TRACKS AND TRAILS OF ED-TECH FIRMS IN INDIA

Gnanakumar Baba 1![]()

![]() ,

M. K. Baby 1

,

M. K. Baby 1![]()

1 Professor, School of Management, Kristu Jayanti College, Bengaluru, India

|

|

ABSTRACT |

||

|

The Indian

educational technology (Edtech) industry has been experiencing remarkable

growth in recent years, driven by a range of factors, including increased

demand, investor interest, and mergers and acquisitions. The COVID-19

pandemic has also played a significant role in accelerating the growth of the

industry. With the closure of schools and universities during lockdowns,

there was a surge in demand for online education solutions. In India, the

growth rate of edtech firms decreased during the year 2022. An analysis of

customer reviews from 2020 to 2022 are used in this article to determine why

edtech firms succeed and fail. |

|||

|

Received 27 February 2023 Accepted 29 March 2023 Published 13 April 2023 Corresponding Author Gnanakumar Baba, gnanakumar12000@yahoo.com DOI 10.29121/granthaalayah.v11.i3.2023.5109 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2023 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Edtech, Sentiment Analysis, Text Mining |

|||

1. INTRODUCTION

The Indian edtech market has been experiencing tremendous growth in recent years, making it a lucrative industry for investors and startups alike. In 2017, KPMG reported that India's edtech market was the second largest after the U.S., estimated to grow to $1.96 billion. The COVID-19 pandemic has further accelerated the growth of the edtech industry in India, as schools and colleges were forced to shift to online modes of teaching. This has resulted in an increase in demand for online learning platforms, and many edtech companies in India have witnessed a surge in user acquisition and revenue. Some edtech companies in India have become unicorns, reaching a valuation of over $1 billion, such as BYJU's, Unacademy, and Vedantu. These companies have been able to provide quality education to students across India through their online platforms, offering a range of courses and programs at affordable prices. Overall, the performance of Edtech firms in India has been strong, with the industry poised for continued growth in the future. The increasing adoption of technology in education and the government's push for digital literacy in India bode well for the edtech industry, making it an attractive space for both investors and startups. EdTech companies are the fastest-growing companies in India and are expected to continue to drive innovation in the field of education. The Edtech industry in India is rapidly growing and is expected to continue to do so in the coming years. Edtech startups in India face a range of challenges, including resistance to change, lack of funding and perseverance, difficulty in scaling at the local level, and difficulty in converting users into paying customers. These challenges make it difficult for EdTech startups to succeed in India. EdTech companies are those that design software to enhance teacher-led virtual classrooms and promote learning virtually. In India, the EdTech industry is growing rapidly, with ed-tech companies changing the concept of learning and making self-paced learning easier for students.

According to research by a data analytics firm, Indian EdTech companies have raised $5.77 billion in funding in 2021 alone. K-12 education experts have contributed $99 million of the total funds raised. The number of K-12 EdTech start-ups established worldwide since 2018 is more than 4,800, with 1,782 of them in India.

Ed-tech companies in India are working to fill the gap in education accessibility. With the help of ed-tech, self-paced learning is becoming easier and more accessible to all students. This is especially important in India, where traditional brick-and-mortar schools can be difficult to access for many students, especially those in rural areas.

As the EdTech industry continues to grow in India, it is likely that more and more students will have access to quality education through virtual classrooms and self-paced learning.

Indian EdTech companies have raised a significant amount of funding in 2021, and they are working to make education accessible to all. The industry is growing rapidly, and more students are expected to have access to quality education through virtual classrooms and self-paced learning in the future.

2. Edtech firms in India

According to a report by HolonIQ, a global market intelligence firm, India is the second-largest market for Edtech in the world, after the United States. However, Indian Edtech firms have not yet achieved the same level of global recognition as their counterparts in the US, China, and other countries Holon (2022); In terms of investment, global Edtech firms raised a total of $16.1 billion in 2020, compared to $2.2 billion for Indian Edtech firms Upadhyay and Pathak (2022).

One factor that sets Indian Edtech firms apart is their focus on serving the large and underserved market of students in tier 2 and 3 cities, who may not have access to high-quality education. This has led to the development of innovative solutions, such as BYJU'S, an Indian Edtech firm that offers online tutoring and learning resources for students in grades K-12.

India has a thriving edtech industry with many companies offering live and self-paced online courses, as well as specialized training programs. Some of the top edtech companies in India are as below:

· WizIQ: WizIQ is one of the best edtech companies in India that provides live and self-paced online courses. WizIQ provides apps for both Android and IOS platforms.

