THE IMPACT OF ENVIRONMENTAL, SOCIAL, AND GOVERNANCE (ESG) ON THE ECONOMIC GROWTH OF ASEAN-5 COUNTRIES

Nur Syazwina

Ghazali 1![]() , Siti Nurazira Mohd Daud 2

, Siti Nurazira Mohd Daud 2![]() , Nur Hafizah Ismail 3

, Nur Hafizah Ismail 3![]()

1, 2, 3 School of Economics, Finance and

Banking, Universiti Utara Malaysia, 06010 UUM Sintok, Kedah, Malaysia

|

|

ABSTRACT |

||

|

ESG program

has become crucial for long-term value and business resiliency through

efficient use of natural resources and effective policies on social and

economic aspects. A country which has a good ESG performance would achieve

higher economic growth. This study examines the ESG country-level performance

across the ASEAN-5 by assessing the impact of ESG on economic growth. The

study utilized annual data from 1990 to 2020 for five countries - Indonesia,

Malaysia, the Philippines, Singapore, and Thailand. This study constructs the

ESG index at the country level by employing frequency statistics of text

mining and factor analysis for each country over time. Establishing an ESG

country index would better reflect the ASEAN-5 nation's progress in ESG

practices. Besides that, the ARDL method was employed to establish the

relationship between ESG and economic growth. The results revealed mixed

impacts of ESG on economic growth, which can be attributed to the variations

in ESG practices and policies across the countries. Some results showed a

significant positive impact of ESG practices on economic growth, while others

showed no significant or negative impact. This study emphasizes the

importance of a suitable ecosystem that supports the effectiveness of ESG

adoption. This study recommends several precautionary policies, such as

low-interest loans, grants, and tax relief, to support a firm's resilience

during pandemics. |

|||

|

Received 13 May 2023 Accepted 14 June 2023 Published 30 June 2023 Corresponding Author Nur Syazwina Ghazali, syazwinaghazali@gmail.com DOI 10.29121/granthaalayah.v11.i6.2023.5194 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2023 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: ESG, ASEAN-5 countries, Principal

Component Analysis, Economic Growth JEL Classifications: Q01, O40, E02, C22 |

|||

1. INTRODUCTION

Encouraging sustainable development appeals to individuals worldwide who aim to safeguard the environment and guarantee their well-being. The significance of sustainable development lies in its ability to foster economic growth while ensuring that environmental harm is minimized, and future generations' needs are not compromised by current development efforts NEF. (2015). The Sustainable Development Goals (SDGs) are a crucial component of the United Nations (UN) 2030 Agenda, which seeks sustainable development. These objectives require the active participation of various stakeholders, such as individuals, corporations, governments, and nations globally. In an effort to align their operations with the SDG objectives, profit-maximizing enterprises have incorporated the environmental, social, and governance (ESG) agenda into their business practices. The SDGs and the ESG frameworks aim to promote sustainability by addressing environmental and social issues. However, while the SDGs apply to all stakeholders, including countries and the general public, ESG primarily focuses on the business community and individual firms. Therefore, while corporations are essential stakeholders in achieving sustainable development, it is vital to ensure that ESG practices are inclusive and involve collaboration between all relevant stakeholders, including governments, non-governmental organizations (NGOs), and civil society.

ESG

investing has become a crucial component of global investment strategies and

has garnered the attention of policymakers, investors, and the public for

promoting sustainable business practices Boffo and Patalano (2020). Every country in the United

Nations has agreed to implement the 2030 Agenda for Sustainable Development.

ESG integration is a key strategy for sustainable investing in the US, Canada, Australia,

New Zealand, and Asia (apart from Japan). In contrast, in Japan, corporate

involvement and shareholder action are the main investment components.

ESG-integrated investment techniques are still in their early phases in Asia

yet have great potential for development

GSIA. (2016). According to the 37th ASEAN

Summit's Implementation Plan for the ASEAN Comprehensive Recovery Framework,

significant areas of attention for a sustainable and resilient future in ASEAN

include circular economy, sustainable energy, green infrastructure, sustainable

investment, and sustainable financing ASEAN. (2020).

Further,

in term of the relation between ESG and country’s economic growth can be viewed

in many ways. Firstly, ESG may serve as a safeguard, lowering risk and ensuring

market efficiency. A strong non-financial performance on ESG problems may

contribute to developing trust between investors and organizations Margaretic and Pouget (2018). Secondly, the active integration

of ESG policies into corporate decision-making will increase GDP growth,

demonstrating to stakeholders, investors, investors, and policymakers that ESG

policy implementation across sectors will result in macroeconomic benefits Zhou et al. (2020).

The implementing

ESG policies can facilitate a smoother transition to a more sustainable and

low-carbon economy by encouraging companies to prioritize sustainable business

practices and promote long-term value creation over short-term profits. For example,

investing in renewable energy infrastructure and sustainable transportation

systems can create jobs and stimulate economic growth while reducing carbon

emissions. However, different countries may have unique circumstances and

regulations that affect their approach to ESG and their ability to integrate

ESG practices into their business operations. These unique characteristics

could be related to a country's regulatory framework, policies, or other

factors that influence how businesses operate and are regulated.

Further, ASEAN-5 countries are concerned about more

accurate data, dispersed standards and disclosure laws, and insufficient

regulatory monitoring to prevent greenwashing. The

exchange rate performance and government involvement in ESG investment policies

of the ASEAN-5 nations vary significantly. Unfortunately, several obstacles

hinder these regulations' effectiveness and dependability. For instance, Windolph (2011) listed six issues: inconsistency, unreliable information, bias,

trade-offs, lack of openness, and independence. In addition, Billio et al. (2021) argued that the low overlap of ESG indexes, which results from

differences in ratings provided by rating agencies, weakens the impact of ESG

investors' preferences on asset prices, thereby nullifying any influence on

financial performance, even for the ESG agreement portfolio. Since the

information used to determine an ESG rating and indexes varies from one rating

agency to another, there is room for disagreement about the current ESG rating

and indexes.

Nevertheless, among the obstacles

to ESG implementation, firms in the Philippines and other countries have

diverse ESG risk exposure, goals, and possibilities. An existing obstacle is

the absence of a universal rating, reporting, and benchmarking system for ESG

performance. This is consistent with the ESG, UN SDGs, and Climate Change

Strategy in Indonesia (2022), which stated that the limitations of ESG

ratings and the absence of a defined system for measuring ESG effect further

reduce the value of external, third-party evaluations. According to the ASEAN. (2022) report, the pandemic has had far-reaching

effects on businesses. The pandemic has expedited specific pre-existing trends

in ASEAN, which must be reconsidered if the region wants to develop a more

conducive working climate post-pandemic. One such trend is the diversification

of supply chains from China to ASEAN, which has greatly helped businesses,

including producing electric vehicles in Thailand and developing sustainable solar

energy in Malaysia. To reduce the effects of automation and digital technology,

it is essential to focus on labor retraining and career routes is essential.

Existing studies on ESG

performance and economic growth among ASEAN-5 countries are scarce. In fact, to

the best of our knowledge, previous studies on ESG practices for economic

growth in the ASEAN-5 context have not been done yet. Many studies only focus

on ESG practices for economic growth in the United Kingdom and other Europe

countries Avetisyan and Hockerts (2017), Eccles and Viviers (2011), Luo (2022), Zhang et al. (2022), Bannier et al. (2019), De Lucia et al. (2020), and Sassen et al. (2016). In fact, according to Mahi et al. (2020), ASEAN-5 countries have the fastest-growing emerging markets compared

to other countries. Therefore, studying ESG performance and economic growth

among ASEAN-5 countries is pertinent. Besides that, ESG is a relatively new

development concept that previous scholars and researchers have addressed as a

broad term for sustainable development; this study contributes to the

literature by constructing a new ESG country index and determining their

effects on economic growth in ASEAN-5 countries.

