|

|

|

|

Role of Digital Payments in Driving Economic Growth in Chennai

K. Sivasubramaniyan 1![]() , M. Teeka Raman 2

, M. Teeka Raman 2![]() , G. Surendar 3

, G. Surendar 3![]()

1 M.A.,

M.Phil., Ph.D., Professor, Research Scholar and M.A. Student Respectively,

Department of Economics, St. Peter’s Institute of Higher Education and

Research, Avadi, Chennai, India

2 M.A.,

Research Scholar, Department of Economics, St. Peter's Institute of Higher

Education and Research Avadi, Chennai, India

3 B.A., M.A. Student, Department of Economics,

St. Peter's Institute of Higher Education and Research Avadi, Chennai, India

|

|

ABSTRACT |

||

|

In

technologically advancing world, financial transactions in many fold and in

several aspects need to be done fast. For this purpose, digital payments come

into rescue and helps eliminating the need for physical cash. With rapid

advancements in technology, digital payments have become the backbone of

modern economies. In India, Tamil Nadu has emerged as a leading state for

digital payments. To examine the role of digital payments in enhancing

Chennai’s economic growth, the study adopted descriptive and causal research

design. Primary data from 50 consumers and business people in Chennai were

collected through questionnaire. The study suggests, a majority of

respondents view digital payments positively interact economic growth. Nearly

half the respondents trust digital payments, while a significant portion

remains unsure, highlighting the importance of improving security features

and user confidence in digital payments. The study suggests a strong

consensus that digital platforms significantly contribute in connecting urban

and rural economic activities, facilitating more inclusive growth in

Chennai's outskirts, and payments are becoming increasingly popular among

street vendors and small merchants. The UPIs are expected to play a crucial

role in shaping the future of digital payments in Chennai, with mobile

wallets and contactless payments also contributing to this trend. In sum, the

research findings highlight a strong preference for digital payments in

Chennai. |

|||

|

Received 05 August 2025 Accepted 02 September 2025 Published 09 October 2025 Corresponding Author K. Sivasubramaniyan,

ksivam2010@gmail.com DOI 10.29121/ijetmr.v12.i9.2025.1675 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2025 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Digital

Payments, Economic Growth, Digital Wallets, UPI, AI |

|||

1. INTRODUCTION

1.1. DIGITAL PAYMENTS

Digital payments refer to financial transactions that take place through electronic means, eliminating the need for physical cash. With rapid advancements in technology, digital transactions have become the backbone of modern economies. The convenience, speed, and security offered by digital payments have led to their widespread adoption across the globe.

2. GLOBAL PERSPECTIVES

Globally digital payments have revolutionized the financial ecosystem, enabling seamless, cashless transactions across borders. With the rise of technologies like Near Field Communication (NFC), block-chain, artificial intelligence etc., have become more secure, efficient, and accessible. Governments and financial institutions worldwide are pushing for cashless economies to increase transparency, reduce corruption, and drive financial inclusion.

In an increasingly interconnected global economy, digital payments have emerged as a critical engine of financial innovation and economic growth. From mobile wallets to instant money transfers, the transition to digital financial transactions is reshaping economies worldwide by reducing transaction costs, enhancing financial inclusion, and promoting transparency. Across the globe, cities that embrace digital payments are experiencing improved business and faster economic growth.

The global digital payment market is expected to reach USD 12.55 trillion by 2027, driven by e-commerce growth, increasing smartphone penetration, and improved internet connectivity. Countries like Sweden, China, and South Korea have adopted near-cashless models, introducing with QR code payments, mobile wallets, and real-time payment systems. The COVID-19 pandemic further accelerated the shift towards digital payments, making them an essential part of daily transactions.

2.1. WORLDWIDE GROWTH OF DIGITAL PAYMENTS

The global digital payment industry has experienced rapid expansion due to several factors:

1) Technological Advancements: Adoption of artificial intelligence (AI), block-chain, and contactless payment solutions has enhanced transaction efficiency and security.

2) Increased Smartphone Penetration: Widespread use of smartphone and internet connectivity has made digital payments accessible to billions of people worldwide.

3) Government and Regulatory Support: Many countries are promoting cashless transactions through policies, incentives, and infrastructure development.

4) E-Commerce Boom: The rise of online shopping platforms has accelerated the use of digital payments globally.

5) Covid-19 Impact: The pandemic significantly boosted digital payment adoption as consumers and business world preferred contactless transactions over cash payments.

2.2. LEADING COUNTRIES IN DIGITAL PAYMENTS

Important countries lead in digital payments adoption

· China: With platforms like Alipay and We Chat Pay, China is at the forefront of mobile payments, processing trillions of dollars annually.

· Sweden: Moving towards a cashless society, Sweden has integrated digital payments into nearly every aspect of daily life.

· United States: With widespread credit/debit card usage, platforms like PayPal, Venmo, and Apple Pay, digital transactions dominate in financial activity.

· India: The introduction of UPI and government-backed initiatives has led to one of the world’s fastest-growing digital payment markets.

· European Union: Countries across the EU are adopting digital payment solutions, with strong regulations ensuring security and transparency.

2.3. DIGITAL PAYMENTS AND ECONOMIC IMPACT

Digital payments contribute significantly to global economic growth by:

· Enhancing Financial Inclusion: Bringing banking services to unbanked and under-banked populations.

· Reducing Transaction Costs: Eliminating intermediaries and lowering service costs.

· Boosting Business Productivity: Faster transactions improve cash flow efficiency.

· Increasing Government Revenue: Digital transactions enhance tax compliance.

· Promoting Cross-Border Trade: Simplified international transactions facilitate global commerce and economic integration.

2.4. CHALLENGES AND FUTURE TRENDS

Despite rapid growth, the global digital payment faces challenges such as cybersecurity threats, regulatory complexities, and infrastructure gaps in developing countries. Future trends include:

· Central Bank Digital Currencies (CBDCS): Several countries are exploring the launch of digital currencies to enhance financial stability.

