GREEN BONDS AND ASSURANCE PROCESS: FIRST PROPOSITIONS ABOUT THE ROLE OF ACCOUNTING PROVIDERS

1 Associate Professor of Accounting,

Department of Management, University of Bologna, Rimini Campus Via Angherà, 22, 47900, Rimini, Italy

|

|

ABSTRACT |

||

|

Green bonds

seem to become more and more a key pillar of Green Finance to reach

sustainable and socially responsible finance. Through a periodization the

paper has the objective to analyze, among different actors, how the process

of auditing (assessment) is able to contribute to

transparency and effectiveness of strong sustainability purposes. Many

perplexities are linked to this on the actual effectiveness of these

investments to ensure the improvement of the environment and climate and on

the actual ethics and transparency of management of the various phases of

issue and auditing / assurance of the same. These perplexities have prompted

the curiosity of the wishes of the paper which aim to respond to the

following research question: “How auditors participate and seek to establish

the particular market segment of green bonds?”. |

|||

|

Received 01 July 2023 Accepted 02 August

2023 Published 16 August 2023 Corresponding Author Maria-Gabriella

Baldarelli, maria.baldarelli@unibo.it DOI 10.29121/granthaalayah.v11.i7.2023.5245 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2023 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Green Bonds, Assurance Process,

Accounting Providers |

|||

1. INTRODUCTION

The pressing issues of climate change and the need for an integral ecology require a commitment on several fronts, in this work the focus is in particular on a piece that could provide support for sustainable development, which analyses green bonds as a tool to direct investments in favour of projects, that respect and improve the company's impact on the environment.

Among a lot of perplexities about the role of finance to increase sustainable development Maltais & Nykvist (2020), Green bonds are becoming a key pillar of Green Finance. In most respects analogous to standard bonds, they add to the conventional financial promise of a borrower, the issuer, to pay a yield to the investor, the one to use the proceeds only for sustainable projects. To this end, green bonds carry in scripted the environmental impact of the proceeds, together with usual financial indicators, such as credit rating, coupon rate and face value, etc.

The phenomenon was the subject of attention from the EU in 2019, in fact the European taxonomy of Green Bonds was approved in the area of defence against climate change (EU Taxonomy Technical Report, June 2019). This document defines the characteristics of the activities, which contribute to reducing climate problems: “An economic activity shall be considered to contribute substantially to climate change mitigation where that activity substantially contributes to the stabilization of greenhouse gas concentrations in the atmosphere at a level which prevents dangerous anthropogenic interference with the climate system by avoiding or reducing greenhouse gas emissions or enhancing greenhouse gas removals through any of the following means, including through process or product innovation “(EU Technical Expert Group on Sustainable finance-Taxonomy Technical report, 2019, art. 6, 29). On the basis of this definition, the activities that fall within it are also specified (EU Technical Expert Group on Sustainable Finance-Taxonomy Technical report, 2019, art 7, 38).

Furthermore, the Document clarifies the content of the Green Bonds: “Green Bond Fund: The Taxonomy can be applied to bonds whose proceeds (or a significant amount) are invested in qualifying environmentally beneficial economic activities. The greenness of a given bond may be calculated by the percentage or amount of proceeds that go to Taxonomy-eligible assets. An example Green Bond fund allocation assessed by EU environmental standards is shown in Figure 12 to demonstrate how Taxonomy eligible investment reporting could be illustrated” (EU Technical Expert Group on Sustainable Finance-Taxonomy Technical report, 2019, 66). The document had been integrated, among others, by the Next generation EU green bond framework, that had been issued in October 2021.

The reasons that led to consider this aspect are due to the enormous growth both in the number of green bonds issued but above all in the large capital invested in them, as highlighted in the following paragraphs.

Many perplexities are linked to this on the actual effectiveness of these investments to ensure the improvement of the environment and climate and on the actual ethics and transparency of management of the various phases of issue and auditing / assurance of the same Maltais & Nykvist (2020). These perplexities have prompted the curiosity of the wishes of the paper, which aim to respond to the following research question: “How auditors participate and seek to establish the particular market segment of green bonds?”

The research design develops considering literature review about accounting approach, mainly based on social and environmental accounting and auditing. Literature review is based on different periods starting form 1990. Methodology consider Enel research case analysis Naumes & Naumes (2006), Yin (2018). Moreover, is interesting to find and to evaluate the expectation gaps and the perplexities about the effectiveness of this financial instrument to ameliorate environmental impact. The first phase sees green finance emerging from the development activities of a few public actors seeking to address and tackle specific project-based issues. The second phase is involving the first issuing of green bonds and the third phase concerns the intervention of public regulators seeking to embed the green bond market in the wider context of climate governance. In this context, we underline how the reframing of climate risk into financial stability risk plays a major role (Table 1).

Table 1

|

Table 1 Historical Evolution of Green Bond Market and the Role of Auditing/Assurance Transparency Requirements |

|

|

Timeline |

The role of auditing/assurance process |

|

90s towards 2007 |

? |

|

2007- 2015 |

? |

|

2015-today |

? |

|

Source Author’ s Elaboration |

|

2. The green bond market evolution

The Green Bond instrument originated in 2008 through the initiative of the World Bank (International Bank for Reconstruction and Development - IBRD) which, recognizing the need to develop a tool to orient investments towards sustainability, defined both the Green Bond and at the same time, the criteria for defining them as such through CICERO (Center for International Climate and Environmental Research, University of Oslo).

