|

|

|

|

Assessing Impact of Demonetization and RERA on Real Estate Sector

Dr. S. G. Sonar 1![]()

![]() ,

Vaibhav L. Tapkeer 2

,

Vaibhav L. Tapkeer 2![]()

1 Associate

Professor, Department of Planning, COEP Technical University, Shivajinagar,

Pune, India

2 Engineer

and Town Planner, India

|

|

ABSTRACT |

||

|

The Real Estate Sector is an aggregate made up of the housing, industrial, office and retail sectors; wherein, housing sector plays the most significant role. At any point in time, this sector may not be at demand-supply equilibrium because of frequent exogenous parameters and several uncertainties present. Sudden announcement of demonetization on 8th November 2016 and implementation of Real Estate Regulation (and Development) Act (RERA), 2016 with effect from 1st May 2017 have severally affected demand-supply equilibrium in Indian Real Estate Sector. Demonetization has adversely affected the Real Estate Sector with cash transactions getting eliminated and wiping out black money from the sector. Further, implementation of RERA aims to create a more transparent environment for property buyers by increasing the accountability of developers and regulating the Real Estate Sector. Therefore, assessment of impact of demonetization and RERA on Real Estate Sector has become inevitable to understand volatility resulting into the sector due to them and perspectives of important stakeholders about them. In this

research paper, assessment of impact of demonetization and RERA on Real

Estate Sector in the city of Pune has been carried out using analysis of

Registrations of Documents, Revenue Collections, Annual Statements Rates and

Market Rates of housing properties, and conducting primary survey of experts,

developers, and buyers. |

|||

|

Received 28 July 2023 Accepted 29 August 2023 Published 13 September 2023 Corresponding Author Dr. S. G.

Sonar, sgs.civil@coeptech.ac.in DOI 10.29121/ijetmr.v10.i9.2023.1365 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2023 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Annual Statement Rates, Demonetization, Pune, Rera, Real Estate Sector |

|||

1. INTRODUCTION

The Real Estate Sector is an aggregate made up of the housing, industrial, office and retail sectors Sonar and Patil (2023) Among these sectors, the housing sector plays the most significant role in the Real Estate Sector. Housing possesses dual properties; it serves as a basic need for human beings and an investment option. Generally, buyers consider housing investment is more superior to other traditional investment options like equities. Housing investment can act as a tool for hedge against inflation and at the same time with an attractive rate of return under relatively lower risk. Direct housing investment has low risk and considerable return than equities and many other investment options. The attractive rate of return is further amplified by leverage as house buying is usually assisted by obtaining loans from banks. The weighting for buying housing properties for consumption and investment purpose vary among buyers Sonar and Patil (2023). It varies from purely consumption purpose, as an end-user of the housing unit, to short term investment motive, as a speculator who motivated solely by perceived capital gains. Housing speculative activities are defined as buying and selling of properties under uncertainty by speculators. They are solely motivated by the capital gains derived from the housing unit through anticipated favorable price changes in the housing sector Sonar and Patil (2023). Speculative activities in the housing sector are the result of uncertainty about future price movements. Uncertainty in housing pricing is resulting due to fractured approvals, non-standardization of products, dispersed buyers, and diversion of cash flows as well as loose regulations Bhandari (2013).

The favorable demographics, acute shortage of housing, rising job opportunities, easy credit availability and high velocity of black money in the economy over last few years have made Real Estate Sector as one of the most preferred investment options in India Bhandari (2013). However, this sector has been largely unregulated and there is an absence of professionalism, standardization, and consumer protection. Issues, such as, delay in construction and delivery of properties, lack of transparency and professionalism, incorrect information related to area / size of the property, false commitments about the amenities / facilities, etc. are very much prevalent in this sector. Though the Consumer Protection Act, 1986 is available as a forum to the buyers in the Real Estate Sector, the recourse is only curative and is inadequate to address all the concerns of buyers and developers in the sector Kapoor (2017). The lack of standardization has been a constraint to the healthy and orderly growth of the sector. Further, the presence of black money, unaccounted cash flows and unearned income have resulted in speculative activities in the Real Estate Sector. Consequently, the need for regulating cash flows in the sector and to create a more transparent environment for property buyers by increasing accountability of developers has been emphasized on various forums. Announcement of demonetization on 8th November 2016 and implementation of Real Estate Regulation (and Development) Act (RERA), 2016 with effect from 1st May 2017 have been enacted to eliminate such anomalies present in the Real Estate Sector.

