|

|

|

|

Exploring the correlation between wages and housing prices - Applying Excel Solver to construct a housing loan dynamic analysis calculator

Yu-Fen Chen 1![]()

1 Associate

Professor, Department of Accounting Information, Chihlee

University of Technology, New Taipei City, Taiwan

|

|

ABSTRACT |

||

|

Starting a family has long been a key life goal for many, yet in recent years, the number of people remaining unmarried and childless has steadily increased. This shift is influenced not only by evolving social structures and personal values, but also by growing economic pressures, persistent inflation, and broader environmental uncertainties. Although Taiwan’s minimum wage has risen for eight consecutive years, these gains have been largely eroded by rising living costs, diminishing real purchasing power. Consequently, for many young people, buying a home has become an increasingly distant dream. This study investigates the rationality of housing prices in Taiwan by comparing global housing trends, evaluating current domestic housing prices, and analyzing the salary levels of Taiwanese workers. It also examines the affordability of home loans and the correlation between wage growth and property prices to assess the financial burden on prospective homeowners. To provide more practical insights, the study integrates Excel Solver to create a dynamic mortgage analysis calculator that links income levels with housing costs. Through this

comprehensive approach, the research highlights the critical challenges

facing today’s young adults in achieving homeownership. Finally, it offers

actionable strategies and policy suggestions aimed at improving housing

affordability and helping the younger generation move closer to realizing

their dream of owning a home. |

|||

|

Received 16 June 2025 Accepted 15 July 2025 Published 24 August 2025 Corresponding Author Yu-Fen

Chen, bephd0713@gmail.com DOI 10.29121/ijetmr.v12.i8.2025.1656 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2025 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Taiwan,

Salary, Housing prices, Housing loans, Interest rates, Excel Solver |

|||

1. INTRODUCTION

1.1. Research background and motivation

With the changes in the global economy and the evolution of social development, the real estate market has always been a topic of widespread concern. As a rapidly developing economy, Taiwan's housing prices have naturally become one of the focal points of public discussion. In the past decade, although overall wages in Taiwan have increased, the house price-to-income ratio has continued to rise year by year. Over the past twelve years, housing prices have skyrocketed. In response, the government has introduced various policies, such as the Actual Price Registration system, the Consolidated Housing and Land Tax, the Vacancy Tax, and the New Youth Secure Home Loan program. However, housing prices have continued to surge like mushrooms after the rain, showing little effect from these policies in curbing price growth—some even argue that they have had the opposite effect. The housing price-to-income ratio, also known as the Home Purchase Pain Index, is the ratio of the median housing price to the median household disposable income. This figure represents the number of years' worth of disposable income required to purchase a median-priced home. According to the World Bank, a house price-to-income ratio between 4 and 6 is considered reasonable. However, since 2009, Taiwan's ratio has exceeded 6, and as of the first quarter of 2024, it has surpassed 10 see Figure 1, more than double the World Bank's recommended range. The increasing burden of mortgage payments has significantly impacted people's daily quality of life as they struggle to repay high housing loans.

Figure 1

|

Figure 1 National Housing Price-to-Income Ratio from 2018 to the First Quarter of 2024 Source Real

Estate Information Platform, Ministry of the Interior (Self-Compiled) |

As housing prices rise far faster than wages, young people are becoming increasingly doubtful about whether they will ever be able to afford a home. Although salaries see slight annual increases, the rapidly soaring cost of living and the ever-unreachable high house prices make the dream of homeownership seem more out of reach than ever.

2. Research Objectives

Considering the current social and economic environment, this study first explores global housing price trends, the state of housing prices in Taiwan, and the salary levels of Taiwanese citizens, followed by an analysis of their mortgage affordability. Furthermore, the study incorporates the "optimization solver" tool within Excel Solver to develop an analytical simulator by presetting certain parameter values, allowing for simulations of salary and housing price fluctuations. Finally, feasible strategies for home purchases are proposed to alleviate the difficulty young people face in affording a home in this generation.

