|

|

|

|

Article Type: Research Article

Article Citation: Dr. Hariharan Narayanan. (2020). VALUE ADDED

TAX – VAT A CENTENARIAN [1920-2020] IN THIS COVID-19. International Journal of

Research -GRANTHAALAYAH, 8(9), 29-42. https://doi.org/10.29121/granthaalayah.v8.i9.2020.1323

Received Date: 25 August 2020

Accepted Date: 24 September 2020

Keywords:

VAT

Value Added Tax

GST

Consumption Tax

Standard Rate

European Union

ABSTRACT

Value Added Tax is an indirect tax which is also termed as Goods and Service Tax. Both these terms are used in the same meaning in different parts of the world. VAT is followed almost in many countries and during this pandemic situation many countries have relaxed VAT for the benefit of the public. This study mainly focuses on the frameworks followed by various nations regarding VAT. It concentrates on the origin, growth and development of VAT, various tax model frameworks followed in nearly 147 different countries all around and the various measures adopted by countries towards VAT during this era of COVID-19 pandemic.

1. INTRODUCTION

VAT refers to Value Added Tax. In some countries it is known as GST, Goods and Services Tax. It is a type of indirect tax which is assessed incrementally. This tax is charged on the added value of a product or service at each stage of production, distribution and selling to consumers. VAT, GST and Consumption Tax[1] are at times used interchangeably. It is a type of tax which is calculated at multiple stages or at multiple points, meaning calculated at each stage or point. Usually countries which adopt VAT scheme require all its businesses to get registered for VAT purposes based on the turnover of businesses. VAT registration becomes compulsory if the turnover crosses a specified limit, and this limit of turnover differs from country to country. VAT registered businesses can be natural persons or legal entities. VAT is usually collected by the end retailer and it is usually a flat tax. In many countries VAT generates a key revenue to the government. Even though many countries favour VAT, the concept has its own flaw as quoted by the sub-national governments. This study will bring out a picture about the origin, concept, growth and evolution of VAT globally, the rates and systems followed by various countries and the measures adopted by different countries towards VAT during this COVID-19 era. The researcher felt that this is the right time to study VAT along with the measures adopted by various countries across the globe.

2. OBJECTIVES

· To study the origin, growth and evolution of VAT

· To study the Standard VAT rates followed globally

· To study the various Tax systems followed by different countries (Global Tax System)

· To study various measures adopted globally towards VAT / GST during COVID-19

3. MATERIALS AND METHODS

This study is carried with Secondary Data from various authentic sources. The study is historical, descriptive and analytical in nature. Since the data are based on secondary source any biased information on the secondary data may reflect on the study which should be taken as a limitation.

4. DISCUSSION AND RESULTS

4.1. ORIGIN, EVOLUTION AND GROWTH

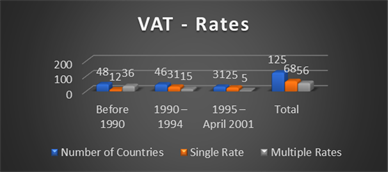

(Ebrill., et al., 2001) German businessman Wilhelm Von Siemens was the intellect who came up with the idea of a VAT in 1920s. During 1920s other suggestions of invoice-credit method by Adams also peeped. Value-added tax or VAT first introduced less than 50 years ago, is now a vital factor of tax schemes around the world. The fast and clearly alluring rise of the VAT is possibly the most extensive tax development of the latter twentieth century. VAT was invented by Maurice Laure (French Economist), Joint Director of the French Tax Authority in 1954. From 10th April 1954 it was introduced for large business and then extended to all business sectors in France. In French it was known as TVA. The following gives a picture about the rates prevailed till 2001 as given by IMF and extracted from the mentioned source

