|

|

|

|

A VENDOR-BUYER SUPPLY CHAIN MODEL WITH IMPERFECT PRODUCTION UNDER TIME, PRICE AND PRODUCT RELIABILITY DEPENDENT DEMANDBiswarup Samanta 1 1, 3, 4 Department of Mathematics, Jadavpur University, Kolkata,700032, India2 Regent Engineering College, Barrackpore, Kolkata 700121, India |

|

||

|

|

|||

|

Received 20 September 2021 Accepted 01 October 2021 Published 22 October 2021 Corresponding Author Biswarup

Samanta, biswarupsamanta6@gmail.com DOI 10.29121/ijetmr.v8.i10.2021.1046 Funding:

This

research received no specific grant from any funding agency in the public,

commercial, or not-for-profit sectors. Copyright:

© 2021

The Author(s). This is an open access article distributed under the terms of

the Creative Commons Attribution License, which permits unrestricted use, distribution,

and reproduction in any medium, provided the original author and source are

credited.

|

ABSTRACT |

|

|

|

This

article investigates a single-vendor single-buyer supply chain model where

the market demand depends on time as well as selling price and product

reliability. The vendor’s production rate is not constant but depends on the

market demand. The vendor’s production process is not perfectly reliable; it

may produce some percentage of defective items during a production run. The

vendor takes up a lot-for-lot policy for delivering the ordered quantity to

the buyer who performs 100% screening after receiving each lot. The average

total profit of the integrated supply chain is derived and a numerical

example is taken to validate the developed model. The optimal results of the

proposed model are also discussed for some particular cases. Sensitivity

analysis is performed to investigate the influence of key model-parameters on

the optimal results. |

|

||

|

Keywords: Supplychain; Vendor; Buyer; Pricing; Reliability; Imperfect Production 1. INTRODUTION Over the past several

decades, the integration of the individual mind-sets of the vendor and the

buyer into the supply chain has been a matter of curiosity to many supply

chain researchers. This helps to identify problem areas in the process,

allows businesses to take decisive steps and reduce costs to improve on final

prices. Improving end-customer gratification and reliability is a by-product

of an integrated supply chain as customer’s perception improves on-time

delivery. The integrated policy makes the supply chain more transparent,

making buyers and vendors more flexible and progressive in relation to each

other and to the market. Undoubtedly the market demand plays a vital role in

determination of such an integrated policy. There are many products

for which the market demand may increase with the passage of time. However,

there are many other factors like product price, after sales service,

advertisement, product quality, etc. which can also affect the market demand.

When a customer wants to buy a product from a shopping mall or supermarket,

two things are knocked in his/her mind. What is the price of the product? How

reliable the product is? Price and reliability play important roles in the

minds of strong customers while buying a product like mobile phone or laptop.

Apple is outstanding for its superior quality but it is so expensive that it

always remains beyond the reach of the middle class family. It only

influences high class customers. On the other hand, Samsung |

|

||

and Lenovo are famous for products that reach relatively low prices and features. Consumer’s preference for higher prices to quality will influence himself to buy Apple products which are regarded suitable for their requirements. By preferring features and prices, end-customers’ accommodate on product quality and buy Samsung or Lenovo products. The vendors need both advanced manufacturing processes and good quality raw materials if they want to produce high reliability products. To assemble laptops, Lenovo uses low cost raw-materials to reduce overall costs whereas Apple uses very high quality ingredients in MacBooks and hence overall costs increases. To optimize a firm’s profit, a balance needs to be struck between time, price and reliability of its product.

Integrated supply chain

models have been developed in the literature based on some limited assumptions.

One of these assumptions is that the vendor produces products of perfect

quality. In fact, there can be a few imperfect items in any production lot due

to poor control of processes, non-adherence to plans, inappropriate operating

guidelines, and so on. If the vendor has to pay extra cost for each defective

item produced then it is profitable to reduce the number of defective items in

the production process. The rate of defective items produced by the vendor

affects other critical decisions such as the vendor’s production lot size and

reliability of the product. Further, a vendor has a reputation for making more

reliable product which is preferable for a buyer to place an order. To improve

the quality of a product, investment can be made to reduce errors in the

vendor’s production process. In an integrated supply chain system, when

non-conformable items are produced, it is most likely that some kind of

supervision/inspection activity needs to be performed by the buyer before

selling the goods to the end customers.

This article develops an

integrated single-vendor single-buyer supply chain model with time, price and

reliability dependent market demand. The vendor’s production process is

imperfect and it rejects all the non-conformable items produced during a

production run. The buyer screens all the items before selling to

end-customers. The defective items are sold in the secondary market with a

discount. The vendor plans for a lot-for-lot production policy to meet the

buyer’s demand. The primary objectives of this article are to find the response

of the following queries:

1)

How much time

will be taken by the vendor and the buyer to produce a lot and sell to

customers?

2)

How much time

will be delayed by the vendor to produce items ordered by the buyer?

3)

What will be the

selling price of each good item from the buyer’s side?

4)

What will be the

reliability of a product produced by the vendor?

The rest of the paper is

arranged as follows: In the next section, the related literatures are reviewed.

Section 3 presents assumptions and notations for developing the proposed model.

Section 4 discusses the mathematical model and solution procedure. A numerical

example is provided in Section 5. The optimal results are analyzed in Section

6. Section 7 concludes the paper and indicates some future research

directions.

2.

LITERATURE REVIEW

In reality, the market

demand of certain products may not remain constant always; it may change with

the passage of time. Hariga and Benkherouf (1994) presented a heuristic inventory model in which the

market demand changes exponentially in time over a finite planning horizon. Hariga (1996) developed an inventory lot-sizing model with time-varying demand for

deteriorating items. An inventory model with Weibull deterioration, time

proportional demand rate and effects of inflation was developed by Chen (1998). Khanra and Chaudhuri (2003) proposed an inventory model with quadratic time dependent demand where

the on-hand inventory deteriorates with time. Ghosh and

Chaudhuri (2006) developed this model by considering shortages in inventory. Actually, a

large volume of research papers on time dependent demand are available in the

literature Giri and Maiti

(2012), Chowdhury et al. (2014), Samanta

et al. (2018)

Now-a-days the

customer’s demand depends not only on time but also on other factors such as

product price, after sales service, advertisement, product quality, etc. Price

of a product plays an important role in customer’s mind. So, it is more

realistic to include price sensitive demand. Burwell et al.

(1991) determined the optimal lot size and selling price when a supplier offers

all-unit quantity discounts by considering price-dependent demand and allowing

for shortages. A finite period system was considered by Datta and Paul (2001) under multi-replenishment scenario, where the demand rate is influenced

by both displayed stock level and selling price. An economic production

quantity (EPQ) model for deteriorating items was developed by Teng and Chang (2005) where the demand rate depends on the selling price and display stock

level with limited display space consideration. You (2005) investigated a supply chain model in which a leading member of the supply

chain gets the scope to settle value of the product to impress demand and more

revenues. Avinadav et al. (2013) formulated a model for finding the optimal pricing, order quantity and

replenishment period for deteriorating items with price- and time-dependent

demand. Yang et

al. (2013) studied a piecewise production-inventory model for a deteriorating item

with time-varying and price-sensitive demand to optimize the vendor’s total

profit. Herbon

and Khmelnitsky (2017) considered a dynamic pricing policy for perishable products, attracting

customers to buy less-fresh products due to expiry, potentially increasing

revenue and eliminating waste. Numerous works in this direction could be found

in the literature You and Hsieh

(2007), Chen et

al. (2010), Ghosh et

al. (2011), Kim et

al. (2011), Bhunia and Shaikh

(2014), Maiti

and Giri (2015), Giri and

Roy (2015), Maiti

and Giri (2017), Chan (2019), Roy and

Giri (2020).