The research objectives are outlined as follows:

1) Exploring housing price trends in major cities worldwide

2) Examining recent changes and current status of housing prices in Taiwan

3) Understanding the current salary situation in Taiwan

4) Applying Excel Solver to develop a dynamic analysis simulator linking salaries and housing prices

5) Providing relevant recommendations for home buying planning

3. Literature review

Many people question whether Taiwan's housing prices are reasonable compared to those in major cities worldwide. Is the housing price-to-income ratio still within a reasonable range? This article explores various aspects, including global housing price trends, changes and the current state of housing prices in Taiwan, Taiwan's wage levels, and the relationship between wages and housing prices. Through data collection and analysis, we aim to gain a preliminary understanding of the background, current situation, and future trends of these issues.

3.1. Overview of housing prices in major cities around the world

Generally speaking, housing prices are influenced by factors such as the local economy, job market, population growth, government policies, and interest rates. Wong (2012) examined the case of rising real estate prices and pointed out that when real income increases, real loan interest rates decline, general inflation rates rise, and the proportion of high-value loans increases, these factors may collectively drive-up real estate demand. An increase in real income means that people have greater purchasing power, which can translate into a higher demand for real estate. A decline in real loan interest rates reduces financing costs, making it easier to obtain capital, thereby enabling more people to buy homes or invest in property. A rise in general inflation rates may prompt individuals to invest in tangible assets, such as real estate, to hedge against the depreciating value of money due to inflation. Additionally, an increase in the proportion of high-value loans may encourage more people to participate in the real estate market, particularly those who would otherwise be unable to provide large sums of cash up front. As these factors interact, they naturally lead to an increase in real estate demand, which is one of the key drivers behind rising housing prices.

According to the Numbeo Global Database. (2009), based on the price of apartments in city centers across various countries see Table 1, assuming a 30-ping apartment is equivalent to 99.1740 square meters, Hong Kong ranks first globally with a price of approximately NTD 88,726,515. Singapore follows in second place at NTD 58,880,298, while Taiwan ranks seventh worldwide, with a price of NTD 26,138,498. This indicates that Taiwan had already been among the top ten countries with the highest housing prices globally as early as 15 years ago.

Table 1 $: NTD

|

Table 1 Apartment Prices in the City Center |

|||

|

Country |

Housing prices |

World ranking |

|

|

Per square meter |

30 pings |

||

|

Hong Kong |

$ 894,655 |

$ 88,726,515 |

1 |

|

Singapore |

$ 593,707 |

$ 58,880,298 |

2 |

|

South Korea |

$ 373,975 |

$ 37,088,597 |

4 |

|

Australia |

$ 267,254 |

$ 26,504,648 |

6 |

|

Taiwan |

$ 263,562 |

$ 26,138,498 |

7 |

|

China |

$ 230,008 |

$ 22,810,813 |

10 |

3.2. The Changes and Current Situation of Housing Prices in Taiwan

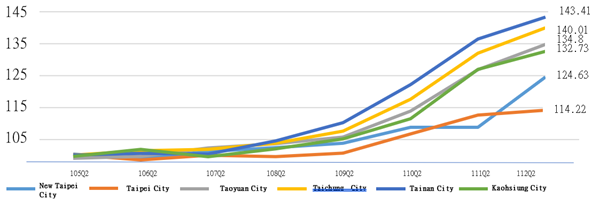

Factors such as people's salary levels, inflation rates, and geographic location all affect fluctuations in the housing price index. According to statistical data from the Ministry of the Interior Real Estate Information Platform. (2019), the housing price index across the six municipality areas in Taiwan has shown an upward trend, indicating that average housing prices are rising year by year. As shown in Figure 2, from Q2 of 2019 to Q2 of 2023, the housing price index in various counties and cities has notably increased, with Tainan City seeing the most significant rise, from 104.67 (Q2 2019) to 143.41 (Q2 2023). In the face of these high housing prices, most people's incomes are insufficient to afford a home. If the government does not implement concrete measures to address the issue, the problem will continue to worsen in the future.