Table 1: VAT

Rates till 2001

|

Date of Introduction |

Number of Countries |

Single Rate |

Multiple Rates |

|

Before 1990 |

48 |

12 |

36 |

|

1990 – 1994 |

46 |

31 |

15 |

|

1995 – April 2001 |

31 |

25 |

05 |

|

Total |

125 |

68 |

56 |

Source: IMF – The Modern VAT

Figure 1

Source: Table 01

4.2. GLOBAL TAX MODEL FOLLOWED

Table 2: Sketch

of Global Tax System with Covid Measure Rates

|

Country |

Tax Model |

E-A-L-Name[2] |

Year[3] |

SR[4] |

Registration[5] |

|

|

1 |

Afghanistan |

VAT |

-- |

2014 |

10% |

Afn150 million |

|

2 |

Albania |

VAT |

TVSH - Tatimi mbi Vleren e Shtuar |

April 1995 |

20% |

ALL2 million |

|

3 |

Algeria |

VAT |

TVA – Taxe sur la Valeur

Ajoutee |

April 1992 |

19% |

Apply for Lump sum tax regime. DZD30 million (not in the scope of VAT) |

|

4 |

Andorra |

VAT |

-- |

January 2013 |

4.5% |

Compulsory for all taxpayers |

|

5 |

Angola |

VAT |

IVA – Imposto sobre

o Valor Acrescentado |

July 2019 |

14% |

None |

|

6 |

Argentina |

VAT IIBB |

IVA – Impuesto al Valor Agregado |

VAT -1975 IIBB -1977 |

21% |

ARS134 million for goods and ARS89 million for services |

|

7 |

Armenia |

VAT |

-- |

January 2018 |

20% |

AMD15 million |

|

8 |

Aruba |

RT HT |

Revenue Tax Health Tax |

January 2007 and July 2018 December 2014 |

3% for both |

For all taxpayers who do business in Aruba |

|

9 |

Australia |

GST |

-- |

July 2000 |

10% |

AUD75,000 (150,000 for nonprofit bodies) |

|

10 |

Austria[6] |

VAT |

-- |

January 1973 |

19% and 20% |

EUR30,000 (Established in Austria) Nil (Established outside Austria |

|

11 |

Azerbaijan |

VAT |

DV – Deyer Vergisi |

January 1992 |

18% |

AZN200,000 |

|

12 |

Bahamas |

VAT |

-- |

January 2015 |

7.5% and 12% |

BSD100,000 |

|

13 |

Kingdom of Bahrain |

VAT |

-- |

January 2019 |

5% |

BHD37,500 |

|

14 |

Bangladesh |

VAT |

-- |

July 1991 and Amended on July 2017 |

15% |

Taka 03 million And (Proposed is BDT 30 million) |

|

15 |

Barbados |

VAT |

-- |

January 1997 |

17.5% |

BBD200,000 |

|

16 |

Belarus |

VAT |

NDS – Nalog na Dobavlennuyu Stoimost |

December 1991 |

20% |

None |

|

17 |

Belgium |

VAT |

BTW – Belasting

over de Toegevoegde Waarde TVA – Taxe

sur la Valeur Ajoutee |

January 1972 |

21% |

EUR35,000 (Distance Selling0 |

|

18 |

Bolivia |

VAT |

IVA – Impuesto

al Valor Agregado |

July 1986 |

14% |

None |

|

19 |

Bonaire, Sint Eustatius and Saba (BES

Islands) |

GET |

General Expenditure Tax |

January 2011 |

Between 6% and 8% |

None |

|

20 |

Botswana |

VAT |

|

July 2002 |

12% |

BWP01 million |

|

21 |

Brazil |

ICMS IPI ISS PIS-PASEP /COFINS |

ICMS – State VAT IPI – Federal VAT ISS – Municipal service tax PIS-PASEP/COFINS – Federal gross receipt

contributions |

ICMS – 1989 IPI – 1964 ISS – 1968 PIS-PASEP – 1970 COFINS - 1991 |

ICMS-0% to 35% IPI-0% to 300% ISS-0% to 5% PIS-PASEP 0.65% to 1.65% COFINS 3% to 7.6% |

