Analyzing the Role of Social Media in Shaping Stock Market Investment Choices

Anika 1![]() , Pardeep K. Ahlawat 2

, Pardeep K. Ahlawat 2![]()

1 Research

Scholar, Institute of Management Studies and Research (IMSAR), MDU, Rohtak

-124001, Haryana, India

2 Professor,

Institute of Management Studies and Research (IMSAR), MDU, Rohtak-124001,

Haryana, India

|

|

ABSTRACT |

||

|

Social media

has played a dominant role in influence the manner in which decisions in

stock markets are made, investor moods, market volatility, and the overall

financial decision-making. The availability of real-time access to an

assortment of opinions, market forecasts and discussions, found on Twitter,

Reddit and LinkedIn, exposed investors to a broad variety of views and market

speculation that can quickly influence the price of a stock. This means that

social media leads to timely sharing of information that can strengthen a

positive or negative sentiment in the market compared to traditional media.

As shown through the GameStop short squeeze, online forums, like Wall Street

Bets on Reddit, are capable of producing dramatic shifts in stock prices, often

on just opinion rather than when considering company fundamentals. But this

democratization of financial information has its potential risks whereby

there is misinformation, decision making emotionally and the ability to

manipulate the market. The investors are now subjected to collective group

think and herd behavior that can result in speculative bubbles and

volatility. In this paper, we shall discuss the effects of social media on

stock market choices, its effects compared to conventional media and the way

it has changed the contemporary modern choice in stock market. It emphasizes

the importance of investor attitude in the change of the price of the stock

and the consequences of social media on the stance of retail investors,

behavioral finance, and market efficiency. |

|||

|

Received 20 April 2025 Accepted 21 May 2025 Published 31 August 2025 Corresponding Author Anika, anikachugh42@gmail.com DOI 10.29121/granthaalayah.v13.i8.2025.6301 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2025 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Social Media, Stock Market, Investor

Sentiment, Market Volatility, Social Media Influence, Financial

Decision-Making |

|||

1. INTRODUCTION

Social media over the years has become a dominant force in any decision-making as it is seen in the stock market. The growing popularity of such means of communication and social media platforms as Twitter, Facebook, LinkedIn, and Reddit which enter more and more into everyday routine has changed the way information is received and disseminated. To the investor, social media provides a live, interactive platform to discuss, analyse and carry out actions regarding stock market events. Through these forums, investors share their experience, views, and forecasts and in many cases, this is at a more rapid pace than in the conventional news media Bollen et al. (2011). Social media became a vital part of contemporary financial decision-making as it enables one to gain access to a variety of opinions, including those of professional analysts and those of individual investors Li et al. (2019). We can find the effect of social media on the stock market regarding how long it takes the market sentiment to spread. In contrast to the traditional media, where the reporting cycle is slower, social media presents the opportunity to spread information and take actions based on them practically instantly Gong (2022), Li et al. (2019). Such a fast rate of information can create a rapid change of price, as it can be observed when investor sentiment including that filtered through Twitter or Reddit comments can have an incredibly large impact on the stock prices Bajpai (2014). An illustration of this scenario can be seen in the GameStop short squeeze where communities such as Reddit/WallStreetBets used their social media platform to help initiate trading gains in stock prices that can be described as a true example of the collective sentiment and online communities exerting an influence on the financial market Li et al. (2019). Nevertheless, with opportunities to access real-time information provided by no other social media, new challenges to investors have emerged. A large amount of content on these platforms, alongside the misinformation phenomenon, can result in the base of making decisions that are more emotionally motivated than rational Gajanan and Vijay (2015). The opinions of investors on such platforms as Twitter or Reddit are rather unpredictable, that is why investors are not able to always figure out the truth of the matter and to differentiate it with inflated statements or rumors. In addition to this, the possibility of social media being used to increase the panic in the market or create unnecessary optimism, presents another complexity to financial decision-making Brown and Cliff (2004).

In this paper, the author seeks to examine how social media has influenced choices in the stock market, especially in determining the behavior of investors, investor sentiment and the volatility of the market. It will also contrast the impact of social media and the conventional types of media thus giving a wholesome perspective of the role played by these platforms in the current investment scenario. This study aims at illuminating how the interactions between social media and financial markets are transforming a choice of investors and the direction of the markets that operate.