· AI and Block-Chain Integration: Innovations in AI-driven fraud detection and block-chain-based transactions will further enhance security and efficiency.

· Expansion of Contactless Payments: Increased adoption of NFC and biometric authentication will improve transaction convenience and security.

2.5. DIGITAL PAYMENTS LANDSCAPE IN INDIA

India has witnessed a massive digital payments revolution, largely propelled by government initiatives such as Demonetization (2016), Digital India, and the Unified Payments Interface (UPI). With a compounded annual growth rate (CAGR) of over 20%, India’s digital payments sector is one of the fastest growing in the world.

Key contributors to India’s digital payments growth include:

1) Unified Payments Interface (UPI): Introduced by the National Payments Corporation of India (NPCI), UPI allows instant, interoperable payments. India recorded over 10 billion UPI transactions per month in 2023.

2) Aadhaar-Enabled Payment System (AEPS): Facilitates biometric-based transactions, promoting financial inclusion in rural areas.

3) Digital Wallets: Platforms like Paytm, Google Pay, Phone Pay, and Amazon Pay have revolutionized peer-to-peer (P2P) and business transactions.

4) Government Policies: Initiatives like Bharat QR, e-RUPI, and the Digital Rupee have further strengthened digital payments in the country.

5) E-Commerce Boom: The rise of online shopping platforms such as Flip-kart, Amazon, and Myntra has increased digital transactions significantly.

Digital payments impact in India has been profound, leading to greater financial inclusion, reduced dependence on cash, improved tax compliance, and enhanced economic efficiency.

2.6. GROWTH OF DIGITAL PAYMENTS IN INDIA

The Indian digital payment sector has seen rapid expansion due to two key factors:

1) Government Initiatives: Policies such as Demonetization (2016), Digital India, and the Pradhan Mantri Jan Dhan Yojana (PMJDY) have accelerated the adoption of digital payments.

2) Fintech Revolution: Digital wallets, contactless payments, and neo-banking solutions have further enhanced the ecosystem.

2.7. IMPACT ON ECONOMIC GROWTH

Digital payments have contributed to India's economic development in the following ways:

· Financial Inclusion: Options available for digital payment has empowered unbanked and under-banked people, increasing their participation in the formal economy.

· Reduction in Cash Dependency: More digital transactions boost the economy work more efficiently, reducing leakages, corruption, and counterfeit currency issues.

· Tax Compliance and Revenue Growth: Digital transactions create transparent financial records, leading to increased tax compliance and government revenue.

· Ease of Doing Business: Seamless transactions, reducing operational costs and enhancing productivity are benefits for the business.

· Employment and Innovation: Digital payments industry has generated employment opportunities and spurred fintech innovations, strengthening the financial sector.

3. CHALLENGES AND FUTURE PROSPECTS

Despite its rapid growth, digital payments in India face several challenges such as digital literacy gap, and infrastructure limitations in rural areas. Addressing these challenges through security measures and awareness campaigns will be critical for sustained growth.

Looking ahead, India’s digital payment is expected to witness further advancements with the rise of Central Bank Digital Currency (CBDC), AI-driven financial services, and deeper Fintech collaborations. With continued government support and technological innovation, digital payments will play a pivotal role in India towards a cashless and robust future.

4. DIGITAL PAYMENT ADOPTION IN TAMIL NADU

Tamil Nadu has emerged as one of the leading states in India for digital transactions. With strong IT infrastructure, widespread smartphone adoption, and progressive government policies, digital payments have gained significant traction across urban and rural areas. Several factors contribute to digital payment growth in Tamil Nadu:

Government Initiatives: Tamil Nadu government has promoted cashless transactions in government services, property registration, transport, and welfare schemes.

Smart City Projects: Cities like Chennai, Coimbatore, and Madurai have integrated digital payments into municipal services, improving efficiency.

Banking and Fintech Growth: Leading banks and Fintech startups have set up digital banking kiosks and Fintech innovation hubs in the state.

Tourism and Retail Industry: With a thriving tourism and retail industry, digital payments have become essential in hotels, restaurants, and marketplaces.

Despite progress, challenges like cyber security risks, digital illiteracy, and infrastructure gaps in rural areas remain, necessitating further reforms and awareness campaigns.

5. GROWTH OF DIGITAL PAYMENTS IN TAMIL NADU

Tamil Nadu has emerged as a leader in digital transactions. The state government has integrated digital payments into various sectors, including public services, retail, and tourism. The introduction of smart city initiatives, fintech innovation hubs, and digital banking kiosks has further promoted cashless transactions.

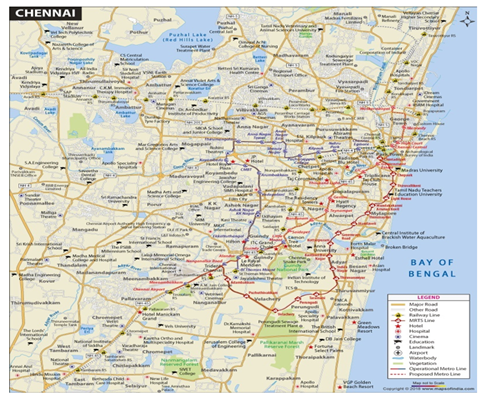

Chennai is expected to continue its growth trajectory in the coming decades. As a major metropolitan city, it is likely to see the increased urbanization, with population reaching more than 25 million by 2030. There will be a continued need for sustainable infrastructure to accommodate these population while addressing environmental and quality of life concerns.

Chennai has undergone rapid population growth driven by migration and economic opportunities. While it remains an important urban center in India, it faces challenges related to infrastructure, urban sprawl, and environmental sustainability that need to be addressed.

