A study On Customers Perception Towards Neo banking System

Adityadev V 1![]()

![]() ,

Dr. Jagadeesh B 2

,

Dr. Jagadeesh B 2![]()

1 Research

Scholar, Department of commerce, University College Mangalore, India

2 Associate

professor, Department of commerce, University College Mangalore, India

|

|

ABSTRACT |

||

|

The inception

of digitalization in the economy throws light on the development of Neo

banks. Neo banks have created evolution in the banking sector which bridge a gap between the services that traditional banks

offer and the evolving expectations of customers in digital

age. The social acceptance of Neo Banking and the customer’s

perspective matters a lot for the further empowerment of this Neo banking

system. The pandemic situation further pushed the citizens towards Neo

banking as it provided convenience and contactless access towards

banking services. So, the present study was undertaken to investigate

customer’s perception towards Neo banking system and to understand the

significance and limitations of Neo banks in digital age. Data has been

collected from both primary and secondary sources to meet the objectives. The

paper strongly believes that there is hope for Neo banks to replace

traditional banking system in future. |

|||

|

Received 26 March 2023 Accepted 27 April

2023 Published 12 May 2023 Corresponding Author Adityadev V, adithyadevadithyadev@gmail.com DOI 10.29121/granthaalayah.v11.i4.2023.5116 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2023 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Digitalization, Banking, Attitude and

Perception |

|||

1. INTRODUCTION

The world around us is becoming more digitally and

technologically empowered day by day. Digital innovation is transforming

financial services in every sector. The most recent innovation in the banking

industry is the idea of neo-banks. Many users have opted for this new,

tech-driven, and innovative banking model in recent years because it offers

something different and easier to use. Due to the advent and fast phase growth of technology Neo

banking took its prominence globally in the year 2017 as a Challenger for

traditional banking system. Currently, Neo -banking in India is at a nascent

stage where some positive developments have happened in the last few years. As

they provide numerous benefits to meet the changing needs of new-age users, neo

banks are increasingly becoming the preferred option for many customers. They

focused on making banking services more user-friendly and quickly

in meeting their needs.

A Neo bank is a digital bank that doesn't have any

physical locations. Neo banking is totally online, as

opposed to having a physical presence at a certain place. Neo banking refers to

a broad range of financial service companies that primarily cater to tech-savvy

clients. A Neo bank is essentially a fin-tech company

that offers digital and mobile-first services including investments, payments,

debit and credit cards, lending, money transfers, and more.

In the past few quarters, there has been a significant

injection of capital into the Indian Neo banking sector, making it one of the

most profitable possibilities for fintech businesses. According to Inc42’s ‘State

of Indian Fintech Report, 2022. InFocus: Neo banks’, Indian Neo banking

startups raised $869 million across 48 deals between 2014 and 2022. These factors have seen Neo banking become a huge

market opportunity in recent times Shankar (2023). According to

the Inc42 report, Neo banking in India is a $48 billion market opportunity in

2022 and is set to increase 281% to reach $183 billion by 2030. Neo banks will

account for 9% of India’s total fintech market size in 2030, which is estimated

to reach $2.1 trillion by then. Hemant (2022)

2. Objectives of the study

1)

To understand the merits and demerits of Neo

banking over conventional system of Banking.

2) To study the customer perception towards Neo banking system.

3. Review of Literature

· Asma et al. (2022) Stated Neo banks enables seamless banking with numerus services to bridge the gap between traditional banking services and customers. Neo banks were considered as they were convenient in payments, collection process, tax compliances and to file indirect taxes.

· Jaiswal (2022) Made a comprehensive study of Neo banks model and consumer perception in India. The study found that the consumers were ready to welcome the bank with no physical existence and they were unaware of all the functions of the Neo banking system. Hence, the study suggested to create awareness campaigns and programs to provide insights regarding various benefits and facilities of new events.

· Tiwary (2022) Studies the structure of new banks in India and made a comparison between you wise and traditional banks. It was stated that new banks virtual banks which relied on their parenting banks the function in efficient manner. It was noticed that new banks were cost effective in its operation and were technology oriented which provided 24/7 access for its customers.

· Temelkor (2020) Discussed the differences between traditional Bank model and fintech based digital brand and Neo bank models and stated that innovations created distribution in financial technology where its impact was seen in operations of the bank. It was concluded that Neo bank business were in its early stage and have to overcome obstacle to conquer potential market.

