|

|

|

|

DISCLOSING MONETARY TERMS OF R&D ALLIANCES

Edward Levitas 1![]() , Sarthak Singh 1, M.

Ann McFayden 2, Mujtaba

Ahsan 3

, Sarthak Singh 1, M.

Ann McFayden 2, Mujtaba

Ahsan 3

1 Sheldon

B. Lubar College of Business, University of Wisconsin-Milwaukee, Milwaukee

2 College

of Business, The University of Texas at Arlington, Arlington

3 Fowler

College of Business, San Diego State University, San Diego

|

|

ABSTRACT |

||

|

We investigate

how biotechnology and pharmaceutical R&D alliances operating in an

emerging and uncertain environment affects the partner’s decisions to provide

unmandated alliance monetary terms. We

identify factors promoting R&D alliance partners' desire to disclose

monetary arrangements, and factors compelling firms to conceal these

arrangements. Voluntarily disclosed

monetary arrangements of R&D alliances may impact the overall success of

the alliance, partners' performance independent of the alliance, and future

R&D costs. Disclosure likely

lowers the future cost of capital for certain partners, reducing future

R&D costs; yet, disclosure may inadvertently provide proprietary

information to competitors. Biotechs

seek partnership with pharmaceuticals with established track records in

getting drugs to market.

Pharmaceuticals seek partnerships with biotechs possessing skills, (i.e.

R&D research). We contend the

biotech partner's stock price uncertainty and near-term financial capital

needs and the larger pharmaceutical firm's market experience will impact the

decision to disclose alliance monetary arrangements. We find support for our hypotheses using

Probit regressions. |

|||

|

Received 16 July 2024 Accepted 22 August 2024 Published 27 September 2024 Corresponding Author Edward

Levitas, levitas@uwm.edu DOI 10.29121/ijetmr.v11.i9.2024.1486 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2024 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: R&D,

Alliances, Signaling, Biotechnology, Pharmaceutical |

|||

1. INTRODUCTION

Heightened pace of technological change, and evidence that collaborative R&D is often more effective than solitary efforts in addressing change, has increased interest in technology alliances. Recently, scholars have focused on firm benefits from signaling participation in collaborative alliances (e.g., Choi & Contractor (2019), Wang et al. (2023), Yasar et al. (2020). Disclosing alliance partnership information may act as a signal to external constituents. A signal is an action conveying information to a receiver regarding the sender’s future intentions, goals, and quality Spence (1974). While participants of R&D collaborations are required to disclose material events about alliances Anand & Khanna (2000), some R&D partners voluntarily choose to disclose additional, more than mandated monetary alliance information James & Shaver (2016).

Signaling participation in an R&D partnership is generally thought of as positive. Often, publicly traded firms realize increases in market value upon public recognition of collaboration Anand & Khanna (2000), Chan et al. (1997), Das et al. (1998), reflecting investors’ expectation of resource sharing/learning opportunities provided by alliances. Further, R&D partnering, may provide validation of a firm’s abilities, and reduce cost of financial capital Janney & Folta (2006), Nicholson et al. (2005) as signals offer capital providers reassurances of firm quality and potential investment returns.

While previous research suggests revealing participation in R&D collaborations may provide positive benefits, more work is required to understand why partners choose to voluntarily disclose additional information James & Shaver (2016). Disclosure may provide benefits for the sending firm, yet may also be quite detrimental as it may reveal to competitors important information about a firm's direction Bhattacharya & Ritter (1983). Bhojraj et al. (2004). Partners must balance benefits of disclosure against its detriments.

We examine this issue in the context of R&D biotechnology/pharmaceutical alliances. Generally, pharmaceutical firms contribute complementary resources/skills (experience in manufacturing, distribution, regulatory management, market experience, cash). Notably, pharmaceuticals often rely on biotechnology firms for R&D related research skills Audretsch & Feldman (1996). Given limited successful product approvals and relatively young age, biotechs often lack critical skills to bring new drugs to market. In combination, the complementary skills/resources of pharmaceutical and biotech firms increase the probability of successfully commercializing a promising therapy Hoang & Rothaermel (2010), Nicholson et al. (2005).

Drawing upon R&D alliance, signaling and disclosure literatures, we focus on the partners’ decision to voluntarily disclose monetary terms of R&D alliances. We argue partners’ stock price uncertainty and near-term financial capital needs influence disclosure decisions. We contribute to the literature as our study is one of few to examine voluntary disclosure of R&D alliance monetary terms to external stakeholders. We examine the motivation behind voluntary monetary disclosures of biotech/pharmaceutical R&D alliances, and identify factors that promote the alliance partners’ desire to disclose monetary arrangements and that compel firms to conceal these arrangements. Biotech firms voluntarily disclose monetary terms to aid investors in making better informed and more confident investment decisions. And, are more likely to disclose additional information to reduce stock price volatility, potentially reducing the cost of capital. Further, when the biotech partner faces high near-term financial capital needs, the partnership will more likely disclose to enhance its ability to raise future cash. Finally, biotechs which partner with pharmaceuticals with strong market experience will provide additional disclosure.

Our assessment of announcements of R&D alliances formed between US-based publicly traded biopharmaceutical and pharmaceutical firms indicates approximately half include disclosure of alliance monetary terms. We address why partners disclose these contractual provisions.

Signaling theory suggests that though firms may not fully communicate their inherent quality or value, observers may generate estimations about the quality of the sender’s capabilities via supplementary mechanisms Spence (1974). For example, managers face considerable difficulty when identifying suitable job applicants. Spence (1974) suggests educational attainment provides a robust differentiator between high/low quality job applicants since this achievement indicates possession of, and ability to acquire, a relatively high level of knowledge. Thus, education attainment serves as a signal of the applicant’s potential value. Similarly, finance scholars have argued that debt and dividend policy often allow outside investors to differentiate between high/low quality firms. This results from the idea that borrowing and dividend policies obligate the firm to make payments to investors. Since such payment streams can only be maintained by high quality firms Bhattacharya (1979), Ross (1977)., the firm’s debt and dividend policy acts as a signal of investment merit. Effective signals have the ability to provide indications of high quality in a manner not easily duplicated by lower quality actors Bergh et al. (2014).

Signals can provide important information, allowing stakeholders to differentiate the quality of R&D alliances. Firms intuitively understand their own R&D abilities. However, articulating tacit, complex R&D knowledge to outsiders may be difficult Aboody & Lev (2000), Hall (2005). R&D success hinges on the use of a single technology and the intermingling of multiple knowledge bases/technologies (market knowledge, chemistry/molecular biology, etc.). Even when codifiable information exists (prototypes, procedure manuals), firms may be unwilling to divulge information for fear of imitation Anton & Yao (2002); Bhattacharya & Ritter (1983). Thus, the progress of research intense processes may appear blurred to outsiders Bergh et al. (2019); Pisano, G. (2006).

