|

|

|

|

FOREIGN INFLOWS, TRADE AND ECONOMIC GROWTH: EVIDENCE FROM A NEWLY INDUSTRIALIZED COUNTRYRavinder 1 1, 2 Research Scholar, Haryana School of Business, Guru Jambheshwar University of Science & Technology, Hisar, India3 Assistant Professor, Haryana School of Business, Guru Jambheshwar University of Science & Technology, Hisar, India |

|

||

|

|

|||

|

Received 15 December 2021 Accepted 28 January 2022 Published 17 February 2022 Corresponding Author Ravinder,

ravinderhsbgju@gmail.com DOI 10.29121/ijetmr.v9.i2.2022.1099 Funding:

This

research received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright:

© 2022

The Author(s). This is an open access article distributed under the terms of

the Creative Commons Attribution License, which permits unrestricted use, distribution,

and reproduction in any medium, provided the original author and source are

credited.

|

ABSTRACT |

|

|

|

The

current paper analyzes the underlying relations between Foreign Inflows,

Trade and Economic Growth in the case of Turkey over the period 1970-2019.

The novel technique of ARDL is applied to investigate the presence of a long-

and short-run relationship amongst Foreign Inflows, Trade and Economic

Growth. The findings revealed the existence of a cointegrating relationship

among the variables. Further, outward inflows and export are the key elements

of economic progress in the long run in Turkey. Many important inferences can

be made from the estimation results in the study such as the concerned

authorities should focus on increasing stockholders’ confidence in the

country by reducing political uncertainty and providing a favorable

environment to foreign investors. Further attention should be paid towards

the amount and productivity of external investment flowing in the country in

such a way that optimum growth can be achieved. |

|

||

|

Keywords: Exports, Imports, Economic Growth, FDI, Turkey, ARDL 1. INTRODUCTION The movement of foreign

inflows had amplified worldwide over the last decades and many experts have

had the opinion that there might be existing a robust connection between

trade, overseas inflows and economic growth Iqbal et al. (2010), Mahmoodi and Mahmoodi

(2016), Oumarou and Maiga

(2019), Saleem et al. (2020), Sandalcilar and Dilek

(2017), Szkorupová (2014). Foreign inflows

have important implications in the external backing of developing and

developed countries across different sectors. Capital inflows of foreign

investors and companies in developing countries allow strengthening

infrastructure, increasing creativity, boosting export, output and producing

employment generations. Additionally, FDI acts as a source to obtain advanced

technology and mobilize foreign exchange resources. The importance of outward investment in

the development of host and home countries continues to be an area of debate

among the experts not only because of the multiple direct and indirect

beneficial effects but because of an upsurge in the foreign flows in recent

few decades, following the impact of the globalization. The chief drive of the

current work is to give an intense outline about the effect of foreign

inflows on economic growth and likewise to explore the causal connection amid

GDP, trade, and foreign inflows, in the case of Turkey. |

|

||

FDI is generally taken as an exogenous variable while studying the notional and experimental influence of foreign influx because various factors affecting the FDI are not taken into account. Further, the pattern and association between Foreign Inflows and growth are contingent on various social and institutional factors. It is reported in various studies that various factors such as skilled labour, political stability, institutional quality, etc. positively influence the relationship between overseas inflows and growth. Foreign inflows stimulate economic development through various ways such as encouraging sector-level growth, expanding technological advances and accumulation of capital, etc.

Turkey, categorized as a newly industrialized country (NIE), has made significant progress in the last few decades. Exports and imports of Turkey rise from $ 2.0 billion and $ 3.9 billion in 1974 to $ 245 billion and $ 227 billion, respectively in 2019. FDI inflows augmented from $.058 billion in 1970 to $ 09 billion in 2019 while the worth of GDP amplified from $17 billion in 1970 to $761 billion in 2019. This significant increase in both variables captures attention towards the practicality of the theoretical relation amid the FDI, trade and growth. Therefore, the present study explores the relation amongst foreign inflows, trade, and economic growth in Turkey for the period of 1970-2019 applying various sophisticated time-series methods, specifically the Augmented Dickey-Fuller unit root test, ARDL model and Bound test.

