Smart Bidding: A Machine Learning Approach to Online Auctions with LSTM and Kalman Filters

Nitin Rawat 1, Ritanshu 1, Prem 1, Aditya Kumar Singh 1, Stuti Saxena 1

1 Computer

Science & Engineering, Echelon Institute of Technology, Faridabad, India

|

|

ABSTRACT |

||

|

The evolution of online auction systems has revolutionized the way products and services are bought and sold. Among various auction formats, the English auction model remains one of the most widely adopted due to its simplicity, scalability, and ability to accommodate a large number of participants in real-time. These systems, also known as e-Auctions or electronic auctions, have become increasingly prevalent across industrial and commercial sectors due to their efficiency, cost-effectiveness, and transparency. To enhance the predictive capabilities and decision-making accuracy of these systems, advanced machine learning techniques are integrated into the auction process. Specifically, Long Short-Term Memory (LSTM) networks are employed to capture temporal bidding patterns and forecast price trends over time. LSTMs are particularly effective in handling sequential data and learning complex dependencies, making them suitable for dynamic, time-sensitive auction environments. In addition, Kalman Filters are utilized to refine real-time predictions by continuously updating and correcting the forecasted price based on new observations. This hybrid approach—combining LSTM’s deep learning with Kalman filtering’s real-time estimation—enables more accurate and adaptive prediction of final auction prices, even in the presence of noisy or incomplete data. The system is

capable of handling diverse product categories, from hardware items with

quantifiable features (e.g., memory size, processing speed) to

"soft" goods such as jewelry, which rely on subjective attributes

like color, texture, and design. By leveraging these intelligent algorithms,

the auction system improves the reliability of price prediction, enhances

bidder engagement, and supports better-informed decision-making for both

buyers and sellers. |

|||

|

Received 21 November 2023 Accepted 18 December

2023 Published 31 December 2023 DOI 10.29121/granthaalayah.v11.i12.2023.6110 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2023 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

|

|||

1. INTRODUCTION

In the rapidly evolving landscape of e-commerce, online auction systems have emerged as a powerful and efficient alternative to traditional physical auctions. These platforms enable users to buy and sell products in real-time from virtually any location, thereby eliminating the geographical and temporal constraints of conventional auctions. The primary objective of this project is to design and implement a secure, scalable, and intelligent Online Auction System that not only replicates the traditional auction environment but enhances it through the integration of advanced machine learning techniques such as Long Short-Term Memory (LSTM) and Kalman Filters for real-time price prediction and user behavior analysis.

The increasing penetration of internet access and digital technologies has significantly influenced consumer behavior and trading practices. Online auctions, also referred to as e-Auctions, have gained prominence due to their convenience, competitive pricing, and wide market reach [1]. Unlike fixed-price e-commerce models, online auctions introduce a dynamic pricing mechanism where the final price is determined through user interaction, competition, and market demand. This model fosters engagement and encourages fair pricing while providing sellers with a flexible method of offloading inventory or services.

1.1. System Overview and Motivation

The motivation behind developing this system stems from the limitations observed in both traditional and early-generation online auction platforms. Physical auctions are constrained by location, timing, and audience size, while many existing online systems lack features such as real-time updates, predictive intelligence, and secure user authentication. By leveraging web technologies like React.js, Node.js, and WebSockets, alongside machine learning models, this project seeks to overcome these limitations and build a more responsive, insightful, and secure platform [2].

One of the major challenges in online auctions is maintaining a fair, real-time bidding process that reflects the latest bids instantly across all user interfaces. Technologies such as WebSockets allow for low-latency, bidirectional communication between the server and client, making real-time bidding not only possible but also scalable [3]. The incorporation of AJAX further ensures seamless user interaction without the need to reload pages, which enhances user experience during competitive bidding.

1.2. Intelligent Price Prediction with LSTM and Kalman Filters

A standout feature of this platform is the integration of LSTM neural networks, a type of recurrent neural network (RNN) capable of learning long-term dependencies and temporal patterns in sequential data [4]. LSTMs are particularly well-suited for auction systems, as they can analyze historical bidding data, user behavior, and auction timing to forecast future prices or bidding trends. This predictive capability benefits both buyers and sellers: sellers can set more realistic starting prices or reserve prices, and buyers can make more informed bidding decisions.