When external information about attributes are limited, R&D-focused firms may face a ‘lemons’ problem Ackerlof (1970) when attempting to raise financial capital since investors may not easily distinguish the quality of firms. High-quality firms, unable to transfer knowledge and convince capital markets to finance activities at reasonable costs, may be forced to forego profitable projects Myers et al. (1984). Signaling information regarding alliances to outside sources about the merits of partnerships is vital to future success.

Voluntary Disclosures

By law, companies seeking financial capital on public US exchanges must disclose information considered to be ‘material’. (TSC Industries v. Northway [426 US 438], 1976). Information is “material” if an investor would likely have viewed it important when casting proxy votes, or making decisions relevant to trading in the firm’s equity Heitzman et al. (2010); also see Basic Inc. v. Levinson [485 US 224], 1988), including disclosures of events such as a firm’s acquisition of another company, product launches, restructuring plans, top management changes, and other information impacting trading activity.

Conversely, voluntary disclosures include guidance on sales estimates/related costs, business segment reporting, earnings forecasts, socially responsible actions, and R&D project progress. Although not required, managers have incentives to voluntarily disclose such information to external stakeholders. Dissemination of this information can increase investors’ assessments of a firm’s future cash flows, reduce the projected riskiness of those cash flows, and increase the firm’s credibility with external stakeholders. However, disclosures can entail costs as in alerting competitors to the firm’s level of investment and future strategic direction Bhojraj et al. (2004). Effective disclosure management must balance benefits with costs.

Biotechnology-pharmaceutical R&D alliances provide an effective setting to examine this phenomenon. Such alliances are highly research intensive, leading to the creation of new tacit complex knowledge not easily disclosed and/or feared of competitor appropriation Ryan-Charleton et al. (2022). Pharmaceutical partners have traditionally provided experience in manufacturing, distribution, regulatory management and cash, yet have not been able to master research-related skills. Yet, biotech firms' contribution often resides in their ability to manipulate living organisms and processes within them to produce human and animal therapeutics Pisano (2006). Given the uncertainty of success in implementing biotechnologies to develop therapeutics, limited successful product approvals, and their relatively young age, biotech firms often lack the complementary assets which more experienced pharmaceutical firms possess Audretsch & Weigand (2005); Audretsch & Feldman (1996). Complementary skills/resource between these two types of firms have instigated the volume of R&D alliances Roijakkers & Hagedoorn (2006).

Stock Price Uncertainty

R&D requires considerable cash resources due to the inherent uncertainty of the invention process. Identifying promising opportunities, funding of learning, and avoiding program termination due to “dead ends” or “wrong turns” requires considerable flexibility. Limited internal cash reserves can plague a biotech firm's research progress. These firms can face lemons problems when attempting to raise external cash due to difficulties in conveying knowledge to external capital markets Aboody & Lev (2000); Hall (2005). Much of what governs successful R&D is tacit, and not easily articulated to those not directly involved in the R&D process. Moreover, R&D success hinges on the use of a multiple complex knowledge bases; creating additional barriers to investors’ comprehension, furthering complicating attempts to describe the merits of a firm's invention efforts to investors.

Clearly, published articles, patents, or progress past regulatory hurdles can act as signals to reduce the severity of these communication problems Levitas & McFadyen (2009). Yet, these signals only occur at the end of certain phases of R&D efforts. Voluntary disclosure of other facets of the R&D process occuring at earlier points of the R&D efforts may provide important information to investors when considering investments in firms James & Shaver (2016).

Driving the decision to disclose an alliance's monetary arrangements is the biotech's relationship with public capital markets, and the opportunity to reveal their potential as a high quality participant in the R&D process. Providing voluntary guidance on the amount of cash to be potentially exchanged can increase investors’ assessments of the size of the biotech partner's future cash flows. Such disclosures should also reduce the projected riskiness of those cash flows in the minds of investors since investors have greater information with which to evaluate other firm operations. Although the decision to disclose will likely have limited impact on the pharmaceutical partner's capital costs due to its larger scale and more diversified operations, "stock price movement for biotechs is highly sensitive to company-specific R&D-related events” Ferrara (2011). We therefore believe that voluntary disclosures of alliance monetary amounts will have considerable effects on a biotech's future cost of procuring financial capital.

Voluntary disclosures allows investors to better compare the disclosing firm’s prospects with those of other similar firms Lambert et al. (2007). Disclosure tends to increase the accuracy and reduces the dispersion of equity analysts’ estimates of earnings Lang & Lundholm (1996); Mc Namara & Baden-Fuller (2007), thereby reducing uncertainty surrounding the firm’s prospects. Several studies also indicate that voluntarily releasing information lowers the disclosing firm’s systematic risk Handa & Linn (1991). Since investors cannot reduce systematic risk via portfolio diversification, holding lower beta stocks reduces overall portfolio risk and, lowers the required returns for those companies. Stocks of disclosing firms also tend to be in greater demand by investors and thus have higher valuations Handa & Linn (1991). Surveys of corporate executives indicate that top managers tend to believe voluntary disclosures reduce their costs of capital Graham et al. (2006). Failure to provide investors with "expected levels" of voluntary disclosures may reduce investors' perceived understanding of business operations, reducing interest in that stock and ultimately increasing the firm's capital procurement costs Verrecchia (2001)

Research indicates that the benefits of voluntary disclosures are not limited to positive news. A number of studies suggest that voluntarily disclosing positive and negative news to shareholders can reduce that firm's cost of capital. Positive information disclosure may increase capital market valuations of a firm, reducing the uncertainty surrounding that firm’s operations, reducing the firm’s cost of procuring external capital Botosan (2006); Guo & Zhou (2004); Healy et al. (1999). Disclosure of negative information allows managers to reduce surprise-induced stock price swings by “preparing” investors in advance. Negative information disclosure may also increase the credibility of a firm’s disclosure practices by convincing investors of managerial forthrightness Lang & Lundholm (1996). Overall, voluntary disclosure provides signals of quality to investors as “a management team that has confidence in both its own abilities and its strategy will not shy away from telling the market its plans for the future and how well it is doing today Eccles et al. (2001):192.” Indeed, mangers disclose “bad” news to avoid such costs.

