A CASE STUDY ON HRM PRACTICES IN PRIVATE CONVENTIONAL AND ISLAMIC SHARIAH-BASED BANKS: A BANGLADESH PERSPECTIVE

Md. Shahidul Islam 1![]() , Md. Kamal Hossain 2,

Ismail Hossain 3

, Md. Kamal Hossain 2,

Ismail Hossain 3

1 Assistant

Professor, Department of Human Resource Management, Islamic University, Kushtia, Bangladesh

2 Assistant

Professor, Department of Accounting and Information Systems, Islamic

University, Kushtia, Bangladesh

3 Research

Assistant, Department of Human Resource Management, Islamic University, Kushtia, Bangladesh

|

|

ABSTRACT |

||

|

The bank is

the lifeblood of a modern economy. The overall success and performance of a

bank are largely reliant on competent and skilled employees. A dynamic,

capable, and talented workforce will be ensured through the efficient use and

practice of Human Resource Management. This research study examines the HRM

practices in private Conventional and Islamic Shariah-based banks in

Bangladesh. The study investigates various aspects of Human Resource

Practices, including analysis of jobs, hiring policies, educational programs,

performance management, salary structure, Occupational health and safety, and

promotion policy. This research is based on secondary data. The utilization of

journals, books, authorized papers, yearly reports, and internet material

made this study feasible. The results of the findings show that both types of

banks have established these HRM practices efficiently. The research suggests

that banks ought to prioritize the implementation of environmentally friendly

HRM practices, focus on utilizing data analytics, and establish HRIS to align

with current industry trends. |

|||

|

Received 05 February

2024 Accepted 03 March 2024 Published 31 March 2024 Corresponding Author Md.

Shahidul Islam, shahidultanzina@gmail.com DOI 10.29121/granthaalayah.v12.i3.2024.5522 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2024 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: HRM Practices, Succession Planning,

Employee Recruitment, Training and Development, Performance Appraisal,

Compensation, OSH, HRA, Commercial Bank |

|||

1. INTRODUCTION

In today's era of globalization, organizations recognize human resources as their most valuable asset; however, only a limited number of organizations can effectively leverage and maximize the potential of their human capital Ahmad & Schroeder (2003). The prosperity of a business relies on the caliber of services delivered to clients by its workforce. Therefore, the significance of human resource management (HRM) is crucial in the service industry Guest (2002), Ramu (2008). As a result, organizations must adopt modern and innovative workplace practices to survive in this global market, as well as assist organizations in achieving higher product quality, and more effectively utilizing their employees' skills and information for higher performance and profitability. Human Resource Management (HRM) involves the procedures of recruiting, onboarding, training, assessing, and compensating employees, while also handling matters related to employee relations, safe and healthy work, fairness, and equality Dessler (2020).

The banking sector relies heavily on knowledge. Effective operation of the business necessitates a knowledgeable and adequately skilled workforce. By equipping individuals with essential knowledge, skills, and abilities (KSA), individuals may be developed into valuable human resources. Because of technological advancement, the banking industry is undergoing a series of fast changes and banks now expect their workers to perform better. Roknuzzaman (2007).

The Primary regulatory body and Bangladesh's central bank is Bangladesh Bank. There are a total of 61 scheduled banks currently in operation in Bangladesh. Bangladesh Bank exercises complete control and oversight over the banks. The Government of Bangladesh owns the six SOCBs. Currently, there are now three specialized banks operating, each serving a different objective or purpose. There are 43 privately owned commercial banks, with ownership held by individuals or organizations. PCBs can be grouped into Conventional PCBs (33) and PCBs based on Islamic Shariah (10). Furthermore, 9 FCBs are operating in Bangladesh Bank. (2023).

The commercial banking system is the dominant player in Bangladesh's financial industry. The central management makes the majority of human resource decisions in Bangladesh. These decisions are simply executed in several branches Afroj (2012).

Achieving organizational goals and preserving a competitive edge depends heavily on the application of efficient HRM practices. These activities involve the organizational endeavors to oversee a workforce and ensure their active participation in accomplishing the objectives of the organization Schuler and Jackson (1987). Human Resource Management practices can be described as the strategies, policies, and activities involved in the planning, acquisition, development, utilization, evaluation, maintenance, and retention of proficient employees toward fulfilling the goals of an organization Appelbaum (2001). The banking sectors are presently adopting unique HRM practices, and due to globalization, they are incorporating the latest HRM approaches to accomplish their objectives. This study will reveal the HRM practices used by Bangladesh's private Conventional and Islamic Shariah-based banks. The results of this investigation may be utilized by academicians as well as HR practitioners in other developed and emerging economies to initiate new research and policy efforts.