6. DIGITAL PAYMENT TRENDS IN CHENNAI

Chennai, the capital of Tamil Nadu and a major metropolitan city, is at the forefront of the digital payment’s revolution and it witnessed rapid growth in cashless transactions, driven by:

1) Public Transportation: Chennai Metro Rail, MTC buses, suburban trains now accept digital payments via smart cards and UPI.

2) Retail and Small Businesses: From high-end malls to local street vendors, digital payment adoption has increased significantly.

3) Educational Institutions: Schools and colleges are shifting to online fee payment systems, making transactions easier for students and parents.

4) IT and Corporate Sector: Chennai’s thriving IT industry has embraced digital transactions, with businesses relying heavily on online banking and digital wallets.

5) Healthcare and Public Services: Hospitals, pharmacies, and civic services have incorporated digital payment solutions for enhanced convenience.

7. IMPORTANCE OF DIGITAL PAYMENTS IN TAMIL NADU

Digital payments have become a vital component of economic growth, transforming financial transactions in Tamil Nadu and Chennai. With rapid urbanization, increasing smartphone penetration, and strong government support, digital payment systems have significantly contributed to the state's economic expansion. These payment solutions offer convenience, transparency, and efficiency, fostering a more inclusive and sustainable financial ecosystem. Three important benefits of digital payments are:

1) Financial

Inclusion

· The expanded banking access to rural areas reduces the dependency on cash.

· Government-backed initiatives such as Aadhaar-linked payment systems and UPI transactions have empowered marginalized communities.

2) Growth

of Businesses and SME

· Small and medium enterprises (SMEs) have benefited from faster and more secure transactions, reducing dependency on physical cash handling.

· Online payment gateways and mobile wallets have enabled small and street vendors, retailers to accept digital payments, increasing their customer base.

3) Boosting

Economic Sectors

· Digital payments have strengthened major industries in Tamil Nadu, including manufacturing, information technology, retail, and tourism.

· The hospitality sectors have seen increased digital payment adoption, benefiting from cashless transactions by domestic and international tourists.

8. FUTURE PROSPECTS AND OPPORTUNITIES

1) Advancements

In Contactless and AI-Powered Transactions

· AI-driven fraud detection and voice-enabled payment solutions are expected to enhance transaction security and user convenience.

· Biometric payment systems and NFC-based digital wallets further streamline cashless transactions in Chennai.

2) Government

Policies and Smart City Initiatives

· Digital transaction policies in public services and financial incentives for businesses adopting digital payments will accelerate economic growth.

· Chennai’s Smart City initiative will integrate further digital financial solutions into urban development projects.

3) Expanding

Digital Literacy and Inclusion

· Educational campaigns on digital financial tools will ensure greater adoption across all income groups and also rural migrants in the city.

· Enhanced digital banking infrastructure will help bridge the financial accessibility gap for the unbanked population.

4) Rise

of Block-chain and Crypto Currencies

· Chennai’s growing IT ecosystem provides an opportunity for block-chain based financial solutions and secure crypto-currency transactions.

· Businesses may explore decentralized payment models for improved financial security and transparency.

9. SCOPE AND NEED FOR THE STUDY

This study examines the role of digital payments in enhancing Chennai’s economic growth through financial inclusion, business efficiency, and technological advancements. It explores how digital transactions contribute to the retail, transportation, education, and healthcare sectors. The study also evaluates government initiatives and fintech developments driving cashless transactions. Additionally, it highlights the impact of digital payments on SMEs, employment, and investment opportunities. The research identifies challenges such as cyber security risks and digital literacy gaps. Prospects include AI-powered transactions and blockchain integration. This study aims to provide insights into how Chennai can leverage digital payments for sustained economic progress.

Study on digital payment is essential to understand its impact on the economic growth of Chennai, financial inclusion, and business development. This study helps to analyze how cashless transactions improve efficiency, reduce corruption, and boost government revenue. It provides insights into the role of Fintech advancements, e-commerce expansion, and smart city initiatives in shaping the city’s digital economy. Identifying challenges like cyber security risks and digital literacy gaps can help in developing better policies. The findings contribute to build an inclusive, secure, and efficient digital payment ecosystem in Chennai.

9.1. OBJECTIVES OF THE STUDY

· To study the impact of digital payments on the economic growth of Tamil Nadu.

· To find out the impact of digital payments on the economic growth of Chennai City.

· To analyze the improvement of digital payment and the business efficiency.

· To find out the impact of digital payment an competitiveness.

· To identify the challenges/ barriers to widen digital payment adoption in Chennai.

10. LIMITATIONS OF THE STUDY

· The outcome of this study will not be generalized in other areas.

· The study has primarily focused on certain sectors where the use of digital payments is most extensive and excluded sectors in which digital payments are less prevalent.

· The study is confined from December 2024 to March 2025.

· The outcome of the study may not account for future technological advancement.

Section 2: Review of Literature

Literature review helps to acquire first-hand knowledge on research done by others and to gain insight into the select problem. Also it gives an overview of the field of enquiry: what has already been said on the topic, who are the key writers, what are prevailing theories and hypotheses, what questions asked and what methodologies are appropriate and useful.

Though the earlier literature has focused on different dimensions of digital payments, to study this topic on the “Role of Digital Payments in Driving Economic Growth in Chennai City”, some important literature reviewed is discussed and given in chronological order.

Hattarakihal (2016) in a study "Digital Payment System in India: Issues and Challenges," evaluated the e-transaction system, discussing methods of digital payments, trends, and challenges in making India a cashless economy. The study emphasize adopting electronic transactions efficiency and transparency, enabling faster growth of economy.

Joshi (2017) in his paper "Digital Payment System: A Feat Forward of India," analyzed the trends in various digital payment modes, such as NFS Inter Bank ATM Cash Withdrawal, NACH, CTS, IMPS, AEPS, BBPS, UPI, BHIM (UPI), and NETC over three years. The study found a remarkable growth in digital payments in both volume and value during 2017-18, indicating a shift towards a cashless economy and its potential impact on economic growth.