When end-customers buy

some goods from buyers, it is the outcome of the endeavors of several members

of supply chains. But, the main credit goes to the vendor as the customer

prefer that product for his reliability. So, the balance between price and

reliability is an important factor in inventory/supply chain management.

Therefore, the reliability of a product must be taken into consideration. An

EPQ model with a flexible and imperfect production process was proposed by Cheng (1989) under reliability consideration. Sadjadi et al. (2009) considered a production-marketing problem where the reliability of the

production process assumed to be imperfect and the inventory and the setup

costs per production cycle are not known in advance. An inventory model with

imperfect production process was developed by Shah and Shah (2014) for time-declining demand pattern where reliability of the production

process was considered as a decision variable. Shah and Vaghela (2018) analysed EPQ model with time and advertisement sensitive demand with the

effect of inflation and reliability.

The above works

considered reliability of the product and its effect on the optimal results.

However, none of these works would consider the market demand as a function of

reliability of the product. Khara et al. (2017) considered a model that deals with an imperfect production process, where

both perfect and imperfect quality items are produced and demand depends on

selling price and reliability of the product. Later, Khara et al. (2019) developed that model by considering demand as a function of selling

price, reliability of the product and advertisement cost. Shah and Naik (2020) investigated an inventory model with imperfect production process and

reliability-dependent demand.

Chung

and Wee (2008) developed an integrated production-inventory deteriorating model

considering imperfect production, inspection planning and warranty-period-and

stock-level-dependant demand. Jauhari (2016) proposed a vendor-buyer model where the lot transferred from the vendor

to the buyer contains some defective items and the buyer conducts an imperfect

inspection process to classify the quality of the items. Jauhari et al.

(2016) developed an imperfect production-inventory model where the buyer uses

periodic review policy to manage his inventory. The demand on the buyer side

was assumed to be normally distributed, and the shortage was assumed to be

fully backordered and the defective rate of the items was assumed to be fixed.

In this article, we

consider the market demand as a function of time, selling price and reliability

of the product. The production rate is not constant but depends on the market

demand, as considered by Giri and

Maiti (2012). The variable production rate was also considered by Jauhari et al.

(2016). In the literature, unit production cost is considered as a fixed. But in

reality, it should depends on order quantity to be produced by the vendor. More

production implies less unit production cost and less production implies

expensive production cost. On the other hand, if a vendor prefers to produce an

item with more reliable to keep/increase his reputation in market, then (s)he

has to use raw material which are also more reliable. Thus the material cost

depends on reliability of the product. The demand may change at any time during

production process. In that case, to maintain the on-time delivery to the

buyer, the vendor’s production rate has to be changed. Therefore, we consider

the unit production cost as a function of material cost and production rate.

Variable unit production cost was also considered in different forms by Khara et al. (2017).

3. MODEL ASSUMPTIONS AND NOTATIONS

The notations used

throughout the paper are as follows:

|

|

: |

time interval between successive deliveries

(decision variable) |

|

|

: |

time delayed by the vendor to start

production (decision variable) |

|

|

: |

unit selling price for the buyer(decision

variable) |

|

|

: |

reliability of the product (decision

variable) |

|

|

: |

variable time |

|

|

: |

number of cycles |

|

|

: |

demand rate at the buyer |

|

|

: |

production rate at the vendor |

|

|

: |

scaling constant for production rate |

|

|

: |

set up cost per production run for the

vendor |

|

|

: |

ordering cost per order for the buyer |

|

|

: |

unit stock-holding cost per unit per unit

time for the vendor |

|

|

: |

unit stock-holding cost per unit per unit

time for the buyer |

|

|

: |

quantity produced by the vendor during the

period |

|

|

: |

market demand during the period |

|

|

: |

material cost |

|

|

: |

price elasticity to demand |

|

|

: |

reliability elasticity to demand |

|

|

: |

reliability elasticity to material cost |

|

|

: |

fixed material cost |

|

|

: |

material cost increases the reliability of

the produced item |

|

|

: |

variation constant of tool/die costs |

|

|

: |

transportation cost per shipment |

|

|

: |

unit production cost |

|

|

: |

screening rate |

|

|

: |

unit screening cost |

|

|

: |

unit wholesale price for the vendor |

|

|

: |

discount price per defective item for the

vendor |

|

|

: |

buyer’s inventory level |

|

|

: |

vendor’s inventory level |

|

|

: |

buyer’s profit function |

|

|

: |

vendor’s profit function |

|

|

: |

average total profit to the whole supply

chain |

The following

assumptions are made to develop the proposed integrated vendor-buyer inventory

model:

·

The supply chain

consists of a single-vendor and a single-buyer who stocks and sells a single

product.

·

The demand for a

product depends on time ![]() selling price

selling price ![]() as well as the

reliability of the product

as well as the

reliability of the product ![]() . We assume that the demand rate

. We assume that the demand rate ![]() and

and ![]() are real

constants. This type of demand was considered by Khara et al. (2017).

are real

constants. This type of demand was considered by Khara et al. (2017).

·

The vendor

follows the lot-for-lot policy for replenishment made to the buyer.

·

The buyer

receives the first order from the vendor at time ![]() and (s)he

receives order from the vendor in every

and (s)he

receives order from the vendor in every ![]() time interval.

time interval.

·

Shortages are not

allowed in the buyer’s inventory.

·

As the

reliability of the product depends not only on the manufacturing system but

also on the quality of the raw material of the product, we assume that the

material cost ![]() is an

increasing function of the reliability (

is an

increasing function of the reliability (![]() ) of the product such that

) of the product such that ![]() where

where ![]() and

and ![]() .

.

·

The production

rate of the vendor varies with the demand rate. Also, the production rate is

greater than the demand rate. We take the production rate ![]() as

as ![]() where

where ![]() .

.

·

As the vendor’s

production rate is greater than the buyer’s demand rate, the vendor may start

production with a time delay ![]() in the n-th

production cycle.

in the n-th

production cycle.

·

The production

cost not only depends on the material cost ![]() but also on

tool or die cost, which is proportional to the vendor’s production rate.

Therefore, the unit production cost

but also on

tool or die cost, which is proportional to the vendor’s production rate.

Therefore, the unit production cost ![]() is assumed as

is assumed as ![]() where

where ![]() .

.

·

The vendor’s

production process is not perfectly reliable. During a production run, it may

produce some defective (non-conforming) items.

·

The buyer starts

error-free screening after received products from vendor. We assume that the

number of perfect units is at least equal to the demand during the screening

time.