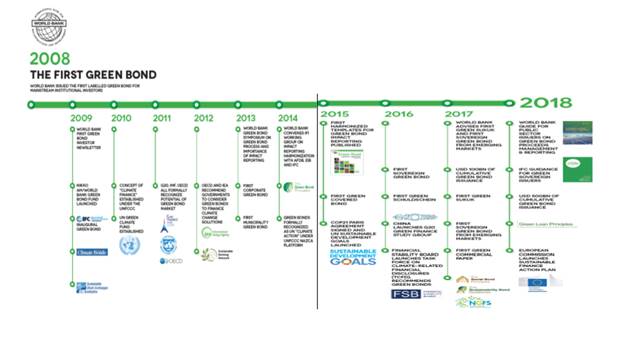

In the following Figure 1 the paper clarifies the historical evolution of these securities.

Figure 1

|

Figure 1 Historical Evolution of the Initiatives Regarding Green Bonds 2008-2018 Source The World Bank Green Bond Impact Report 2018, pp. 6-7 |

While the first green bonds have been issued by Multilateral Development Banks like the European Investment Bank and the World Bank back in the 2000s, the market gained traction only after the International Capital Market Association (ICMA) and the Climate Bond Initiative (CBI) produced market standards for the format and accounting of the bond. As evidenced from the graph, global issuance of green bonds took off in 2016 when it reached almost 100 billions per year. Note that this happened soon after the Paris Agreement and might be put in relationship with the beginning of regulations for not financial disclosures.

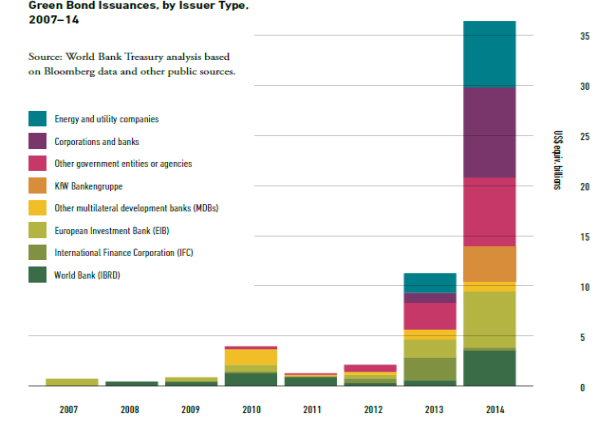

Figure 2

|

Figure 2 Evolution

of the Amount of Money Invested in Green Bonds from 2007 To 2014 Source World Bank. What is

Green Bond?[1] |

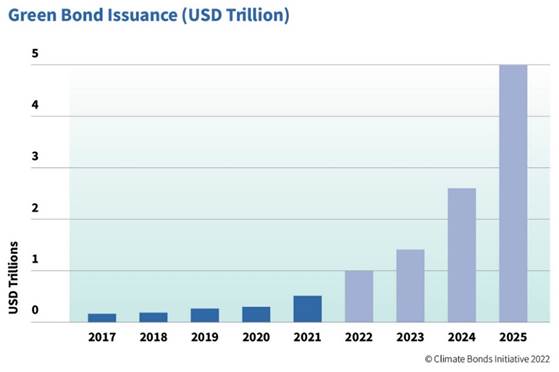

The trend of green bonds in Figure 3 is showing what is happening more recently.

Figure 3

|

Figure 3 Trend Evolution of Green Bonds During and After Pandemic |

After the presentation of the green bond evolution, in the next paragraph the role of auditing and/or assurance is analysed.

3. The role of integrity, transparency and efficiency in auditing and assurance process about the of green bonds market

In this paragraph the description of the role of auditing and assurance in the three periods, that had been described before, is presented.

In the first period (1990-2007) following literature review about auditing and assurance.

The need of auditing is underlined by some authors: "Without audit, no accountability; without accountability, no control; and if there is no control, where is the seat of power?... great issues often come to highlight only because of scrupulous verification of details” Chambers (1966).

To understand the contribution to the “green bond market” It is useful to focus on the whole process of auditing (that is considering (sic!) the financial one).

Moreover, auditing derives from the need to "guarantee" that green bonds follow the rules. Rules and standards / principles for which they were generated and this attestation of adherence to the rules / standards / principles is functional to achieving the objective for which they were created.

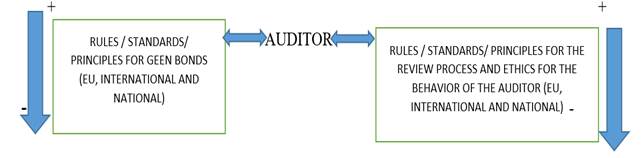

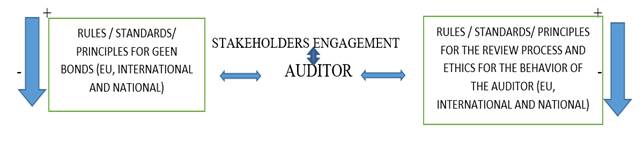

Green bonds have been designed to re-orient (financial) investments towards activities, that can lead to zero impact on the climate in 2050, or in any case to significantly reduce this impact according to the agreements established in the various conferences including those in Paris. And that these investments are actually effective and do not represent a greenwashing operation. So, the auditor, to work well, is at the center of these two "containers of norms / rules and principles (Figure 4).