|

|

|

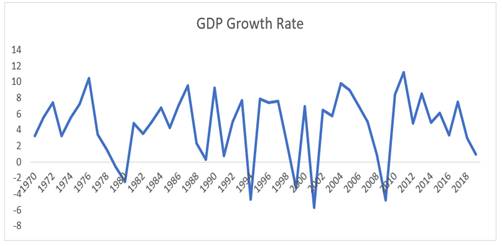

Figure 1 GDP annual Growth Rate of

Turkey Source: World Bank |

As shown in Figure 1, the GDP growth of Turkey is widely fluctuating. The GDP growth in 1970 was 5.56 percent while it recorded negative growth at the beginning of the 1980s. Growth reaches 9.48 percent in 1987 while going to its lowest in 2002 to -5.75 percent. GDP growth declined in 2016 and rise further to 7.50 percent in 2017. The failed coup attempt in July 2016 might be the reason behind the sharp decline along with other factors. Further GDP growth is showing a declining trend since 2011. Turkish growth experience since 2002 is considered as domestic demand driven İzmen and Yılmaz (2009). Thus, wide fluctuations are visible in the growth rate of GDP in Turkey implying a significant impact of various political as well as economic factors. Turkey has been quite vulnerable to internal political vagueness and the uncertain economic policies of consecutive governments as well as external shocks.

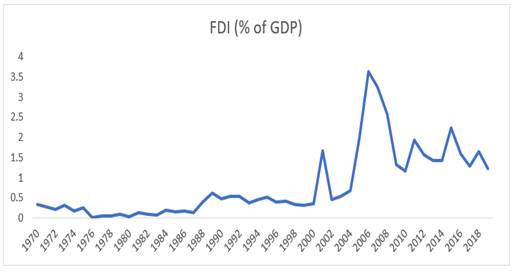

As shown in Figure 2, the trends in FDI inflows in Turkey revealed that FDI inflows increased significantly following the amalgamation of the Turkish economy with the rest of the world economy during the second half of the 1990s. However, flows significantly grew during the economic crisis of 2001 (1.6 % of GDP) but continuously increased after European Union decided to start agreement talks with Turkey in December 2004 İzmen and Yılmaz (2009).

|

|

|

Figure 2 Foreign Direct

Investments in Turkey Source: World Bank |

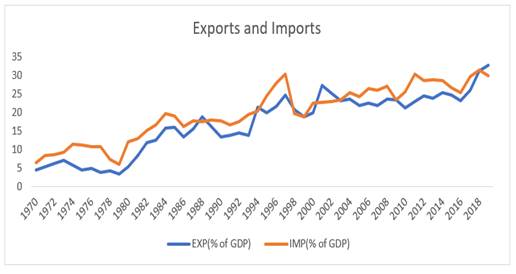

Liberalization of foreign trade in the 1980s characterized the high surge in the ratio of export and import to GDP. The ratio of exports to GDP amplified more than triple (15.62% in 1984 and 27 % in 2001) while the ratio of imports to GDP also augmented more than twice. Further economic integration process gained momentum after the country agreed to form Custom Union with the EU in 1996 and economic predicament in 2001 İzmen and Yılmaz (2009).

|

|

|

Figure 3 Exports

and Imports of Turkey Source: World Bank |

Therefore, it is quite interesting to examine the nexus between foreign inflows, trade, and economic growth in Turkey. The following prominent research has been reviewed to gain deep insights into the relationship between foreign inflows, trade, and economic growth.

Gunaydin and Tatoglu (2005) investigated the causal nexus amid Foreign Inflows and economic growth in Turkey considering data from 1968-2002. Results indicated that the two were cointegrated in the long run while empirical evidence also submitted bi-directional causality amid Foreign Inflows and GDP. Miankhel et al. (2009) observed the association amid export, FDI and GDP growth among selected emerging economies for 1970-2005. The Granger causality test with VECM was used for the direction of causality. Findings suggested unidirectional causality between export and growth in South Asia. Further, bi-directional rapport among exports, Foreign Inflows and GDP in Malaysia, while uni-directional relationship for Thailand was found in long run.

