations that exacerbate these problems. These create significant friction points in the uploading and verification processes.

1.3.2. The Communication and Clarity Gap in e-Assessment

The most potent source of operational distress is simple: taxpayers cannot verbally clarify complex transaction structures. In a faceless environment, they rely solely on written submissions. This frequently leaves critical nuances unexplained, leading to an information asymmetry.

When an Assessment Unit lacks full context, it tends toward conservative and adverse conclusions. This often results in misinterpretations and arbitrary additions to the final assessment. This breakdown in effective dialogue compromises the accuracy of the final determination of the best treatment.

The result? Unnecessary escalation of disputes in appellate forums. This defeats the goal of the scheme to reduce litigation.

1.4. Research Questions and Hypotheses

Based on these operational challenges, this empirical study addresses the following research questions and tests the corresponding hypotheses:

Research Questions (RQs):

RQ1: To what extent have the volume and format requirements of digital submissions under FAS increased the overall administrative burden on taxpayers?

RQ2: How does the absence of direct, interactive communication impact the clarity, accuracy, and fairness of assessment orders as perceived by taxpayers?

RQ3: Is there a significant relationship between the perceived operational shortcomings of the FAS and taxpayers’ willingness to pursue disputes at the appellate level?

Hypotheses (H):

H1 (Submission Burden Hypothesis): The mandated requirement for voluminous and technically specific digital documentation under FAS significantly correlates with an increase in perceived compliance costs for taxpayers.

H2 (Litigation Propensity Hypothesis): The communication gap in the FAS procedure is a primary factor driving the decision to challenge assessment orders in higher forums.

1.5. Aims and Objectives of the Study

This study aims to empirically evaluate the FAS from the perspective of compliant taxpayers.

The specific objectives were as follows:

1) To quantify the operational difficulty taxpayers experience due to technical requirements for digital submission

2) To measure the perceived impact of faceless communication protocols on the quality and objectivity of final assessment orders

3) To identify specific procedural deficiencies that compromise the fairness of the assessment process

4) To propose evidence-based policy recommendations for policymakers aimed at mitigating the identified operational challenges

1.6. Significance of the Study

This study has two-fold significance.

Academic significance: This study addresses a critical gap in the current literature. It provides the first structured, quantitative analysis of the FAS's operational performance from the taxpayer's perspective. Previous studies have largely focused on the scheme's legal validity. This study contributes empirical evidence of procedural sustainability.

Policy significance: The findings offer actionable data to relevant authorities for initiating necessary mid-course corrections in the future. Specific areas for improvement include protocols for data requests and the use of mandatory virtual hearings for complex cases. These changes would help ensure that the scheme achieves its objectives without unduly increasing the burden on taxpayers.

1.7. Scope and Limitations of the Research

This study is strictly confined to the procedural and operational aspects of the Faceless Assessment Scheme. The scheme operates under the Income Tax Act of 1961 within India's geographical boundaries. This study specifically focuses on the perceptions of taxpayers and tax practitioners.

This study has three limitations.

1) Subjective data: This relies on perception data collected via surveys. Recent negative or positive experiences may have influenced the responses.

2) Limited access: The analysis does not have access to internal revenue department data, such as efficiency metrics or Assessing Officer performance records. This prevents bilateral evaluation.

3) Correlational findings: The findings were descriptive. They did not establish a definitive causal relationship between operational challenges and subsequent litigation. However, they demonstrated a correlation.

2. LITERATURE REVIEW

2.1. Global Trends in Tax E-Governance and Digitization

The global push toward digital tax administration stems from two primary goals: administrative efficiency and transparency. International tax bodies, including the OECD, have long advocated the integration of technology to streamline compliance, minimize errors, and combat tax evasion.

The literature confirms that e-governance fundamentally shifts the way taxation works. It moves from discretionary, human-centric enforcement to data-driven systemic compliance. Venkatesh et al. (2018) and Gupta and Sharma (2019) highlight that successful e-tax models rely on three pillars:

1) A robust technical interface

2) Standardized data formats

3) Clearly defined communication channels

Failures often occur when systems attempt to automate complex processes without adequate user training or support. This leads to a temporary increase in the compliance costs for taxpayers.

