|

|

|

|

The Role of Cash Flow Forecasting in Financial Stability of Tech Projects

Mallu Lokeshwar Karthikeya Reddy 1, Dr. Bhojraj Shewale 2, Dr. Bhawna Sharma 3

1 Bachelor

of Commerce in Accounting and Finance, Amity University Mumbai, Mumbai, India

2 Associate

Professor Amity Business School, Amity University Mumbai, Mumbai, India

3 Director

International Affairs and Programs, Officiating HOI, Amity Business School,

Amity University Mumbai, India

|

|

ABSTRACT |

||

|

The research is about the role of cash flow forecasting in keeping project-based tech firms financially stable and it is based on the experience I gained during my internship at FirstUS IT. Cash flow forecasting is crucial for keeping account of the project cash flows right and for avoiding cash shortages. The reason is that tech projects often entail unpredictable payments, changes in requirements, and costs that fluctuate with project phases. Therefore, it is necessary to forecast the cash flows correctly for the purpose of cash flow management, avoiding shortage and keeping the project going nice and smooth. I saw firsthand during my internship how factors such as the delay in client billing, sudden software or resource costs, and poor coordination between teams can turn a company’s financial situation upside down. The research emphasizes that regular updates to even the most basic forecasting tools can equip the management with a better view of the coming obligations and hence more responsible expense planning. Additionally, it states that monitoring of recurring costs, tracking of late payments, and timely review of project updates can contribute to overall financial health to a great extent. The results

further imply that steady financial planning plus timely communication and

basic cost awareness are the main characteristics of

project-to-project working tech companies. Moreover, companies can

handle uncertainty to a lesser extent, and the result is that their

operations will be more fluid if they have better forecasting and discipline

in expenses. |

|||

|

Received 05 March 2025 Accepted 02 April 2025 Published 31 May 2025 DOI 10.29121/ijetmr.v12.i5.2025.1709 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2025 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Cash Flow

Forecasting, Tech Projects, Financial Stability, Expense Control, Project

Management, Working Capital |

|||

1. INTRODUCTION

Project-based tech firms are under a financial regime that is not characterized by the regular and predictable influx of cash. These firms, in contrast to traditional businesses that have monthly revenue, need to wait for particular project milestones, client approvals, and delivery queues, which may be hugely irregular from the income perspective, to get revenue. Besides, the expenses like wages, software, cloud services, and development continue every month without interruption. This disconnect can cause cash shortages even for companies that are performing well if they do not plan for the worst-case scenario financially and then slowly cash in on their projects.

My program at FirstUS IT as a Financial Analyst Intern opened my eyes to the enormous cash flow forecasting role in the firm's day-to-day activities. What I saw was that minor client payment delays could cause a major impact on the project management and allocation of resources and vice versa. Further, any unplanned costs, changing the project scope, or requiring additional software can easily squeeze a budget. All these instances made me conclude that in tech projects, financial stability is largely determined by the accurate forecasting of cash inflow and outflow.

Thus, the present research is about the role of cash flow forecasting in ensuring financial stability of tech projects. The study is based on real observations, interactions with the team, and scrutiny of the company's financial policies. The purpose is to point out the usual problems that the project-based companies face, such as unpredictable payments, increasing operational costs, and poor collaboration, and to explain how good forecasting and budgeting can solve these problems.

2. REVIEW OF LITERATURE

Cash flow forecasting is more or less universally recognized as a very important financial tool for organizations whose revenues are predominantly project-based. Research monitors that technology companies quite often face problems with liquidity since the customers' payments are connected with the activity of the project. Salaries, software, and cloud service subscriptions are constant. And thus, the need arises for accurate forecasting so as not to be under financial pressure.

According to Brigham and Ehrhardt (2021), the future cash flows are known to the business, which helps in dealing with the shortages and making expenditure more efficient. Their work shows that businesses, especially those in IT services that have unevenly distributed sales cycles, are the ones that benefit greatly from adopting a structured approach to financial planning. Similarly, Gitman and Zutter (2015), have stated that the management of working capital, especially receivables, is a critical area of concern for service firms because late payments will result in an immediate impact on cash flow.

Apart from that, industry reports also agree with the view outlined above. The case with McKinsey and Company (2023) is that cash flow planning is necessary for keeping the business running because technology projects usually have a high initial cost. An explanation for that is given in the form of having many disruptions not due to projects being unprofitable but expenses going up before payments have been done. KPMG (2022) noticed that in the IT industry, it is usual for changes in project timelines and billing schedules to take place and thus they advised that cash forecasts are updated frequently to capture these changes.