2. Literature review

Majumder (2012) researched the existing approaches of HRM and how HRM practices in Bangladesh's private banking sector affect employee satisfaction. The report revealed the multiple areas of employee dissatisfaction including compensation and reward systems, career growth, training opportunities, and management practices, and suggested a need for improvements in HRM practices to increase morale and enhance performance within the organization.

Fathima (2015) examined a study that investigated the vital role of HRM in shaping the success of banks. The study findings emphasize that HRD in the banking sector is not just a routine task; it is a strategic imperative that impacts the bank's competitiveness and financial performance. By investing in the development of its human capital, a bank can enhance its operational efficiency and the quality of financial services, ultimately providing greater value to its customers and maintaining a competitive edge in the market.

Ali et al. (2014) examined an empirical survey on the effect of succession planning on employee performance in Pakistani commercial banks. The research aimed to shed light on the relationship between employee effectiveness and the presence of formalized succession planning initiatives within Pakistani banks. The findings of the interview of 127 respondents highlighted the importance of robust succession planning and performance appraisal systems for improving employee performance and securing the future of commercial banks.

Rahman & Nower (2020) conducted a research project investigating the job analysis practices employed by private commercial banks in Bangladesh. Their research indicates that Bangladeshi commercial banks systematically collect data on diverse aspects like academic backgrounds, requisite skills and competencies, workplace settings, and specific job duties and responsibilities. The study identifies four key areas for optimizing the job analysis process in Bangladeshi banks: 1) involving people and effectively acquiring data, 2) guaranteeing data accuracy and maintaining correct documentation, 3) investing in job analyst training, and 4) formulating clear job analysis methodologies and specifying the analysis goal.

Eva (2018) engaged in a study to explore the most used recruiting sources and selection methods in Bangladeshi commercial banks. It is found that all banks have established recruitment and selection policies. These policies rely on job analysis to guide job advertisements and fill vacant positions. The study also reveals barriers to effective recruitment and selection, such as inadequate HR planning, a shortage of qualified applicants, competition for the same candidates, and a lack of alignment with HR strategies and organizational goals.

Islam & Sarker (2020) conducted research that aims to reveal the relationship between MBO implementation and both performance evaluation and employee morale. The study suggests that Management by Objectives is a valuable performance appraisal tool in commercial banks in Rajshahi. It shows A favorable link between performance appraisals and satisfaction among staff members as well as a well-structured reward mechanism that can boost employee satisfaction. However, there is a weak correlation between MBO and employee satisfaction, possibly due to challenges in achieving desired goals.

Anjum & Rahman (2021) conducted a case study on the methods used by Bangladesh's state commercial banks for performance evaluation and promotion. All three investigated banks - Sonali Bank PLC, Rupali Bank PLC, and Agrani Bank PLC - utilize established criteria for promotions, allocating points based on Annual Confidential Reports (ACRs) for different positions. However, the grading scales and point allocation algorithms employed differ among these banks.

Afroz (2018) conducted a study exploring how strategic HR practices influence employee engagement among Bangladeshi bank employees. The results of the interview of 150 people revealed that the employees who participated in the training program were more driven, pleased, and involved in their jobs at the corresponding institutions. Also, the research discovered an extensive positive connection between comprehensive training initiatives and enhanced employee engagement within Bangladeshi banks.

Ray et al. (2021), in their critical analysis of Bangladeshi banking sector HR practices, identified a noteworthy trend that private commercial banks in Bangladesh possess a notable competitive edge in attracting and retaining talent due to their superior compensation packages. In addition, these banks offer a more appealing and comprehensive array of both financial and non-financial benefits compared to State-owned commercial banks.

Hameed et al. (2014) engaged in a study on the influence of compensation on employee performance within the Pakistani banking sector. The researchers aimed to understand how factors like pay, incentive programs, and non-monetary benefits impact employee output. It discovered that increased remuneration levels directly improve employee performance. This suggests that competitive compensation packages can play a significant role in driving employee motivation and productivity.

