Digital Capital Market Operations: A Literature Review

Harshith B. 1![]()

1 Assistant

Professor, G T Institute of Management Studies and Research Bangalore,

Karnataka - 560091, India

|

|

ABSTRACT |

||

|

An immense

amount of change, development and improvement in the performance of capital

market due to the advancement in the technology and

its use in daily transactions in worldwide economies. This research paper

aims to present an overview about the digital

operations conducted in capital markets. The study is descriptive research in

nature, it employs the descriptive research approach

that is suitable in reviewing the available literature in

order to gain an insight into the digitalization process and the

digital operations taking place in Indian capital markets. The output of the

study indicates that digitalization is widely adopted in capital markets in order to facilitate the daily transaction taking place

in such markets. Further, research indicates that new investment tools are

presented in the capital market with the help of digitalization and

technology. Research also indicates that the threat of disruption, acquiring

and retaining digital talent and the innovation are

considered major challenges for the digital

operations in capital markets. While investigating the opportunities in front

of digital capital market operation, they include assets inflow, expanding

products offering, improved technology and data mining and globalization,

such opportunities can contribute towards the development of the financial

markets’ performance. Regardless of the opportunities that exist in front of

the digital capital market operation, there are also tremendous challenges

that hinder the performance of digital capital market operation. This

requires policy makers to investigate the chances of developing the

technological infrastructure so as to facilitate the

performance of digital capital market operations. |

|||

|

Received 07 April 2025 Accepted 08 May 2025 Published 30 July 2025 Corresponding Author Harshith

B., harshithh82@gmail.com DOI 10.29121/granthaalayah.v13.i7.2025.6257 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2025 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Capital Market, Digitalization and Globolisation |

|||

1. INTRODUCTION

Digitalization is transforming economies as businesses and

industries move towards adopting advanced solutions such as digital payments,

online banking, and cashless transactions. Digital technology in capital

markets is changing the market operations. The last ten years have seen

new technologies and innovation impact most industries, introducing varying

levels of disruption (impacting established technologies, products and

services, and business models) and changing the competitive landscape.

In fact, the technological progress in capital markets is offering the opportunities to boost flexibility, scale efficiencies and reduce complexity in how the markets operate. The impact of disruptive technology on capital markets is as significant to the participants in markets.

Digital technologies are widespread across the industries.

The capital markets industry is based on data. Its leaders understood, very

early on in the process, the importance of digitalization and were the

first to apply it in their day-to-day operations to improve efficiency,

reduce costs and pass on the benefits to their customers. However, the

degree of digitalization in this industry lags behind

other financial services while the overall sector trails consumer

goods/retail business.

Capital market is a broad term used to describe the in-person and digital spaces in which various entities trade different types of financial instruments. These venues may include the stock market, the bond market, and the currency and foreign exchange markets. Most markets are concentrated in major financial centers such as New York, London, Singapore, and Hong Kong.

Digital Capital Markets is a distinctive investment platform

offering investors opportunities In the crypto

markets. We emphasize on understanding our client’s requirement. Going digital

in capital markets will be a result of innovation rather than operations and

enablement. The challenges in front of the digital leaders are manifold as they

embark on the change journey.

2. REVIEW OF LITERATURE

The review of literature has been considered with conceptual

clarification of some important terms implicated in the research topic. Such

terms and concepts include digital technology and digital operation of capital

market also capital market peculiarities and information and technology.

Devereux and Vella (2018), Digitalization is the process of spreading of a general-purpose technology. The last similar phenomenon was electrification. Digitalization of products and services shortens distances between people and things. It increases mobility. It makes network effects decisive. It allows the use of specific data to such an extent that it permits the satisfaction of individual customer needs – be it consumers or businesses. It opens up ample opportunities for innovation, investment, and the creation of new businesses and jobs. Going forward it will be one of the main drivers of sustainable growth Gaspar et al. (2014).