Vally and Divya (2018) in their study "Digital Payment in India with Perspective of Consumer Adoption," discussed how demonetization led to a surge in digital payments, supported by Digital India. It highlights the resulting transparency in transactions and the empowerment of consumers through digital payment adoption.

Ravikumar et al. (2019) indicate Digital payments emerge as a favorite mode of payments all over the world and have been picking up rapidly in India since 2014 due to “Digital India” initiatives, internet and smart-phone penetration and adoption of technologies. India has achieved a Cumulative Average Growth Rate (CAGR) of 58.9% in volume and CAGR of 28.4% of value in digital payments in 2019. This growth rate is remarkable in the global payments market NITI Aayog (2018).

Potey and Soni (2019) observed, according to PWC's 2015 Retail Survey, India shows strong acceptance of mobile payments, with 67% prefer debit cards and 66% cash, challenging the digital payment sector. While India leads in debit card adoption (67% vs. global 57%), credit card usage remains low. Despite cash being seen as safer, India lags China in digital platform adoption (22% vs. 71%).

Ranjith et al. (2021) showed that Digital India's push for a cashless economy, supported by initiatives like PMJDY, UPI has driven significant growth in digital payments. The benefits include faster transactions, increased customer satisfaction, and financial inclusion. However, challenges like lack of education, security concerns, and infrastructure issues hinder full adoption. This study explores consumer perceptions of online payments and the obstacles in achieving a cashless economy.

Kaleeth and Chellammal (2021) examined the satisfaction levels of college students in rural Ramanathapuram with digital payments, focusing on factors influencing their adoption and usage. It offers insights into the effectiveness in fostering financial inclusion and economic growth in rural areas. The research also explores the role of education and awareness in enhancing digital literacy and boosting adoption among youth.

Saha (2021) found during the COVID-19 lockdown, the use of electronic transactions surged to reduce physical bank visits, with the global payment gateway market expected to grow by $23.45 billion by 2024. E-wallets allow digital transactions without a bank account. Major providers like Google Pay, Paytm, and Phone Pay helped facilitate contactless transactions, promoting safety and convenience.

Anisha et al. (2022) found during the COVID-19 pandemic, mobile payments have become essential in today's tech-driven world, offering seamless, secure, and cashless transactions. The study of Chennai's mobile payment adoption highlighted increased awareness and satisfaction among customers, who appreciated the ease and security of digital transactions. However, issues like network problems and server errors were identified as common challenges faced by users.

Bhatia‐Kalluri and Caraway (2023) article uses Paytm as a case study to explore the role of digital intermediary platforms in promoting financial inclusion within India's digital financial services ecosystem. It examines how regulatory frameworks, including demonetization in 2016, facilitated the shift to digital payments and impacted the cash-dependent economy. The study highlighted the growth of Paytm, its governance, and multi-stakeholder collaborations all helped shape India's large cashless platform ecosystem.

Karthikeyan (2023) examined, digital payments in India began in the 1980s with credit and debit cards, starting with Andhra Bank's credit cards in 1981. The first ATM was set up by HSBC in 1987, but cash remained dominant until the internet era. The NPCI was established in 2008 to oversee payments, and several digital payment options emerged. UPI, launched in 2016, became a crucial part of India's transition to a cashless economy.

Jose (2023) studied the COVID-19 pandemic accelerated the shift from a cash-based economy to digital payments, following earlier government efforts like demonetization to reduce cash usage. Lockdowns and restrictions drove both consumers and merchants to adopt cashless transactions for convenience and safety. This transition is to achieve sustainable development goals by enhancing financial infrastructure and supporting economic growth.

Patel et al. (2024) in their article "Adoption of Digital Payment Systems in India: A Review of Current Trends and Future Prospects," focused the digital payment systems in India, with an emphasis on UPI and comparing traditional payment methods. They analyze factors influencing adoption across different demographic segments and economic sectors, highlighting UPI's potential to drive financial inclusion and efficiency.

Veeranna (2024) found that India's digital economy, contributing 8% to the GDP in 2021 and projected to reach 20% by 2025, is transforming various sectors through initiatives like Digital India, fintech platforms, and e-commerce growth. While driving financial inclusion and creating job opportunities, challenges such as the digital divide, data security, and digital literacy persist, especially in rural areas. This research explores the impact of India's digital economy on growth, employment, and socio-economic development, offering insights for fostering an inclusive digital ecosystem.

Sarkar and Ghosh (2025) studied digital payments have revolutionized marketing by enhancing customer satisfaction and sales through efficient, secure transactions. With the rise of smart phones and government initiatives, digital payments like UPI, mobile wallets, and credit/debit cards have reshaped traditional marketing strategies, focusing on speed, accessibility, and personalization. India saw rapid growth in digital payments after demonetization, with UPI becoming a significant player in the economy. All popular methods are also contributing to India’s digital payment boom.

Section 3 Research Methodology

Research is a systematic enquiry of finding facts. The present study focuses on research design, approach, strategy, variables, and selection of study area. Resources of data collection, population, sampling procedure, research instrument, pilot study, reliability and validity, data collection, processing & analysis, ethical considerations, limitations and scheme of the report are other related components.

1) RESEARCH

DESIGN

The study adopts descriptive research and causal research design. The former aims to describe the use of digital payment methods in Chennai and their economic impact. The latter explores how its adoption directly or indirectly contributes to economic growth in Chennai.

2) RESOURCES

OF DATA COLLECTION

Primary data were collected from consumers and business people in Chennai city. A structured questionnaire was used to collect data on their usage patterns, preferences, and perceptions of the role of digital payments in driving economic growth.

3) SAMPLE

POPULATION

The study was focused on 50 consumers and business people in Chennai city. The population consists of individuals who make payments via digital platforms (e.g., mobile wallets, online banking, UPI) for goods and services, and businesses that accept payments.