None |

|

22 |

Bulgaria[7] |

VAT |

DDS – Danak varhu Dobavenata Stoinost |

April 1994 |

20% |

BGN50,000 |

|

23 |

Cameroon |

VAT |

-- |

January 1999 |

19.5% |

XAF50 million |

|

24 |

Canada |

GST HST |

Goods and Services Tax Harmonized Services Tax |

GST January 1991 HST April 1997 |

GST -5% HST – 13% to 15% |

CAD30,000 |

|

25 |

Chile |

VAT |

IVA – Impuesto

al Valor Agregado |

December 1974 |

19% |

None |

|

26 |

China (mainland) |

VAT |

-- |

January 1994 |

6% to 16% |

CNY5,000 to CNY20,000 (Monthly) |

|

27 |

Colombia[8] |

VAT |

IVA – Impuesto

sobre las Ventas |

December 1983 |

19% |

None |

|

28 |

Cook Islands |

VAT |

Similar to OECD model |

1997 |

15% |

$30,000 |

|

29 |

Costa Rica[9] |

VAT |

-- |

December 2018 |

13% |

None |

|

30 |

Croatia |

VAT |

PDV – Porez na Dodanu Vrinjednost |

January 1998 |

25% |

HRK300,000 (Business established in

country) |

|

31 |

Curacao |

TOT |

Turnover Tax |

March 1999 |

6% |

None |

|

32 |

Cyprus[10] |

VAT |

-- |

July 1992 |

19% |

EUR35,000 |

|

33 |

Czech Republic[11] |

VAT |

-- |

January 1993 |

21% |

CZK01 million |

|

34 |

Denmark |

VAT |

-- |

July 1967 |

25% |

DKK50,000 (Business established in the

country) |

|

35 |

Dominican Republic |

Tax |

Tax on the Transfer of Industrialized

Goods and Services ITBIS – Local name |

May 1992 |

18% |

None |

|

36 |

Ecuador |

VAT |

IVA – Impuesto

al Valor Agregado |

December 1981 |

12% |

None |

|

37 |

Egypt |

VAT |

-- |

September 2016 |

14% |

EGP500,000 |

|

38 |

El Salvador |

VAT |

ITBMS – Impuesto

a la Transferences de Bienes Muebles

y a la prestacion de Servicios |

July 1992 |

13% |

USD5,714.29 |

|

39 |

Estonia |

VAT |

-- |

January 1991 |

20% |

EUR40,000 |

|

40 |

Ethiopia |

VAT |

-- |

January 2003 |

15% |

ETB01 million |

|

41 |

Fiji |

VAT |

-- |

July 1992 |

9% |

FJD 100,000 |

|

42 |

Finland |

VAT |

|

June 1994 |

24% |

EUR10,000 |

|

43 |

France |

VAT |

TVA – Taxe

sur la Valeur Ajoutee |

April 1954 |

20% |

None |

|

44 |

Georgia |

VAT |

-- |

December 1993 |

18% |

GEL100,000 (Business established in

country) |

|

45 |

Germany[12] |

VAT |

-- |

January 1968 |

19% |

None |

|

46 |

Ghana |

VAT |

-- |

March 1998 |

12.5% |

GHS200,000 |

|

47 |

Greece[13] |

VAT |

FPA – Foros Prostithemenis Aksias |

January 1987 |

24% |

None |

|

48 |

Guam |

VAT |

Sales Tax Rate |

2014 |

2% |

-- |

|

49 |

Guatemala |

VAT |

IVA – Impuesto

al Valor Agregado |

July 1992 |

12% |

None |

|

50 |

Guinea |

VAT |

-- |

|

15% |

GNF 500 million |

|

51 |

Gulf Cooperation Council [Bahrain Saudi Arabia Kuwait Oman Qatar UAE] |

VAT |

-- |

Saudi Arabia and UAE – January 2018 Bahrain January 2019 |

5% |

SAR375,000 |

|

52 |

Guyana |

VAT |

-- |

January 2007 |

14% |

G$ 15 million |

|

53 |

Honduras |

VAT or Sales Tax |

-- |

January 1964 |

15% |

None |

|

54 |

Hungary |

VAT |

-- |

January 1988 |

27% |

For all taxable person |

|

55 |

Iceland |

VAT |

-- |

January 1990 |

24% |

ISK02 million |

|

56 |

India |

GST and Customs Duty |

-- |

GST July 2017 Customs Duty 1962 |

GST From 5% to 28% |

INR01 million (Special Category States

specified) 02 million (Other States) |

|

57 |

Indonesia |

VAT |

PPN – Pajak Pertambahan Nilai |

January 1984 |

10% |

IDR4.8 billion (Small enterprises) |

|

58 |

Iran |

VAT |

-- |

September 2008 |

9% |

-- |

|

59 |

Ireland[14], Republic of |

VAT |

-- |

November 1972 |

23% |

EUR37,500 (Supplying Services) to

EUR75,000 (Supplying Goods) |

|

60 |

Isle of Man |

VAT |

-- |

April 1973 |

20% |

GBP85,000 (Established Business) |

|

61 |

Israel |

VAT |

|

July 1976 |

17% |

ILS99,003 |

|

62 |

Italy |

VAT |

IVA – Imposta

sul Valore Aggiunto |

January 1973 |

22% |

None |

|

63 |

Jamaica |

GCT |

General Consumption Tax |

1991 |

15% |

$10 million |

|

64 |

Japan |

CT |

CT – Consumption Tax |

April 1989 |

10% |

JPY10 million |

|

65 |

Jersey, Channel Islands |

GST |

-- |

May 2008 |

5% |

JEP300,000 |

|

66 |

Jordan |

GST GT ST |

General Sales Tax General Tax Special Tax |

June 1994 |

For GT 16% For ST Various rates |

JOD10,000 to JOD75,000 (Depends on

Business) |

|

67 |

Kazakhstan |

VAT |

NDS – Nalog na Dobavlennuyu Stoimost KKS – Kosylgan

Kun Salygy |

December 1991 |

12% |

USD200,000 for 2019 |

|

68 |

Kenya[15] |

VAT |

-- |

January 1990 |

16% |

KES05 million |

|

69 |

Korea |

VAT |

-- |

July 1977 |

10% |

None |

|