2. Demonetization

On the evening of 8th November 2016, Indian government announced a sudden denomination of ₹500 and ₹1000 bank notes. Demonetization means withdrawing the legal tender rights of any denomination of currency Kushwah (2018). Surprisingly, the government announced that these bank notes would not be legal tender after midnight of the 8th of November; means the high value bank notes would not be legal for transaction. Although, the old notes could be exchanged till 31st December 2016. In India, there were many occasions, when high denomination bank notes were demonetized. Along with India, many countries in the world had done demonetization in the history. Almost all countries that had done demonetization had some common objectives of demonetization, which were to curb corruption, inflation ridden economies, high domestic prices, unearned income, and mainly black money. In India, after demonetization, significant reduction in black money and hoarding of cash was expected. According to Reserve Bank of India report on 31st March 2016, ₹500 and ₹1000 bank notes consist around 86 per cent of total cash circulation having value of ₹15.44 lakh crore Fatima (2017) In this process, 97 per cent of old notes around ₹14.97 lakh crore were deposited in banks up to 31st December 2016. Demonetization was a bold decision that paved the way towards elimination of black money and cash transaction dealings in the Real Estate Sector.

The demonetization move was received with a lot of panic, causing buyers to be wary of spending, leading to a decline in demand for properties. The Real Estate Sector had been badly hit with cash transactions getting eliminated and a major share of trades going online Sridevi & Sarangi (2017). Demonetization has resulted in buyers adopting virtual wallets with the penetration of alternative forms of payment. Activities in the Real Estate Sector, which includes a lot of cash transactions, unaccounted cash flows and black money slowed down significantly. After demonetization, sales volumes have dropped, supply of new owner properties for sale has reduced, new launches have fallen, cement demand has dropped, unsold inventory level has brought down, etc. Post demonetization, buyers are shifting from “buying” to now “renting” and the rentals of both commercial and housing properties are going up to a maximum Sridevi & Sarangi (2017). A fall in discretionary consumption had hurt industries operating in this sector Fatima (2017). Impact of demonetization has resulted in a fall in registrations of documents by about 40 per cent at state level. The Primary Real Estate Market is slightly less affected as it is far more structured and less exposed to cash dealings. Secondary Real Estate Market which is heavily dependent on cash had borne the massive brunt of demonetization move Sridevi & Sarangi (2017).

3. The Real Estate (Regulation and Development) Act (RERA), 2016

The Real Estate Regulation (and Development) Act, 2016 (RERA) came into effect on May 1, 2017, aims to boost investments in the Real Estate Sector and create a more transparent environment for property buyers by increasing the accountability of developers. As per the new Act, registration is mandatory for all commercial and residential projects, where the land is over 500 sq. mt. or includes eight apartments Choudhary (2018). Failing to register projects will attract a penalty up to 10 per cent of the project cost and a repeated violation could send the developer to jail. Every phase of the project is considered a standalone real estate project, and separate registration needs to be obtained for each project. According to the Act, the developer can’t make any changes to the plan without written consent of the buyer Sonar and Patil (2023). The sale of property to buyers is based on a Carpet Area which is defined in the RER Act and not on a Super Built-up Area, which is illegal under this Act. This provision will not allow the developer to increase the price of their properties. The Act ensures that The Real Estate Project is to be completed on time. If delayed, then the developer will have to pay interest on the amount paid by the buyer. If the buyer finds any shortcomings in the project, then buyer can contact the developer in writing within one year of taking possession. It is compulsory for a State Government to establish a State Real Estate Regulatory Authority under this Act. Buyers could approach this body for redressal of their grievances Choudhary (2018).

