Integrating Financial Literacy into the National Education Policy (NEP) 2020

1 Assistant

Professor, Department of Commerce C.D.R.J.M, Butana, Haryana, India

|

|

ABSTRACT |

||

|

Financial

Literacy or financial education are gaining worldwide attention as a critical

skill for livelihood. Education is a skill for survival like food, home, and

shelter. The National Education Policy (2020) is an education system with the

tagline "Educating the Next Generation." NEP's core ideas include

focusing on real-world skills, critical thinking, and hands-on learning,

making it an ideal framework for financial education. Its main goal is to

demonstrate how the policy's flexible and practical approach is a perfect fit

for integrating essential financial skills into the school system, from a

young age all the way through high school, so that students can learn about

saving, investment banking, budgeting concepts, and more. The NEP's primary

component is the inclusion of financial acumen, which transforms it from a

purely academic subject into a strategic necessity by enabling young people

to secure their own prospects and support the national economy. The

objectives of the research paper are to find out the present status of

financial literacy in India and the role of NEP in its promotion. The

research also proposes a financial literacy model and identifies potential

challenges, while simultaneously providing strategic recommendations for the

effective implementation of the NEP with integrated financial education. |

|||

|

Received 07 August 2025 Accepted 10 September 2025 Published 11 October 2025 Corresponding Author Dr. Seema

Devi, sdphougat@gmail.com DOI 10.29121/granthaalayah.v13.i9.2025.6381 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2025 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: National Education Policy (NEP) 2020,

Financial Literacy, Economic Resilience, Curriculum Integration |

|||

1. INTRODUCTION

Poverty is often not a choice but a condition perpetuated by a lack of opportunity. Education is considered the primary means of escaping poverty, yet access remains unequal. For a quality life, education must be accessible, equitable, affordable, and accountable. While efforts have been ongoing since India's independence, the pivotal step came in 2009 with the Right to Education Act, which mandates free education for children aged 6 to 14. NEP (2020) represents a significant step toward realizing education as a fundamental right.

The UN Sustainable Development Goals emphasize on “equal access to resources, including financial services, for all, particularly the most vulnerable. Achieving this requires a financially literate population. The transition from the National Policy on Education (1986) to NEP 2020 aligns India's agenda with global SDG targets by embedding financial education within a holistic, multidisciplinary curriculum across all levels of education.”

A Survey by the World Bank (2009) analyzed the impact of qualitative, accessible, equitable, and affordable education at all levels (primary, secondary, and higher) on reducing poverty by more than half the current numbers Filmer (2008), Loeb and Eide (2004). The World Bank survey, additionally supported by a UNESCO report, led to the opinion that more than 420 million people worldwide could escape poverty and halve the number of impoverished people in the world if all children had access to only elementary and secondary education. UNICEF's latest assessment on the status of Every Child in the SDG Era (2018) provides additional evidence of the universal ambition which majesty, "The Sustainable Development Goals embody our highest aspirations for a better world – and reflect our greatest responsibility as a global community: To provide children and young people today with the services, skills, and opportunities they need tomorrow to build better futures for themselves, their families, and their societies." It is only education that provides the guarantee for progressive development by reviving exceptional potential in students' academic and non-academic realms. As stated in the National Education Policy (2020), the goal of "productive and contributing citizens for an equitable and vibrant society” aligns precisely with the fundamental objectives of financial Literacy as outlined by the Ministry of Human Resource Development. (2020). OECD. (2014) define financial literacy as “A critical life skill in the 21st century can contribute to individual and families’ well-being as well as to financial stability in our economies.” Cherry Dale, Director of Financial Education at Virginia Credit Union, by highlighting the critical nature of financial knowledge said that “If people fully understand how financial systems function at a young age or even later in life; if they've made poor decisions but discover how to go back and rectify them and begin planning for the future, then they can take measures to improve their lives for themselves.”

Financial Literacy is an essential life skill for both social and individual wellbeing. Building long-term financial abilities, such as saving, investing, consumer awareness, and adapting to technological advancements in financial transactions, requires early financial education in the household and educational settings. The purpose of this study is to: 1. Identify the relationship between the financial literacy curriculum and NEP (2020); 2. Provide a progressive Financial Literacy Model; 3. To determine the possible implementation obstacles and to offer tactical suggestions for the successful integration of unified financial education with NEP.