·

Product quality

may be imperfect. In other words, only ![]() of all produced

items meet the demand while

of all produced

items meet the demand while ![]() of items are

defective. It is apparent that the maximum reliability of the production

process cannot exceed

of items are

defective. It is apparent that the maximum reliability of the production

process cannot exceed ![]() . This type of assumption was also considered by Sadjadi et al.

(2009).

. This type of assumption was also considered by Sadjadi et al.

(2009).

·

The vendor

produced ![]() quantity in

total during n-th production cycle

and delivered to the buyer to meet the customer / market demand

quantity in

total during n-th production cycle

and delivered to the buyer to meet the customer / market demand ![]() in the next

cycle.

in the next

cycle.

4. MODEL FORMULATION

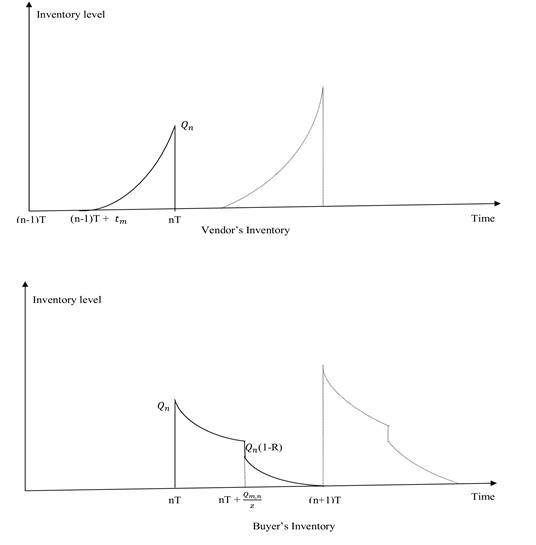

The graphical

presentation of the vendor-buyer model is shown in Figure 1. We suppose that ![]() is the length

of each cycle. For the

is the length

of each cycle. For the ![]() -th cycle, the vendor starts his/her production at

time

-th cycle, the vendor starts his/her production at

time ![]() and the buyer

receives his/her order of quantity

and the buyer

receives his/her order of quantity ![]() from the vendor

at time

from the vendor

at time ![]() ,

, ![]() and meets the

market demand

and meets the

market demand ![]() for period

for period ![]() . The buyer starts screening at a rate of

. The buyer starts screening at a rate of ![]() units per unit

time immediately after receiving the products from the buyer. The buyer’s

screening is completed at time

units per unit

time immediately after receiving the products from the buyer. The buyer’s

screening is completed at time ![]() . We assume that only

. We assume that only ![]() of received

products are acceptable as good products to meet the customer demand. The

customer’s demand rate at time

of received

products are acceptable as good products to meet the customer demand. The

customer’s demand rate at time ![]() is

is ![]() where

where ![]() and

and ![]() are real

constants.

are real

constants.

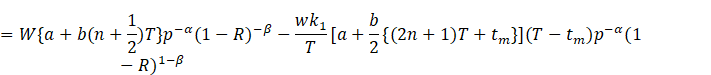

Therefore, the total

demand during the period ![]() is given by

is given by

![]() (1)

(1)

|

|

|

Figure 1 A

schematic diagram to represent the vendor’s and the buyer’s inventory. |

The quantity ![]() produced by the

vendor in the time interval

produced by the

vendor in the time interval ![]() is given by

is given by

![]()

![]() (2)

(2)

4.1. DECENTRALISED MODEL

4.1.1. VENDOR’S PERSPECTIVE

Let ![]() be the vendor’s

inventory level at any time

be the vendor’s

inventory level at any time ![]() . Then the instantaneous states of the vendor’s

inventory level can be described by the differential equation:

. Then the instantaneous states of the vendor’s

inventory level can be described by the differential equation:

![]() (3)

(3)

Solving (3), we get

![]() (4)

(4)

At time ![]() , we have

, we have

![]()

![]()

The vendor’s holding cost per unit time for

the period ![]()

![]()

The vendor’s production cost per unit time in

that period

![]()

As the vendor’s sales revenue = ![]() set-up cost

set-up cost ![]() , discount cost for defective items per unit time =

, discount cost for defective items per unit time = ![]() , therefore, the vendor’s total profit per unit time

is given by

, therefore, the vendor’s total profit per unit time

is given by

![]()

![]()

![]() (5)

(5)

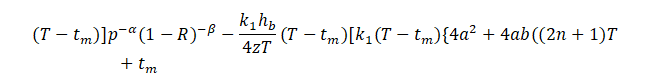

4.1.2. BUYER’S PERSPECTIVE

The differential

equation governing the buyer’s inventory level at any time ![]() is given by

is given by

Solving, we get

From (6), the buyer’s

inventory level at the time point![]() is given by

is given by

![]() (7)

(7)

Also, we have

![]() (8)

(8)

From (7) and (8), we

have

![]() (9)

(9)

Which is a quadratic

equation in ![]() with

discriminant

with

discriminant

![]() .

.

Hence there always

exists a positive (real) production lot size ![]() of the vendor

in any time interval

of the vendor

in any time interval ![]() , for all

, for all ![]() .

.

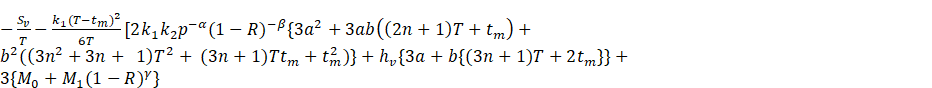

Now, the buyer’s holding

cost per unit time

![]()

![]()

![]()

![]()

Also, sales revenue per

unit time = ![]() , purchase cost per unit time =

, purchase cost per unit time =![]() , transportation cost per unit time =

, transportation cost per unit time = ![]() , screening cost per unit time =

, screening cost per unit time = ![]() and ordering

cost per unit time =

and ordering

cost per unit time = ![]() . Therefore, the buyer’s total profit per unit time is

given by

. Therefore, the buyer’s total profit per unit time is

given by

![]()

![]()

![]()

![]() (10)

(10)

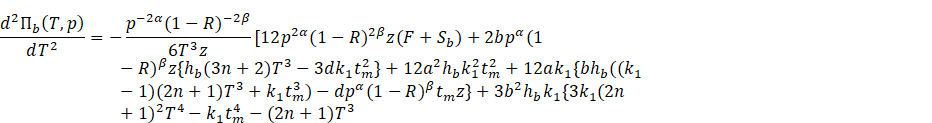

Proposition 1 When the

buyer’s selling price ![]() is known, the profit function

is known, the profit function ![]() is concave with respect to

is concave with respect to ![]() for all

for all ![]() where

where

![]()

![]()

![]()

provided that ![]()

Proof.

Differentiating (10) twice with respect to ![]() , we get

, we get

![]()

It is clear from the

above that ![]() provided that

provided that

![]() which gives

which gives ![]() (say)

(say)

![]() which gives

which gives

![]()

or, ![]() (say)

(say)

![]()

or, ![]()

or, ![]() [since

[since ![]() ]

]

or, ![]()

or, ![]() (say)

(say)

Hence the proposition is

proved.