Billio et al. (2021) explored the disagreement between ESG rating agencies and its

consequences on identifying ESG index constituents. This issue is pertinent

given the absence of data and the limited availability of reliable information

on the present ESG index. Thus, this study uses a text-mining approach to

construct an ESG country index score and assess the impact of ESG on economic

growth in the ASEAN-5 countries. This study will employ data mining techniques,

specifically the text mining word frequency statistic, to analyze news articles

related to ESG. This will help to gauge the level of attention given to ESG

issues.

This study provides three approaches. First, the study

constructs an ESG country index score that better reflects the evolution of ESG

throughout the ASEAN-5 countries. By using Google Trend analytics (which

provides access to a large sample of search requests), it is possible to

observe the evolution of ESG on economic growth in the ASEAN-5 countries.

Second, the ARDL method was employed to establish the relationship between ESG

and economic growth. Third, the study reviews the changes in the economic cycle

or shock, particularly the pandemic crisis.

The remainder of this study is organized as follows.

Section 2 explained the literature review, and Section 3 includes the model

construction, explaining the development of the main constructs and detailing

how data were collected and synthesized. Section 4 analyses the empirical

results and conducts a robust check and Section 5 summarizes the conclusions,

main contributions, limitations and provides practical implications for

policymakers.

2. Literature review

Romer's (1990) endogenous growth theory posits that

internal forces inside the economic system, as opposed to external pressures,

are responsible for sustained economic growth. This theory challenges the

neoclassical perspective by proposing that economic considerations influence

the rate of technological innovation and, consequently, the rate of long-term

economic growth. This theory begins with the observation that technological

growth results from innovation, which primarily manifests as new products,

processes, and markets as a result of economic activity. According to the

endogenous growth theory, economic incentives to attract or retain corporate

operations positively influence long-term growth. One of the first things that

come to mind when focusing on this concept is that it requires investments in

knowledge, human capital, research, and development (R&D), innovation, and

direct investments in physical assets and basic labor. Therefore, increasing

investment would increase production capacity and stimulate economic expansion.

Investing in skills and education, for example, will increase labor

productivity. Additionally, increasing new technology and capital will boost

the economy's productivity and production capacity.

ESG Ratings and Indexes

According to Avramov et al. (2022), Brandon et al. (2021), Landi et al. (2022) and Shaikh (2022), investors face uncertainty when making

sustainable investments due to the difficulty in accurately assessing a firm's

actual ESG profile. Avramov et al. (2022) conducted a study using ESG rating data from six

different sources, namely Asset4 (Refinitiv), MSCI KLD, MSCI IVA, Bloomberg,

Sustainalytics, and RobecoSAM, all of which are market leaders in ESG ratings

and widely used by practitioners and researchers. The study found that rating

ambiguity leads investors to perceive the market as riskier, which drives up

market premiums and reduces investor demand. Next, Brandon et al. (2021) analyzed the same

database and determined that screening and ESG integration are the two most

widely used approaches in responsible investing. However, ESG data tends to be

limited to larger companies and more recent years. In another study, Landi et al. (2022) utilized double risk

measurement and panel data analysis to examine the influence of firm social

performance on corporate financial risk, as measured by an ESG evaluation.

Increasing investor uncertainty regarding corporate sustainability performance

is likely due to conflicting objectives between investors and investees.

Furthermore, Shaikh's (2021) study investigates

the relationship between the ESG-based sustainability index and economic policy

uncertainty (EPU) utilizing multiple indices, including the EPU index, equity

market policy uncertainty index, and economic and political developments. The

research demonstrates a significant negative correlation between the Dow Jones

Sustainability Index (DJSI) and policy unpredictability. In addition, the

results indicate that socially responsible investment (SRI) is more resilient

than conventional equity investing because it is not affected by political and

economic volatility. The empirical evidence supports the conclusion that SRI

investing is not susceptible to political and economic environmental

fluctuations. Next, Escrig-Olmedo et al. (2019) investigated the evolution of criteria used by ESG rating agencies in

the past decade. The study analyzed data from leading ESG rating and

information providers in the financial sector between 2008 and 2018, comparing

the changes in their assessment models. Despite updates to include new criteria

to reflect emerging opportunities and threats, the research found that ESG

rating agencies still need to fully integrate sustainability principles into

their evaluation process of corporations' sustainability.

ESG and Country Economic Growth

To the best of our knowledge only a few research that measure the development of ESG at the country level. The literature regarding ESG, and country economic growth implies that countries with good ESG performance should have higher long-term economic growth, while the short-term effect is less clear. A study by Kocmanová and Dočekalová (2012) examined the method for assessing a company's economic performance in the Czech Republic concerning ESG indicators. It advocated that economic performance indicators enable businesses to assess their economic performance and contribute value toward sustainability. This means that companies should be able to monitor their economic performance and add value to achieve long-term sustainability using the specified economic performance indicators. Ferktaji (2019) utilized the Granger causality test to investigate the link between ESG performance and economic growth in 118 countries from 1999 to 2015. The research showed that the relationship between environmental and social performance and economic growth is bidirectional, while the link between governance and growth is unidirectional for all nations. However, the findings for different socioeconomic categories of countries are inconclusive, in contrast to the clear overall pattern observed in the entire sample.

Furthermore, Yawika and Handayani

(2019), in their studies within Indonesia, found

that the effectiveness of corporate governance has a beneficial impact on financial reporting

but a negative impact on the stock market. Using multiple regression analysis to study the

relationship between ESG performance and economic performance, neither

corporations nor investors

take environmental and social performance into account. Regarding

stakeholder management, there need to be

more information and sustainability measures

that are irrelevant. Also, on the negative

impact, a previous study discovered uncertainty regarding ESG practices and claimed that ESG

performance might inhibit growth

(Meher et al., 2020). According to the study, ESG

goals and regulations necessitate a high consumption and production process, which will limit economic growth.

As goods and services

already require energy

to be produced, reducing

energy consumption, or switching to more expensive kinds of energy will inevitably diminish

the economic output.

Within the ASEAN-5 context, a lesser focus is placed

on economic growth. A study done by (Tarmuji et al., 2016) compared ESG with economic growth in two countries which

are Singapore and Malaysia, by using panel data analysis and data extracted

from ASSET4® database of Data- Stream, by Thomson Reuters Incorporation. Using

economic growth as the dependent variable and ESG practices as the independent

variables, the researchers discovered that social and governance practices

significantly impacted economic growth. Compared to the United States and

Europe, Malaysian and Singaporean companies' ESG indices are still in their

early stages of development.

The Impact of the Pandemic Crisis on

Economic Growth

The empirical research on the influence of the

pandemic crisis on economic growth has been growing in recent years as

researchers seek to understand the extraordinary shocks that the pandemic has

created, taking into account the cross-country spillovers of the virus. Also,

from both the national and international levels, some research papers on the

impact of the pandemic crisis on macroeconomics have been published. A study by Goel et al. (2021) examines the global supply chain logistics performance and the

subsequent effects of pandemic crises on economic growth using OLS estimation

for 136 countries from 2007 to 2017. The authors claimed that amid the present

pandemic crisis, when supply networks are affected or undermined in various

ways, countries are likely to face a heightened level of difficulty. In a

worldwide economy, the bottlenecks in the supply chain may have downstream

impacts that ripple across borders. These results also argue against blanket

growth-promoting measures applied to countries with varying growth rates. Furthermore,

Inegbedion (2021) indicated that the lockdown imposed by the pandemic crisis

had had a severe impact on the country's economic operations and circular flow

of money.