2. Literature Review

Unforeseen complication characterizes today's economic environment. People must make numerous financial decisions that have a significant impact on their safety and happiness, ranging from sophisticated financial instruments and electronic financial services to widespread consumer lending and adjustments to retirement plans Shen and Hueng (2018). The need for financial Literacy, the ability to understand and effectively use various financial skills, including personal financial management, budgeting, and investing, has never been more critical Ravikumar et al. (2022). Understanding, learning to manage their financial resources, including investing, saving, and avoiding excessive debt, benefits not only the individual but also their family and community. Individuals become the cornerstone of a stronger and more resilient society Lyons and Kass-Hanna (2021). Their astute behaviors contribute to greater stability and prosperity for both community and nation Adebayo et al. (2024). Atkinson and Messy (2012) defined “Financial literacy is a combination of financial awareness, knowledge, skills, attitudes and behaviours necessary to make sound financial decisions and ultimately achieve individual financial wellbeing.” Ahmad et al. (2020) called financial Literacy as Human Capital. Tinghög et al. (2021) identify the importance of financial literacy in reducing gender inequalities. Financial Literacy helps inculcate entrepreneurial abilities among students by sharpening their planning, management, and control skills Romadhon and Mulyadi (2025). The Indian citizenry still lacks adequate knowledge regarding finances, which makes it crucial to make informed decisions Shen et al. (2018). Adolescents, in particular, have low levels of financial awareness Tony and Desai (2020), Fanta and Mutsonziwa (2021). India requires immediate steps to enhance its financial and digital literacy in order to address its challenges Stephen (2022). Knowledge of digital technologies can significantly enhance the financial learning experience for internet users Anita (2019), Tiwari et al. (2020). A new and important concept that sits at the nexus of digital and financial Literacy is called “digital financial literacy” (DFL) Melinda Gates Foundation. (2021). According to the Alliance for Financial Inclusion, DFSWG, & CEMCWG. (2021), the process of acquiring the information, abilities, self-assurance, and competencies necessary to utilize electronically provided financial resources responsibly, make informed decisions, and act in the best interest of investment.

Effectively, DFL combines financial capability with digital proficiency to enable individuals to harness the full benefits of Digital Financial Services (DFS) Alliance for Financial Inclusion, DFSWG, & CEMCWG. (2021), Dimova et al. (2021). Consequently, a higher degree of DFL is a fundamental requirement for the active and effective use of DFS, as it enables users to navigate these platforms safely and confidently Morgan et al. (2020). Normawati et al. (2021) identify the role of financial behavior, which is influenced by financial knowledge, digital financial knowledge, and financial attitude. DFL has rightfully become a focus for regulators and governments Alliance for Financial Inclusion, DFSWG, & CEMCWG. (2021). Measuring the multidimensional concept, however, is still evolving; current approaches vary, as seen in Morgan et al. (2020), who measure DFL through knowledge of DFS, risk awareness, risk control, and understanding of consumer rights. A more comprehensive framework given, as proposed by Lyons and Kass-Hanna (2021), specifies five core dimensions: basic knowledge and skills, awareness, practical know-how, decision-making, and self-protection. Literacy, numeracy, access, consumer awareness, and platform design are some of the substantially diverse factors that support DFL Melinda Gates Foundation. (2021). Although several well-established criteria consider combined digital and financial literacy, their application in the Indian context remains limited. Morgan et al. (2020) scale is widely used in Indian studies on DFL Azeez and Akhtar (2021), Bansal, (2019), Rajdev et al. (2020).

A substantial body of international research underscores the socio-economic benefits of financial Literacy. Thus, financial literacy encompasses both financial knowledge and financial behavior Lusardi (2019). Lusardi and Mitchell (2014) demonstrated that financially literate individuals are better equipped to plan for retirement, manage debt, and weather economic shocks. In the Indian context, studies have consistently revealed alarming gaps in financial understanding across demographics National Bank for Agriculture and Rural Development. (2019). These gaps often lead to poor financial decisions, over-indebtedness, and vulnerability to fraud. Some efforts to promote financial education in India, such as the RBI's initiatives or NCERT's optional modules, have been fragmented and additive rather than integrative. But these efforts often suffered from a one-size-fits-all approach and were not fully integrated into the core pedagogical fabric. The NEP, with its systemic overhaul, presents an opportunity to move beyond these piecemeal efforts towards a structured, developmental, and inclusive model of financial education.