70 |

Kosovo |

VAT |

TVSH – Tatimi

mbi Vleren e Shtuar |

May 2001 |

18% |

EUR30,000 |

|

71 |

Kyrgyzstan |

VAT |

-- |

-- |

12% |

KGS 08 million |

|

72 |

Latvia |

VAT |

-- |

May 1995 |

21% |

EUR40,000 (Business established in

Latvia) |

|

73 |

Lebanon |

VAT |

-- |

February 2002 |

11% |

LBP100 million |

|

74 |

Liberia |

GST |

VAT |

2010 |

10% |

LRD 03 million |

|

75 |

Liechtenstein Principality of |

Swiss VAT |

-- |

July 2012 |

7.7% |

Swiss VAT Act followed |

|

76 |

Lithuania[16] |

VAT |

-- |

May 1994 |

21% |

EUR45,000 |

|

77 |

Luxembourg |

VAT |

TVA – Taxe

sur la Valeur Ajoutee |

August 1969 |

17% |

None |

|

78 |

Macedonia, Former Yugoslav Republic of |

VAT |

-- |

April 2000 |

18% |

MKD01 million |

|

79 |

Madagascar |

VAT |

-- |

1962 |

20% |

MGA200 million |

|

80 |

Malawi |

VAT |

-- |

July 2016 |

16.5% |

K10 million |

|

81 |

Malaysia[17] |

SST |

Sales tax and Service tax |

September 2018 (For Both) |

Sales Tax – 10% Service Tax – 6% |

RM500,000 (For Both) |

|

82 |

Maldives |

GST |

TGST – Tourism goods and service tax |

October 2011 |

6% |

MVR01 million |

|

83 |

Malta |

VAT |

-- |

January 1999 |

18% |

None |

|

84 |

Mauritius |

VAT |

-- |

September 1998 |

15% |

MUR06 million |

|

85 |

Mexico[18] |

VAT |

IVA – Impuesto

al Valor Agregado |

January 1980 |

16% |

None |

|

86 |

Moldova[19] |

VAT |

TVA – Taxa pe Valoarea

Adaugata |

July 1998 |

20% |

MDL1.2 million |

|

87 |

Monaco |

VAT |

-- |

January 1993 |

20% |

USD 38,910 |

|

88 |

Mongolia |

VAT |

-- |

July 1998 |

10% |

MNT50 million |

|

89 |

Montenegro |

VAT |

-- |

2001 Revised in 2017 |

21% |

Above 18,000 Euros |

|

90 |

Morocco |

VAT |

TVA – Taxe

sur la Valeur Ajoutee |

January 1986 |

20% |

None |

|

91 |

Myanmar |

CT |

Commercial Tax |

March 1990 |

8% |

MMK50 million |

|

92 |

Namibia |

VAT |

-- |

November 2020 |

15% |

NAD500,000 |

|

93 |

Nepal |

VAT |

-- |

1998 |

13% |

NPR 05 million |

|

94 |

Netherlands |

VAT |

BTW – Belasting

over de Togevoegde Waarde |

January 1969 |

21% |

None |

|

95 |

New Zealand |

GST |

-- |

October 1986 |

15% |

NZD60,000 |

|

96 |

Nicaragua |

VAT |

-- |

December 1984 and revised in May 2003 |

15% |

None |

|

97 |

Nigeria |

VAT |

-- |

December 1993 |

7.5% |

None |

|

98 |

Norway |

VAT |

-- |

January 1970 |

25% |

NOK50,000 |

|

99 |

Pakistan |

ST |

Sales Tax |

November 1990 |

Standard Rates of 17%, 16%,15% and 13%

for different categories |

PKR10 million |

|

100 |

Panama |

VAT |

-- |

December 1976 |

7% |

USD36,000 |

|

101 |

Papua New Guinea |

GST |

-- |

January 2004 |

10% |

PGK250,000 |

|

102 |

Paraguay |

VAT |

IVA – Impuesto

al Valor Agregado |

July 1992 |

10% |

None |

|

103 |

Peru |

VAT |

-- |

August 1991 |

18% |

None |

|

104 |

Philippines |

VAT |

-- |

January 1988 |

12% |

PHP03 million |

|

105 |

Poland |

VAT |

-- |

July 1993 |

23% |

PLN200,000 |

|

106 |

Portugal |

VAT |

-- |

January 1986 |

23%, 22% and 18% for different regions |

None |

|

107 |

Puerto Rico |

SUT |

Sales and Use Tax |

November 2006 |

10.5%+1% = 11.5%[20] |

None |

|

108 |

Qatar |

GCC |

-- |

January 2020 |

5% |

Gulf Cooperation Council |

|

109 |

Romania |

VAT |

-- |

July 1993 |

19% |

EUR88,500 |

|

110 |

Russian Federation |

VAT |

-- |

December 1991 |

20% |

None |

|

111 |

Rwanda |

VAT |

-- |

January 2001 |

18% |

RWF20 million |

|

112 |

Saint Lucia |

VAT |

-- |

October 2012 |

12.5% |

XCD400,000 |

|

113 |

Saudi Arabia[21] |

VAT |

-- |

January 2018 |

5% |

SAR375,000 |

|

114 |

Serbia |

VAT |

-- |

January 2005 |

20% |

RSD08 million |

|

115 |

Seychelles |

VAT |

-- |

July 2012 |

15% |

SR05 million |

|

116 |

Singapore |

GST |

-- |

April 1994 |

7% |

SGD01 million |

|

117 |

Sint Maarten |

RT |

Revenue Tax |

January 1997 |

5% |

None |

|

118 |

Slovak Republic |

VAT |

-- |

January 1993 |

20% |

EUR50,000 |

|

119 |

Slovenia |

VAT |

-- |

July 1999 |

22% |

EUR50,000 (For business established

Slovenia) |

|

120 |

South Africa |

VAT |

-- |

September 1991 |

15% |

ZAR01 Million |

|

121 |

South Korea |

VAT |

-- |

1977 |

10% |

None |

|

122 |

South Sudan |

VAT |

-- |

1991 |

20% |

None |

|

123 |

Spain |

VAT |

-- |

January 1986 |

21% |

None |

|

124 |

Sri Lanka |

VAT |

-- |

August 2002 |

8% |

LKR 50 million |

|

125 |

St. Lucia |

VAT |

-- |

2012 |

12.5% |

$180,000 |

|