Regarding R&D alliances, disclosure of monetary terms can reduce uncertainty surrounding the biotech partner's research program by confirming, elevating or decreasing capital markets expectations. Disclosure of amounts paid for access to a biotech's technology provides additional information about the program on which collaboration is based, and can reduce guessing by analysts and other investors about the merits of that program. Forthrightness can also increase the credibility of the biotech partner's other entrepreneurial programs. Overall, disclosing monetary amounts provides information about the potential quality of both partners’ research programs.

Accordingly, uncertainty surrounding the biotech partner's stock value will provide impetus for overt management of relationships with investors. Clearly, stock market volatility may result from uncertainty created by the gap in knowledge between managers and investors Akgiray (1989); Baillie & DeGennaro (1990); Bergh et al. (2019); Sentana & Wadhwani (1991). Voluntarily disclosing information narrows this gap, resulting in more stabilized stock prices Healy et al. (1999); Lang & Lundholm (1996); Simpson & Tamayo (2020). Indeed, recent research suggests that firms with relatively high costs of capital in preceding years choose to disclose socially responsible actions in efforts to reduce capital costs Dhaliwal et al. (2011). Because of the high likelihood of knowledge asymmetries in the context of R&D alliances, we believe the biotech partner’s stock price uncertainty preceding alliance announcement will affect that partner’s desire to disclose monetary terms. Higher uncertainty provides greater desire for the biotech partner to reduce knowledge asymmetries and signal its quality. Relatively lower levels of uncertainty provides reduced disclosure impetus allowing firms to avoid potentially harmful disclosure.

Hypothesis 1: The biotech partner's stock price uncertainty preceding the alliance announcement will positively impact the likelihood of monetary disclosure.

Burn Rate

The intensity with which a biotech partner "burns" through cash should impact disclosure likelihood. Cash is a vital, diminishing resource Pisano (2006) . Anecdotal evidence indicates that investors use burn rates to identify company cash needs and solvency Hamilton (2002). For example, GeneralMotors used its cash burn to justify its receipt of US government bailout funds Businessweek (2008). Burn rates are especially important to biotech investors given biotechs' dependence on and high utilization of cash Jacobs (2002). We believe the rate which a biotech partner consumes cash will impact disclosure likelihood. All else constant, high burn rates should indicate a biotech firm's greater likelihood of needing to raise near-term cash Jacobs (2002).

Some evidence exists regarding the relationship between disclosure and the need to raise external cash. Frankel et al. (1995). find firms which frequently raise cash through public equity markets have higher rates of earnings-related information releases than firms not as dependent on external capital. Similarly, Lang & Lundholm (2000) find firms tend to increase performance-related disclosures in the six months preceding efforts to raise external equity. Firms tend to make voluntary disclosures when the need for external capital procurement arises Healy et al. (1999), and withhold information otherwise. Thus, we believe biotech partners will prefer disclosure as capital needs arise. Lower burn levels lead to lower likelihoods of disclosure.

Hypothesis 2: The biotech partner's burn rate at the time of alliance announcement will positively impact the likelihood of monetary disclosure.

Stock Price Uncertainty/Burn Rate

We expect the biotech partner's burn rate to moderate the relationship between its stock price uncertainty and the likelihood of monetary disclosure. Stock price uncertainty potentially leads to an increase in capital procurement costs Lang & Lundholm (1996), prompting the biotech partner to reduce capital costs through additional disclosure. This relieves some uncertainty surrounding stock value, providing reassurance to investors of biotech's inventive abilities.

We argued high burn rates indicate the biotech partner's need to raise near-term cash. Higher burn rates coupled with higher stock price uncertainty should promote disclosure as the partner will seek to sooth investors’ concerns regarding the firm’s stock value. Consequently:

Hypothesis 3: The relationship between the biotech partner's stock price uncertainty and the likelihood of alliance monetary disclosure is moderated by the biotech partner's burn rate such that higher burn rates will increase the effect stock price uncertainty has on the likelihood of monetary disclosure.

Stock Price Uncertainty and Third Party Endorsements

Biotech firms will often collaborate with more established pharmaceutical partners with expertise in areas in which it is deficient. The drug discovery process is highly uncertain and time consuming, only one in 10,000 new drug discoveries will complete all three phases of clinical trials and win FDA approval. The entire process for a successful drug may take up to15 years to complete (http://www.gao.gov/new.items/d0749.pdf). A pharmaceutical firm which has previously introduced new drugs to the market signals its potential to identify potentially valuable therapeutic candidates, and its ability to manage through arduous periods of clinical trials and manufacture drugs in volumes large enough for human testing and commercialization Pisano (2006) .

By virtue of its experience, the pharmaceutical partner demonstrates an understanding of industry norms, operations and technology potential that industry outsiders lack, acting as a credible "third party" that verifies information to "endorse" the quality of biotech partner Admati & Pfleiderer (1994); Gulati & Higgins (2003). This is especially important in novel therapy arenas given uncertainties regarding technology efficacy and regulatory approval. Continued experience in technology development and commercialization efforts enhances a pharmaceutical firm's ability to assess the potential value of collaborating with a biotechnology firm. Experience combined with due diligence in seeking out or accepting a collaboration offer from the partner should provide the pharmaceutical firm with a rich understanding of the biotech partner's prospects than that available to "ordinary" investors Chemmanur & Fulghieri (1994).

Consequently, when equity investors are uncertain about the merits of investing in the biotech firm, they may look for clues from the biotech firm’s pharmaceutical partner. Such clues may seem even more robust since poor selection of partners can negatively impact the pharmaceutical firm's reputation (e.g. Podolny (1994). We thus expect a high level of experience in developing and commercializing therapeutics will provide a pharmaceutical firm legitimacy from the perspective of equity investors and, via its linkage, implied value for the less experienced biotech partner (e.g., Gulati & Higgins (2003).

Thus, pharmaceutical firm's experience should moderate the likelihood of disclosure-iotech stock price uncertainty relationship. The pharmaceutical firm’s previous market experience is important as due to manufacturing and distribution expertise, and reputations Nerkar & Roberts (2004). Further, previous new product market success increases the likelihood of future market success Roberts & McEvily (2005). Yet, the pharmaceutical firm’s market experience presents two possible competing sets of moderation effects. First, pharmaceutical partner experience may increase the effect the biotech firm’s stock price uncertainty on the likelihood of disclosure, enhancing the credibility of disclosure, making disclosure even more likely. Thus:

Hypothesis 4a: The relationship between the biotech partner's stock price uncertainty and the likelihood of alliance monetary disclosure is moderated by the pharmaceutical partner's market experience such that higher experience will increase the effect stock price uncertainty has on the likelihood of monetary disclosure.