RESEARCH INSTRUMENT (QUESTIONNAIRE)

A structured questionnaire was developed to collect all information and data.

4) DATA

COLLECTION

Primary data were collected from both consumers and businesses in Chennai. This method allows the researcher to capture direct, specific data on the subject matter.

5) DATA

PROCESSING

Based on filled-in questionnaire, data entry was done. Any missing or inconsistent data were identified and rectified. The data were organized systematically for further analysis.

Section 4: Data Analysis and Interpretation

In this chapter, the variables used to study the role of digital payments in driving economic growth in Chennai city are analyzed and interpreted.

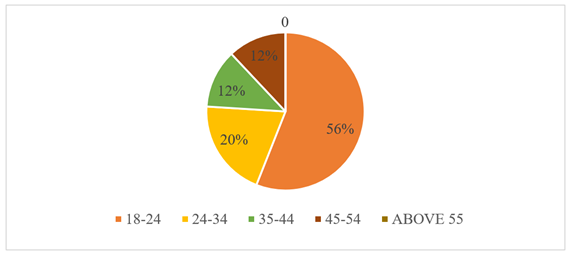

Table 1 and Chart 1 present the age group distribution of respondents. Most of the respondents, 56%, fall within the 18-24 age range, with 28 individuals. The 25-34 age group makes up 20% of the respondents, totaling 10 people. Respondents aged 35-44 and 45-54 in each represent 12% of the total, with 6 individuals in each group. There were no respondents above the age of 55. The total number of respondents is 50, representing 100% of the sample.

Table 1

|

Table 1 Age of Respondents |

||

|

Age |

Respondents |

Percentage |

|

18-24 |

28 |

56 |

|

25-34 |

10 |

20 |

|

35-44 |

6 |

12 |

|

45-54 |

6 |

12 |

|

Above 55 |

- |

- |

|

Total |

50 |

100 |

|

Source Primary

Data, March, 2025 |

||

Chart 1

|

Chart 1 Age of Respondents |

Table 2 presents the distribution of respondents by occupation. The majority, 58%, are professionals. Students represent the second-largest group, comprising 32%. Homemakers account for 8%, while entrepreneurs make up the smallest segment of 2%. This data reveals a diverse mix of occupations, with a significant majority being employed in professional roles. All respondents ensure a broad perspective of their occupation.

Table 2

|

Table 2 Occupation of Respondents |

||

|

Occupation |

Respondents |

Percentage |

|

Working professionals |

29 |

58 |

|

Student |

16 |

32 |

|

Homemaker |

4 |

8 |

|

Entrepreneur |

1 |

2 |

|

Total |

50 |

100 |

|

Source Primary Data, March, 2025 |

||

Table 3 provides the monthly income distribution. A majority, 68%, earn less than Rs. 20,000 p/m. Respondents with an income between Rs. 20,000 and Rs. 50,000 is 20%. Those earning between Rs. 50,000 and Rs. 100,000 constitute 10%. Only 2% of respondents earn more than Rs. 100,000 per month. This data indicates that a substantial portion of respondents fall into lower income brackets, with relatively few in higher income categories.

Table 3

|

Table 3 Monthly Income of Respondents |

||

|

Monthly

Income |

Respondents |

Percentage |

|

Less than

Rs.20,000 |

34 |

68 |

|

Rs.

20,000- Rs. 50,000 |

10 |

20 |

|

Rs.

50,000- Rs. 100,000 |

5 |

10 |

|

More than

Rs. 100,000 |

1 |

2 |

|

Total |

50 |

100 |

|

Source Primary Data, March, 2025 |

||

The enquiry with the respondents indicate that the usage of digital payment methods is more, i.e., 96%, of their transactions, indicating a strong preference and reliance on digital payments. Only 4% of respondents do not use digital payments. This information suggests that digital payment options are widely accepted and adopted by the respondents.

Table 4 highlights the frequency of digital payments. Respondents with 76%, use it daily, indicating a high reliance and comfort. Weekly users make up 12%. Those use monthly and rarely each account for 6% each. So the digital payments are an integral part of daily life.

Table 4

|

Table 4 Methods of Digital Payments |

||

|

Digital

payment methods |

Respondents |

Percentage |

|

Daily |

38 |

76 |

|

Weekly |

6 |

12 |

|

Monthly |

3 |

6 |

|

Rarely |

3 |

6 |

|

Total |

50 |

100 |

|

Source Primary Data, March, 2025 |

||

Table 5 provides the primary reasons for using digital payment methods. Convenience is the most cited reason (60%) followed by Security (26%). Speed is a reason for 10% of respondents, and cost-effectiveness is considered by 4%. The data indicate ease use and safety are primary drivers for adopting digital payments.

Table 5

|

Table 5 Primary Reasons for Using Digital Payment Methods |

||

|

Primary

reasons |

Respondents |

Percentage |

|

Convenience |

30 |

60 |

|

Security |

13 |

26 |

|

Speed |

5 |

10 |

|

Cost-effectiveness |

2 |

4 |

|

Total |

50 |

100 |

|

Source Primary Data, March, 2025 |

||

Table 6 shows the use of different digital payment methods. The most common method is UPI, used by 18 respondents. Online banking by 15 respondents, while 12 respondents (24%) use credit/debit cards. Mobile wallets are used by 3, and 2 respondents used other methods.

Table 6

|

Table 6 Digital Payment Methods |

||

|

Digital

Payment Methods |

Respondents |

Percentage |

|

Online

banking |

15 |

30 |

|

Mobile

wallets |

3 |

6 |

|

Credit/debit

cards |

12 |

24 |

|

Unified

Payment Interface (UPI) |

18 |

36 |

|

Others |

2 |

4 |

|

Total |

50 |

100 |

|

Source Primary Data, March, 2025 |

||

Table 7 shows that 36% of respondents use digital payments for shopping, 24% for bill payments, and 22% for food delivery services. Travel-related expenses are made by 16%, while 2% use them for all purposes.

