REPRESENTATION OF THE FINANCIAL NEEDS OF RURAL MALAGASY HOUSEHOLDSL. S. Razafindrakoto 1 1 Doctoral School of Natural Resources Management and Development Host Team, Agro-Management and Sustainable Development of Territories University of Antananarivo, Madagascar. |

|

||

|

|

|||

|

Received 16 October 2021 Accepted 16 November 2021 Published 30 November 2021 Corresponding Author L.

S. Razafindrakoto, ffarramg@yahoo.fr DOI 10.29121/granthaalayah.v9.i11.2021.4352 Funding:

This

research received no specific grant from any funding agency in the public,

commercial, or not-for-profit sectors. Copyright:

© 2021

The Author(s). This is an open access article distributed under the terms of

the Creative Commons Attribution License, which permits unrestricted use, distribution,

and reproduction in any medium, provided the original author and source are

credited.

|

ABSTRACT |

|

|

|

Madagascar

is committed to implementing local financial services to facilitate rural

households' access to these various services and promote rural development.

The objective of the study is to understand the realities of the financing

system in rural areas and more particularly in the rural commune of Alakamisy

Itenina in vohibato district, and this, through the experience of rural

households that determine the different financial needs and their financial

priority. Using the Schwartz formula, surveys of 81 households were

statistically treated. The results show that rural households prioritize

social needs by meeting the social obligations dictated by fihavanana. The

first place of the social obligations is perceived through the attachment to

the traditional practice by the proverb “atero k'alao” which means "one

receives by giving". This is how behavioural logic has been observed in

localities far from financial services. Changing this behavioral logic turns

out to be the best option. Rural households should accept new forms of

financial innovation. |

|

||

|

Keywords: Rural

Financing System, Financial Needs, Financial Priority, Behavioural Logic,

Social Obligation, Behavioural Change 1. INTRODUCTION Agricultural and rural

finance has been an important component of development strategies adopted by

Southern countries since the late 1950s Yaron et al. (1998). Thus, credit

has long been considered a key element in the development process. In

Madagascar, rural credit is conceived as one of the main tools for removing

the obstacles to increasing agricultural production. The history of

institutional agricultural credit in Madagascar, dating back to 1926, has

much in common with other African countries colonized by France. However,

Malagasy peasants have experienced nominal benefit from agricultural credit

because they have received only 3% of the total profits. The access of the

peasants to credit is blocked by onerous procedures as well as the inadequacy

of the requested guarantees. Moreover, the use of credit in rural areas is

not part of household investment logic. More often, it is the only way to

meet social or family obligations or simply to survive until the next

harvest. The needs of the rural population determine their priority for

access to credit and the use of their income. Indeed, the analysis of new

credit practices was implemented at a time when the entire rural financing

system was undergoing reform. In this case, the study should focus on the

factors of success and failure of interventions conducted by banks or

development projects. But first, the mechanisms of |

|

||

informal credit and the relationships between lenders and borrowers, savings practices, and credit needs should be documented Droy (1993).

It is important to remember the importance of investment to innovate, according to Schumpeter's theory of innovation Harrisson (2012). However, the establishment of the culture of saving, credit and investment depends on the evolution of the traditional society into a modern society by changing the financial priority Deliège (2008). Thus, the change of behavioral logic for the use of income from the farm is considered in order to increase the agricultural yield and improve the living condition of rural households.

This study focuses on the motivation of rural households to access credit to increase agricultural productivity. Hence the following question: How can rural households be motivated to access operating and investment credit to increase agricultural productivity? Since motivation is linked to the prioritization of social needs over other financial needs, the following research questions arise: How can the different types of financial needs of rural households be allocated? How can we identify the financial priority of rural households? How do rural households behave in the face of financial needs? The objective of this study is to understand the realities of the rural finance system. The specific objectives are to present the typology of financial needs of rural households, to identify the financial priority, and to analyze the financial behaviors of rural households. The following hypotheses are put forward: the financial needs of rural households are divided into several classes, the needs of rural households determine their financial priority, and finally, the financial behavior of rural households depends on the logic of peasants.