3. Financial Literacy and NEP (2020)

Several different fields of learning are covered in Financial Literacy. In the context of its impact on domestic decision-making, certain individuals view it as representing a thorough understanding of finances. For others, it is the deliberate use of fundamental money management techniques, including insurance, investing, saving, and budgeting. In India, a significant gap exists between generating income and managing finances, which hinders economic growth in various sectors. According to a report by the National Centre for Financial Education, only 27% of Indian adults are financially literate, a percentage that is considerably lower than the global standard of 42%. Despite only 19% of millennials exhibiting sufficient financial awareness yet professing substantial confidence in their financial skills, the issue is very worrisome. This discrepancy between perceived and actual financial Literacy seriously threatens the generation of wealth and long-term financial stability. Although revolutionary, the digital banking revolution has highlighted this knowledge gap even more. Only 31% of Indians are aware of the hazards involved and the necessary security precautions, despite 82% of them using digital payment systems for everyday transactions. Even more concerning is the fact that only 24% of people can correctly calculate simple interest, a key idea in financial planning. Problems are much more severe in rural areas, where financial literacy rates are only about 23%.

A new education system was the requirement of the era, where students could learn the basics of financial concepts, money management, and investment from an early age in school. The NEP's architecture is uniquely suited for integrating financial concepts in an age-appropriate and engaging manner. The NEP-2020 draws extensively from the UNCRC’s four broad pillars of Child Rights: Survival, Development, Protection, and Participation (SDPP) in the context of education. Goal 4 (SDG4) of the 2030 Sustainable Development Goals, which India adopted in 2015, reflects the global objective for advancing education and strives to “guarantee high-quality education is available to all and foster perpetual learning prospects for every individual” by 2030. These principles are embodied in the NEP-2020 Pillars of 4 Es, i.e., Enrolment, Equity, Excellence, and Employability. Specific targets are set towards Universal access, full equity and inclusion, quality, and learning, which reveal the Government's commitment to achieving the above. Financial education under the NEP is not confined to a single subject but a cross-curricular theme. It includes the following:

· Mathematics: Practical application of percentages, ratios, and algebra to calculate interest, returns, and EMI.

· Social Science: Understanding the economic environment, the role of RBI, and the history of trade and commerce.

· Vocational Courses: Embedded directly into courses on entrepreneurship, banking, and retail.

· Experiential Learning: The NEP's push for bag-less days, internships, and community projects can be leveraged for visits to banks, financial simulations (e.g., stock market games), and projects on household budgeting.

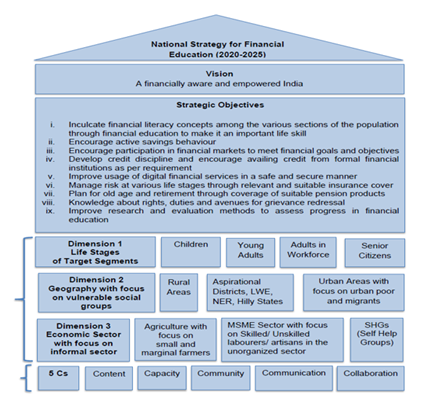

Figure 1

|

Figure 1 Vision and Strategic

objectives of NSFE (2020-2025) Source National

Strategy for Financial Education 2020-2025 |

The vision and strategic goals of India's National Strategy for Financial Education (NSFE) for 2020–2025 are depicted in Figure 1 The goal of the NSFE is to address the country's enormous geographic and demographic diversity, thereby fostering a nation that is empowered and financially aware. Its strategic goals are organized along several key aspects, including the life stage of the target audience, the target audience's geography (with a focus on disadvantaged groups), and specific economic sectors. The "5 C's" framework serves as a guide for implementing these goals, which include incorporating financial education Content into academic curricula, increasing the Capacity of financial service intermediaries, utilizing Community-led literacy models, implementing efficient Communication techniques, and encouraging Collaboration among all parties involved.

4. Financial Literacy Model

NEP-2020 expands its coverage to formally bring pre-school age children within its fold by making Early Childhood Care and Education (ECCE) a part of the education sector. Thus, holding itself accountable for children from 3 to 18 years of age, the curricular and pedagogical structure has been restructured from the earlier 10+2 to 5+3+3+4. The new structure corresponds to the following age ranges: 3-8, 8-11, 11-14, and 14-18 years. Now, with a strong foundation in Early Childhood Care and Education (ECCE), children from the age of 3 are also included in formal schooling, aiming to promote 'better overall learning, development, and wellbeing' (NEP-2020). Thus, the education sector now covers the age cohort of 3-18 years, as opposed to 6 to 18 years previously. Now, ECCE can be described as:

1) Foundational Stage (Age 3-8): The focus on numeracy through games and everyday activities provides a natural entry point. Concepts like counting, identifying currency, and understanding the fundamental difference between "needs" and "wants" can be introduced without formal instruction.