Figure 2

|

Figure 2 Housing Price Index of Taiwan’s Six Municipality Areas Source Real Estate

Information Platform, Ministry of the Interior (2019) |

3.3. The salary situation in Taiwan.

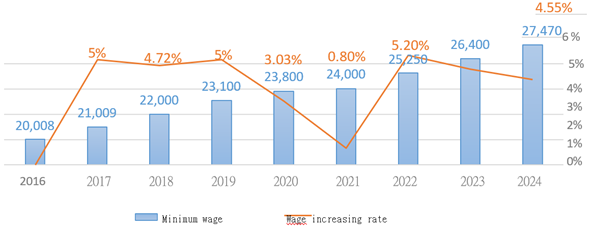

The minimum wage has been raised consecutively for many years. According to the Ministry of Labor Global Information Network. (2023) statistical data, Taiwan's minimum wage will be increased to NTD 27,470 in 2024 see Figure 3. However, the wage increases this time shows a significant decrease compared to the year 2022 and 2023. On the surface, it may seem like a salary increase, but for most employees whose monthly salaries are already above the minimum wage, every time a pay adjustment is made, prices soar along with it. This causes real expenses to rise in tandem with the increase in the minimum wage. After deducting basic expenses each month, the actual salary ends up not increasing but rather decreasing.

Figure 3

|

Figure 3 The Minimum Wage

-Adjusted Each Year Data Source Ministry of

Labor Global Information Network (2023) |

3.4. The Relationship Between Salary and Housing Prices

In November 2023, an analysis was conducted by the National Statistics Department of the Executive Yuan on the annual total salary median of employees in Taiwan's industrial and service sectors. It was found that the median annual salary increased year by year from 2016 to 2022, reaching NT$518,000 in 2022 as shown in Figure 4. This translates to a monthly salary of about NT$43,000. While this income can cover basic living expenses, it would be insufficient to afford the ever-increasing housing prices if one were to consider the need to buy a home.

Figure 4

|

Figure 4 Median and Average

Annual Salaries of Employees in the Industrial and Service Sectors Source National

Statistics, General of Budget, Accounting and Statistics, Executive Yuan

(2023) |

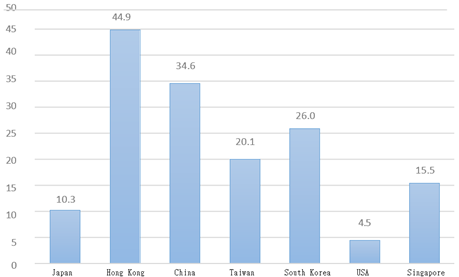

As shown in Figure 5, the housing price-to-income ratio in Taiwan in 2021 was 20.1, meaning that the people of Taiwan would need 20 years to afford a house without spending any money on food, drink, or other expenses. In contrast, Hong Kong's housing price-to-income ratio reached 44.9, the highest in the world, more than double that of Taiwan, making it exceedingly difficult to buy a home there. Next is China with a ratio of 34.6, while the lowest is the United States with a ratio of 4.5, indicating that buying a home in the U.S. is much easier compared to other countries.

Figure 5

|

Figure 5 Housing

Price-to-Income Ratio by Country in 2023 Source Numbeo Global Database. (2009) |

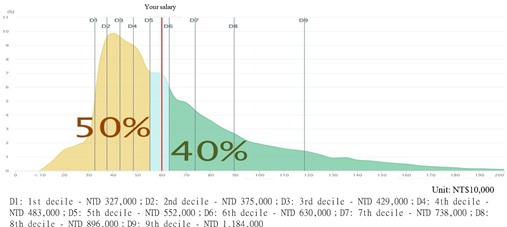

Liu (2023) reported that a certain presidential candidate once proposed a policy called the "555 Plan," which aimed to allow young people under the age of 40, with no major credit issues, to take out full loans for home purchases. The plan included a full loan of NT$15 million, preferential interest rates for five years, a 0.5% interest subsidy, and an extension of the mortgage term from the usual 30 years to 40 years. Under this plan, assuming a loan amount of NT$15 million, the monthly payment for the first five years would be around NT$20,000. However, after five years, the monthly payment would rise significantly to approximately NT$50,000. According to calculations from the Directorate-General of Budget, Accounting, and Statistics' salary platform see Figure 6, for individuals aged 30 to 39 with a monthly salary of NT$50,000, half of them would be unable to afford the high mortgage payments after five years. Moreover, about 50% of employed individuals in this age group currently earn less than NT$50,000 per month.