Sewu et al. (2019) explored the potential connections between robust occupational health and safety measures (OHSMs) and the overall performance of banks in Ghana. Their research revealed a positive, albeit modest, correlation, suggesting that implementing robust OHSMs can contribute to improved bank performance. The research recommends that Ghanaian banks could benefit from adopting specific measures to improve occupational health and safety practices including the provision of regular medical check-ups for employees, ensuring access to clean and safe drinking water within the workplace, and the implementation of directional markings to enhance navigational clarity and safety.

3. Objectives of the study

Finding out what HRM practices are now in place at Bangladesh's private Conventional and Islamic Shariah-based banks is the study's primary goal. The following are the study's other goals:

1) To analyze the traits, varieties, and occupational specializations of the human resources used by Bangladeshi banks.

2) To gain knowledge of job analysis, hiring and selection, succession planning, OSH, HRA, performance evaluation, pay structure, and promotion policy.

3) To find continuing development efforts, such as management development programs, professional progression possibilities, and education and training initiatives

4) To make suggestions for improving HRM procedures in these Bangladeshi banks.

4. Research methodology

The study's objectives include looking at several HRM practices in Bangladesh's banking industry, such as job analysis, hiring and selection processes, training and development programs, remuneration policies, incentive and reward schemes, employee relations and engagement, and health and safety protocols. For its inquiry, the research mostly uses secondary data sources. These sources include a variety of items such as books, government documents, yearly reports, published newspapers, and information gleaned from different websites. The scope of the study includes all six Conventional and Shariah-based Islamic banks that are active in Bangladesh. Mercantile Bank PLC, Islami Bank Bangladesh PLC, Al-Arafa Islami Bank PLC, Pubali Bank PLC, BRAC Bank PLC, and Shahjalal Islami Bank PLC.

5. Findings and Discussion

For a more thorough understanding of human resource management techniques, I examined the annual reports of many private Conventional banks as well as Islamic banks that are founded on Shariah. We looked over the annual banking report, focusing on the HRM practices of planning for succession, analysis of jobs, hiring policies as well as educational programs. In addition, we examined pay, incentives and motivation, relationships and commitment to staff, worker health and safety, and labor relations. Further explanations of each parameter's results are provided below:

5.1. Nature of Banks’ Human Resources

Across the nation, both Conventional and Islamic banks employ a vast network of individuals. The selection process for these positions varies depending on the specific role, with Conventional banks primarily focusing on skills and experience, while Islamic banks additionally consider adherence to Islamic principles. These institutions employ a diverse workforce, including permanent staff for core functions, temporary personnel for seasonal needs, and project-based specialists for specific initiatives. The bank operates on a multi-tiered structure with varying levels of authority and responsibility. At the top tier, the Managing Director and Deputy Managing Directors set the overall direction and make crucial decisions, followed by General Managers and Deputy General Managers who oversee specific branches. In Middle Management, there are AGM, Sr. Principal Officers, and Senior Officers. Finally, the Officer, Junior Officer, and Cash Officer directly execute tasks and fulfill specific responsibilities at the Operational Level.