2) Preparatory Stage (Age 8-11): The policy encourages interactive classrooms. This is ideal for introducing basic financial concepts, such as saving, budgeting, managing pocket money, and the value of money, through the use of projects, stories, and simple simulations.

3) Middle Stage (Age 11-14): As students develop abstract thinking, the curriculum can incorporate more formal concepts. Lectures on simple and compound interest, banking amenities, electronic payments, and elementary entrepreneurial skills (such as managing a small venture) are made possible by the NEP's focus on practical implementation. This is consistent with the strategy's objective, which is to foster “rational and coherent discourse.”

4) Secondary Stage (Ages 14-18): The NEP's key features of flexibility and choice become crucial. Students can opt for courses in economics, commerce, or vocational subjects, such as retail management and entrepreneurship. Here, financial education can deepen to include:

· Personal Finance: Taxes, insurance, loans (educational, personal), credit scores, and investment basics (stocks, mutual funds, bonds).

· Critical Evaluation: Understanding financial risks, digital financial fraud, and critically analyzing financial advertisements and schemes.

· Entrepreneurship: Business planning, financial projections, and access to credit, directly supporting the NEP's vision to “create entrepreneurs.”

Table 1

|

Table 1 Progressive Financial Literacy Curriculum |

||||||||||

|

Age |

Activities/ Classes |

Scope |

Cognitive Process |

Curriculum (Learning) |

Considerable Factors |

Development |

Dimension |

Outcome |

||

|

Fundamental Stage (3-8) |

Gaming Activities |

Content Enabling |

Understanding, Remember |

Identifying the currencies, Counting the currencies, difference between

needs and wants, Awareness of Product, Holding and using Product |

Family, Financial Literacy Educator |

Cognitive Thinking |

Financial Awareness |

1.

Increased Savings 2.

Better Debt Management 3.

Effective use of Banking Services 4.

Successful Financial Negotiations 5.

Forward Financial Planning 6.

Improves Financial Performance 7.

Increased responsiveness to the financial service

needs of the poor |

||

|

Preparatory Stage (8-11) |

Interactive Classes |

General |

Undestanding, Applying |

Propensity to save and spend, through pocket money, budgeting, value of

money with the help of projects, stories, simple simulation, Time preference

(Present vs. Future) |

Family, Friends, Financial Literacy Educators, Media |

Financial Knowledge |

Financial Knowledge |

|||

|

Middle Age (11-14) |

Abstract thinking |

Capability |

Applying, Analyzing, Evaluating |

Mathematical implications, Simple and Compound Interest, Banking

Services, Inflation Time Value of Money, Risk and Return, Digital Transactions, Introductory

Entrepreneurship |

Family, Friends, Financial Literacy Educators, Media, Money, Circle |

Conative Ability |

Financial Attitude |

|||

|

Secondary Stage (14-18) |

Analytical & Logical Reasoning |

Specific |

Applying, Analyzing, Evaluating, Creating |

Keep track of money, Personal Finances, taxes, Insurance, Loans, Credit

Scores, Risk Diversification, Short and Long term Planning |

Family, Friends, Financial Literacy Educators, Media, Money, Circle,

Financial Planners |

Tangible Action |

Financial Behavior |

|||

|

|

Source Researchers’ own (information Collected from Various

Sources) |

|||||||||

Table 1 outlines a progressive financial literacy curriculum that adapts to a child's cognitive development, laying the foundation for financial awareness. It begins with gaming activities for children aged 3 to 8 that emphasize fundamental concepts, such as recognizing currency and distinguishing between necessities and wants, to promote cognitive development. As individuals mature (between the ages of 8 and 11), the emphasis shifts to engaging activities that teach basic financial concepts through practical budgeting and personal finance assignments. Adolescence (ages 11–14) is a period when abstract concepts, such as interest and risk, are introduced into the school program, thereby encouraging the development of critical thinking skills and the emergence of positive financial perspectives. It concludes with logical reasoning and analytical exercises on specific, complex subjects, such as taxes, loans, and credit, for individuals between the ages of 14 and 18, with the ultimate goal of transforming knowledge into informed financial behavior in maturity.