Iqbal et

al. (2010) explored the nexus

amid Trade, Foreign inflows, and Economic growth using data from 1998 to 2009

in Pakistan. The VECM framework was used to test the connection between the

variables. The results suggested long-run rapport among the factors. Further,

outcomes of the VECM test indicated bidirectional causation between exports,

FDI and economic growth. Moreover, Foreign Direct Investment had a positive

bearing on the trade growth rate in Pakistan. Kakar et

al. (2011) highlighted the

bearing of trade openness and foreign influx on economic growth by comparing

Pakistan & Malaysia from 1980 to 2010 by applying the Granger causality

test and Johansen co-integration test. The study occasioned that in long run, the

growth rate has been impacted by trade openness. Also, trade openness has

become an important key determinant of economic growth. Arya and Singh (2021) examined the nexus

between external debt and economic growth in SAARC nations for the period 1971

to 2020 using the panel ARDL approach and findings negative debt-growth

relationship. Sharma

and Kaur (2013) highlighted the

causation between FDI and trade in China and India from 1976 to 2011 with the

help of the Granger causality test. The results indicated that the

unidirectional causality has been found running from FDI to imports and exports

in the case of China but in the case of India, bidirectional causation was

found between FDI and exports and imports. Rehman

(2016) used panel data from 1970 to 2012

to explore the association between FDI and GDP. The author used GDP per capita,

FDI, Literacy rate and exports data from UNCTAD. The empirical results reported

economic growth to be an explanatory variable while FDI depended on the

economic growth, but the relationship was not vice-versa. Further economic

growth in Pakistan was determined by FDI, human capital and exports.

Adhikary (2017) investigated various macroeconomic elements of FDI in five South Asian countries. The author used fully modified ordinary least squares for analysis. The results showed that a large number of macroeconomic variables were determining the FDI inflows however no explicit set of FDI determinants exists in all the countries of South Asia. Carbonell and Werner (2018) analysed the impact of FDI on GDP from 1984 to 2010 for Spain. The evidence was found in support for the neutral hypothesis suggesting no influence from FDI to economic growth. Further growth was also not affected by the Spanish EU and euro entry in Spain.

Bilas (2020) analysed the association between FDI and economic growth in Croatia from 2000 to 2019. The author used of Engle cointegration and Johansen cointegration test. The study indicated that no long-run nexus was inferred amid FDI and Economic Growth. Moreover, no Granger causality was found between Foreign Direct Investment and Economic Growth. Singh and Kumar (2020) examined the long-run rapport among Exports, Imports and Economic Growth using yearly data for 1995 to 2018. The authors used ADF Test and Cointegration Test for the relationship. The results of the Granger Causality test unveiled two-way causality amid Exports and economic progress. Also, a uni-directional connection was found between GDP and Imports.

Sharma and Kautish (2020) employed nonlinear ARDL with an unknown structural break to inspect how certain macroeconomic variables were pouring FDI influxes in India over the period 1979 to 2016. Also, the influence of downward and upside arrangements of microelements on FDI in India was examined. The results indicated the presence of a positive connection between Foreign Direct Investment and Economic Growth. Sindze, Nantharath and Kang (2019) examined the causal relationship between key macroeconomic indicators for the Central African Economic and Monetary Community (CEMAC) during the period 2007-2017. The findings exposed that foreign inflow has a negative effect on the GDP of Congo and Gabon but a positive impact on Cameroon, Chad, Central Africa Republic, and Equatorial Guinea. Odhiambo (2021) examined the casual connection amid foreign inflows and economic growth in Kenya in the period 1980–2018 by applying the ARDL approach. The findings indicated one-way causation from economic growth to foreign inflows.

Hobbs et al. (2021) investigated the associations midst foreign flows, trade, and economic growth using yearly data in Albania. The results reported a long-term connection between foreign inflows, trade, and economic growth and unidirectional causality from economic growth to exports and foreign influx. Liang et al. (2021) investigated the connection between foreign inflow and economic growth and reported a positive connection between foreign influx and economic growth. The study also found that economic policies, institutional hearings, and absorption levels also positively influence the nexus while the FDI-GDP nexus is also influenced by the quantity and type of FDI inflow.