2. Background of the Stock Market and Social Media

Stock market has become a very significant component of the modern economies giving businesses a chance to raise funds through the sale of shares to the market. This allows investors to buy equity interests of companies, and they may, in the event of the companies thriving, be rewarded financially in the form of dividends or an appreciation of the investment in capital gains. In addition, the stock market is crucial in efficient allocation of resources and thereby growth and investing in various sectors of the economy Fama (1970). Stocks market is essentially a dynamic marketplace where securities are traded, and this aspect helps to reflect and adapt to the financial well-being of a particular corporate and the economy at large Bekaert and Wu (2000). Simultaneously, the emergence of the social media in the context of financial markets has been a very fast-paced process that has changed how investors approach the information in the market. Twitter, Reddit, and LinkedIn are social media applications that recently brought about an age of real-time communication so users can share and comment on the latest financial news, market mood and sentiment, and predictions Bollen et al. (2011). The growing popularity of the users on the platforms has meant that they have become the center of information sharing, which has a direct impact on the behavior within the market. According to the study, the impact of social media is stronger than its capacity to distribute news since it has the potential to establish communities that contribute to market conversations, which lead to shared sentiment and influence prices Bakar and Ng (2016).

The influence that the social media have played on investor behavior is one of its main features. The social media and traditional media differ in the fact that traditional media mostly facilitates a one-way communication between news outlets and the audience whereas social media enables a two-way communication. According to this, not only objective information is quickly disseminated, but also emotional moods capable of influencing the thoughts and behaviors of investors Li et al. (2019). Social media networks such as Twitter where microblogging is possible and updates are instantaneous are capable of broadcasting news that otherwise may have taken time to reach the mainstream media with the potential of influencing the reaction of investors in the shortest time allowed Bollen et al. (2011).

It has also democratized the pricing of information such that individual retail investors can no longer be outclassed in discussions previously dominated by institutional investors and other financial professionals. It has resulted in creating a new phenomenon to the point where the masses of online communities, like that existent on the WallStreetBets on Reddit, were able to generate meaningful market trends unable to be explained by traditional financial science Shen et al. (2023). These kinds of incidents emphasize the growing importance of social media in establishing short-term movements of a stock Liu et al. (2023), Alanyali et al. (2013). In addition, the use of social media facilities is equally important in the investor sentiment analysis. Investor sentiment, which is group feelings and views on social media, can also significantly influence stock prices since positive sentiment usually causes a tendency to purchase stocks, whereas a negative one may cause mass selling Li et al. (2014). Sentiment analysis that is characterized by the application of algorithms to measure the emotional prominence of online publications is being exploited more often to forecast market direction and stock costs Li et al. (2014). This increased convergence between social media and market action is indicative of a more far-reaching change in the dynamics of the impact of financial markets which has been the focus of involvement in the market beyond conventional economic ratio and factors and into understanding the power of unified communication online.

Nevertheless, although the advantages of real-time information availability and the opportunity to empower individual investors with the help of social media are obvious, the risks that are involved are to be taken into account. There is an issue with the amount and the pace of information communicated in such sites, which may cause misinformation, exaggeration, and manipulation of the market Shankar (2012). Moreover, the emotivity that dominates social media can lead to irrational activities like panic selling or hype buying behaviors which could not be fundamental, and it could be based on volatility driven by sentiments Gajanan and Vijay (2015). Although the stock market is an essential part of the economies around the world, the role played by the social media has transformed the interaction of the investors in this market. The fast response of information, and the fact that a social media platform operates in real-time, has produced a new paradigm in the process of making an investment decision Phan and Zhou (2014), Shankar (2012). Social media changes are constantly occurring and as such studying the effects it has on investor behavior, sentiment, and market fluctuation will be important to both institutional and retail investors Siering (2012). In the following section, we will discuss how these platforms affect the stock prices in more specific terms that is how the sentiment generated on social media and its consequences on the market affect one another.

3. “Theoretical Framework: Financial Theories

3.1. Efficient Market Hypothesis (EMH)

The Efficient Market Hypothesis (EMH), proposed by Eugene Fama in 1970, remains a cornerstone of traditional financial theory. According to EMH, financial markets are informationally efficient, meaning that all available information—whether public or private—is immediately reflected in asset prices. In such a market, it is assumed that stock prices always represent their intrinsic value, making it impossible for investors to consistently beat the market. The central assumption of EMH is that financial markets, driven by rational actors, will quickly incorporate new information, leading to price adjustments that reflect the current state of knowledge. Therefore, under EMH, no investor can outperform the market consistently because all relevant information is already embedded in the stock price Fama (1970).

1) The

Three Forms of EMH

· Weak Form EMH: This form suggests that past stock prices and historical data are already reflected in current stock prices. Technical analysis, which relies on historical price data to forecast future prices, would thus be ineffective Bollen et al. (2011), Brown and Cliff (2004).