·

Agarwal

(2020) The article covered

how the financial sector is developing swiftly. With the use of the case study

of e-KYC and UIDIA, they have distinguished between digital banks and Neo

banks. They have emphasised some of Neo Bank's advantages as well as its

drawbacks and shortcomings. In order to describe the

Neo banking structure, how they deliver end-to-end service, as well as the

benefits and drawbacks of Neo banks, the author has leaned on this article.

·

Palepu (2019) Discussed the

regulatory framework for Neo banks in India with the reasons for restrictions

imposed by RBI to limit its certain operations. Further it was stated that the

banks were partnering with Neo banks they had potential to build differentiated

business proposition He also mentioned that Neo banks have more potentiality in

India since they have a future consumer base along with the various digital services,

they are offer which traditional banks cannot offer.

· Gudova (2018) This investigation examines the similarity or difference between a digital bank and a Neo bank. How will Neo banks use artificial intelligence? What is it? Is using Neo banks secure? According to the report, the thought of an online bank may be frightening. Digital banks and Neo banks might arise when online banking's capabilities increase with the addition of new app features and useful online services by banks.

4. Research methodology

This study is exploratory in

nature. Both primary and secondary data sources are used for the study. Primary

data is collected from a survey method. Structure questionnaire on the subject

will be prepared and canvassed among the selected respondents with the sample

size of 180 people residing in Mangalore, Karnataka using snowball sampling

method. Collected data is analyzed through percentage method. The secondary

data is collected from the official publications of RBI, NPCI, various

reference books, journals, websites, and other publications.

5. Scope of the Study

Banking and financial instruments are ever progressing as per the need of the economy. New banking is one of the evidence of this progression with the fusion of information technology and artificial intelligence. With smartphone penetration and bond of people with the technology have created a charm in them to switch towards the new banking. This new banking system is providing seamless experience to its customers we can evidence avoid number of customers with a special need such as contractor’s, freelancers, E-Commerce platforms etc. The significant reason why the industrials are choosing the new banking is mainly because of the technology driven environment and the drawbacks of the conventional banking system. The study is limited to the number of respondents.

6. Merits of Neo banks

1) Simple

operating models: Although the process to open a traditional bank

account is less complicated than it once was, there is still a significant

amount of paperwork and form filling needed. Some banks even require their customers

to visit the near-by branch in order to open a savings

account. Neo-banks make the procedure simple and eliminate the need for clients

to visit a branch to create an account because there isn't one. On a mobile

device, the account can be opened in two to three steps.

2)

Highly secure: Neo

banks tend to have strict policies for privacy of data, security, and safety of

their platforms since they don't rely on antiquated, legacy technology.

Customer data security is given top importance.

3) Cost: Neo-banks have been hailed for their cost-saving advantages over

conventional banks ever since their establishment. The operating and staffing

costs are almost nothing because these banks don't have any physical branches Banerjee et al. (2022). Customers need not to pay any fees to

create an account with neo banks, there are no required minimum balances,

monthly fees, wire fees, or account opening costs.

4) Speed: It takes

little time to open an account online. The account is promptly created and typically

made use the same day. Additionally, your online account's functions that you

use every day are quickly accessible: You always get a daily snapshot of your

funds since transfers, deposits, and withdrawals are synchronised in real-time.

Without rapid transfers, it is hard to conceive internet purchasing. The

creation and availability of new items is likewise happening quickly.

7. Demerits of Neo banks

1) No

personal assistance: For

most consumers, the lack of in-person assistance for complicated financial

processes or transactions may be unpleasant. Because Neo banks don't provide

the same range of services as traditional banks, some segments of the

population, such as senior citizens and less tech-savvy clients, might not feel

comfortable using them for specific transactions.

2) Lack of regulatory clarity:

Regulatory acceptance

of neo-banks is lacking. The RBI doesn't fully acknowledge neo-banks. An

institution must have a large number of retail

locations in order to be approved by the RBI. A fully digital bank does not

receive a permission to open a storefront independently, which clarifies the

main issue at hand. A conventional bank must collaborate with them.

3) Lack

of trust: The

difficulty in building the trust is the disadvantage of Neo banks that is most

frequently addressed in the literature. Since it lacks a physical location and

no licence, it is challenging to contact anyone in the event of frauds or other

legal problems. Fintech start-ups are becoming increasingly popular not just in

India but around the world, yet many businesses are still unable to fully earn

the trust of their customers. Even when start-ups are granted government

licences, consumers still view established banks as safe and are wary of them.