Figure 4

|

Figure 4 The Scheme About the Auditor Role Source

Author’s Elaboration of Marchi, 2008:19 |

The downward arrow on the left indicates the transparency and "precision" decreasing from top to bottom of the rules / standards. This trend is related to the quality of the auditor's work, in the sense that the more transparent they are and the more specific aspects they regulate, the better the audit result could be. The arrow on the right, on the other hand, indicates the degree of adherence to the deontological rules which has the same effect on the result of the review.

In this context it seems that the higher the quality of the audit, the greater the effectiveness of the process and therefore the mitigation of the climate impact (which is only an indirect purpose with respect to the auditor's work, because the auditor must work on the adherence to principles / rules, etc ... following the ethical rules of conduct. So, it is expected that if the standards are transparent and precise with adherence to high auditing standards, the auditor can provide a very high result compared to the quality of the audit.

Another third area is part of this contest, which represents a level of internal “control / revision”, that the companies subject to the audit are already implementing. The presence of internal control processes certainly increases the quality of the audit. In this period, the concept of environmental auditing developed. The definition of environmental auditing refers above all to a managerial control tool. In reality, later this tool also becomes a harbinger of the need to issue "standards" to give trust to professionals and to be able to expand the possibilities of the same. This is why the first certification standards were born in the 90s, including EMAS and ISO 14000. Maltby (1995) identifies the first definitions of environmental auditing with the problems of differences of view and also of other kinds in an almost completely new field of analysis. Initially, several definitions are developed that are different from each other. Maltby (1995) states that: “The environmental audit potentially requires a knowledge of the legal framework within which the company operates, and also of any forthcoming changes in the law, an understanding of the company’s processes, raw materials, products, wastes and energy usage, the effects of each of these on the environment locally and globally, and the ability to suggest ways in which the company might change or improve what it does. “(Maltby (1995), 16).

Another interesting analysis derives from Gray & Symon (1992), that consider the word "audit" excessive, as they define some pre-requisites to make this activity possible, which at the time were not associated with defined and consolidated standards and practices. In this way Gray & Symon (1992) consider this activity as a "mere verification" of the first level and not a real "revision". Gray & Symon (1992) suggest: “They list five prerequisites for an audit under company law: an independent auditor, information to be audited; standards as a basis for judgement; distinct and identifiable bodies of information preparers and users; and information systems generating audit evidence. Using these criteria, they claim that “most uses of the term ‘audit’ are not audits at all but, more usually, a form of review” (Maltby (1995), 17 and in Gray & Symon (1992), 10,11).

According to some Authors, environmental auditing is part of social auditing (more stakeholder-oriented) emphasizing the independence of auditors Medawar (1976).

The role of accountants inside of environmental auditing had been analysed by several scholars, that underlined the important contribution of the accounting competences to auditing results (Bebbington et al. (1994), Collison & Gray (1997), Greeno et al. (1988), Huizing & Dekker (1992).

The development of this type of auditing, according to Power (1991) pays greater attention in identifying risk. Power (1991) about auditing process undermines the neutrality of the relationship between principal and agent through the form of the contract. In fact, two situations could arise between the principal and the agent, of which the first concerns information asymmetries and the second is about the moral risks of instead of carrying out actions in Favor of the principal, the agent is oriented to carry out actions for the benefit of himself (Power (1991), 31).

The risk involves the presence of conflicts between the manager and the auditor and can open the doors to consenting behaviour of the auditors with respect to problematic situations, which can invalidate the content of the audit opinion by flattening out a greater superficiality of evaluation and increasing the risk that the evaluation is not actually independent. This is because it is rather difficult to define standards regarding the environmental behaviour of companies (Maltby (1995), p. 18; Power (1991), Power (2011)). This idea is confirmed by Gray (2000) that consider very problematic for “accountant” the activity of social and environmental auditing and attestation, because of the weakness about the practices of attestations that are made especially by accounting professions. That weakness is due to the lack about environmental and social accounting and auditing inside of educational training of accounting professions (Gray (2000):1).

Literature underlines that for environmental auditing is very important the creation of multidisciplinary teams to fill the gaps of expertise (De Moor & De Beelde (2005), Hillary (1998), Unhee (1997), Stanwick & Stanwick (2001).

Some Authors underlined the urgent need of independent external assurance to moderate the potential for “managerial capture” (O'Dwyer & Owen (2005); Deegan (2002)).

Finally, in this first period, some pre-requisites emerge: independence of auditor, the typology of information to be audited, the quality of standards at the base of the evaluation (Maltby (1995), Gray & Symon (1992)). These pre-requisites are connected to the research question attributes, that are: integrity (Gray (2000), Tarquinio (2018), 173), transparency and efficiency (De Moor & De Beelde (2005), 212), of green bond market. Transparency is the attribute that is considered also very important (Gray et al. (2014)) about the passage from accountability to sustainability.

Table 2 is showing the attributes and pre-requisites of auditing and assurance.