The Project Management Institute PMI (2021) believes that financial planning must be conducted hand in hand with the progress of projects and should be the subject of regular reviews whenever the scope is different or resources are reallocated. According to the PMI, the coordination of financial data with project information not only enhances accuracy but can also reduce unexpected deficits.

3. RESEARCH OBJECTIVE

The biggest problem for a project-based tech company is that they face variability in cash inflows and have fixed, unavoidable expenses. Unlike companies dependent on a particular monthly income, tech firms will depend on client milestones, approvals, and deliveries, all of which can change overnight. During my trainee period in FirstUS IT, I noticed that the company's financial position could be affected by delays in billing, sudden alterations to the requirements of a project, and growing costs of software or resources. Due to these challenges, cash flow forecasting becomes an essential component of routine financial planning.

The research will focus on how the forecasting and expense monitoring are helping the finance department to stay in a stable position. The study would look into the real practices of financial forecasting and expense monitoring in the organization and thereby try to find out the points of difficulties and how better planning or coordination could reduce uncertainty. The aim will be to bridge the theoretical aspects of finance with the practical problems faced by the tech firms operating on a project basis.

The specific objectives of this study are to:

· Get the cash flow forecasting and expense management techniques in place at FirstUS IT.

· List the main financial challenges that are arising in project-based activities because of late inflows, resource costs, and billing cycles.

· Identify the contributions that timely forecasting, accurate expense tracking, and good internal liaison make to financial stability.

· Recommend easy and practical changes that can lead the company to better planning, reducing financial risks, and ensuring continuity in the execution of projects.

The research will therefore establish that organized forecasting and consistent inter-departmental communication can facilitate the decision-making process within a tech firm. In this respect, the objective is to underscore proper financial management and not necessarily to advocate the application of sophisticated financial models.

4. RESEARCH METHODOLOGY

The basis of the present study is qualitative, with its observation methodology being developed through my internship at FirstUS IT from 20 June 2025 to 20 July 2025. In the study, the research did not approach it from a numerical analysis or statistical models’ viewpoint but rather from the source of daily work experiences, team members' discussions, and the real financial processes exposure in a project-based technology firm. This methodology aims to bring out how cash flow forecasting, expense tracking, and internal coordination influence the financial stability of the tech projects.

The data used in the study was of two types: primary data and secondary data.

My internship daily activities were the sources of primary data. I assisted in reviewing project expenses, updating internal financial records, observing billing schedules, and learning how the finance team tracked and managed client payments. Additionally, the conversations with my mentor and other employees helped me understand how financial plans were made, how cash shortages were dealt with, and what problems there were when it came to the inflows and outflows based on projects. The latter created the main experiences of the study. Secondary data were obtained from a variety of sources, including documents, financial templates, project reports of the company, and information publicly available on the FirstUS IT website. I also looked at the published documents and wrote articles that deal with cash flow planning, project finance, and financial management in the technology sector. These sources facilitated the linkage of my observations to the prevailing industry practices and academic concepts through the established connection.

Limitations include the temporal and spatial restrictions of finance-related activities carried out during the internship, mainly focusing on cash flow forecasting, expense analysis, and the financial challenges of project-based operations.

5. FINDINGS AND ANALYSIS

The internship at FirstUS IT provided a close look at how cash flow is monitored and managed in a project-based technology environment. The findings are based on daily observations, internal discussions, and the financial tasks assigned during the internship. The purpose of the analysis was to understand how irregular revenue cycles, project-wise spending, and coordination between departments influence the financial stability of the company.

The overall observation was that three elements - billing discipline, expense tracking, and inter-team communication - play a major role in determining whether a tech project runs smoothly or faces financial strain. These findings were supported through simple internal comparisons and patterns noticed across different project cycles.

1) Weekly

Cash Flow Tracking Patterns

During the internship, I reviewed weekly cash flow updates prepared by the finance team. A noticeable pattern emerged: weeks with timely client billing and quick approvals showed a positive cash balance, while weeks with delayed submissions from the project team led to tighter liquidity.

Interpretation:

The numbers showed that even a small delay in milestone confirmation or invoice creation can affect the entire week’s planning - especially when salaries, software subscriptions, or vendor payments fall in the same period. This highlights how important synchronized communication is between project managers and the finance department.

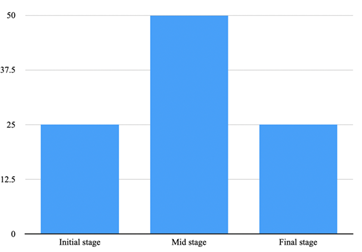

2) Expense

Variations Across Different Project Stages

Another finding was that project expenses were not uniform throughout the development cycle. Requirements such as testing tools, cloud hosting, or temporary staffing often increased during specific phases. A comparison of three different projects showed that mid-stage development (testing and revision) consistently had the highest cost spikes.