8. Results and discussions of the study

The following tables and charts shows results of the total number of respondents that were contacted for the survey (180). This covers all banking clients, regardless of whether they are familiar with Neo banks or not. This will help us to understand the perception of people towards Neo banking system.

Table 1

|

Table 1 Customers Visit to Bank |

||

|

Levels |

No. of Customers |

Percentage |

|

Few times a week |

32 |

17 |

|

Few times in a month |

68 |

37.77 |

|

Few times a year |

75 |

41.66 |

|

Once a year |

5 |

2.77 |

|

Total |

180 |

100 |

|

Source Survey data |

||

Table 1 shows how often customers visit the banks in their regular life. 37.77 percent of respondents visit bank on few times a month, 17 percent visit few times a week 41.66 percent visit few times a year and 5 out of 180 people visit bank once in a year that is 2.77 percent. From the above data we can conclude that majority of customers do not enjoy visiting branches physically, but they would like to enjoy banking services at their place.

Table 2

|

Table 2 Customers Awareness, Usage, and Adoption Level of Neo Banking System |

||

|

Levels |

No. of Response |

Percentage of customers |

|

Fully aware |

26 |

14.44 |

|

Partially aware |

35 |

19.44 |

|

Interested |

43 |

23.88 |

|

Used |

23 |

12.77 |

|

Not aware |

39 |

21.66 |

|

Not Interested |

14 |

07.77 |

|

Source Survey data |

||

Table 2 is framed to determine the level of awareness, usage, and adoption level of Neo banking system among the surveyed banking customers. 6 main levels used to determine it. 14.44 percent of banking customers among the survey are fully aware about the Neo banking system. 19.44 percent of customers are partially aware, that they know Neo banking provide banking facility as same as traditional banks without physical existence but do not know the complete details about Neo banking. 23.88 percent of customers among surveyed are known that Neo bank exist and interested in adopting Neo banking system. 12.77 percent of customers already have Neo banking accounts in different Neo banks. 21.66 percent of customers not aware about the existence of Neo banking system. Only 7.77 percent of customers are not interested in Neo banking system.

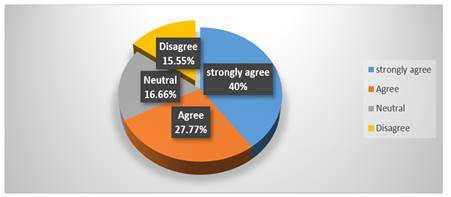

Figure 1

|

Figure 1 Customers Agree-Ness

Regarding Safety of Neo Banking System Source Survey data |

Figure 1 Above graph shows that most of the customers that is 40 percent strongly agrees that Neo banking system provide safety to their funds and investments. 27.77 percent believes Neo banking is safe to use and 15.55 percentage of customers Neo banking is not safe to use they believe it has less secured compared to traditional banking system. 16.66 percent are still in neutral opinion. We can expect that most people would be happy and at ease using Neo -banks once they are fully operational in India because the majority of them feel safe and secure utilising Neo -banks.

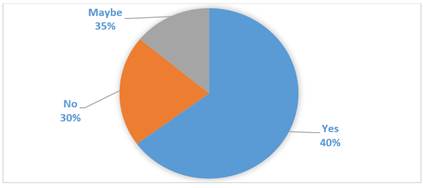

Figure 2

|

Figure 2 Preference

of Neo Banking Over Traditional Banking Source Survey

data |

From the above graph we can conclude that most of the respondents 40 percent are ready to accept Neo banking system over traditional banking system. 30 percent that is 54 out of 180 customers are not willing to accept Neo banking system and 35 percent of customers are still in grey area that they may accept if they get better features.

Table 3

|

Table 3 Customers Satisfied with the Services Offered by Neo Banking System |

||

|

Levels |

No. of responses |

Percentage |

|

Satisfied |

58 |

32.22 |

|

Not satisfied |

22 |

12.22 |

|

Need to be improved |

70 |

38.88 |

|

Not aware |

30 |

16.66 |

|

Total |

180 |

100 |

|

Source Survey results |

||

Table 3 depicts that 32.22 percent of respondents are satisfied with the services offered by Neo banking system and few 12.22 percent are not satisfied with current Neo banking services. 38.88 percent of respondents are suggesting that Neo banking services need to be improved and 16.66 percentage of people still not aware of Neo banking services. This shows us that Neo banks have gained the customer satisfaction up to certain level from the users. Majority users suggested that it needs to be improvised in terms of technological upgradation, security, privacy, and more user friendly. If these are fixed, it will unquestionably satisfy the demands of the current generation of banking consumers.