Table 2

|

Table 2 Pre-Requisites and Attributes |

|||||

|

Pre-requisites/attributes of the process of auditing |

Independence |

Information to be

audited; |

Standards as a basis

for judgement; |

Distinct and

identifiable bodies of information preparers and users |

Information systems

generating audit evidence |

|

Integrity |

|||||

|

Transparency |

|||||

|

Efficiency |

|||||

|

Source Author’s elaboration |

|||||

At this stage of research, the pre-requisite of auditing in the first period are considered very low in their implementation and the role of auditors about integrity, transparency and efficiency is low at the same. During the second period (2008-2015), that start at the date of first issuing of the green bond, the debate about auditing and assurance is starting.

The increase of interest in environmental, social and sustainability reporting start to be accompanied by the upgrade in the use of independent assurance process about these reports Paris (2010).

The concept of auditing is mainly considered for green bond such as assurance provider, but in this paper the focus is on the category of “accounting providers”, that is: auditing firms and professionals, who have an accounting preparation as their basis.

In this phase, the role of the review in the green bond market creates the conditions for the creation of value or for the destruction of the same, for which in the space of this paper the research question will have a partial answer regarding the conditions that auditing/assurance can create for or against the value creation process. The answer would require a broader space for reflection, but it rests on these first considerations. In fact, with respect to the standards and guidelines for assurance engagement, two different approaches can be considered. The first approach of which is called the “accountancy based approach” and the second one “stakeholder-centered based approach” (Tarquinio (2018), 103; Cooper & Owen (2014)). The FEE (Fedération des Expert comptables Europeéns) standards converge on the accountancy-based approach providing assurance on sustainability reports (Discussion paper 2002). Instead, the document issued by the IASSB (International Accounting Standard-Setting Board), defined ISAE(International Standard on Assurance Engagements) 3000 (updated) considers the assurance process including in it the expression of an assessment of the reliability (by the provider) of the non-financial report with respect to the stakeholders and clearly the provider is different from the compiler of the report, in the merit to the subject of the review.

From this it follows that the subject of the assurance can be the entire report or part of it Tarquinio (2018).

Figure 5

|

Figure 5 The Scheme About the Accounting Provider Role Source Author’s Elaboration

of Marchi, 2008:19 |

After a brief description of the modification about auditing and assurance in a marked that is greatly evolving, in the second period this paper focus on the listed pre-requisites, as mentioned before: independence of auditor, the typology of information to be audited, the quality of standards at the base of the evaluation (Maltby (1995) and in Gray & Symon (1992). Those pre-requisites are connected to the research question attributes, that are: integrity, transparency, and efficiency of green bond market. At this stage of research, the pre-requisite of assurance and auditing in the second period are considered very important and their implementation, all over the world, are influencing trust and the survive of the Green Bond market. About their implementation and the role of auditors concerning: integrity, transparency and efficiency is very important, because there are standards and the approach follows the structuring of audits for financial statements, with rather detailed steps to arrive at an assessment of the reliability of the non-financial report too at different stages of green bonds process of issuing. Very important is the contribution of the assurance accounting providers. But some perplexities remain about the quality of evaluation, especially about independency considering that there are may different actors that are offering these services and often they are the “big four” with assignments that are involving both financial and not-financial reporting verification and certification. This may create commitment between the assurance provider/auditor and the ouditee, with perspective danger to independence, efficiency, and transparency of the Green Bond market.

Moving to the third period (2015-till today) the attention is focused on the role of the assurance carried out by the "accounting providers" in the various stages of their issuance. These types of auditors, as told before, are represented by auditing firms and individual professional auditors (Tarquinio (2018): 94). Furthermore, the auditing services, according to the research carried out, are provided by the auditing companies, which consider the traditional auditing activity to which they add social and environmental, sustainability auditing, even if at a global level the percentage varies according to the nations (Tarquinio (2018)). The presence of the verification unfolds in all phases of planning and implementation of what are defined as Green Bonds. The intervention of the verification in the various phases of issuing green bonds has a different connotation if there are organizational positions within the company, that in some way manage and control the social and environmental impact of the same, as CSR (Corporate Social Responsibility) manager, internal auditing, sustainability managers and CSR committees. This is because the company demonstrates with organizational positions included in it, the attempt to focus more attention on sustainable development also in governance activities Tarquinio (2018). The first phase of the life cycle of green bonds is the issue phase considering the company that wishes to use this type of finance. This company defines a framework on which to base the Project for which to apply for funding and establishes the procedures for allocating and monitoring the securities. In this phase it is necessary to check and verify (defined pre-issuance) both of the basis considered for the green bond, and that of monitoring the initial process and any corrective action in this first phase. At this stage it is necessary to verify the investment risk and the degree of adherence of the green bond to the base taken as a reference. This basis is dictated by the type of reference green bond. The second phase (post-issuance) consists in the listing of the stock in the green bond market and the related need to prepare periodic reports, relating to the performance of the stock, its degree of risk, yield, etc.

In the third period the attention is on the above listed pre-requisites (Maltby (1995), Gray & Symon (1992) and them are connected to the research question attributes, that are: integrity, transparency, and efficiency of green bond market. This because there is the typology of information to be audited and “distinct and identifiable bodies of information preparers and users “at least of EU after the taxonomy regulation. The analysis must underline the independence, that is difficult to reach for the enforced reasons of commitment that previously is mentioned and about the information systems that generate audit /assurance information. The last pre-requisite consider that the process can be different, considering transparency very difficult to reach at the same level in different countries. Finally, assurance and auditing are very important to create trust in the market, but the risk is the excessive concentration on the reduction of risk, that is a sort of ” financialization” of environmental matters Table 3.