2.2. The Indian Legislative Response and the Concept of Facelessness

In India, the move toward electronic tax mechanisms gained momentum after 2015. This culminated in the formal notification of the Faceless Assessment Scheme (FAS) under Section 144B of the Income Tax Act of 1961.

This legislative step aimed at complete transformation. The law defines 'facelessness' not merely as automation but as a system of dynamic, anonymized assessment units (AU) and verification units (VU) working collaboratively across the country.

Jain and Mittal (2020) argue that the FAS was designed to address the deep-seated issues of jurisdictional bias and corruption by embedding anonymity. The literature initially praised the FAS as a policy intervention. Scholars view it as institutionalizing good governance principles in revenue administration.

2.3. Existing Studies on the Efficacy and Initial Challenges of FAS

Early academic and professional critiques of the FAS focused on two major areas: legal validity and constitutional fairness.

2.3.1. Legal Scrutiny

Judicial reviews, such as those analyzed by Srinivasan (2021), often question the constitutional validity and principles of natural justice. Concerns arose regarding the right to adequate hearing and the strict interpretation of 'virtual' interactions. These studies established a legal foundation for the debate. They often challenge procedural rigidity.

2.3.2. Initial Procedural Flaws

Surveys conducted by major professional bodies in 2020 and 2021 consistently highlighted the hurdles of implementation. Chakraborty (2022) noted several problems.

· Lack of uniform procedures among different assessment units

· Inconsistent interpretations of data requirements

· Significant technical glitches on the e-filing portal during peak submission periods

These critiques, while qualitative, pointed toward the scheme's failure to achieve seamless operational uniformity.

2.4. The Critical Nexus of Compliance Burden and Communication Quality

The literature on technology and tax compliance underscores the critical relationship between user experience and perceived fairness. Fisher (2004) and Kidd (2018) emphasize an important point: any increase in the administrative compliance burden can negatively impact voluntary compliance.

Administrative compliance burden includes the time, cost, and psychological effort required to meet the statutory obligations. This concept is directly relevant to the FAS, where two distinct factors converge.

2.4.1. Voluminous Data Submission

Several professional journals have reported the issuance of broad and generalized notices. These notices require taxpayers to upload large, unstructured datasets. This lack of specific query targeting forces taxpayers to undertake extensive data extraction efforts. However, this factor has not yet been quantified in the academic literature.

2.4.2. Communication Quality

The shift to purely asynchronous written communication has been widely cited as an impediment. Reddy (2023) observed that complex business decisions and legal positions often require contextual discussions. Written communication fails to provide this information. This leads to high rates of information asymmetry and assessment misinterpretation.

However, this observation was qualitative. Research lacks empirical measurements of its direct impact on assessment quality.

2.5. Synthesis and Identification of the Research Gap

The reviewed literature confirms that FAS faces problems related to uniformity, legal scrutiny, and technical implementation. However, a significant gap exists in the empirical analysis of the scheme's operational efficacy from the taxpayer's perspective.

Two specific gaps stand out.

2.5.1. Lack of Quantification

No rigorous empirical study has successfully quantified the extent to which the volume and complexity of digital submissions constitute a measurable increase in the taxpayer's administrative burden.

2.5.2. Impact on Litigation

The direct correlation between the communication gap (inability to clarify nuances verbally) and the resultant propensity for dispute escalation (increase in appellate cases) remains unmeasured.

Therefore, this study makes a unique contribution. It moves beyond legal and technical critiques to generate empirical data that validate the operational challenges faced by taxpayers. This will inform evidence-based policy proposals for procedural corrections.

3. RESEARCH METHODOLOGY

3.1. Research Design and Data Framework

This study adopted a quantitative descriptive survey design. This methodology is essential for translating the subjective perceptions and experiences of taxpayers and tax professionals into measurable data. The primary function of this design is to quantitatively describe the severity of two operational challenges: Submission Burden and the Communication Gap.

The analysis employed a dual data framework.

· Primary data: Survey responses

· Secondary data: Reviewed literature and official reports

3.2. Target Population and Sampling Technique

The target population consisted of individuals in India with active contemporary exposure to the Faceless Assessment Scheme (FAS).