Table 1

|

Table 1 Number of employees all Over Bangladesh in 2022 |

||||||

|

Name of the bank |

Types of employees |

Male |

Female |

Total Employee |

||

|

Executives |

Officers |

Others |

||||

|

Pubali Bank Limited |

241 |

6827 |

1963 |

7628 |

1403 |

9031 |

|

Brac Bank Limited |

785 |

7078 |

- |

6747 |

1116 |

7863 |

|

Mercantile Bank Limited |

325 |

2299 |

2650 |

4527 |

747 |

5274 |

|

Islami Bank Bangladesh Ltd |

1072 |

12613 |

7107 |

19160 |

1632 |

20792 |

|

Shahjalal Islami Bank Ltd |

310 |

2038 |

487 |

2363 |

472 |

2835 |

|

Al-Arafa Islami Bank |

349 |

3821 |

1014 |

4406 |

778 |

5,184 |

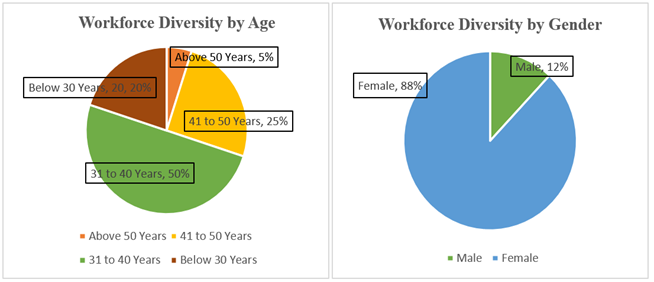

5.2. Workforce Diversity and Inclusion

Building a diverse and inclusive workforce is crucial for businesses to thrive in today's competitive environment. Fostering innovation, and creativity, and achieving sustained success over the long term relies heavily on having a diverse team comprising individuals from varied backgrounds, experiences, and perspectives Boulom et al. (2021). Inclusion and Diversity mean strengthening employee by acknowledging as well as recognizing their particular diversity, which includes seniority, sex, ethnicity, faith, handicap, qualification, and nationality. Both private Conventional and Islamic Shariah banks provide equal pay and benefits for everyone, regardless of their characteristics.

To maintain a diverse workforce, they actively focus on both attracting and retaining talent from diverse backgrounds. In addition, the banks provide support for the career advancement of women, acknowledging their unique challenges and providing them with the support they need to thrive.

5.3. Job Analysis

In the case of selecting qualified workers, first of all, it is necessary to determine the necessary qualifications of the workers based on the type of post, job roles, duties, work environment, etc. And this process of determining the necessary qualifications of the worker is job analysis.

Both Conventional and Islamic Shariah-based banks have shifted from simply job analysis to a competency-based approach that identifies the essential knowledge, skills, abilities, and characteristics (KSAOs) required for an individual to excel in the position. Notably, Islamic Shariah banks emphasize the specific behaviors required for each role, ensuring that candidates not only possess the technical expertise but also demonstrate ethical conduct and values aligned with Islamic principles. The job analysis practices of the banks are:

1) Job Description: Each year, the management typically opens positions for probationary officers. Additionally, they provide different opportunities for higher-level roles such as executives, senior vice presidents, senior assistant vice presidents, managing directors, and deputy managing directors.

2) Job Specification: The necessary qualifications for these positions vary depending on the specific job role and its requirements.

Generally, all the banking authorities use interviews, questionnaires, and observation for job analysis. Moreover, Conventional banks leverage software tools to streamline job analysis processes. Job analysis serves as the foundation for many human resource activities. It provides the framework for drafting clear job descriptions, identifying required skills and qualities (job specifications), and crafting attractive employment advertisements (job circulars). Furthermore, it helps to assess job duties (job evaluations), build fair remuneration systems, evaluate employee performance, and identify areas where training is required.

5.4. Recruitment and Selection

Prioritizing merit-based recruitment to attract diverse talent, Conventional and Islamic Shariah-based private commercial banks implement a methodical and competitive recruiting process that covers all positions. Ensuring compliance with the bank's service rules, they often leverage e-recruitment tools for better person-job fit and cost-effectiveness. However, Islamic Shariah banks sometimes integrate assessments of Shariah knowledge, and Shariah scholars in the selection process to examine a candidate's understanding of Shariah principles.

While banks strive for fair and transparent hiring, creating a truly bias-free environment requires ongoing effort. Implementing tangible efforts to eliminate unconscious bias, supporting diverse recruitment techniques, and guaranteeing clear selection criteria are all critical steps toward a more equal system.

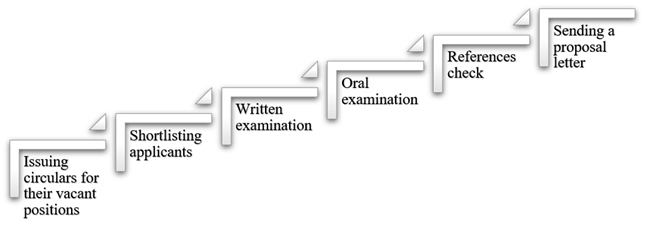

1) The process of recruitment and selection: The Conventional and Islamic Shariah-based private commercial banks follow the same process for recruitment and selection. At first, these banks individually issue circulars to hire candidates for their vacant positions. The banks initially shortlist applicants based on their academic achievements and require them to take a written examination. Those who pass this written test are then subjected to an oral examination. After those references are requested for a check, following these assessments, the banks compile a merit-based list of candidates and invite them to join the organization. This recruitment and selection process often consumes a significant amount of time.