126 |

Suriname |

TOT |

Turnover Tax |

December 1997 |

10% for goods and 8% for services |

None |

|

127 |

Sweden |

VAT |

-- |

January 1969 |

25% |

SEK30,000 |

|

128 |

Switzerland |

VAT |

MWST – Mehrwertsteuer TVA – Taxe

sur la Valeur Ajoutee IVA – Imposta

sul valore Aggiunto |

January 1995 |

7.7% |

CHF100,000 |

|

129 |

Taiwan |

VAT and GBRT |

Business Tax including VAT and Gross

Business Receipts Tax |

June 1931 and revised on December 2015 |

5% |

None |

|

130 |

Tanzania |

VAT |

-- |

July 1998 amended on July 2015 |

18% |

TZS100 million |

|

131 |

Thailand |

VAT |

-- |

January 1992 |

7% |

THB1.8 million |

|

132 |

Togo |

VAT |

Taxe sur la Valeur Ajoutee |

-- |

18% |

FCFA 50 million |

|

133 |

Trinidad and Tobago |

VAT |

-- |

January 1990 |

12.5% |

TTD500,000 (from January 2016) |

|

134 |

Tunisia |

VAT |

-- |

June 1988 |

19% |

TND100,000 |

|

135 |

Turkey[22] |

VAT |

KDV – Katma Deger Vergisi |

November 1984 |

18% |

None |

|

136 |

Uganda |

VAT |

|

July 1996 |

18% |

UGX150 million |

|

137 |

Ukraine |

VAT |

PDV – Podatok

na Dodanu Vartist |

January 1992 |

20% |

UAH01 million |

|

138 |

United Arab Emirates |

VAT |

-- |

January 2018 |

5% |

AED375,000 |

|

139 |

United Kingdom[23] |

VAT |

-- |

April 1973 |

20% |

GBP85,000 |

|

140 |

United States |

SUT |

Sales and Use Tax |

1930 and 1936 |

Range from 2.9% to 7.25% |

45 to 50 US states follow |

|

141 |

Uruguay |

VAT |

-- |

December 1972 |

22% |

None |

|

142 |

Uzbekistan |

VAT |

-- |

-- |

20% |

-- |

|

143 |

Vanuatu |

VAT |

-- |

1998 |

12.5% |

VUV 04 million |

|

144 |

Venezuela |

VAT |

-- |

October 1993 |

16% |

None |

|

145 |

Vietnam |

VAT |

-- |

January 1999 |

10% |

None |

|

146 |

Zambia |

VAT |

-- |

July 1995 |

16% |

ZMW800,000 |

|

147 |

Zimbabwe |

VAT |

-- |

January 2004 |

15% |

USD60,000 |

Source: Compiled by Author from various secondary sources.

4.3. VAT – ADOPTION ACROSS GLOBAL COUNTRIES

(Cnossen, 1998) VAT has become one of the pillars of the tax system in over one hundred countries since late 1960s. It has become an inviting tax system because of the revenue generation. This study clearly states that properly designed and administered VAT system can generate more revenue with lower operational and economic costs. It also clearly states that the drawback and danger is that VAT becomes over-used in the sensitivity that it supplies to the care of an oversized, inefficient public sector.

(Cnossen, 2010) Three VAT studies: This study was separated into three parts, first concentrating on VAT for lawyers, economists, and accountants with special reference to Netherlands, second being examination and evaluation of VAT coordination in the EU against the backdrop of analysis of VAT fraud and finally the third discussing that value changes in exempt immovable property should be brought into the VAT footing identical to other second-hand goods that are bartered by taxable dealers. This three segmented part has made contribution towards better understanding of the VAT. First being the role of VAT correlating the views of lawyers, economists and accountants followed by VAT coordination aspects and the analysis of exempt immovable property and finally giving an evidence that domestic shadow economy fraud and contrived insolvency fraud are much more important than carousel fraud, which receives so much importance. This study is based on the papers presented at conferences held in Vienna, Washington DC and Oxford by Cnossen.

(Symons et al., 2010) VAT is now most common form of consumption tax system used around the world. This study was carried considering VAT and equivalent sales tax systems implemented in 145 different countries. The main objective was to look into the differences in the time required for VAT compliance in different countries. Data from World Bank Group and PricewaterhouseCoopers LLP (PwC) were used for the study. The summary states that VAT is predominant and used throughout the world, time taken to comply with VAT is less in developed countries than developing countries, time taken to comply with VAT is more in countries where indirect taxes are not administered by the same tax authority that handles the corporate income tax, less time to comply in countries where business adopts online filing and payment of VAT, compliance takes longer time if documentation is more at the time of submission and there is correlation between VAT compliance and the time delay in receiving a VAT refund.