Conversely, the pharmaceutical partner's experience may reduce the effects stock price uncertainty on disclosure. Third party endorsements by highly experienced pharmaceutical partners reduce information leakage by substituting monetary disclosure for other information.

Hypothesis 4b: The relationship between the biotech partner's stock price uncertainty and the likelihood of alliance monetary disclosure is moderated by the pharmaceutical partner's market experience such that higher experience will decrease the effect stock price uncertainty has on the likelihood of monetary disclosure.

2. METHODS

We collected our sample from a population of alliances involving US-based, publicly-traded firms from 1991 to 2003. Using the Windover RX deals database, we identified all R&D alliances involving at least one publicly traded US-based biopharmaceutical firm. We omitted alliances involving more than two partners due to complexities of modeling alliance decisions, and eliminated alliances involving generic pharmaceutical companies and university/non-profit collaborations. These constraints resulted in a final sample of 108 alliances. We obtained data from Compustat, Windover Information Inc.’s RX Deals, and IMS R&D Focus.

Dependent variable - We measured Disclosure of Monetary Terms as a binary variable coded 1 if the partners publicly disclosed monetary terms, 0 otherwise. Information was contained in Windover’s RX Deals database. Windover examines publicly available sources (i.e. industry newsletters, press releases, SEC filings, and security analysts reports) for information Windover creates a summary of deal terms and provides press releases relevant to the deal. The breadth of Windover’s analyses provides accurate comprehensive information regarding public disclosure of alliances and associated revelation of monetary terms.

Independent variables - We measured Biotech partner's stock price uncertainty for the 365 trading days (less if a firm’s public equity had a shorter trading history) preceding the alliance agreement. We estimated it as the conditional variance from a generalized autoregressive conditional heteroscedasticity (GARCH) estimation Bollerslev (1986). GARCH models have been used extensively in the literature Akgiray (1989); Baillie & DeGennaro (1990); Sentana & Wadhwani (1991); Folta & Janney (2004); Levitas & Chi (2010) to robustly estimate investors’ uncertainty about company operations. Biotech partner's burn rate is the total of its operating cash flows, minus its financing cash flows and capital expenditures, divided by its total cash and equivalents. All numbers are taken from the year of the alliance. Pharma partner's market experience is the count of all current Phase 1 – 3 projects and marketed drugs preceding the alliance date.

Control variables - We measured Biotech Partner's Liquidity by dividing its total current assets by its total current liabilities in the year of the alliance. Pharmaceutical Partner's Market Experience is a count of all current Phase 1 – 3 projects and marketed drugs in which the biotech partner had pursued before the alliance date. Total Alliances is a count of the number of alliances in which a partner is involved in the year and therapeutic class of the focal alliance. We constructed for Pharma Partner Technology Owned and Biotech Partner Technology Owned variables, coded 1 if that partner possessed patent protection on the technology explored in the alliance, and 0 otherwise. Patent ownership in pharmaceuticals often provides strong property rights over the ability to exclude others from using technologies Henderson & Cockburn (1994). We controlled for Pharma Partner's Size (natural log of its total employees). A biotech control was dropped due to its collinearity with other variables.

Competition may impact partners’ willingness to disclose information Healy & Palepu (2001).; Simpson & Tamayo (2020) ; Verrecchia (1990). The intensity of competition faced by the alliance partners via Total Competitive Projects in Indication is a count of projects and marketed drugs in the year of the alliance and in focal indication by firms not involved in the alliance. We included a dummy variable to control for Stage of Development on which the alliance is focused Nicholson (2005). Phase 1 is coded 1 if the alliance stage of development occurs at Phase 1 of FDA clinical trials at announcement and 0 if the alliance is focused on Phase 2 or 3.

We measured Total Number of Indications that a drug candidate currently or will target(s). Hoang & Rothaermel (2010) note drug commercialization success increases with an increasing number of indications since leverageable knowledge provides greater opportunities for approval. The European Pharmaceutical Market Research Association classifies drugs into 16 broad categories or indications of therapy. We included the four therapeutic indication dummy variables from this classification represented in our sample to control for the indication on which our sample alliances are focused Nicholson (2005). We control for relative power of each partner by first computing a power index (from a factor produced from number of marketed projects, total alliances and size) for each partner, and then dividing the biotech partner's power by that of the pharmaceutical firm (PowerRatio). We control for the historical preference of each partner to signal by dividing the number of times in which the partner disclosed monetary amounts of R&D alliances in the last 2 years by the total number of times it withheld such disclosures (PharmaPartnerDealRatio, BiotechPartnerDealRatio). Finally, we coded Equity 1 if the pharma partner owned 5% or more of the common equity of the biotech partner at the end of the year in which the alliance was announced, and 0 otherwise.

Simultaneous inclusion of Total Number of Indications and Therapeutic Dummy variables allowed us to control for the possibility that expected value of the drug on which the alliance focuses may, at least partially, determine partners’ willingness to disclose alliance monetary terms Gallini & Wright (1990). Increasing numbers of indications increases leverageable knowledge and, with therapeutic indication, can proxy for the potential value of the drug Hoang & Rothaermel (2010); Nicholson (2005). Similarly, inclusion of these variables controlled for the possibility that size of the monetary terms as well as these terms’ materiality Heitzman (2010) may determine partners’ willingness to disclose.

3. RESULTS and DISCUSSION

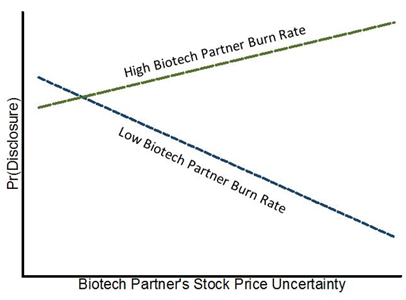

Table 1 provides summary statistics, Table 2 presents results of empirical estimations modeled by Probit regressions. Chi-square statistics for all models are significant at p < .001. The positive significant coefficient of Biotech’s Stock Price Uncertainty (0.352, p<.01; Model 2) provides support for Hypothesis 1. As indicated in Model 3, we did not find support for Hypothesis 2. The interaction coefficient in Model 3 is significant and positive (1.235, p<.05) (see Figure 1) supporting Hypothesis 3. (Burn Rate low = 25th percentile level, high = 75th percentile). The high Biotech Burn line is positively sloped, suggesting that at high Burn Rates, probability of disclosure increases as Stock Price Uncertainty increases. The opposite is true at low burn rates.

