THE PUBLIC DEBT PHENOMENON IN FISCAL SUSTAINABILITY, AND FINANCIAL DEVIATIONS IN SELECTED OECD COUNTRIES

1 Bandirma Onyedi Eylul

University, Faculty of Economics and Administrative Sciences, Public Finance

Department, Turkey

|

|

ABSTRACT |

||

|

In this study,

we attempt to put forth the sustainability phenomenon, an empirical that

occurs a significant fiscal impact on developing countries, which aim to

reach the desired economic growth levels. Sustainability of public fiscal

balances, especially in terms of debt policies, refers to a structural impact

mechanism that means paying debts without default and restructuring them

without risk in a period when the payment and redemption deadlines have come,

especially in terms of external debts. This mechanism of influence is also

expressed in the restructuring of a financial process, which can be expressed

in different values, especially in developing countries, and whether the

defaulted public liabilities refer to the later debt phenomenon. In this respect,

public fiscal sustainability means that the real level of future primary

surpluses is equal to the current real value of the public debt at a

fundamental level. In our analytical study, the four countries were taken as

the basis and the analytical values of these four countries in

the financial balances were determined as emerging economies on the basis of these selected countries as Turkey,

Poland, Chile, and Mexico. Besides, based on debts and public deficits, this

fact also means a sustainable fiscal structure that can emphasize all kinds

of debt phenomena at different levels, especially local governments, and the

central government throughout the country. In addition, a debt obligation

covering the entire public sphere also expresses sustainability in the narrow

sense, representing the central government budget, which is essential in

terms of sustainable budget balances. On the other hand, the sustainability

of debts in developing countries where foreign public debt is in question,

especially the public debt of central banks, can also lead to unexpected

financial weakness and vulnerabilities. The policies as public borrowing

instruments can create uncertainty about the level of financial-institutional

impact in terms of future principal and interest payments and negatively

affect fiscal policies sustainability. In this context, the acceptability of

this fiscal process regarding the receivables of all institutions such as

private bondholders, banks, and the World Bank is accepted as the

sustainability of the debts in an ongoing process with mutually positive

financial formations. When countries demand debt from financial markets, they

have to maintain their fiscal sustainability

regarding whether they should retake financial risks, especially in developing

countries. This approach, which can also be expressed as the stability of

debts, also puts forward a position identical to the expectations of stable

ground for developing economic growth potential and financial infrastructure. |

|||

|

Received 17 June 2022 Accepted 01 July 2022 Published 20 July 2022 Corresponding Author Ahmet Niyazi Özker, DOI 10.29121/granthaalayah.v10.i7.2022.4692 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2022 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Budget Balances, Debt Sustainability,

Emerging Economies, Financial Deviations, Fiscal Balances JEL Codes: H11, H30,

H63, H68 |

|||

1. INTRODUCTION

Public debt sustainability is based on the ability to maintain the Debt Service options, which generally consist of interest and principal, in terms of financial balances within a specific cycle without adversely affecting the public deficits for the year. It appears that the share of external debts in GNP, especially in public debts, provides an important analytical basis for the sustainability of domestic and foreign total debt IMF (2002) This ground also emerges as an essential structural change and fiscal planning cycle of fiscal balances and sustainability. However, it is observed that the current account deficit in the control of public obligations by some actors and international institutions in the market and the transactional whole caused by the primary budget deficit are also discussed Eurostat (2019) This approach includes also all kinds of public income options that can generate income for the treasury and the packages of measures accepted as an analytical value regarding the sustainability of public debts and restrict public expenditures based on financial sustainability IMF (2009) On the other hand, it should emphasize that the approaches to the issue that the burden of public debts can be alleviated and fiscal sustainability can be achieved on this basis within the scope of property change regarding private areas by shrinking the public space, especially for developing countries Mushkani and Ono (2020) This approach also expresses the obligations of the debt phenomenon and an ongoing structure that does not resort to any debt postponement beyond a situation such as debt postponement. This structural position, which is also accepted as an approach to the concept of solvency, points to fiscal sustainability that expresses the public payment financial power of the relevant states Balassone et al. (2009) Therefore, it emphasizes that the primary surplus indicates a structure where the current discounted debts in the future can be repaid at a higher and higher value, and the proportional share of the national income does not increase in real terms. In addition, the analysis of how much public conditions will accompany adjustment provide for social services and which commercial activities will have a positive effect on GNP are also accepted as important reasons for fiscal sustainability based on public debts OECD (1990)