· Cybervie: Cybervie is an ed-tech startup that provides the best cybersecurity training program.

· Simplilearn: Simplilearn is another edtech company in India that offers certification courses in a wide range of domains, including digital marketing, cybersecurity, cloud computing, data science, and more. Simplilearn has partnered with leading universities and companies to offer industry-recognized certifications.

· BYJU'S: BYJU'S is one of the most well-known edtech companies in India. It offers a learning app for students from kindergarten to grade 12 and also offers test preparation courses for competitive exams like JEE, NEET, CAT, and more.

· UpGrad: UpGrad is an online higher education platform that offers degree programs and executive education courses in partnership with leading universities and institutions.

3. Knowledge gap

Burch and Miglani (2018) argued that the ascendance of education technology is being fueled by actions of a new national administration with a clear agenda to use technology to encourage more public-private partnerships. Miglani and Burch (2019) article on EdTech firms concluded that teachers have been marginalized in discussions regarding the planning and implementation of EdTech in schools. Vandenberg et al. (2020) research also mentions that EdTech startups employ technology in creative ways to improve teaching and learning, both within schools and through tutorial and other out-of-classroom activities. In 2021, Sikandar studied the strengths, weaknesses, opportunities, and challenges (SWOC) analysis attached to EdTech companies in the post-COVID-19 scenario. He concluded that EdTech companies promise cost-saving, flexibility, and a personalized learning experience. In 2022, Bhatnagar conducted research on EdTech firms and studied how technology-assisted classrooms can bring us closer to understanding the reality of today's learners. Also in 2022, Rani analyzed the range of factors that contribute to the global exponential growth of the Indian EdTech company "Biju’s," which was established in 2011. Fouad studied the responsibility of education technology (EdTech) vendors for the cyber (in)security challenge, with a particular focus on EdTech in India. In the same year, Jha argued that the spread of coronavirus and resulting lockdowns have significantly disrupted every facet of human life, including education, and led to the creation of a new platform called EdTech in India. In 2022, Mazari studied how EdTech interventions can exacerbate the digital divide that further compounds the disadvantage of marginalized groups. Cohen (2022) examined the implications of the growing use of profit-driven educational technologies for the politics and spatial practices of schooling in the same year. The research work of Tripathy and Devarapalli (2021) contends that EdTech firms mainly concentrate on the young minds' learning process through effective original content, live streaming video lectures through animation, and interactive simulations that help students understand topics easily and in a fun manner. However, the present research aims to measure the sentiments of the stakeholders in edtech firms in India.

4. Aim

The Indian edtech market grew rapidly, with a 46% increase in investment in 2020 compared to the previous year. However, in 2022, most edtech firms in India were unable to implement growth strategies ROW (2022). Therefore, this research aims to identify the reasons for the success and failures of edtech companies from the customers' perspective from January 2020 to December 2022.

5. Methodology

Reviews of EdTech firms were extracted from various websites including trustpilot.com, mouthshut.com, g2.com, appgrooves.com, and trustradius.com. The authenticity of the reviews was measured using a text mining process developed by Netzer et al. (2012). The same procedure is used to position the attributes of the EdTech firms. The text mining apparatus was used to extract primary keywords in the first step, followed by a comparison with the EdTech firm’s attributes to identify the most prominent ones. In the final stage, the gathered data were analyzed using multidimensional scaling. The first stage of the process includes five sub-stages.

Firstly, the web pages containing reviews for Byju, Unacademy, iQuanta, TrainerCentral, UpGrad, Vedantu, Classplus, Embibe, Pesto, and Edukart in India were downloaded in HTML format from a given forum site and segmented into three groups based on the years 2020, 2021, and 2022. A total of 5214 reviews were downloaded, including 1578 web pages created between 2020 and 2022.

Secondly, HTML tags and non-textual information such as images and commercial advertisements were removed from the downloaded files.

Thirdly, messages were analyzed to extract product terms and attributes using key-word extraction. Fourthly, the text was broken up into threads, messages, and sentences that provide information about various attributes such as expertise, content management, ease of use, commitment, and value to learning. The equivalent meaning of attributes was identified based on the online standard Webster dictionary. Prominent keywords based on the attributes were found out, and irrelevant keywords were filtered out.