According to Coccia (2021), Ikram (2021), and Apergis

(2021), the pandemic crisis had a detrimental influence on the GDP in recent

studies. As a result of these studies, it has been found that nations with more

significant healthcare investments (as a percentage of GDP) have reduced the

fatality rate of the pandemic while also applying a shorter lockdown period,

which has lessened the negative consequences on economic growth. Coccia (2021)

indicates that exports of goods and services, logistics performance, ISO 9001

and ISO14001 certifications, notably in six heavily affected nations (India,

Iran, Philippines, Bangladesh, and Pakistan) during an outbreak of a pandemic

virus are all negatively affected by the pandemic crisis.

The Role of the Pandemic Crisis on

the Effect of ESG on Economic Growth

Many past studies have

investigated the influence of the pandemic crisis on ESG scores and

performance. Financial markets were exceedingly turbulent during the first

quarter of 2020 as the pandemic crisis spread over the world. During the

pandemic crisis timeframe, it is critical that researchers look at the role

that ESG ratings play in explaining economic growth. Díaz (2021) examined the influence

of ESG in US markets by examining the three Fama-French factors that

characterize stock returns (market return; size factor, which measures small

enterprises' outperformance relative to large organizations; and value factor).

This study found that ESG factors explain a sizable portion of industry

returns. The E and S aspects are the primary determinants of the ESG impact

across industries. It was noted that a similar technique used by the study of

Broadstock et al. (2021) to evaluate the relationship between ESG issues and

financial performance in China claimed that during the pandemic crisis, ESG

performance was favorably correlated with the short-term cumulative returns of

CSI300 equities.

Next, Engelhardt et al. (2021) investigated whether companies with higher ESG ratings outperformed

those with lower ratings during the pandemic crisis. Their study used a sample

of 1,452 companies from 16 European countries and analyzed whether firms with

high CSR ratings based on Refinitiv's ESG ratings from Thomson Reuters Eikon

outperformed those with deficient CSR ratings. The authors divided the dataset

based on the median scores of the country characteristics and performed baseline

regression models on the subsamples to investigate the relationship between the

components. The study suggests that participation in ESG initiatives in

countries with low levels of trust could decrease market uncertainty during the

pandemic crisis. Other than that, a study by Palma-Ruiz et al. (2020) researched the potential

profitability of business strategies during global catastrophes such as

pandemics. Based on a survey administered to 575 residents of Spain, this study

was able to conclude that the current economic crisis will cause consumers to

reevaluate their support for businesses that have been socially irresponsible

or unsupportive. Furthermore, people's perceptions of businesses will change

after normalcy has been restored during the pandemic.

In conclusion, existing studies have discussed the

information used to determine an ESG rating and indexes, which varies from one

rating to another, and the disagreement about the current ESG ratings and

indexes used in measuring the performance of ESG. However, these studies did

not focus on the impact of ESG practices on the economic aspect. Besides that,

a limited number of studies analyze the ESG performance and economic growth of

the ASEAN-5 economy because most studies only investigate the influence of

environmental, social, and governance factors on economic development. Our

study differs by focusing on the impact of ESG on economic growth. This study

fills the gap in the literature by analyzing the possible impact of ESG

practices and policies on economic growth in the ASEAN-5 countries, which is an

area where there may be a need for more research.

3. Data

This

study utilizes yearly data from 1990 to 2020 for all variables. In this study,

we measure each country's economic growth using GDP per capita, where the data

was obtained mainly from World Bank Open Data. Next, to study the impact of ESG

on ASEAN-5 countries, ESG data was obtained using ESG index score, where the

score was created using a data mining technique. Data on the pandemic was

obtained from the World Pandemic Uncertainty Index.

4. Methodology

4.1. Constructing the country's ESG index

This study aims to investigate the impact of ESG on economic

growth in ASEAN-5 countries. To achieve the objective, an ESG index is

constructed. Following Borms et al. (2021), the index was created

by utilizing data mining techniques and technology, particularly word frequency

statistics from text mining, which show that attention would be brought to ESG

if a news article about it were to be published. To the best of our knowledge,

there is no universal definition of ESG. Therefore, this study uses seed terms

from Borms et al. (2021) to define the

environmental, social, and governance elements. Using the Google search engine,

the initial search comprised ESG keywords and the names of the ASEAN-5

countries to focus on the implementation of ESG. By doing so, the original

keywords for these three categories (namely environmental, social, and

governance) will be established, and we will be able to effectively categorize

the ESG types and cover all of the key terms associated with ESG in the ASEAN-5

nations. The final keywords used to represent the Environmental are mobility,

biodiversity, and ecology. Meanwhile, for Social are, human rights,

discrimination, donation, governance, bribery, corruption, and animal testing.

Table 1

|

Table 1 List

of Category and Keywords |

||

|

Environmental |

Social |

Governance |

|

Environment, energy, mobility, nuclear, climate, biodiversity, carbon,

pollution, waste, ecology, sustainability, emission, renewable, oil, oil leak |

Society, health, human rights, social, discrimination, inclusion,

donation, strike, slavery, stakeholder, employee, employer, mass fire, labor,

trade union, depression, diversity |

Court, budget, justice, governance, management, bribery, corruption,

ethics, audit, patent infringement, gender neutral, money laundering, animal

testing, lobbyism, top wage |

|

Source Adapted from Borms et al. (2021) |

||

Based on the discussion in the literature reviews

section, the suggested expected signs of economic growth, ESG and other macroeconomic

drivers are shown in Table 2.

Table 2

|

Table 2 Description of the Data |

||||

|

Variable |

Abbreviation |

Measurement Unit |

Expected Sign |

Source |

|

Economic growth |

GDP |

GDP per capita

(percentage, %) |

|

World

Development Indicators |

|

Environmental,

social, governance |

ESG |

ESG index

score |

+ |

Author’s

calculation |

|

Fixed

capital formation |

FCF |

At

the constant price (the base year 2010) in log form. |

+ |

World Development Indicators |

|

Labor force |

LF |

Total |

+ |

World

Development Indicators |

|

Population growth |

PGR |

Population growth (annual %) |

+/- |

World

Development Indicators |

|

Trade openness |

OP |

[(Export

plus import)/GDP] |

+ |

World

Development Indicators |

|

Pandemic uncertainty index |

WPUI |

% of “uncertain” |

− |

World

Pandemic Uncertainty Index |

|

Source World Bank Open Data and World Pandemic

Uncertainty Index |

||||

Table 3 shows the results of

the sampling adequacy of the ESG index. The Kaiser-Meyer-Olkin (KMO) test,

Bartlett test, and Cronbach Alpha results denote greater adequacy of the factor

analysis, confirming that the variables are correlated and that the items used in

constructing the ESG Index have relatively high internal consistency. Thus, it

is concluded that these keywords are appropriate for factor analysis. The

procedure continues with extracting common factors where the eigenvalue value

is more significant than one, implying that the extracted factors can reflect

the information in the keywords. Finally, the first component was used to

derive a score for ESG. The scores obtained are normalized to 0 and 100, where

the higher value indicates more activity on ESG or a high level of ESG. The ESG

Index has been constructed for each country to determine their ESG levels over

time.