It seems from the review of the existing literature that a consensus has not been reached yet how and in what way, foreign investments exactly related to the growth of emergent economies and its varying positive/ negative effect on economic growth are yet irresolute for the economies existing at different levels of the economy.

2. MATERIALS AND METHODS

The study analyses the connection between FDI, Trade and Economic Growth in Turkey by taking yearly data from World Development Indicators (WDI) considering the period 1970 to 2019 World Bank (2019). Foreign net inflows as a percentage of GDP are taken to proxy for FDI while, GDP growth is calculated as the monetary worth of all ultimate goods and services manufactured and marketed in a country in one year, and trade as exports and imports made by the country.

The sophisticated technique of the Autoregressive Distributed Lag model is used for the study. ARDL method offers various advantages over the other techniques of cointegration (Engle-Granger Cointegration and Johansen Cointegration test) such as it provides efficient results in case of a small sample and can be used nonetheless of the order of integration. Augmented-Dickey Fuller and Phillip-Perron Unit root tests are used done for determining the instance of a unit root. ARDL bound testing is done for long and short-run coefficients.

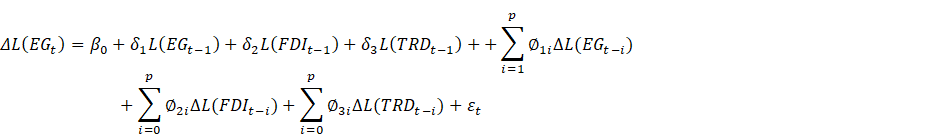

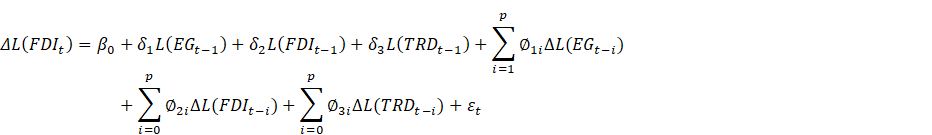

Where, β0 is the drift, δ1, δ2, δ3 are long-run quantities while the lagged values of FDI, Trade and Economic growth used along with the delta (Δ) operator represent the coefficients of short-run. p is the maximum lag order determined as per AIC and ε is the error term which is identically and independently distributed. The hypothesis under the model are as follows:

H0: δ1= δ2= δ3= δ4=0(no long run relationship)

Ha: δ1≠ δ2≠ δ3≠ δ4≠0 (long-run relationship)

If the joint significance F-statistic exceeds the critical value, the null hypothesis gets rejected and vice versa. However, if F-statistics is in between upper and lower bounds, the conclusion is indecisive. Afterward, we estimated the short-run coefficients and also examined for Error Correction term which illustrates the rate at which the disequilibrium is being corrected. Finally, diagnostic testing is done to confirm the stability of the parameters. Various tests such as Serial Correlation LM test, Heteroscedasticity and the normality of the residuals are tested, and the stability of the coefficients is tested by recursive methods (CUSUM and CUSUM Square graph).

3. RESULTS AND DISCUSSIONS

|

Table 1 Summary Statistic |

||||

|

Variables |

GDP |

FDI |

EXP |

IMP |

|

Mean |

4.53566 |

0.80016 |

17.0223 |

19.8762 |

|

Std. Dev. |

4.04636 |

0.85393 |

8.06817 |

7.31776 |

|

Minimum |

-5.75 |

0.0195 |

3.21803 |

5.88172 |

|

Maximum |

11.2001 |

3.62338 |

32.7414 |

31.3425 |

|

Skewness |

-0.8058 |

1.50975 |

-0.3001 |

-0.2753 |

|

Kurtosis |

3.14826 |

4.80067 |

1.99161 |

1.9739 |

|

Jarque-Bera |

5.45736 |

25.7496 |

2.86914 |

2.82486 |

|

Probability |

0.06531 |

3E-06 |

0.23822 |

0.24355 |

|

Observations |

50 |

50 |

50 |

50 |

|

Source: The

Authors |

||||

Table 1 encapsulates the nature, pattern, and shape of four macroeconomic variables of Turkey. The minimum GDP growth in Turkey is -5.75 percent while the average growth is 4.53 percent. The FDI inflows in Turkey are highly skewed, while import, exports and GDP growth rates are negatively skewed. Jarque-Bera statistics of all the variables except FDI is greater than 5 % that confirming the normal distribution of variables.