Morley et al. (2018) Digitalization is the growing application of ICT across the economy “encompassing a range of digital technologies, concepts and trends such as artificial intelligence, the “Internet of Things” (IoT) and the Fourth Industrial Revolution” IEA (2017)

Gebre-Mariam and Bygstad (2019) Digitalization refers to the development and implementation of ICT systems and concomitant organizational change, it involves the transformation of socio-technical structures formerly mediated by non-digital artifacts into ones mediated by digitized artifacts Yoo et al. (2010)

The term Digital Marketing was first used in the 1990s. The

digital age took off with the coming of the internet and the development of the

Web 1.0 platform. The Web 1.0 platform allowed users to find the information

they wanted but did not allow them to share this information over the web. Up

until then, marketers worldwide were still unsure of the digital platform. They

were not sure if their strategies would work since the internet had not yet

seen widespread deployment.

The cookie was another important milestone in the digital marketing industry. Advertisers had begun to look for other ways to capitalize on the fledgling technology. One such technique was to track common browsing habits and usage patterns of frequent users of the internet so as to tailor promotions and marketing collateral to their tastes. The first cookie was designed to record user-habits. The use of the cookie has changed over the years, and cookies today are coded to offer marketers a variety of ways to collect literal user data.

Global capital markets rapidly accelerated their

digitalization journey, leveraging the software-as-a-service model, as well as

emerging technologies, including the cloud, machine learning and artificial

intelligence, according to FaycalBelyazid, Managing

Director Middle East & Africa for Nasdaq Market Technology.

At the African

Securities Exchange Association (ASEA) annual meeting, hosted by Casablanca

Stock Exchange, Belyazid and with an esteemed panel

of experts explored the technologies driving the evolution of the capital

markets. While most people around the world know Nasdaq as the stock exchange

group that operates exchanges in the U.S. and across the Nordic and the Baltic

regions, Nasdaq is also a major technology provider to other exchanges and

financial institutions worldwide. Nasdaq’s technology powers more than 2,300

companies in 50 countries that span the world's financial industry, including

capital markets infrastructure operators, market participants, banks and

regulators.

The world’s leading capital markets firms have embarked on a transformation journey since the financial crises. The magnitude of the crises required large-scale changes, and we have seen most banks and industries undertaking big bang transformation initiatives since 2011–2012. As banks and industries embark on their next generation of transformation, the drivers and levers of change are also evolving. The obvious underperformers have been identified and dealt with; major improvements will now come from innovative thinking and agile execution. In that pursuit banks and industries are looking to adopt an evolutionary and flexible approach.

3. RESEARCH METHODOLOGY

In order to achieve the stated objectives, a systematic literature review was employed in order to clarify the digitalization capital market operation concept, to provide an overview of the existing theory. The present study was a conceptual survey with exploratory cum descriptive in nature. This research follows the analytical research methodology.

4. OBJECTIVES OF STUDY

·

To understand the digital concepts and

terminologies in capital market operations

· To examine the impact on capital market with digital operations to the various channels

5. SOURCESS OF DATA

The research study

was completely based on secondary data. Data has been collected from various

Books, articles from national and international journals, blogs of authors,

Government and private organization Reports and websites, Etc.

6. DIGITAL DRIVE IN CAPITAL MARKET OPERATIONS

The digitalization focused on developing and maintaining legacy technology to meet regulatory requirements. Different forms of digital technology are available in the capital market such as are following:

6.1. Digital

securities

Digital security is the collective term that describes the

resources employed to protect your online identity, data, and other assets like

book entry accounting on computer networks, biometrics, electronic signature and

secured personal devices. These are the securities effectively managed through

the electronic operation mode in the capital markets of investors, brokers,

dealers, issuers and banking sectors.

6.2. Cloud computing

Cloud computing is the delivery of different services through

the Internet. These resources include tools and applications like data storage,

servers, databases, networking, and software. these services distributed by

various channels that could be include laptop, desktop, mobile, tablet and also many users adapting these technologies as

wealth/fund managers, retail clients, institutional clients, traders and

brokers of the capital markets.

6.3. Mobile computing

Mobile computing refers to the set of IT technologies,

products, services and operational strategies and procedures that enable end

users to access computation, information and related resources and capabilities

of investors and customers in the capital market while mobile.

6.4. Internet of

things (IoT)

he Internet of Things describes the network of physical

objects— “things”—that are embedded with sensors, software, and other

technologies for the purpose of connecting and exchanging data with other

devices and systems over the internet. These devices range from ordinary

household objects to sophisticated industrial tools. With more than 7 billion

connected IoT devices today, experts are expecting this number to grow to 10

billion by 2020 and 22 billion by 2025. Also, which increase in the

availability of cloud platforms enables both businesses and consumers to access

the infrastructure they need to scale up without actually

having to manage in the business capital markets.