Table 3

|

Table 3 Historical Evolution and Auditing and Assurance Role in Green Bond Market |

|

|

Timeline |

Certification, Auditing, and assurance |

|

90s towards 2007 |

-Voluntary disclosure -Introduction and development of social and

environmental auditing. Concerns about its use. |

|

2008- 2015 |

MARKET BASED DISCLOSURE GUIDELINES The term assurance is more and more used to indicate

the previous “auditing”. The assurance process involves stakeholders inside

the process of verification instead of the previous “auditing”. Very

important contribution of the assurance accounting providers. But some

perplexities remain about the quality of assessment process |

|

2015-till today |

EU TAXONOMY AND GREEN BONDS STANDARDS AND REGULATIONS Assurance and auditing are very important to create

trust in the market, but the risk is the excessive concentration on the

reduction of risk that is a sort of” financialization” of environmental

matters. The attributes: integrity, transparency and efficiency

are considered very important |

|

Source Author’s elaboration |

|

To face that potential danger the focus of empirical investigation is implemented to analyse the attribute of integrity, because that is a synthesis of the other pre-requisits, in order to guarantee the environment integrity. Transparency (on climate risk) because is the focus of the assurance result and process: “At the heart of CICERO ’s approach to green bond external reviews is a commitment to reflecting the latest climate science, protecting the environmental integrity of the voluntary green bond market, and promoting transparency on climate risk.” CICERO Milestones (2018), p.1. Efficiency is the third attribute that is relative to: energy efficiency; water use efficiency, etc, because is an indirect indicator of the respect and safeguard the environment.” CICERO Milestones (2018), p.12.

4. Enel

green bonds case study: the analysis of the attributesOBSERVATIONS

About methodology, in order to ensure

rigour and reliability to the research case Naumes and Naumes (2006), the research

protocol is presented below Yin (2018) Table 4.

Table 4

|

Table 4 Enel Case Study Research Protocol |

|

|

A) introduction |

Objectives: to verify the implementation of

attributes and prerequisites in assurance process in Enel research case |

|

|

Research question: “How auditors participate and

seek to establish the particular market segment of green bonds?” |

|

|

Literature: auditing and assurance process |

|

B) information gathering procedure |

International standards: |

|

|

EU Technical Expert Group on Sustainable

finance-Taxonomy Technical report, 2019.Environmental Auditing-14-Department

of Environmental Affairs and Tourism, Pretoria, South Africa, Green Bond

Principles Voluntary Process Guidelines for Issuing Green Bonds, June

2018,ICMA-Guidelines for Green, Social and Sustainability Bonds External

Reviews, June 2018, ICMA-Green Bond Principles Voluntary Process Guidelines

for Issuing Green Bonds, June 2018; International Standard on Related

Services (ISRS) 4400; Next Generation EU - Green Bond Framework 2021. |

|

|

Content analysis research about: integrity,

transparency, and efficiency |

|

C) Protocol questions |

Enterprise description: mission, governance, and

strategy, that is divided in the three periods that had been involved

(1990-2007; 2008-2015; 2015-till today. |

|

D) Report framework |

|

Enel Group is Limited company that in June 2022 considered:

revenues (millions of Euros) of 67.258; Electricity distribution and

transmission network (km)of 2.250.771 of with 43% of clean and accessible

energy; number of employees of 67,117 (Half-year financial report as of June

30, 2022, p. 10). Mission: " We open access to energy to more people; We

open the world of energy to new one’s technologies; We open

up to new uses of energy; We open up to new ways of managing energy for people;

We open up to new partnerships. With Values:

Confidence, Proactivity, Responsibility, Innovation "(Half-yearly

financial report as of 30 June 2022)

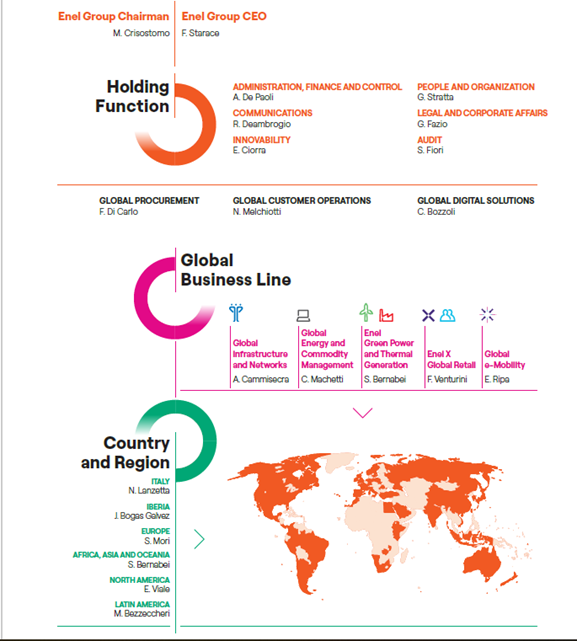

About governance, the organization chart is showed below (Figure 6)

Figure 6

|

Figure 6 Enel Organization

Chart 2022 Source (Half-Yearly Financial Report as of June 30th, 2022, p. 23) |

Enel had been established in1962, when the Italian Parliament

approved the nationalization of the electrical system, with the aim to

rationalize and optimize resources’ utilization on a national scale, with the

name of Enel (Ente Nazionale per l’Energia Elettrica).