|

The Process of Recruitment and Selection of These Banks |

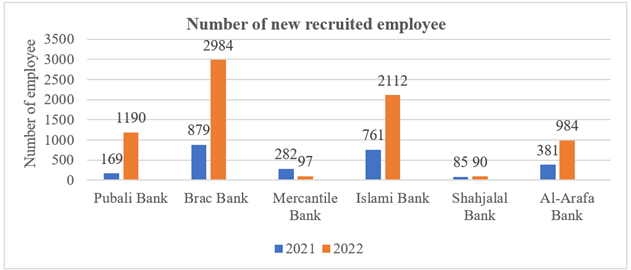

2) The sources of recruitment used by the banks: By utilizing both internal and external sources, banks can create a diversified talent pool and find the best employees for each role, fostering both internal mobility and fresh perspectives. External recruitment includes the Company website, Job website, Interns (Less frequently used), and newspaper advertisements. In contrast, Internal recruitment includes job posting, promotions and transfers, and employee referrals. Every year these banks recruit a huge number of employees through the external recruitment process.

From the following graph, it is found that Brac Bank has the most number of employees recruited in both 2021 and 2022 among all other banks. However, the least number of employees is recruited by the Shahjalal Islami Bank in those years.

5.5. Succession Planning

Organizations must cultivate their workforce to remain competitive on a global scale. The success of an organization is a collective effort, but top management's leadership and vision are indispensable for navigating challenges and driving sustainable growth. To fulfill these duties, each organization must strategically plan for the succession of its management team. Succession planning is a systematic approach employed by organizations to guarantee the availability of competent individuals for crucial roles within the company.

Through the succession planning process, both private and Islamic Shariah-based banks recruit and cultivate highly qualified employees, enhance their expertise, skills, and capabilities, and lastly prepare them for progression into more demanding positions. The ultimate goal is to identify and groom new leaders who can seamlessly replace departing, retiring, or deceased leaders within the company. Additionally, succession planning can effectively mitigate the challenges associated with the sudden absence of senior or key executives, arising from events such as retirement, resignation, or termination.

In these banks, Human resources (HR) leaders or senior executives play a crucial role in formulating an organization's succession plan. They craft leadership development programs to cultivate potential leaders for the future. The initiatives offer exposure to diverse operational environments, enabling participants to gain the essential knowledge and skills needed for successful leadership.

5.6. Training and Development

While knowledge remains a cornerstone of power, today's competitive edge hinges not just on possessing knowledge, but on continuously learning, adapting, and applying it effectively Drucker (1991), the banking industry is renowned for its knowledge-based operations. Banking activities and knowledge are always changing. So, each bank built a training institute that provides diverse training programs through online and physical formats. The training programs focus on new knowledge, regulatory compliance, and leadership skills that will contribute to the bank's long-term success and advance employees’ careers.

For its staff, private Conventional and Islamic Shariah-based banks regularly offer training and development opportunities. The requirements of training are discovered through need assessment procedures. These banks provide Product Awareness, Self-Learning, Specific Competency Training, Management Development Programs, Training on Money Laundering and Anti-terrorism, RBCF training, Green Banking Training, and IT Training. Also, they arrange regular seminars, workshops, and training programs by reputable institutes like BIBM, BBTA, BAB Research and Training Centre, SEIP, BIM, etc.

Banks frequently work with researchers and specialized training institutions to ensure that personnel are well-prepared to manage this complex financial world. This collaboration promotes a holistic learning environment in which people get the knowledge and skills they need to flourish in their industry.

Both Conventional and Islamic banks provide the opportunities to take part in continuous professional development programs to keep the staff up to date on evolving trends and laws, but Islamic banks go a step further. Islamic bank's educational opportunities extend beyond traditional financial understanding. It explores extensively Sharia principles, Islamic financial products, and the ethical issues that govern Islamic banking procedures.

By investing in their employees' development through on-the-job and off-the-job learning opportunities, these banks are putting themselves in a successful position for the future and making sure that their staff is aware and prepared to handle changing opportunities and challenges. There are given investments made by each bank to train their employees as follows:

Table 2

|

Table 2 The Information Table Regarding Training and Development |

||||

|

The name of the Bank |

The number of

training programs (2022) |

The number of participants (2022) |

Training expenses |

|

|

2022 |

2021 |

|||

|

Pubali Bank |

214 |

6210 |

19,606,311 |

3,316,901 |

|

Brac Bank |

224 |

30,988 |

37,000,556 |

8,596,578 |

|

Mercantile Bank |

36 |

4201 |

6,934,398 |

1,841,152 |

|

Islami Bank |

538 |

49905 |

28,876,657 |

19,653,910 |

|

Shahjalal Islami Bank |

168 |

5751 |

7,460,010 |

2,126,090 |

|

Al-Arafa Islami Bank |

127 |

8289 |

15,828,837 |

3,572,674 |

5.7. Performance Appraisal

In today's fast-paced corporate climate, performance reviews are more than simply annual rituals. Organizations that incorporate ongoing feedback and growth opportunities into their assessment processes may build a culture of learning and adaptability, which is critical for prospering in the face of fast change.