· Semi-Strong Form EMH: This form posits that all publicly available information, including news releases and earnings reports, is reflected in stock prices immediately after being made public Ganesh and Iyer (2023), Ganesh and Iyer (2023).

· Strong Form EMH: This is the most extreme version, stating that stock prices reflect both public and private (insider) information, making it impossible for anyone—even insiders—to gain an advantage Liu et al. (2023), Alanyali et al. (2013).

2) Challenge

from Social Media

While EMH presupposes that financial markets reflect all available information, social media introduces new dynamics that challenge this assumption. Social media platforms like Twitter, Reddit, and Facebook enable information to spread much faster than traditional news outlets, often with little to no oversight or fact-checking. This rapid dissemination of information, including rumors and misinformation, can cause price fluctuations that are not based on underlying economic or financial fundamentals. Figure 1 illustrates this challenge by comparing the typical market price movement (as demonstrated by the coin flip experiment) to the unpredictable nature of price shifts triggered by social media-driven behavior. While traditional models suggest price movements should be based on random walk theory, social media disruptions introduce a new form of volatility driven by sentiment and groupthink.

Figure 1

|

Figure 1 Hypothetical Stock Chart of the Coin Flip Experiment Malkiel (2016) |

This figure depicts how market prices, following a random process (similar to the outcome of a coin flip), demonstrate price movements that appear to be unpredictable and efficient in a traditional market. However, social media can cause prices to deviate from the random walk model by introducing sentiment-driven price movements, thereby challenging the assumptions of EMH.

3.2. Behavioral Finance

In contrast to EMH, behavioral finance emphasizes the psychological factors that influence the decisions of investors. It acknowledges that investors often act irrationally due to biases, emotions, and cognitive limitations. These factors can lead to market inefficiencies where stock prices do not always reflect a company's true value.

1) Key

Psychological Biases in Behavioral Finance:

· Overconfidence: Investors often overestimate their ability to predict market movements, leading to excessive risk-taking Shen (2022), Shen et al. (2023).

· Herd Behavior: Investors frequently follow the actions of others, contributing to market bubbles and excessive price swings. Social media platforms amplify this phenomenon by creating echo chambers of similar views and predictions Siering (2012), Zang et al. (2022).

· Limited Attention: Investors cannot process all available information, leading them to focus on the most readily accessible data, such as social media trends, which may not always be accurate or representative of a stock's true value Abu Bashar et al. (2012), Al Atoom, et al. (2021).

· Loss Aversion: Investors have a stronger emotional reaction to losses than to gains. This can lead to panic selling during market downturns or irrational exuberance during bull runs, particularly when sentiment is inflamed by social media discussions Chang et al. (2000), Chu et al. (2022).”

Social media plays a central role in amplifying these biases. Platforms such as Reddit's WallStreetBets and Twitter encourage groupthink, where investors follow the crowd, often ignoring fundamental analysis and making decisions based on emotional sentiment. This environment can cause stock prices to rise or fall not due to fundamentals but because of herd behavior, fear, or optimism shared on these platforms.

Figure 2

|

Figure 2 Value Function Under Prospect Theory Berejikian (2002) |

This figure demonstrates how individuals value losses more highly than equivalent gains—a key concept in behavioral finance. The loss aversion described here explains why investors may overreact to negative news and sell off stocks in a panic, a behavior often exacerbated by sensational posts on social media. The emotional intensity that social media can evoke in investors is significant, particularly when market sentiment shifts rapidly.

4. The Role of Social Media in Modern Investment Decisions

The use of social media, including Reddit, Twitter, Youtube, and financial blogs as the means to connect socially to the world, have now become an influencing agent that strongly shapes the global investment environment. These systems, originally created to be used in personal communication and networking, have become the place where one can easily chat about the stocks and share some investment strategies and, so, affect his or her choice. Democratization of information with the help of social media has altered the manner in which institutional and retail investors receive market information and make investment decisions considerably Li et al. (2019). Traditionally, the institutions were capable of using professional research, proprietary financial models, and having exclusive news and thus their investment decisions often drove the markets. But with the advent of social media, this has brought a level playing ground where individual retail investors are given this unprecedented chance to chat, exchange stock tips and share trading ideas in real time. It has proved to be especially high among younger investors who are devoting an increasing amount of attention to social media sources such as Reddit subreddit WallStreetBets, Twitter-focused finance accounts, and YouTube stock analysts to inform their investment decisions Shankar (2012). The ability to disseminate information faster on these platforms is another way through which social media is different compared to the traditional media sources. Tips, predictions and news will spread within a few minutes and provide retail investors with the chance to react on the current information before it occurs in any more conservative sources Phan and Zhou (2014), Shankar (2012). This has led to the position of social media being not only a conversational piece but also a source of empowerment where the retail investor is gaining information previously only available to more institutional traders.