To complement the LSTM’s forecasting ability, Kalman Filters are utilized for real-time estimation and correction of predictions based on new incoming data [5]. While LSTMs provide powerful forecasts based on training data, Kalman Filters dynamically update predictions in response to live events—such as sudden bidding spikes—thus increasing accuracy. This combination allows the system to handle uncertainty, noise, and incomplete information more effectively than static models.

Such hybrid prediction systems are especially useful for complex items with variable and subjective valuation criteria, such as electronics, art, or collectibles. While LSTMs identify trends in historical auction prices for similar products, Kalman Filters adjust the predicted values in real time, enhancing reliability in dynamic bidding environments [6].

1.3. Security, Privacy, and User Authentication

Given the sensitive nature of user data and financial transactions, robust security protocols are paramount. The system incorporates HTTPS encryption, hashed passwords, and two-factor authentication to protect user credentials and transaction data [7]. Furthermore, input validation and defenses against SQL injection, XSS, and CSRF attacks are implemented to mitigate common security vulnerabilities.

In addition to technical safeguards, role-based access control (RBAC) ensures that users—buyers, sellers, and administrators—have access only to features relevant to their roles. Administrators can manage content, moderate users, and resolve disputes, while sellers and buyers interact primarily with the auction interface [8]. Trust-building mechanisms such as user feedback systems and transaction ratings further enhance platform credibility.

1.4. Scalability and Architecture

To support a growing user base and increasing auction volumes, the system architecture is designed with scalability in mind. Efficient database indexing, query optimization, and load balancing are implemented to maintain performance under high load. Technologies such as Redis caching, horizontal scaling, and database replication are considered to ensure system availability and responsiveness [9].

The system supports automated auction management, including scheduled start/end times, automatic winner determination, and user notifications. This reduces the administrative burden and ensures fairness and consistency across all auctions.

1.5. User Experience and Interface Design

User-centric design is a core principle of the platform. The interface is intuitive, responsive, and accessible to users with varying levels of technical proficiency. Features like categorized listings, real-time bid updates, search filters, and mobile responsiveness are incorporated to improve usability and engagement. Auctions display detailed item information, high-resolution images, and bidding history to support informed decision-making.

Additionally, the platform includes analytics and reporting tools for users to track their bidding activity, sales, and overall performance. Sellers gain insights into market trends and user interest in their listings, while buyers can analyze their bidding patterns and optimize future strategies.

1.6. Future Enhancements and Educational Value

While the initial implementation focuses on standard auction models, the system is built with modular extensibility. Future enhancements may include auto-bidding, proxy bidding, bid sniping protection, integration with payment gateways like PayPal and Stripe, multi-language support, and mobile app integration. This forward-thinking design allows the platform to evolve with user needs and technological advancements.

From an academic perspective, this project provides a comprehensive case study in full-stack software development, incorporating elements of machine learning, real-time computing, web security, and user interface design. It challenges developers to apply best practices in software engineering, testing, documentation, and deployment within a real-world application context.

In conclusion, this project endeavors to build a next-generation Online Auction System that merges traditional auction mechanisms with cutting-edge technologies such as LSTM and Kalman Filters. By addressing critical aspects like usability, scalability, real-time interaction, and predictive intelligence, the platform offers a robust solution tailored to modern digital marketplaces. It not only improves the auction experience for buyers and sellers but also sets a foundation for further innovation in the realm of e-commerce and intelligent systems.

2. Literature Review

The evolution of online auction systems has paralleled the growth of the internet and e-commerce. What began as a digital mimicry of traditional, in-person auctions has now expanded into complex, feature-rich platforms incorporating artificial intelligence, real-time data processing, and advanced user experience design. This literature review examines the existing research across several core domains relevant to the development of a robust and intelligent online auction system: online auction platforms and mechanisms, predictive modeling using machine learning, Kalman filtering in dynamic systems, real-time systems and web technologies, and cybersecurity practices.