Further valuable intuition could be made from the unconditional correlation matrix given in Table 2, which provides the apparent degree of mutuality or co-movement among the variables. GDP is positively and significantly related to FDI and import while negatively related to FDI. FDI is positively related to exports and imports (0.61 and 0.65 respectively). Import is highly related to Export and Import while moderately related to GDP. But these corollaries are based on unconditional correlation which needs to be confirmed from conditional correlations.

|

Table 2 Correlation matrix |

||||

|

Variables |

GDP |

FDI |

EXP |

IMP |

|

GDP |

1 |

- |

- |

- |

|

FDI |

0.02 |

1 |

- |

- |

|

EXP |

-0.01 |

0.61 |

1 |

- |

|

IMP |

0.17 |

0.65 |

0.94 |

1 |

|

Source:

The Author |

||||

Table 3 abridged the results of the Dickey-Fuller and Phillip-Perron test for analysing the stationarity. The Dickey-Fuller and PP test reveal that the GDP series is integrated to order 0 while FDI, Import and Export series are integrated to order one. Since the different series are integrated at dissimilar levels, the ARDL procedure is adopted to observe the long-run connection amongst the variables.

|

Table 3 ADF and PP Unit Root Test |

|||||

|

Variables |

ADF |

PP |

Variables2 |

ADF3 |

PP4 |

|

At Level |

At Difference |

||||

|

GDP |

-6.76153*** |

-6.75594*** |

DGDP |

-7.64202*** |

-22.4512*** |

|

FDI |

-2.1154 |

-2.0076 |

DFDI |

-6.5534*** |

-12.1387*** |

|

EXP |

-0.7184 |

-0.5526 |

DEXP |

-6.98943*** |

-7.10461*** |

|

IMP |

-1.5937 |

-1.3493 |

DIMP |

-6.88716*** |

-9.86187*** |

|

Note.

The asterisks ***, **, * denote significance as per convention Source: The

Author |

|||||

|

Table 4 ARDL Bound Test to Cointegration |

|

|||||||||||||||

|

Model |

ARDL |

F-statistics |

Decision |

|

||||||||||||

|

GDP (GDP/FDI, EXP, IMP |

ARDL (1,0,0,0) |

18.46521 |

Cointegration |

|

||||||||||||

|

FDI (FDI/GDP, EXP, IMP |

ARDL (1,0,0,0) |

11.5311 |

Cointegration |

|

||||||||||||

|

EXP (EXP/FDI, GDP, IMP |

ARDL (1,0,0,0) |

22.34278 |

Cointegration |

|

||||||||||||

|

IMP (IMP/FDI, EXP, GDP |

ARDL (1,0,0,0) |

24.72685 |

Cointegration |

|

||||||||||||

|

Critical Value of the F-statistics |

|

|||||||||||||||

|

90% |

95% |

99% |

||||||||||||||

|

k |

I (0) |

I (1) |

I (0) |

I (1) |

I (0) |

I (1) |

||||||||||

|

3 |

2.538 |

3.398 |

3.048 |

4.002 |

4.188 |

5.328 |

||||||||||

|

Source: The Author |

||||||||||||||||

The bound test is executed to establish the long-run connection amongst the variables, which is based on joint F-statistic under the maintained proposition of no cointegration. It is observed from Table 4 that the F-value for all the four macroeconomic variables (GDP, FDI, Import and Export) is significantly larger than the upper critical value, indicating the substantial long-run connection amongst the fundamental variables. Thus, we can say that the long-run causation exists amongst the economic growth, FDI, export and import of Turkey. These results confirm the findings of Gunaydin and Tatoglu (2005) and İzmen and Yılmaz (2009) who found a positive association between FDI, Export-Import and the Economic progress of Turkey. Further, Gunaydin and Tatoglu (2005) provided bi-directional causality between FDI and Economic Growth.