In terms of financial sustainability, the definitions of the IMF and the World Bank regarding the sustainability of public debt also indicate medium and long-term financial stability Chalk and Hemming (2000), Burnside (2005) According to this, obligatory countries that are within a certain debt repayment period regarding public borrowings are defined as having to fulfil the debt service facts consisting of principal and interest in paying these debts for the future in terms of financial sustainability, without going to any other borrowings and without experiencing a real decrease in their reserves. In a briefer expressed, the current present value of interest payments compared with the present value of future primary surpluses should be equivalent to the future interest values to each other, as located in classic literature stated. As more technical considered based on the budget, the primary approach to the sustainability of public debt within fiscal sustainability is the analytical values within the scope of the Public Sector Borrowing Requirement (PSBR) and to what extent these fiscal change values will affect debt service amortization European Commission (2017) Fiscal sustainability is related to the monetary policy dynamics that directly affect PSBR and the structural relationship of Treasury reserves to financial markets. In this context, the financial impact of the Public Sector Borrowing Requirement (PSBR) limits and the position of the interest rates determined on this basis also constitute the rational forecasting analytics of public debt sustainability for the future. In other words, the position of interest obligations, the proportional role of PSBR to GDP and the proportionate value of primary surplus in terms of national income constitute an essential analytical basis for the sustainability of public debts. In this context, fiscal sustainability is directly related to the Treasury's borrowing options, debt interests' structural position with composition and inflation rates in the OECD aforementioned countries. Therefore, if the increase in interest rates due to money supply shocks is higher than the increase in GDP rates, it is seen that the increasing actual public liabilities in PSBR rates cause significant fiscal deviations on fiscal sustainability Nicholls et al. (2014)

2. LITERATURE REVIEW

First of all, Fiscal Sustainability in Theory and Practice: A Handbook as named prepared by the World Bank Burnside (2005) as a handbook is a study that theoretically approaches the relationship between financial sustainability and public debt putting forth forward. In this study, we see that the impact levels of the current global dynamics of public debt sustainability are evaluated at different scales, especially by addressing the details of the fiscal sustainability theory. Another critical study, which also includes regional developments in terms of emerging economies based on financial sustainability and public obligations, is the study named Shadow Economy and Public Debt Sustainability in Turkey, which was made by Ahmet et al. (2007)

This study discusses the scale of the impact of financial sustainability in Turkey as a rising economy and its global position. At the beginning of the studies that can be handled specially at the level of countries, the study named Debt Sustainability and Economic Growth in Egypt, which was made in 2009 based on the financial sustainability in Egypt, by El-Mahdy and Torayeh (2009) In this study, the periodic analytical relative relationship of the relationship between economic growth and fiscal sustainability, especially in developing countries, was mentioned, and significant determinations were made regarding the level of impact of financial sustainability. Again, one of the most critical current studies is Public Debt Sustainability: An Empirical Study on OECD Countries named, made by Beqiraj et al. (2018) This significant study reveals the relationship between public debt dynamics via its analytical determinations together with this concerned study reveals also impact criteria of public debt deviations. Again, one of the most important current studies is Public Debt Sustainability named, made by Debrun et al. (2019) It is a study that reveals the relationship between fiscal sustainability and public debt with its theoretical as well as analytical determinations and reveals the interpretations of meaningful determinations of public debt deviations.

3. THE POSITION OF FISCAL LIABILITIES IN EMERGING ECONOMIES AND THE DYNAMICS OF FISCAL SUSTAINABILITY

It appears that this situation creates a considerable blockage effect in the economic growth targets based on countries primarily representing emerging economies, which are members of the OECD, due to the negative impact of fiscal sustainability gotten into. It is also a fact that the redemption process regarding the payment and collection of public liabilities directly affects the existence of public debts and that public debts offer significant change options in terms of structural policies OECD (2013) Besides, it should emphasize that debt sustainability is highly dependent on growth, especially in terms of fiscal sustainability. Because it is a fact that the effect of foreign debt interests, primarily due to the positive growth values created by the added value created by the market actors in the financial market, is an important factor in the payment of the foreign debt directly Holmstrom (2015)

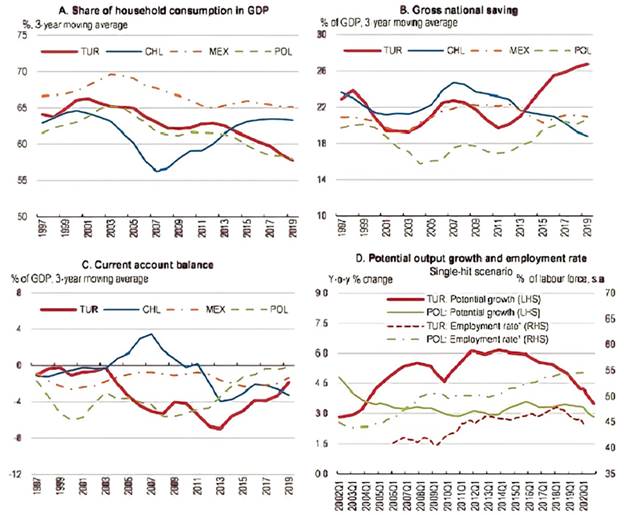

However, it is widely believed that the outsourced structure of investments made by the private sector needs an effective financial cycle in terms of financial sustainability goals. The public domestic debt analyses shared with the private sector will also positively affect it. At the same time, it is also possible that all kinds of public debt will gain continuity with new structural policies and turn into an uncertain sustainability phenomenon with unilateral public decisions Dewulf and Biesbroek (2018) Economic dynamics related to closing the foreign trade deficit, which emerged with the increase in global trade options, positively affect the sustainability of public debt elements. However, based on developing OECD countries, a negative financial ground agreed with the international advanced financial institutions reveals an essential uncertainty in terms of financial sustainability of these developing countries. Graphic 1 below shows the recent position and change in the values of fiscal sustainability dynamics based on selected countries representing emerging economies:

Graphic 1

|

Graphic 1 Global Position of Fiscal Sustainability and Sustainability Dynamics in Selected Countries Source OECD (2021-a), Key Policy Insights, https://www.oecd-ilibrary.org/sites/73effaa5-en/index.html?itemId=/content/component/73effaa5-en, (Accessed March, 13, .2022). OECD (2021a) |

It appears that the fiscal sustainability values of Graphic 1 reveal some critical comments in terms of showing the effect values of balance dynamics in selected countries together with other macro variables, especially debt volatility. As seen in Graphic 1 national savings were also influential in this period and countries such as Turkey, Chile, Mexico, and Poland, which represent the economies of the four selected emerging economies, were subject to some very significant changes and their impact values at the global level showed a similar trend and an increasing trend. The changes in the position of national savings, which constitute an essential fund infrastructure and an important fund infrastructure in public borrowings, are significant, especially in the comparison of real household consumption margins, which can be considered on the basis of national income and national savings OECD (2002) T

his significance, as a phenomenon affecting the current account balance process, also reveals an emerging economy's position showing that it was not very effective in the process. It is observed that some significant current account deficits related to the balance of payments debts emerged based on countries representing these emerging economies selected until 2019, especially at values that can be considered after 1997. The most important values in the emergence of these current account deficits are Turkey Mexico and Poland which has current account deficits in standards that show a more balanced fiscal sustainability. In our analytical study, the four countries were taken as the basis and the analytical values of these four countries in the financial balances were determined as emerging economies on the basis of these selected countries as Turkey, Poland, Chile, and Mexico. However, it is observed that potential growth values are effective in comparing actual economic growth rates, which is an important macro indicator, with employment rates. However, especially after the 2009 crisis, Turkey's potential growth position has a fluctuating growth trend Sevinç et al. (2021) On the other hand, Poland has created a more positive fiscal sustainability and debt system compared to Turkey, where the potential values are compared; a position of fiscal sustainability appears to have emerged, resulting in a further decline in unemployment rates in Poland OECD (2018)

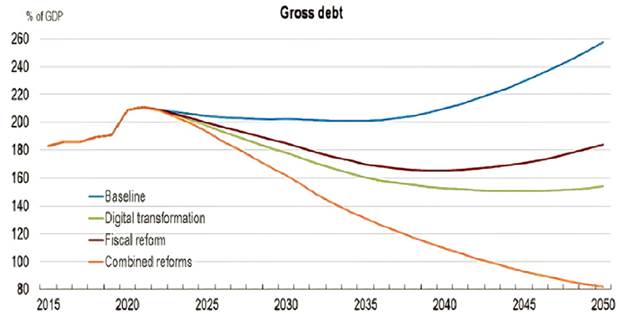

It can be said that such values, which can be expressed in any case, are most affected by different perception options, especially after the economic crisis, and that the positive debt ceiling in fiscal sustainability persists in the current account deficit period. It should not overlook that gross national savings, which are not considered much, have a significant positive effect on investments based on these OECD countries OECD (2020) It is observed that the actual increase in national savings, primarily based on national income, has an important place in the Turkish economy. In contrast to Mexico and Poland, which are more stagnant at the same level, it is understood that national savings tend to deviate in emerging economies such as Chile Freytag and Voll (2013) In brief, it appears that in terms of fiscal sustainability based on debt management, budgetary liabilities are directly correlated with nationwide savings and national income growth. It appears that both debt scenarios and expectations regarding fiscal reforms regarding a fiscal sustainability phenomenon, where the issue is handled on a larger scale and at a global level, come to the fore. It is possible to monitor the global position and future scenarios regarding the course of gross debts in Graphic 2 below, which is directly related to financial sustainability at the global level.

Graphic 2

|

Graphic 2 Global Dynamics in Ensuring and Sustaining Financial Sustainability Source OECD

(2021-b), OECD Economics, 3

December 2021, https://twitter.com/OECDeconomy/status/1466682232417005573

(Accessed March, 13.2021). OECD (2021b) |

As can be seen in Graphic 2 above, it appears that gross debts are based on different foundations at the global level, and protection with financial reforms is a priority. In this context, it is observed that fundamental reforms are at a convenient level in the formation of large debts. Despite the decrease in the status of gross debts at the level of the GDP, the combined reforms revealed a low idle trend in overcoming financial obligations. Therefore, the position of the total debt limits in the monitored global OECD countries, as the OECD average, in the ratio of GDP tends to increase as the base debt limits OECD (2017) Future scenarios reveal that this upward trend towards the future will increase with a greater angle, especially after 2022 and 2023. Therefore, it is understood that the increasing debt base also reduced the effect of some combined reforms and financial reforms within the scope of gross debts within the scope of rising debts. It is observed that each debt trend among emerging economies brings an important debt restructuring policies to the agenda especially for the four base countries Turkey, Mexico, Chile, and Poland. This phenomenon, on the other hand, has brought this current phenomenon, which means the evaluation of the financial sustainability of debt action at different stages, the deviations in the debt trend and the increase in the current account deficits, to a position that provides important information for our analytical analysis. The phenomenon of debt in ensuring financial sustainability also reveals that the increasing global debt phenomenon for the future will be frequently brought to the agenda in this empirical analysis we have made in terms of emerging economies OECD (2014) Related studies support that financial sustainability can enter into a negative process with the increasing debt phenomenon for the future Blommestein and Turner (2012) Our study reveals that the levels of borrowing and financial sustainability have an impact that may occur at different levels, especially in the process until 2020 and 2021, and that the borrowing process will increase, and financial sustainability will enter a riskier strategy, and this process will often bring a combined reform process to the plan again with the details it provides us. It is necessary to interpret the increase in the financial reform processes on private digital transformation based on these data.