(Gerard & Naritomi, 2018) This study says VAT has become one of the most important instruments of revenue mobilization in the developing world. VAT exists in almost more than 160 countries and roughly eighty percent of countries in sub-Saharan Africa have adopted VAT. It says that the key strengths of VAT systems are their self-enforcing properties. It also states that the legal system needs to be adapted to sufficiently support the new levels of information flowing into tax authorities. The layout of new policies should thoroughly consider ‘take-up’ costs in the local situation for consumers, firms and tax administrations.

(Evans et al., 2018) This study depends on the survey carried in the 47 member countries of the Forum on Tax Administration (FTA) that administer VAT or GST regime. It is a comparative cross-country assessments of the VAT compliance burden and its main drivers. The major findings were: VAT is considered “fit for purpose” as a vigorous instrument efficient of measuring and evaluating the business VAT compliance burden across the 47 FTA countries. It states that roughly 30% of the countries (14) have indications of a low to very low VAT compliance burden. The driving significant factors influence is grouped in the order, Policy Framework, administrative Framework and finally with capabilities of the revenue services with less prominence towards driving factors. It also clearly states that the VAT compliance burden is influenced by the economic development of the country and GDP.

(Alavuotunki et al., 2019) It highlights the influence of the debut of VAT on inequality and government revenues using anew released macro data. It states that with the accessible country-level inequality data one cannot evaluate those tax incidence impacts that could emerge from differences in the savings rates across people with different income levels. It also states that there is no evidence that the VAT would lead to widening welfare disparities.

(Blei, 2020) The standard VAT generally applies to all goods and services, unless advised differently by the legislation. The Standard rate in 2019 ranged from 27% in Hungary to less than 10% in Japan, Switzerland and Canada. In 2019 the average standard VAT rate of the 22 OECD countries which are member of the EU was at 21.8% which is notably higher than the OECD average.

4.4. VAT – SPECIAL MEASURES DURING COVID-19

(Deloitte, 2020) This speaks about high-level indicator of Covid-19 related VAT and sales tax measures introduced globally to mitigate the likely economic and fiscal effects of Covid-19 on business and individuals in various countries. It clearly specifies the countries which implemented measures towards VAT and also the types of measures adopted by each country during this Pandemic. The countries which have not implemented any measures are British Virgin Islands, Curacao, Indonesia, Mexico, New Zealand, Nicaragua, Serbia and Trinidal and Tobago. All other countries have implemented various measures. There are three types of measure implemented by various countries.

· Delayed or Spread Payment of VAT / Sales tax due and Delayed filing of VAT / Sales tax returns

· Reduction in rate of VAT and Sales tax rates and

· Other Measures.

The main measure implemented by almost all the countries are “Delayed or Spread payment of VAT/Sales tax due and Delayed filing of VAT/Sales tax returns”. Some countries like Colombia, Czech Republic, France, Germany, Malaysia, Malta, Norway, Paraguay, Poland, Portugal, Puerto Rico, Slovenia, South Korea, Spain, Sweden, United Kingdom, have reduced the rate of VAT and Sales tax rates apart from delayed payment and delayed filing of VAT / Sales tax. Those countries which has implemented measures have included a term “other measures” which is more descriptive and followed in other means apart from the implantation of other two measures as mentioned above.

(ICC Statement, 2020) COVID-19 pandemic is an unusual health and economic crisis, disturbing the lives and livelihoods of workers, as well as the continued operations of businesses universally. MSMEs – Micro, Small and Medium-sized Enterprises and their workers, as well as entrepreneurs and the self-employed, are among the seriously hit. ICC – International Chamber of Commerce has highlighted number of measures which the government should take to save SMEs. The measures are quantified in a nutshell as: flexibility in extending deadlines for tax filing/payment, waiving of tax payments – both corporate income tax and indirect tax (Chile, Cyprus, Peru), flexible payment agreements with no interest or penalties (Chile, Cyprus, Peru), temporary reduction in VAT rates payable by small businesses (Republic of South Korea), 0% tax on essential products (Brazil), Cash-flow assistance for MSMEs (Australia, Cook Islands, Bosnia, Herzegovina, France, South Africa.

(Commission, 2020a) Exemptions and reliefs towards Import duties and VAT are given for all those goods needed to combat the effects of the COVID-19 as per the request made by Italy, France, Germany, Spain, Austria, Cyprus, Czechia, Estonia, Greece, Croatia, Lithuania, Netherlands, Poland, Portugal, Slovenia, Belgium, Bulgaria, Denmark, Finland, Hungary, Ireland, Luxembourg, Latvia, Romania, Slovakia, United Kingdom, Sweden and Malta.