6.5. Block chain

technology

Block chain is a shared, immutable ledger that

facilitates the process of recording transactions and tracking assets in a

business network.in the business firms and corporate institutions operate

electronic mode the various assets both tangible asset as house, car, cash,

land and intangible assets as patents, copyrights, branding in the markets.

6.6. Artificial

intelligence (AI)

Artificial intelligence is the simulation of human

intelligence processes by machines, especially computer systems. Specific

applications of AI include expert systems, natural

language processing, speech recognition and machine vision. Working in such

a heavily regulated industry, risk and compliance professionals need to adapt

to changes that impact their investments in real time. But the pace of change

makes it challenging to maintain compliance. Financial institutions can use AI

to help comply with ever-changing regulatory frameworks by automating document

processing for regulatory notices, consultation papers, and policy statements.

In the capital markets, organizations can integrate financial services AI

across research workflows, using the solution to help scan for investment

opportunities.

6.7. Distributed

Ledger Technology (DTL)

Distributed ledger technology (DLT) refers to the protocols and supporting infrastructure that allow computers in different locations to propose and validate transactions and update records in a synchronized way across a network. Some of the other compelling applications for DLT in the capital markets includes payment, bank finance, fund administration, customer identification. DLT can deliver many potentially transformative applications in the capital markets.

6.8. Robotic Processing Automation (RPA)

Robotic process automation (RPA) is a software technology that makes it easy to build, deploy, and manage software robots that emulate human’s actions interacting with digital systems and software.

Let it to be identified areas as client on boarding,

reconciliation, reporting, corporate action in the capital market industry

wherein RPA can play an important role in achieving cost efficiencies, reducing

transactional errors, driving higher accuracy and enhancing compliances and

controls.

7. DIGITAL

OPERATIONS: OVERVIEW ON CAPITAL MARKET

The capital markets industry, today found

itself in a transitional period where it has the opportunity

to adapt to digital trends and technologies as well as innovate with new

business models and products/services.

7.1. The developed and

developing countries

Regarding this context has considering over the last year,

the pandemic has caused the global economy to contract by 4.4%. At the same time, one trend has accelerated

worldwide: digitalization. As countries face repeated lockdowns, school

closures, and shutdowns of entire industries and business firms. The world

economies with both high levels of existing digitalization and strong momentum

in continuing to advance their digital capabilities. There

such countries as South Korea, Singapore, U.S., Hong Kong, Estonia, Taiwan, and

the United Arab Emirates, are consistently top performers in capital market

operations through the using digitalization technologies under the developed

countries. Although, estimating the developing countries whereas, china,

Russian federation, Brazil, India, South Africa. These are the country play

lower performance in digital capital market operations over the world.

7.2. India context

Digital capital will be enable

faster economic growth, make small businesses Atmanirbhar

(self-reliant), modernize agriculture and multiply farm incomes, and create an

ecosystem for affordable healthcare and education and India will have an

advantage over its peers in the future due to its enormous digital capital.

AI-driven digitization chimes with the aim of digital

operation of capital market to connect billions of Indians through internet and

data-based services."In the coming decades,

nations will increasingly compete on digital capital. India has the unique

advantage to harness its enormous digital capital for AI-driven development

which is bottom-up and inclusive. This is because of our twin strengths of

democracy and demography,”

In August 2021,

the Union Minister of State for Electronics and Information Technology, Mr.

Rajeev Chandrasekhar, announced that the IT export target is set at US$ 400

billion for March 2022. In addition, the central government plans to focus on

areas, such as cyber security, hyper-scale computing, artificial intelligence

and block chain.

In March 2022, debt marketplace Cred Avenue raised US $ 137 million in a

funding round led by Insight Partners, B Capital Group, and Dragoneer

Investment Group, which propelled the start-up’s valuation to US $ 1.3 billion.

India, today, is well established as a credible business

partner, preferred investment destination, rapidly growing market, and provider

of quality services and manufactured products; and,

stands on the threshold years of unprecedented growth by the

way of digital operation.

7.3. Karnataka context

Karnataka is a leader in India’s technology sector, both in

terms of investments and exports. Many new business opportunities in Karnataka

are emerging in capital markets.