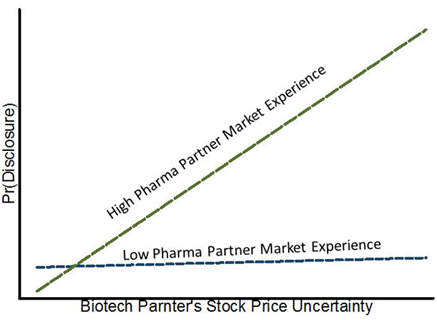

The significant coefficient for the interaction term (2.098, p<.05; Model 4) provides support for Hypothesis 4a, (see Figure 2). The graph suggests that high levels of Pharma Partner's Market Experience enhance the positive effect Biotech Partner's Stock Price Uncertainty has on the likelihood of disclosure.

We focused on biotech/pharmaceutical R&D alliances as they create considerable knowledge asymmetries between firms and external stakeholders Bergh et al. (2019). We argue that understanding when firm’s signal by voluntarily disclosing monetary arrangements of R&D alliances is important as it may impact the overall success of the alliance and partners' performance independent of the alliance and future costs of R&D. Disclosing nonmandated monetary terms of these alliances provides insight into the firm’s value as a collaborator and inventor. Disclosing information may also reveal proprietary information to competitors about a firm’s strategy.

Our study makes several important contributions. First, it is one of few to examine disclosing monetary terms of R&D alliances to external stakeholders. We find both biotech and pharmaceutical firms choose to signal, yet motivations that drive decisions to signal differ. Biotech firms, faced with finding novel ways to reduce knowledge asymmetries, will voluntarily disclose monetary terms of the alliance agreement in order to aid investors in making better informed and more confident investment decisions regarding the biotech partner’s strength. A motivating factor is to reduce overall cost of capital from external investors. We extend the literature by finding relationships between burn rates, stock price uncertainty and likelihood of disclosure. Higher burn coupled with higher stock price uncertainty heighten the need for disclosure as the biotech partner attempts to inform investors of their value and future cash needs to reduce their cost of capital.

In addition, partnering with a pharmaceutical firm with market experience will also lead the biotech firm to additional disclosure. Partnering with experienced firms indicates that the pharmaceutical has identified a high potential new drug discovery and a biotech firm which possesses the necessary R&D skills. As a result, biotech firms will likely signal this good news to investors by providing additional disclosure.

Our findings should also be of interest to managers. Due to increasing needs to engage in R&D alliances, firms best able to manage exploration alliances may be positioned to obtain competitive advantages. Understanding of signaling to reduce uncertainty and aid investors should lead to better relationships between investors and biotech partners.

Our study has limitations. First, while our focus on a single industry enabled us to generate highly precise data, this may limit the generalizability of our findings. Second, subsequent studies that incorporate private firms may increase the robustness of our conclusions.

4. Conclusion

Our findings provide valuable insights into when alliance partners are likely to voluntarily disclose monetary information to external stakeholders. While disclosing may be beneficial to external investors, more insight is needed to determine other external stakeholders which may be likely to act on the disclosure and the impact of the disclosures on competition.