Long and Short-run

causality

The results of long and short-run causation for four macroeconomic variables are reported in Table 5. The ECT fits in the short-run causation with the long-run dynamics without losing long-run information. The Error Correction Term is negative and substantial implying that the GDP of Turkey moves to the equilibrium at the rate of 1.07% following the deviations in another variable. Narayan and Smyth (2006).

|

Table 5 Short and

Long-run Coefficients of ARDL Model |

||||

|

A. Long-run outcomes |

||||

|

Dependent Variable: GDP |

||||

|

Regressor |

Coefficient |

std. error |

t-Statistics |

Prob. |

|

D(FDI) |

0.6056 |

1.2844 |

0.4715 |

0.6397 |

|

D(EXP) |

-1.6489 |

0.488 |

-3.379 |

0.0016 |

|

D(IMP) |

1.9551 |

0.5801 |

3.3706 |

0.0016 |

|

C |

4.5126 |

0.6248 |

7.2219 |

0 |

|

B. Short-run outcomes |

||||

|

Dependent Variable: GDP |

||||

|

Regressor |

Coefficient |

std. error |

t-Statistics |

Prob. |

|

GDP (-1) |

0.222 |

0.1393 |

1.5938 |

0.1185 |

|

D(FDI) |

0.4711 |

1.0283 |

0.4582 |

0.6492 |

|

D(EXP) |

-1.2828 |

0.2462 |

-5.2098 |

0 |

|

D(IMP) |

0.9802 |

0.2156 |

4.5466 |

0 |

|

D (IMP (-1)) |

0.5408 |

0.2003 |

2.7004 |

0.0099 |

|

CointEq(-1) |

-1.0715 |

0.1468 |

-7.298 |

0 |

|

C |

3.5107 |

0.7908 |

4.4394 |

0.0001 |

|

Diagnostic Testing |

||||

|

Diagnostic tests |

Statistics |

p-value |

||

|

R2 |

0.449848 |

|||

|

Adjusted R2 |

0.384353 |

|||

|

Durbin-Watson stat |

2.312708 |

|||

|

F-statistics |

6.868499 |

0.000092 |

||

|

JB (Normal) |

1.667835 |

0.434344 |

||

|

LM (Serial correlation) |

1.560903 |

0.176 |

||

|

Heteroscedasticity |

1.213442 |

0.3196 |

||

|

Source:

The Author |

||||

|

|

|

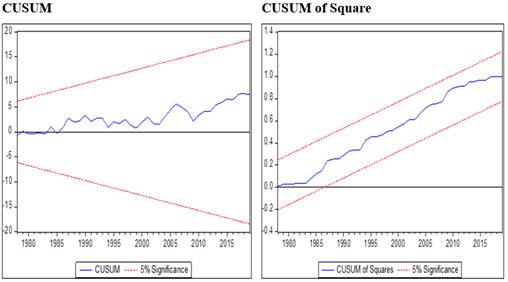

Figure 4 CUSUM

and CUSUM SQ Graphs Source: The Author |

We have also validated the stability of the model and the estimated coefficients by using various robustness tests. The values of the cumulative sum of recursive residuals (CUSUM) and square test (CUSUMSQ) tests are lying within the 5% critical interval implying stability of the parameters. The estimated residuals are found to be normally distributed and there is no presence of autocorrelation and heteroscedasticity, supporting the results.

4. CONCLUSIONS AND RECOMMENDATION

Turkey is a newly industrialized country, facing varied fluctuations at the macroeconomic level widely due to political uncertainty in the internal and external environment of the country. GDP growth and the inflows of external investment are showing declining trends since the beginning of the decade while trade has increased significantly. The present paper observes the causal relation amongst foreign influx, trade and economic progress in Turkey considering the period 1970-2019. The novel estimation technique of the ARDL bound approach is applied to investigate the existence of a long-run and short-run connection between FDI, trade and economic progress. The results revealed that there exists a long-run connection amongst the foreign inflows, trade, and the economic growth of Turkey. Further, foreign direct investment and exports are the key elements of economic growth in the long run in Turkey. These results confirm the findings of Gunaydin and Tatoglu (2005) and İzmen and Yılmaz (2009) who found the positive impact of FDI and export-import over the economic growth of Turkey. Further, Gunaydin and Tatoglu (2005) provided two-way causation between Foreign Influx and Economic Progress. Many important inferences can be made from the estimation results in the study. The authorities should focus on increasing investors’ confidence in the country by reducing political uncertainty and providing a favourable environment for foreign investors. Further, the authorities should pay attention to the amount and kind of external investment flowing in the country and emphasize productive investment. Policies should be developed in such a way that optimum growth can be achieved.