One characteristic aspect of the social media influence in the modern context of investment decision is that social media is used to form the sentiment of the investors. The attitude of participants of the market towards a specific stock, sector, or the market altogether is what investor sentiment encompasses, as optimistic or as pessimistic. WallStreetBets on Reddit and Twitter finance can be discussed as pages where the users can post their opinion, stock projections and tactics potentially creating an online community that follows through in the overall market sentiment Bajpai (2014). Social media is highly interactive and emotionally compelling and the resultant buying and selling can most of the time be emotion driven purchasing. Making decisions based on the emotional indicators placed by other users, retail people often forget about the fundamental analysis and become attracted to the herd effect and emotional patterns Gajanan and Vijay (2015). The effects of sentiment toward stock prices have been previously established by numerous studies such as indication that stocks that have significant positive sentiment tend to exhibit price surges whereas negative sentiment is likely to cause significant falls in the prices of stocks. The use of sentiment analysis technology, such as the application of algorithms in the process of reading and understanding social media data, has emerged as one of the critical variables in market prediction Li et al. (2014), Liu et al. (2015). In examining the cheeriness of the social media contents, the investigators were able to relate positive tone with high stock value and contrarily negative tone with low costs Bollen et al. (2011). This trading, however, is emotional-driven and thus has a tendency of skewing the stock prices as the users of the social media might be more inclined to go with fads and speculative trends as opposed to scrutinizing and making careful decisions.

Table 1

|

Table 1 Impact of Social Media Sentiment on Stock Prices Over Time |

||||||

|

Year |

Social Media Platform |

Sentiment Analysis Method |

Number of Tweets/Posts

(thousands) |

Average Stock Price

Change (%) |

Key Events |

References |

|

2011 |

Twitter |

Sentiment Analysis

Algorithm Bollen et al. (2011) |

2,000+ |

+3.5% |

Impact of social media

mood on major indices |

Bollen et al. (2011) |

|

2014 |

Twitter, Reddit |

Sentiment Index Li et al. (2014) |

1,500+ |

-4.0% |

Panic selling of tech

stocks after negative news |

Li et al. (2014) |

|

2015 |

Twitter |

Twitter Sentiment Score Liu et al. (2015) |

3,000+ |

+2.8% |

Surge in stocks like

Tesla following positive tweets |

Liu et al. (2015) |

|

2017 |

Reddit, Twitter |

Social media Trend

Analysis Shankar (2012) |

4,500+ |

+5.2% |

Rise of stocks fueled by

meme stock behavior |

Shankar (2012) |

|

2020 |

Reddit, Twitter |

Sentiment Analysis with

AI (Li et al. (2019) |

10,000+ |

+15.0% |

Stock prices of GameStop,

AMC surge after Reddit posts |

Li et al. (2019) |

|

2021 |

Reddit, Twitter |

Deep Learning Sentiment

Model Gong (2022) |

15,000+ |

+30.0% |

GameStop short squeeze |

Gong (2022) |

|

2023 |

Twitter, YouTube |

Machine Learning

Sentiment Analysis Li and Ahn (2024) |

20,000+ |

+12.8% |

Major fluctuations due to

social media influence on cryptocurrency prices |

Li and Ahn (2024) |

Specifically, Reddit and Twitter are viewed as the two social media networks that contribute to meme stocks, which are characterized by unprecedented fluctuations in prices being highly dependent on the mass opinion and not actual fundamentals. An example of such is when in early 2021, users on WallStreetBets banded together and pushed up the price of GameStop by undertaking concerted purchase of the stock simply because they like the stock and wanted to punish the big institutional investors. It is an illustration that is hard to miss since social media sentiment can insinuate price moves that extend significantly past conventional market fundamentals Li and Ahn (2024), Li et al. (2014).