Proposition 2 For ![]() where

where ![]() and

and

![]() , the profit function

, the profit function ![]() is concave with respect to

is concave with respect to ![]() for all

for all ![]() satisfying the condition

satisfying the condition ![]()

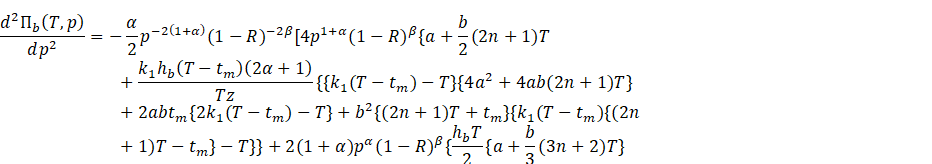

Proof.

Differentiating (10) twice with respect to ![]() , we get

, we get

![]()

From above, ![]() provided that

the following conditions hold:

provided that

the following conditions hold:

![]() which implies

which implies ![]() .

.

![]()

Considering the above

inequation as equation, we see that the two roots of the equation are

We take ![]() such that

such that![]() .

.

![]()

As the buyer’s selling

price ![]() is always

greater than the vendor’s wholesale price

is always

greater than the vendor’s wholesale price ![]() , we have

, we have ![]() . Hence, the proposition is proved.

. Hence, the proposition is proved.

Proposition 3 For known ![]() ,

, ![]() and

and ![]() , the vendor’s profit

function

, the vendor’s profit

function ![]() is concave with respect to

is concave with respect to ![]() if

if ![]() provided

that

provided

that ![]() .

.

Proof.

Differentiating (5) twice with respect to ![]() , we get

, we get

Clearly, ![]() if

if ![]()

![]()

![]()

![]()

If ![]() , then from above we have,

, then from above we have,

![]()

Again, if ![]() , then from above we have,

, then from above we have,

![]()

This proves the

proposition.

Proposition 4 For known ![]() , the profit function

, the profit function ![]() is concave with respect to

is concave with respect to ![]() for all

for all ![]() where,

where, ![]() and

and ![]() .

.

Proof.

Differentiating (5) twice with respect to ![]() , we get

, we get

![]()

![]()

Clearly, the profit

function ![]() will be concave

with respect to

will be concave

with respect to ![]() if the

following two conditions are satisfied:

if the

following two conditions are satisfied:

![]()

![]()

From ![]() we have

we have![]()

From ![]() we have

we have![]()

Hence, the proposition

is proved.

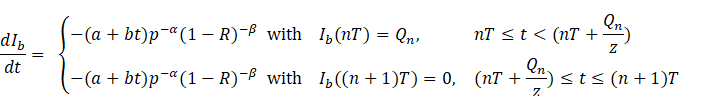

4.2. CENTRALISED MODEL

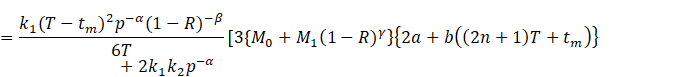

The average total profit

of the integrated supply chain is given by

![]()

![]()

![]()

![]()

![]()

![]()

![]() (11)

(11)

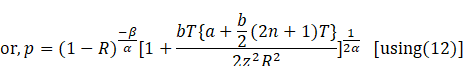

Proposition 5 In case of the

centralized supply chain system, the product reliability ![]() depends on the decision variables

depends on the decision variables ![]() and

and ![]() given by the

relation

given by the

relation

![]() (12)

(12)

Proof.

The vendor delivers ![]() quantity of

items to the buyer, of which

quantity of

items to the buyer, of which ![]() is found to be

defective after completion of the buyer’s screening process. Hence, only

is found to be

defective after completion of the buyer’s screening process. Hence, only ![]() quantity is

considered as good items and sold by the buyer to meet the market demand

quantity is

considered as good items and sold by the buyer to meet the market demand ![]() . Since, there is no shortage and no excess items, we

can claim that

. Since, there is no shortage and no excess items, we

can claim that ![]() Using (1) and

(2), we have

Using (1) and

(2), we have

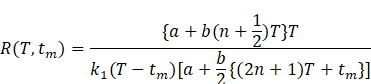

Proposition 6 The buyer’s

selling price ![]() depends on the decision variables

depends on the decision variables ![]() and

and ![]() given by the

relation

given by the

relation ![]() (13)

(13)

where ![]() is given by (12).

is given by (12).

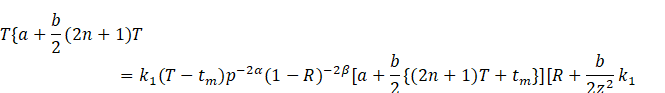

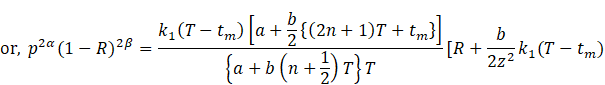

Proof.

Substituting the value of ![]() from (2) into

the relation (9), we get

from (2) into

the relation (9), we get

![]()

![]()

Hence, the proposition

is proved.

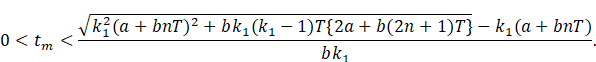

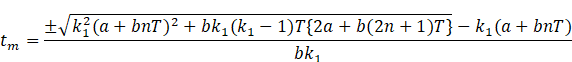

Proposition 7 To meet the customer demand ![]() , the vendor produces

, the vendor produces ![]() quantity of

items with delay in time

quantity of

items with delay in time ![]() satisfying the

relation

satisfying the

relation

Proof. Since ![]() , therefore, from (12) it is obvious that

, therefore, from (12) it is obvious that ![]() .

.

Again, ![]() gives

gives![]()

or, ![]()

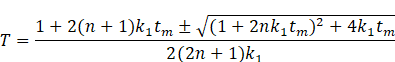

Considering the above

inequation as equation, we see that the two roots of the equation are

The smaller root is

negative and hence the proposition is proved.

Using (12) and (13), the

profit function ![]() can be reduced

to the function

can be reduced

to the function ![]() of two

independent variables

of two

independent variables ![]() and

and ![]() . It is not possible to prove analytically that

. It is not possible to prove analytically that ![]() is jointly

concave. However, we can prove the following proposition:

is jointly

concave. However, we can prove the following proposition:

Proposition 8 For known

values of ![]() and

and ![]() , the profit function

, the profit function ![]() is concave with respect to

is concave with respect to ![]() for all

for all ![]() according as

according as ![]() and

and ![]() satisfies the relation

satisfies the relation ![]() where,

where,

![]()

![]()

![]()

Proof.

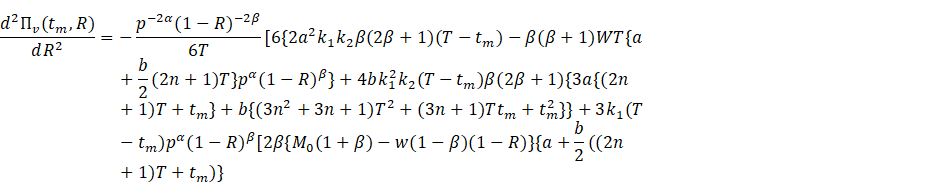

Differentiating (11) twice with respect to ![]() , we get

, we get

The profit function ![]() will be concave

with respect to

will be concave

with respect to ![]() if

if

![]()

For ![]() , we have

, we have![]() .

.