ACKNOWLEDGEMENTS

We are thankful to the editor and anonymous referees for their useful comments. We are also thankful to Ms. Vandana, Research Scholar at Haryana School of Business, for her assistance in econometric methodology.

REFERENCES

Adhikary, B. K. (2017). Factors influencing foreign direct investment in South Asian economies : A comparative analysis. South Asian Journal of Business Studies, 6(1), 8-37. Retrieved from https://doi.org/10.1108/SAJBS-10-2015-0070

Al Jazeera. (2017) Turkey's failed coup attempt : All you need to know 15 Jul 2017. Retrieved from https://doi.org/10.12968/npre.2017.15.5.230

Arya, V., & Singh, S. (2021). Revisiting the Nexus between External Debt and Economic Growth in the SAARC Countries : A Panel ARDL Approach. Available at SSRN 3993122. Retrieved from https://doi.org/10.2139/ssrn.3993122

Bermejo Carbonell, J., & Werner, R. A. (2018). Does foreign direct investment generate economic growth ? A new empirical approach applied to Spain. Economic geography, 94(4), 425-456. Retrieved from https://doi.org/10.1080/00130095.2017.1393312

Bilas, V. (2020). Examining the Relationship Between Foreign Direct Investment and Economic Growth : Evidence from Croatia. Montenegrin Journal of Economics, 16(2), 117-129. Retrieved from https://doi.org/10.14254/1800-5845/2020.16-2.9

World Bank, (2019). World Development Indicators. Retrieved from https://databank.worldbank.org/reports.aspx?source=world-development-indicators

Gunaydin, I., & Tatoglu, E. (2005). Does foreign direct investment promote economic growth ? Evidence from Turkey. Multinational Business Review, 13(2), 89. Retrieved from https://doi.org/10.1108/1525383X200500010

Hobbs, S., Paparas, D., & E AboElsoud, M. (2021). Does Foreign Direct Investment and Trade Promote Economic Growth ? Evidence from Albania. Economies, 9(1), 1. Retrieved from https://doi.org/10.3390/economies9010001

Iqbal, M. S., Shaikh, F. M., & Shar, A. H. (2010). Causality relationship between foreign direct investment, trade and economic growth in Pakistan. Asian Social Science, 6(9), 82. Retrieved from https://doi.org/10.5539/ass.v6n9p82

Kakar, Z. K., Khilji, B. A., & Khan, M. J. (2011). Financial development and energy consumption : empirical evidence from Pakistan. International Journal of Trade, Economics and Finance, 2(6), 469. Retrieved from https://doi.org/10.7763/IJTEF.2011.V2.150

Liang, C., Shah, S. A., & Bifei, T. (2021). The Role of FDI Inflow in Economic Growth: Evidence from Developing Countries. Journal of Advanced Research in Economics and Administrative Sciences, 2(1), 68-80. Retrieved from https://doi.org/10.47631/jareas.v2i1.212

Mahmoodi, M., & Mahmoodi, E. (2016). Foreign direct investment, exports and economic growth: Evidence from two panels of developing countries. Economic Research-Ekonomska Istrazivanja, 29(1), 938-949. 2 Retrieved from https://doi.org/10.1080/1331677X.2016.1164922

Miankhel, A. K., Thangavelu, S. M., & Kalirajan, K. (2009). Foreign direct investment, exports, and economic growth in South Asia and selected emerging countries : à multivariate VAR analysis. Center for Contemporary Asian Studies. CCAS Working paper, 23.

Murad Sezer. (2016) Policemen stand atop military armored vehicles after troops involved in the coup surrendered on the Bosphorus Bridge in Istanbul July 16, 2016.