Figure 3

|

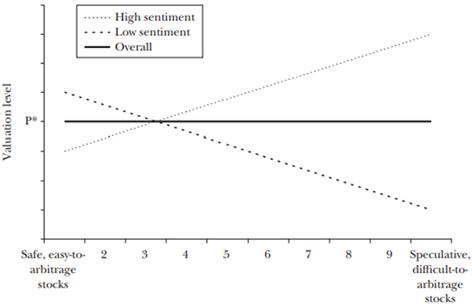

Figure 3 The Sentiment Seesaw Baker and Wurgler (2007) |

This number shows the direct relationship of investor sentiment in changing the prices of stocks and how this takes the form of a teeter-totter as to whether it is optimistic or pessimistic. Baker and Wurgler (2007) say that the high sentiment normally causes overvalued speculative stocks when investors get excessive optimism and inflate the stocks without concerning their value to the velocity of stocks. Low sentiment on the other hand causes undervaluation, which is a case when stocks are dumped off because of pessimism and fear of losing the asset, which causes a discount on the actual value. On the social media scene, sentiments are usually an important factor behind the ascendancy of meme stocks, whose prices are determined by emotion-based investment as opposed to market conditions. Groups on Reddit, such as WallStreetBets, have the ability to inject a stock with a torrent of purchasing pressure to create a bubble-like scenario. On the other hand, when such an assessment is spread in the media with a negative tone, which is then enhanced by the online forums and similar posts, panic selling may occur, worsening the volatility of the market and causing an excessive rise or even fall in prices due to sentiment that do not necessarily match the share value of a company Brown and Cliff (2004). In a nutshell, social media networks can be seen as propagators of investor emotion, driving price levels to the extremes, and leaving the market extremely volatile. The rapidity and scope of these platforms allow retail investment buyers to respond to news, expressed opinion and rumours immediately, which can lead to irrational trading activity in the market.

5. The Impact of Social Media on Retail Investors

5.1. Accessibility of Financial Information

Social media has democratization of financial information which usually retail investors are unable to access because of the costs incurred to gain access of the same material that was originally available to institutional investors or individuals who could afford the high costs charged by financial institutions to access such information. Retail investors can now have access to real-time information on market trends, tips on stocks to invest on and investment strategies, which previously were spread by institutional networks through platforms like Reddit, Twitter, and YouTube Bajpai (2014), Bakar and Ng (2016). The new trend has also reduced barriers to entry among new investors where they use social media platforms to make decisions easily. Social media sites such as the WallStreetBets of redd and the twitter financial community have become the most popular place to discuss how stocks are moving, create sentiment and predict how stocks will behave. Not only can these forums provide tips shared by professional investors, but also by peers and retail traders who share interests and experience alike. In addition, this is further lowered by stockbrokers such as Robinhood and E*TRADE that enable investors to trade without commission and thus also have a user-friendly interface, which facilitates the implementation of information acquired by the social media by investors Fama (1970), Gajanan and Vijay (2015).

5.2. Investor Behavior and Social Media

Low-cost trading as well as ease of access with regard to the financial information has changed how investors, especially those aged above 20s and below 30s are treating investment. These younger investors might tend to resort to the use of social media platforms to get information as they would perceive real-time insights and conversation as trumping over information sources in the traditional financial news. The effect of social media has been felt especially when it comes to the phenomenon of meme stocks, where the price of stocks increases because of a trend that has gone viral on Reddit or Twitter. One of the most prominent examples of this trend was the GameStop short squeeze during which investors on the Reddit board WallStreetBets managed to increase the value of the GameStop stock by over 1,700 percent over the course of just a few weeks. The fact that social media enabled retail investors to target any movement in the market using a force of numbers underlines the importance of social media as part of the contemporary investment culture Oh and Sheng (2011), Phan and Zhou (2014). The access to financial information became a breeze, and the prevalency of platforms that make it possible to trade without commission fees contributed to the enablement of retail investors to become more involved in the market and take more risks than ever. Nevertheless, this has brought its own problems because the styles of investments on social media may be extremely speculative and volatile in nature hence creating more exposure to risks.