Since the vendor’s

production delay time ![]() is always

positive, the numerator of the right hand expression must be positive and hence

is always

positive, the numerator of the right hand expression must be positive and hence

![]() . This proves the proposition.

. This proves the proposition.

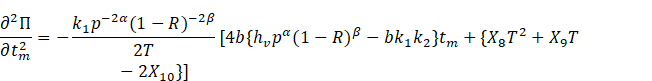

Proposition 9 For pre-defined

values of ![]() and

and ![]() , the profit function

, the profit function ![]() is concave with respect to

is concave with respect to ![]() if

if

![]()

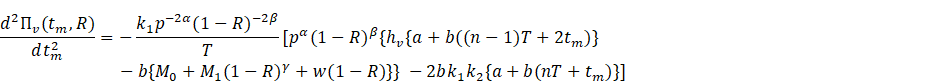

Proof.

Differentiating (11) twice with respect to ![]() , we have

, we have

![]()

![]()

![]()

![]()

![]()

![]()

In the right-hand side

of the above equation, the expression within the third bracket will be positive

if the following three conditions are satisfied:

![]()

![]()

![]()

From ![]() we have,

we have, ![]() .

.

From ![]() we have,

we have, ![]() provided that

provided that ![]()

From ![]() we have

we have ![]() .

.

Hence, the proposition

is proved.

5. NUMERICAL EXAMPLE

To illustrate the

developed models numerically, we consider the following data-set (Giri and Maiti (2012)):

![]() and

and ![]() . Also, we consider

. Also, we consider ![]() in appropriate

units.

in appropriate

units.

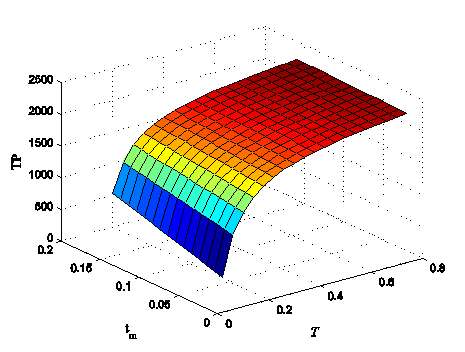

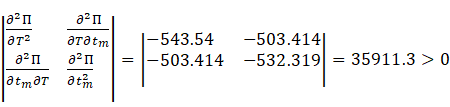

To check the concavity

of the profit function ![]() , we observe that

, we observe that ![]() and

and ![]() have to satisfy

the conditions

have to satisfy

the conditions![]() and the variable

and the variable ![]() has no

restriction. So, we consider

has no

restriction. So, we consider ![]() and

and ![]() The decision

variables

The decision

variables![]() and

and ![]() are found from the propositions 6 and 7, respectively

as

are found from the propositions 6 and 7, respectively

as ![]() and

and ![]() . Then we have,

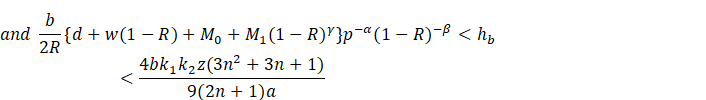

. Then we have, ![]() and the

determinant of Hessian matrix associate with

and the

determinant of Hessian matrix associate with ![]() is given by

is given by

This proves that, for

the above data set, the profit function ![]() is concave in

is concave in ![]() and

and ![]() . One evidence is shown in Figure 2 for

. One evidence is shown in Figure 2 for ![]() . We observe that, if we move from one cycle to the

next cycle, the buyer’s ordering time period

. We observe that, if we move from one cycle to the

next cycle, the buyer’s ordering time period ![]() and the

vendor’s delay time

and the

vendor’s delay time ![]() to start

production change very slowly whereas the average total profit of the supply

chain increases considerably. Without any loss of generality, we consider the

sixth cycle

to start

production change very slowly whereas the average total profit of the supply

chain increases considerably. Without any loss of generality, we consider the

sixth cycle ![]() and we obtain

and we obtain ![]() and

and ![]() . In this sixth cycle, the vendor produces

. In this sixth cycle, the vendor produces ![]() quantity of

items. After receiving these items, the buyer performs screening and

quantity of

items. After receiving these items, the buyer performs screening and ![]() of

of ![]() quantity of

items is considered as good quality and perfect items to meet the demand

quantity of

items is considered as good quality and perfect items to meet the demand ![]() given by

(1).

given by

(1).

|

|

|

Figure 2 Graphical

representation of the profit function |

The buyer’s selling

price ![]() , the product reliability

, the product reliability ![]() and the average

total profit of the supply chain increase as we move from one cycle to the next

cycle. Since the changes in

and the average

total profit of the supply chain increase as we move from one cycle to the next

cycle. Since the changes in![]() and

and![]() are

insensitive, we present in Table 1 the values of

are

insensitive, we present in Table 1 the values of ![]() and

and ![]() for successive

ten cycles.

for successive

ten cycles.

|

Table 1 Optimal results of the proposed model for successive ten

cycles |

|||

|

|

|

|

|

|

1 |

12.9386 |

0.874390 |

2035.33 |

|

2 |

12.9523 |

0.837046 |

2053.32 |

|

3 |

12.9660 |

0.837050 |

2071.32 |

|

4 |

12.9798 |

0.837055 |

2089.34 |

|

5 |

12.9935 |

0.837059 |

2107.37 |

|

6 |

13.0073 |

0.837063 |

2125.42 |

|

7 |

13.0210 |

0.837068 |

2143.48 |

|

8 |

13.0348 |

0.837072 |

2161.56 |

|

9 |

13.0485 |

0.837076 |

2179.66 |

|

10 |

13.0623 |

0.837080 |

2197.77 |

5.1. THE CASE OF

![]()

In this scenario, we

assume that the demand rate depends on time only and hence we put ![]() and

and ![]() in our proposed

model. The demand rate becomes

in our proposed

model. The demand rate becomes ![]() and the

vendor’s production rate is

and the

vendor’s production rate is ![]() with

with ![]() Also, we assume

that unit production cost does not depend on reliability and it is fixed and

denoted by

Also, we assume

that unit production cost does not depend on reliability and it is fixed and

denoted by ![]() . To compare the results with the optimal results of

our proposed model, we take

. To compare the results with the optimal results of

our proposed model, we take ![]() ,

, ![]() and

and ![]() . This

. This

|

Table 2 Comparison of the results of our model and the model with |

|||||

|

|

Model with |

Our model |

Difference of profits |

||

|

|

|

|

|

|

|

|

1 |

3.19089 |

1.06363 |

1016.77 |

2035.33 |

1018.56 |

|

2 |

4.10970 |

1.36990 |

1052.09 |

2053.32 |

1001.23 |

|

3 |

4.91770 |

1.63923 |

1092.64 |

2071.32 |

978.68 |

|

4 |

5.32066 |

1.77355 |

1134.25 |

2089.34 |

955.09 |

|

5 |

5.44683 |

1.81561 |

1174.16 |

2107.37 |

933.21 |

|

6 |

5.43545 |

1.81182 |

1211.56 |

2125.42 |

913.86 |

|

7 |

5.35954 |

1.78651 |

1246.45 |

2143.48 |

897.03 |

|

8 |

5.25452 |

1.75151 |

1279.06 |

2161.56 |

882.50 |

|

9 |

5.13785 |

1.71262 |

1309.67 |

2179.60 |

869.93 |

|

10 |

5.01832 |

1.67277 |

1338.52 |

2197.77 |

859.25 |

implies that ![]() of received

items from the vendor is sold by the buyer at the retail price

of received

items from the vendor is sold by the buyer at the retail price ![]() to meet the

market demand. All the remaining assumptions are kept unchanged. Thus, we take

to meet the

market demand. All the remaining assumptions are kept unchanged. Thus, we take ![]() ,

, ![]() and

and ![]() and all other

parameter-values are same as assumed before. With this data-set, we find that

for

and all other

parameter-values are same as assumed before. With this data-set, we find that

for ![]() ,

, ![]() and the average

total profit of the supply chain as

and the average

total profit of the supply chain as ![]() which is

$2125.42 less than that of our proposed model. In Table 2, we compare the optimal results of ten successive

cycles with those of the proposed model.

which is

$2125.42 less than that of our proposed model. In Table 2, we compare the optimal results of ten successive

cycles with those of the proposed model.