This data highlights that the plan would not effectively solve the housing affordability issue for young people and could even lead to a situation where they can afford to buy a house but struggle to make payments. Additionally, if young people's salaries do not increase as expected over time, they may make the wrong decision to purchase a home, leading the well-intentioned extension of the mortgage term to 40 years to ultimately result in a lifetime burden of debt.

Figure 6

|

Figure 6 Salary Comparison of

Employed Workers Aged 30 to 39 in the Year 2022 Source

Directorate-General of Budget, Accounting and Statistics, Executive Yuan – Salary Information Platform (2023) |

According to the standards set by the United Nations and the World Bank, a housing price-to-income ratio (PIR) exceeding 5.1 is classified as "severely unaffordable." In 2023, the PIR in the United States was approximately 4.5. During Japan's bubble economy era, the PIR soared to around 15, leading to extreme price fluctuations and a massive financial crisis. Taiwan’s PIR has long surpassed this threshold, indicating a potential housing bubble risk.

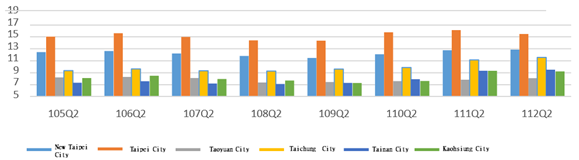

As shown in Figure 7, among the six major municipalities, Taipei City has consistently had the highest PIR nationwide. In Q2 of 2022, Taipei's PIR reached 16.17, meaning a resident would need to save every penny for 16 years to afford a home in Taipei. New Taipei City followed closely behind, while Tainan had the lowest PIR. For most young people, wages have failed to keep up with rapidly rising housing prices, making homeownership an increasingly distant dream. As a result, more and more people are giving up on buying a house altogether.

Figure 7

|

Figure 7 Price-to-Income ratio of Six Major Municipalities in Taiwan Note: Source Real Estate Information Platform, Ministry of the

Interior (2019) |

The mortgage burden ratio refers to the proportion of a household's monthly mortgage payment to the median disposable household income when purchasing a residential property. This ratio reflects the degree of financial strain a household experiences in repaying a mortgage. When the mortgage burden ratio reaches 50% (inclusive) or above, it indicates extremely low housing affordability. A ratio between 40% (inclusive) and 50% (exclusive) indicates low housing affordability. A ratio between 30% (inclusive) and 40% (exclusive) suggests slightly low housing affordability, while a ratio below 30% (exclusive) represents reasonable affordability Ministry of the Interior, Republic of China. (2022).

According to Table 2, the nationwide average housing price-to-income ratio in the second quarter of 2022 was 9.69, while the mortgage burden ratio was 36.62%. This indicates that housing affordability was classified as "slightly low." Apart from the Taipei and New Taipei areas, which were categorized as "extremely low," only Yunlin, Chiayi, Pingtung, and Keelung reached the "reasonably affordable" level. Unaffordable mortgage payments are often a major barrier preventing people from buying homes. Moreover, this ratio continues to rise, leading more and more people to choose renting over buying.

If the housing price issue is not resolved promptly, it is highly likely to face an economic bubble crisis in Taiwan similar to that of Japan. The government should pay greater attention to the impact of housing prices on people's lives.

Table 2

|

Table 2 Mortgage Affordability Indicators of National and Six Municipalities in the Second Quarter of 2022 |