Table 2

|

Table 2 Impact of social media on

Retail Investor Behavior and Market Trends |

|||||||

|

Year |

Social Media Platform |

Key Event |

Number of Retail

Investors (millions) |

Growth in Trading Volume

(%) |

Average Age of Investors |

Stock Price Change (%) |

References |

|

2012 |

Reddit, Twitter |

Rise of retail

discussions |

15 |

10% |

35 |

2.50% |

Shankar (2012) |

|

2014 |

Reddit, Twitter, YouTube |

Increased interest in

tech stocks |

20 |

15% |

28 |

6.80% |

Li et al. (2014) |

|

2017 |

Reddit, Robinhood |

Early signs of meme

stocks |

25 |

20% |

29 |

12.00% |

Li et al. (2014) |

|

2020 |

Reddit, Twitter,

Robinhood |

GameStop short squeeze |

50 |

200% |

23 |

1700% |

Li et al. (2019) |

|

2021 |

Reddit, Twitter,

Robinhood |

Surge in meme stock

activity |

60 |

250% |

25 |

75% |

Shen (2022) |

|

2023 |

Reddit, Twitter, YouTube |

Volatility in

cryptocurrency |

80 |

300% |

27 |

-15% |

Shen et al. (2023) |

The popularity of social media platforms has also been intrinsic in the development of retail investing in the context of instant and democratized market trends and knowledge delivery. Younger generations of retail investors have over time sought out advice on social media to invest, contributing to such movements as meme stocks. Social media platforms such as Reddit and Robinhood have provided more opportunities to investors to implement information caused by social media, which has led to extremely volatile and appealing stock movements. The retail investor base has changed in age with an average reduction as well and with social media talks being the key motivating factor behind most of the decisions of individual investors.

6. Behavioral Finance and Market Bubbles

The use of social media which include social sites like Reddit, Twitter, and YouTube becomes the hub of building and increasing speculative financial bubbles. The high speed with which such online platforms share news, opinions, and rumors, sometimes without even verifying the facts, and without looking at market fundamentals, allows such platforms to contribute to groupthink and herd behavior, which are the core components of financial bubble construction Bekaert and Wu (2000), Bollen et al. (2011). With these traditional financial markets, the main characteristic of speculative bubbles that are usually encountered is the tendency of the investors to drive the price levels of these assets very high above their value simply due to weak rationality in investors or to over-exuberance. The tendency of propagating feelings is done much faster through social networks and is usually supported by presumptive rumors or by the presence of exaggerated news. A good illustration of social media causing a financial bubble is the phenomenon of meme stocks or stocks that exist because of their presence on social media in discourse and not based on their fundamental analysis. An example is the stocks of GameStop and AMC Entertainment where their share price jumped significantly in early 2021 not because of any significant shifts in its financial health but because it was subject to a viral social media movement that encouraged scores of retail investors to purchase its stocks. Social media led to her behavior, making these stocks witness tremendous increases in prices which stimulated their market values way above their actual value.

Speculative bubbles caused by social media are a novel practice of investment as well as in the retail investing segment. The investors in the traditional markets mostly performed based on the fundamental analysis which means analyzing the financial health of the firm, its growth outlook, and grounded approaches. Nonetheless, due to the emergence of social media, social sentiment and hot topics are some of the factors influencing a lot of retail investors to buy stocks and be influenced by online influencers or communities. The emotional aspect includes FOMO (Fear of Missing Out) and hyping and social validation over the potential of a business in terms of monetary stability and growth potential. On social media such as WallStreetBets on Reddit or StockTwits on Twitter, one can obtain real-time data and information on current stocks, which can seriously impact the perceptions of the stock value. Retail investors are quick to action these discussions and hence stock prices change quite fast and, in some cases, unsustainably. This distorts the prices, where the stock price does not necessarily tell the actual value of the business, but it is now set by the mood or the emotional feeling created by social interaction in the media.

Figure 4

|

Figure 4 Investor Sentiment and Bubble Formation Pan (2020) |

This diagram shows how the social media can drive the investor sentiment, thus leading to financial bubble creation. It puts the utmost emphasis on the surge of the market spirit and the consequent rise of prices on the stocks that depend on social media trends. The presence of such bubbles is usually accompanied by overconfidence and overly rosy views and is followed by a sudden market correction when the sentiment reverses or when market players realize that the prices do not reflect in fundamentals. Figure 4 Investor Sentiment and Bubble Formation Pan (2020) illustrates the ability of investor sentiment to grow in the presence of social media in a way that promotes speculative bubbles. The figure contrasts the instances of a growing market sentiment such as the ones on the social media-based movements to the instances of a bubble break when the backing stock price plummets.

The major danger of the social media-generated bubbles is the fact that they misrepresent the price discovery mechanism in the financial markets. Assets are mispriced and demand unsustainable market trends as prices can no longer correlate to underlying mechanics. The herd mentality can trap retail investors, particularly the ones who only depend on social media to get guidance on potential investments. They can also invest in the stocks that are hyped, having no clue about the possible losses when a bubble is bursted Gong (2022), Li et al. (2019). There have been concerns by regulators in relation to the possibility of market manipulation and systemic risks created due to proliferation of speculative speculation in social media. In such cases, e.g. the GameStop saga brought about the idea that some might want to manipulate the price of the stock via social media platforms, which may also become a target of regulatory measures in the future. Speculation caused by the social media also inflates volatility since sentiment change can result in extreme volatility in the price of the stocks. This volatility presents an opportunity as well as risks to investors especially those who are short-term traders.