5.2. THE CASE OF

![]()

Here we assume that the

vendor’s produced items are all perfect, although in reality it may not always

happen. To compare the results with those of the proposed model, we assume the

market

|

Table 3 Comparison of profits of the proposed model and our model

with |

|||||

|

Model with |

Our model |

Difference of profits |

|||

|

|

|

|

|

|

|

|

1 |

4.10977 |

1.36992 |

729.98 |

2035.33 |

1305.35 |

|

2 |

5.99780 |

1.99927 |

765.33 |

2053.32 |

1287.99 |

|

3 |

8.86478 |

2.95493 |

815.01 |

2071.32 |

1256.31 |

|

4 |

11.4611 |

3.82038 |

878.73 |

2089.34 |

1210.61 |

|

5 |

13.3829 |

4.46097 |

951.72 |

2107.37 |

1155.65 |

|

6 |

14.7948 |

4.93159 |

1030.37 |

2125.42 |

1095.05 |

|

7 |

15.8619 |

5.28731 |

1112.63 |

2143.48 |

1030.85 |

|

8 |

16.6930 |

5.56433 |

1197.30 |

2161.56 |

964.26 |

|

9 |

17.3571 |

5.78570 |

1283.65 |

2179.60 |

895.95 |

|

10 |

17.8994 |

5.96648 |

1371.22 |

2197.77 |

826.55 |

demand as ![]() , where

, where ![]() and

and ![]() . The production rate is

. The production rate is ![]() with

with ![]() In this case,

the buyer’s holding cost changes to

In this case,

the buyer’s holding cost changes to ![]() . As before, we assume that unit production cost

. As before, we assume that unit production cost ![]() . Since, all products are perfect, there is no need to

screen and hence we take

. Since, all products are perfect, there is no need to

screen and hence we take ![]() and

and ![]() . All the remaining assumptions are kept unchanged.

Thus, in numerical data, we take

. All the remaining assumptions are kept unchanged.

Thus, in numerical data, we take ![]() ,

, ![]() and

and ![]() , keeping all other parameter-values unchanged. From

the numerical experiment, we find that

, keeping all other parameter-values unchanged. From

the numerical experiment, we find that ![]() ,

, ![]() and the average

total profit of the supply chain model is

and the average

total profit of the supply chain model is ![]() , which is

, which is ![]() less than that

of our proposed model. In Table 3, we compare the optimal results of ten successive

cycles with those of our proposed model.

less than that

of our proposed model. In Table 3, we compare the optimal results of ten successive

cycles with those of our proposed model.

6. SENSITIVITY ANALYSIS

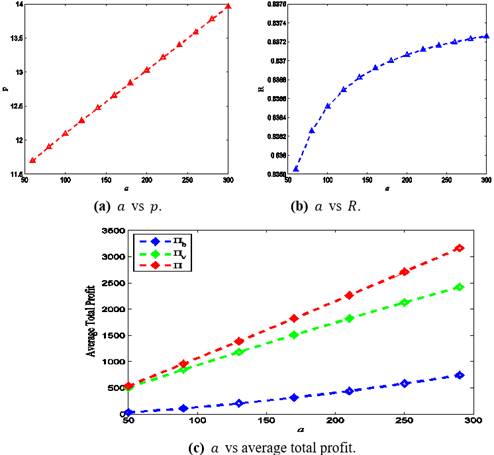

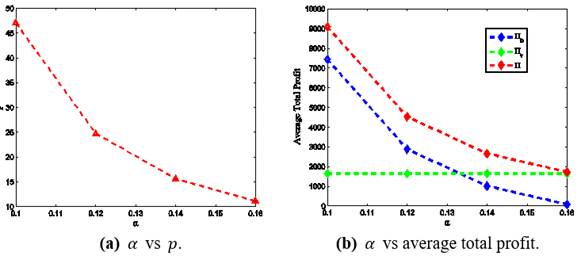

In this section, we

investigate the effect of change of one parameter-value at a time keeping the

remaining parameter-values unchanged. The sensitivity of the parameters ![]() and

and ![]() are shown in

the Figure 3, Figure 4, Figure 5, Figure 6, Figure 7. Some insights from our investigation are given

below.

are shown in

the Figure 3, Figure 4, Figure 5, Figure 6, Figure 7. Some insights from our investigation are given

below.

1) Both the buyer’s selling price ![]() and the product

reliability

and the product

reliability ![]() increase

rapidly as

increase

rapidly as ![]() increases (Figure 3

increases (Figure 3![]() ). The vendor has to produce more reliable product as

). The vendor has to produce more reliable product as ![]() increases. As a

result, the vendor’s unit production cost increases and at the same time, the

market

increases. As a

result, the vendor’s unit production cost increases and at the same time, the

market

|

|

|

Figure 3 Change

(%) in optimal results w.r.t. |

demand also increases. Therefore, the buyer’s average total

profit as well as the vendor’s average total profit increase as ![]() increases.

Consequently the average total profit of the integrated supply chain increases

as

increases.

Consequently the average total profit of the integrated supply chain increases

as ![]() increases (Figure 3

increases (Figure 3 ![]() ).

).

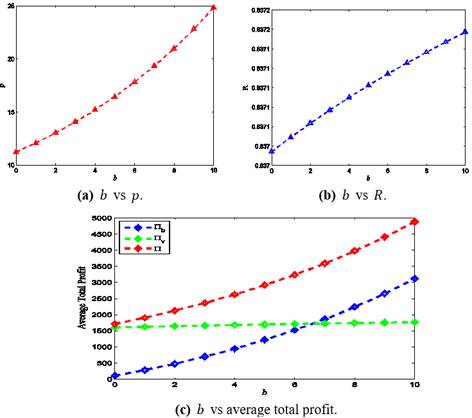

2) As ![]() increases, the

selling price

increases, the

selling price ![]() increases but

the rate of increase in

increases but

the rate of increase in ![]() is not so high.

The buyer’s average total profit increases significantly but the vendor’s

average total profit increase is very low. As a result, the average total

profit of the integrated supply chain model increases moderately as the value

of

is not so high.

The buyer’s average total profit increases significantly but the vendor’s

average total profit increase is very low. As a result, the average total

profit of the integrated supply chain model increases moderately as the value

of ![]() increases (Figure 4

increases (Figure 4 ![]() ).