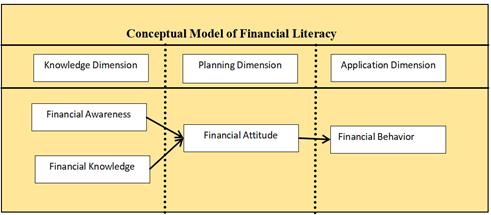

According to the theoretical framework Figure 2, financial literacy is a methodical process based on three interconnected dimensions/aspects: Knowledge, Planning, and Application. Initially, the Knowledge Dimension, which lays the fundamental groundwork for Financial Awareness and Financial Knowledge, delineates a distinct evolutionary pathway. This fundamental understanding then drives the Planning Dimension, where people develop an optimistic financial mindset by learning to set objectives and devise plans. The Application Dimension, where integrated knowledge and a planned attitude are converted into concrete Financial Behavior, determines how the entire procedure eventually comes to a close. Financial attitude has a direct impact on a person's decision-making, as a high financial attitude leads to a positive attitude towards planning Lusardi and Mitchell (2008).

Figure 2

|

Figure 2 Conceptual Model of

Financial Literacy Source Author's own

Conceptual Model |

In essence, the model captures the complete journey from theoretical understanding to practical action, progressing from learning fundamental concepts to developing intentional plans, and ultimately executing real-world financial decisions. This trajectory, which depicts an inevitable growth of a child's early financial awareness to an adolescent's competent and accountable fiscal behaviors, closely resembles the pattern of development described in the previous age-based paradigm.

5. Implementation Challenges

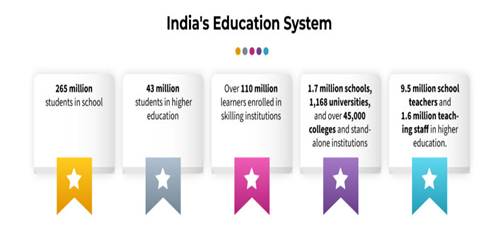

A network of more than 1.7 million schools and 45,000 institutions supports India's education system, which is among the biggest in the world and serves an astounding 265 million schoolchildren and 43 million in higher education. However, there are significant implementation issues due to the size and complexity of this extensive ecosystem, which also includes more than 110 million students enrolled in skilling schools.

Figure 3

|

Figure 3 Indian

Education System |

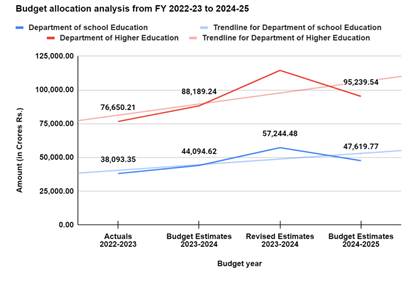

Figure 4 depict that the Department of School Education's funding dropped precipitously from ₹1,04,277.79 crore (Actual 2022-23) to a projected ₹75,650.21 crore (Budget Estimates 2024-25), according to the statistics, which shows a constant decreasing tendency. In the same time frame, the Department of Higher Education's budget drops from ₹57,244.48 crore to ₹47,619.77 crore. Examining the Revised Estimates for 2023–2024 reveals a significant in-year drop for both departments, making this trend especially concerning, as it suggests that allocated monies are not being fully disbursed. This creates a critical implementation challenge, as ambitious educational goals—from integrating financial literacy into a vast network of 1.7 million schools to enhancing the quality of higher education across 45,000 colleges require sustained and even increased investment. The shrinking budget directly threatens the feasibility of such initiatives, risking the quality of education for hundreds of millions of students and potentially widening existing gaps in access and outcomes.

Figure 4

|

Figure 4 Budget Allocation Analysis

from FY 2022-23 to 2024-25 |

Despite the extensive education system and budget, several other formidable challenges also exist, like:

1) Teacher Capacity: A critical bottleneck is the lack of trained educators who are confident in teaching financial concepts. A massive-scale teacher training and professional development program is essential.

2) Curriculum Design: Developing a standardized yet flexible national curriculum framework for financial education that is age-appropriate, culturally relevant, and available in regional languages.

3) Resource Allocation: Developing engaging teaching-learning materials (TLMs), digital content, and assessment tools requires significant financial investment.