Finally, the relationship between products and attributes sentiment of the relationship was extracted using KH-Coder, a quantitative textual analysis program. All capital letters in customer reviews were converted to lowercase during the pre-processing step, and irrelevant stop words were removed.

A POS tagger was used to annotate Nouns and Noun phrases in customer comments, and the sentiments were identified using Hu and Liu's (2004) technique. It has been widely recognized that customer satisfaction ratings reflect the performance of mentioned attributes, and the proportion of mentioned attributes indicates the level of customer preference.

The word "recommend" was treated distinctively with "satisfaction" in terms of a three-point Likert scale that contains the attributes. Alternatively, quantitative summaries of content such as ratings on attributes were used to represent consumers' opinions. We tested the sensitivity of the analyses to alternative co-occurrence and similarity measures using the Lift ratio.

6. Analysis

Based on the above methodology we done the sentiment analysis. After the web pages has been pre-processed and vectorized, the sentiment analysis model has been trained using Heroku cloud solutions platform. The results are grouped based on the year and tabulated.

Table 1

|

Table 1 Text Extraction Results for 2020 |

||||||||

|

S. No. |

Firm |

No of reviews |

Positive |

Reason |

Neutral |

Reason |

Negative |

Reason |

|

1 |

Byju’s |

231 |

191 |

Good App |

4 |

Experience |

36 |

Rigid |

|

2 |

Unacademy |

148 |

81 |

Coaching |

48 |

Time management |

19 |

Technical Errors |

|

3 |

iQuanta |

168 |

83 |

Session plan |

21 |

Time management |

64 |

Fake Promise |

|

4 |

TrainerCentral |

121 |

45 |

Live session |

21 |

Ease |

55 |

Rigid content |

|

5 |

UpGrad |

94 |

39 |

Good Faculty |

32 |

Ease |

23 |

Rigid content |

|

6 |

Vedantu |

166 |

61 |

Good Faculty |

78 |

Contents |

27 |

Poor Response |

|

7 |

Classplus |

92 |

51 |

Features |

12 |

Readable Contents |

29 |

Poor Response |

|

8 |

Embibe |

91 |

18 |

Contents |

0 |

73 |

Fake Promise |

|

|

9 |

Pesto |

88 |

38 |

Content |

0 |

50 |

Expensive |

|

|

10 |

Edukart |

136 |

65 |

Contents |

0 |

71 |

Technical Errors |

|

According to a report by Indian consulting firm Redseer (2020), global Edtech firms raised a total of $16.1 billion in 2020, which is significantly higher than the $2.2 billion raised by Indian Edtech firms in the same year. During the year 2020, 50% of the responses given by the users of the edtech firms were positive. Only one third of the responses are negative. The users were satisfied with the features available in the app. Indian edtech firms used a range of features to improve the quality of their offerings and attract more users. These features may include interactive learning tools, personalized learning pathways, adaptive assessments, gamification elements, and social learning features, among others. The Edtech providers attracted the students with more personalized methods such as individual attention, personalized study schedules, boosted morale and confidence of students, guidance for homework and class tests, and assistance in learning exam strategies and methods.

Table 2

|

Table 2 Text Extraction Results for 2021 |

|||||||||

|

S. No. |

Firm |

No of Reviews |

Positive |

Reason |

Neutral |

Reason |

Negative |

Reason |

|

|

1 |

Byju’s |

198 |

68 |

Coaching |

71 |

Experience |

59 |

Harassing parents |

|

|

2 |

Unacademy |

154 |

84 |

Teaching |

21 |

Ease |

49 |

Expensive |

|

|

3 |

iQuanta |

132 |

79 |

New ideas |

2 |

Time Management |

51 |

Expensive |

|

|

4 |

TrainerCentral |

122 |

21 |

Live session |

11 |

Ease |

90 |

Limited resources |

|

|

5 |

UpGrad |

85 |

8 |

Curriculum |

11 |

Commitment |

66 |

Expensive |

|

|

6 |

Vedantu |

145 |

67 |

Teaching |

41 |

Ease |

37 |

Expensive |

|

|

7 |

Classplus |

73 |

32 |

Features |

6 |

Readable Contents |

35 |

Fake Promise |

|

|

8 |

Embibe |

76 |

8 |

Contents |

3 |

Ease |

65 |

Fake Promise |

|

|

9 |

Pesto |

81 |

19 |

Content |

0 |

62 |

Expensive |

||

|

10 |

Edukart |

92 |

29 |

Content |

0 |

63 |

Waste of Money |

||

According to the IBEF research, the online education market in India increased at CAGR of 52% from 2016 to 2021, driven by increased consumer adoption, improvements in offerings, and changes in business models IBEF (2022). However, during the year 2021, 49% of the reviews are against the edtech firms. The edtech companies' pricing models have been hurtful in various ways, including the lack of transparency in pricing. Companies that charge different base rates and keep these figures hidden from potential clients hurt the reputation of edtech, and edtech users often have no idea if they're paying too much or getting a good deal.