||||||||||

|

National |

New Taipei |

Taipei |

Taoyuan |

Taichung |

Tainan |

Kaohsiung |

Yilan |

Miaoli |

Hsinchu |

|

|

Mortgage affordability ratio |

36.62 |

52.41 |

66.12 |

32.01 |

45.54 |

38.26 |

38.17 |

37.66 |

38.64 |

32.84 |

|

House price-to-income ratio |

9.69 |

12.82 |

16.17 |

7.83 |

11.14 |

9.36 |

9.34 |

9.21 |

9.45 |

8.03 |

|

Changhua |

Nantou |

Yunlin |

Chiayi County |

Pingtung |

Taitung |

Hualien |

Penghu |

Keelung |

Chiayi

City |

|

|

Mortgage affordability ratio |

36.57 |

37.56 |

29.13 |

24.25 |

28.03 |

32.98 |

36.74 |

34.35 |

24.06 |

25.75 |

|

House price-to-income ratio |

8.94 |

9.19 |

7.12 |

5.93 |

6.85 |

8.06 |

8.98 |

8.4 |

5.88 |

6.3 |

|

Note 1: The mortgage affordability ratio, also known as the

mortgage-to-income ratio, is calculated as follows: Median Monthly Mortgage Repayment/Median Monthly Household Disposable

Income The median monthly mortgage repayment is determined based on a

20-year loan term with equal principal and interest payments, assuming a

loan-to-value (LTV) ratio of 70%. |

||||||||||

|

Note 2: The house price-to-income ratio is calculated as

follows: Median House Price/ Median Household Disposable Income |

||||||||||

|

Source Ministry of the Interior, Republic

of China. (2022). |

||||||||||

4. Research Methods and Procedures

The research begins by understanding the changes in salary and housing prices, observing the growth rate of people's salaries (financial situation) and the trends in housing prices in recent years. Excel Solver is then applied to construct a mortgage dynamic analysis calculator. Users can input their own down payment, monthly loan amount, expected repayment period, interest rate, etc. The Excel Solver, using sensitivity analysis, is used to assess and calculate the data. This includes formulas for affordable housing price calculations, sensitivity analysis, and debt repayment ability analysis. It helps the public determine how to calculate affordable housing prices and mortgage amounts based on their salary income, personal needs, and financial situation.

Figure 8

.

.

|

Figure 8 Research Flowchart |

5. Research results

This study applies Excel Solver to construct a dynamic analysis calculator linking salaries and housing prices. When conducting sensitivity analysis, one should select a few factors that are more likely to vary significantly and have a greater impact on the target value being studied as parameter values for simulation analysis, rather than considering and calculating all uncertain factors. In this study, the selected research parameters include housing prices, salaries, interest rates, and loan terms. Variations in these variables will affect the economic benefits of the target value. First, tools such as Solver and Multivariate Analysis in Microsoft Office Excel are used to set the various variables affecting home buying as parameter values, develop the " Dynamic Salary and Housing Price Analysis Calculator," and provide relevant suggestions to assist with home-buying planning.

Example 1

Assuming that the down payment is 20% of a house price of 7.1 million, which amounts to a fixed down payment of 1.42 million, the previous affordable mortgage calculator shows that monthly income is positively correlated with the affordable house price. Therefore, the loan amount varies with salary growth (assuming monthly salaries of $70,000, $80,000, $90,000, and $100,000). Using multi-factor sensitivity analysis, the main parameters are analyzed based on the variation of loan amount with interest rates and loan terms. The monthly repayment amount for each scenario is calculated see Table 4. From the data, it is clear that lower interest rates and longer loan terms lead to a lower monthly repayment amount, which can ease the mortgage burden for homebuyers. Conversely, if the loan term is shortened to 25 years, the monthly repayment exceeds one-third of the salary, making it unaffordable for most people.