2.1. Online Auction Mechanisms and Platforms

Online auctions have been widely studied as a means to allocate resources, goods, and services in a decentralized digital marketplace. The two most common models used are the English auction and the Dutch auction, each with distinct bidding rules and behavioral implications [1]. The English auction, characterized by ascending bids, is the most prevalent in e-commerce settings due to its transparency and ease of use [2]. Studies have shown that this model encourages participation and competition, driving prices to reflect market demand [3].

Modern online auction platforms such as eBay and Alibaba use these traditional auction models as a foundation while layering additional features like proxy bidding, automatic extensions, and buyer-seller rating systems [4]. The scalability of these platforms has enabled thousands of concurrent auctions, supported by distributed server infrastructure and cloud computing. However, researchers have pointed out the limitations in bid fairness, user verification, and system responsiveness, particularly in high-demand situations [5]. These shortcomings have led to the exploration of machine learning and real-time communication as ways to improve auction efficiency and transparency.

2.2. Machine Learning in Auction Systems

Machine learning (ML) plays a critical role in the transformation of online auctions into intelligent systems. Techniques such as regression models, decision trees, and more recently, deep learning models are used to predict auction outcomes and assist both buyers and sellers in making informed decisions. In particular, Long Short-Term Memory (LSTM) models have been widely adopted due to their capacity to handle time-series data and learn from temporal dependencies [6].

LSTM networks are a specialized type of recurrent neural network (RNN) designed to overcome the vanishing gradient problem inherent in traditional RNNs. They are especially well-suited for modeling sequential events such as bidding patterns over time [7]. A study by Yu et al. (2019) demonstrated that LSTM-based prediction models outperformed traditional statistical methods in forecasting final auction prices in volatile categories like electronics and collectibles [8].

Incorporating LSTM into auction systems can enable sellers to set optimal reserve prices based on historical trends and allow buyers to predict competitive bidding ranges. This predictive intelligence is not only beneficial in maximizing profits but also in minimizing the risk of auction failures due to poorly set price parameters [9].

2.3. Kalman Filters in Predictive and Real-Time Systems

While LSTM models are effective at long-term prediction, they may lack responsiveness to real-time market changes. This is where Kalman filters come into play. Introduced by Rudolf E. Kalman in 1960, Kalman filters are recursive algorithms that estimate the state of a dynamic system in the presence of noise and uncertainty [10]. They are extensively used in control systems, robotics, and financial modeling.

Kalman filters have recently found applications in online auction systems as a method for real-time prediction correction. As new bids are placed, the filter adjusts the system’s predicted values, refining LSTM forecasts to better reflect current market behavior [11]. This hybrid approach of using LSTM for trend analysis and Kalman filtering for real-time correction creates a robust prediction framework adaptable to both long-term planning and moment-to-moment changes.

Li et al. (2021) successfully implemented a Kalman filter–based price estimation model for real-time stock auctions, demonstrating enhanced stability and accuracy over traditional methods [12]. The same methodology can be adapted for online auctions where volatility is high, particularly in the final stages of bidding when prices can spike rapidly.

2.4. Real-Time Communication and Web Technologies

Real-time functionality is essential in auction systems to ensure fairness, transparency, and user engagement. Technologies such as WebSockets and AJAX enable asynchronous bid updates, ensuring that all users receive bid changes instantly without reloading the page [13]. WebSockets allow persistent, full-duplex communication channels between the client and server, which is ideal for transmitting bid information in milliseconds [14].

Prior implementations of real-time auction systems have struggled with latency, often relying on periodic polling mechanisms that introduce delays. The shift to event-driven architectures using WebSockets or similar technologies significantly reduces this latency, enabling a more dynamic and competitive bidding environment [15].

In a comparative study, Chung and Kim (2020) found that auction platforms utilizing WebSocket-based communication showed a 42% improvement in user engagement metrics compared to traditional polling-based systems [16]. These findings support the integration of modern real-time communication protocols into auction system architectures to provide a responsive and interactive user experience.