Table 3

|

Table

3

Results of Sampling Adequacy of the ESG Index |

|||

|

Variable |

Kaiser-Meyer-Olkin |

Bartlett

Test (chi-square) *** |

Cronbach

Alpha |

|

Environmental |

0.773 |

868.885 |

0.8766 |

|

Social |

0.786 |

968.898 |

0.9655 |

|

Governance |

0.793 |

903.776 |

0.8039 |

|

Overall ESG |

0.795 |

1026.243 |

0.9886 |

4.2. Estimation model

This study

adapts the standard growth model in the literature to investigate the relationship between ESG, pandemic crisis,

and economic growth, and is expressed as in Equation 1:

![]() (1)

(1)

Where ESG

includes the overall score of ESG and its component score, 𝑋t is the control variable of the growth model at time t, which include

fixed capital formation, labor force, government expenditure, domestic credit,

trade, and population growth, while 𝑌𝑡

is country GDP, and ɛ is the error term.

To

capture capital investment by a corporation that results in an increase in

productivity, which could result in long-term growth if strong economies are

formed through investment, gross fixed capital formation is included, which is

a major component of domestic investment and is viewed as an important process

that could accelerate economic growth. The estimation model is presented in Equation

2.

𝑌𝑡

= 𝛽0 + 𝛽1𝐸𝑆𝐺𝑡

+ 𝛽2𝑋1 + 𝛽3𝑋2

+ 𝜀𝑡 (2)

𝑌𝑡

= 𝛽0 + 𝛽1𝐸𝑆𝐺𝑡

+ 𝛽2𝑋1 *𝐸𝑆𝐺𝑡

+ 𝛽3WPUI𝑡 + 𝛽4𝑋2

+ 𝜀𝑡 (3)

𝑌𝑡

= 𝛽0 + 𝛽1𝐸𝑆𝐺𝑡

+ 𝛽2𝑋1 + 𝛽3WPUI

∗ 𝐸𝑆𝐺𝑡 + 𝛽4𝑋2

+ 𝜀𝑡 (4)

Where

ESG includes the overall score of ESG and its component score, 𝑋1 is

fixed capital formation, 𝑋2 is the control variable of the growth

model, WPUI is pandemic uncertainty index, while 𝑌𝑡 is country

GDP, and ɛ is the error term (see Widarni & Bawono, 2021; Busu, 2020; Opeoluwa

& Akingba, 2017).

4.3. Method

To achieve the

objective of the study, a preliminary unit root test is conducted to determine

whether trending data should be regressed on a deterministic function of time

and to verify that none of the study's variables are I(2). Non-stationary time

series are known to exhibit long-run equilibrium relationships, and if the

variables are I(1), cointegration techniques can be employed to represent these

relationships Nkoro and Uko (2016). The

Phillips-Perron (PP) test is used as the unit root test in this study, which is

a modified version of the widely used Dickey-Fuller (DF) test. The PP test is

similar to the DF test, but it allows for a more general class of errors and

accounts for the possibility of serial correlation. The PP test is particularly

useful when the time series under study has a drift or trend. This is because

the PP test allows for a deterministic trend in the model, which makes it more

flexible than the DF test. The PP test also automatically selects the optimal

lag length, which reduces the potential for bias in the estimation Phillips and Perron (1988).

In exploring the long

run relationship among dependent variable (GDP) and independent variables (ESG,

pandemic, fixed capital formation, labor force, population growth, and trade

openness), ARDL cointegration is used in this study. Following Pesaran et al. (2001), ARDL can assess the long-term

cointegration connection between variables and to construct an error correction

model (ECM) model from the ARDL model without surrendering any long-term

information. This model is based on the optimization approach of ordinary least

squares and is a mixed-order integration model. This method can be applied to

stationary or nonstationary time series, depending on the situation. This model

is employed because the ARDL approach technique allows for the examination of

the effects of the dependent and independent variables through time and the effects

of the past. ARDL approach technique is a key advantage of this approach to be

able to identify cointegrating vectors in the presence of numerous

cointegrating vectors, which is particularly useful when there are several

cointegrating vectors present Menegaki (2019); Nkoro and Uko (2016).

5. Empirical results and discussions

The

descriptive statistics for the ESG country index score of ASEAN-5 countries are

shown in Table 3. From 1990 to 2020, the mean ESG

score for the ASEAN-5 countries is still low, with the highest score being

0.64. The mean environmental score for the ASEAN-5 countries between 1990 and

2020 was 0.311, which indicates that companies in the region performed poorly

on environmental metrics. Similarly, the mean social score for the ASEAN-5

countries was 0.512, indicating that regional companies also performed poorly

on social metrics. The standard error for the social score was 0.117, which is

relatively high and further emphasizes the uncertainty of the mean estimate. The

mean governance score for the ASEAN-5 countries was 1.213, indicating better

performance than the environmental and social scores. However, the score is

still relatively low, considering the maximum score for governance was only

2.15.

Based on Table 4, the standard deviation values

range from 0.395 to 0.970, with the highest standard deviation value belonging

to the overall ESG score. This suggests a wide range of overall ESG performance

scores among the companies in this dataset, with some companies achieving

significantly higher scores than others while some were lagging. However, when

looking at the year 2001 until 2020, the mean ESG score for ASEAN-5 countries

was 16.059 for environmental, 16.541 for social, 16.140 for governance, and

18.407 for overall ESG. These scores indicate that ASEAN-5 countries have made

significant progress in incorporating ESG criteria into their business

practices, with an overall ESG score higher than the individual scores for

environmental, social, and governance. This shows that companies in ASEAN-5

countries are taking a holistic approach to ESG and are paying attention to all

three areas.

Table 4

|

Table 4 Results of Descriptive Statistics for the ESG Index Score of ASEAN-5 Countries from 1990 to 2020. |

||||||||

|

1990-2000 |

2001-2020 |

|||||||

|

Environmental |

Social |

Governance |

Overall ESG |

Environmental |

Social |

Governance |

Overall ESG |

|

|

Mean |

0.311 |

0.512 |

1.213 |

0.640 |

16.059 |

16..541 |

16.140 |

18..407 |

|

Std. Dev |

0.395 |

0.870 |

0.633 |

0.970 |

24.751 |

24.132 |

27.410 |

26.316 |

|

Minimum |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Maximum |

1.530 |

3.719 |

2.150 |

4.023 |

100 |

I00 |

100 |

100 |

|

1990-2020 |

||||||||

|

Environmental |

Social |

Governance |

Overall SG |

|||||

|

Mean |

10.471 |

10.853 |

10.843 |

12.103 |

||||

|

Std. Dev |

21.237 |

20.829 |

23.119 |

22.765 |

||||

|

Minimum |

0 |

0 |

0 |

0 |

||||

|

Maximum |

I00 |

I0O |

100 |

I00 |

||||

Overall,

the result shows that ESG scores for ASEAN-5 countries have progressed over the

past two decades. This is evidenced by the mean ESG score of 18.407, higher

than the individual scores for environmental, social, and governance. It is

also supported by the minimum score for all four criteria is 0, indicating that

companies are gradually adopting sustainable and ethical practices. The ESG

scores for ASEAN-5 countries from 2001 to 2020 indicate that there has been

progress in incorporating ESG criteria into business practices. It is important

to encourage companies who have not been involved with ESG practices to adopt

sustainable and ethical practices. For example, offering tax incentives or

grants for ESG initiatives could be a powerful way to motivate companies to

invest in sustainability. Besides that, the scores also show that the

government must continue supporting companies implementing ESG practices by

providing additional incentives such as public recognition or preferential

treatment in government contracts.