Table 1

|

Table 1 Summary Statisticsa |

|||||||||||||||||

|

Variable |

Mean |

S.D. |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

14 |

|

|

1 |

Disclosure |

0.45 |

0.5 |

||||||||||||||

|

2 |

Bio Burn |

-0.02 |

0.34 |

0.09 |

|||||||||||||

|

3 |

Bio Stk Prc Unc |

0.02 |

0.04 |

-0.03 |

-0.01 |

||||||||||||

|

4 |

Bio Burn x Stk Unc |

-0.0006 |

0.006 |

0.04 |

-0.48*** |

0.06 |

|||||||||||

|

5 |

Pharm Mkt Exp x Bio

Stk Unc |

0.67 |

2.93 |

0.15 |

-0.01 |

0.11 |

0.11 |

||||||||||

|

6 |

Bio Mkt Exp |

20.88 |

50.48 |

-0.14 |

-0.39*** |

0.07 |

-0.40*** |

-0.07 |

|||||||||

|

7 |

Bio Tot Allian |

0.31 |

1.3 |

0.19* |

0.11 |

-0.08 |

-0.08 |

0.06 |

-0.01 |

||||||||

|

8 |

Bio Liquidity |

8.81 |

9.95 |

0.1 |

0.28*** |

-0.1 |

-0.17 |

-0.07 |

-0.07 |

0.08 |

|||||||

|

9 |

Bio Tech Own |

0.47 |

0.5 |

0.52*** |

0.16 |

-0.31*** |

-0.04 |

-0.09 |

-0.19+ |

0.13 |

0.18 |

||||||

|

10 |

Bio Deal Ratio |

0.2 |

0.29 |

-0.09 |

-0.01 |

0.07 |

0.12 |

0.06 |

-0.12 |

-0.15 |

-0.15 |

-0.29*** |

|||||

|

11 |

Pharm Mkt Exp |

0 |

0.82 |

0.40*** |

0.13 |

-0.05 |

-0.02 |

-0.21* |

-0.1 |

-0.08 |

0.16 |

0.39*** |

-0.15 |

||||

|

12 |

Pharm Tot Allian |

0.01 |

0.88 |

0.17+ |

0.06 |

-0.04 |

-0.03 |

-0.09 |

-0.05 |

-0.02 |

0.06 |

0.26* |

-0.06 |

0.32*** |

|||

|

13 |

Pharm Size |

10.27 |

2.43 |

-0.05 |

0.12 |

0.09 |

-0.04 |

-0.14 |

-0.09 |

-0.03 |

0.07 |

-0.16 |

-0.07 |

0.15 |

0.02 |

||

|

14 |

Pharm Tech Own |

0.1 |

0.3 |

0.06 |

0.24* |

-0.08 |

-0.13 |

0.001 |

-0.08 |

-0.01 |

0.20* |

0.29*** |

-0.24* |

0.28*** |

0.08 |

-0.02 |

|

|

15 |

Phram Deal Ratio |

0.24 |

0.33 |

-0.1 |

-0.12 |

-0.04 |

-0.08 |

-0.03 |

0.40*** |

-0.07 |

0.01 |

-0.13 |

-0.09 |

0.22* |

0.09 |

-0.09 |

-0.02 |

|

16 |

Tot Comp Projects |

0.18 |

1.22 |

-0.17+ |

-0.06 |

0.34*** |

0.16 |

0.001 |

0.02 |

-0.08 |

-0.1 |

-0.34*** |

0.29*** |

-0.11 |

-0.08 |

0.18+ |

-0.12 |

|

17 |

Stage 1 |

0.76 |

0.43 |

-0.36*** |

0.13 |

0.11 |

-0.02 |

-0.09 |

-0.05 |

0.03 |

-0.05 |

-0.34*** |

0.20* |

-0.20* |

-0.03 |

-0.08 |

-0.03 |

|

18 |

Total Indications |

2.47 |

2.29 |

0.40*** |

-0.04 |

-0.17+ |

-0.01 |

0.09 |

-0.04 |

0.18+ |

-0.01 |

0.47*** |

-0.11 |

0.03 |

0.02 |

-0.15 |

0.001 |

|

19 |

Power Ratio |

5183.27 |

39886.67 |

0.13 |

-0.1 |

-0.05 |

0.09 |

0.04 |

0.09 |

-0.02 |

-0.05 |

0.13 |

-0.09 |

-0.04 |

-0.02 |

-0.13 |

-0.02 |

|

20 |

Equity |

0.06 |

0.23 |

0.1 |

0.04 |

-0.07 |

-0.02 |

-0.07 |

-0.06 |

-0.06 |

-0.04 |

0.18+ |

-0.17+ |

0.11 |

0.26* |

-0.01 |

0.19+ |

|

21 |

Thera Class 1 |

0.13 |

0.34 |

-0.19+ |

-0.07 |

0.20* |

-0.13 |

-0.04 |

0.25* |

-0.09 |

-0.12 |

-0.31*** |

0.03 |

-0.14 |

-0.02 |

0.17+ |

-0.04 |

|

22 |

Thera Class 2 |

0.04 |

0.19 |

0.02 |

0.01 |

0.03 |

0.01 |

-0.01 |

-0.02 |

-0.05 |

-0.1 |

-0.09 |

-0.03 |

-0.02 |

-0.05 |

0.22* |

-0.07 |

|

23 |

Thera Class 3 |

0.07 |

0.26 |

-0.19+ |

0.02 |

0.39*** |

0.06 |

0.05 |

-0.06 |

-0.01 |

0.04 |

-0.20* |

-0.02 |

-0.13 |

-0.07 |

0.14 |

-0.1 |

|

24 |

Thera Class 4 |

0.03 |

0.17 |

0.07 |

0.01 |

0.02 |

0.01 |

0.03 |

-0.05 |

-0.04 |

0.01 |

-0.05 |

0.14 |

-0.03 |

-0.04 |

-0.04 |

-0.06 |

|

Variable |

15 |

16 |

17 |

18 |

19 |

20 |

21 |

22 |

23 |

||||||||

|

16 |

Tot Comp Projects |

0.02 |

|||||||||||||||

|

17 |

Stage 1 |

0.01 |

0.19* |

||||||||||||||

|

18 |

Total Indications |

-0.13 |

-0.23* |

-0.31*** |

|||||||||||||

|

19 |

Power Ratio |

-0.08 |

-0.05 |

-0.19* |

0.15 |

||||||||||||

|

20 |

Equity |

0.03 |

-0.09 |

0.04 |

-0.07 |

-0.03 |

|||||||||||

|

21 |

Thera Class 1 |

0.15 |

-0.1 |

0.02 |

-0.18 |

-0.05 |

-0.09 |

||||||||||

|

22 |

Thera Class 2 |

-0.02 |

-0.07 |

-0.12 |

-0.06 |

-0.03 |

-0.05 |

-0.08 |

|||||||||

|

23 |

Thera Class 3 |

-0.15 |

0.17+ |

0.16 |

-0.1 |

-0.04 |

-0.07 |

-0.11 |

-0.06 |

||||||||

|

24 |

Thera Class 4 |

0.001 |

-0.06 |

0.1 |

-0.03 |

-0.02 |

-0.04 |

-0.07 |

-0.03 |

-0.05 |

|||||||

Table 2

|

Table 2 Probit Estimations: Determinants of Disclosure Likelihooda |

||||

|

Variable |

Model 1 |

Model 2 |

Model 3 |

Model 4 |

|

Biotech Partner's

Stock Price Uncertainty |

0.352** |

0.319* |

0.884+ |

|

|

-0.129 |

-0.131 |

-0.463 |

||

|

Biotech Partner’s Burn

Rate |

0.317 |

0.595+ |

0.18 |

|

|

-0.247 |

-0.311 |

-0.281 |

||

|

Pharma Partner's Mkt.

Experience |

0.983** |

1.039** |

1.604*** |

|

|

-0.304 |

-0.327 |

-0.438 |

||

|

Biotech Burn Rate x

Biotech Stk Prc Unc |

1.235* |

|||

|

-0.541 |

||||

|

Pharma Market Exp x

Biotech Stk Prc Unc |

2.098* |

|||

|

-0.959 |

||||

|

Biotech Partner's Mkt.

Experience |

-0.004 |

0.001 |

0.009 |

0.003 |

|

-0.003 |

-0.003 |

-0.006 |

-0.004 |

|

|

Biotech Partner's

Total Alliances |

0.312 |

0.356 |

0.465 |

0.396 |

|

-0.21 |

-0.281 |

-0.327 |

-0.275 |

|

|

Biotech Partner's

Liquidity |

-0.013 |

-0.001 |

0.001 |

0.014 |

|

-0.018 |

-0.019 |

-0.02 |

-0.021 |

|

|

Biotech Partner Tech.

Owned |

0.458 |

0.146 |

0.177 |

0.578 |

|

-0.465 |

-0.576 |

-0.592 |

-0.61 |

|

|

Biotech Partner Deal

Ratio |

0.522 |

0.419 |

0.422 |

0.634 |

|

-0.582 |

-0.656 |

-0.655 |

-0.694 |

|

|

Pharma Partner's Total

Alliances |

0.13 |

0.036 |

0.033 |

-0.049 |

|

-0.133 |

-0.199 |

-0.207 |

-0.174 |

|

|

Pharma Partner Size |

0.003 |

-0.026 |

-0.011 |

-0.016 |

|

-0.062 |

-0.076 |

-0.073 |

-0.083 |

|

|

Pharma Partner Tech.