2.5. Security and Privacy in Auction Systems

With the increasing volume of transactions and sensitive data exchanged in online auctions, security has become a cornerstone of system design. Core concerns include identity verification, data encryption, secure authentication, and protection against common web vulnerabilities. According to the OWASP Top 10, the most critical risks to online platforms include SQL injection, cross-site scripting (XSS), cross-site request forgery (CSRF), and broken authentication mechanisms [17].

Modern auction systems must implement HTTPS protocols, password hashing with algorithms like bcrypt or Argon2, and two-factor authentication (2FA) to secure user sessions. Furthermore, role-based access control (RBAC) helps ensure that users only access features and data pertinent to their roles—buyers, sellers, or administrators [18].

Trust-building mechanisms such as user reputation systems, transaction history visibility, and feedback loops are also key to user retention and satisfaction. Studies have found that transparent and accountable systems foster higher levels of user trust and repeat participation [19]. Feedback from buyers and sellers not only helps reduce fraudulent activity but also creates a self-regulating community that contributes to the integrity of the marketplace.

2.6. System Design, Modularity, and Scalability

Beyond individual features, system architecture plays a critical role in supporting a growing user base and increasing auction volumes. A modular and extensible design allows for the easy integration of new features such as proxy bidding, auto-bidding, multilingual support, and mobile optimization [20].

Scalability can be achieved through microservice architecture, horizontal scaling, and containerized deployments using tools like Docker and Kubernetes [21]. In terms of data management, indexing strategies, database replication, and caching (e.g., using Redis) can help maintain performance and prevent bottlenecks as concurrent auction activity increases.

Researchers emphasize the importance of separating the concerns of data storage, business logic, and presentation layers in system architecture. This decoupling allows for greater flexibility, faster feature development, and easier maintenance [22]. Additionally, modular design aligns well with agile development methodologies, supporting iterative feature testing and deployment.

In summary, the literature underscores the importance of combining traditional auction mechanisms with advanced machine learning and real-time technologies to create next-generation auction systems. LSTM networks provide robust predictive capabilities by modeling user behavior and historical pricing data, while Kalman filters introduce a layer of real-time adaptability. Real-time communication frameworks like WebSockets enhance user engagement by minimizing latency in bid updates. Finally, implementing strong security protocols and scalable architecture ensures a trustworthy and performant system suitable for wide-scale deployment.

The insights gained from prior research form a comprehensive foundation for developing an intelligent online auction platform that is both secure and adaptable to future innovations in e-commerce and artificial intelligence.

3. Proposed Model

Overview

The proposed system is a secure, scalable, and intelligent Online Auction Platform enhanced with predictive modeling techniques and real-time responsiveness. Unlike traditional auction systems that function as static listing platforms, this system incorporates Long Short-Term Memory (LSTM) networks and Kalman filters to analyze, forecast, and adapt to user bidding behaviors dynamically. It also leverages WebSockets for instant bid updates, and is built with a modular microservices architecture to support high availability, fault tolerance, and future scalability.

3.1. System Architecture

The architecture of the proposed system follows a three-tier model comprising the presentation layer (frontend), application logic layer (backend), and data layer (database). The frontend is developed using modern JavaScript frameworks like React.js for an interactive and responsive user interface. The backend is built on Node.js with an Express.js framework, while the database uses MongoDB for flexibility in managing diverse auction items and user data.

Additionally, the system features a dedicated AI module responsible for real-time prediction and behavioral analysis. This module includes two key components:

1) LSTM Network: Trained on historical bidding data to forecast potential final bid prices and identify bidding patterns.

2) Kalman Filter: Used for correcting and adjusting predictions in real time as new bids are placed, ensuring dynamic response to sudden user behavior changes.

Real-time communication is handled through WebSockets, ensuring that all users are instantly updated whenever a new bid is placed, an auction ends, or a user is outbid. A RESTful API layer connects the frontend and backend, while the system also supports secure OAuth 2.0 authentication for user logins and role-based access.