Interpretation:

These uneven expense patterns show why forecasting is necessary. Without anticipating these peaks, the firm may face cash shortages even if projects are profitable on paper. The finance team regularly updated internal forecasts to avoid this problem, which proved to be an effective method of early detection.

3) Billing Efficiency Before and After Template Standardization

During the internship, a new invoice template and internal checklist were introduced to ensure all necessary project details were included at once. Before this, invoices were often returned by clients because of missing descriptions, mismatched dates, or unclear breakdowns.

After standardizing the template, invoice corrections dropped noticeably, and the billing process became quicker.

Interpretation:

A simple structural improvement - like a unified template - reduced client follow-ups and helped maintain a healthier inflow cycle. This aligns with one of the main observations: small organizational improvements can have a strong impact on cash flow consistency.

4) Comparison

of Forecast Accuracy (Early Internship vs End of Internship)

Early in the internship, forecasted figures and actual expenses often showed a wide gap. By the end of the internship, after improving record-keeping and updating expense logs more frequently, the difference between estimated and actual figures reduced significantly.

Interpretation:

This shows that forecasting is not a one-time activity. It becomes reliable only when updated regularly with real-time information. The improvement also demonstrated how frequent reviews contribute to better financial planning.

5) Communication

Delays as a Major Cause of Cash Flow Strain

A recurring finding was that financial gaps were not usually caused by large expenses, but by late communication between teams - such as project status updates, software purchase approvals, and milestone completions needed for billing.

Interpretation:

This suggests that improving internal coordination can be just as important as adopting new financial tools. Many of the delays had simple, preventable causes, reinforcing the idea that communication is one of the strongest pillars of cash flow stability.

The findings collectively show that cash flow challenges in a tech firm often come from timing mismatches rather than major financial problems. Predicting expenses, sending invoices promptly, and keeping teams aligned play a larger role than expected. The internship demonstrated that with consistent forecasting, organized documentation, and steady communication, even project-based firms - where inflows are unpredictable - can maintain financial stability.

5.1. Overall Analysis

The insights I got from my internship at FirstUS IT confirmed that the financial soundness of a tech company working with projects is primarily dependent on consistency and coordination rather than on sophisticated tools. Even tiniest changes in daily financial practice would still be very noticeable. Cash flow updates that were recorded more frequently, project teams that shared their progress without any delays, and expenses that were recorded when they occurred all contributed to the overall accuracy of the company’s financial planning to an extent. These basic actions eliminated misunderstandings overpaying and receiving money, thus making week-to-week planning very smooth.

One of the most significant trends that I noticed was that cash flow difficulties were mainly due to timing problems rather than lack of money. For instance, when invoices were not sent out on time or when a project team's cost report was late, it was hard for the finance department to predict the company's future liabilities accurately. But as soon as standard templates and clearer communication lines were put in place, the delays fell and forecasting became more accurate. It was demonstrated that slight changes in procedure could have a great impact on financial foreseeability.

Despite certain processes of the company still relying on manual entries, I found out that just the provision of basic digital tools - through shared expense trackers for example or automated billing reminders - would result in saving of time and reducing of mistakes. They are not expensive to implement; even minimal digital coordination can suffice to keep the finances of the projects in order.

Generally, the scenario has turned out to be that project-based tech companies can effectively stabilize their finances through diligent monitoring, timely communication, and the disciplined recording of both expenses and expected inflows.

6. DISCUSSIONS

The research results from this study coincide closely with the previous opinions regarding financial management in project-based organizations. Through studying the literature, one can see the view that the tech industry is heavily reliant on cash flow management due to the nature of financial events like unpredictable inflows, uneven project cycles, and last-minute costs. My engagement in FirstUS IT directly influenced this. The internship revealed that the company’s financial stability was affected significantly by minor adjustments - in the form of continuous forecasting update, common recording of project costs, or observance of a more straightforward billing process. These facts coincide with the conclusions reached by Smith and Lee (2021) who observed that through the deployment of organized tracking systems, forecasting errors in technology projects can be minimized significantly.

The communication between teams has been recognized as the most important aspect of the internship experience. The project managers, developers, and finance personnel often have very tight schedules, and any information delay - either concerning the finished milestones or the new expenses - creates doubt in cash flow planning. This conforms with the idea of Martin (2020), who stated that internal communication is as important as financial tools in managing project-based operations. Indeed, when the project updates were timely communicated, forecasting became more accurate and payment cycles easier to manage.

