|

|

|

|

Analyzing Operational Efficiency and Process Optimization in SIP Management: A Study Based on Internship Experience at Tarun Capital and Investor Services

Swara Joshi 1![]() , Linu George 2, Dr

Bhawna Sharma 3

, Linu George 2, Dr

Bhawna Sharma 3![]()

1 Program:

Bachelor of Business Administration (BBA), Student, Amity Business School, Amity

University, Mumbai, Maharashtra, India

2 Associate

Professor, Amity Business School, Amity University, Mumbai, Maharashtra,

India

3 OFFG.

HOI, Amity Business School, Amity University, Mumbai, Maharashtra, India

|

|

ABSTRACT |

||

|

During my time at Tarun Capital & Investor Services, I became curious about how SIPs are actually handled behind the scenes. This paper is based largely on what I saw, learned, and experienced during that internship. My work made me realise that something as simple as keeping documents in order, having clear client information, and following compliance routines properly can make a huge difference in how smoothly financial operations run. While dealing with everyday tasks, I came across a number of issues that repeatedly slowed down the SIP process. Many clients submitted incomplete KYC details, which meant extra follow-ups. At times, several documents had to be tracked simultaneously, and without a good system, they were easy to misplace or overlook. Another challenge was the limited use of automation, which resulted in more manual work and unavoidable delays. From what I observed, even small improvements—like using a consistent checklist, maintaining a proper filing method, and communicating with clients before problems arise—can significantly speed up SIP activation and reduce errors. The research follows a qualitative approach because most insights came from practical exposure rather than numerical data. Daily interactions with paperwork, routine tasks, and discussions with mentors gave me a clearer understanding of where the process works well and where it slows down. These experiences showed me that adopting better documentation habits, shifting some tasks to digital tools, and ensuring transparent communication can greatly improve the overall efficiency of investment service operations. In the end,

this paper argues that neither humans nor technology alone can solve these

challenges. Long-term efficiency comes from finding the right balance—using

automation for repetitive tasks while relying on human judgment where

accuracy and personal interaction matter. |

|||

|

Received 05 February 2025 Accepted 02 March 2025 Published 30 April 2025 Corresponding Author Swara

Joshi, swara.info23@gmail.com DOI 10.29121/ijetmr.v12.i4.2025.1702 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2025 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Sip

Management, Operational Efficiency, Process Optimization, Kyc Compliance,

Financial Services, Investment Operations, Data Accuracy, Workflow

Improvement |

|||

1. INTRODUCTION

The financial services industry in India has changed rapidly, with Systematic Investment Plans (SIPs) becoming one of the most popular and reliable ways to invest. SIPs promote regular investments in mutual funds, making precision and efficiency crucial for financial institutions. Smooth SIP execution depends on proper documentation, compliance with regulations, and careful data management. Even small errors can lead to delays or dissatisfied clients.

Tarun Capital & Investor Services is a financial advisory firm that provides mutual fund investments, SIP setup, insurance, and tax-saving solutions. The operations team is essential for ensuring smooth investment processing through KYC verification, FATCA compliance, SIP activation, and record management. During my internship as an Operations Intern, I noticed that maintaining efficiency in these operations requires strong coordination, careful documentation, and standardized processes.

This research aims to examine the efficiency and optimization practices in SIP management at Tarun Capital & Investor Services. Using a qualitative approach based on direct observations, interactions, and internal documents, the study identifies key challenges such as incomplete KYC, reliance on manual workflows, and data inconsistencies. It also explores how checklists for verification, organized filing systems, and digital tools can enhance the accuracy and speed of operations. The findings aim to provide insights for improving operational performance and client satisfaction in investment service firms.

2. REVIEW OF LITERATURE

As SIPs continue to attract more investors in India, the need for smooth and reliable operational processes in financial firms has grown even more important. Since SIPs involve small, recurring investments, firms must ensure every instalment goes through correctly, without delays or mistakes. While reviewing different reports and earlier studies on the subject, it became clear that most researchers agree on one thing: the backbone of efficient SIP management lies in neat documentation, reliable data practices, and the use of supportive digital tools.

AMFI’s 2024 data shows that SIPs now account for a large share of the monthly inflows into mutual funds. This rise in popularity shows how much confidence investors place in SIPs, but it also increases the pressure on firms to manage a heavier load of client information. SEBI, in its 2023 guidelines, warns that even a small slip in KYC or paperwork can slow down the activation of an SIP. Such errors not only create delays but also shake the investor’s trust, which makes compliance and accurate verification extremely important.