Developers must place 70 per cent of the money collected from buyers in a separate escrow account to meet the construction cost of the project Kadam (2018). This will keep a check on developers who divert the buyer's money to start a new project, instead of finishing the one for which money is collected and ensure that the respective project is completed in time. According to this Act, developers now have the liberty to use only 30 per cent of the funds for other purposes. Purchase of land may become more expensive because banks are not allowed to lend money for land purchase. It promises to transform the Real Estate Sector into an organized, transparent, quality focused, and profitable sector. This Act will also bring accountability for not only developers but also for material suppliers and contractors to deliver high quality work as per sanctioned plan and specifications Choudhary (2018) Ensuring transparency and efficiency in the Real Estate Sector regarding sale of plot, apartment, building or real estate project may increase their rates of interest which developers will be forced to pay. This additional cost might ultimately lead to an increase in property prices. The Act may lead to slightly higher prices of properties due to the reduced competition Kadam (2018). New project launches might be limited as developers are not able to launch without obtaining approvals, which could take two to three years Kadam (2018).

3.1. Real Estate Sector in Pune City

Pune is the eighth largest city in India, and it has the sixth largest metropolitan economy; has been considered for assessment of impact of demonetization and RERA on Real Estate Sector. Proximity to the financial capital – Mumbai and rapidly improving infrastructure has made Pune City one of the most sought-after destinations in the country today. Housing market in Pune City has grown more rapidly and to higher levels than in most other Indian cities. Housing prices have multiplied in almost all parts of the city and the suburbs and neighboring areas have been getting absorbed at a considerable pace. There are various reasons for Pune's sudden rise in housing prices Sonar and Patil (2023). Pune is home to many educational and training institutions that cover every aspect of academics. The dynamic culture and job opportunities attract migrants and students from all over India and abroad Tripathi (2013). The growth in the city is peripheral and the driving forces for this growth are mainly the development of its IT industry as well as the economic boom in the automobile sector, which forms a major portion of the industries in and around Pune City. The peripheral development has resulted in growth of the residential real estate space as well as the infrastructure and other facilities requisite for sustainable urbanization. The Real Estate Sector’s growth is primarily linked to developments in the retail, hospitality, automobile and ancillary industries and IT industry. City has offered big IT companies the required space and infrastructure they needed. The sector has been driven by genuine demand resulting in increased development of both commercial as well as residential space Tripathi (2013).

The sudden announcement of demonetization on 8th November 2016 and implementation of RERA, 2016 with effect from 1st May 2017 had severally affected the Real Estate Sector in the city of Pune. Maharashtra was one of the few states ready to implement RERA immediately after the Act was notified. It has taken a lead over similar bodies in other states with the registration of 20,901 projects and 19,787 real estate agents till May 2019. Since the inception of RERA in the state, at least 4,000 projects registered under it have been completed successfully without any complaints Welankar (2019). Before the advent of RERA in the state, developers indulged in malpractices that exploited the buyers in many ways. It has made the Real Estate Sector in the state more transparent and accountable by increasing confidence of the buyer’s manifold. Similarly, demonetization had eliminated black money from the sector has resulted in a liquidity crunch. It has significantly affected cash transactions and unaccounted cash flows in the sector Sridevi & Sarangi (2017). It has affected demand in the market, launching of new projects, property pricing, unsold inventory, vacancy rate, rental market, payment terms and options, completion of projects, land banking, etc. Launching of housing projects considerably reduced as developers’ focus shifted towards completing on-going projects Welankar (2019). Change in buyer’s preference towards ready-to-move-in properties over under-construction properties also resulted in sluggish demand.