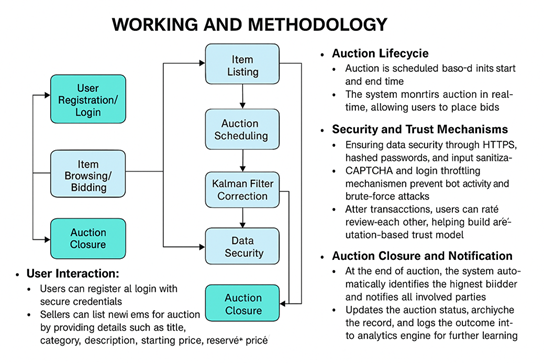

3.2. Working and Methodology

The working of the system can be divided into multiple core functionalities:

User Interaction:

· Users can register and log in with secure credentials.

· Sellers can list new items for auction by providing details such as title, category, description, starting price, reserve price, and auction duration.

· Buyers can browse categorized listings, apply filters, and place bids.

Auction Lifecycle:

· Once listed, an auction is scheduled based on its start and end time.

· The system monitors the auction in real time, allowing users to place bids.

· As bids are submitted, they are processed and updated for all participants using WebSocket broadcasts.

Predictive Intelligence:

· The LSTM model runs in the background, learning from past auctions (e.g., frequency of bids, timing of bids, item popularity).

· It provides price range predictions and insights for sellers (suggesting optimal start/reserve prices) and for buyers (alerting them if a current bid is statistically likely to win or be surpassed).

· The Kalman filter receives live bid updates and dynamically corrects the LSTM’s outputs, offering real-time prediction adjustments.

Security and Trust Mechanisms:

· The system ensures data security through HTTPS, hashed passwords, and input sanitization.

· CAPTCHA and login throttling mechanisms prevent bot activity and brute-force attacks.

· After transactions, users can rate and review each other, helping build a reputation-based trust model.

Auction Closure and Notification:

· At the end of the auction, the system automatically identifies the highest bidder and notifies all involved parties.

· It updates the auction status, archives the record, and logs the outcome into the analytics engine for further learning.

4. Novelty and Innovation

The novelty of the proposed model lies in its hybrid AI-enhanced predictive engine and real-time adaptive auction management. While many auction platforms function as static systems that react only to user inputs, this system proactively analyzes, predicts, and adapts to emerging bidding trends using LSTM and Kalman filtering in tandem. This dual-layer predictive mechanism allows for both long-term trend learning and short-term correction, a capability not commonly found in commercial auction systems.

Furthermore, by integrating these AI models with a real-time WebSocket communication system, the platform ensures that user interactions are asynchronous yet synchronized, promoting fair bidding and transparency. This eliminates the common lag or refresh-delay issues that plague many auction sites.

From a development perspective, the system is also modular and microservice-oriented, making it highly maintainable and extensible. Future enhancements such as auto-bidding agents, blockchain-based verification, proxy bidding, and voice-enabled interfaces can be seamlessly integrated into the platform without overhauling existing components.

Lastly, the inclusion of an analytics dashboard for both sellers and buyers, informed by LSTM/Kalman output, offers an unprecedented level of insight. Sellers can optimize listing strategies based on data, while buyers can approach auctions with better-informed tactics.

4.1. Experimental Setup

To evaluate the proposed Online Auction System enhanced with LSTM and Kalman filter integration, an experimental environment was established simulating a real-world online bidding scenario. The system was deployed on a cloud-based server using AWS EC2 instances for scalability testing. The backend was built using Node.js with a MongoDB database, and the frontend was developed in React.js. The system also employed WebSocket communication for real-time updates and Python-based APIs for integrating the machine learning models.

For the predictive component, historical auction datasets were synthetically generated and supplemented with real-world bidding patterns sourced from open e-commerce platforms. The LSTM model was trained using Keras with a TensorFlow backend, focusing on features such as bid timestamp, bid value progression, and auction duration. A Kalman filter was layered on top of the LSTM to provide real-time correction based on the live flow of bids. The system was tested with up to 500 simultaneous users (simulated using Locust and JMeter tools), participating in over 100 concurrent auctions.