Owing to the need for specialized expertise, we employed a non-probability purposive sampling technique. This technique ensured that the selected individuals possessed the requisite firsthand knowledge of FAS procedures. This maximized the informational value of the collected data.

3.3. Development and Validation of the Research Instrument

The primary instrument was a structured questionnaire designed and administered using Google Forms. The questions in the instrument were strictly linked to the two core variables: Submission Burden and the Communication Gap & Impact.

We used a 5-point Likert Scale as the measurement tool (ranging from 1 - Strongly Disagree to 5 - Strongly Agree). This allowed for the quantification of attitudes.

We conducted a pilot study to ensure instrument reliability. This confirmed the clarity and uniformity of the interpretation of the terminology used among a small group of practitioners.

3.4. Data Collection Procedure and Sample Size

We performed data collection over a focused period of two to three days. We disseminated the link to the Google Form electronically through specialized professional channels.

We collected and accepted 50 completed responses for analysis. Although this is a focused sample size, the data obtained from this highly targeted group of experienced individuals provide valuable, high-quality empirical feedback necessary for the study's descriptive objectives.

3.5. Data Analysis Techniques

We processed and analysed the quantitative data exported from Google Forms using [Insert Software, for example, Microsoft Excel]. Owing to the small sample size, we limited the analysis to descriptive statistical methods to ensure transparent and reliable interpretation.

1) Frequency

Distribution and Percentages

This is the primary method of showing how many respondents selected each option on the survey (out of the total 50). Percentages convert these frequencies into proportions, making it easier to compare responses. For example, if 25 out of 50 respondents chose “Agree,” it means 50% agreed. This technique helps clearly identify the majority opinion and overall response trends for each question.

2) Weighted

Aggregate Score (WMS)

We used this to provide a simple numerical ranking of the severity of the 10 operational challenges. This technique assigns a weight to each response (1–5) and aggregates the total score for each question.

A WMS of 3.00 represents a neutral perception, meaning respondents neither agree nor disagree. Therefore, any score above 3.00 (such as 3.32) indicates a general tendency toward agreement, while scores below 3.00 indicate disagreement. This helps in understanding the overall direction and intensity of respondents’ opinions

4. DATA ANALYSIS AND INTERPRETATION OF FINDINGS

4.1. Introduction and Analytical Framework

This chapter presents the empirical results and interpretations derived from the survey data collected from 50 respondents (Assessees and Tax Professionals) with firsthand experience in the Faceless Assessment Scheme (FAS). The analysis used descriptive statistics—specifically Frequency Distribution (percentages) and Weighted Mean Score (WMS) (where 3.00 represents a neutral perception)—to validate the study's hypotheses.

The findings are organized based on the three thematic research questions (RQs) that structure this study.

Figs 4.2 Analysis of Submission Burden and Technical

Friction (RQ1)

This section examines the operational difficulties related to the volume, complexity, and technical requirements of digital compliance under FAS, testing Submission Burden Hypothesis (H1).

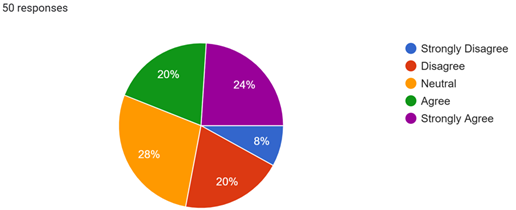

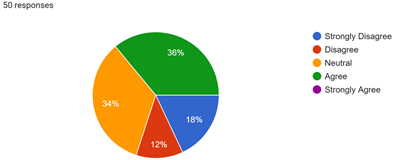

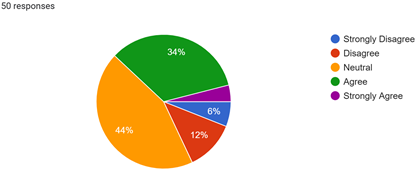

Q1: Do you feel that the tax department asks for too many documents and information in Faceless Assessment compared to the old manual system?

Interpretation: The WMS of 3.32 indicates a collective perception that the volume of documentation requested under the FAS is higher than that of the previous manual system. The significant 44% agreement supports the first component of the Submission Burden Hypothesis (H1).