Table 7

|

Table 7 What Purposes Do You Use Digital Payments |

||

|

Purposes of digital

payments |

Respondents |

Percentage |

|

Shopping

(online/offline) |

18 |

36 |

|

Bill payments

(electricity, water, etc.) |

12 |

24 |

|

Travel (cabs, trains,

etc.) |

8 |

16 |

|

Food delivery services |

11 |

22 |

|

All the above |

1 |

2 |

|

Total |

50 |

100 |

|

Source

Primary Data, March, 2025 |

||

The enquiry on challenges faced by respondents while using digital payments shows that a majority (60%), reported experiencing challenges in terms of difficulties in usage, whereas 40% did not face any issues. Identifying and addressing these challenges can help improve user experience and encourage even broader adoption of digital payment methods.

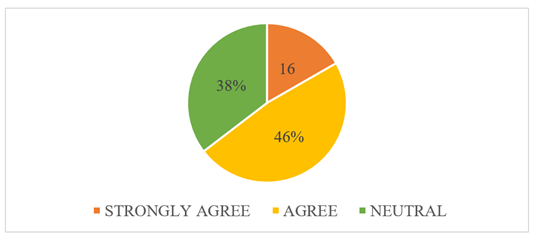

Table 8 and Chart 2 reveal respondents' opinion on digital payments' impact on economic growth. Among the 50 respondents, 16% strongly agree that digital payments contribute to economic growth, while 46% agree. Another 38%, remains neutral. Notably, no respondents disagree or strongly disagree with the statement. This data suggest that a majority of respondents view digital payments positively interact economic growth, with a significant portion remaining undecided.

Table 8

|

Table 8 Digital Payments and Economic Growth |

||

|

Digital

Payment and Economic Growth |

Respondents |

Percentage |

|

8 |

16 |

|

|

Agree |

23 |

46 |

|

Neutral |

19 |

38 |

|

Disagree |

- |

- |

|

Strongly

disagree |

- |

- |

|

Total |

50 |

100 |

|

Source Primary Data, March, 2025 |

||

Chart 2

|

Chart 2 Digital

Payments and Economic Growth |

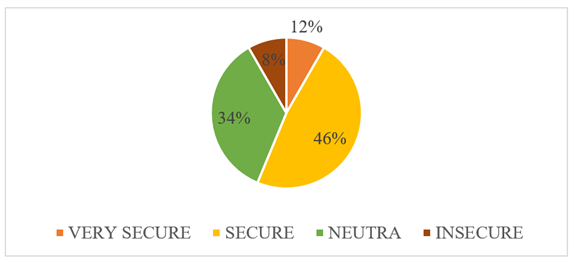

Table 9 and Chart 3 evaluates how secure respondents feel using digital payments among 50 participants. Only 8% respondents feel very secure, while 46% feel secure. A notable 34% remains neutral. Another 8% feel insecure, and no feel very insecure. The data suggests that nearly half the respondents trust digital payments, while a significant portion remains unsure, highlighting the importance of improving security features and user confidence in digital payment systems. The above table is presented in the form of pie Chart 3.

Table 9

|

Table 9 Type of Digital Payments Security |

||

|

Digital Payments

Security |

Respondents |

Percentage |

|

Very secure |

6 |

12 |

|

Secure |

23 |

46 |

|

Neutral |

17 |

34 |

|

Insecure |

4 |

8 |

|

Very insecure |

- |

- |

|

Total |

50 |

100 |

|

Source

Primary Data, March, 2025 |

||

|

|

||

Chart 3

|

Chart 3 Digital Payments and Security |

The benefits of using digital payment methods Table 10 show that more than a third of respondents (34%) highlighted faster transaction processing as the main benefit, followed by increased convenience (28%). Improved security was noted by 22% of respondents, while reduced transaction costs and other benefits were less frequently cited.

Table 10

|

Table 10 Benefits of Using Digital Payment Methods |

||

|

Benefits

of Digital Payment Methods |

Respondents |

Percentage |

|

Increased

convenience |

14 |

28 |

|

Improved

security |

11 |

22 |

|

Faster

transaction processing |

17 |

34 |

|

Reduced

transaction costs |

7 |

14 |

|

Others |

1 |

2 |

|

Total |

50 |

100 |

|

Source Primary Data, March, 2025 |

||

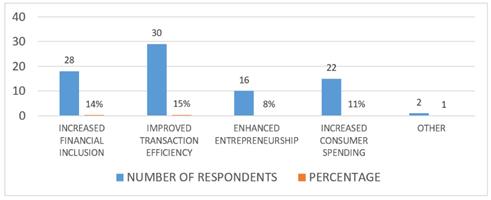

Table 11 and Chart 4 show, how digital payments can drive economic growth in Chennai City. Majority of respondents (30%) emphasized improved transaction, while 28% highlighted increased financial inclusion. Other benefits include increased consumer spending (22%) and enhanced entrepreneurship (16%), with a small percentage citing other factors. The data reflects various ways digital payments could boost Chennai's economy.

Table11

|

Table 11 Digital Payment Methods and Economic Growth in Chennai |

||

|

Digital

payment methods |

Respondents |

Percentage |

|

Increased

financial Inclusion |

14 |

28 |

|

Improved

transaction Efficiency |

15 |

30 |

|

Enhanced

entrepreneurship |

8 |

16 |

|

Increased

consumer Spending |

11 |

22 |

|

Other |

2 |

4 |

|

Total |

50 |

100 |

|

Source Primary Data, March, 2025 |

||

Chart 4

|

Chart 4 Digital Payment Methods and Economic Growth in Chennai City |

Table 12 presents issues experienced by all respondents while using digital payments. The most common issue was lack of internet connectivity (34%), followed by fraud/scams (26%) and technical glitches (22%). Additionally, 18% of respondents faced challenges due to a lack of knowledge about digital payments.

