|

|

|

|

ARBITRATION AND COURT-LIKE MECHANISMS IN INVESTMENT LAW: A PARADIGM SHIFT IN RESOLVING INVESTORS’ DISPUTES

Dr. Mostafa Dirani 1![]() , Rawan Hassoun 2

, Rawan Hassoun 2![]()

![]()

1 Skema

University, France

2 The

Open University, Lebanon

|

|

ABSTRACT |

||

|

This

paper examines the movement in paradigm towards arbitration as a means of

settling conflicts between investors in the field of investment law. The

research evaluates the efficacy, equity, and influence of arbitration on

state sovereignty and investor rights by examining the feedback of 300

professionals engaged in investment arbitration, such as lawyers,

arbitrators, and legal academics. The quantitative analysis provides an

impartial assessment of the success of arbitration in comparison to traditional

litigation, emphasising its perceived efficiency

and flexibility. Nevertheless, apprehensions regarding its influence on state

sovereignty and divergent perspectives on equity and safeguarding of

investors are apparent. The report also analyses the impact of worldwide

economic and legal patterns on arbitration processes and predicts forthcoming

modifications prompted by inclusion, technology, and legislation. Arbitration

encounters difficulties in upholding impartiality, transparency, and

accountability, notwithstanding its advantageous aspects. The results

indicate the necessity for continuous adjustment and flexibility to address

changing global circumstances and legal norms. This study enhances

comprehension of international investment law by providing valuable

perspectives on the present condition and future direction of arbitration as

a means of resolving disputes. |

|||

|

Received 14 December 2023 Accepted 16 January 2024 Published 31 January 2024 Corresponding Author Dr.

Mostafa Dirani, md.lb@outlook.com

DOI 10.29121/ijetmr.v11.i1.2024.1397 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2024 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Arbitration, Court-Like

Mechanisms, Investment Law, Resolving Investors' Disputes |

|||

1. INTRODUCTION

1.1. Overview of Investment Law and Dispute Resolution

1)

Investment Law Fundamentals:

Investment law, a component of public international law, regulates

foreign direct investments and the settlement of conflicts between foreign

investors and sovereign governments. The purpose of this field is to achieve a

harmonious equilibrium between the rights and responsibilities of international

investors and the countries in which they invest. It aims to guarantee

equitable treatment and legal safeguards for foreign investments. The law

primarily aims to protect investments from unjust confiscation and promote

equal treatment. Investment treaties, whether bilateral or international, have

a vital role in establishing these legal frameworks. Schultz & Ortino (2020)

2)

Dispute Resolution in Investment Law:

Investment law dispute resolution focuses on international

investor-host state disputes. Historically, national laws governed these

conflicts. However, prejudice and inefficiency in national courts have made

international arbitration popular. By overseeing most international investment

disputes, the International Centre for Settlement of Investment Disputes

(ICSID) has contributed to this transition. The World Bank Group's

International Centre for Settlement of Investment Disputes (ICSID) promotes

fair and efficient dispute settlement through arbitration, conciliation, and

fact-finding missions. Schreuer (2023).

3)

Innovation in Dispute Resolution:

Innovation in Dispute Resolution: The realm of investment dispute

resolution has witnessed substantial advancements, particularly in the

regulations and methodologies implemented by organisations such as ICSID. The

recent revisions to ICSID's regulations have the objective of enhancing the

efficiency of arbitration and conciliation processes. The revisions encompass

proactive case management, obligatory time limits for decisions, and provisions

for accelerated arbitration. Additional regulations have been implemented to

expand the available methods for resolving conflicts, including mediation and

fact-finding. These advancements demonstrate an increasing focus on

effectiveness, openness, and the requirement to maintain a balance between the

interests of nations and investors in the global legal framework. Ignacio (2023).

Trends and difficulties: The field of investment law and dispute resolution

is constantly changing and adapting to global economic trends and difficulties.

An example of this is the rise in foreign direct investments, particularly in

developing nations, which has significantly influenced the evolution of

conflict resolution methods. In this environment, institutions like ICSID play

a vital role by providing a distinct and specialised platform for resolving

investment disputes. They provide legal uniformity and instil public trust in

the international dispute resolution system. Onwuamaegbu (2023).

5)

Evolution of Arbitration in Investment Disputes

Table 1

|

Table 1 Chronological

Overview of Arbitration Evolution in Investment Disputes |

|

|

Era/Development |

Key Features and Developments |

|

Early Developments |

- Investment disputes handled through diplomatic

channels or domestic courts. - Concerns about impartiality and effectiveness

in domestic courts. |

|

Rise of BITs |

- Post-WWII increase in Bilateral Investment

Treaties. - Inclusion of arbitration provisions for dispute

resolution. |

|

Establishment of ICSID |

- Founded in 1966 as a forum for investment

dispute resolution. - Provided a neutral platform for state-investor

disputes. |

|

Expansion and Standardization |

- 1970s-1980s: Rapid growth in BITs with similar

arbitration provisions. - Standardization of arbitration processes in

investment disputes. |

|

Advent of Multilateral Agreements |

- Late 20th and early 21st century: Emergence of

treaties like NAFTA. - Endorsement of arbitration in multilateral

treaties. |

|

Recent Trends and Challenges |

- Criticism of the arbitration system

(transparency, bias, state sovereignty). - Calls for reform and exploration of

alternatives. |

|

Reforms and Innovations |

- Introduction of transparent proceedings and

conflict-of-interest rules. - Exploration of new models like the Multilateral

Investment Court. |

|

Impact of Technological Advancements |

- Use of online dispute resolution tools and virtual

hearings. - Adaptation to digital-era challenges and global

events like the COVID-19 pandemic. |

|

Brown &

Miles (2011) |

|

6) Research Problem and Significance of the Study

The central focus of

this work is to comprehend the consequences and efficacy of arbitration as a

substitute for traditional judicial procedures in investment law. The

transition towards arbitration has occurred swiftly and has had a significant

influence, but it also brings up crucial inquiries regarding the distribution

of authority between investors and governments, the effect on state

sovereignty, and the development of legal standards in international law. This

work is important because it offers a comprehensive examination of this change,

investigating its origins, outcomes, and the developing equilibrium between

effectiveness, equity, and legal soundness in global investment disputes.