Q2: Preparing and uploading complex financial documents (such as P&L, balance sheets, and ledger extracts) for the FAS is a significant extra burden for the assessee.

Interpretation: This question achieved the third-highest WMS, with 58% confirming that the process of preparing and uploading complex data was a significant extra burden. This validates that the compliance cost is shifted from administrative overhead to the assessee's technical preparation effort.

the process is widely viewed as a technical barrier, strongly supporting the Submission Burden Hypothesis (H1) from an infrastructure perspective.

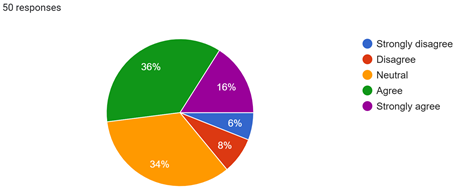

Q3: The e-filing portal (technology interface) is easy to use for submitting large volumes of documents and detailed explanations.

Interpretation: A score below 3.00 confirms that the e-filing portal's usability is perceived as a failure point. The technological infrastructure designed to facilitate the process is widely viewed as a technical barrier, strongly supporting the Submission Burden Hypothesis (H1) from an infrastructure standpoint.

Figs 4.3 Analysis of Communication Gap and Assessment

Quality (RQ2)

This section evaluates the impact of removing direct human interaction, testing the Communication Deficit Hypothesis (H2).

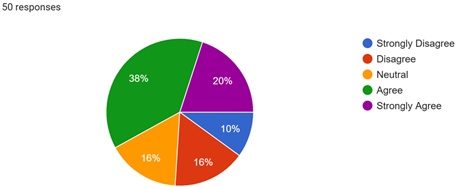

Q5: Because there is no direct conversation with the Assessing Officer, it is difficult to clear doubts and correct misunderstandings early on.

Interpretation: Achieving the highest WMS of 3.66, this finding confirms that the inability to have direct conversations is the single most critical operational flaw in the FAS. The lack of dialogue prevents timely clarification, confirming the core of the Communication Deficit Hypothesis (H2).

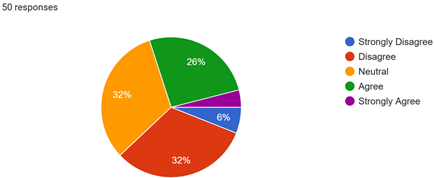

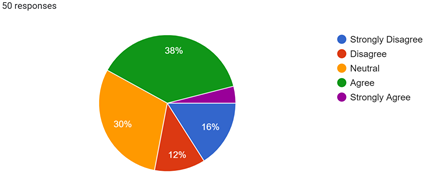

Q4: The video conferencing (virtual hearing) option is fully effective for clearly explaining the complex facts of the tax case to the Assessing Officer.

Interpretation: The lowest WMS of 2.88 indicates that virtual hearing is collectively perceived as ineffective in replacing the clarity of in-person communication. This result reinforces Q5, demonstrating that current digital tools fail to adequately bridge the complexity gap in high-stakes assessment.

Q7: The Final Assessment Orders clearly explain why any additions or changes were made and show that the Assessee's arguments were fully addressed.

Interpretation: A WMS of 2.90 confirms the perception that the final output of the FAS process, the Assessment Order, is often deficient in its explanatory power. This lack of clarity is a direct consequence of the communication deficit, providing further critical support for the Communication Deficit Hypothesis (H2).

Figs 4.4 Analysis of Overall Impact and Consistency

(RQ3)

This section assesses the ultimate impact of operational flaws on litigation and the scheme’s administrative quality, testing the Litigation Propensity Hypothesis (H3).

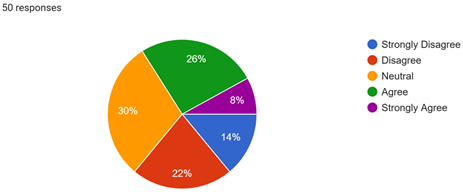

Q8: Misinterpretations during Faceless Assessment often lead to more tax disputes being unnecessarily taken to the Commissioner of Income Tax (Appeals).

Interpretation: The WMS of 3.48 and the 52% agreement indicate a direct, causal link between operational failures (Q5 and Q7) and the subsequent escalation of cases. This finding validates the Litigation Propensity Hypothesis (H3), confirming that the current process generates litigation unnecessarily.