9. Suggestions

· Majority of banking customers are aware of Neo banking system but do not know all the functions and benefits of Neo banks. Various awareness programs and campaign should be conducted to make people aware about all functions and benefits of Neo banking system.

· Still customers believe that Neo banks are less secured compared to traditional banks due to present generation cyber-attacks. Neo banks should use structure layers of security in terms of software, banking application, and in performing banking functions.

· Neo banking sector extend their service to core banking products and upgrade digitalization models according to the technological change and customer needs.

· Services provided by the Neo banks should be improvised in accordance with the customer preferences. AI should be used in enhanced manner to guide the customers in handling their accounts, investments, and other banking functions.

· Government and RBI should form a separate regulatory framework for Neo banks. Authoritative body should be created to regulate and manage the functions of Neo banks. This will enhance the scope of Neo banks in India.

10. Conclusion

It can be concluded that to improvise and strengthen the root of the banking system in India there is a need of leap to be taken from the traditional system of banking to digitalization. Neo banking system by operating solely on digital platform provides an extensive benefit over traditional banking system. Even though Neo banks suffer from its own set of drawbacks to overcome this extended safety and security models should be installed. The customer perceptions place a major role to robust development of the Neo banking system in India. Awareness and knowledge of Neo banks should reach to the grass root level. Additionally, government should take all the necessary measures to regulate and control the functions of Neo banks to make Digital India possible.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

This study was funded by University Grants Commission (UGC) under the JRF scheme.

REFERENCES

Agarwal, R. A. (2020). Neobanks and the Next Banking Revolution. Retrieved from Retrieved fro PwC India.

Asma, U., Jhonson, M., & George, G. (2022). A Study on Challanges and Futures of Neo Banks in India. Journal of Conteporary Issues in Business and Government, 28(04), 178-196. 2. https://doi.org/10.47750/cibg.2022.28.04.0013.

Banerjee, R., Majumdar, S., & Albastaki, M. (2022). Ideal Self-Congruence : Neobanking by Traditional Banks and the Impact on Market Share - A Case of UAE Banks. International Journal of Professional Business Review, 7(4), e0779. https://doi.org/10.26668/businessreview/2022.v7i4.e779.

Glushchenko, M., Hodasevich, N., & Kaufman, N. (2019). Innovative Financial Technologies as a Factor of Competitiveness In the Banking. SHS Web of Conferences, 69(05), 01-05. https://doi.org/10.1051/shsconf/20196900043.

Gudova, M. (2018). Digital Banking and Neobanks. Retrieved from Fintech News.

Hemant, K. (2022). The Rise of Neobanking in India : Decoding Growth Drivers, Funding Trends & More. Inc42.

Hikida, R., & Perry, J. (2020). Fintech Trends in the United States : Implications for Household Finance. Public Policy Review, 16(4), 1-32.

Jaiswal, N. (2022). A Comprehensive Study of Neo Banks Model and Consumer Perception in India. International Journal of Innovative Science and Research Technology, 7(4), 821-851.

Padmanaban, A. (2021). Neo Banks The Next Evolution of Banking. Economic Times.

Palepu, A. R. (2019). India’s Neo-Banks : What’s So ‘Neo’ About Them ? Retrieved from Electronic Bloombergquint :

Sardana, V. & Singhania, S. (2018). Digital Technology in the Realm of Banking : A Review of Literature. International Journal of Research in Finance and Management, 1(2), 28-32.

Shankar, A. (2023). The Rise of Neo-Banking in India. E cell, 1.

Srivastav, R. (2008). Customers Perception on Usage of Internet Banking. Innovative Marketing Journal, 3(4), 67- 73. 14. 13.

Tosun, P. (2020). Brand Trust for Digital-Only Bank Brands : Consumer Insights from an Emerging Market. ATLAS 7th International Conference on Social Sciences. ATLAS.

Watkins, S. (2018). Neo–Banking : What – Another Innovation ? Press Industries.

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2023. All Rights Reserved.