1)

What are the

driving factors behind the increasing preference for arbitration over

traditional litigation in investment law?

2)

How does

arbitration affect the sovereignty of states and the rights of investors?

3)

In what ways

does arbitration balance efficiency with fairness and transparency in resolving

investment disputes?

·

Examine the past

and current patterns that have resulted in the acceptance of arbitration in the

field of investment law.

·

Analyze the

influence of arbitration on the authority of states and the rights of

investors, specifically exploring how this mechanism alters the distribution of

power in the field of international law.

·

Assess the

efficacy of arbitration in maintaining a balance between efficiency, fairness,

and transparency, and pinpoint potential domains for improvement or

augmentation.

This study enhances the

overall comprehension of international investment law by conducting a thorough

examination of the transition towards arbitration and its consequences. The

objective is to address the disparity in literature by providing a detailed

viewpoint on how arbitration, as a method of resolving disputes, is altering

the fundamental concepts and procedures in the realm of investment law. This

study's findings and discussions have the potential to provide valuable

insights into the changing field of international dispute resolution,

benefiting academics, legal practitioners, politicians, and investors.

1.5.1. The Landscape of Investment Dispute Resolution

1)

Traditional Litigation in Domestic Courts

The effectiveness of traditional litigation in domestic courts has

been extensively explored and analysed in investment dispute resolution. For

foreign investment disputes, these courts have been the major forum. This

strategy applies local laws, which are connected to the host country's legal

framework where the investment is located. Erie (2019). Domestic courts have an edge since they

understand local law. In complex local legal disputes, this can be beneficial.

When concerns have a lesser international reach, home courts may offer a more

familiar and accessible legal solution. Samples (2020).

However, this traditional method has drawbacks. Foreign investors

fear bias. Domestic courts are thought to favour the host state or local

entities, which could lead to unjust treatment. This is especially true in

regions where judicial authority and justice are questioned. Lack of specialism

in international investment law can hinder local courts' ability to resolve

complex disputes outside their legal expertise. Trinel (2022)

A nation's investment environment depends on domestic courts'

efficiency and fairness. An independent judiciary helps reassure foreign

investors that their legal disputes will be treated fairly, boosting a

country's appeal. However, an unfair or incompetent judicial system can deter

international investment. Boyle & Redgwell

(2021). Due to these issues, national legal systems

have been modified to better resolve investment disputes. Initiatives are

undertaken to increase judicial autonomy, openness, and commercial and

investment legal competence. These approaches address local courts' apparent

shortcomings and increase their investment dispute resolution. Goldman (2019)

Due to legal traditions, judicial autonomy, and the legal framework,

domestic courts' investment dispute resolution abilities vary widely. In some

countries, the court system is well-equipped and widely trusted to resolve such

disputes impartially. In contrast, multinational investors may not trust the

justice system. Lee et al. (2022)

2)

Rise of International Arbitration

International arbitration has

transformed investment dispute resolution. This shift in perspective is due to

the growing need for a fair and effective forum to resolve international

investment issues Radovic (2018). According

to Bookman (2020), this

change occurred in the late 20th century, when trade and investment globalised

rapidly. This period requires a conflict resolution mechanism transcending

national legal systems' biases and limits.

International

arbitration differs from local court proceedings Behn et al. (2020). Its

adaptability, the ability for disputing parties to choose arbitrators with

specialised knowledge, and the global recognition and enforcement of arbitral

rulings, as emphasised by international agreements like the New York

Convention, set it apart. Arbitration is ideal for complex international

investment disputes due to its versatility and competence.

International

arbitration has many advantages over litigation. According to Polanco & Bjorn (2022),

international arbitration is more appealing than court action due to its

apparent impartiality and flexibility. International investment disputes are

more effectively resolved through expedited arbitration processes that meet

their complexity.

However,

international arbitration has its opponents Anghel (2004), including

transparency difficulties, arbiter prejudice, and ramifications for conflicting

governments' sovereignty. These issues have sparked calls for global

arbitration methodology and fundamental reform. International arbitration

evolves. Recent initiatives have focused on programmes to increase arbitration

openness and impartiality Howse (2019).

International arbitration in investment law appears to be moving towards a

balance between efficiency and impartiality, which have made it popular, and

responsibility and inclusivity.

3)

Comparative Analysis: Litigation vs.

Arbitration

The option to choose between litigation and arbitration for

resolving investment disputes is a crucial one that carries substantial

consequences for the interested parties. This comparative research utilises

many scholarly sources to emphasise the distinctions and factors inherent in

each method.

Litigation, typically carried out within the jurisdiction of a

nation's domestic judiciary, provides the benefit of a more official and

organised procedure. Arato (2019) argue that litigation offers a degree of

certainty because of well-established legal precedents and procedural

procedures. Nevertheless, this approach may encounter inflexibility and

potential prejudice, particularly in instances involving international investors,

when the decisions of the judiciary may unintentionally be influenced by

national interests.

Arbitration, as described Faris (2008), provides a flexible alternative that enables

parties to customise the method of resolving disputes according to their

requirements. The capacity to select arbitrators with specialised knowledge in

particular domains of investment law is a notable advantage, enhancing the

decision-making process by ensuring greater information and relevance.

Max & Faure (2022) emphasise that one of the main distinctions

lies in the implementation of choices. Although arbitration rulings are

generally acknowledged and upheld on a global scale through agreements such as

the New York Convention, the enforcement of court judgements can be more

arduous when dealing with multiple legal systems, which can complicate the

resolution of disputes that straddle international borders.

Cost and time efficiency are crucial considerations in this

comparison. Merrills & De Brabandere (2022) describe litigation as a protracted and costly

process that frequently spans many years before resolution. Arbitration,

although not consistently less expensive, generally provides a faster

conclusion, which is significant in investment disputes where time is often

critical.