Table 5

|

Table

5 Summary of Unit Root Test Results |

|||||

|

Variable |

Malaysia |

Indonesia |

Thailand |

Philippines |

Singapore |

|

ln (GDP per capita) |

I(1) |

I(1) |

I(1) |

I(1) |

I(1) |

|

ln (Labor) |

I(1) |

I(1) |

I(0) |

I(1) |

I(1) |

|

ln (Gross capital formation) |

I(1) |

I(1) |

I(1) |

I(1) |

I(1) |

|

ln (Trade openness) |

I(1) |

I(1) |

I(1) |

I(1) |

I(1) |

|

Population growth |

I(0) |

I(0) |

I(0) |

I(0) |

I(0) |

|

ESG |

I(1) |

I(1) |

I(0) |

I(1) |

I(1) |

|

Environmental |

I(1) |

I(1) |

I(0) |

I(1) |

I(1) |

|

Social |

I(1) |

I(1) |

I(0) |

I(1) |

I(1) |

|

Governance |

I(1) |

I(1) |

I(0) |

I(1) |

I(1) |

|

WPUI |

I(0) |

I(0) |

I(0) |

I(0) |

I(0) |

|

Notes: Detail

on the results are available upon request. |

|||||

Table 5 shows that the

variables are either stationary in terms of levels or stationery in terms of

first differences based on the test results. Based on the result, none of the

variables have an integration order of two. In the table above, the results of

applying the one break PP unit root test with break test to each series over

the sample period for each country are displayed. Where there are series that

are integrated at level, implying I(0) variables, and at first difference,

there are contradictory outcomes. However, I(2) variables are not found in the

sample across countries.

Table 6 reports the results

of ARDL bound test. The value of F-statistics 7.112, 12.243, 10.791, 13.115,

and 7.310 for estimated model for Malaysia, Indonesia, Thailand, Philippines,

and Singapore respectively is greater than upper bound value at 5 percent

significance level. This indicates that the null hypothesis of no cointegration

among the variables of the study can be rejected, implies that there is

evidence of long-run ARDL cointegration model for Malaysia, Indonesia,

Thailand, Philippines, and Singapore.

Table 6

|

Table

6 Cointegration Bound Test

Analysis |

|||||

|

|

F-statistics |

||||

|

Critical value |

Malaysia |

Indonesia |

Thailand |

Philippines |

Singapore |

|

(Narayan, 2005) |

7.112** |

12.243** |

10.791* |

13.115*** |

7.310** |

|

I(0): 90% -1.5213, 95%- 1.876 |

|

|

|

|

|

|

I(1): 90% -3.757, 95%- 4.437 |

|

|

|

|

|

|

Notes: *,

** and *** represents significance at 10%, 5%, and 1% significance levels.

All models do not include intercept and trend in the estimation except for

Singapore with constant. |

|||||

The results on the estimated long-run ARDL cointegration model are shown in Table 5. By applying the Schwarz criterion (SC), the ESG coefficient is positive and statistically significant for Malaysia and the Philippines' economic growth at the 5% level. In contrast, the ESG is found to be statistically significant at 10% for Singapore. This positive relationship between ESG and the country's economic growth indicates that positioning the country towards achieving ESG would benefit the country's long-term growth. Directing the country's efforts toward the achievement of ESG would be beneficial to Malaysia's growth in the long run. Intuitively, a high-quality environment would safeguard natural resources such as increased biodiversity and habitat conservation and reductions in greenhouse gases (GHG), which are fundamental to a land protection and preservation plan. In addition, it reduces the expenses associated with externalities and has a favourable influence on the health of human capital, resulting in greater productivity and efficiency. This is consistent with the findings of Ayuso et al. (2020), who found that integrating social values improves economic, financial, and social values.

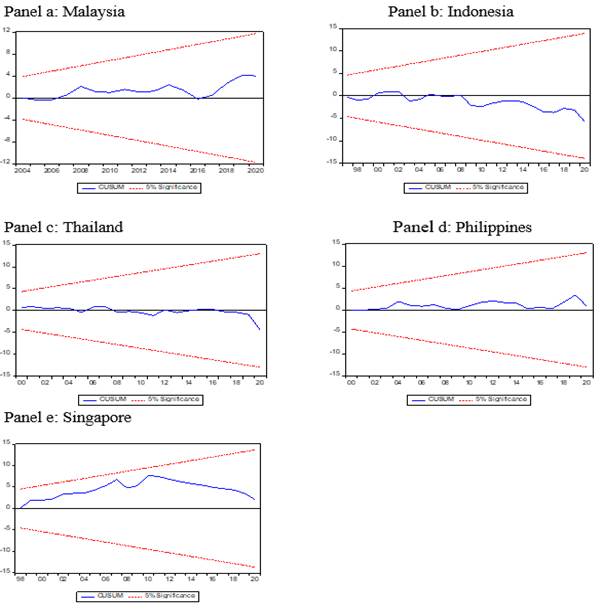

The Error Correction Terms are all negative and

significant, showing that convergence to the long run is feasible in the

models. In addition, from the

results of the Breusch-Godfrey serial correlation F- test and the Breusch-Pagan-

Godfrey heteroscedasticity F-test, we fail to reject the null-hypotheses of no

serial correlation and no heteroscedasticity of the residuals. Therefore, the results from

the model are void of spurious regression. To check the stability of the

estimated parameters, this paper also performs a Cumulative Sum of Recursive

Residual (CUSUM) test, as depicted in Figure 1. The line in the CUSUM plot in Figure 1 does

not exceed the 5% significance level, indicating that there is no evidence of a

structural change in the time series data. In other words, the estimated

coefficients are consistent over time, and the model is stable.

Table 7

|

Table 7 Results of Long-Run

Coefficient of Baseline Model |

|||||

|

ln (GDP per

capita) |

Malaysia |

Indonesia |

Thailand |

Philippines |

Singapore |

|

ln (Labor) |

2.1684** (0.9030) |

0.5576*** (0.1116) |

0.4705* (0.1593) |

0.4625*** (0.0225) |

0.7759** (0.2154) |

|

ln (Gross capital formation) |

0.6833** (0.2389) |

0.4526* (0.2346) |

0.2241 (0.1757) |

0.2922*** (0.0774) |

-0.2346 (0.2540) |

|

ln (Trade openness) |

2.7066*** (0.6223) |

-0.7335* (0.4143) |

0.0022 (0.4676) |

-0.2006* (0.0567) |

0.0586 (0.4909) |

|

Population growth |

-8.9949*** (1.8619) |

-0.7342 (0.2266) |

-0.5037* (0.1632) |

-0.2402 (0.1007) |

-0.0842 (0.0951) |

|

ESG |

0.0177** (0.0047) |

-0.0033 (0.0026) |

0.6113 (0.4464) |

0.0594** (0.0189) |

0.0424* (0.0033) |

|

Error

correction term |

-0.5494*** |

-0.2872*** |

-0.1700*** |

-0.3359*** |

-0.1757*** |

|

Serial correlation |

3.3573 |

7.5176 |

0.9998 |

1.2241 |

2.4744 |

|

Heteroscedasticity |

0.8673 |

0.1211 |

0.0027 |

0.7494 |

0.8446 |

|

Adjusted-R2 |

0.3938 |

0.9022 |

0.1559 |

0.3278 |

0.6624 |

|

Notes: *, **, and *** denote

significant at 10, 5, and 1 per cent significance levels. Numbers in brackets

represent the robust standard error. |

|||||

Figure 1

|

Figure 1 CUSUM Stability Test |

This study also includes an important element of

the pandemic since there has been economic turmoil resulted from it. Table 8 determines the

impact of pandemic uncertainty on the country's economic growth. The

F-statistics of the estimated models for Malaysia, Indonesia, Thailand,

Philippines, and Singapore are greater than the upper bound value at a

significance level of 5%, indicating the existence of a long-term ARDL

cointegration model.