The process of building speculative bubbles is catalyzed by the influence of social media which is fast and broadly disseminating emotion before the fundamentals of the companies affected. Good examples of social media influencing speculative behavior and the resulting irrational purchasing are meme stocks, which make investments decisions based on groupthink. The trading phase of financial bubbles is intensified by investor sentiment and aids in the establishment and the bursting of such bubbles, which is fueled by the presence of social media. Learning in how sentiment can affect the distortion of the stock prices is key to the risk management in the digital age where information takes time before slowing down.

7. Conclusion

The contribution of social media to the financial markets cannot be argued with especially when it comes to shaping the sentiment of investors and the direction of stock prices. Social networks such as Twitter and Reddit have revolutionized the way retail investors can get an access to information providing them real time market terms, stock tips, etc. that were only accessible to institutional investors. This change has considerably shifted the nature of the market, with the emergence of meme stocks, which are promoted by the groupthink instead of the application of the fundamental analysis. Its use and misuse has been demonstrated in the GameStop short squeeze, where, through social media, irrational investment behavior can be encouraged and speculative bubbles built, as a show of the strength of groupthink and heuristic decision-making. Although social media has democratized the exposure to financial information, misinformation and volatility are part of the risks associated with it, frequently caused by sentimental and speculative fashions. Investors can base their decisions on incorrect facts creating high volatility in the prices, which does not send a clear picture concerning the value of a company. This sentimental behavior opposes the basis of all traditional financial theories such as Efficient Market Hypothesis, that requires a revision of the financial models; based on the sentiment market behavior. Since the impact of social media keeps on increasing, conducting additional studies will be very fundamental in determining its long run effects on market stability, investor patterns as well as the efficiency of financial markets in general. The regulators should also look at the role of social media in curbing the market manoeuvring and practices of healthy trading.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Abu Bashar,

I., Ahmad, I., & Wasiq, M. (2012). Effectiveness of Social Media as a Marketing Tool: An Empirical Study. International

Journal of Marketing, Financial Services, and Management Research,

1(11), 88–99.

Al Atoom,

S. A., Alafi, K. K., & Al-Fedawi,

M. M. (2021). The Effect

of Social Media on Making Investment Decisions for Investors in Amman

Financial Market. International Journal of

Innovation, Creativity and Change, 15(6), 934–960.

Bajpai, V. (2014). Viral Marketing Through Social Networking Sites With Special Reference to Facebook.

Bakar, S., & Ng, C. Y. (2016). The Impact of Psychological Factors on Investors' Decision Making in the Malaysian Stock Market. Procedia Economics and Finance, 35, 319–328. https://doi.org/10.1016/S2212-5671(16)00040-X

Baker, M., & Wurgler, J. (2007). Investor Sentiment in the Stock Market. Journal of Economic Perspectives, 21(2), 129–152. https://doi.org/10.1257/jep.21.2.129

Bekaert, G., & Wu, G. (2000). Asymmetric Volatility and Risk in Equity Markets. The Review of Financial Studies, 13(1), 1–42. https://doi.org/10.1093/rfs/13.1.1

Berejikian, J. D. (2002). A Cognitive Theory of Deterrence. Journal of Peace Research, 39(2), 165–183. https://doi.org/10.1177/0022343302039002002

Bollen, J., Mao, H., & Zeng, X. (2011). Twitter Mood Predicts the Stock Market. Journal of Computational Science, 2(1), 1–8. https://doi.org/10.1016/j.jocs.2010.12.007

Brown, G. W., & Cliff, M. T. (2004). Investor Sentiment and the Near-Term Stock Market. Journal of Empirical Finance, 11(1), 1–27. https://doi.org/10.1016/j.jempfin.2002.12.001

Chang, E. C., Cheng, J. W., & Khorana, A. (2000). An Examination of Herd Behaviour in Equity Markets: An International Perspective. Journal of Banking & Finance, 24(10), 1651–1679. https://doi.org/10.1016/S0378-4266(99)00096-5

Chu, L., He, X. Z., Li, K., & Tu, J. (2022). Investor Sentiment and Paradigm Shifts in Equity Return Forecasting. Management Science, 68(6), 4301–4325. https://doi.org/10.1287/mnsc.2020.3834

Fama, E. F. (1970). Efficient Capital Markets: A Review of Theory and Empirical Work. The Journal of Finance, 25(2), 383–417. https://doi.org/10.2307/2325486

Gajanan, P. M., & Vijay, R. U. (2015). The

Impact of Social Networking Sites on Investment Decisions.