In private Conventional and Islamic Shariah-based banks, performance appraisal is done every year. The banks have a comprehensive performance appraisal system in place for evaluating the performance of their executives, officers, and staff. Managers-in-operations or Department Heads conduct performance appraisals without significant external pressure. The bank's appraisal system primarily evaluates employees against job-related criteria rather than personal traits. These institutions evaluate employee performance through Management by Objective, KPI, Ranking method, and ACR with structured criteria for promotion. Most of the time appraisal is done on a five-point scale (Excellent, Very Good, Good, Average, Below Average). The bank's performance appraisal program serves specific purposes, including pay increases, promotions, fringe benefits, layoffs, and employee development and transfers.

The performance reviews at the Islamic Banks go beyond Conventional approaches. While the fundamental components or processes remain the same, their system has a unique blend of Shariah-compliant elements. Evaluations consider not only financial performance but also adherence to Islamic values and Shariah principles in daily operations. This comprehensive strategy ensures that the Bank's performance immediately reflects its commitment to ethical behavior and strict adherence to Islamic principles in all financial transactions.

5.8. Compensation

Following dedicated effort and performance evaluation, employees rightfully expect compensation that reflects their contributions. Employee compensation encompasses all forms of financial and non-financial rewards they receive through their employment. Simply offering competitive salaries isn't enough. To maximize its impact, organizations need to design a strategic compensation system that aligns rewards with desired outcomes. Henri Fayol believed that a person should be fairly and equitably compensated.

Every bank ensures an equitable and consistent pay structure for their employees. Employees of both private Conventional and Islamic Shariah-based banks get a handsome and lucrative compensation package. To ensure fairness and alignment with market standards, a senior management committee chaired by the Managing Director periodically assesses and adjusts employee compensation packages

|

The Employee Benefits and Propositions Offered by these

Banks |

Shariah-compliant banks have a different pay system than regular banks. While fundamental features such as pay and benefits remain consistent, Islamic banks emphasize shared risk and return. This translates to a combination of base income and profit-sharing bonuses, which connect employee pay to the bank's performance. This is in contrast to traditional banks, where workers are paid a base salary, performance-based bonuses, and sometimes stock options, with a higher emphasis on increasing shareholder profits.

5.9. Occupational Safety and Health

Occupational safety and health are ongoing issues for HRM, as this obligation falls under the purview of the HR function Gannon & Paraskevas (2019). Employee safety encompasses the prevention of injuries and work-related incidents, including factors like stress, injuries, and domestic violence at the workplace. Employee health encompasses the psychological, psychological, sentimental, and interpersonal well-being of individuals within the labor force Mondy et al. (2016). Management should prioritize employee’s health and safety, as it not only saves lives but also contributes to increased productivity and cost savings.

The private Conventional and Islamic Shariah-based prioritize employee health by maintaining a clean workplace, offering in-house medical treatment, counseling services for mental health, developing a maternity care program, and providing six months of paid leave for female employees. The Department of Safety and Security (DSS) safeguards personnel and assets with measures spanning physical security, CCTV, fire safety, health protocols, and crisis management. Besides, they try to follow the Guidebook for Occupational Safety and Health of the Banking and Finance Industry. Moreover, Some of the bank conducts health and safety audits.

5.10. Promotional Policy

Promotion is a crucial aspect of human resource management that requires careful handling. It can either bring satisfaction or invite criticism from employees, depending on how it is managed. HR managers have the responsibility to design and implement a fair, impartial, and consistent promotion policy within an organization.

Both private Conventional and Islamic Shariah Banks have established a promotion policy that considers factors such as educational qualifications, merit, seniority, and the availability of vacant positions. The Promotion relies on merit and various assessments, including Annual Confidential Reports (ACR), the length of service, educational qualifications, and interviews. The line of promotion starts with a junior officer and ends with a deputy general manager.