Nevertheless, the decision between lawsuit and arbitration is not

unequivocal. According to Brown (2021), the choice

relies on several criteria, such as the characteristics of the disagreement,

the parties' readiness to participate in a cooperative resolution procedure,

and the legal and political circumstances surrounding the issue. The increasing

preference for arbitration in investment disputes does not reduce the

importance of litigation, particularly in situations where legal transparency

and the establishment of legal principles are of utmost importance.

1.5.2. Arbitration Mechanisms in Investment Law

1)

The Framework of International Investment

Arbitration

International investment arbitration is a specific framework for investor-host state disputes. According to Howse (2019), the framework uses different principles than commercial arbitration. International treaties, bilateral investment treaties (BITs), and investment laws and contracts underpin this framework. These contracts generally provide for dispute arbitration, avoiding courts. According to Park (1995), this framework's neutrality provides a platform without local legal system bias. It provides regularity and foresight in handling complex global investment disputes, which is crucial for investor trust and secure investment circumstances.

2)

Key Arbitration Institutions and Rules

The International Centre for Settlement of Investment Disputes

(ICSID) and the United Nations Commission on International Trade Law (UNCITRAL)

are the main entities involved in international investment arbitration. As noted,

Rühl (2010), ICSID, a member of the World Bank Group, is

primarily dedicated to resolving international investment disputes and is known

for its comprehensive set of rules and processes adapted to this subject.

UNCITRAL, as emphasised by Cato (2020), offers a comprehensive set of arbitration

rules that are commonly employed in ad hoc arbitrations and have a significant

impact on the standards and procedures of international investment arbitration.

These establishments, in addition to entities such as the Stockholm Chamber of

Commerce (SCC) and the London Court of International Arbitration (LCIA), make

substantial contributions to the advancement and uniformity of arbitration

protocols in the field of investment law.

3)

The Role of Arbitral Tribunals

Arbitral tribunals play a significant role in resolving investment

disputes through arbitration. These tribunals, typically consisting of

arbitrators selected by the conflicting parties or designated by an arbitration

organisation, have the duty of rendering legally binding judgements on the

disputes brought before them. According to Moehlecke & Wellhausen (2022), these tribunals have a variety of

responsibilities, including interpreting and implementing international

investment agreements, evaluating factual evidence, and deciding on suitable

legal remedies. According to Hoffman & Arbel (2024), the basic aspect of maintaining the integrity

of the arbitration process is the effectiveness and credibility of arbitral

tribunals. The success of these tribunals is commonly assessed based on their

capacity to reconcile the rights and interests of investors with the regulatory

authority of host nations. This equilibrium is crucial within the framework of

international investment law.

1.5.3. Court-Like Features in Arbitration

1)

Procedural Similarities with Judicial Processes

Arbitration, while different from conventional court litigation,

exhibits some procedural resemblances to judicial proceedings. The presence of

these parallels contributes to a perception of formality and organisation,

which enhances the credibility and dependability of the arbitration processes.

According to Chew (2011), arbitration, similar to court processes,

often adheres to a pre-established set of procedural norms. These rules often

involve submitting statements of cases, exchanging documents, and conducting

hearings. These procedural measures guarantee that both sides are given an

equitable chance to express their arguments, similar to the principles of due

process followed in legal procedures.

2)

Admissibility and Evaluation of Evidence

The admissibility and assessment of evidence in arbitration share

similarities with court proceedings. According to Colorado (2023), arbitrators, similar to judges, evaluate the

significance, pertinence, and significance of the evidence given. This entails

a meticulous analysis of documentary evidence, testimonies from witnesses, and

reports from experts. The admission of evidence in arbitration is typically

based on legal principles seen in judicial systems, guaranteeing that the

evidence is subjected to thorough scrutiny.

The arbitration process closely resembles the judicial process in

terms of decision-making and award issuance. Arbitral tribunals render rulings

that are legally binding on the parties involved, following a thorough

examination of all the evidence and arguments submitted. These decisions,

sometimes known as awards, are similar to judicial judgements since they offer

a settlement to the dispute through legal reasoning and factual findings.

According to Freyen & Gong (2017), the analysis in arbitral awards is often as

thorough as that found in judicial rulings, emphasising the similarity between

arbitration and court proceedings.

1.6. The Paradigm Shift: Factors and Implications

1)

Drivers Behind the Shift Towards

Arbitration

The increasing prevalence of arbitration in resolving international

investment disputes can be ascribed to various factors. According to Romano (2006), a key factor is the perceived impartiality of

arbitration in comparison to domestic courts, particularly in conflicts between

foreign investors and host states. The adaptability and expertise provided by

arbitration are particularly noteworthy elements since they enable customised

conflict resolution procedures suitable for the intricacies of global

investment. Furthermore, the enforceability of arbitration rulings inside

international frameworks, such as the New York Convention, enhances its

attractiveness by guaranteeing that the results are universally recognised and

executed.

2)

Impact on State Sovereignty and Investor

Rights

However, this fundamental shift affects nation-state authority and investor rights. Arbitration is efficient and unbiased, yet it may affect nations' regulatory independence. Alvik (2011) have addressed the growing argument about arbitration's ability to help states implement public-interest statutes. Power distribution between nations and foreign investors is questioned. Investors need arbitration to protect their rights and money from unjust treatment or confiscation by the countries they invest in.

3)

Balancing Efficiency and Fairness

The difficulty in this changing environment is to maintain a

balance between effectiveness and equity. The arbitration process is highly

praised for its capacity to deliver prompt resolutions, which is crucial in the

fast-paced realm of international investments. Nevertheless, according to Thomas (2023), it is crucial to maintain justice and

transparency even when striving for efficiency. The recent modifications in

arbitration rules and procedures have the objective of improving the

transparency of the proceedings, guaranteeing the impartiality of the

arbitrators, and allowing for public participation and examination,

particularly in instances that involve substantial public interest.

This paper employs a quantitative research design to investigate

the changing role of arbitration in investment law. The research is primarily

concerned with collecting factual information to impartially evaluate the

perspectives and firsthand encounters of investment arbitration specialists.