).

|

|

|

Figure 4 Change (%) in

optimal results w.r.t. |

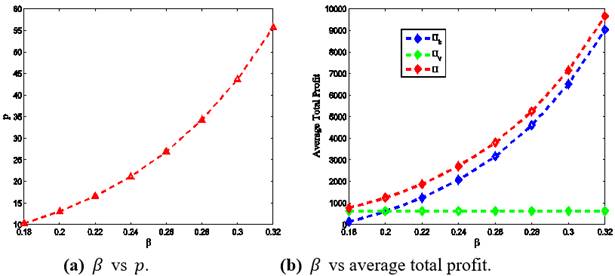

3) The product reliability ![]() is not affected

by the price elasticity to demand

is not affected

by the price elasticity to demand ![]() but the buyer’s

selling price is highly sensitive with respect to

but the buyer’s

selling price is highly sensitive with respect to ![]() as shown in Figure 5

as shown in Figure 5![]() . A

. A ![]() increase in the

value of

increase in the

value of ![]() results

results ![]() decrease in the

value of the selling price

decrease in the

value of the selling price ![]() . But it does not have any impact on the vendor’s

average total profit. A lower selling price results in lower profit from the

buyer’s perspective as well as from the integrated supply chain’s perspective (Figure 5

. But it does not have any impact on the vendor’s

average total profit. A lower selling price results in lower profit from the

buyer’s perspective as well as from the integrated supply chain’s perspective (Figure 5 ![]() ).

).

|

|

|

Figure 5 Change (%) in

optimal results w.r.t. |

4) As ![]() increases, the

selling price

increases, the

selling price ![]() and the average

total profits of the buyer and the entire supply chain increase (Figure 6

and the average

total profits of the buyer and the entire supply chain increase (Figure 6![]() ).

).

|

|

|

Figure 6 Change (%) in

optimal results w.r.t. |

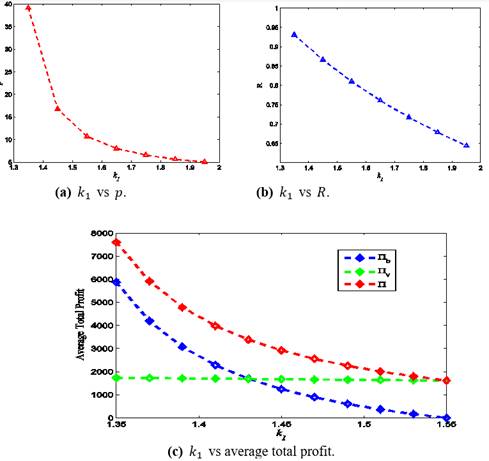

5) Figure 7![]() shows that, as

shows that, as ![]() increases, the

buyer’s selling price and reliability of the product decrease (Figure 7

increases, the

buyer’s selling price and reliability of the product decrease (Figure 7![]() ). Due to increase in production rate, the vendor’s

production time decreases but there is at most no change in the average total

profit of the vendor. However, the average total profit of integrated supply

chain decreases as

). Due to increase in production rate, the vendor’s

production time decreases but there is at most no change in the average total

profit of the vendor. However, the average total profit of integrated supply

chain decreases as ![]() increases (Figure 7

increases (Figure 7![]() ).

).

|

|

|

Figure 7 Change

(%) in optimal results w.r.t. |

7. CONCLUSION

The paper considers a

single vendor single buyer integrated supply chain model in which the market

demand is assumed to be dependent on time, price and reliability of the

product. The vendor follows a lot-for-lot policy. The items are delivered to

the buyer with an agreement that the buyer himself screens all those products

and, if any item is found defective, it should be sold with price discount and

the cost must be borne by the vendor. The reputation of the vendor and the

buyer increase as the product bears good and perfect quality to the best of

their knowledge. On the other hand, the end customer’s satisfaction increases

as the product is more reliable. In this paper, some propositions are derived

which help to choose the data-set in the numerical example as well as to find

the optimal values of the decision variables. From the numerical analysis, we

have found that the vendor has to maintain the reliability of the product and

produce items not more ![]() defective. It

is also observed that the scaling constant

defective. It

is also observed that the scaling constant ![]() for the demand

act important roles to increase the profits of the buyer, vendor and the integrated

supply chain.

for the demand

act important roles to increase the profits of the buyer, vendor and the integrated

supply chain.

In this article, we have

assumed a deterministic market demand, which has limited applications in the

business world. So, this model can be extended by considering stochastic

demand. Shortages are not allowed in our model. So, one can extend the present

model with inclusion of shortage in the buyer’s inventory. One can also

consider multi-vendor and/or multi-buyer supply chain for further study. Terms

and conditions may be imposed by the vendor to sell the defective items (from

buyer’s screening) with price discount.

REFERENCES

A Bhunia and A Shaikh (2014). A deterministic inventory model for deteriorating items with selling price dependent demand and three-parameter Weibull distributed deterioration. International Journal of Industrial Engineering Computations, 5(3):497-510. Retrieved from https://doi.org/10.5267/j.ijiec.2014.2.002

Avi Herbon and Eugene Khmelnitsky (2017). Optimal dynamic pricing and ordering of a perishable product under additive effects of price and time on demand. European Journal of Operational Research, 260(2): 546-556. Retrieved from https://doi.org/10.1016/j.ejor.2016.12.033

B Samanta, Bibhas C Giri, and K S Chaudhuri (2018). A Vendor-Buyer Supply Chain Model for Deteriorating Item with Quadratic Time-Varying Demand and Pro-rata Warranty Policy. In International workshop of Mathematical Analysis and Applications in Modeling, pages 371-383. Springer. Retrieved from https://doi.org/10.1007/978-981-15-0422-8_31

Balaji Roy and Bibhas C Giri (2020). A three-echelon supply chain model with price and two-level quality dependent demand. RAIRO-Operations Research, 54(1):37-52. Retrieved from https://doi.org/10.1051/ro/2018066

Barun Khara, Jayanta Kumar Dey, and Shyamal Kumar Mondal (2017). An inventory model under development cost-dependent imperfect production and reliability-dependent demand. Journal of Management Analytics, 4(3):258-275. Retrieved from https://doi.org/10.1080/23270012.2017.1344939

Barun Khara, Jayanta Kumar Dey, and Shyamal Kumar Mondal (2019). Effects of product reliability dependent demand in an EPQ model considering partially imperfect production. International Journal of Mathematics in Operational Research, 15(2):242-264. Retrieved from https://doi.org/10.1504/IJMOR.2019.10022969

Bibhas C Giri and B Roy (2015). A single-manufacturer multi-buyer supply chain inventory model with controllable lead time and price-sensitive demand. Journal of Industrial and Production Engineering, 32(8):516-527. Retrieved from https://doi.org/10.1080/21681015.2015.1086442

Bibhas C Giri and T Maiti (2012). Supply chain model for a deteriorating product with time-varying demand and production rate. Journal of the Operational Research Society, 63(5): 665-673. Retrieved from https://doi.org/10.1057/jors.2011.54