Owned |

-0.541 |

-1.378* |

-1.473* |

-1.701* |

|

-0.534 |

-0.589 |

-0.586 |

-0.688 |

|

|

Pharma Partner Deal

Ratio |

-0.047 |

-0.818 |

-1.201+ |

-1.502* |

|

-0.478 |

-0.549 |

-0.645 |

-0.661 |

|

|

Total Comp. Projects

in Indication |

0.194 |

0.169 |

0.132 |

0.226 |

|

-0.135 |

-0.16 |

-0.155 |

-0.178 |

|

|

Total Number of

Indications |

0.518** |

0.810** |

0.878** |

0.711* |

|

-0.196 |

-0.281 |

-0.285 |

-0.287 |

|

|

Power Ratio |

0.0001* |

0.0001* |

0.0001* |

0.0001 |

|

-0.0001 |

-0.0001 |

-0.0001 |

-0.0001 |

|

|

Equity |

1.110* |

1.474** |

1.571** |

1.744* |

|

-0.553 |

-0.572 |

-0.571 |

-0.696 |

|

|

Constant |

-0.922 |

-0.752 |

-1.066 |

-1.109 |

|

-0.951 |

-1.013 |

-1.042 |

-1.052 |

|

|

Pseudo R-squared |

0.4 |

0.52 |

0.54 |

0.57 |

|

Model Chi-square |

46.52*** |

75.24*** |

73.81*** |

531.09*** |

|

Log Pseudolikelihood |

-43.96 |

-35.09 |

-34.01 |

-31.51 |

Figure 1

Figure 2

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Aboody, D., & Lev, B. (2000). Information Asymmetry, R&D, and Insider Gains. Journal of Finance, 55(6), 2747 - 2766. https://doi.org/10.1111/0022-1082.00305

Ackerlof, G. A. (1970). The Market for 'lemons'. Quarterly Journal of Economics, 84, 488 - 500. https://doi.org/10.2307/1879431

Admati, A. R., & Pfleiderer, P. (1994). Robust Financial Contracting and the Role of Venture Capitalists. Journal of Finance, 49(2), 371 - 402. https://doi.org/10.1111/j.1540-6261.1994.tb05146.x

Admati, A. R., Pfleiderer, P., & Zechner, J. (1994). Large Shareholder Activism, Risk Sharing, and Financial Market Equilibrium. Journal of Political Economy, 102(6), 1097-1130. https://doi.org/10.1086/261965

Akgiray, V. (1989). Conditional Heteroscedasticity in Time Series of Stock Returns. Journal of Business, 62(1), 55-80. https://doi.org/10.1086/296451

Anand, B. N., & Khanna, T. (2000). Do Firms Learn to Create Value ? Strategic Management Journal, 21(3), 295-315.https://doi.org/10.1002/(SICI)1097-0266(200003)21:3<295 : AID-SMJ91>3.0.CO ;2-O

Anton, J. J., & Yao, D. A. (2002). The Sale of Ideas: Strategic Disclosure, Property Rights, and Contracting. Review of Economic Studies, 69(3), 513 - 531. https://doi.org/10.1111/1467-937X.t01-1-00020

Audretsch, D. B., & Feldman, M. P. (1996). R&D Spillovers and the Geography of Innovation and Production. American Economic Review, 86(3), 630-640.

Audretsch, D. B., & Weigand, J. (2005). Do Knowledge Conditions Make a Difference?: Investment, Finance and Ownership in German Industries. Research Policy, 34(5), 595-613. https://doi.org/10.1016/j.respol.2004.12.004

Baillie, R. T., & DeGennaro, R. P. (1990). Stock Returns and Volatility. The Journal of Financial and Quantitative Analysis, 25(2), 203 - 214. https://doi.org/10.2307/2330824

Bergh, D. D., Connelly, B. L., Ketchen Jr, D. J., & Shannon, L. M. (2014). Signalling Theory and Equilibrium in Strategic Management Research: An Assessment and a Research Agenda. Journal of management Studies, 51(8), 1334-1360. https://doi.org/10.1111/joms.12097

Bergh, D. D., Ketchen Jr, D. J., Orlandi, I., Heugens, P. P., & Boyd, B. K. (2019). Information Asymmetry in Management Research: Past Accomplishments and Future Opportunities. Journal of Management, 45(1), 122-158.https://doi.org/10.1177/0149206318798026

Bhattacharya, S. (1979). Imperfect Information, Dividend Policy, and 'The Bird in hand' Fallacy. Bell Journal of Economics, 10(1), 259- 270. https://doi.org/10.2307/3003330

Bhattacharya, S., & Ritter, J. R. (1983). Innovation and Communication : Signaling with Partial Disclosure. Review Of Economic Studies, 50, 331 - 346. https://doi.org/10.2307/2297419

Bhojraj, S., Blacconiere, W. G., & D'Souza, J. D. (2004). Voluntary Disclosure in a Multi-Audience Setting. The Accounting Review, 79(4), 921 - 947. https://doi.org/10.2308/accr.2004.79.4.921

Bollerslev, T. (1986). Generalized Autoregressive Conditional heteroscedasticity. Journal of Econometrics, 31, 307 - 327. https://doi.org/10.1016/0304-4076(86)90063-1

Botosan, C. A. (2006). Disclosure and the Cost of Capital. Accounting and Business Research, 31 - 40. https://doi.org/10.1080/00014788.2006.9730042

Businessweek. (2008). GM's crippling burn rate. Businessweek.

Choi, J., & Contractor, F. J. (2019). Improving the Progress of Research & Development (R&D) Projects by Selecting an Optimal Alliance Structure and Partner Type. British Journal of Management, 30(4), 791-809. https://doi.org/10.1111/1467-8551.12267

Dhaliwal, D. S., Li, O. Z., Tsang, A., & Yang, Y. G. (2011). Voluntary Nonfinancial Disclosure and The Cost of Equity Capital. The Accounting Review, 86(1), 59 - 100. https://doi.org/10.2308/accr.00000005

Eccles, R. G., Hertz, R. H., Keegan, M., & Phillips, D. M. H. (2001). The Value Reporting Revolution : Moving Beyond the Earnings Game. New York : Wiley.

Ferrara, J. S. (2011). Biotech vs. pharmaceutical Companies: What's the Difference? http://www.valueline.com/Tools/Educational_Articles/Stocks_Detail.aspx?id=10278

Folta, T. B., & Janney, J. J. (2004). Strategic Benefits to Firms Issuing Private Equity Placements. Strategic Management Journal, 25(3), 223-242. https://doi.org/10.1002/smj.373

Folta, T. B., & O Brien, J. P. (2004). Entry in the Presence of Dueling Options. Strategic Management Journal, 25, 121 - 138. https://doi.org/10.1002/smj.368

Frankel, R., McNichols, M., & Wilson, G. P. (1995). Discretionary Disclosure and External Financing. The Accounting Review, 70(1), 135 - 150.

Gallini, N. T., & Wright, B. D. (1990). Technology Transfer Under Asymmetric Information. RAND Journal of Economics (RAND Journal of Economics), 21(1), 147-160. https://doi.org/10.2307/2555500

Graham, J. R., Harvey, C. R., & Rajgopal, S. (2006). Value Destruction and Financial Reporting Decisions. Financial Analysts Journal, 62(6), 27-39. https://doi.org/10.2469/faj.v62.n6.4351

Guo, R.-J., Lev, B., & Zhou, N. (2004). Competitive Costs of Disclosure by Biotech IPOs. Journal of Accounting Research, 42(2), 319-335. https://doi.org/10.1111/j.1475-679X.2004.00140.x

Hall, B. H. (2005). The Financing of Innovation. In S. Shane (Ed.), Blackwell Handbook of

Technology and Innovation Management. Oxford : Blackwell Publishers.