(KPMG (China) Limited, 2020) Exemptions and reliefs carried are quoted here: 100% tax depreciation for newly purchased equipment for manufacturing of Covid-19 prevention and control materials, VAT Exemption for income from transportation of Covid-19 prevention and control materials and refund of carried forward excess input VAT for manufacturers of Covid-19 prevention and control materials. The policy overviews mentions that, expanded scope for duty-free imported of donated goods-imported goods donated for Covid-19 prevention exempt from import duties, VAT and consumption Tax, Tax paid on donated imported goods will be refunded and Donated goods from US not subject to additional duties and tax paid will be refunded.

(Bulletin, 2020) Covid-19 pandemic has elicited a very different response when compared to previous financial crises. Many governments are modifying VAT/GST systems as an accelerated response measure to reinforce with financial liquidity. The impact of COVID-19 crisis on VAT/GST systems are reduction in business, customer default, practical challenges of operating in lockdown and repurposing production line. Many governments are providing relief for many affected businesses by extending the time limit of submission, reducing the rate of tax and providing all other measures to give life to the businesses.

5. CONCLUSION

VAT concept has emerged in 1920s and has expanded immensely across globe till date. The analysis makes it evident that the VAT rates are minimum at 2% in the country “Guam” and maximum at 27% in the country “Hungary”, followed by Croatia, Denmark, Norway and Sweden with 25%, Finland, Iceland and Greece with 24%, Ireland and Poland with 23%, Italy, Slovenia and Uruguay with 22%, Argentina, Czech Republic, Latvia, Lithuania, Montenegro, Netherlands and Spain with 21%. Apart from VAT these are the countries which have minimum and maximum rate of tax in their own systems. Aruba has minimum of 3% for RT – Revenue Tax and HT – Health Tax, Canada with 5% GST and Brazil has the highest tax bracket of 0% to 300% in the name of IPI – Federal VAT. Majority of countries which do not come into the bracket of VAT have adopted GST and other few countries have their own method of tax system which is more or less similar and equivalent to other global standards. During this COVID-19 era many countries have adopted tax rate reductions for all categories of goods and services and some countries have adopted for selective categories of good and services. The study identifies Austria, Bulgaria, Colombia, Costa Rica, Cyprus, Czech Republic, Germany, Greece, Ireland, Kenya, Lithuania, Malaysia, Mexico, Moldova, Turkey and United Kingdom are the countries which has reduced the tax rates as a measure of COVID-19 in order to make the public benefitted, whereas the only country which has taken a different route is Saudi Arabia which has increased the tax rate during this pandemic situation.

AUTHOR’S SENSATION

The author feels that this decrease or increase in VAT rates from the Standard Rate during this COVID-19 era will be an eye opener for all countries as to how best it can fit and match with the economy and benefit the public. This is a “New Model” which is developed in this challenging pandemic era and henceforth all countries will adopt such measures in the post Covid era considering this as a “Base Model”.

VAT becomes a

Centenarian in this COVID-19.

The author

wishes many more returns for VAT without COVID INFLUENCE

SOURCES OF FUNDING

This research received no specific grant from any funding agency in the public, commercial, or not-for-profit sectors.

CONFLICT OF INTEREST

The author have declared that no competing interests exist.

ACKNOWLEDGMENT

None.

REFERENCES

[1]

Alavuotunki, K., Haapanen, M., & Pirttilä, J.

(2019). The Effects of the Value-Added Tax on Revenue and Inequality. Journal

of Development Studies, 55(4), 490–508.

https://doi.org/10.1080/00220388.2017.1400015

[2]

Blei, F. (2020).

Update June 2020. OECD Better Policies for Better Lives, 18(3), 284–318.

https://doi.org/10.1089/lrb.2020.29087.fb

[3]

Bulletin,

T. P. (2020). COVID-19: The impact on VAT / GST systems. Pwc.

[4]

Cnossen, S.

(1998). Global Trends and Issues in Value Added Taxation. International Tax and

Public Finance, 5, 399–428. https://doi.org/10.1023/A:1008694529567

[5]

Cnossen, S.

(2010). Three VAT Studies. In CPB Netherlands Bureau for Economic Policy

Analysis.

[6]

Commission,

E. (2020a). Relief from Import Duties and VAT Exemptions for goods needed to

combat the effects of the COVID-19. 4.

[7]

Commission,

E. (2020b). VAT rates applied in the Member States of the European Union.

January (1).

[8]

Covid-19

Related VAT and Sales Tax Measures Global summary. (2020). Deloitte, July.

[9]

Ebrill, L., Keen,

M., & Summers, V. (2001). The Modern VAT. In the Modern VAT.

https://doi.org/10.5089/9781589060265.071

[10] Ernst & Young. (2019). Worldwide VAT, GST

and Sales Tax Guide. 1–1072.

https://www.ey.com/en_gl/tax-guides/worldwide-vat-gst-and-sales-tax-guide-2019

[11] Evans, C., Highfield,

R., Tran-nam, B., Walpole, M., & Sydney, U.

(2018). Diagnosing the VAT Compliance Burden: A Cross-Country Assessment.

October, 1–53.