C J Chung and H-M Wee (2008). An integrated production-inventory deteriorating model for pricing policy considering imperfect production, inspection planning and warranty-period-and stock-level-dependant demand. International Journal of Systems Science, 39(8):823-837. Retrieved from https://doi.org/10.1080/00207720801902598

Haoya Chen, Youhua Frank Chen, Chun-Hung Chiu, Tsan-Ming Choi, and Suresh Sethi (2010). Coordination mechanism for the supply chain with leadtime consideration and price-dependent demand. European Journal of Operational Research, 203(1):70-80. Retrieved from https://doi.org/10.1016/j.ejor.2009.07.002

Hau-Ling Chan (2019). Supply chain coordination with inventory and pricing decisions. International Journal of Inventory Research, 5(3):234-250. Retrieved from https://doi.org/10.1504/IJIR.2019.10020307

Jen-Ming Chen (1998). An inventory model for deteriorating items with time-proportional demand and shortages under inflation and time discounting. International Journal of Production Economics, 55(1):21-30. Retrieved from https://doi.org/10.1016/S0925-5273(98)00011-5

Jinn-Tsair Teng and Chun-Tao Chang (2005). Economic production quantity models for deteriorating items with price-and stock-dependent demand. Computers & Operations Research, 32(2):297-308. Retrieved from https://doi.org/10.1016/S0305-0548(03)00237-5

Jungkyu Kim, Yushin Hong, and Taebok Kim (2011). Pricing and ordering policies for price-dependent demand in a supply chain of a single retailer and a single manufacturer. International Journal of Systems Science, 42(1):81-89. Retrieved from https://doi.org/10.1080/00207720903470122

Moncer A Hariga and Lakdere Benkherouf (1994). Optimal and heuristic inventory replenishment models for deteriorating items with exponential time-varying demand. European Journal of Operational Research, 79(1):123-137. Retrieved from https://doi.org/10.1016/0377-2217(94)90400-6

Moncer Hariga (1996). Optimal EOQ models for deteriorating items with time-varying demand. Journal of the Operational Research Society, 47(10):1228-1246. Retrieved from https://doi.org/10.1057/jors.1996.151

Nita H Shah and Bhavin J Shah (2014). EPQ model for time-declining demand with imperfect production process under inflationary conditions and reliability. International Journal of Operations Research, 11(3):91-99.

Nita H Shah and Chetansinh R Vaghela (2018). Imperfect production inventory model for time and effort dependent demand under inflation and maximum reliability. International Journal of Systems Science: Operations & Logistics, 5(1):60-68. Retrieved from https://doi.org/10.1080/23302674.2016.1229076

Nita H Shah and Monika K Naik (2020). Inventory Policies with Development Cost for Imperfect Production and Price-Stock Reliability-Dependent Demand. In Optimization and Inventory Management, pages 119-136. Springer. Retrieved from https://doi.org/10.1007/978-981-13-9698-4_7

P S You (2005). Inventory policy for products with price and time-dependent demands. Journal of the Operational Research Society, 56(7):870-873, Retrieved from https://doi.org/10.1057/palgrave.jors.2601905

Peng-Sheng You and Yi-Chih Hsieh (2007). An EOQ model with stock and price sensitive demand. Mathematical and Computer Modelling, 45(7-8):933-942. Retrieved from https://doi.org/10.1016/j.mcm.2006.09.003

Po-Chung Yang, Hui-Ming Wee, Shen-Lian Chung, and Yong-Yan Huang (2013). Pricing and replenishment strategy for a multi-market deteriorating product with time-varying and price-sensitive demand. Journal of Industrial & Management Optimization, 9(4):769. Retrieved from https://doi.org/10.3934/jimo.2013.9.769

R Roy Chowdhury, S K Ghosh, and K S Chaudhuri (2014). An order-level inventory model for a deteriorating item with time-quadratic demand and time-dependent partial backlogging with shortages in all cycles. American Journal of Mathematical and Management Sciences, 33(2):75-97. Retrieved from https://doi.org/10.1080/01966324.2014.881173

S K Ghosh and K S Chaudhuri (2006). An EOQ model with a quadratic demand, time-proportional deterioration and shortages in all cycles.International Journal of Systems Science, 37(10):663-672. Retrieved from https://doi.org/10.1080/00207720600568145

S K Ghosh, Sudhansu Khanra, and K S Chaudhuri (2011). Optimal price and lot size determination for a perishable product under conditions of finite production, partial backordering and lost sale. Applied Mathematics and Computation, 217(13):6047-6053. Retrieved from https://doi.org/10.1016/j.amc.2010.12.050

Seyed J Sadjadi, Mir-Bahador Aryanezhad, and Armin Jabbarzadeh (2009). An integrated pricing and lot sizing model with reliability consideration. In 2009 International Conference on Computers & Industrial Engineering, pages 808-813. IEEE. Retrieved from https://doi.org/10.1109/ICCIE.2009.5223880

Sudhansu Khanra and K S Chaudhuri (2003). A note on an order-level inventory model for a deteriorating item with time-dependent quadratic demand. Computers & Operations Research, 30(12):1901-1916. Retrieved from https://doi.org/10.1016/S0305-0548(02)00113-2

TCE Cheng (1989). An economic production quantity model with flexibility and reliability considerations. European Journal of Operational Research, 39(2):174-179. Retrieved from https://doi.org/10.1016/0377-2217(89)90190-2

Tal Avinadav, Avi Herbon, and Uriel Spiegel (2013). Optimal inventory policy for a perishable item with demand function sensitive to price and time. International Journal of Production Economics, 144(2):497-506. Retrieved from https://doi.org/10.1016/j.ijpe.2013.03.022

Tapan Kumar Datta and Karabi Paul (2001). An inventory system with stock-dependent, price-sensitive demand rate. Production planning \& control, 12(1):13-20. Retrieved from https://doi.org/10.1080/09537280150203933

Tarun Maiti and Bibhas C Giri (2015). A closed loop supply chain under retail price and product quality dependent demand. Journal of Manufacturing Systems, 37:624-637. Retrieved from https://doi.org/10.1016/j.jmsy.2014.09.009

Tarun Maiti and Bibhas C Giri (2017). Two-period pricing and decision strategies in a two-echelon supply chain under price-dependent demand. Applied Mathematical Modelling, 42:655-674. Retrieved from https://doi.org/10.1016/j.apm.2016.10.051

Timothy H Burwell, Dinesh S Dave, Kathy E Fitzpatrick, and Melvin R Roy (1991). An inventory model with planned shortages and price dependent demand.Decision Sciences, 22(5):1187-1191. Retrieved from https://doi.org/10.1111/j.1540-5915.1991.tb01916.x

Wakhid Ahmad Jauhari, Nelita Putri Sejati, and Cucuk Nur Rosyidi (2016). A collaborative supply chain inventory model with defective items, adjusted production rate and variable lead time. International Journal of Procurement Management, 9(6):733-750. Retrieved from https://doi.org/10.1504/IJPM.2016.10000438

Wakhid Ahmad Jauhari (2016). Integrated vendor-buyer model with defective items, inspection error and stochastic demand. International Journal of Mathematics in Operational Research, 8(3):342-359. Retrieved from https://doi.org/10.1504/IJMOR.2016.075520

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© IJETMR 2014-2021. All Rights Reserved.