2. MATERIALS AND METHODS

The study was conducted in the Rural Commune of Alakamisy Itenina, which is located in the district of Vohibato in the Haute Matsiatra Region. This region is part of the central highlands of Madagascar. It is located between 21° 27′ 00″ south, 47° 05′ 13″ east. Its name comes from the vegetation, called "tenina" (Imperata sylindrica). The Rural Commune of Alakamisy Itenina is bounded by the Rural Commune of Mahasoabe to the North, the Rural Commune of Mahaditra to the South, the Rural Commune of Vohibato-West to the West and the Rural Commune of Vohitrafeno to the East. The characteristics of this locality are interesting in the context of this analysis because it represents the current problems of the Highlands of Madagascar. This locality is one of the large areas with high agricultural potential, but unfortunately, it is not yet fully utilized.

The identification of financial needs was based on an elaborate questionnaire, which takes into account the complex farming system of rural households. A data collection tool called kobocollect was used to collect data on the daily expenditures of rural households in the Commune Rurale of Alakamisy Itenina. Prior to data collection on mobile devices, the questionnaire forms were designed using a web application[1]. The collected data is then centralized in a data visualization platform called kobotoolbox. This is a tool to meet the needs of researchers who go to the field because the pre-programmed forms can be used without internet access[2]. The data is then transported in Xlstat for analysis. Referring to the rate of bank coverage in the Commune Rurale d'Alakamisy Itenina, which amounts to 5.55% of the population, the sample size is defined by the Schwartz formula: n=z² (p.q)/e². This formula includes 81 households studied and takes into account 28 variables of financial need. The sample is distributed among the 13 village communities or Fokontany.

Four steps were conducted, including Hierarchical Ascending Classification (HAC) followed by Discriminant Factor Analysis (DFA), which were used to develop a typology of financial needs with a determination of p-value. In addition, scheduling was used to determine financial priority and a study of intervariable correlations was used to identify variables that would allow for the development of strategies to change economic behavior. The p-value is the probability of obtaining the observed results of a test, assuming that the null hypothesis is correct. It is used as an alternative to rejection points to provide the lowest level of significance at which the null hypothesis would be rejected[3]. Thus, a p-value of less than 0.05 is considered the benchmark for measuring the statistical quality of an experiment[4]. After the determination of the p-value, 16 variables are retained and divided into 4 classes.

3. RESULTS

Typology of financial needs

The financial needs of rural households are divided into four distinct classes, each with specific characteristics: rice occupation, domestic accumulation, daily life and social obligation versus land accumulation and livestock. The class 1 corresponds to rice occupation, including the rice field and labor (Figure 1 a). The class 2 consists of domestic accumulation, i.e., basic necessities and kitchen utensils (Figure 1. b). The class 3 concerns daily life, including coal, savings, business assets, payment of the water and electricity bill, paddy and chicks (Figure 1. c). The class 4 consists of social obligation, pigs, feed, schooling, land and vaccines (Figure 1. d).

|

|

|

|

Figure 1 a, b, c, d |

|

Financial priorities

The social obligation is the priority need, followed by coal. Business, kitchen utensil, water and electricity, labor, paddy, pigs, basics necessity (oil, sugar, soap), chicks and rice come next. Schooling is the second most important financial need. Savings, feeds, land and vaccine rank last among the financial needs of rural households (Figure 2).

|

|

|

Figure 2 Ordering of financial needs

according to farmers' logic |

Strategic variables of financial needs

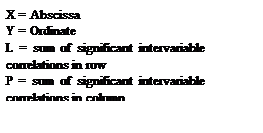

The variables such as kitchen utensil, labor, paddy and pigs present influence effects for changes in the set of variables that are lower than it, i.e., (X=L/P) less than or equal to 1, including chicks, basic necessities, feeds, rice field, schooling, land and vaccine. The financial needs as social obligation, coal, savings, business assets, water and electricity constitute the domination effect, the basis of the strategic formulation for a change in economic behavior (Chart 1).