During the ’90 Enel raising and structure furthermore its

partnership with ecological NGOs and associations. With the law 9/91, the

government the energy production and distribution sector’ liberalization,

allowing Enel to promote its activities and operation in foreign countries

through the constitution of public limited company (S.p.A). Enel started a

diversification strategy to develop new business all over the world.

From 1997 to 2002 the national electricity sector was opened, and

Enel become an industrial holding company. Enel, because of the decree, had

sub-divided its production, transmission, distribution and selling activities

in many subsidiaries, also reducing its production. Moreover, the transmission

operations have been granted to “Gestore della Rete di Trasmissione”, one

of Enel’s subsidiaries, where the society’s major stakeholder were the

Treasury.

In November 2002, enhancing its diversification strategy through

the development of new businesses. Furthermore, in the following years, early

’10 mainly, Enel sought to develop a more structured and comprehensive strategy

to suddenly diminish its dependency from fossil fuel and so to ease its natural

footprint, mainly through a new subsidiary: Enel Green Power.

In order to do that, and also to manage the development and communication

process to the shareholders and the stakeholders, in 2004 Enel formed its

Corporate Social Responsibility Department.

In May 2003, the 2002 Sustainability Report was known as the core

instrument to communicate Enel’s effort toward sustainability in three areas:

economic, social, and environmental.

From 2003 to 2005, Enel joined a number of

initiatives, such as the United Nations Global Compact initiative, formalized

in 2004, and also fulfilled with a number of social and environmental

standards, such as ISO 14001 environmental certification, also obtaining EMAS

recording for nearly a half of its plants global. In the same years, within the

CSR departments detailed training activities in data gathering and reporting

were supported. In addition to regular courses, counselling, and management

activities with the goal of spread the principles of CSR – but also Human Rights,

Equal Opportunity, and Zero Corruption policies principles – throughout the

company and its many subsidiaries. Through these efforts, Enel was admitted to

the: Ethical Index EURO, Ethical Index GLOBAL, Sustainability Index of the

Financial Times Stock, Dow Jones Sustainability Index (DJSI), Accountability

Global 50, etc Pistoni & Songini

(2009).

Furthermore, from 2008 to 2014, Enel has managed to balance

shareholders and stakeholders’ interest, developing green businesses through

Enel Green Power, opening renewable energy plant. In addition, in 2011, Enel

inaugurated the first model carbon dioxide-capture facility in Italy, in the

Enel Federico II power plant, in Brindisi, and inaugurated the first smart

grid, in Isernia. The same year, Enel became a partner of the United Nations

Global Compact, an initiative that stimulate businesses to embrace sustainable

strategy and policies. The following year, Enel sold its remaining shares of

«Terna», exiting the high-voltage market. In 2013, Enel sold its shares in

«Arctic Russia» and «SeverEnergia», two joint ventures

with Eni.

In 2015, half of the electricity produced by Enel was carbon-free.

Also, Enel has stated the commitment to decarbonize its total energy production

by 2050. In order to do that, in 2015 Enel established

a plan.

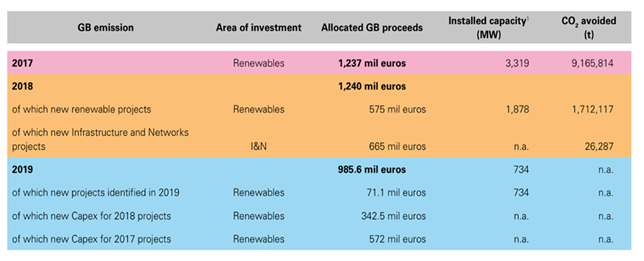

Starting from 2017 to 2019, Enel issued three green bonds on the

European financial market, for a total amount of € 3,5 billion: January 2017- €

1,25 billion, January 2018-€ 1,25 billion, January 2019- € 1 billion.

These green bonds, issued through the subsidiary Enel Finance

International NV, are proposed for institutional investors, and guaranteed by

Enel, and their aim is to finance green projects functional to a transition to

a circular and carbon-free economy.

Figure 7

|

Figure 7 Enel Green Bonds Overall Results Representation: 2017, 2018, 2019 Source Enel Green

Bond Report 2019, p.4 |

In September 2019 Enel issued on the international markets a

peculiar typology of green bond, namely the «general purpose SDG-linked bond»,

for a total amount of US$ 1,5 billion, linked to «affordable and clean energy»

– namely: affordable and clean energy: 3 million beneficiaries by 2020,

particularly in Latin America, Asia, and Africa.

After the brief history description of Enel company and Enel Green

bond emissions, the implementation of the frequency of the three attributes is

investigated using the research protocol (Table 3).