Rao and Kumar (2022) point out that many problems in financial operations start from something as basic as manual handling or loosely structured processes. Their research indicates that moving towards digital verification, organized databases, and step-by-step documentation processes can significantly cut down on errors. Patel (2021) adds to this by showing that firms that used simple tools—like checklists or standard templates—completed SIP registrations faster and with fewer issues than those that relied on informal methods.

Ghosh (2020), on the other hand, focuses on the challenges faced by smaller advisory firms. Unlike big companies with access to advanced tech, smaller firms often have to rely on manual checks and the experience of their staff. Ghosh argues that even without full-scale automation, improvements can still be achieved through better file organization, clearer coordination with clients, and regular staff training.

Taken together, these studies make one thing evident: effective SIP processing depends heavily on maintaining precise client records, keeping communication straightforward, and using technology wherever it can genuinely help. However, very little research talks about how smaller advisory firms actually handle these challenges in daily practice. This study attempts to fill that gap by reflecting on what I observed during my internship at Tarun Capital & Investor Services and by suggesting practical steps that could help streamline their processes.

3. RESEARCH OBJECTIVE

Over the last few years, I’ve noticed that the financial services industry in India has been placing a lot more importance on how smoothly their internal processes run. A major reason for this is the rise of Systematic Investment Plans (SIPs). Since SIPs are based on small, regular contributions, the entire system behind them has to function without glitches. Even one mistake in the paperwork or data entry stage can delay the investor’s first instalment. When I looked at earlier studies and industry reports, almost all of them stressed the same thing: good documentation, proper data handling, and the right use of technology can make SIP operations far more reliable.

AMFI’s 2024 report shows that SIPs now form a big part of the monthly mutual fund inflow. To me, this clearly reflects how much faith people have in SIPs as a long-term investment option. But at the same time, it also means that financial firms are dealing with more clients and more information than before. SEBI’s 2023 guidelines mention how even a small error in a KYC document can hold up the entire activation process. This made me realise why compliance checks and verification steps are such a big deal for financial firms.

Several researchers have talked about these operational issues too. Rao and Kumar (2022) pointed out that many problems arise simply because firms rely too much on manual work or unstructured processes. They found that digital verification, shared databases, and clearer documentation routines can save both time and effort. Patel (2021) also showed that firms that use simple tools—like checklists or templates—tend to finish SIP registrations much faster.

Ghosh (2020) looked at this from another angle. His study focused on smaller financial companies that don’t have access to advanced software. These firms often depend on manual checks and the experience of their staff, which naturally slows things down. But even in such situations, Ghosh found that a few basic improvements—like organizing files better, staying in closer contact with clients, and training employees regularly—can make the whole process run more smoothly.

All of this connects strongly with what I saw during my internship at Tarun Capital & Investor Services. SIPs may look simple from the outside, but behind every activation, there are many steps: onboarding the client, checking their documents, verifying their details, and finally getting the SIP started. During my time there, I saw that incomplete KYC forms, manual data entry, and delays in communication often slowed down the workflow.

Because of these observations, this research focuses on understanding where these operational issues come from and how they can be improved. The main idea is to figure out how better documentation, organized workflows, and small process changes can help financial firms handle SIPs more efficiently.

The specific objectives of this study are as follows:

· To review the current operational practices in SIP management at Tarun Capital & Investor Services.

· To identify the key challenges faced by the operations team, especially in client onboarding, KYC compliance, and data management.

· To evaluate how organizing processes, ensuring documentation accuracy, and improving team communication contribute to operational efficiency.

· To recommend practical process improvements and tools that can enhance accuracy, compliance, and client satisfaction.

By focusing on these objectives, the study aims to link theoretical concepts of operations management with their real-world application in a small to mid-sized financial advisory firm. It also seeks to demonstrate how simple changes, such as using checklists for documentation and improving coordination, can lead to meaningful gains in daily operations. The ultimate goal is to provide actionable insights for organizations looking to strengthen their operational foundations in investment management.

4. RESEARCH METHODOLOGY

This research uses a qualitative and observational approach, based on my personal experience during an internship at Tarun Capital & Investor Services from June 7, 2025, to July 23, 2025. Instead of relying on numbers or statistics, the study focuses on real workplace observations, employee interactions, and daily tasks. The goal is to understand how regular operations, workflow systems, and documentation practices affect the efficiency of Systematic Investment Plan (SIP) management in a financial advisory firm.

For this research, I used two main sources of information: primary data and secondary data.