Table 12

|

Table 12 Experience of the Following Issues while Using Digital Payments |

||

|

Issues Experienced

while using digital payments |

Respondents |

Percentage |

|

Technical glitches |

11 |

22 |

|

Lack of internet

connectivity |

17 |

34 |

|

Fraud/scams |

13 |

26 |

|

Lack of awareness or

Knowledge |

9 |

18 |

|

Total |

50 |

100 |

|

Source

Primary Data, March, 2025 |

||

The impact of digital payments on business operations in Chennai was perceived by respondents. A majority of 82%, believe that digital payments have improved business operations. Only 6% think otherwise, and another 12% are unsure. This data indicates a strong positive sentiment towards the benefits of digital payments in enhancing business efficiency and effectiveness in Chennai. Also, the impact of digital payments on customer footfall in small/local businesses, according to respondents, show that a majority of 88%, believe that digital payments have increased customer footfall.

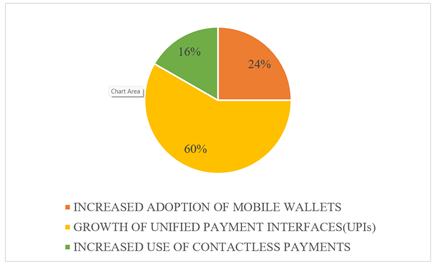

Table 13 and Chart 5 outline respondents' views on the future of digital payments in Chennai. Among 50 respondents, 60% foresee significant growth in Unified Payment Interfaces (UPIs). Increased adoption of mobile wallets is anticipated by 24% of respondents, while 16% predict a rise in the use of contactless payments. The data suggests that UPIs are expected to play a crucial role in shaping the future of digital payments in Chennai, with mobile wallets and contactless payments also contributing to this trend.

Table 13

|

Table 13 Future of Digital Payments in Chennai City |

||

|

Future digital

payments |

Respondents |

Percentage |

|

Increased adoption of

mobile wallets |

12 |

24 |

|

Growth of unified

payment interfaces (UPI) |

30 |

60 |

|

Increased use of

contactless payments |

8 |

16 |

|

Total |

50 |

100 |

|

Source

Primary Data, March, 2025 |

||

Chart

5

|

Chart 5 Future Digital Payments in Chennai City |

Table 14 identifies the key factors driving digital payment growth in Chennai. Government initiatives were seen as the most significant factor (38%), followed by growing internet connectivity (32%) and increasing smart phone penetration (26%). Private sector investment was considered as smaller contributor (4%).

Table 14

|

Table 14 Key Factors Driving Growth of Digital Payments in Chennai City |

||

|

Factors for the growth

of digital payments |

Respondents |

Percentage |

|

Increasing smartphone

Penetration |

13 |

26 |

|

Growing internet

connectivity |

16 |

32 |

|

Government initiatives |

19 |

38 |

|

Private sector

investment |

2 |

4 |

|

Total |

50 |

100 |

|

Source

Primary Data, March, 2025 |

||

The digital payments adoption rate among street vendors and small merchants in Chennai shows that overwhelming majority, 92%, reported an increase in digital payment adoption, while only 8% did not observe any change. This data suggests that digital payments are becoming increasingly popular among street vendors and small merchants in Chennai, likely due to the convenience and efficiency they offer in daily transactions. Further, the responses on the role of digital payment platforms in bridging the gap between urban and rural economic activities in Chennai's outskirts indicate that 84% believe these platforms help bridge the gap, while 6% disagree, and 10% consider it not applicable. The data suggests a strong consensus that digital payment platforms significantly contribute in connecting urban and rural economic activities, facilitating more inclusive growth in Chennai's outskirts.

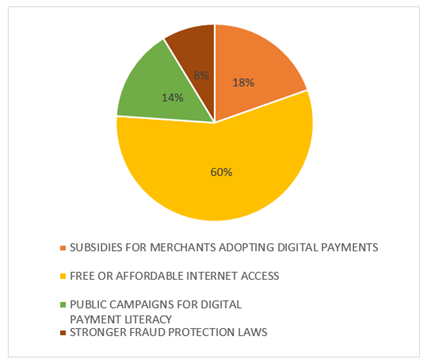

Table 15 and Chart 6 highlights government measures to promote digital payments in Chennai, with 60% of respondents favoring free or affordable internet access. Subsidies for merchants (18%) and public campaigns (14%) also received support. The data indicate that affordable internet is viewed as the most effective measure.

Table 15

|

Table 15 Government initiative to Promote Digital Payments in Chennai |

||

|

Government

Initiatives |

Respondents |

Percentage |

|

Subsidies for merchants

adopting digital payments |

9 |

18 |

|

Free or affordable internet

Access |

30 |

60 |

|

Public campaigns for digital

Payment literacy |

7 |

14 |

|

Stronger fraud protection laws |

4 |

8 |

|

Total |

50 |

100 |

|

Source Primary Data, March, 2025 |

||

Chart 6

|

Chart 6 Government Initiative to Promote Digital Payments in Chennai |

Respondents' awareness of current policies regarding digital payments in Chennai is also investigated. A significant majority, 84%, are aware of the policies. Meanwhile, 10% of respondents are unaware, and 6% are unsure. Likewise, the respondents' views on digital payments financial literacy among users in Chennai show that 88% believe that digital payments do promote financial literacy, while 12% do not. Also, Respondents' participation in campaigns, workshops, or programs in promoting digital payments shows that 66% participated in such initiatives, while the rest did not participate.

Section V - Findings, Suggestions and Conclusions

The findings of the study are summarized, and the conclusion is made accordingly.

11. FINDINGS

The age distribution of 50 respondents is 56% are aged 18-24, followed by 20% in the 25-34 range, and no respondent is above 55 years.