Digital enablers such as AI, machine learning, digital

analytics, process automation, and the creation of new and innovative tools

which supported the country during the pandemic have made the state of

Karnataka innovative and put the state on the global map of innovation and

entrepreneurship

‘’venture capital investment in startups has only been

increasing, venture capital firms infused a total of $17.2 billion investment in to Indian startup ecosystem during January-July this year

2021, with a large amount invested in Karnataka based startups which included

Udaan, meesho, cred, Razorpay,

Vedantu and Dunzo’’ that

Digi echo system in Karnataka offers plenty of innovative.

In the present year, Karnataka which has a robust ecosystem

of R&D centers, academic institutions. Leading

technology companies has been 8 startups achieving the unicorn status of US $1

billion in valuation and Bangalore, the capital city of state is home to one of

the largest start ecosystems in the world.

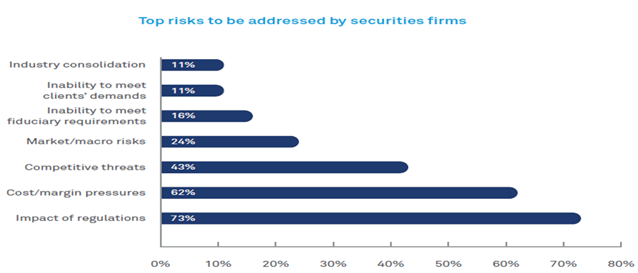

7.4. Top risks

reported by securities firms

The various securities firms have been adopted digital

technology and innovations. Here by analysis of securities firms whereas,

performance was different from each segment an evaluation of risks, as industry

consolidation firms being 11percent risk, inability to meet clients demands

firm having 11 percent, inability to meet fiduciary requirements has 16 percent

risk, market/micro risk 24 percent, competitive threats 43 percent, cost/

margin pressures 62 percent, and impact of regulations include 73 percent being

risks by all securities firms in digital capital market operations.

Figure 1

|

Figure 1 Top Risk Addressed by Securities Risk |

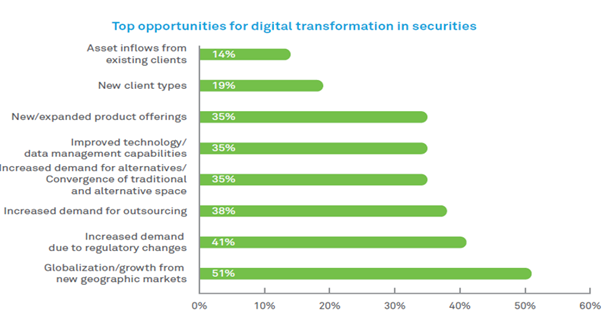

7.5. Top opportunities for digital

transformation of securities

Globalization and growth

from new geographic markets, regulatory changes, and the increasing convergence

of traditional and alternative business models, are key drivers for the

adoption of digital transformation strategies Figure 2. Outsourcingpresents a key opportunity for capital

markets companies to balance the demand for embracing new capabilities

presented by digital while reducing costs for the organization.

Below the table shows the

percentage of getting opportunies for transformation as asset inflows from

existing clients 14 percent, new client types 19 percent, expanded product

oeering 35 percent, imporoved technology 35 percent, convergence of traditional

and alternative space 35 percent, incrased demaond for regulatory changes 41

percent and globalisation from geographic markets include 51 percent of opportunity in securities.

Figure 2

|

Figure 2 Top Opportunities for Digital Transformation in Securities |

8. CHALLANGES

Capital market firms can overcome these challenges. Firms must adopt multi-year, incremental strategies deployed over the longer term. Key success factors include refreshing talent across the board, dismantling traditional management hierarchies, and developing new ways of working. New talent is required to drive business model transformation, challenge current practice, introduce advanced technologies, modernize legacy systems and increase agility.

1) Acquiring and retaining digital talent and building the right culture.

2) There is a tremendous need for continuous investment in technologies.

3) The threat of disruption also impedes technology investment. This threat comes more from insiders within the industry than from outsiders.

4) Insiders,

particularly those with scale, can afford to invest in new technologies to

challenge their slower and smaller industry competitors.

5) Consolidating

technology works on paper so long as you have the capital behind it, sometimes

unlimited capital. It is marketing in the name of innovation, and there is no

other way of saying it as these consolidation exercises downplay the

complexities, capital required and the realities of the technology challenges.