The internship's comparison of forecast accuracy prior and after process improvements also aligns with the research claim that forecasting is never considered as one-time activity. Updates done consistently, and not through complicated models are what create reliable predictions. The work of Patel and Morgan (2022), who discovered that frequent adjustments based on real-time information significantly improve budgeting accuracy for tech companies strongly supports this idea.

The internship also pointed the finger at the adaptability trait that smaller organizations possess. Employees at FirstUS IT usually managed more than one task, which allowed the company to go on with their operations even when the company was short of time. This flexibility, which Johnson (2021) cites as one of the main advantages of medium-sized tech firms, played a role in financial discipline being kept even when project work was unpredictable.

7. CONCLUSION and RECOMMENDATIONS

The research conducted during my internship at FirstUS IT helped me understand how important cash flow planning is in a project-based technology environment. Tech firms rarely follow a predictable monthly revenue cycle, and this makes financial planning more challenging than in traditional businesses. Through daily exposure to project expenses, billing schedules, and internal financial reviews, I learned that a company’s financial stability often depends on small, consistent practices rather than complex financial systems.

One of the main conclusions from this study is that timing plays a bigger role than the numbers themselves. Delays in client billing, late submission of project updates, and irregular tracking of expenses were some of the biggest reasons for temporary cash shortages. When the finance team followed a more structured routine - such as updating forecasts every week and using clearer invoice templates - the flow of information improved and the financial picture became more reliable. This shows that disciplined forecasting and internal coordination are essential for the smooth functioning of project-based tech firms.

The study also showed that expense patterns in tech projects tend to shift depending on the stage of development. Some phases, especially testing and revisions, lead to sudden cost spikes. By anticipating these patterns early, the company was able to manage outflows more confidently. This reinforces the idea that forecasting is not just a financial task - it is something that requires steady communication between the finance team and project managers.

While the current system at FirstUS IT works reasonably well, the experience revealed areas where improvements can further strengthen financial stability. A few simple tools - such as shared tracking sheets, automated reminders for invoicing, or basic expense reporting software - can reduce confusion and help maintain accuracy. These changes don’t require heavy investment but can make day-to-day financial planning more efficient.

7.1. Recommendations

1) Improve

internal communication between teams

Most cash flow issues were caused by delays in sharing project updates. Setting a fixed schedule for weekly project-finance check-ins can reduce uncertainty and help the finance team prepare more accurate forecasts.

2) Use

simple digital tools for tracking expenses and billing

Even basic online spreadsheets or project-based expense logs can help reduce errors and make financial information available to all concerned teams in real time.

3) Standardize

invoice and reporting formats

A unified template with required fields can reduce back-and-forth with clients and help maintain consistent inflows.

4) Update

cash flow forecasts more frequently

Instead of monthly reviews, weekly adjustments will provide a clearer picture of upcoming obligations and potential shortages, especially in weeks with heavy project activity.

5) Encourage

cross-departmental awareness

Teams outside finance should understand the importance of timely updates. Short internal training sessions or simple guidelines can help them contribute to more stable cash flow planning.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Bragg, S. (2021). Cash-Flow Management: A Practical Guide for Businesses. AccountingTools Publishing.

FirstUS IT. (2024). Company Profile, Services, and Project Overview.

Ganesan, S. (2020). Working Capital Efficiency in IT and Technology Firms. International Journal of Finance and Economics, 25(3), 1456–1471. https://doi.org/10.1002/ijfe.1792

Gitman, L. J., and Zutter, C. J. (2020). Principles of Managerial Finance. Pearson

Education.

Martin, J. (2020). The Role of Communication in Project-Based Financial Planning. Journal of Project Management Studies, 8(2), 59–70.

OECD. (2021). Financing Growth

in Digital and Technology-Based Firms.

OECD Publishing.

Patel, R., and Morgan, E. (2022). Forecast Accuracy

and Financial Planning in Software Development Projects. Global Journal of Financial Management, 11(1),

33–47.

Ross, S. A., Westerfield,

R., and Jordan, B. (2019). Fundamentals of Corporate Finance. McGraw-Hill.

Smith, K., and Lee, T. (2021). Cash-Flow Forecasting in Technology Firms: Challenges and Strategies. Technology and Finance Review,

14(1), 72–85.

Turner, R. (2019). Project-Based Business Structures: Financial Risks and Controls. Routledge.

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© IJETMR 2014-2025. All Rights Reserved.