Table 8

|

Table

8 Cointegration Bound Test Analysis |

|||||

|

|

F-statistics |

||||

|

Critical value |

Malaysia |

Indonesia |

Thailand |

Philippines |

Singapore |

|

(Narayan, 2005) |

8.536* |

8.513** |

9.767* |

17.899** |

8.965* |

|

I(0): 90% -1.748, 95%- 2.111 |

|

|

|

|

|

|

I(1): 90% -3.664, 95%- 4.317 |

|

|

|

|

|

|

Notes: * and ** denote significant at 10 and 5 percent

significance levels. All models do not include intercept and trend in the

estimation except for Singapore with constant. |

|||||

Table 9 reports the impact

of pandemic uncertainty on the economic growth in ASEAN-5. According to the

results, the pandemic has had a negative and significant impact on the economic

growth of Singapore and Thailand. This means that the pandemic has caused a

decrease in the economic growth of these two countries. On the other hand, the

impact of pandemic uncertainty on the economic growth of Malaysia, Indonesia,

and the Philippines was found to be insignificant. This suggests that the

pandemic did not significantly affect these countries' economic growth or that favorable

global commodity prices, or strong domestic demand may have mitigated the

negative impact of the pandemic on their economies. The diagnostics test

indicates no evidence of higher-order autocorrelation and heteroscedasticity in

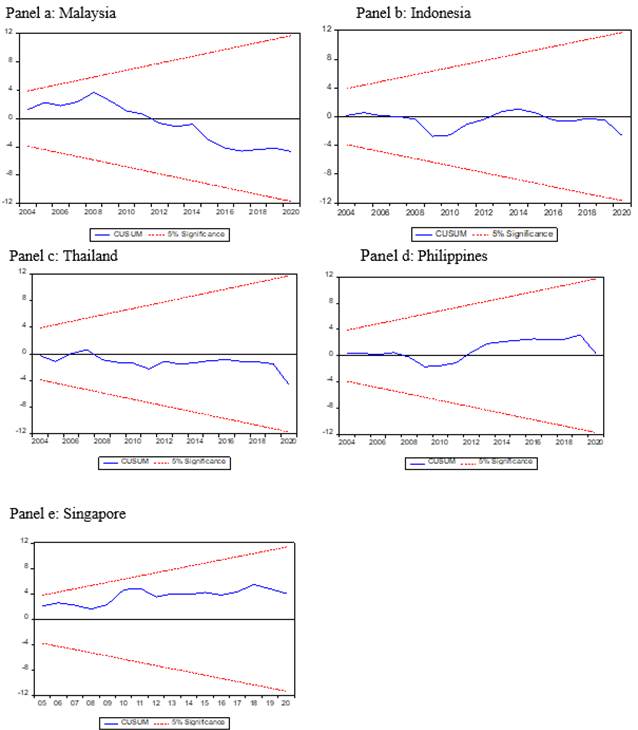

the model. The CUSUM test shown in Figure 2 indicates that the

models are structurally stable.

Table 9

|

Table

9 Results of Long-Run Coefficient: The Role of Pandemic Uncertainty on

Country Economic Growth. |

|||||

|

ln (GDP per

capita) |

Malaysia |

Indonesia |

Thailand |

Philippines |

Singapore |

|

ln (Labor) |

2.8804** (1.3533) |

1.1479 (0.3268) |

0.4580** (0.1296) |

0.4628*** (0.0371) |

0.7660*** (0.0911) |

|

ln (Gross capital formation) |

1.3310*** (0.2466) |

0.1884 (0.1971) |

0.2000 (0.1594) |

0.2964* (0.1143) |

-0.2541 (0.1188) |

|

ln (Trade openness) |

1.3873** (0.3324) |

-0.4281 (0.1753) |

0.0646 (0.3681) |

-0.0191 (0.0923) |

0.0653 (0.2057) |

|

Population growth |

-1.3474** (0.3332) |

-0.0262 (0.3609) |

-0.5263** (0.1463) |

-0.5545*** (0.0565) |

-0.1069* (0.0491) |

|

WPUI |

-0.0294 (0.0369) |

-0.0155 (0.0053) |

-0.0034* (0.0018) |

-0.0236 (0.0172) |

-0.0495* (0.0108) |

|

Error

correction term |

-0.1749*** |

-0.4179*** |

-0.1915*** |

-0.2676*** |

-0.3158*** |

|

Serial

correlation |

0.6480 |

0.7589 |

1.4771 |

1.4396 |

0.9323 |

|

Heteroscedasticity |

0.8161 |

0.0928 |

0.0860 |

0.6188 |

0.2156 |

|

Adjusted-R2 |

0.8287 |

0.8226 |

0.1538 |

0.7745 |

0.6141 |

|

Notes: *, **, and *** denote

significant at 10, 5, and 1 percent significance levels. Numbers in brackets

represent the robust standard error. |

|||||

Figure 2

|

Figure 2 CUSUM Stability Test |

The results of the ARDL bounds tests for the model

that includes the interaction term between the pandemic crisis and ESG in the

estimated growth model are presented in Table 8. The F-statistic

exceeds the upper bound critical values at the 5% and 10% significance levels

for Indonesia, Thailand, Philippines, Singapore, and Malaysia, respectively.

This further clarifies the long-term relationship between the interaction

variable of ESG and pandemic crisis, other explanatory variables, and economic

growth.

Table 10

|

Table

10 Cointegration Bound Test

Analysis |

|||||

|

|

F-statistics |

||||

|

Critical value |

Malaysia |

Indonesia |

Thailand |

Philippines |

Singapore |

|

(Narayan, 2005) |

8.536* |

13.721** |

8.985* |

14.676** |

8.247* |

|

I(0): 90% -1.740, 95%- 2.114 |

|

|

|

|

|

|

I(1): 90% -3.685, 95%- 4.379 |

|

|

|

|

|

|

Notes: *

and ** denote significant at 10 and 5 percent significance levels. All models

do not include intercept and trend in the estimation except for Singapore

with constant. |

|||||

Table 10 provides an in-depth result to

capture the complement effect that possible play by the pandemic uncertainty on

the effect of ESG on economic growth. It is shown that the implementation of

ESG during pandemic uncertainty has a negative and insignificant impact on

economic growth for Indonesia, the Philippines, Singapore, and Thailand. This

means that during times of pandemic uncertainty, the implementation of ESG

activities only significantly impacts economic growth in these countries. To meet ESG goals and regulations, consumption and output must be high,

which will slow economic growth, especially during a pandemic. These findings are

similar to the previous studies, which indicate that the costs associated with

participating in ESG activities during the COVID-19 epidemic outweighed any

potential benefits Aydoğmuş et al. (2022); Tampakoudis et al. (2021).