|

Chart 1 Economic behavior of rural households |

||

|

X=L/P |

Y=L*P |

|

|

social obligation |

1,1 |

3,9 |

|

coal |

1,5 |

3,1 |

|

savings |

1,3 |

2,9 |

|

business assets |

1,5 |

2,8 |

|

water and electricity |

1,2 |

2,7 |

|

kitchen utensil |

1,4 |

2,5 |

|

labor |

2,2 |

2,2 |

|

paddy |

1,9 |

1,9 |

|

pigs |

1,6 |

1,6 |

|

chicks |

1,0 |

1,0 |

|

basic necessities |

1,0 |

2,8 |

|

feeds |

0,9 |

3,0 |

|

rice field |

0,7 |

2,3 |

|

schooling |

0,6 |

1,8 |

|

land |

0,4 |

2,7 |

|

vaccine |

0,3 |

3,1 |

4. DISCUSSION

Social obligation is the financial priority for rural households. The latter prioritise social aspects while leaving aside economic ones. On the one hand, this situation handicaps the economic development of rural areas. On the other hand, it contradicts Schumpeter's theory of innovation, which refers to the importance of investment. For Schumpeter, innovation is the commercialisation of any new combination of new materials and components, the introduction of new processes, the opening of new markets, or the introduction of new organisational forms. Thus, the role of innovation and entrepreneurs explain economic development.

This study shows that financial needs are distributed according to their typology. Moreover, households in the Commune Rurale d'Alakamisy Itenina honour social needs by giving priority to social obligation over other needs. Several authors cite the constraints faced by rural households in paying social obligations. According to Droy (1990), replication and extension may not occur when profits from an activity are spent on social expenditures because these disrupt income allocation.

According to Condominas (1991), the various obligations arising from fihavanana govern village social organisation in the highlands of Madagascar and these rules are accepted by all. The fihavanana and its obligations transcend mere interpersonal relations because they influence the opinions, behaviours, attitudes and actions of community members.

Moulende-Fouda (2003) argues for the primacy of the social spending aspirations. Indeed, spending on social needs was still dominant in terms of current and future use of income and borrowing, while productive investment was still quite low. Moreover, the trend is towards frequent use of informal sources and personal savings to meet social needs.

Baumann (2004) confirms that solidarity obligations are increasingly experienced as a mortgage on personal projects. The maintenance of a community management becomes an additional source of risk. In other words, maintaining the social link is becoming increasingly costly for the whole population.

Gannon and Sandron (2006) argue that the activation of solidarity mechanisms jeopardises the economic survival of the community. Thus, the convention of fihavanana can be a brake on innovation and development projects if they do not require unanimity. In other words, it could become a brake on the adoption of new techniques insofar as it allowed the transfer of the risks associated with individual innovation to the community as a whole. Under these conditions, in order not to harm the community, no one dares to innovate until it is proven that the proposed innovation has an almost certain probability of success.

According to Sandron (2007), rural society refuses to open up to progress because of the attachment to tradition. According to Rakotonarivo (2011), the obligations arising from fihavanana are called adidy or social obligations or social duties. These are the obligations of an individual towards the members of the social community. The principle of solidarity derived from fihavanana is coupled with financial and material constraints for survival. Expenditure on the various social obligations is a major factor in the use of funds.

In addition, the economic behaviour of rural households depends on logic of peasants. According to Droy (1993), behaviour towards savings and credit is closely linked to the precariousness of living conditions. For the rural population, credit is perceived as a harmful and dangerous act because, first of all, debt can turn people into brigands, secondly, it precedes shame and dishonour, and thirdly, it is like a whirlwind, demolishing the house in the process. Credit is like a thorn in the side, hurting all those who are used to touching it.

However, access to finance is necessary for rural development to take place. Several authors cite the importance of access to financing for the rural world. It is recognised that access to finance can promote the dynamics of accumulation and the development of productive activities of rural households, leading to the strengthening of the rural economic fabric and the modernisation of agriculture Lapenu (2007), Doligez et al. (2008), Morvant-Roux (2008). Investment should also aim at developing innovative financial mechanisms to stimulate the local economy Houngbo (2014). In addition, it is desirable to provide financial tools tailored to the specific needs of rural households. It is therefore necessary to better understand the functioning and mechanisms of the rural credit market by looking at the nature of demand and the adequacy of supply Bouquet et al. (2007).