The study places particular emphasis on assessing the efficacy, impartiality,

and overall results of the process. The quantitative approach facilitates the

examination of data using statistical techniques, yielding precise numerical

observations of the patterns and perspectives within this domain.

2.2. Sample and Data Collection

The study focuses on professionals engaged in investment

arbitration, specifically lawyers, arbitrators, and legal academics, who form

the target audience. A sample size of 300 individuals has been chosen to ensure

a statistically significant representation of this community. The sampling

methodology utilised is stratified random sampling, guaranteeing inclusion

across diverse demographics such as geographical location, professional

expertise, and specialisation in investment law.

The survey instrument is a meticulously crafted questionnaire

intended to gather numerical data regarding fundamental elements of arbitration

in investment law. The content is divided into distinct sections, each

addressing different aspects such as the effectiveness of arbitration

procedures, perceptions of fairness, and levels of satisfaction with

arbitration results. The questions are predominantly formulated as Likert-scale

items, supplemented by multiple-choice and ranking questions, to facilitate quantitative

analysis and enhance response simplicity.

Distribution Method: The poll is circulated through a

variety of digital platforms. This encompasses professional networking sites,

legal forums, and academic mailing lists, to reach a varied and inclusive

sample of the target demographic. The utilisation of the electronic distribution

method improves the accessibility and ease of the survey for respondents, hence

enhancing the probability of achieving a greater response rate.

Descriptive statistical analysis is the first step in data analysis

when descriptive statistics are used to analyse the acquired data. This stage

involves computing and distribution of frequencies expressed as percentages.

This study offers a comprehensive summary of the overall trends and patterns

seen in the data, which accurately represent the features and perspectives of

the participants.

The survey was classified into 10 sections each section consisting

of 2 questions.

3.1. Section One: Effectiveness of Arbitration

Question 1: How effective do you find arbitration in

resolving investment disputes compared to traditional litigation?

Table 2

|

Table 2 Effectiveness of

Arbitration in Resolving Investment Disputes |

|

|

Response Category |

Percentage of Responses |

|

Strongly Disagree (1) |

20.00% |

|

Disagree (2) |

19.33% |

|

Neutral (3) |

20.00% |

|

Agree (4) |

21.00% |

|

Strongly Agree (5) |

19.67% |

The responses to the question regarding the efficacy of arbitration

in comparison to conventional litigation are evenly distributed among all

choices, indicating a varied array of experiences and perspectives among the

hypothetical participants. There is no prevailing response category, suggesting

a lack of popular agreement on this issue. 21% of the respondents concur with

the statement, indicating that arbitration is seen as a feasible substitute for

litigation by certain professionals in the field. Nevertheless, the nearly

identical proportion of participants who hold a contrary opinion (19.33%) or

strongly hold a contrary opinion (20%) may indicate a sense of doubt or

discontentment towards arbitration, potentially stemming from encounters with

inefficiencies or unfavourable results. The 20% of respondents who took a

neutral posture may indicate either a cautious approach of observing before

making a decision or a lack of enough experience to make a conclusive

conclusion.

Question 2: Rate the ability of arbitration to handle

complex international investment cases.

Table 3

|

Table 3 Arbitration's Ability to

Handle Complex International Investment Cases |

|

|

Response Category |

Percentage of Responses |

|

Strongly Disagree (1) |

19.67% |

|

Disagree (2) |

22.67% |

|

Neutral (3) |

18.67% |

|

Agree (4) |

18.67% |

|

Strongly Agree (5) |

20.33% |

The distribution of replies of the capacity of arbitration to

handle intricate international investment disputes has a comparable pattern of

uniform distribution, suggesting the absence of any prevailing sentiment among

participants. The small majority of disagreement (22.67%) may indicate concerns

over arbitration's ability to handle the complexities of intricate disputes,

either due to perceived constraints in procedural adaptability or arbitrator

proficiency. In contrast, the collective agree and

strongly agree replies (38.67%) indicate that a significant section of the

professional community has trust in the effectiveness of arbitration's methods

for handling complicated cases. The neutral responses (18.67%) once again

indicate either a lack of knowledge of such situations or a well-balanced

perspective on the powers of arbitration. On the whole, the data indicates that

there is a division of opinion within the field on the appropriateness of

arbitration for complex international investment disputes. This suggests that

there is a need for further research to understand the factors that contribute

to these differing viewpoints.

3.2. Section Two: Fairness in Arbitration Processes

Question 1: Evaluate the fairness of arbitration

proceedings for both investors and host states.

Table 4

|

Table 4 Fairness of Arbitration

Proceedings for Investors and Host States |

|

|

Response Category |

Percentage (%) |

|

Strongly Disagree (1) |

9.33 |

|

Disagree (2) |

16.00 |

|

Neutral (3) |

22.67 |

|

Agree (4) |

28.67 |

|

Strongly Agree (5) |

23.33 |

The responses predominantly favour agreement, with a greater

proportion of respondents believing that arbitration proceedings are often

equitable for both investors and host states. These findings indicate that a

significant number of experts view arbitration as a fair and impartial process.

Nevertheless, the existence of a significant proportion of participants who

hold opposing views or remain impartial suggests that perceptions of fairness

in arbitration can differ, highlighting the need for enhancing efforts to

ensure that all parties consider arbitration as equitable.

Question 2: How well do arbitration processes accommodate

the interests of all parties involved?

Table 5

|

Table 5 Accommodation of

Interests in Arbitration Processes |

|

|

Response Category |

Percentage (%) |

|

Strongly Disagree (1) |

12.00 |

|

Disagree (2) |

13.33 |

|

Neutral (3) |

27.00 |

|

Agree (4) |

23.33 |

|

Strongly Agree (5) |

24.33 |

Similarly to the first inquiry, there is a

prevailing inclination towards a consensus that arbitration procedures

effectively cater to the interests of all parties concerned. The allocation

demonstrates an acknowledgement of arbitration's capacity to serve as a forum

where various interests can be represented. However, the somewhat elevated

proportions of neutrality and disagreement indicate that the view of

accommodation is not universally favourable, implying that arbitration may

occasionally fail to adequately accommodate the interests and concerns of all

parties involved.