[12] Gerard, F., & Naritomi,

J. (2018). Value Added Tax in developing countries: Lessons from recent

research VAT systems incentivise accurate reporting

on B2B transactions, but evasion and administration challenges still exist.

International Growth Centre, May.

[13] Limited, K. A. (China). (2020). Managing

China Tax issues in Covid-19 disruption period. KPMG, February.

[14] Statement, I. C. C. (n.d.). ICC STATEMENT TAX

MEASURES TO SAVE OUR SMES IN RESPONSE TO COVID-19. 1–3.

[15] Symons, S., Howlett, N., & Alcantara, K.

R. (2010). The impact of VAT compliance on business. The World Bank/

International Finance Corporation; Price Water House Coopers, 25543(09/10),

1–15.

WEB LINKS

[1]

https://www.avalara.com/vatlive/en/vat-rates/international-vat-and-gst-rates.html

[2]

https://en.wikipedia.org/wiki/Consumption_tax

[3]

https://www.elibrary.imf.org/search?q=vat&searchBtn=

[4]

https://www.vat.international/brazil/

[5]

https://www.worldbank.org/en/search?q=vat

[6]

https://www.pwc.com/gx/en/tax/pdf/impact-of-vat.pdf

[7]

http://www.oecd.org/ctp/tax-policy/tax-database-update-note.pdf

[8]

https://www2.deloitte.com/content/dam/Deloitte/be/Documents/tax/COVID-19_TaxSurvey.pdf

[9]

https://taxfoundation.org/digital-tax-europe-2020/

ABOUT THE AUTHOR

|

|

Dr. N. HARIHARAN is

the Founder and Director of SHRI ACADEMY, Pune, Maharashtra, India. He is into Academics for more than 25 years

serving in various capacities at reputed institutes teaching Core Finance and

Business subjects at Undergraduate, Postgraduate and Professional Course levels

in India and Abroad. He has attended and

presented papers in various national and international conferences. He is also

a Visiting Faculty in different B-Schools.

He is member, board of studies/examiner in various universities and

institutions. He is also member of

Editorial Board of various Management Journals published from USA and

India. He specializes in the field of

Taxation, Accountancy and Finance. He

has authored 12 editions of Income Tax Law and Practice and Income Tax Problems

and Solutions (Indian Tax System). He

has co-authored 02 books on Cost Accounting.

He has guided more than 1000 projects for postgraduate courses for

Indian and International Universities.

His qualification is approved and recognized by BQA – Botswana

Qualifications Authority as equivalent to NCQF Level 10.

https://shriacademy.co.in/Home/Founder_Director

[1] It is an indirect tax which is charged on

the consumption spending of goods and services. Stamp Tax, Tax on Tea and

Whiskey Taxes will speak more about the History of Consumption Tax. More

reference can be seen in this link https://en.wikipedia.org/wiki/Consumption_tax

[2] Expansion, Alternate or Local Name

[3] Year of Introduction

[4] Standard Rate in Percentage

[5] Registration Thresholds (In Annual

Turnover)

[6] Has reduced VAT rate due to COVID-19 to 50% of the standard rate applicable from 01 July to 31 December 2020

[7] Standard Rate is presently reduced to 50%

due to COVID-19

[8] Has reduced VAT rate to 0% for

Hospitality, restaurants and cafes due to COVID-19 till 31 December 2020

[9] Has reduced VAT rate to 9% due to COVID-19

[10] Has reduced VAT rate to 5% due to COVID-19

from 1 July 2020 to 10 January 2021, for hotel, accommodation, hospitality,

restaurants, cafes and public transport

[11] Has reduced VATT rate to 10% from 1 July

2020 to 31 December 2020 due to COVID-19 for accommodation, sports and cultural

activities

[12] Has reduced the Standard Rate to 16% from

1 July 2020 to 31 December 2020, due to COVID-19

[13] Has reduced the Standard Rate to 13% for Public Transport, taxis, ferries from 1 June 2020 to 31 October 2020 due to COVID-19

[14] Has reduced the Standard Rate to 21% from

1 September 2020 to 28 February 2021, due to COVID-19

[15] Has reduced the Standard Rate to 14% from

1 April 2020 due to COVID-19

[16] Has reduced the Standard Rate to 9% till

31 December 2020 due to COVID-19

[17] Has reduced the Standard Rate for Service

to 0% from 30 March 2020 to 30 June 2021

[18] Has reduced the Standard Rate to 10% due

to COVID-19

[19] Has reduced the Standard Rate to 15% for Hospitality, restaurants and cafes from 1 May 2020 to 31 December 2020 due to COVID-19

[20] State Tax is 10.5% and 1% is Municipal Tax

[21] Has increased the Standard Rate from 5% to

15% from 1 July 2020 due to COVID-19

[22] Has reduced the Standard Rate from 18% to

1% due to COVID-19 from 1 April 2020 to 30 November 2020

[23] Has reduced the Standard Rate from 20% to 0% for E-books and online journals, from 20% to 5% for Hospitality and tourism due to COVID-19 till January 2021

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© Granthaalayah 2014-2020. All Rights Reserved.