Table 3

|

Table 3 Monthly Repayment Amount |

||||||

|

Loan

amount* |

||||||

|

56,80,000 |

67,00,000 |

77,10,000 |

87,30,000 |

|||

|

Monthly

salary income |

||||||

|

70,000 |

80,000 |

90,000 |

1,00,000 |

|||

|

Year

= 30 |

Rate |

1% |

-18,269.12 |

-21,549.85 |

-24,798.41 |

-28,079.13 |

|

1.50% |

-19,602.83 |

-23,123.05 |

-26,608.77 |

-30,129.00 |

||

|

2% |

-20,994.39 |

-24.764.50 |

-28,497.66 |

-32,267.78 |

||

|

Rate

=2% |

Year |

25 |

-2,40,74,093 |

-28,398.24 |

-32,679.17 |

-37,002.48 |

|

35 |

-18,815.73 |

-22,194.61 |

-25,540.36 |

-28,919.24 |

||

|

45 |

-15,960.64 |

-18,826.82 |

-21,664.89 |

-24,531.06 |

||

|

Note: * Loan amount = House price - Down

payment (assumed to be 1,420,000) |

||||||

|

Source Compiled by the author of this study. |

||||||

Example 2

Recently, the New Youth Home Loan Policy has sparked a wave of home purchases among young people. Using the nationwide housing price-to-income ratio of 9.69 in the second quarter of 2022 as a benchmark, and referencing salary median data for 2023 from the Directorate-General of Budget, Accounting, and Statistics, the annual median salaries are as follows: NT$488,000 for individuals aged 25–29, NT$557,000 for those aged 30–39, NT$594,000 for the 40–49 age group, and NT$558,000 for those aged 50–64. Assuming both spouses in a dual-income household fall within the same age bracket, their combined annual income would be twice the median salary of their respective age group. By using household annual income and housing price fluctuations as parameters for sensitivity analysis, the results indicate the following: if the housing price-to-income ratio is less than the benchmark value, it suggests affordability and a lighter financial burden for purchasing a home. Conversely, if the ratio exceeds the benchmark, it indicates a heavier financial burden and suggests that purchasing a home may not be advisable.

Table 4

|

Table 4 Housing Price-to-Income Ratio |

||||

|

PIR |

Household annual income |

|||

|

1,000,000.00 |

1,114,000.00 |

1,188,000.00 |

1,116,000.00 |

|

|

96,90,000.00 |

9.69 |

8.7 |

8.16 |

8.68 |

|

1,10,00,000.00 |

11 |

9.87 |

9.26 |

9.86 |

|

1,20,00,000.00 |

12 |

10.77 |

10.1 |

10.75 |

|

1,30,00,000.00 |

13 |

11.67 |

10.94 |

11.65 |

|

PIR: Price-to-Income Ratio= Housing prices/ Household annual income |

||||

Example 3

Assuming the purchase of a house valued at NTD 11 million, with a down payment of NTD 3 million and a remaining loan of NTD 8 million, the first five years would have a favorable interest rate of 1.775% under the New Youth Home Loan Policy. The monthly repayment would be approximately NTD 11,833. For the following 35 years, assuming a fixed interest rate of 2%, the monthly repayment would be NTD 26,501. The mortgage would account for about one-third of the salary, meaning that the loan is affordable. However, if the interest rate rises to 2.3%, the monthly repayment would exceed one-third of the salary, increasing the financial burden on individuals and indirectly impacting their quality of life. Many young people do not foresee the future repayment amounts, and as a result, may not be able to pay off their mortgage, forcing them to sell their homes. This could potentially lead to a wave of foreclosures in the next five years. Therefore, it is crucial to think carefully when purchasing a home, evaluating one's salary and the affordability of the house is an important consideration.

Table 5

|

Table 5 Monthly Repayment Amount |

||||||

|

Monthly

repayment amount |

Loan

amount* |

|||||

|

6,000,000 |

7,000,000 |

8,000,000 |

9,000,000 |

|||

|

Monthly

salary income |

||||||

|

60,000 |

70,000 |

80,000 |

90,000 |

|||

|

Year

= 35 |

Rate |

2% |

-19,875.77 |

-23,188.39 |

-26,501.02 |

-33,126.28 |

|

2.30% |

-20,811.94 |

-24,280.59 |

-27,749.25 |

-34,686.56 |

||

|

2.50% |

-21,449.71 |

-25.024.67 |

-28.599.62 |

-35,749.52 |

||

|

Source Compiled by the Author of this Study. |

||||||

6. Conclusions and suggestions

On September 19, 2024, the Central Bank announced the seventh round of selective credit controls, which aim to curb excessively high housing prices and stabilize the market. The measures include lowering the loan-to-value ratio for housing loans and eliminating grace periods.