4. EMPIRICAL MODEL APPROACH AND DATA

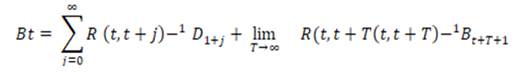

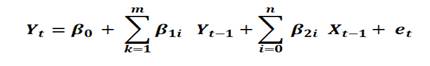

It is aimed to present the model we created for the empirical study of a debt-based fiscal sustainability approach, especially at the emerging economies, as a panel data model within the scope of time series. This model has been tried to determine the effects of change and deviation on the dependent variable with the structure of the independent variables, especially in the four main criteria. At this stage, it aims to determine the effect values of the standard deviations on the model by evaluating the model within the scope of this model to understand the model there is a standard panel and interpret it more rationally. The data series used in creating the intended model also reveals a global approach taken within the scope of the OECD and based primarily on emerging economies that can be handled at a worldwide level. In this context, our empirical model may be expressed as follows:

![]() (1)

(1)

![]()

In the study, a budget-based current account deficit calculation in the calculation of the current account deficits of Mexico, Turkey, Poland, and Chile, which we take as the emerging economies, is handled with the following equation:

(2)

(2)

The point that should be emphasized here is that the discount difference of the interest rates between the periods, which we consider as the time series, is also taken. In this context, it should be emphasized that the discount values of the four countries' budget deficits related to fiscal sustainability, which we take as a basis in the model, are included in the model -as an inflation valuation- by reducing the discount values to the interest rates, as related to the basis of budget expenditures.

(3)

(3)

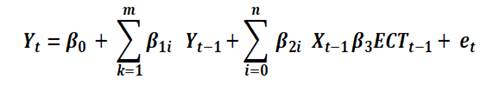

As an empirical model, the Auto-Regressive Distributed Lag Models (ARDL 4,0,4,0) that we use is, and extraordinary seasonal changes have not been considered. The stationarity of the series, by the position of the "H0" and "H1" values, where been evaluated and it ensured the stationary flowing process for each series taken from the first difference. ARDL model, which was handled generally by Pesaran et al. (2001) within the framework of not requirement stationarity in time series, but nevertheless it was handled again with series that provided stationarity for the interpretation of rationality in a more efficient scale in the analysis and interpretation. In this context, the theoretical framework of our ARDL model, which was considered for our analysis, was formed as follows:

(4)

(4)

(5)

(5)

It is considered the budget-based fiscal sustainability phenomenon (LnDBFS) that is regarded as the dependent variable in our model. Besides, the independent variables: the position of the budget deficits (LnBt,) current account balance (LnCAB) and the position of gross national savings (LnGNS) have been considered.

However, in the structural analyses related to the fact that the series in the model structurally cover the post-1990 period, the approach based on the values of the natural logarithms (Ln) (as Ln x=loge x) of the years was preferred, and it was aimed to measure the effective values of the series in the related equation more clearly, in which the stationarity of this approach was ensured. In this context, each value is placed as the logarithmic value in the model and logarithmic values are used in the model. In this context, we can express the semantic values of growth and other independent variables in the model related to the budget-based intended to the financial sustainability values principle, the dependent variable used in our model below.

Table 1

|

Table 1 Expresses of Dependent and Independent Model Components in The Model |

|

|

LnDBFS |

Debt-Based

Fiscal Sustainability |

|

LnBt |

Budget

Deficits Variations (as a percentage of GDP) |

|

LnCAB |

Current

Account Balance (as a percentage of GDP) |

|

LnGNS |

Gross

National Savings (as a percentage of GDP) |

It can formulate the theoretical expansion of the ARDL model within the scope of dependent and independent variables, which we mean above, by considering the periodic logarithmic changes and periodical differences in the model as follows:

LnDBFS = + C (1)* LnDBFS (-1) + C(2)* LnDBFS (-2)

+ C (3)* LnDBFS (-3) + C(4)* LnDBFS (-4)

+ C (5) * LnBt + C(6)* LnCAB + C(7)* LnCAB (-1)

+ C (8) LnCAB (-2) + C(9)* LnCAB (-3) + C(10)* LnCAB (-4)

+ C (11)* LnGNS + C(12) (6)