4) Socio-Economic Disparities: The curriculum must be sensitive to the vast economic diversity of Indian students, ensuring it is relatable and not biased towards urban, affluent contexts.

5) Assessment: Moving beyond rote memorization to assess practical understanding and behavioral change poses a methodological challenge.

6. Strategic Recommendations for Effective Implementation

A coordinated, multifaceted approach is necessary for the NEP with integrated financial literacy to be implemented successfully and genuinely promote long-term economic resilience. Before a full-scale launch, this should start with a staged nationwide roll-out, starting pilot programs in states that are prepared to do so. Utilizing their resources and stake in a financially literate populace, financial institutions, regulators, fintech companies, and non-governmental organizations must form robust Public-Private Partnerships (PPPs) to ensure expertise and relevance. To guarantee scalability and engagement, this content should be distributed via extensive digital integration using interactive, gamified platforms. Notably, the success of this project hinges on a commitment to teacher preparation, which involves incorporating financial pedagogy into programs for both pre-service and in-service teachers. Finally, to create a supportive ecosystem, parental and community engagement through workshops is vital, as financial habits are often formed at home, thereby reinforcing the lessons learned in the classroom and building a foundation for collective economic resilience.

7. Conclusion

The National Education Policy 2020 is a social and economic manifesto for a new India, not just an education plan. Its structure must incorporate a strong, well-considered, and widespread foundation for financial literacy. It is a potent instrument for social empowerment that can break the debt and poverty cycles by providing pupils with functional, long-lasting skills. We can go beyond theory and produce a generation of genuinely economically savvy people by utilizing the NEP's adaptable and comprehensive approach. Teaching kids the distinction between needs and wants, equipping teens with the skills to manage a budget and comprehend credit, and educating young adults on the fundamentals of investing, insurance, and tax planning are all examples of how to cement key competencies at every step.

Additionally, the NEP can promote trustworthy venture capitalists and savvy customers by incorporating a critical assessment of digital financial fraud and sustainable entrepreneurial finance into the curriculum. Although there are substantial implementation obstacles, the long-term benefits are revolutionary. Through this effort, India will become recognized as a country of proactive, knowledgeable financial planners rather than one of inactive depositors. Financial Literacy is undoubtedly among the foundational components for achieving the full potential of NEP 2020 since it empowers a generation to create stable financial futures for themselves while making sustainable contributions to the national economy.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Adebayo, V. I., Paul, P. O., & Eyo-Udo, N. L. (2024). Sustainable Procurement Practices: Balancing Compliance, Ethics, and Cost-Effectiveness. GSC Advanced Research and Reviews, 20(1), 98–107. https://doi.org/10.30574/gscarr.2024.20.1.0247

Ahmad, G. N., Widyastuti, U., Susanti, S., & Mukhibad, H. (2020). Determinants of Islamic Financial Literacy. Accounting. https://doi.org/10.5267/j.ac.2020.7.024

Alliance for Financial Inclusion, DFSWG, & CEMCWG. (2021). Digital Financial Literacy toolkit.

Alliance for Financial Inclusion. (2021). Digital financial literacy.

Anita. (2019). Financial Literacy in India: A Critical Review of Digitalization and Demonetization. International Journal of Economic Research, 16(2), 267–271.

Atkinson, A., & Messy, F. (2012). Promoting Financial Inclusion Through Financial Education: OECD/INFE Evidence, Policies and Practice (OECD Working Papers on Finance, Insurance and Private Pensions, No. 34). OECD Publishing.

Azeez, N. P. A., & Akhtar, S. M. J. (2021). Digital Financial Literacy and its Determinants: An Empirical Evidence from Rural India. South Asian Journal of Social Studies and Economics, 11(2), 8–22. https://doi.org/10.9734/sajsse/2021/v11i230279

Bansal, P. (2019). A Conceptual Framework for Digital Financial Literacy. International Journal of Management and Applied Science, 5, 2394–7926.

Dimova, M., Berfond, J., Kelly, S., & Mapes, W. (2021). Empowering Women on a Journey Towards Digital Financial Capability. Women’s World Banking.

Fanta, A., & Mutsonziwa, K. (2021). Financial Literacy as a Driver of Financial Inclusion in Kenya and Tanzania. Journal of Risk and Financial Management, 14(11), 561. https://doi.org/10.3390/jrfm14110561

Filmer, D. (2008). Disability, Poverty, and Schooling in Developing Countries: Results from 14 Household Surveys. World Bank Economic Review, 22(1), 141–163.