The main objectives of this credit control measure, along with the increase in the required reserve ratio, are threefold: First, by strengthening the quantitative management of monetary credit, the intense public expectation of rising housing prices can be cooled, thereby suppressing speculative motives. Second, this measure reduces the loan-to-value ratio for real estate-related loans, which can guide banks to independently manage their portfolios, making it easier to achieve the goal of reducing the total volume of real estate loans within the next year. Third, by reallocating funds from loans related to speculative demand, priority can be given to housing loans for those without self-use residences.

In light of the current overheated housing market, with a rapid increase in mortgage amounts and historically high real estate loan concentrations, it is necessary to adjust selective credit control measures. The Central Bank forecasts that the year-on-year consumer price index (CPI) inflation rate will fall below 2% in 2025, but housing prices will remain high and continue to rise. Due to the delayed response of housing prices, they are expected to continue rising. Inflation risks remain, and monetary policy should respond to potential inflationary pressures, which suggests that the policy interest rate is unlikely to be lowered in the short term.

This study analyzes the housing affordability of the Taiwanese people by examining the global housing price trends, the current housing market in Taiwan, and the salary conditions of the Taiwanese population. It then applies Excel Solver to construct a dynamic analysis calculator linking salaries and housing prices, summarizing the challenges the public faces in purchasing a home. Finally, taking into account various influencing factors, the study presents three suggestions for policymakers to consider in policy planning, with the hope of helping the public achieve their dream of homeownership.

6.1. Increase Housing Supply and System Reform

Currently, most counties and cities have social housing, but the number is far from sufficient to meet the demand. The government can continue to promote urban renewal, increase the construction of social housing, lower the application standards, and extend eligibility to individuals studying or working in other counties and cities. Additionally, rental subsidies can continue to be provided.

6.2. Increase Market Regulation

Strictly review the identities of applicants for social housing to ensure that the needs are provided to those who truly require assistance. In addition to identity checks, the responsible management units should also enhance internal monitoring by regulatory personnel to prevent corruption or misconduct. Regular rotations and leave policies should be implemented. Furthermore, in combating speculative investors who engage in property flipping or land speculation, a thorough review of the identities and transaction records of both buyers and sellers should be conducted, and the accuracy of the actual transaction price should be verified.

6.3. Improvement of Transportation Infrastructure

Establish additional transportation stops in suburban areas, increase the number of bus services during peak hours, add inter-county and "jump frog" bus routes, improve the accuracy of transportation APP information, and reduce waiting times. These measures aim to shorten the distance between urban and rural areas, encouraging people to avoid overcrowding in the cities and alleviating the pressure on housing demand within urban areas.

Through the above three suggestions, part of the population would be redirected to areas outside the city, alleviating urban overcrowding, while simultaneously curbing the rising housing prices and easing the mortgage burden on the public, ultimately improving the quality of life. While the government introduces various new policies, it is important to not only hold public hearings to gather public opinion before implementation but also clearly define the policy's start date, applicable conditions, and implementation methods. After the policy is enacted, it requires the recognition and compliance of the entire nation to collectively maintain a healthy real estate market.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Directorate-General of Budget, Accounting, and Statistics. (2023, November 30). Statistics on the Median and Distribution of Annual Salaries of Employees in Industry and Services in 2022.

Liu, G.-T. (2023, December 8). Hou You-yi's Policy on Youth Homeownership: First-Time Buyers Under 40 Can Borrow Up to 15 Million with No Down Payment. Central News Agency. 2024 Presidential and Legislative Election – Housing Policy.

Ministry of Labor Global Information Network. (2023). The Process of Establishing and Adjusting the Minimum Wage.

Ministry of the Interior Real Estate Information Platform. (2019). Price Indicators. [Unavailable – Request Rejected]

Ministry of the Interior, Republic of China. (2022). Second Quarter of 2022, National Housing Loan Burden Rate Increased by 1.27%.

Numbeo Global Database. (2009). Apartment Prices: Price Per Square Meter to Buy an Apartment in the City Center.

Weng, B. Y. (2012). An Empirical Study on the Fluctuation of Housing Prices and Income Inequality in Taiwan (Master’s thesis). Graduate Institute of Economics, National Taiwan University.

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© IJETMR 2014-2025. All Rights Reserved.