Islamic Shariah-based banks prioritize ethical behavior and Shariah compliance with traditional promotion criteria such as job performance, experience, and skills. Transparency and fairness are essential throughout the process. Understanding Islamic finance becomes critical for specific professions for performance appraisal, demonstrating the bank's commitment to ethical procedures based on Islamic principles.

Every year, banks announce promotions for our eligible executives and officers, aiming to inspire, motivate, and encourage their personal and professional development toward the attainment of individual and organizational objectives.

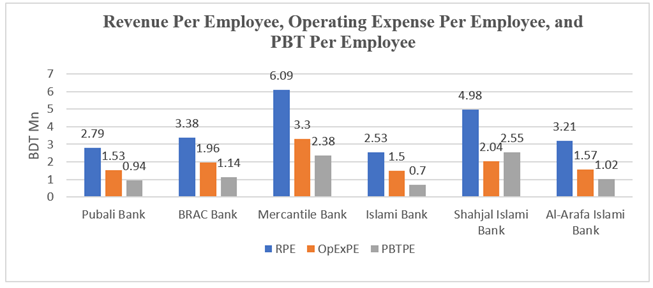

5.11. Human Resource Accounting

Human Resource Accounting (HRA) is a methodology used to measure the value of human resources within an organization by assigning monetary values to the costs and contributions of employees Palanivelu (2007). This process involves identifying and quantifying essential information and data related to human resources, including the value of their skills, knowledge, and experience. The analysis of such information provides valuable insights that empower leadership to make well-informed decisions. Within the Banks, Human Resource Accounting serves the purpose of allocating, budgeting, and reporting expenditures made on employees. Simultaneously, it aids in assessing their impact on the organization's growth, efficiency, and profitability. HRA plays a crucial role in decision-making processes related to Human Resources, whether it involves retaining their services, discontinuing employment, or providing extensive training opportunities.

6. Recommendation

To enhance human resource management practices in both Conventional and Islamic banks in Bangladesh, the study suggests implementing the following recommendations:

• Certain banks in Bangladesh have seen positive results from implementing initiatives like Green HRM, HR audit, job evaluation, and conflict management. Therefore, different banks must adopt these measures to guarantee the sustainability of HRM policies.

• The managers of the banks should establish a system for employees to provide feedback on HRM practices, including areas where they see room for improvement.

• To improve overall HR efficiency, Human Resource Information Systems (HRIS) should be introduced in these banks to streamline HR processes.

• The banks should leverage data analytics to measure the influence of HRM on key metrics like organizational performance and employee satisfaction, enabling data-driven decisions for HR optimization and improved business outcomes.

• HRM practices and strategies should adapt to changing industry trends, regulations, and employee expectations in these institutions.

7. Conclusion

Human Resources plays a pivotal role in fostering a culture of lifelong learning and development, ensuring employees have the knowledge and skills needed to adapt and thrive in a dynamic environment. To build a competitive edge in today's dynamic business landscape, organizations must actively invest in their human capital. A competent workforce is essential for overcoming the various challenges that an organization faces in pursuit of its goals. Banks, operating in such an environment, should emphasize HRM practices, including aspects such as ensuring employment security, strategic recruitment, offering competitive leave policies, providing creative compensation packages, fostering employee engagement, sharing relevant employment information, investing in training and development, and facilitating career promotions. Implementing these HRM practices empowers banks to attract and retain top talent, leading to a more skilled and diverse workforce that can tackle complex challenges and contribute to the bank's long-term success.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Afroj, S. (2012). Ongoing Corporate Human Resource Management Practice in the Banking Sector of Bangladesh. Global Journal of Management and Business Research, 12(2).

Afroz, N. N. (2018). Effects of Training on Employee Performance - A Study on Banking Sector, Tangail Bangladesh. Global Journal of Economics and Business, 4(1), 111-124. https://doi.org/10.12816/0048158

Ahmad, O. & Schroeder, R. (2003). The Impact of Human Resource Management Practices on Operational Performance: Recognizing Country and Industry Differences. Journal of Operations Management, 21, 19-43. https://doi.org/10.1016/S0272-6963(02)00056-6

Ali, Z., Mehmood, B., Ejaz, S., & Ashraf, S. F. (2014). Impact of Succession Planning on Employee's Performance: Evidence from Commercial Banks of Pakistan. European Journal of Social Sciences, 44(2), 213-220.