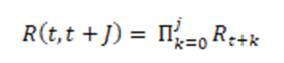

It is considered the budget-based fiscal sustainability phenomenon that is regarded as the dependent variable in our model. Besides, the independent variables: the position of the budget deficits, current account balance and the position of gross national savings have been considered. Phillips-Perron Test Statistic determined that all series were stationary by stationarity test analysis. The following table has been created by taking the primary differences of the series about providing the stationary:

Phillips-Perron Test Analitically (EViews, 2021):

![]() (7)

(7)

Table 2

|

Table 2 Unit Root Analysis Testing Results to the Stability of Variables |

||||

|

Phillips-Perron

Test Statistic |

||||

|

First

Differences |

||||

|

Variables |

Cofficient |

Std. Error |

T-Statistic |

Probably |

|

D(LnDBFS (-1)) |

-0.63529 |

0.3539 |

-2.448 |

0.0002 |

|

D (LnDBFS (-1), 2) |

-0.84543 |

0.2054 |

-1.498 |

0.0034 |

|

D (LnBt (-1)) |

-1.3785 |

0.0643 |

-1.276 |

0 |

|

D (LnCAB (-1)) |

-0.5039 |

0.1639 |

-2.382 |

0 |

|

D (LnCAB (-1), 2) |

-0.43739 |

0.2695 |

-1.387 |

0.0093 |

|

D(LnCAB

(-2),2) |

-0.55409 |

0.0492 |

-3.209 |

0.0051 |

|

D(LnCAB

(-3),2) |

-0.66208 |

0.2957 |

-2.934 |

0 |

|

D (LnGNS (-1)) |

-1.99538 |

0.1907 |

-1.008 |

0 |

|

D(LnGNS

(-1),2) |

-1.2957 |

0.1005 |

-1.441 |

0.0001 |

In the above Table 2 where the stops of the dependent and independent variables are determined, it is seen that the probability values of the series whose primary differences are taken are less than 0.05 (0.05>), and that all series are stationary on the basis of their primary difference.

5. EMPIRICAL FINDINGS

In particular, the short-term and long-term positions and scale contribution values of our model were investigated, and accordingly, both the standard deviation values and the deviation values are based on the budget-based fiscal sustainability principle. In this framework, the used ARDL MODEL put forth the meaningful criteria values and has been watched the standard deviations as related to the model.

In determining the short-term effects of the mentioned independent variables on the dependent variable, the effective values of the integration coefficients were determined, and the short-term significance of the cointegrated effect values was interpreted. The expansion of the variables whose differences were taken this determination in the substitution coefficients and in the cointegration equation and the rigid of the cointegration equation values are as follows:

Cointegrating Equation (for short term):

D(LnDBFS) =-0.009348245301 -1.185088118716* LnDBFS (-1)

-1.027009967880* D (LnBt)** + 0.23704212650* D(LnCAB) (-1)

-0.648206759970* D(LnGNS) **

+ 0.14747618852* D(LnDBFS) (-1))

-0.090370675763* D(LnDBFS) (-2))

-0.685384036504* D(LnDBFS) (-3))

-0.096932290399* D (LnCAB) -0.103995678539* D (LnCAB (-1))

+0.363689948641*(D(LnDBFS)

- (-0.00277539196* D (LnBt)** (-1) + 0.773082792* D (LnCAB (-1)

-1.897456769485* D(LnGNS) (-1) -5.6348934074)

-0.626492734669* D(LnCAB) (-1)))

As seen above, in the post-1993 position of a budget-based financial sustainability phenomenon, the calculation of the short-term cointegration distribution for the time series period, whose logarithmic infrastructure is taken, has been chosen. It is clearly seen that there are some deviations and positive contribution values, especially regarding the periodic distribution of the determined values among the determined cointegration equation values. In particular, it is observed that the budget-based financial sustainability phenomenon, which is the dependent variable in the impact process, was directly negatively affected (as -0.009348245301; -1.185088118716 LnDBFS (-1); -1.027009967880 D (LnBt); + 0.23704212650 D(LnCAB) (-1)). In addition, in Table 3 below, it is possible to see the constraints determined in the contribution values of our model and to monitor the evaluation of these criteria, especially with standard deviations on the basis of independent variables:

Table 3

|

Table 3 The Restriction Analyses Limits related to Contribute Criteria* |

||||

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

D (LnBt) |

-0.007129 |

0.1968895 |

-0.00198 |

0.89878 |

|

D(LnCAB) |

0.782592 |

0.618364 |

1.178944 |

0.01669 |

|

D(LnGNS) |

-1.259366 |

1.0096926 |

-1.234181 |

0.36893 |

|

C |

-4.198794 |

9.397754 |

-0.28541 |

0.48094 |

|

EC = D(LnDBFS)

- (-0.0037* D(LnBt) + 0.562868* D(LnCAB) -0.8678* D(LnGNS) -

4.83659) *As Constant and No Trend |

||||

As seen in Table 3 above, it appears that the coefficient criteria of the independent variables on the dependent variable do not have a very significant constraint effect in the short term. It is possible to discuss a minimal negative impact in the short run, especially from the increasing borrowing effect, budget deficits "-0.007129". In addition, it can be mentioned that a result close to the same effect is mentioned as a positive value at the level of current account deficits, and the phenomenon of “Twin Deficits” is not reflected in the short term "+0.782592". However, it also reveals that in the short run, independent variables and especially insufficient national savings are highly affected "-1.259366". Looking at the issue based on budget deficits does not this relationship directly creates a scale effect at a different level within this structural relationship of budget deficits, and also no extra level of impact emerges from integration as minimal impact for the short-term. Table 4 below examines the long-term level of structural relationship to ensure the fiscal sustainability of the four emerging economies that we take as our base.