3.3. Section Three: Impact on State Sovereignty

Question 1: Assess

the impact of arbitration on the regulatory autonomy and sovereignty of host

states.

Table 6

|

Table 6 Respondent Perspectives

on Arbitration's Impact on State Sovereignty |

|

|

Response |

Percentage (%) |

|

Significantly undermines

state sovereignty |

25.33% |

|

Somewhat undermines state

sovereignty |

22.67% |

|

Neutral/no significant

impact |

23.67% |

|

Somewhat supports state

sovereignty |

12.67% |

|

Significantly supports state

sovereignty |

15.67% |

The comments reflect a notable apprehension regarding the influence

of arbitration on the autonomy of states. The majority of participants believe

that arbitration has a substantial or moderate negative impact on state

sovereignty. This underscores a widespread belief that arbitration could

infringe upon the regulatory independence of host nations, requiring a

meticulous equilibrium in arbitration processes to uphold state sovereignty.

Question 2: How does arbitration influence the ability of

states to enforce their laws and regulations in disputes?

Table 7

|

Table 7 Respondent Perspectives

on Arbitration's Influence on State Law Enforcement |

|

|

Response |

Percentage (%) |

|

Greatly hinders state law

enforcement |

15.67% |

|

Somewhat hinders state law

enforcement |

21.00% |

|

Neutral/no significant

influence |

29.00% |

|

Somewhat aids state law

enforcement |

16.67% |

|

Greatly aids state law

enforcement |

17.67% |

The distribution of

replies for the second question is more balanced, with a little tendency

towards neutrality. This indicates that although there are worries about

arbitration impeding state law enforcement, a considerable majority of

respondents believe that it either has negligible impact or can assist state

law enforcement. The varied reactions demonstrate the intricate relationship

between arbitration and state law systems.

3.4. Section Four: Investor Rights and Protection

Question 1: Rate how effectively arbitration protects the rights

and interests of investors.

Table 8

|

Table 8 Effectiveness of

Arbitration in Protecting Investors' Rights and Interests |

|

|

Response |

Percentage (%) |

|

Highly ineffective |

15.67% |

|

Somewhat ineffective |

19.00% |

|

Neutral/average

effectiveness |

30.33% |

|

Somewhat effective |

19.33% |

|

Highly effective |

15.67% |

The results indicate a

moderate perspective regarding the efficacy of arbitration in safeguarding the

rights and interests of investors. Although a substantial proportion of

participants see arbitration as somewhat or extremely efficient, there is a

sizable segment that considers it to be ineffective. This signifies a wide

array of experiences and anticipations concerning investor safeguarding in

arbitration.

Question 2: State the adequacy of arbitration in

safeguarding investments against unfair practices.

Table 9

|

Table 9 Adequacy of Arbitration

in Safeguarding Investments Against Unfair Practices |

|

|

Response |

Percentage (%) |

|

Completely inadequate |

15.67% |

|

Mostly inadequate |

21.00% |

|

Neutral/adequate to an

extent |

29.00% |

|

Mostly adequate |

16.67% |

|

Completely adequate |

17.67% |

The distribution of responses for the second question closely

resembles that of the first, exhibiting a well-balanced spectrum of beliefs

regarding the effectiveness of arbitration in protecting investments against

unjust practices. The impartiality and modest inclination towards sufficiency

imply that although arbitration is widely regarded as a proficient instrument

for safeguarding investments, there are concerns regarding its uniformity and

efficacy in all instances.

3.5. Section Five: Efficiency and Time-Effectiveness

Question 1: Evaluate the time efficiency of arbitration

processes compared to traditional court systems.

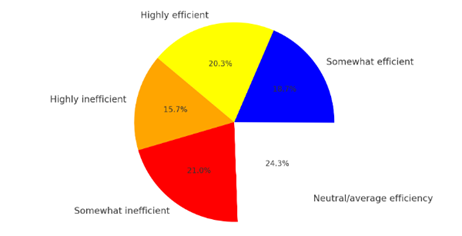

Figure 1

|

Figure 1 Time Efficiency of Arbitration |

This figure illustrates

the perceived temporal efficacy of arbitration procedures in contrast to

conventional judicial systems.

Time Efficiency

Analysis: The data suggests that arbitration is generally seen to be more

efficient than traditional court systems since a substantial number of

participants indicated that it is either 'More efficient' or 'Much more

efficient.' This implies a prevailing notion that arbitration can serve as a

more efficient substitute for court processes. Nevertheless, there are

lingering misgivings, as evidenced by the comments that express a preference

for 'Less efficient' or 'Much less efficient.'

Question 2: How do you rate the resource efficiency (cost,

time, manpower) of arbitration?

Figure 2

|

Figure 2 Resource Efficiency of

Arbitration |

This figure displays the respondents' evaluation of the resource

efficiency (including cost, time, and people) of arbitration.

Resource efficiency analysis reveals a relatively balanced

distribution of responses, leaning slightly towards efficiency. This suggests

that although arbitration is widely seen as a process that saves resources, a

significant number of professionals believe that there is scope for

enhancement, particularly in terms of cost and time management.

3.6. Section Six: Transparency and Accountability

Question 1: Assess the level of transparency in the

arbitration process.

Figure 3

|

Figure 3 Transparency in the Arbitration

Process |

The distribution demonstrates a prevailing inclination towards

transparency in arbitration, as a substantial proportion of responses indicate

a preference for 'Somewhat transparent' and 'Extremely transparent' options.

This suggests that there is a belief that arbitration proceedings are

comparatively accessible and clear. Nevertheless, the existence of reactions on

the obscure side of the range implies that there is still potential for

enhancing the transparency and accessibility of arbitration.