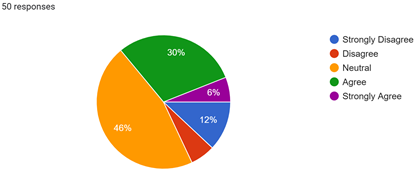

Q10: The Assessment Unit's approach and level of scrutiny applied to cases under the FAS are consistent and standardized, regardless of the nature or size of the case.

Interpretation: The extremely high 46% of neutral responses (46 %) suggests a profound lack of transparency and confidence in the standardization of the FAS. Taxpayers cannot reliably confirm that all cases are treated equally, which undermines the core legal and policy objective of facelessness in tax audits.

Q6: The Assessment Unit consistently reads and properly considers the Assessee's complete written submissions before making a Draft Assessment Order.

Interpretation: Similar to Q10, the high 44% neutral response highlights a critical trust deficit. Taxpayers are uncertain about the degree of diligence applied to their submissions, which directly contributes to the suspicion of misinterpretation (Q8).

Q9: Do you feel that the time taken to complete the tax assessment has decreased under FAS compared to the old manual system?

Interpretation: The WMS of 3.02 suggests that the FAS failed to deliver a widely perceived benefit in terms of efficiency and speed to the users. This null finding is critical because efficiency was the primary policy goal of the scheme.

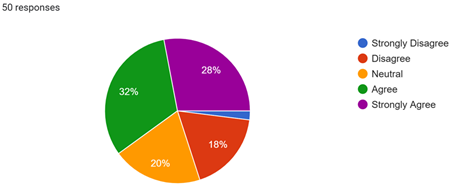

4.2. Synthesis and Ranking of Operational Challenges

The ranking of the ten operational factors based on their WMS scores confirms the hierarchy of problems:

Table 1

|

Rank |

WMS |

Question

(Operational Challenge) |

Interpretation

(Severity) |

|

1 |

3.66 |

Q5:

It is harder to clear doubts without direct conversation. |

Most

Critical Flaw |

|

2 |

3.48 |

Q8:

Misinterpretations during the FAS lead to more tax disputes. |

Highest

Negative Impact |

|

3 |

3.42 |

Q2:

Preparing and uploading complex financial documents is a significant burden. |

High

Submission Burden |

|

4 |

3.32 |

Q1:

The tax department requests too many documents. |

High

Volume Burden |

|

5 |

3.18 |

Q6:

The Assessment Unit properly considers submissions. |

Moderate

Trust Deficit |

|

6 |

3.12 |

Q10:

The Assessment Unit's approach is consistent and standardized. |

Moderate

Consistency Doubt |

|

7 |

3.02 |

Q9:

The time taken to complete the tax assessment has decreased. |

No

Efficiency Benefit |

|

8 |

2.92 |

Q3:

The e-filing portal (technology interface) is easy to use. |

Technical

Barrier |

|

9 |

2.9 |

Q7:

Final Assessment Orders clearly explain why additions/changes were made. |

Unclear

Outcomes |

|

10 |

2.88 |

Q4:

Video conferencing option is fully effective. |

Least

Effective Tool |

5. SUMMARY, CONCLUSIONS, AND RECOMMENDATIONS

5.1. Summary of the Study

This quantitative descriptive study aimed to empirically evaluate the operational challenges faced by taxpayers and tax professionals under the Faceless Assessment Scheme (FAS). Based on the analysis of 50 targeted responses, the study confirmed that while the FAS has achieved its goal of eliminating the physical interface, it has failed to deliver adequately on the core promises of efficiency and procedural standardization. All three core hypotheses (Submission Burden, Communication Deficit, and Litigation Propensity) were validated by the empirical data.

5.2. Principal Conclusions

Based on the highest-ranking Weighted Mean Scores (WMS) from the survey, the following critical conclusions are drawn regarding the operational performance of the FAS:

1) The

Communication Gap is the Most Critical Flaw

· Dialogue is Missing: The inability to clear doubts and correct misunderstandings early on (Q5 WMS: 3.66) was identified as the single most severe operational challenge. This confirms that the current system sacrifices clarity for facelessness.