Table 11

|

Table 11 Results of Long-Run

Coefficient on the Role of Innovation in ESG-Growth |

|||||

|

GDP per capita |

Malaysia |

Indonesia |

Thailand |

Philippines |

Singapore |

|

ln (Labor) |

0.5409 (0.4553) |

0.6244*** (0.1348) |

0.4092* (0.1627) |

0.4623*** (0.0478) |

0.7640*** (0.0663) |

|

ln (Gross capital formation) |

-0.1310 (0.7993) |

0.1252 (0.3533) |

0.3301 (0.2029) |

0.3026 (0.2696) |

-0.2616* (0.0984) |

|

ln (Trade openness) |

0.3579 (1.3674) |

-0.8440 (0.4364) |

0.1545 (0.4761) |

-0.0171 (0.1359) |

0.0655 (0.1554) |

|

Population growth |

-0.5935 (0.6423) |

-0.5090 (0.3639) |

-0.4769* (0.1724) |

-0.5625* (0.2726) |

-0.0934* (0.0466) |

|

ESG |

0.0003 (0.0075) |

-0.0033 (0.0027) |

-0.0795 (0.5657) |

-0.0001 (0.0039) |

-0.0010 (0.0016) |

|

WPUI |

-0.0838 (0.0845) |

-0.0245 (0.0104) |

-0.0085* (0.0035) |

-0.0239 (0.0211) |

-0.0253* (0.0110) |

|

ESG*WPUI |

0.0064 (0.0054) |

-0.0004 (0.0021) |

-0.0004 (0.0034) |

-0.0273 (0.0427) |

-0.0057 (0.0068) |

|

Error

correction term |

-0.1749*** |

-0.1749*** |

-0.1697*** |

-0.2626*** |

-0.3692*** |

|

Serial

correlation |

0.6480 |

0.6480 |

0.9726 |

1.3768 |

0.9367 |

|

Heteroscedasticity |

0.8161 |

0.8161 |

0.0014 |

0.6145 |

0.0529 |

|

Adjusted-R2 |

0.8287 |

0.8287 |

1.3815 |

0.9719 |

0.9196 |

|

Notes: * and ** denote significance

at 5 and 10 percent significance levels. Numbers in brackets represent the

robust standard error. The critical values are provided by Pesaran et al. (2001), unrestricted intercept, and no

trend. All models include intercept in the estimation. |

|||||

The

results have shown that economic growth in Malaysia slowed when pandemics

struck, particularly during the coronavirus (COVID-19) crisis; however, we

discovered that implementing ESG activities indirectly helps solve

environmental and social problems by changing the way private funds are used.

This implies that although the direct impact of ESG on economic growth during

pandemics is not significant in Malaysia, other positive externalities are

associated with ESG activities that can contribute to society's overall

well-being. For example, companies that prioritize ESG practices may invest in

measures that lead to improved public health, such as reducing air pollution or

promoting sustainable agriculture practices, which can have long-term benefits

for the health and well-being of the population. In addition, the Breusch-Godfrey

and serial correlation F- test and the Breusch-Pagan-

Godfrey heteroscedasticity F-test could not reject the null of non-normality,

no serial correlation, and no heteroscedasticity problem, respectively implies

the estimation is efficient and unbiased.

In addition,

the graphs in Figure 3 reveal that none of the lines

surpass the 5% significance level, indicating that the null hypothesis of

stability is not rejected. The estimated equation is, therefore, stable over

time.

Figure 3

|

Figure 3 CUSUM Stability Test |

6. Conclusion

This study contributes to new knowledge regarding the

impact of ESG on economic growth in ASEAN-5 countries. First, the empirical

results have shown that ESG has mixed results on the impact on the economic

growth in ASEAN-5 countries influenced by the level

of government support for ESG practices or the level of awareness and

understanding of ESG practices among businesses and investors. Some results

showed a significant positive impact of ESG practices on economic growth, while

others showed no significant or negative impact. The mixed results can be

attributed to factors such as country practices, regulations, and ecosystems to

support ESG. Some ASEAN countries may have more advanced ESG frameworks and

policies, while others may still need to. As a result, the impact of ESG on

economic growth may vary depending on the country's level of implementation. This

is in line with the previous studies done by Madison and Schiehll (2021); Minkkinen et al. (2022).

Second, the results indicate that other variables

such as labor, capital formation, trade openness, and population may have a

greater impact on economic growth than ESG. For example, factors such as

technological progress, infrastructure development, and political stability may

have a more significant influence on economic growth in certain countries or

contexts. Therefore, the impact of ESG on economic growth needs to be evaluated

in conjunction with other economic factors to get a more comprehensive

understanding of the relationship between ESG and economic growth in the

ASEAN-5 region.

Third, the results show that the pandemic has had a

negative and significant impact on the economic growth of Singapore and

Thailand. On the other hand, surprisingly, the impact of pandemic uncertainty

on the economic growth of Malaysia, Indonesia, and the Philippines was found to

be insignificant. The possible explanation is that the fight against pandemics

slows production recovery in many industries and raises preventative expenses,

as well as the circular flow of money. Besides that, longer mobility

restrictions will result in economic scarring, making it more difficult for the

economy to recover. Lastly, the overall demand fell due to lower consumer

spending, mobility constraints, and weaker demand from outside countries.

Therefore, policymakers, institutional investors,

and regulators should play vital roles in assisting the Government in

supporting ESG practices among business companies by creating a sustainable

ecosystem. Over the past decade, the Government has adopted various

sustainability programs and incentives, such as tax incentives for companies

that prioritize ESG factors, introducing regulations requiring companies to

report on their ESG practices, and investing in research and development to

promote innovation in sustainable practices. A precautionary policy should be

made to support firms in shock. The proposed policies should include the

financial assistance to companies, such as low-interest loans, grants, and tax

relief. In addition, the policies should also focus on improving the resilience

of firms by promoting the adoption of ESG practices.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

This research was supported by Ministry of Higher Education (MoHE) of Malaysia through Fundamental Research Grant Scheme (FRGS/1/2020/SS0/UUM/02/25).

REFERENCES

ASEAN. (2020). ASEAN Comprehensive Recovery Framework. ASEAN : A Community of Opportunities for All, 7, 1, 37–72.

ASEAN. (2022). Investing in ASEAN 2021–2022.

Avetisyan, E., & Hockerts, K. (2017). The Consolidation of the Esg Rating Industry as an Enactment of Institutional Retrogression. Business Strategy and the Environment, 26(3), 316–330. https://doi.org/10.1002/bse.1919.

Avramov, D., Cheng, S., Lioui, A., & Tarelli, A. (2022).

Sustainable Investing with ESG Rating Uncertainty. Journal of Financial

Economics, 145(2), 642–664. https://doi.org/10.1016/j.jfineco.2021.09.009.

Aydoğmuş, M., Gülay, G., & Ergun, K. (2022).

Impact of ESG Performance on Firm Value and Profitability. Borsa Istanbul

Review, 22, S119–S127. https://doi.org/10.1016/j.bir.2022.11.006.

Ayuso, S., Sánchez, P., Retolaza, J. L., & Figueras-Maz, M. (2020). Social Value Analysis: The Case of Pompeu Fabra University. Sustainability Accounting, Management and Policy Journal, 11(1), 233–252. https://doi.org/10.1108/SAMPJ-11-2018-0307.

Bannier, C. E., Bofinger, Y., & Rock, B. (2019). Doing Safe by Doing Good: ESG Investing and Corporate Social Responsibility in the U.S. and Europe. CFS Working Paper Series, 621.