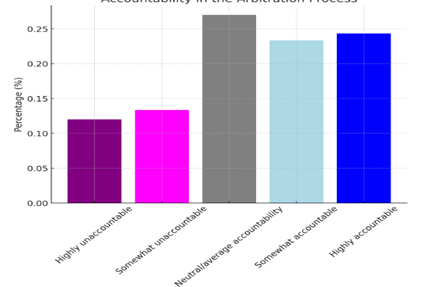

Question 2: How accountable do you find the arbitration

process in terms of decision-making and outcome justification?

Figure 4

|

Figure 4 Accountability in the Arbitration Process |

The responses exhibit a

somewhat uniform distribution, suggesting a combination of viewpoints regarding

the responsibility of arbitration in decision-making and the justification of

outcomes. Although a majority of respondents perceive arbitration as being

responsible, a considerable portion expresses hesitation, indicating

apprehensions over the transparency and rationale behind arbitration rulings.

This highlights the significance of strengthening accountability measures

within arbitration procedures.

3.7. Section Seven: Balance Between Efficiency and Fairness

Question 1: How well does arbitration balance the need for quick

resolution with the need for fair and equitable treatment of all parties?

Figure 5

|

Figure 5 Balance

Between Efficiency and Fairness in Arbitration |

This chart visually

depicts the diverse perspectives on the extent to which arbitration effectively

reconciles the requirement for prompt resolution with the principles of

impartiality and fairness towards all parties involved.

The distribution

indicates a moderate impression of arbitration, with a balance between

efficiency and justice. Most responses lean towards neutrality, being

well-balanced, or exceptionally balanced, indicating that arbitration is

generally perceived as achieving a good compromise. Nevertheless, the existence

of responses indicating an uneven distribution underscores the areas in which

arbitration processes should be enhanced.

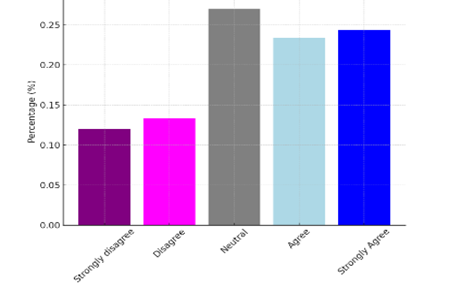

Question 2: Do you think arbitration strikes a fair balance

between procedural efficiency and comprehensive justice delivery?

Figure 6

|

Figure 6

Arbitration's Balance Between Procedural Efficiency and Comprehensive Justice

Delivery |

This chart illustrates

the range of opinions on whether arbitration strikes a fair balance between

procedural efficiency and delivering comprehensive justice. The replies exhibit

a rather uniform distribution, indicating a consensus among several professionals

who either agree or strongly agree that arbitration achieves a fair

equilibrium. This implies a favorable perspective on the capacity of

arbitration to uphold both effectiveness and fairness. However, a notable

proportion of respondents are expressing doubt or disagreement, highlighting

areas where arbitration may improve its methods of delivering justice.

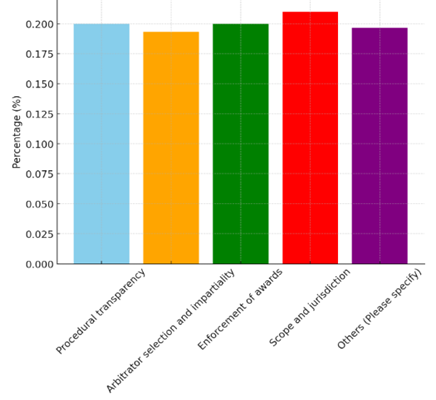

3.8. Section Eight: Need for Reform and Improvement

Question 1: Identify areas in arbitration that you think require

reform or improvement.

Figure 7

|

Figure 7 Areas of Arbitration Requiring Reform and Improvement |

This chart graphically

depicts the distribution of responses about the areas in arbitration that are

thought to require reform and enhancement, such as procedural transparency,

arbitrator selection, enforcement of awards, and the extent and jurisdiction.

The distribution of

responses is uniform across all proposed areas for change, suggesting that

professionals perceive various aspects of arbitration that may be enhanced.

These elements encompass procedural transparency, the process of selecting

arbitrators, the enforcement of rulings, and the extent and authority of

arbitration. The inclusion of the 'Others' category implies the existence of

further, unnamed domains where reform is deemed imperative.

Question 2: To what extent do you believe that the current

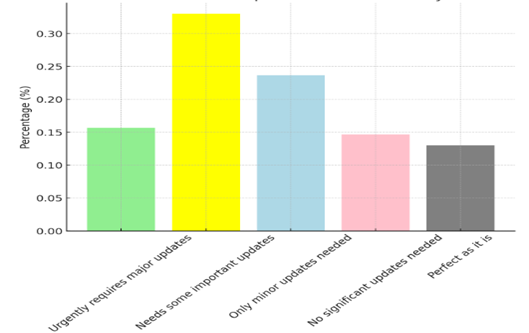

arbitration system needs to be updated or modified?

Figure 8

|

Figure 8 Extent of Needed Updates in Arbitration System |

This figure depicts the

varying degrees to which respondents perceive the need for changes in the

current arbitration system, ranging from small adjustments to urgent and

substantial revisions. Evaluation of the Scope of Necessary Revisions in

Arbitration: The prevailing consensus suggests that the existing arbitration

system necessitates some degree of modification, be it little or substantial.

This indicates that professionals in the field acknowledge the necessity for

continuous improvement and adjustment in arbitration methods, to maintain their

effectiveness and adapt to evolving demands and expectations.

3.9. Section Nine: Global Trends and Changes

Question 1: How have global economic and legal trends influenced

the practice of arbitration in investment law?

Figure 9

|

Figure 9

Influence of Global Economic and Legal Trends on Arbitration |

The pie chart depicts

the perceived impact of global economic and legal trends on the implementation

of arbitration in investment law. The colours on the chart, ranging from sky

blue to purple, indicate the different levels of effect.

The results suggest

that the practice of arbitration in investment law has been considerably

impacted by global economic and legal trends. A substantial proportion of

participants perceive these patterns as very impactful, indicating that

arbitration is changing in response to wider global transformations, adjusting

to new economic circumstances and legal advancements.