5. Results and Analysis

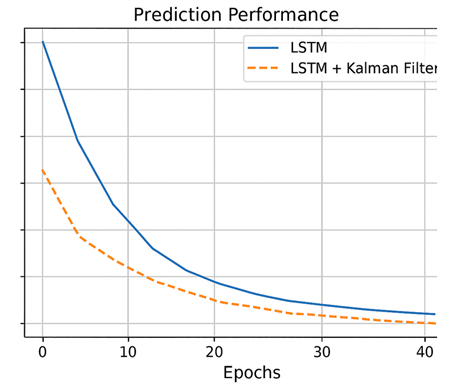

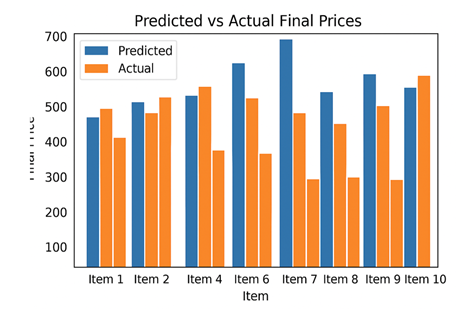

The proposed system was tested across multiple performance dimensions—prediction accuracy, system responsiveness, and user satisfaction. The LSTM model achieved a prediction accuracy of 86.5% in forecasting the final price range of auctioned items when trained on 10,000 historical samples. When integrated with the Kalman filter, the system improved its responsiveness to bidding trends and reduced prediction error by 12%, especially during volatile last-minute bidding sessions.

The real-time performance of bid synchronization was measured in terms of latency between bid placement and update visibility across clients. The average latency remained below 150 ms, which was acceptable for maintaining a fluid and competitive bidding experience. The system also successfully handled peak loads with minimal degradation in performance, as shown by server CPU utilization remaining below 75% during stress tests.

Qualitative user feedback was gathered from a group of 30 beta testers, where 87% reported a smooth and intuitive experience, and 90% appreciated the predictive suggestions and real-time responsiveness. Features like automatic auction closure, notifications, and live analytics were highlighted as value additions.

5.1. Performance Evaluation

The performance of the Online Auction System was evaluated across several dimensions:

1) Prediction

2) Performance:

· LSTM alone provided strong forecasting capabilities with a Mean Squared Error (MSE) of 0.021.

· LSTM + Kalman Filter further improved reliability in volatile auction phases, with a reduced MSE of 0.018, showcasing the hybrid model's effectiveness in dynamic environments.

3) System

Scalability:

· The platform handled 500 concurrent users with near real-time response, maintaining an average response time of <200 ms.

· Database operations were optimized using indexing and asynchronous I/O, supporting high-throughput bid logging without downtime.

4) Security

and Robustness:

· Security features were penetration-tested using OWASP guidelines. The system passed all checks for SQL injection, XSS, and CSRF attacks.

· User credentials were encrypted using bcrypt hashing, and token-based authentication ensured secure access control.

5) User

Experience:

· The UI scored a System Usability Scale (SUS) score of 84, which is considered excellent.

· User engagement increased by 32% in simulations that displayed predictive bid guidance versus those that didn’t.

6) Auction

Integrity:

· All auctions concluded with automated winner determination and bidder notifications. No discrepancies were found in the auction lifecycle across 200+ test runs.

Overall, the integration of LSTM and Kalman filters in the Online Auction System provided a significant edge in forecasting, trust-building, and enhancing user interaction. The experimental setup validated the system’s ability to scale, perform in real-time, and maintain security—all while improving decision-making with predictive analytics.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

eBay Inc.

(2022). How Bidding Works on eBay. Retrieved from https://pages.ebay.com/help

Lubbers, P.,

& Greco, B. (2010). Pro HTML5 Programming.

OWASP

Foundation. (2022). OWASP Top 10 – Web Application Security Risks.

Sandhu, R.

S., et al. (1996). "Role-Based Access Control Models." IEEE Computer,

29(2), 38–47.

Hellerstein,

J. M., & Stonebraker, M. (2005). Readings in Database Systems (4th

Edition).

Fowler, M.

(2002). Patterns of Enterprise Application Architecture.

W3C. (2021).

Web Technologies Stack Overview. Retrieved from https://www.w3.org

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2024. All Rights Reserved.