Anjum, N., & Rahman, M. M. (2021). Performance Appraisal and Promotion Practices of Public Commercial Banks in Bangladesh: A Case Study on ACR Method. SEISENSE Journal of Management, 4(3), 1-16. https://doi.org/10.33215/sjom.v4i3.602

Appelbaum, S. H., (2001). Human Resource Management. John Molson School of Business, Concordia University, Montreal.

Armstrong, M., & Taylor, S. (2020). Armstrong's Handbook of Human Resource Management Practice. London: Kogan Page Publishers.

Bangladesh Bank. (2023). Web Site

Boulom, V., Hasanadka, R., Ochoa, L., Brown, O. W., McDevitt, D., & Singh, T. M. (2021). Importance of Diversity, Equity, and Inclusion in the Community Practice Setting. Journal of Vascular Surgery, 74(2), 118S-124S. https://doi.org/10.1016/j.jvs.2021.03.051

Dessler, G. (2020). Human Resource Management. (16th Ed.). New York: Pearson.

Eva, T. P. (2018). Recruitment and Selection Strategies and Practices in the Private Sector Commercial Banks of Bangladesh: Evidence from Human Resource Practitioners. European Business & Management, 4(1), 28-38. https://doi.org/10.11648/j.ebm.20180401.15

Fathima, J. S. (2015). Human Resource Management in the Banking Sector. Shanlax International Journal of Management, 02(03), 111-21. https://doi.org/10.4236/jhrss.2013.13004

Gannon, J., & Paraskevas, A. (2019). In the Line of Fire: Managing Expatriates in Hostile Environments. The International Journal of Human Resource Management, 30(11), 1737-1768. https://doi.org/10.1080/09585192.2017.1322122

Guest, D. (2002). Human Resource Management, Corporate Performance and Employee Wellbeing: Building the Worker into HRM. The Journal of Industrial Relations, 44(3), 335-358. https://doi.org/10.1111/1472-9296.00053

Hameed, A., Ramzan, M., & Zubair, H. M. K. (2014). Impact of Compensation on Employee Performance (Empirical Evidence from the Banking Sector of Pakistan). International Journal of Business and Social Science, 5(2).

Islam, M. A. R. H., & Sarker, R. I. N. K. (2020). The Effect of Management by Objectives on Performance Appraisal and Employee Satisfaction in Commercial Banks. Journal of Social and Development Sciences, 32(6), 4-23. http://dx.doi.org/10.7176/EJBM/12-20-02

Majumder, T. H., (2012). Human Resource Management Practices and Employees' Satisfaction Towards Private Banking Sector in Bangladesh. International Review of Management and Marketing, 2(1), 52-58.

Mondy, R. W., & Joseph J. Martocchio. (2016). Human Resource Management. (14th Ed.). England: Pearson.

Palanivelu, R.P. (2007). Accounting for Management. Laxmi Publication LTD, Delhi.

Rahman, M. N., & Nower, N. (2020). An Evaluation of the Job Analysis Process in the Private Commercial Banks of Bangladesh. International Journal of Human Resource Studies. https://doi.org/10.5296/ijhrs.v10i1.16332

Ramu, N. (2008). Human Resource Management in Cooperative Banks in India, CAB CALLING, 67-72.

Ray, S., Bagchi, S., Alam, M. S., & Luna, U. S. (2021). Human Resource Management Practices in Banking Sector of Bangladesh: A Critical Review. OSR Journal of Business and Management, 23, 1-7.

Roknuzzaman, M. (2007). Status of Human Resource Management in Public University Libraries in Bangladesh. International Information & Library Review, 39, 52-61. https://doi.org/10.1080/10572317.2007.10762731

Schuler, R., and Jackson, S., (1987). Linking Competitive Strategies with Human Resource Management Practices, Academy of Management Executive, 1(3), 207-19. https://doi.org/10.5465/ame.1987.4275740

Sewu, G. J. A., Gyabeng, E., Dadzie, A. A., & Nkrumah, N. K. (2019). The Effect of Occupational Health and Safety Management on Performance in the Banking Sector, Ghana. International Journal of Business and Management, 14(10). https://doi.org/10.5539/ijbm.v14n10p172

Tarique, I. and Schuler, R.S. (2010). Global Talent Management: Literature Review, Integrative Framework, and Suggestions for Further Research. Journal of World Business, 45(1), 22-133. https://doi.org/10.1016/j.jwb.2009.09.019

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2024. All Rights Reserved.