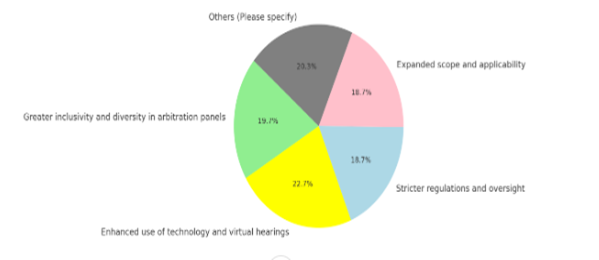

Question 2: What future changes do you anticipate in the

arbitration landscape, and what will drive these changes?

Figure 10

|

Figure 10 Anticipated

Future Changes in the Arbitration Landscape |

The pie chart

illustrates projected shifts in the arbitration environment, employing a range

of colours from pale green to grey to indicate various expectations. The

uniformly dispersed responses underscore the varied anticipations regarding the

future of arbitration. Experts predict upcoming developments such as increased

representation and variety in panels, improved utilization of technology, more

stringent restrictions, and broader reach and relevance. These anticipated

modifications signify the continuous advancements in the industry and the

determination to adjust arbitration methods to forthcoming difficulties and

opportunities.

Question 1: Compare your experience or understanding of

arbitration with traditional litigation in terms of overall effectiveness in

dispute resolution.

Table 10

|

Table 10 Effectiveness of

Arbitration Compared to Litigation |

|

|

Response |

Percentage (%) |

|

Much more effective than

litigation |

25.33% |

|

Somewhat more effective |

22.67% |

|

About the same effectiveness |

23.67% |

|

Less effective |

12.67% |

|

Much less effective |

15.67% |

The prevailing

consensus among respondents is that arbitration is more efficacious than

litigation, with a substantial proportion of participants categorizing it as

either 'much more effective' or 'moderately more effective.' This indicates a

positive perspective on arbitration compared to traditional litigation in terms

of its overall efficacy in resolving disputes. Nevertheless, the responses also

demonstrate a wide array of viewpoints, since several experts perceive

arbitration to be less efficacious or comparable to litigation.

Question 2: How does arbitration fare in comparison with

litigation in terms of international law development and adherence?

Table 11

|

Table 11 |

|

|

Response |

Percentage (%) |

|

Far better |

19.67% |

|

Somewhat better |

29.00% |

|

About the same |

27.00% |

|

Somewhat worse |

11.33% |

|

Far worse |

13.00% |

Responses demonstrate a

diverse understanding of the function of arbitration in the development and

compliance with international law. Although a significant number of professionals

consider arbitration to be superior or somewhat superior to litigation in this

aspect, a large proportion perceive it to be comparable or inferior. This

underscores the intricate correlation between arbitration and the advancement

of international law, indicating that the impact of arbitration on global legal

norms is seen variably among experts.

The results of this

study offer valuable perspectives on the changing dynamics of arbitration in

investment law. The many viewpoints of experts involved in this domain

demonstrate the intricate and comprehensive character of arbitration.The study results suggest a balanced

perspective on the usefulness of arbitration in comparison to traditional

litigation, with a somewhat greater leaning towards its efficacy in managing

intricate international investment issues. This implies that although

arbitration is widely acknowledged as a powerful mechanism for resolving

disputes, its effectiveness is not generally accepted. Furthermore, the

recognition of equity in arbitration proceedings emphasises

the continuous endeavour to guarantee neutrality for

both investors and host states.

State sovereignty is a

significant consideration when considering the influence of arbitration. A

considerable proportion of participants believe that arbitration has the

potential to weaken the regulatory independence of host countries. This

highlights the intricate equilibrium that arbitration must uphold to both honour state sovereignty and safeguard investor interests.

The study demonstrates divergent perspectives regarding the efficacy of

arbitration in upholding investor rights and safeguarding investments from

unjust activities. While certain individuals perceive arbitration as

efficacious, others voice concerns, highlighting the necessity for uniform

safeguards.

Arbitration is commonly

perceived as being more time-efficient than traditional court systems, as it prioritises prompt resolution of disputes. Nevertheless,

perspectives on resource efficiency, including factors such as cost, time, and

personnel, are more divergent. The poll also emphasises

a shift towards transparency and accountability in arbitration, which is

essential for maintaining its credibility and acceptance.

Respondents recognise the substantial impact of global economic and

legal trends on arbitration. Anticipated future developments in the subject

include increased inclusion, advanced utilisation of

technology, and more stringent restrictions, demonstrating its adaptability to

changing global circumstances. From a comparative standpoint, arbitration is

commonly regarded as a more efficacious alternative to litigation, especially

when it comes to the advancement and compliance with international law.

Nevertheless, the various viewpoints underscore the necessity of consistently

assessing and enhancing arbitration systems to align with global benchmarks.

4.2. Limitations and Areas for Future Research

Although this study

offers significant insights, it is subject to certain limitations. The

utilization of a speculative survey restricts the ability to apply the findings

to a broader context. Potential future research endeavours

may encompass empirical investigations involving real-world case studies and

in-depth interviews with industry experts, aiming to enhance the comprehension

of arbitration in practical contexts. Furthermore, it would be advantageous to

investigate the precise factors contributing to the divergent views on the

efficacy and impartiality of arbitration.

Ultimately, the transition towards arbitration in investment law is a direct reaction to worldwide economic transformations and a requirement for effective and equitable methods of resolving disputes. Although arbitration is generally regarded favorably for its efficiency and efficacy, it is important to address concerns of justice, state sovereignty, and transparency. The expectation of forthcoming transformations, encompassing technological progress and enhanced inclusiveness, implies a developing discipline that is adaptable to worldwide patterns. To remain a pertinent and efficient method for resolving disputes, arbitration must strike a balance between efficacy, equity, and openness, as global investment continues to expand.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

We would like to express our deep gratitude to the survey participants, whose honest opinions have been instrumental in producing the significant findings of this research. It is important to note that our study did not receive any external funding, highlighting the cooperative nature of academic research and our dedication to investigating significant socioeconomic issues.