Loeb, M. E., & Eide, H. E.

(2004). Living Conditions Among People with

Activity Limitations in Malawi: A National Representative study. SINTEF Health

Research.

Lusardi, A. (2019). Financial literacy and the Need for Financial Education: Evidence and

Implications. Swiss Journal of Economics and Statistics, 155(1), 1–8.

Lusardi, A., & Mitchell, O.

S. (2008). Planning and Financial Literacy: How do

women fare? American Economic Review, 98(2), 413–417.

Lusardi, A., & Mitchell, O. S. (2014). The Economic Importance of Financial Literacy: Theory and Evidence. Journal of Economic Literature, 52(1), 5–44.

Lyons, A. C., & Kass-Hanna, J. (2021). A Methodological Overview of Defining and Measuring "Digital" Financial Literacy. SSRN Electronic Journal, 1(217), 0–27. https://doi.org/10.2139/ssrn.3836330

Melinda Gates Foundation. (2021). Enabling women's Financial Inclusion Through Digital financial

literacy.

Ministry of Human Resource Development. (2020). National Education Policy 2020. Government of India.

Ministry of Human Resource Development. (2020). National Education Policy 2020.

Morgan, P., Huang, B., & Trinh, L. (2020). The Need to Promote Digital Financial Literacy for the Digital Age. Asian Development Bank Institute.

National Bank for Agriculture and Rural Development. (2019). National Survey on Financial Inclusion.

Normawati, R., Rahayu, S., & Worokinasih, S. (2021). Financial Knowledge, Digital Financial Knowledge, Financial Attitude, Financial Behaviour and Financial Satisfaction on Millennials. In Proceedings of the 4th International Conference on Law, Social Sciences, Economics, and Education (ICLSSEE). https://doi.org/10.4108/eai.6-3-2021.2305967

OECD. (2014). Financial education for youth: The Role of Schools.

Organisation for Economic Co-operation and Development. (2020). PISA 2018 Results (Volume IV): Are Students Smart About Money? OECD Publishing.

Rajdev, A. A., Modhvadiya, T., & Sudra, P. (2020). An Analysis of Digital Financial Literacy Among College Students. Pacific Business Review International, 13(5), 32–40. https://doi.org/10.1016/s1057-0810(99)80006-7

Ravikumar, T., Suresha, B., Prakash, N., Vazirani, K., & Krishna, T. A. (2022). Digital Financial Literacy Among Adults in India: Measurement and validation. Cogent Economics and Finance, 10(1). https://doi.org/10.1080/23322039.2022.2132631

Reserve Bank of India. (Various years). Reports of the Committee on Financial Inclusion.

Romadhon, D. N. A., & Mulyadi, H. (2025). Why is it Important? Financial Literacy in Students in Entrepreneurship: A Systematic Literature Review. F1000Research, 14(138). https://doi.org/10.12688/f1000research.160829.1

Shen, Y., Hu, W., & Hueng, C. J. (2018). The Effects of Financial Literacy, Digital Financial Product Usage, and Internet Usage on Financial Inclusion in China. MATEC Web of Conferences, 228, 1–6. https://doi.org/10.1051/matecconf/201822805012

Stephen, G. (2022). Digital Financial Literacy Skills Among Library and Information Science Professionals in Northeast India: A Study. Library Philosophy and Practice. https://digitalcommons.unl.edu/libphilprac/12788

Tinghög, G., Ahmed, A., Barrafrem, K., Lind, T., Skagerlund, K., & Västfjäll, D. (2021). Gender Differences in Financial Literacy: The Role of Stereotype Threat. Journal of Economic Behavior and Organization, 192. https://doi.org/10.1016/j.jebo.2021.10.015

Tiwari, C. K., Gopalkrishnan, S., Kaur, D., & Pal, A. (2020). Promoting Financial Literacy Through Digital Platforms: A Systematic Review of Literature and Future Research Agenda. Journal of General Management Research, 7(2), 15–26.

Tony, N., & Desai, K. (2020). Impact of Digital Financial Literacy on Digital Financial Inclusion. International Journal of Scientific and Technology Research, 9(1), 1911–1915.

United Nations. (2015). Sustainable Development Goals Kick off with Start of New Year.

United Nations. (n.d.). Sustainable

World Bank (2009). People with Disabilities in India: From Commitments to Outcomes. (Washington, DC: 2009)

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2025. All Rights Reserved.