Billio, M., Costola, M., Hristova, I., Latino, C.,

& Pelizzon, L. (2021). Inside the ESG Ratings: (Dis) Agreement and

Performance. Corporate Social Responsibility and Environmental Management,

28(5), 1426–1445. https://doi.org/10.1002/csr.2177.

Boffo, R., & Patalano, B. (2020). ESG Investing : Practices, Progress and Challenges, OECD.

Borms, S., Boudt, K., Van Holle, F.,

& J. (2021). Semi-Supervised Text Mining for

Monitoring the News About the ESG Performance of Companies. In Data Science for

Economics and Finance. https://doi.org/10.1007/978-3-030-66891-4.

Brandon, R. G., Schmidt, P. S., & Brandon, R. G. (2021). ESG Rating Disagreement and Stock Returns, June.

De

Lucia, C., Pazienza, P., & Bartlett, M. (2020). Does Good ESG Lead

to Better Financial Performances by Firms? Machine learning and Logistic

Regression Models of Public Enterprises in Europe. Sustainability, 12(13),

1–26. https://doi.org/10.3390/su12135317.

Eccles, N. S., & Viviers, S. (2011). The Origins and Meanings of Names Describing Investment Practices that Integrate a Consideration of ESG Issues in the Academic Literature. Journal of Business Ethics, 104(3), 389–402. https://doi.org/10.1007/s10551-011-0917-7.

Engelhardt,

N., Ekkenga, J., & Posch, P. (2021). Esg Ratings and Stock

Performance During the Covid-19 Crisis. Sustainability, 13(13), 1–15.

https://doi.org/10.3390/su13137133.

Escrig-Olmedo,

E., Fernández-Izquierdo, M., Ferrero-Ferrero, I., Rivera-Lirio, J., &

Muñoz-Torres, M. (2019). Rating the Raters: Evaluating How ESG Rating

Agencies Integrate Sustainability Principles. Sustainability, 11(3).

https://doi.org/10.3390/su11030915.

Ferktaji, E. L. (2019). Munich Personal RePEc Archive the Dynamic Causality Between ESG and Economic Growth : Evidence from Panel Causality Analysis Ho, Sy-Hoa and OUEGHLISSI, Rim and el FERKTAJI, 95390.

Goel, R. K., Saunoris, J. W., & Goel, S. S. (2021). Supply Chain

Performance and Economic Growth: The Impact of COVID-19 Disruptions. Journal of

Policy Modeling, 43(2), 298–316. https://doi.org/10.1016/j.jpolmod.2021.01.003.

GSIA. (2016). Global Sustainable Investment Review. 2016. Indonesia. (2022). ID, March.

Landi,

G. C., Iandolo, F., Renzi, A., & Rey, A. (2022). Embedding Sustainability

in Risk Management: The Impact of Environmental, Social, and Governance Ratings

on Corporate Financial Risk. Corporate Social Responsibility and Environmental

Management, January(4), 1096–1107. https://doi.org/10.1002/csr.2256.

Luo, D. (2022). ESG, Liquidity, and Stock Returns. Journal of

International Financial Markets, Institutions and Money, 78, 101526. https://doi.org/10.1016/j.intfin.2022.101526.

Madison,

N., & Schiehll, E. (2021). ESG Ratings and Scores with a High

Financial Materiality Index May Provide Investment Opportunities as They Allow

Identification of Firms with a High Score on Business-Critical ESG Issues.

Sustainability (Switzerland), 13(7). https://doi.org/10.3390/su13073652.

Mahi,

M., Phoong, S. W., Ismail, I., & Isa, C. R. (2020). Energy-Finance-Growth

Nexus in ASEAN-5 Countries: An ARDL Bounds Test Approach. Sustainability,

12(1), 1–16. https://doi.org/10.3390/SU12010005.

Margaretic, P., & Pouget, S. (2018). Sovereign Bond

Spreads and Extra-Financial Performance: An Empirical Analysis of Emerging

Markets. International Review of Economics and Finance, 58(April), 340–355. https://doi.org/10.1016/j.iref.2018.04.005.

Menegaki, A. N. (2019). The ARDL Method in

the Energy-Growth Nexus Field ; Best Implementation Strategies. Economies,

7(4), 1–16. https://doi.org/10.3390/economies7040105.

Minkkinen, M., Niukkanen, A., & Mäntymäki, M. (2022).

What About Investors? ESG Analyses as Tools for Ethics-Based AI Auditing. AI

and SOCIETY. https://doi.org/10.1007/s00146-022-01415-0.

NEF. (2015). Reducing Economic Inequality as a Sustainable Development Goal. 1–61.

Nkoro, E., & Uko, A. K. (2016). Autoregressive Distributed Lag (ARDL) Cointegration Technique : Application and Interpretation. Journal of Statistical and Econometric Methods, 5(3), 63–91.

Palma-Ruiz, J. M., Castillo-Apraiz, J., & Gómez-Martínez, R. (2020). Socially Responsible Investing as a Competitive Strategy for Trading Companies in Times of Upheaval Amid Covid-19: Evidence from Spain. International Journal of Financial Studies, 8(3), 1–13. https://doi.org/10.3390/ijfs8030041.

Phillips, P., & Perron, P.

(1988). Testing for a Unit Root in Time Series

Regression Author (s) : Peter C. B. Phillips and Pierre Perron Published by :

Oxford University Press on behalf of Biometrika Trust Stable, 75(2), 335–346.

https://doi.org/10.1093/biomet/75.2.335.

Sassen, R., Hinze, A. K., & Hardeck, I. (2016). Impact of

ESG Factors on Firm Risk in Europe. Journal of Business Economics, 86(8),

867–904. https://doi.org/10.1007/s11573-016-0819-3.

Shaikh, I. (2022). On the Relationship

Between Policy Uncertainty and Sustainable Investing. Journal of Modelling in

Management, 17(4), 1504–1523. https://doi.org/10.1108/JM2-12-2020-0320.

Tampakoudis,

I., Noulas, A., Kiosses, N., & Drogalas, G. (2021). The Effect of

ESG on Value Creation from Mergers and Acquisitions. What Changed During the

COVID-19 Pandemic? Corporate Governance, 21(6), 1117–1141. https://doi.org/10.1108/CG-10-2020-0448.

Tarmuji, I., Maelah, R., & Tarmuji, N. H. (2016). The Impact

of Environmental, Social and Governance Practices (ESG) on Economic Performance:

Evidence from ESG Score. International Journal of Trade, Economics and Finance,

7(3), 67–74. https://doi.org/10.18178/ijtef.2016.7.3.501.

Windolph, S. E. (2011). Assessing

Corporate Sustainability Through Ratings : Challenges and their Causes. Journal

of Environmental Sustainability, 1(1), 1–22.

https://doi.org/10.14448/jes.01.0005.

Zhang, D., Zhao, Z., & Lau, C. K. M. (2022).

Sovereign ESG and Corporate Investment : New Insights from the United Kingdom.

Technological Forecasting and Social Change, 183(July).

https://doi.org/10.1016/j.techfore.2022.121899.

Zhou,

X., Caldecott, B., Harnett, E., & Schumacher, K. (2020). The Effect of

Firm-Level ESG Practices on Macroeconomic Performance. SSRN Electronic Journal,

4214(20), 0–49. https://doi.org/10.2139/ssrn.3618748.

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2023. All Rights Reserved.