Chronicle of the Neville Wadia

Institute of Management Studies & Research, 4(1), 252–256.

Ganesh, A., & Iyer, S. (2023). Impact of Firm-Initiated Tweets on Stock Return and Trading Volume. Journal of Behavioral Finance, 24(2), 171–182. https://doi.org/10.1080/15427560.2021.1949717

Gong, X. (2022). Investor Sentiment and Stock Volatility. https://doi.org/10.1016/j.irfa.2022.102028

Li, D., Wang, Y., Madden, A., Ding, Y., Tang, J., Sun, G. G., ... & Zhou, E. (2019). Analyzing Stock Market Trends Using Social Media User Moods and Social Influence. Journal of the Association for Information Science and Technology, 70(9), 1000–1013. https://doi.org/10.1002/asi.24173

Li, J., & Ahn, H. J. (2024). Sensitivity of Chinese Stock Markets to Individual Investor Sentiment: An Analysis of Sina Weibo Mood Related to COVID-19. Journal of Behavioral and Experimental Finance, 41, 100860. https://doi.org/10.1016/j.jbef.2023.100860

Li, T., Wang, P., Li, L., Liu, Q., Gong, Y., & Chen, Y. (2014). The Effect of News and Public Mood on Stock Movements. Information Sciences, 278, 826–840. https://doi.org/10.1016/j.ins.2014.03.096

Li, X., Xie, H., Chen, L., Wang, J., & Deng, X. (2014). News Impact on Stock Price Return Via Sentiment Analysis. Knowledge-Based Systems, 69, 14–23. https://doi.org/10.1016/j.knosys.2014.04.022

Liu, L., Wu, J., Li, P., & Li, Q. (2015). A Social-Media-Based Approach to Predicting Stock Price Movement. Expert Systems with Applications, 42(8), 3893–3901. https://doi.org/10.1016/j.eswa.2014.12.049

Liu, W., Yang, J., Chen, J., & Xu, L. (2023). How Social-Network Attention and Sentiment of Investors Affect Commodity Futures Market Returns: New Evidence from China. SAGE Open, 13(1). https://doi.org/10.1177/21582440231152131

Malkiel, B. G. (2016). A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing (11th ed.). W.W. Norton and Company.

Alanyali, M., Moat, H. S., & Preis, T. (2013). Quantifying the Relationship Between Financial News and the Stock Market. Scientific Reports, 3, 3578. https://doi.org/10.1038/srep03578

Oh, C., & Sheng, O. (2011). Investigating the Predictive Power of Stock Microblog Sentiment in Forecasting Future Stock Price Directional Movement. ICIS 2011 Proceedings, 57–58.

Phan, K. C., & Zhou, J. (2014). Factors Influencing Individual Investor Behavior: An Empirical Study of the Vietnamese Stock Market. American Journal of Business and Management, 3(2), 77–94. https://doi.org/10.11634/216796061403527

Shankar, V. (2012). Social Media Marketing Trends and Implications for the Financial Sector.

Shen, Y. (2022). Social Media and Stock Market Predictions: A Behavioral Finance Approach.

Shen, Y., Liu, C., Sun, X., & Guo, K. (2023). Investor Sentiment and the Chinese New Energy Stock Market: A Risk-Return Perspective. International Review of Economics & Finance, 84, 395–408. https://doi.org/10.1016/j.iref.2022.11.035

Siering, M. (2012). "Boom" or "Ruin"—Does It Make a Difference? Using Text Mining and Sentiment Analysis to Support Intraday Investment Decisions. In 2012 45th Hawaii International Conference on System Sciences (pp. 1050–1059). https://doi.org/10.1109/HICSS.2012.2

Zang, Z., Zhu, H., Uddin, M. I., & Amin, M. A. (2022). Big Data-Assisted Social Media Analytics for Business Model for Business Decision Making System Competitive Analysis. Information Processing & Management, 59(1), 102762. https://doi.org/10.1016/j.ipm.2021.102762

Pan, W.-F. (2020). Does Investor Sentiment Drive Stock Market Bubbles? Beware of Excessive Optimism. Journal of Behavioral Finance, 21(1), 27–41. https://doi.org/10.1080/15427560.2019.1587764

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2025. All Rights Reserved.