1) The occupational distribution of respondents is: 58% professionals, 32% students, 8% homemakers, and 2% entrepreneurs.

2) Monthly income distribution of respondents is: with 68% earning less than Rs. 20,000. Only 2% earn more than Rs. 100,000, indicating a concentration in lower income brackets.

3) The digital payment methods show that 96% of respondents use it, while only 4% do not.

4) Frequency distribution of digital payments use show that 78% use it daily, while 12% use it weekly.

5) Usage of UPI is 38%, online banking 26%, and 20% use credit/debit cards. Alsos some respondents use multiple payment methods.

6) The purpose of digital payments shows that 26% for shopping, 6 for bills, 20% for food delivery, and 18% for travel expenses. A few do multiple uses.

7) Regarding challenges in using digital payments show that 62% face it, while 38% do not.

8) Opinion of digital payments contribution to economic growth indicate that 16% strongly agree, and 48% agree, while the rest remain neutral. No respondent disagree, indicating a positive outlook on digital payments' economic impact.

9) Digital payments transaction efficiency is highlighted by 40% of respondents. Other benefits include increased financial inclusion (34%) and the rest is consumer spending.

10) Issues like internet connectivity is faced by 46%, followed by technical glitches/ fraud (42%). About 12% struggled with a lack of awareness or knowledge about digital payments.

11) Significant growth (58%) in UPIs is foreseen, while 25% expect more mobile wallet adoption. The data highlights UPIs as key to the future of digital payments in Chennai.

12) More than a third viewed that government initiatives as the key driver of digital payment growth, followed by internet connectivity (30%) and smartphone penetration (26%). Private sector investment is a smaller contributor (8%).

13) Adoption of digital payments among street vendors and small merchants in Chennai is 92%, while 8% saw no change. This highlights the growing popularity of convenience.

14) Digital payments bridge the gap between urban and rural economic activities which is found 86% in Chennai's outskirts.

15) Digital payments promote financial literacy in Chennai that is believed by 88% of respondents, while 12% disagree.

12. SUGGESTIONS

· It would be helpful to include more detailed age categories above 55 to gain a better understanding of the age distribution for older respondents.

· Consider expanding the occupational categories to capture a broader range of roles and provide a more detailed view of the respondents' employment backgrounds.

· It would be beneficial to include more income brackets to better understand the distribution within the lower and higher income ranges.

· It would be useful to provide more context on how each benefit specifically impacts users to deepen the understanding of digital payment advantages.

· It may be helpful to explore the specific causes of internet connectivity and technical issues to identify targeted solutions for improving the digital payment experience.

· It would be beneficial to examine the impact of private sector investment in more detail to understand its potential role in driving digital payment growth.

· It would be useful to investigate the factors driving this adoption among street vendors and small merchants to identify key enablers and challenges.

· To enhance policy effectiveness, targeted awareness campaigns could address the gaps in knowledge among the respondents who are either unaware or unsure.

· It would be valuable to explore the reasons why a third did not participate in digital payments, to identify barriers and improve future engagement strategies.

13. CONCLUSION

The research findings highlight a strong preference for digital payments, with 96% of respondents using them regularly and 78% making daily transactions. UPI is the most preferred method, primarily for shopping and bill payments. Key drivers include convenience and security, though challenges like internet issues and fraud persist. Digital payments are seen as most contributing to economic growth, improving business operations, and increasing customer footfall. Government initiatives, internet access, and smartphone penetration are key factors driving adoption. There is high awareness of digital payment policies, and many respondents have engaged in awareness campaigns. Overall, digital payments are shaping a more inclusive and cashless economy.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Anisha, P., Gautaman, M., Vimal Raj, A. A., & Rayappa, J. J. (2022). Journal of Positive School Psychology, 6(3), 7401–7408.

Bhatia‐Kalluri, A., & Caraway, B. R. (2023). Media and Communication, 11(3), 320–331. https://doi.org/ISSN2183–2803

Hattarakihal, S. M. (2016). Digital Payment System in India: Issues and Challenges. International

Journal of Creative Research Thoughts, 5(4), 955–960.

Jose, S. (2023). International Journal of Science and Research (IJSR), 12(3).

Joshi, M. (2017). Digital Payment System: A Feat Forward of India. Research Dimension, 7(1), 1–12.

Kaleeth, A. B. L., & Chellammal, T. (2021). International Journal of Early Childhood Special Education, 13(2). https://doi.org/10.48047/intjecse/v13i2.21208

Karthikeyan, C. (2023). Journal of Development Economics and Management Research Studies

(JDMS), 10(16), 177–187.

Patel, M., Singh, V., & Reddy,

S. (2024). Adoption of Digital Payment Systems in

India: A Review of Current Trends and Future Prospects. International Journal

of Research and Analytical Reviews, 11(3), 297–310.

Potey, D., & Soni, J. (2019). The Management Quest, 2(1), April–September. Durgadevi Saraf

Institute of Management Studies (DSIMS).

Ranjith, P. V., Kulkarni, S., & Varma, A. J. (2021). Psychology and Education, 58(1), 3304–3319.

Ravikumar, T., Suresha, B., Sriram, M., & Rajesh, R. (2019). International Journal of Innovative Technology and Exploring Engineering (IJITEE), 8(12), October. https://doi.org/ISSN2278-3075

Saha, R. (2021). International Journal of Multidisciplinary Educational Research, 1(2), January.

Sarkar, A., & Ghosh, D. (2025). International Journal for Multidisciplinary Research (IJFMR), 7(2). https://doi.org/IJFMR250238202

Vally, K. S., & Divya, K. H.

(2018). A Study on Digital Payments in India with

Perspective of Consumer Adoption. International Journal of Pure and Applied

Mathematics, 118(24), 1–15.

Veeranna, S. C. (2024). International Journal of Research Publication and Reviews, 5(8), 937–946.

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© IJETMR 2014-2025. All Rights Reserved.