Table 4

|

Table 4 The Default Position of Rate Changes in Terms of Fiscal Sustainability and Growth* |

||||||

|

-1 |

0.5 |

1 |

2 |

3 |

4 |

|

|

Mexico** |

-0.23 |

-0.36 |

-0.12 |

-0.02 |

0.28 |

0.45 |

|

Turkey** |

-0.34 |

-0.17 |

0.23 |

1.28 |

2.57 |

3.18 |

|

Chile** |

-0.91 |

-0.82 |

0.58 |

1.93 |

1.98 |

2.23 |

|

Poland** |

1.61 |

2.21 |

2.87 |

3.91 |

4.12 |

4.26 |

|

* As Alternative Discount Rates for

Current Year related to Fiscal Sustainability. ** As be based for 2019. |

||||||

In Table 4 above, for each level of this structural relationship, the rate of decrease in interest rates over debts has been calculated for fiscal sustainability as be based for 2019. The appears that the shrinkage effect created by each value calculated here will create a positive value for developing countries in the following years.

However, the phenomenon of fiscal sustainability undoubtedly presents a meaningful picture with the periodic effect values in the long-term rather than the current movements in the short-term in these countries. In this context, it is seen that the ratio of national savings to GDP, as well as the periodic differences and current account balance in the evaluation of budget-based fiscal sustainability, creates meaningful values in the long run. In this respect, it is important to investigate the statistical significance of any increase in value. It is possible to see the long-term effect levels of the values that may be in question on this basis, especially based on the series whose primary differences are taken, in Table 5 below within the framework of the ARDL model:

Table 5

|

Table 5 Long-Run Change Effects on the Budget Based Fiscal Sustainability Selected Emerging Economies |

||||

|

Dependent

Variable: D(LnDBFS) |

||||

|

Selected

Model: ARDL (4, 0, 4, 0) |

||||

|

Included

observations: 31 (as Yearly) 1990-2021 |

||||

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

D (LnDBFS (-1)) |

0.111765 |

0.237862 |

1.654501 |

0.0225 |

|

D (LnDBFS (-2)) |

-0.197588 |

0.262056 |

-1.27654 |

0.0469 |

|

D (LnDBFS (-3)) |

-0.009974 |

0.187639 |

-0.14559 |

0.0297 |

|

D(LnBr) |

-0.128649 |

0.236651 |

-0.32287 |

0.0006 |

|

D (LnBr (-1)) |

0.093347 |

0.349962 |

-0.28849 |

0.0045 |

|

D (LnBr (-2)) |

-0.459195 |

0.982751 |

-0.48629 |

0.0309 |

|

D(LnCAB) |

-0.091285 |

0.00349 |

-0.65095 |

0.0532 |

|

D (LnCAB (-1)) |

-0.013886 |

0.066598 |

-1.172965 |

0.0476 |

|

D (LnCAB (-2)) |

-0.184273 |

0.014076 |

-1.759249 |

0.0004 |

|

D (LnCAB (-3)) |

-0.530289 |

0.013787 |

-4.749963 |

0.0023 |

|

D (LnGNS (-1)) |

-0.128569 |

0.261043 |

-2.76439 |

0.0012 |

|

D (LnGNS (-2)) |

-0.275391 |

0.013749 |

-1.662841 |

0.0034 |

|

CointEq (-1) * |

-0.497668 |

0.079246 |

-3.996569 |

0.0003 |

|

R-squared |

0.728988 |

Mean

dependent var |

0.0011 |

|

|

Sum squared

resid |

4.934963 |

Schwarz

criterion |

1.39852 |

|

|

Test

Statistic |

Value |

Signif. |

I (0) |

I (1) |

|

F-statistic |

3.00834 |

10% |

2.37 |

3.2 |

|

k |

3 |

5% |

2.79 |

3.67 |

|

2.5% |

3.15 |

4.08 |

||

|

1% |

3.65 |

4.66 |

||

As shown in Table 5 above, a budget-based fiscal sustainability phenomenon in the long term, such as Turkey, Poland, Chile, and Mexico, has been negatively affected. Throughout these four countries, especially in the previous periods, this effect has directly affected terms of current budget balance ratios as in terms of probability values to have created a major negative impact being “D (LnCAB (-1) -0.013886”; “D (LnCAB (-2) -0.184273”; “D (LnCAB (-3) -0.530289”. Especially in the previous three years, a unit increase in current account deficits has created an approximate negative rate of "-0.530289" on budget-based fiscal sustainability. It is understood that this fiscal phenomenon has a negative impact on financial sustainability and puts forth an important constraint for the year. Besides, real budget deficits D(LnBr) have an important impact role in fiscal sustainability. It is understood that as current “D(LnBr) -0.128649” and “D (LnBr (-2) -0.459195” due to debts taken over from previous years and fiscal deficits level is significant has caused significant criteria impacts. Even if the scale effect of real budget deficits D(LnBr) on fiscal sustainability in the current period decreases, it is still seen that the negative effect of "-0.128649" against Unit increase is significant in terms of causing a negative process. Also, in terms of a periodical fiscal sustainability phenomenon, it is understood that the ratio of national savings to national income, D(LnGNS), has a significant negative effect based on these four countries. Because each Unit deviation, including the current year, has not been reflected in the markets and public economy in terms of economic development, it has created a financial sustainability deviation on the scales of “-0.128569 (-1)” and “-0.275391(-2)”, and these criterion values related to fiscal sustainability deviation have been found significant.