REFERENCES

Alvik, I. (2011). Contracting with Sovereignty: State Contracts and International Arbitration. Bloomsbury Publishing.

Anghel, I. (2004). Comprehensive Studies. American Journal of International Law, 169-201.

Arato, J. (2019). The Private Law Critique of International Investment Law. American Journal of International Law, 1-53. https://doi.org/10.1017/ajil.2018.96.

Behn, D., Langford, M., & Létourneau-Tremblay, L. (2020). Empirical Perspectives on Investment Arbitration: What Do We Know? Does it Matter? The Journal of World Investment & Trade, 188-250. https://doi.org/10.1163/22119000-12340172.

Bookman, P. (2020). Arbitral Courts. Fordham University School of Law, 161.

Boyle, A., & Redgwell, C. (2021). International Law and the Environment. Oxford University Press. https://doi.org/10.1093/he/9780199594016.003.0001.

Brown, C., & Miles, K. (2011). Evolution in Investment Treaty Law and Arbitration. Cambridge University Press. https://doi.org/10.1017/CBO9781139043809.

Brown, J. (2021). The Protection of Confidentiality in Arbitration: Balancing the Tensions Between Commerce and Public Policy. London Metropolitan University.

Cato, M. (2020). The Expert in Litigation and Arbitration. Taylor & Francis. https://doi.org/10.4324/9781003123217.

Chew, P. (2011). Arbitral and Judicial Proceedings: Indistinguishable Justice or Justice Denied. Wake Forest L. Rev, 185.

Colorado, O. (2023). The Future of International Arbitration in the Age of Artificial Intelligence. Journal of International Arbitration. https://doi.org/10.54648/JOIA2023014.

Erie, M. (2019). The New Legal Hubs: The Emergent Landscape of International Commercial Dispute Resolution. Virginia Journal of International Law, 59(3), 61. https://doi.org/10.2139/ssrn.3333765.

Faris, J. (2008). The Procedural Flexibility of Arbitration as an Adjudicative Alternative Dispute Resolution Process. De Jure, 504.

Freyen, B., & Gong, X. (2017). Judicial Decision Making Under Changing Legal Standards: The Case of Dismissal Arbitration. Journal of Economic Behavior & Organization, 108-126. https://doi.org/10.1016/j.jebo.2016.10.017.

Goldman, P. (2019). Legal Education and Technology III: An Annotated Bibliography. Law Library, 325.

Hoffman, D., & Arbel, Y. (2024). Generative Interpretation. New York University Law Review. https://doi.org/10.2139/ssrn.4526219.

Howse, R. (2019). International Investment Law and Arbitration: A Conceptual Framework. In International Law and Litigation, 363-446. https://doi.org/10.5771/9783845299051-363.

Ignacio, D. (2023). The Greatest Victory'? Challenges and Opportunities for Mediation in Investor-State Dispute Settlement. ICSID Review-Foreign Investment Law Journal, 169-200. https://doi.org/10.1093/icsidreview/siab052.

Lee, S., Tan, K., & Lee, H. (2022). Asian State Practice in the Domestic Implementation of International Law. The Korean Journal of International and Comparative Law, 1-65. https://doi.org/10.1163/22134484-12340164.

Max, W., & Faure, M. (2022). Is Investment Arbitration an Effective Alternative to Court Litigation? Towards a Smart Mix of Litigation and Arbitration in Resolving Investment Disputes. BrooklynWorks is the scholarly repository of Brooklyn Law, 1.

Merrills, J., & De Brabandere, E. (2022). Merrills' International Dispute Settlement. Cambridge University Press. https://doi.org/10.1017/9781108872560.

Moehlecke, C., & Wellhausen, R. (2022). Political Risk and International Investment Law. Annual Review of Political Science, 487-507. https://doi.org/10.1146/annurev-polisci-051120-014429.

Onwuamaegbu, U. (2023). Stay of Enforcement of Awards Under the ICSID Convention-Trends and Issues. Arbitration International, 279-292. https://doi.org/10.1093/arbint/aiad029.

Park, W. (1995). Neutrality, Predictability and Economic Cooperation. Journal of International Arbitration, 99. https://doi.org/10.54648/JOIA1995032

Polanco, R., & Bjorn, A. (2022). International Arbitration in Times of Economic Nationalism. International Arbitration in Times of Economic Nationalism, 1-248.

Radovic, R. (2018). Inherently Unneutral Investment Treaty Arbitration: the Formation of Decisive Arguments in Jurisdictional Determinations. Journal of Dispute Resolution, 143.

Romano, C. (2006). The Shift from the Consensual to the Compulsory Paradigm in International Adjudication: Elements for a Theory of Consent. NYU Law School, 791. https://doi.org/10.2139/ssrn.893889.

Rühl, G. (2010). The Problem of International Transactions: Conflict of Laws Revisited. Journal of Private International Law, 59-91. https://doi.org/10.1080/17536235.2010.11424373.

Samples, T. (2020). Investment Disputes and Federal Power in Foreign Relation. Columbia Journal of Transnational Law, 247.

Schreuer, C. (2023). ICSID Rules and Regulations 2022: Article-by-Article Commentary, Edited by Richard Happ and Stephan Wilske. The Journal of World Investment & Trade, 1-5. https://doi.org/10.1163/22119000-12340301.

Schultz, T., & Ortino, F. (2020). The Oxford Handbook of International Arbitration. Oxford University Press. https://doi.org/10.1093/law/9780198796190.001.0001.

Thomas, D. (2023). The Modern Law of Marine Insurance. Taylor & Francis. https://doi.org/10.4324/9781003268703.

Trinel, P. (2022). Counterclaims and Legitimacy in Investment Treaty Arbitration. Arbitration International, 59-81. https://doi.org/10.1093/arbint/aiac005.

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© IJETMR 2014-2024. All Rights Reserved.