5. CONCLUSION

The financial situation of rural households in the Commune Rurale d'Alakamisy Itenina is characterised by a high degree of social dependence, as is the case for rural households in Madagascar. This situation is due to the attachment to habits and customs. The latter affects both the social and economic priorities, and clearly shows the interdependence between socio-cultural logic, community logic, and financial logic. However, access to finance for rural households is part of the financial inclusion policies implemented by most developing countries such as Madagascar. For innovation to take place, the culture of credit and entrepreneurship should be developed in the rural world. A change in behavioural logic that prioritises social obligations is desirable for access to economic development. Thus, agriculture should be revitalised to build an economy strong. Boosting investment in rural areas promotes food security, crisis resilience and social peace. It should be accompanied by an understanding of the needs and financial choices of rural households based on the diversity of their profiles and strategies.

REFERENCES

Anonymous, (2021) Definition of the P-value [online] http://datascience.eu, page consulted on 20 January 2021

Anonymous, (2021) Geomatics on the smartphone, Kobotoolbox [online] http://monge.univ-mlv.fr, page consulted on 20 January 2021

Baumann, E., (2004). Microenterprise and vulnerability management in sub-Saharan Africa, past and present. Dialogue ADA-Appui au Développement Autonome, n°33, pp. 31-53.

Bouquet, E., Wampfler, B., Ralison, E., Roesch, M., (2007). Credit trajectories and vulnerability of rural households. Le cas des CECAM de Madagascar. Autrepart pp.157-172. Retrieved from https://doi.org/10.3917/autr.044.0157

Condominas, G., (1991). Fokon'olona and rural communities in Imerina. Paris: ORSTOM, 265 p.

Deliège, A., (2008). The place of the market economy in a rural Malagasy society: the relevance of Polanyi's work. Interventions Economique, n°38, 28p.

Denworth, L., (2021) P-value, a significant problem [online] http://www.pourlascience.fr, page consulted on 20 January 2021

Doligez, F., Lemelle, J. P., Lapenu, C., & Wampfler, B., (2008). Financing agricultural and rural transitions. In J.-C. Devèze (ed) Défis agricoles africains, 313 p.

Droy, I., (1990). Women and rural development. Paris: Karthala, 184 p.

Droy, I., (1993). The usurer and the banker: rural credit in Madagascar. Paris: ORSTOM, pp. 291-311.

Dubois, R., (1978). Olombelona. Essay on personal and collective existence in Madagascar. Paris: L'Harmattan, 157 p.

Gannon, F., and Sandron, F., (2006). Exchange, reciprocity and innovation in a farming community. Une lecture conventionnaliste. Economie Rurale, n°292, 18p. Retrieved from https://doi.org/10.4000/economierurale.741

Harrisson, D., (2012). Social innovation and the Schumpeterian entrepreneur: two theoretical readings. Interventions Economiques, n°45, 20p.

Houngbo G., (2014). Investing in rural transformation in Africa is essential. International Labour Organization.

Lapenu, C., (2007). Recent developments in agricultural finance supply and strategies. CERISE, 18p.

Morvant-Roux, S., (2008). What microfinance for agriculture in developing countries? 8p.

Moulende-Fouda, T. M., (2003). Financing mechanisms in Cameroonian rural areas, Thesis in Economic Sciences. University of Versailles, 379 p.

Rakotonarivo, A., (2011). Living there, existing here: absence and presence of migrants in the Highlands of Madagascar. Varia, pp. 249-263. Retrieved from https://doi.org/10.4000/eps.4481

Sandron, F., (2007). Anti-risk strategies and safety nets in a rural Malagasy commune. Autrepart n°44, pp. 141-156. Retrieved from https://doi.org/10.3917/autr.044.0141

USAID, (2021) Frequently Asked Questions: Using Mobile Device Data Collection in the LAUNCH Project [online] http://publications.jsi.com, page accessed 20 Jan 2021

Yaron, J., Benjamin, M., Charitenko, S., (1998). Promoting Efficient Rural Financial Intermediation. The World Bank Research Observer n°13, pp. 147-170. Retrieved from https://doi.org/10.1093/wbro/13.2.147

[1] http://publications.jsi.com ; frequently

asked questions: use of data collection

[2] http://monge.univ-mlv.fr ; geomatics on smartphone, Kobotoolbox

[3] http://datascience.eu ; definition of the P-value

[4] http://www.pourlascience.fr ; p-value, a

significant problem

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2021. All Rights Reserved.