6. CONCLUSION

Our panel data study for Turkey, Chile, Poland, and Mexico, which we take as the emerging economies, shows that budget-based fiscal sustainability is related to achieved depending on some meaningful criteria, including the past periods. It can be said that the most critical effect scale of these criteria is current account deficits. Then the position of real budget deficits in the national income level creates a meaningful financial sustainability phenomenon with a significant effect scale. This phenomenon also means a structure in which some dynamics related to these countries emerge in fiscal sustainability. In particular, it appears that the scale authority of the debt services, which are shaped based on the previously taken over budget deficits and interest rates periodically, are often at a more significant negative level in these countries.

It is understood that the real position of a budget-based deficit, a continuous deficit relationship with current account deficits and balance of payments deficits creates a negative effect mechanism by bringing the phenomenon of Twin Deficits to the schedule. But this position entered an increasingly negative trend in the following years, and the contribution processes related to the current account deficit balance regarding fiscal sustainability have a positive effect in the first period in emerging economies. In terms of scale value, there is a co-integrated process in which the increase in the budget deficits in the following periods negatively affects financial sustainability. However, it is observed that especially fiscal sustainability has increased the proportional probability of budgetary sustainability with a significant discount rate in the interest burden rate of budget-based debt services. In this context, it is understood that as the discount values of the public debts on the budget-based interest of the payments related to each interest rate increase, the decrease in the debt service values is related to the financial sustainability. This fact has means that the principle also has a positive effect on financial sustainability. In addition, the real ratio of national savings over the national income scale in terms of national savings reveals remarkable negative results, especially with a mechanism based on the lack of each national financial savings. In other words, when the actual national savings in the past years are considered periodically, it is understood that the phenomenon of fiscal sustainability shows a significant deviation tendency sometimes. In these countries, where the proportional value of these national savings based on national income decreases, the inflation of this ratio decreases, which negatively affects fiscal sustainability and negatively affects fiscal sustainability periodically.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Ahmet, B. Y. İbrahim, S. E. and Alparslan, B. (2007). Shadow Economy and Public Debt Sustainability in Turkey, Economski Anali, 52(173), 85-104. https://doi.org/10.2298/EKA0773085B

Balassone, F. Cunha, J. Langenus, G. Manzke, B. Pavot, J. Prammer, D. and Tommasino, P. (2009). Fiscal Sustainability And Policy Implications for The Euro Area, European Central Bank Working Paper Series. https://doi.org/10.2139/ssrn.1684453

Beqiraj, E. Fedeli, S. and Forte, F. (2018). Public Debt Sustainability: An Empirical Study on OECD Countries, Journal of Macroeconomics, 58, 238-248. https://doi.org/10.1016/j.jmacro.2018.10.002

Blommestein, H. J. and Turner, P. (2012). Interactions Between Sovereign Debt Management and Monetary Policy Under Fiscal Dominance and Financial Instability, OECD Working Papers on Sovereign Borrowing and Public Debt Management. https://doi.org/10.1787/5k9fdwrnd1g3-en

Burnside, C. (2005). An Introduction to Fiscal Sustainability in Theory and Practice, in Fiscal Sustainability in Theory and Practice : A Handbook, Craig Burnside (Ed.), No. 39648, Washington D.C. : The World Bank Publications, 1-9. https://doi.org/10.1596/978-0-8213-5874-0

Burnside, C. (2005). Fiscal Sustainability in Theory and Practice : A Handbook, Craig Burnside (Ed.), No. 39648, Washington D.C. : The World Bank Publications. https://doi.org/10.1596/978-0-8213-5874-0

Chalk, N. and Hemming, R. (2000). Assessing Fiscal Sustainability in Theory and Practice, International Monetary Fund (IMF). https://doi.org/10.5089/9781451850352.001

Debrun, X. Ostry, J. D. and Wyplosz, C. (2019). Public Debt Sustainability, International Macroeconomics and Finance and Public Economics, Discussion Paper DP14010, London : Economic Policy Research. Research. https://doi.org/10.1093/oso/9780198850823.003.0005

Dewulf, A. and Biesbroek, R. (2018). Nine Lives of Uncertainty In Decision-Making: Strategies for Dealing With Uncertainty In Environmental Governance, Policy and Society, 37(3), 1-18. https://doi.org/10.1080/14494035.2018.1504484

El-Mahdy, A. M. and Torayeh, N. M. (2009). Debt Sustainabiliy and Economic Growth in Egyp, IDEAS/RePEc Search. 6-1.