Table 3

|

Table 3 Text Extraction Results for 2022 |

||||||||

|

S. No. |

Firm |

No of reviews |

Positive |

Reason |

Neutral |

Reason |

Negative |

Reason |

|

1 |

Byju’s |

121 |

27 |

Content |

34 |

Time management |

60 |

Fake Promise |

|

2 |

Unacademy |

147 |

45 |

Content |

4 |

Ease |

98 |

Expensive |

|

3 |

iQuanta |

105 |

26 |

Teaching |

3 |

Ease |

76 |

Fake Promise |

|

4 |

TrainerCentral |

98 |

11 |

Live Session |

2 |

Ease |

85 |

Expensive |

|

5 |

UpGrad |

81 |

8 |

Materials |

3 |

Arranging loan |

70 |

Incompetent to teach |

|

6 |

Vedantu |

102 |

24 |

Teaching |

9 |

Ease |

69 |

Expensive |

|

7 |

Classplus |

58 |

13 |

Features |

5 |

Readable Contents |

40 |

Fake Promise |

|

8 |

Embibe |

23 |

0 |

0 |

23 |

Incompetent to teach |

||

|

9 |

Pesto |

41 |

6 |

Content |

0 |

35 |

Fake Promise |

|

|

10 |

Edukart |

61 |

0 |

0 |

61 |

Fake Promise |

||

During the year 2022, 73% reviews are against the Edtech firms in India. There are critics of edtech companies in India who claim that they make false promises to customers. Ministry of Education, Government of India warned the parents about the fake promises make by Edtech firms in India. The success of the industry has come with its share of notoriety. Edtech companies have been accused of making false promises, ‘hard-selling’ products to parents who cannot afford them and even refusing to cancel subscriptions even after repeated requests. Parents fall prey to the rhetoric of ‘a bright future’ awaiting, they think they might be denying an opportunity for their children to compete if they don’t opt to buy the product.

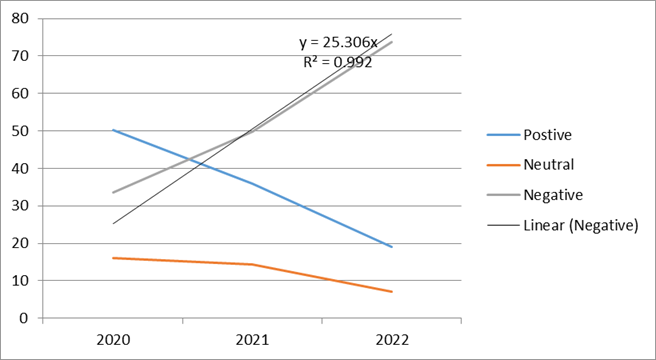

Exibit 1

|

Exibit 1 Forecasting the Trend for Ed-tech Companies’ Perception |

Providing educational services through online videos, classes and interactive content, the Indian education technology industry is one of the fastest growing sectors in the world. With companies like Byju’s, Unacademy and Vedantu leading the market, the industry was valued at $750 million in 2020. In just five years, its value is set to reach $4 billion. The reasons why edtech companies have flourished may be multifold but a matter of solicitude is the parents’ perception of the lack of effectiveness of the current education system. Excessive competition and lack of individual attention for students may prompt parents to seek out such courses. This, however, is only a quick-fix solution. However, the Exibit 1 shows that the customers’ sentiments towards the Ed-tech firms are moving in a negative manner.

7. Conclusion

Edtech startups, which aim to use technology to enhance education, have been facing challenges in India due to following reasons. Many edtech startups try to provide a one-size-fits-all solution for all students, without considering the diverse needs and backgrounds of the students. Many educators and students in India are not open to new ways of learning, making it difficult for edtech startups to introduce new technologies and methods. Many edtech startups lack sufficient funding and perseverance to sustain their business in the long run. Edtech startups face difficulties in scaling their business at the local level due to the lack of infrastructure and resources. Many edtech startups have a good number of users, but they struggle to convert them into paying customers. This results in a lack of revenue and ultimately, failure.