6)

Innovation can play its part in the journey,

focusing more on adopting the right solutions for the problems, rather than

adapting a technology to a problem. However, over years the line between

innovation and entrepreneurship has become vague.

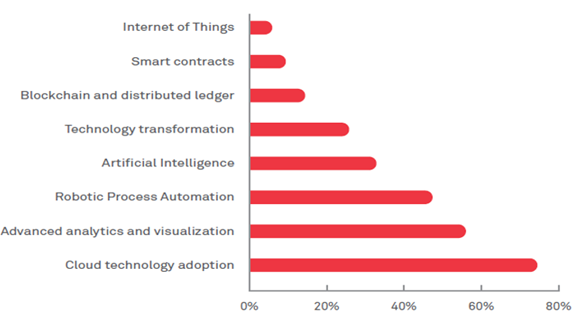

Among the CXO level stakeholders in capital market organizations there is higher investment appetite for cloud, advanced analytics, and RPA. This is followed by AI, technology transformation and block chain. Block chain is starting to move beyond the concept stage. The bottom line for industry leaders is that digital transformation is a strategic imperative across front, middle and back-office processes. They need to identify the tipping point by analyzing the trends, and understanding the implications, much faster than others.

Tools associated with digital transformation

Demonstrate the

digital technology regarding capital market operation were found various things

that those technologies use from availability in the market. Such impacts

digital transformation on business firms as internet of things 5 percent, smart

phones 10 percent, block chain and distributer ledger 15 percent, technology

transformation 25 percent, artificial intelligence 35 percent, robotic process

automation 48 percent, advanced analytic and visualization 58 percent and cloud

technology adoption 78 percent uses innovation terms in business firms for

effective operate of digital capital market.

Figure 3

|

Figure 3 Innovations Themes and Appetite for Adoption |

9. RECCENT TRENDS IN

DIGITALISATION OPERATION ON CAPITAL MARKETS

The capital market improved day by day, in the considering

digitalization technology are to be using various technologies in operation of

capital market. so on during study were was seeing

tremendous changes and trends in the digital operation of capital market such

as:

·

Digitalization is being used to increase cost-effectiveness,

efficiency in operations, and to develop additional high-margin products and

services.

·

Smart phones and tablets are changing the way customers

approach capital markets industry.

·

Design-thinking and service design to reimagine information

intensive and customer-facing processes.

·

Digitalization being used for enhancing customer experience

and personalization, attaining operational agility, enabling IT support teams,

facilitating collaboration and simplifying processing.

·

The emergence and growth of capabilities such as cloud,

RPA/AI, machine learning, paired with analytics and block chain systems.

·

Growth of innovative fintechs

that have harnessed the power of digital technologies to deliver disruptive

product – service experiences

10. SOLUTIONS

Capital markets firms are increasingly embracing emerging

technologies to accelerate business transformation, enable innovation and

customer centricity by leveraging the information advantage. Business is

focused on enhancing market share, reducing cost, prudent risk management and

improving client experience by redefining business and operating model through

Digitalization. IT is responding to the business imperatives by identifying use

cases to effectively leverage the power of technologies such as AI/ ML, RPA,

NLP and Cloud based solutions.

·

Deep understanding of capital markets and investment

management.

·

Dedicated consulting service and execution capability.

·

Matured product competency centers

across the value chain.

·

Methodologies and past experience to

deliver solutions.

·

IMPACT and VRM framework to handle end-to-end business

transformations

·

Proven relationship with leading FSIs over multiple years.

·

Executed multiple assignments across consulting IT, and BPO.

·

Experience across equities, fixed income and derivatives.

·

Sound understanding of system requirements.

·

Experience and track record-bringing deeper know how.

11. CONCLUSION

This study draws on digitalization capital market operation

are roots that way on how new technologies are assisting firms and industries

and the customers to create value in the markets. Moreover, this study

contributes to digitalization capital market operation literature by providing

a clear understanding of its existing scenario of digital technology market and also technology using in securities, assets and using

distributed ledger technology in the capital markets. Know digital capital

market compare to past year still has been developing and

tremendous changing in the industry and firms. Nowadays not even nations across

the globally as digitalization was impact on capital market operations and also crates huge opportunity in the markets for hedgers,

speculators, arbitrators and marginal traders.