Nantharath, P., & Kang, E. (2019). The effects of foreign direct investment and economic absorptive capabilities on the economic growth of the Lao People's Democratic Republic. The Journal of Asian Finance, Economics and Business, 6(3), 151-162. Retrieved from https://doi.org/10.13106/jafeb.2019.vol6.no3.151

Narayan, P. K., & Smyth, R. (2006). The dynamic relationship between real exchange rates, real interest rates and foreign exchange reserves : empirical evidence from China. Applied Financial Economics, 16(9), 639-651. Retrieved from https://doi.org/10.1080/09603100500401278

Odhiambo, N. M. (2021). Foreign direct investment and economic growth in Kenya : An empirical investigation. International Journal of Public Administration, 1-12. Retrieved from https://doi.org/10.1080/01900692.2021.1872622

Oumarou, I., & Maiga, O. A. (2019). A Causal Relationship Between Trade, Foreign Direct Investment and Economic Growth in Niger. Journal of Social and Economic Statistics, Retrieved from https://doi.org/10.2478/jses-2019-0003

Rehman, N. U. (2016). FDI and economic growth : empirical evidence from Pakistan. Journal of Economic and Administrative Sciences, 32(1), 63-76. Retrieved from https://doi.org/10.1108/JEAS-12-2014-0035

Saleem, H., Shabbir, M. S., & Bilal khan, M. (2020). The short-run and long-run dynamics among FDI, trade openness and economic growth: using a bootstrap ARDL test for co-integration in selected South Asian countries. South Asian Journal of Business Studies, 9(2), 279-295. Retrieved from https://doi.org/10.1108/SAJBS-07-2019-0124

Sandalcilar, A. R., & Dilek, Ö. (2017). Foreign Direct Investments, Export and Economic Growth : Evidences from Selected Developing Countries. Uluslararası İktisadi ve İdari İncelemeler Dergisi, (19), 197-210. Retrieved from https://dergipark.org.tr/tr/pub/ulikidince/issue/29069/286749

Sharma, R., & Kaur, M. (2013). Causal links between foreign direct investments and Trade : A Comparative study of India and China. Eurasian Journal of Business and economics, 6(11), 75-91.

Sharma, R., & Kautish, P. (2020). Examining the nonlinear impact of selected macroeconomic determinants on FDI inflows in India. Journal of Asia Business Studies. Retrieved from https://doi.org/10.1108/JABS-10-2019-0316

Sindze, P., Nantharath, P., & Kang, E. (2021). FDI and Economic Growth in the Central African Economic and Monetary Community (CEMAC) Countries : An Analysis of Seven Economic Indicators. International Journal of Financial Research, 12(1). Retrieved from https://doi.org/10.5430/ijfr.v12n1p1

Singh, K., & Kumar, A. (2020). empirical analysis of India's foreign trade and economic growth. International Journal of Research-GRANTHAALAYAH, 8(10), 105-111. Retrieved from https://doi.org/10.29121/granthaalayah.v8.i10.2020.1805

Szkorupová, Z. (2014). A Causal Relationship between Foreign Direct Investment, Economic Growth and Export for Slovakia. Procedia Economics and Finance, 15(14), 123-128. Retrieved from https://doi.org/10.1016/S2212-5671(14)00458-4

THE INVESTOPEDIA TEAM. (2020) Emerging Market Economy March 16, 2020. Retrieved from https://www.investopedia.com/terms/e/emergingmarketeconomy.asp

UNCTAD (2020c). World Investment Report 2020 : International Production Beyond the Pandemic. United Nations publication. Sales No. E.20. II. D.23.

Verma, R. A. V. I. N. D. E. R., Saini, V. P., & Arya, P. (2021). Impact of Macroeconomic Determinants on Economic Growth in Bangladesh : An ARDL Approach. Available at SSRN 3993498 Retrieved from https://doi.org/10.2139/ssrn.3993498

İzmen, Ü., & Yılmaz, K. (2009). Turkey's recent trade and foreign direct investment performance. Turkey and the Global Economy. London : Routledge, 173-204

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© IJETMR 2014-2022. All Rights Reserved.