I gathered primary data by directly participating in various tasks like SIP documentation, KYC verification, and data entry. I also learned from regular interactions with my mentor and colleagues. This interaction gave me a clear understanding of how client records are managed and how compliance checks are performed according to SEBI and AMFI rules. These daily experiences formed the foundation of my analysis.

I obtained secondary data from company files, SEBI guidelines, AMFI reports, and articles related to financial operations and process management. This information allowed me to compare what I found during my internship with broader industry standards and see how other firms address similar challenges.

The study focuses on the operations department, particularly SIP setup, client onboarding, and document verification. I used a case-based observation method, meaning I analyzed real operational processes and identified patterns of efficiency and inefficiency.

All data and experiences shared in this paper are kept confidential. No personal or client-sensitive information has been included. The aim of this study is purely academic; it seeks to highlight learnings from a professional setting and explore how small procedural changes can boost daily efficiency.

In summary, this research is rooted in hands-on experience rather than theory. It draws lessons from practical exposure to understand the challenges in financial operations and suggests that organized documentation, teamwork, and simple digital tools can speed up and enhance processes. This approach offers a realistic view of how operational improvements can be made in firms like Tarun Capital & Investor Services.

5. FINDINGS AND ANALYSIS

The internship at Tarun Capital & Investor Services offered detailed exposure to the operational side of SIP (Systematic Investment Plan) management. The findings of this research are based on practical observations, daily documentation work, and workflow analysis. The goal was to understand how the operations team ensures compliance, accuracy, and client satisfaction while handling multiple investment requests simultaneously.

The analysis revealed that documentation accuracy, communication consistency, and time management are the three main factors that influence operational efficiency. Each of these was studied and visualized through simple data-based observations made during the internship period.

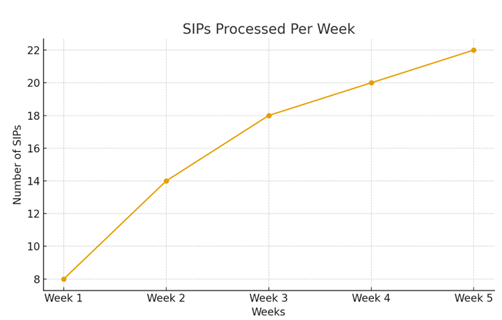

1) SIPs

Processed Per Week

The first chart shows the number of SIPs processed over five weeks of internship.

Interpretation:

In the initial week, only a few SIPs were completed, as I was still learning the process and becoming familiar with the firm’s systems. However, as I gained confidence and began using checklist-based verification, the number of successfully processed SIPs increased steadily each week; from 8 in Week 1 to 22 in Week 5.

This steady rise reflects an improvement in efficiency, teamwork, and familiarity with

documentation requirements. It also highlights how process standardization can reduce delays and make day-to-day operations smoother.

2)

KYC Documentation Errors Before and After

Checklist Implementation

The second chart compares the number of KYC errors before and after the introduction of a structured verification checklist.

Interpretation:

Initially, many KYC forms were rejected or delayed because of issues such as mismatched signatures, incomplete addresses, or missing documents. Before the checklist was implemented, there were about 12 documentation errors per batch. After introducing the checklist, the number dropped to around 5 errors, showing a clear improvement in accuracy.

This finding confirms that even a simple process improvement like using a step-by-step verification list can have a strong impact on operational performance. It reduced rework, improved client satisfaction, and helped maintain compliance with SEBI and AMFI norms.

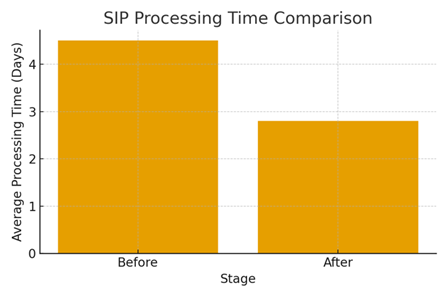

3) SIP

Processing Time Comparison (Before vs After)

The third chart presents the change in the average processing time of SIP activation before and after workflow improvements.

Interpretation:

Before the process was refined, the average SIP took about 4.5 days to complete due to delays in document checking and client follow-ups. After implementing the improved workflow and communication system, the processing time reduced to approximately 2.8 days.

This reduction in turnaround time demonstrates better coordination between the operations team and clients, along with more efficient handling of documentation. Faster processing also meant that clients received confirmations sooner, improving overall trust in the service.