Edtech firms could take to address these concerns include being transparent about their data collection practices, implementing fair and unbiased algorithms, and ensuring their platforms are accessible to all users, regardless of their abilities. Additionally, firms should regularly review and update their policies and practices to ensure they are aligned with ethical principles and best practices in the industry. There is a lack of transparency in pricing, which could lead to the perception of high fees among edtech users. It is important for edtech companies to be transparent in their pricing models and provide clear explanations for their pricing to avoid any misconceptions or negative perceptions about their pricing practices.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Bhatnagar, A., & Sonawane, S. (2022). Educational Technology Revolution Impacting the Learning Behavior of the Indian Students in 21st Century Classrooms. International Journal of Scientific Research in Multidisciplinary Studies, 8(4), 26-30.

Burch, P., & Miglani, N. (2018). Technocentrism and Social Fields in the Indian Edtech Movement: Formation, Reproduction and Resistance. Journal of Education Policy, 33(5), 590-616. https://doi.org/10.1080/02680939.2018.1435909

Cohen, D. (2022). Any Time, Any Place, Anyway, Any Pace: Markets, Edtech, and the Spaces of Schooling. Environment and Planning A: Economy and Space, 0308518X221084708. https://doi.org/10.1177/0308518X221084708

Fouad, N. S. (2022). The Security Economics of Edtech: Vendors' Responsibility and the Cybersecurity Challenge in the Education Sector. Digital Policy, Regulation and Governance, (ahead-of-print). https://doi.org/10.1108/DPRG-07-2021-0090

Harsh Upadhyay & Shashank Pathak (2022). The Rise and Fall of Edtech Startups in 2022: Entrackr Report.

Holon (2022). EdTech Global Startup Activity - Global Ecosystems Report.

Hu, N., Bose, I., Koh, N. S., & Liu, L. (2012). Manipulation of Online Reviews: An Analysis of Ratings, Readability, and Sentiments. Decision Support Systems, 52(3), 674-684. https://doi.org/10.1016/j.dss.2011.11.002

IBEF (2022). Future of Ed-Tech in India.

Jha, A., Jha, N., Bhatele, K. R., Patsariya, S., &

Pahariya, J. S. (2022). COVID-19: A Creative Destruction in the

Education Sector of India. In Cases on Practical Applications for Remote,

Hybrid, and Hyflex Teaching (pp. 26-55). IGI Global. https://doi.org/10.4018/978-1-7998-9168-0.ch002

Mazari, H., Baloch, I., Thinley, S., Kaye, T., & Perry, F. (2022). Learning Continuity in Response to Climate Emergencies: Preliminary Insights on Supporting Learning Continuity Following the 2022 Pakistan Floods. EdTech Hub. https://doi.org/10.53832/edtechhub.0134

Miglani, N., & Burch, P. (2019). Educational Technology in India: The Field and Teacher's Sensemaking. Contemporary Education Dialogue, 16(1), 26-53. https://doi.org/10.1177/0973184918803184

Netzer, O., Feldman, R., Goldenberg, J., & Fresko, M. (2012). Mine Your Own Business: Market-Structure Surveillance Through Text Mining. Marketing Science, 31(3), 521-543. https://doi.org/10.1287/mksc.1120.0713

Rani, V. (2022). EDTECH, A Paradigm Shift in Conventional Learning Method Turn Out a Big Business Opportunity for the Indian Unicorn Byju's (Doctoral Dissertation, Mahidol University).

Redseer (2020). Edtech Report.

ROW (2022). Hundreds of Complaints": India's Edtech Startups are Failing to Regulate Themselves.

Sikandar, M. A., & Rahman, P. F. (2021). Edtech Start-Ups in the Education Ecosystem in the Post-Covid-19 Era in India. Towards Excellence: Journal of Higher Education, UGC-HRDC, Gujarat University, India. https://doi.org/10.37867/TE130482

Tripathy, S., & Devarapalli, S. (2021). Emerging Trend Set by A Start‐Ups on Indian Online Education System: A case of Byju's. Journal of Public Affairs, 21(1), e2128. https://doi.org/10.1002/pa.2128

Vandenberg, P., Hampel-Milagrosa, A., & Helble,

M. (2020). Financing of Tech Startups in Selected Asian countries (No.

1115). ADBI Working Paper Series. https://doi.org/10.1142/9789811235825_0006

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2023. All Rights Reserved.