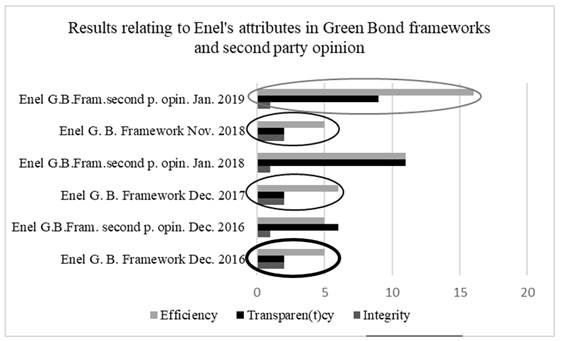

The analysis developed in two phases. The first is involving the

Green Bond frameworks 2016, 2017, 2018 and Enel Green Bond Framework second

party opinion 2016, 2018 and 2019. The Green Bond second party opinion about

the framework of 2017 Green Bond emission had been issued in January 2018. The

same timing had been used for that of 2018. The second phase is considering the

investigation of the Green Bond reports from 2017 to 2020.

Figure 8

|

Figure 8 Source Author’s Elaboration |

The results about the frequency of the attributes Gray (2000), Tarquinio (2018) (Figure 8) are showing that

the two attributes about integrity and transparency have the same frequency

inside of the Green Bond frameworks 2016, 2017, 2018 and the attribute

transparency has similar trend. Instead of the Green Bond second party opinion

about the framework from 2016 to 2019 is showing the increase of the efficiency

and there is greater frequency of transparency then integrity.

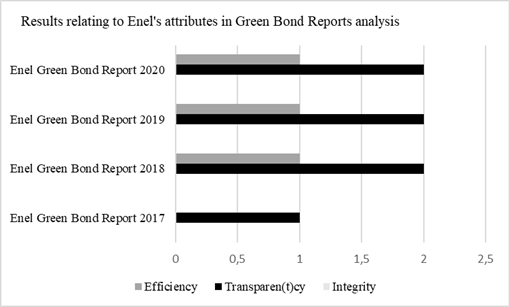

The analysis of the attributes of Enel’s Green Bond Reports, from

2017 to 2020 (Figure 9), is evidencing

only transparency and efficiency, but integrity is not present. There is a sort

of contradiction between the auspice to reach integrity and the lack of this

attribute in ENEL case. Moreover, the presence of transparency is focusing the

attention more on quantitative disclosure then qualitative one.

Figure 9

|

Figure 9 Source Author’s Elaboration |

After the analysis above, in the next section conclusion is

presented.

5. Conclusion

In order to answer to the research question: “How auditors participate and

seek to establish the particular market segment of green bonds?”

The paper described the role of auditing and assurance considering

especially the Green Bond market. Three different periods are considered in

which the meaning and the word auditing profoundly changed to involve more and

more environmental, social and sustainability matters.

Among the complex of the different avenues that should have

considered the attention is focused on the accounting provider ‘s role. Moreover,

among the pre-requisites Gray & Symon (1992) and the attributes Gray (2000), Tarquinio (2018); De Moor & De Beelde (2005), Gray et al. (2014), the analysis

regards the attributes that are better able to represent the amelioration of

the process of verification of the Green Bond issuing, to (perhaps) increase

the trust inside of the respective market.

In particular, what emerges from Enel case, is that these financial

instruments are used to develop a certain representation of the company’s

social and environmental profile. Therefore, from the empirical analysis of the

attributes (Gray (2000), Tarquinio (2018)) emerge a

representation that is focused mainly Integrity, transparency and Integrity

have the same frequency inside of the Green Bond frameworks 2016, 2017, 2018.

But there is a different trend in second party opinion (O'Dwyer & Owen (2005), Deegan (2002) about the framework

from 2016 to 2019, in which efficiency and transparency is increasing more than

the others to underline that there is a very positive contribution of

assurance/auditing activities in order to improve transparency and efficiency

in Green Bond Market.

Moreover, the scalability of green bond markets relies primarily

on a paradigm change: green bonds are perceived as communication tools, with

limited financial benefits. The best way to expand it is to support a

harmonized exertion, in order to develop solid

data-driven authority and reliability in terms of sustainability and financial

advantages, reducing transaction costs and thus attracting more issuers and

investors to the market, paving the way for a push into green finance thumbs

up.

The limits of the work concern the consideration of a single case,

which should also be extended and compared to other similar cases.

Therefore, a relational perspective can be seen in the logic of

"we", that could re-generate the initial loss of trust. If this were

not the case, a sterile and end in itself corporate

culture would be perpetuated.

Furthermore, the empirical analysis opens the door to a paradox which cannot be explained in the paper, and which should be further investigated, and which will find space in subsequent research.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Arens, A. A., & Loebbecke, J. K. (1984). Auditing : An Integrated Approach (3rd ed) (1st ed. 1976). Prentice Hall International Editions, Englewook Cliffs.

Bebbington, J., Gray, R., Thomson, I., & Walters, D. (1994). Accountants' Attitudes and Environmentally, Sensitive Accounting, 109-120. https://doi.org/10.1080/00014788.1994.9729470.

CICERO Milestones (2018).

A Practitioner's Perspective on the Green Bond Market.

Chambers, D. A. (1966). Internal Auditing Theory and Practice. Pitman, London.

Collison, D. & Gray, R. (1997). Auditors' Responses to Emerging Issues : A UK Perspective on the Statutory Financial Auditor and the Environment. International Journal of Auditing, 1(2), 135-149. https://doi.org/10.1111/1099-1123.00018.