6. Overall Analysis

During my internship, I realized how much of a difference small operational changes can make in the SIP process. Once I started using a simple checklist, keeping regular communication with clients, and arranging documents in a clearer way, the entire workflow became smoother. These small habits reduced the number of mistakes in the paperwork and helped the team stay more coordinated, which ultimately made SIP activations faster and less stressful.

Even though a large part of the firm’s work still relies on manual entries and physical files, it became clear to me that adding a few basic digital tools could save a lot of time. Something as straightforward as digital KYC verification or letting clients upload documents online would reduce back-and-forth communication and minimise errors. What stood out from my experience was that improving operations doesn’t always require expensive technology or major system overhauls—sometimes, consistent routines, better planning, and good teamwork are enough to make a visible improvement.

Overall, my internship showed me that smaller financial firms can definitely enhance their efficiency by tracking their processes regularly, communicating openly within the team, and making minor adjustments whenever needed. These small but meaningful changes can help companies like Tarun Capital & Investor Services grow steadily while maintaining accuracy, compliance standards, and a positive experience for clients.

7. DISCUSSIONS

The findings that emerged from my internship experience ended up reinforcing many of the themes discussed in the literature review, though in a much more practical and grounded way. While working on SIP processing at Tarun Capital & Investor Services, I could see how small adjustments inside the workflow influenced the overall speed and accuracy of the tasks. Something as basic as following a documentation checklist or having a clearer system for communicating with clients made a noticeable difference in how smoothly day-to-day work progressed. These observations reflected what researchers like Rao and Kumar (2022) and Patel (2021) had pointed out: firms that rely on consistent procedures and routine verification tend to perform better and face fewer compliance problems.

One insight that came through very strongly during the internship was the role of communication within operations. Whenever clients received timely reminders or updates about missing documents, the number of stalled cases reduced quickly. This matched the emphasis SEBI (2023) placed on communication and documentation as essential elements for maintaining both compliance and investor confidence. Observing this in real time gave me a deeper understanding of how operational delays often come from gaps in information flow rather than technical constraints alone.

A further point that became clear was the firm’s mixed use of digital and manual systems. Even though tools like Excel and CRM software were part of the workflow, a substantial amount of information continued to be stored in paper files. This occasionally slowed processes but also showed the reality of smaller firms that operate with limited technological resources. Ghosh (2020) mentions this challenge in his work, noting that many smaller financial firms cannot fully automate their processes but still manage to achieve acceptable levels of efficiency by organizing their tasks systematically.

The data used in this study supports the idea that meaningful process improvements do not always require major technological upgrades. After the introduction of simple tools like verification checklists, the frequency of KYC-related mistakes reduced sharply. Processing time also improved once the team adopted a clearer, more structured workflow. These findings point to the value of incremental changes, where small refinements introduced consistently can produce measurable gains in operational performance.

Another observation was the adaptability of the employees. Team members often stepped into multiple roles whenever required, ensuring that work continued even during high-volume periods. This flexibility seems to be a characteristic strength of smaller firms and contributes significantly to their ability to maintain stable operations despite constraints.

Overall, the results of this study indicate that the experiences at Tarun Capital & Investor Services reflect several broader patterns in the financial services sector. Accuracy in documentation, organized workflows, and steady communication appear to strengthen operational efficiency just as effectively as advanced automation might. For developing financial firms, gradually balancing manual oversight with selective digital adoption seems to be a realistic and sustainable way to improve long-term efficiency.

8. CONCLUSION AND RECOMMENDATION

The research I carried out during my internship at Tarun Capital & Investor Services gave me a clearer understanding of how central operational efficiency is to financial services. Because I was involved every day in tasks like SIP documentation, KYC verification, and various compliance checks, I was able to see how even the smallest adjustments in routine work could influence overall performance and the client experience. What became evident through the study was that well-maintained documentation, steady communication, and consistent monitoring form the backbone of effective investment operations.

The findings also showed that many of the challenges the team faced were not major system failures but smaller issues that repeated themselves: missing signatures, mismatched data, or delays in receiving the right information from clients. Introducing systematic checks and setting up a more structured workflow helped reduce these errors. When I used a verification checklist and kept records arranged in a clearer format, the processing of SIP requests became noticeably quicker. These improvements demonstrated that firms can strengthen their processes without relying on heavy technological upgrades.

Although the existing workflow at the firm is functional, there is room for further development. Gradually shifting more records to digital formats and automating parts of the KYC verification process would reduce manual work and make data handling more reliable. Training employees to use digital tools confidently and encouraging better communication between departments could also support smoother operations in the long term.