Hamilton, D. P. (2002). As Investors Flee Biotechs, Dreaded 'Burn Rate' Returns. Wall Street Journal.

Handa, P., & Linn, S. C. (1991). Equilibrium Factor Pricing with Heterogeneous Beliefs. The Journal of Financial and Quantitative Analysis, 26(1), 11 - 22. https://doi.org/10.2307/2331240

Healy, P. M., & Palepu, K. G. (2001). Information Asymmetry, Corporate Disclosure, and the Capital Markets. Journal of Accounting and Economics, 31(1-3), 405-440. https://doi.org/10.1016/S0165-4101(01)00018-0

Healy, P. M., Hutton, A. P., & Palepu, K. G. (1999). Stock Performance and Intermediation Changes sUrrounding Sustained Increases in Disclosure. Contemporary Accounting Research, 16(3), 485 - 520. https://doi.org/10.1111/j.1911-3846.1999.tb00592.x

Heitzman, S., Wasley, C., & Zimmerman, J. (2010). The Joint Effects of Materiality Thresholds and Voluntary Disclosure Incentives on Firms' Disclosure Decisions. Journal of Accounting and Economics, 49(1/2), 109 - 132. https://doi.org/10.1016/j.jacceco.2009.10.002

Henderson, R., & Cockburn, I. (1994). Measuring Competence? Exploring Firm Effects in Pharmaceutical Research. Strategic Management Journal, 15, 63 - 84. https://doi.org/10.1002/smj.4250150906

Hoang, H., & Rothaermel, F. T. (2010). Leveraging Internal and External Experience: Exploration, Exploitation, and R&D Project Performance. Strategic Management Journal, 31(7), 734-758. https://doi.org/10.1002/smj.834

Jacobs, T. (2002). Biotech Follows Dot.com Boom and Bust. Nature Biotechnology, 20(10), 973. https://doi.org/10.1038/nbt1002-973

James, S. D., & Shaver, J. M. (2016). Motivations for Voluntary Public R&D Disclosures. Academy of Management Discoveries, 2(3), 290-312. https://doi.org/10.5465/amd.2013.0006

Janney, J. J., & Folta, T. B. (2006). Moderating Effects of Investor Experience on the sIgnaling Value of Private Equity Placements. Journal of Business Venturing, 21(1), 27 - 44. https://doi.org/10.1016/j.jbusvent.2005.02.008

Lambert, R., Leuz, C., & Verrecchia, R. E. (2007). Accounting Information, Disclosure, and the Cost of Capital. Journal of Accounting Research, 385 - 420. https://doi.org/10.1111/j.1475-679X.2007.00238.x

Lang, M. H., & Lundholm, R. J. (1996). Corporate Disclosure Policy and Analyst Behavior. The Accounting Review, 71(4), 467 - 492.

Levitas, E., & Chi, T. (2010). A look at the Value Creation Effects of Patenting and Capital Investment Through a Real Options Lens. Strategic Entrepreneurship Journal, 4(212 - 233). https://doi.org/10.1002/sej.92

Levitas, E., & McFadyen, M. A. (2009). Managing Liquidity in Research-Intensive Firms. Strategic Management Journal, 30, 659 - 678. https://doi.org/10.1002/smj.762

Myers, S. C., & Majluf, N. S. (1984). Corporate Financing and Investment Decisions when Firms have Information that Investors do not have. Journal of Financial Economics, 13, 187 - 221. https://doi.org/10.1016/0304-405X(84)90023-0

Nicholson, S., Danzon, P. M., & McCullough, J. (2005). Biotech-Pharmaceutical Alliances as a Signal of Asset and Firm Quality. Journal of Business 78(4), 1433-1464. https://doi.org/10.1086/430865

Pisano, G. (2006). Science Business : The Promise, the Reality and the Future of Biotech. Boston : Harvard Business School Press.

Roijakkers, N., & Hagedoorn, J. (2006). Inter-Firm R&D Partnering in Pharmaceutical Biotechnology Since 1975. Research Policy, 35(3), 431-446. https://doi.org/10.1016/j.respol.2006.01.006

Ross, S. (1977). The Determination of Financial Structure. Bell Journal of Economics, 8, 23 - 40. https://doi.org/10.2307/3003485

Ryan-Charleton, T., Gnyawali, D. R., & Oliveira, N. (2022). Strategic Alliance Outcomes: Consolidation and New Directions. Academy of Management Annals, 16(2), 719-758. https://doi.org/10.5465/annals.2020.0346

Sentana, E., & Wadhwani, S. (1991). Semi-parametric Estimation and the Predictability of Stock Market Returns. The Review of Economic Studies, 58(3), 547 - 563. https://doi.org/10.2307/2298011

Simpson, A., & Tamayo, A. (2020). Real Effects of Financial Reporting and Disclosure on Innovation. Accounting and Business Research, 50(5), 401-421. https://doi.org/10.1080/00014788.2020.1770926

Skinner, D. J. (1994). Why Firms Voluntarily Disclose Bad news. Journal of Accounting Research, 32(1), 38 - 60. https://doi.org/10.2307/2491386

Stulz, R. M. (1990). Managerial Discretion and Optimal Financing Policies. Journal of Financial Economics, 26, 3 - 27. https://doi.org/10.1016/0304-405X(90)90011-N

Verrecchia, R. E. (1990). Information quality and Discretionary Disclosure. Journal of Accounting and Economics, 12(4), 365-380. https://doi.org/10.1016/0165-4101(90)90021-U

Verrecchia, R. E. (2001). Essays on Disclosure. Journal of Accounting & Economics, 32(1 - 3), 97 - 179. https://doi.org/10.1016/S0165-4101(01)00025-8

Wang, D., Wei, J., Noorderhaven, N., & Liu, Y. (2023). Signaling Effects of CSR Performance on Cross-Border Alliance Formation. Journal of Business Ethics, 1-20. https://doi.org/10.1007/s10551-023-05432-x

Yasar, B., Martin, T., & Kiessling, T. (2020). An Empirical Test of Signalling Theory. Management Research Review, 43(11), 1309-1335. https://doi.org/10.1108/MRR-08-2019-0338

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© IJETMR 2014-2024. All Rights Reserved.