Cooper, S., & Owen, D. (2014). Indipendet Assurance of Sustainability Reports, in Bebbington, J., Unermann, J., O' Dwyer, B. (eds), Sustainability Accounting and Accountability, Routledge, 72-85.

De Moor, & De Beelde, I. (2005). Environmental Auditing and the Role of the Accountancy Profession : A Literature Review, Environmental Management, 36(2), 205-219. https://doi.org/10.1007/s00267-004-0142-6.

Deegan, C. (2002). Introduction : The Legitimising Effect of Social and Environmental Disclosures - A Theoretical Foundation. Accounting, Auditing & Accountability Journal, 15 (3), 282-311. https://doi.org/10.1108/09513570210435852.

Ferraris, F. R. (1978). L'Indagine Metodologica in Economia Aziendale. Giuffrè, Milano.

Gray, R. (2000). Current Developments and Trends in Social and Environmental Auditing, Reporting and Attestation : A Review and Comment. International Journal of Auditing, 4, 247-268. https://doi.org/10.1111/1099-1123.00316.

Gray, R. (2000). Current Developments and Trends in Social and Environmental Auditing. Reporting & Attestation : A Personal Perspective. The Centre for Social and Environmental Accounting Research, Department of Accounting and Finance, DRAFT 2B : June 2000.

Gray, R. (2001). Thirty Years of Social Accounting, Reporting and Auditing : What (If Anything) Have We Learnt. Business Ethics. A European Review, 10, 9-15. https://doi.org/10.1111/1467-8608.00207.

Gray, R., & Symon, I. (1992). An Environmental Audit by any Other Name. Integrated Environmental Management, 6, 9-11.

Gray, R., Owen, D., & Adams, C. (2014). Accountability, Social Responsibility and Sustainability : Accounting for Society and the Environment. Pearson, Higher Ed.

Greeno, J.L, Hedestrom, G.S., & DiBerto, M., (1988). The Environmental, Health, and Safety Auditor's Handbook. Arthur D. Little, Inc., Cambridge, UK.

Greer, J., & Bruno, K. (1996). Greenwashing. The Reality Behind Corporate Environmentalism, Penang : Malaysia : Third World Network Editor.

Hillary, R. (1998). Environmental Auditing : Concepts, Methods and Developments. International Journal of Auditing, 2(1),1-85. https://doi.org/10.1111/1099-1123.00031.

Huizing, A. & Dekker, C. (1992). Helping to Pull our Planet out of the Red : An Environmental Report of BSO/Origin. Accounting, Organizations and Society, 17(5),449-458, https://doi.org/10.1016/0361-3682(92)90040-Y.

Maltais, A., & Nykvist, B. (2020). Understanding the Role of Green Bonds in Advancing Sustainability. Journal of Sustainable Finance & Investment. https://doi.org/10.1080/20430795.2020.1724864.

Maltby, J. (1995). Environmental Audit : Theory and Practices. Managerial Auditing Journal, 10(8), 15-26. https://doi.org/10.1108/02686909510147372.

Marchi, L. (1988). Strategie di Revisione aziendale, IPSOA, Milano.

Marchi, L. (2019). La creazione e la misurazione del valore : dalla prospettiva finanziaria alla prospettiva economico-sociale, Lectio Magistralis-Pisa, 19 ottobre. https://doi.org/10.3280/MACO2019-001001.

Marchi, L. (2008). Revisione aziendale e sistemi di controllo interno, Giappichelli, Milano.

Medawar, C. (1976). The Social Audit - A Political View, Accounting. Organizations and Society, 1(4), 389-94. https://doi.org/10.1016/0361-3682(76)90041-6.

O'Dwyer, B., & Owen, D. (2005). Assurance Statement Practice in Environmental, Social and Sustainability Reporting : A Critical Evaluation. The British Accounting Review, 37, 205-229. https://doi.org/10.1016/j.bar.2005.01.005

Paris, A. (2010). I Profili Dell'assurance Nel Rendiconto Socio-Ambientale, RIREA, Nov. Dic.

Pistoni, A., & Songini, L. (2009). Enel : CSR and Performance Measurement. In : C. Smith, G. Lenssen (eds.). Mainstream Corporate Responsibility. Hoboken : Wiley, 97-141.

Power, M. (1991). Auditing and Environmental Expertise : Between Protest and Professionalisation. Accounting, Auditing and Accountability Journal, 4(3), 30-42. https://doi.org/10.1108/09513579110141751.

Power, M. (2011). The Audit Society : Rituals of Verification. Published to Oxford Scholarship Online, (Print publication Date : 1999). https://doi.org/10.1093/acprof:oso/9780198296034.001.0001.

Stanwick, P. A., & Stanwick, S. D. (2001). Cut Your Risks with Environmental Auditing. The Journal of Corporate Accounting and Finance. https://doi.org/10.1002/jcaf.2403.

Tarquinio, L. (2018). Corporate Responsibility Reporting e Assurance Esterna. Profili Teorici, Criticità e Prospettive, Collana : Strategia, Management e controllo, Torino, Giappichelli.

Unhee, K. (1997). Environment and Safety Auditing : Program Strategies for Legal, International and Financial Issues, Lewis Publishers, USA, 226.

[1] http://documents1.worldbank.org/curated/en/400251468187810398/pdf/99662-REVISED-WB-Green-Bond-Box393208B-PUBLIC.pdf

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2023. All Rights Reserved.