Finally, it can be concluded this paper focuses on digital technologies how could be impact to firms and industries, what are the digital technologies are to be operation in the capital market across the world. We believe they can play an important role in building awareness and educating on the impact and opportunities of new technologies for industry participants. There also remain a number of jurisdictions where data localization and cyber security laws include requirements for data to be stored onshore. This requirement can often act as a barrier to the development and adoption of certain new technologies.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

ANI News. (2021, October 18). Karnataka as Startup Capital of Asia Offers Digi Tech Ecosystem, Says Minister Ashwatha Narayana.

Businessworld India. (2020, October 5). India has Unique Advantage to Harness its Enormous Digital Capital for AI-Driven Development: Mukesh Ambani.

Celent. (2017, December 12). The Great Transformation in Capital Markets: Revolution to Evolution.

Chakravorti, B., Bhalla, A., & Chaturvedi, R. S. (2020, December 18). Which Economies Showed the Most Digital Progress in 2020? Harvard Business Review.

Cognizant. (n.d.). Capital Markets Technology.

DC Markets. (n.d.). DC Markets Homepage.

Devereux, M., & Vella, J. (2018). Debate: Implications of Digitalization for International Corporate Tax Reform. Intertax, 46(6), 550–559. https://doi.org/10.54648/TAXI2018056

Digital India Investment Grid. (n.d.). Digital India Investment Grid Portal.

Ernst & Young. (2017). New Opportunities for the Securities Industry. ENY Report.

Everest Group. (2018). Enterprise Digital Adoption in Banking and Financial Services: Pinnacle Model. Everest Group.

Gartner. (2017). The Future of Work. https://doi.org/10.5465/AMBPP.2017.13747abstract

Gaspar, V., Collin, P., Devereux, M., Jim, H., Varrak, T., Walsh, M., & Westberg, B. (2014). Commission Expert Group on Taxation of the Digital Economy. European Commission.

Gebre-Mariam, M., & Bygstad, B. (2019). Digitalization Mechanisms of Health Management Information Systems in Developing Countries. Information and Organization, 29(1), 1–22. https://doi.org/10.1016/j.infoandorg.2018.12.002

Global Financial Markets Association & PwC. (2019, March). Technology and Innovation in Global Capital Markets.

Hayes, A. (2025, May 30). Capital Markets: What They are and How They Work. Investopedia.

International Energy Agency. (2017). Digitalization & Energy.

Invest India. (n.d.). Investment Opportunities in Karnataka.

Jayanna, V. (n.d.). Digital Securities: A New form of Asset in Capital Markets. Mindtree.

Morley, J., Widdicks, K., & Hazas, M. (2018). Digitalisation, Energy and Data Demand: The Impact of Internet Traffic on Overall and Peak Electricity Consumption. Energy Research & Social Science, 38, 128–137. https://doi.org/10.1016/j.erss.2018.01.018

Nasdaq. (2022, January 10). Technologies Driving the Evolution of Global Capital Markets.

Norton, J. (2019, March 29). Capital Markets: Top 4 Barriers to Digital Transformation. CGI.

Peve, J. (2021, May 5). DTCC Strategy and Business Development. DTCC Connection Staff.

PricewaterhouseCoopers. (2010). India Capital Market: Growth with Governance.

PricewaterhouseCoopers. (2018). Capital Markets 2020. PwC.

PricewaterhouseCoopers.

(n.d.). Capital Markets Definitions.

PwC.

PricewaterhouseCoopers. (n.d.). Capital Markets Terminology. PwC.

Reserve Bank of India. (2019, July 11). Special Article: Digital Transformation in Indian Financial Markets. RBI Bulletin.

Sandner, P. (2021, August 24). Philipp Sandner – Forbes Contributor Profile. Forbes.

Srinivas, S. (2020, January 14). Digital Capital Markets – Challenges. LinkedIn.

UNCTAD. (2021, February 25). A Few Developing Countries Overperform on Frontier Technologies, but Most Lag Behind – UN Report.

Wipro Digital. (n.d.). Wipro Digital Homepage.

Yoo, Y., Lyytinen, K., Boland, R., & Berente, N. (2010). The Next Wave of Digital Innovation: Opportunities and Challenges. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1622170

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2025. All Rights Reserved.