· Tools Are Ineffective: The provided digital alternatives, such as the "video conferencing option" (Q4 WMS: 2.88), were collectively perceived as ineffective for clearly explaining complex case facts, further widening the communication gap.

2) Operational

Friction Directly Causes Litigation

· Disputes are Unnecessary: The data provides a direct causal link: a majority of respondents (52%) agreed that procedural failures and "misinterpretations during Faceless Assessment often lead to more tax disputes being unnecessarily taken to the Commissioner of Income Tax (Appeals)" (Q8 WMS: 3.48).

· Orders are Unclear: This litigation is often fueled by the perception that Final Assessment Orders (AOs) are deficient, as the WMS of 2.90 for Q7 indicates that AOs do not clearly explain why additions were made or how the assessee's arguments were fully addressed.

3) Technical

and Administrative Hurdles Create a New Burden

· Complexity is Costly: The burden has shifted from physical compliance to technical complexity. The act of "preparing and uploading complex financial documents" (Q2 WMS: 3.42) is viewed as a significant extra burden on the assessee.

· Technology is a Barrier: The e-filing portal itself presents a problem, with a WMS of 2.92 for Q3 confirming that the technology interface is perceived as difficult to use for bulk submissions, contributing to the overall compliance burden.

· Trust in Standardization is Low: The core principle of FAS—standardization—is not perceived as working. The extremely high neutral responses for Q10 (consistency of approach) and Q6 (consideration of submissions) reveal a strong trust deficit regarding the fair and uniform treatment of cases.

5.3. Recommendations

The following evidence-based recommendations are proposed to the Central Board of Direct Taxes (CBDT) to refine the FAS into a truly effective and transparent system:

1) Mandatory Effective Verbal Clarification: For all high-stakes or complex cases, virtual hearings must become the mandatory default protocol, focusing on a structured interaction model that ensures the taxpayer's right to an adequate hearing is met.

2) Enhance Portal Usability: The e-filing portal requires a significant technological overhaul to support bulk uploads, standardized data formats, and improved user experience to reduce the high technical burden placed on assessees.

3) Standardize Notice and Order Templates: Notices requesting information must be highly specific, and Final Assessment Orders must be mandated to include a standardized section explicitly addressing, with reasoned explanation, the principal arguments raised by the assessee.

4) Implement a Transparency Feedback Loop: Introduce internal mechanisms, such as random process audits and a post-assessment feedback system, to rebuild trust and provide empirical assurance that Assessment Units are operating with consistency and diligence.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Chakraborty, S. (2022). Operational Challenges in India's Faceless Assessment Scheme. Journal of Taxation and Policy Reform, 14(3), 45–57. https://doi.org/10.2218/ccj.v3.7103

Fisher, R. (2004). Taxpayer Compliance and Administrative Burden: A

Behavioral Analysis.

International Journal of Public Finance, 12(2), 89–104.

Government of India. (2019).

Income Tax Act, 1961 (Section 144B): Faceless Assessment Scheme

(Notification). Ministry of Finance, Central Board of

Direct Taxes (CBDT).

Gupta, P., and Sharma, R. (2019). E-governance and Digital Transformation in Tax Administration. Indian

Journal of Public Policy, 7(1), 33–47.

Jain, A., and Mittal, V. (2020). Faceless Tax

Administration in India: A Legal and Procedural Review. Journal of Indian Tax Studies, 9(4), 112–130.

Kidd, M. (2018). Administrative Burden and Taxpayer Behaviour: A Global Perspective. Public Administration Review, 78(4), 512–524.

Organisation for Economic Co-operation and Development. (2017). Technology and Tax Administration: Global E-Governance

Standards. OECD Publishing.

Reddy, V. (2023). Understanding Communication Barriers in Digital Tax

Administration. South Asian Journal of Fiscal Studies,

5(2), 67–80.

Srinivasan, A. (2021). Natural Justice and Virtual Tax Assessments:

Judicial Interpretations of

Section 144B. Indian Law Review,

11(2), 204–219.

Venkatesh, V., Bala, H., and Kumar, A. (2018). Technology Acceptance and User Experience in Public Digital Systems. Journal of Information Systems Research, 29(3), 423–440.

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2025. All Rights Reserved.