European Commission (2017). European Semester Thematic Factsheet Sustainability of Public Finances, Brussels : European Commission.

Eurostat (2019). Manual on Government Deficit and Debt, European Union, Implementatıon of ESA 2010, Luxembourg : Publications Office of the European Union.

Freytag, A. and Voll, S. (2013). Institutions and Savings in Developing And Emerging Economies, Public Choice, 157(3-4), 475-509. https://doi.org/10.1007/s11127-013-0121-7

Holmstrom, B. (2015). Understanding The Role of Debt In The Financial System, Bank for International Settlements (BIS), BIS Working Papers No 479, Basel : Bank for International Settlements (BIS).

IMF (2002). Assessing Sustainability, IMF The Policy Development and Review Department, Washington D.C. International Monetary Policy (IMF), the Fiscal Affairs, International Capital Markets, Monetary and Exchange Affairs, and Research Departments.

IMF (2009). Fiscal Rules-Anchoring Expectations for Sustainable Public Finances, IMF The Policy Development and Review Department, December, Washington D.C. International Monetary Policy (IMF), The Fiscal Affairs Department.

Mushkani, R. A. and Ono, H. (2020). Public Spaces of Developing Countries Post COVID-19 : A Reflection on Current Situation from Planning Perspective in Case of Kabul City, Afghanistan, International Journal of Interdisciplinary Research and Innovations, 8(3), 1-5. https://doi.org/10.31219/osf.io/ey752

Nicholls, Peron, G. and Alexandra, O. (2014). Fiscal Sustainability and Public Debt Limits in the Caribbean : An Illustrative Analysis, in Caribbean Renewal: Tackling Fiscal and Debt Challenges (IMF Ed.).

OECD (1990). The Sustainability of Fiscal Policy : New Answers to An Old Question, OECD Economic Studies, Paris : OECD Publishing.

OECD (2002). Measuring the Non-Observed Economy : A Handbook, Paris : OECD Publishing.

OECD (2013). Debt and Macroeconomic Stability, OECD Economics Department Policy Notes.

OECD (2014). Policy Challenges for the Next 50 Years, OECD Economic Policy Paper.

OECD (2017). Resilience in A Time of High Debt, OECD Economic Outlook.

OECD (2018). How Does POLAND Compare ? The New OECD Jobs Strategy Good Jobs for All in a Changing World of Work, Paris : OECD Publishing.

OECD (2020). OECD Business and Finance Outlook, Sustainable and Resilient Finance, Paris : OECD Publishing. https://doi.org/10.1787/eb61fd29-en

OECD (2021-b). OECD Economics.

OECD (2021a). Key Policy Insights.

Pesaran, M. H. Shin, Y. and Smith, R. (2001). Bounds Testing Approaches to the Analysis of Level Relationship, Journal of Applied Econometrics, 16(3), 289-326. https://doi.org/10.1002/jae.616

Sevinç, O. Demiroğlu, U. Çakır, E. and Baştan, E. M. (2021). Potential Growth in Turkey : Sources and Trends, Central Bank of the Republic of Turkey, Ankara : Central Bank of the Republic of Turkey.

APPENDIX

Annex 1

|

Annex 1 Short -Run Independent Component

Effects on the Fiscal Sustainability as Based-Budget* |

||||

|

Selected

Method: ARDL (4.0.4.0) |

||||

|

Included

observations: 372 (as Monthly) 1988-2021 |

||||

|

Dynamic

regressors: D (LnBt) D (LnCAB) D (LnCAB) |

||||

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob.* |

|

D(LnDBFS) (-1) |

0.233378 |

0.058973 |

3.76445 |

0 |

|

D(LnDBFS) (-2) |

-0.538066 |

0.018856 |

-1.322765 |

0.0243 |

|

D(LnDBFS) (-3) |

0.217765 |

0.176433 |

0.646398 |

0.4876 |

|

D(LnDBFS) (-4) |

0.007578 |

0.014891 |

0.114578 |

0.9913 |

|

D (LnBt) |

-0.001598 |

0.094778 |

-0.099178 |

0.8236 |

|

D(LnCAB) |

0.001128 |

0.080995 |

-0.854537 |

0.3659 |

|

D(LnCAB) (-1) |

0.018494 |

0.189445 |

0.897433 |

0.3764 |

|

D(LnCAB) (-2) |

-0.011889 |

0.136569 |

-1.008744 |

0.5937 |

|

D(LnCAB) (-3) |

-0.363874 |

0.118896 |

-3.489566 |

0.0401 |

|

D(LnCAB) (-4) |

0.599784 |

0.187334 |

4.876987 |

0.0029 |

|

D(LnCAB) |

-0.873699 |

0.134685 |

-2.337891 |

0.0401 |

|

C |

-1.392783 |

2.687445 |

-0.687943 |

0.5591 |

|

R-squared |

0.739844 |

F-statistic |

6.016853 |

|

|

Adjusted

R-squared |

0.5674321 |

Prob(F-statistic) |

0.000145 |

|

|

*As Montly for

ARDL |

||||

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2022. All Rights Reserved.