Looking at the broader picture, the research suggests that improving operational efficiency is not a one-time project but a continuous effort. It depends on teamwork, adaptability, and a willingness to examine everyday practices closely. Creating a workplace culture where employees feel responsible for identifying inefficiencies and feel comfortable suggesting solutions can lead to meaningful improvements over time.

In conclusion, the internship provided valuable insight into how investment operations function in real settings and the kinds of challenges financial firms encounter. It strengthened my understanding of SIP processing and regulatory requirements while also helping me develop practical skills such as problem-solving, communication, and time management. Overall, the research shows that efficiency is not driven by technology alone; it also grows from thoughtful processes, accountability, and a consistent focus on doing the work more effectively.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

4OVER4.COM. (n.d.). Essential Financial Labels for Compliance and Trust in Financial Services. 4OVER4.COM.

Asian Development Bank. (n.d.). Supplementary Document to Project 42267-026 (SD-04) [PDF]. Asian Development Bank.

BCM Institute. (n.d.). Understanding your Organisation : Printing Companies. BCM Institute Blog.

Chandnani, R. (2021, September). A Study on Financial Performance and Growth of Non-Banking Financial Companies [Project report, Veer Narmad South Gujarat University] [PDF]. Veer Narmad South Gujarat University.

EHG. (n.d.). Targeted Best Practices to Accelerate Product Label Design and Printing. EHG.

Freshservice. (n.d.). Printing Barcode Labels for Assets. Freshservice Support.

Gordon Tredgold. (2024, July 10). 8 Effective Strategies for Business Printing Cost Management. Gordon Tredgold.

Graphic Media Alliance. (n.d.). Financial Benchmarking Report [PDF]. Graphic Media Alliance.

Heidelberger Druckmaschinen AG. (2017). Annual Report 2017 [Annual report]. Heidelberger Druckmaschinen AG.

Kaliky VanDewater, K. (2025, February 27). Managing Material Costs for Label Converting and Printing. Packaging Impressions.

Khadi and Village Industries Commission. (n.d.). Flex Printing Business: Project Profile [PDF]. KVIC.

Konica Minolta. (n.d.). Label Printing Solutions. Konica Minolta.

Label and Narrow Web. (n.d.). The Label Printing Industry: An Ever-Evolving Market. Label & Narrow Web.

Labels and Labeling. (n.d.). Accounting and Financial Management. Label Academy, Labels & Labeling.

Labels and Labeling. (n.d.). Managing Information in Label and Package Printing. Label Academy, Labels & Labeling.

Microsoft. (2023, May 12). Printing Labels using External Service with Dynamics 365 Warehouse Management. Microsoft Dynamics 365 Blog.

Modeliks. (n.d.). Digital Printing and Copy Services Financial Model example. Modeliks.

PIPI/PRINTING United Alliance. (2023, March). PIPI Report: Financial Benchmarks [PDF]. PRINTING United Alliance.

PIPI/PIAG. (2022, October). PIPI Report (CSA) [PDF]. Printing Industries of America & Graphics.

Ricoh USA. (n.d.). Print Management. Ricoh USA.

S and P Global Ratings. (n.d.). Ratings Regulatory Methodology / Criteria Document [Report]. S&P Global Ratings.

ScienceDirect. (2022). Article S2590123022004881. ScienceDirect.

Scribd. (n.d.). Final Revised Thesis [PDF]. Scribd.

South African Journal of Business Management. (n.d.). Article 3563 [Journal article]. SAJBM.

Tayana Solutions. (n.d.). Manufacturing Labeling Best Practices. Tayana Solutions.

Taylor Corporation. (n.d.). Print Management for Commercial Print Services. Taylor Corporation.

TEKLYNX. (n.d.). 7 Key Components of a Label Management System. TEKLYNX.

Tredgold, G. (n.d.). Business Printing Cost Management Strategies. Gordon Tredgold.

UTEP ScholarWorks. (n.d.). Open Dissertation/thesis (article 4500) [Doctoral dissertation/Master’s thesis]. University of Texas at El Paso.

Vijay Ural. (n.d.). Manufacturing Labeling Best Practices. Tayana Solutions.

WhatTheyThink. (2022, March 17). Printing Industry Financial Ratios & Best Practices Study. WhatTheyThink. \

The Business Research Company. (n.d.). Label Printing Global Market Report. The Business Research Company.

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© IJETMR 2014-2025. All Rights Reserved.