4. Assessment of Impact of Demonetization and RERA on Real Estate Sector Pune City

There are two approaches to assess the extent of impact of demonetization and RERA on the Real Estate Sector in Pune City. These include Direct Approach where reliable data is available through secondary sources, and Indirect Approach based on primary sources in the absence of un-availability of reliable data. Analysis of Registrations of Documents, Revenue Collections, Annual Statements Rates and Market Rates of housing properties has been carried out under Direct Approach. Data pertaining to these parameters has been collected through reliable secondary sources over the period from 2013-14 to 2018-19. Details pertaining to Registrations of Documents, Revenue Collections and Annual Statement Rates of housing properties have been collected from Office of the Inspector General of Registration (IGR) and Controller of Stamps, Pune, Government of Maharashtra. Market Rates of housing properties have been collected from 99 Acres, Magic Bricks, and Prop Tiger websites to avoid any kind of biasness being from the private sector. The city of Pune is divided into five zones, and from each zone four localities have been identified to avoid any kind of locational biasness in Market Rates of housing properties across the city. Identified localities include Ambegaon, Aundh, Bibewadi, Balewadi, Baner, Dhankawadi, Dhayari, Hadapsar, Kharadi, Kondhawa, Kothrud, Katraj, Lohegaon, Manjari, Mundhawa, Narhe, Pisoli, Undri, Wadgaon Sheri and Warje. A map showing identified localities across five zones in Pune City is presented in following Figure 1.

Figure 1

|

Figure 1 Identified

Localities Across Five Zones in Pune City Source

Development Plan, Pune Municipal Corporation, 2018 |

Primary survey of important stakeholders, such as, experts, developers and buyers have been carried out to understand their perspectives regarding impact of demonetization and RERA on Real Estate Sector under Indirect Approach. Around twenty experts from Financial Institutions, Town Planning and Valuation Departments, Urban Local Bodies, Practicing Professionals, etc. have been identified for conducting survey. Similarly, around twenty developers operating in the city and dealing mainly in housing properties have been identified for conducting survey. Pre-tested Questionnaire based on literature review and interactions had with experts from various backgrounds has been used for undertaking survey. The questionnaire was divided into two parts, the first part containing a common set of questions pertaining to impact of demonetization and RERA on Real Estate Sector and second part containing questions sets dealing with respective domain of stakeholders. Parameters considered for primary survey includes impact of demonetization and RERA on buyers’ confidence, transparency, regulation and accountability, speedy complaint redressal, price appreciation, supply of residential properties in market, demand for residential properties in market, launching of new residential project in market, project delivery on time, availability of financing, changes in payment terms and options, etc. Analysis of these parameters is presented in the following subsequent paras.

4.1. Assessment of Impact of Demonetization and RERA by Direct Approach

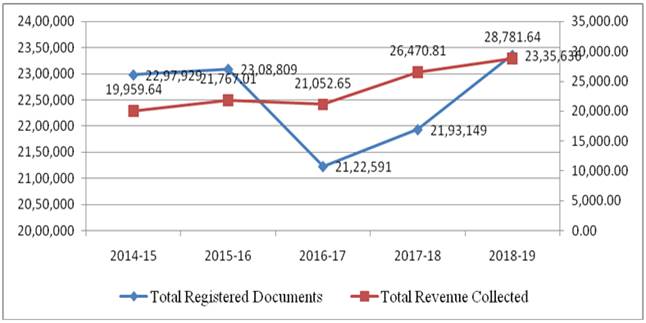

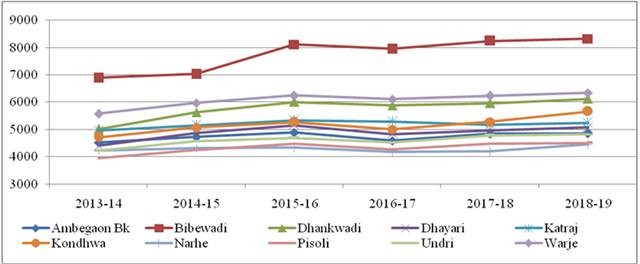

Annual Statement Rate (ASR) is the minimum rate at which a property must be registered in case of its ownership transfer. The rates are determined by State Governments and are revised from time to time according to market dynamics. In fact, ASRs may differ within cities in the same state, and among various localities of a city. Even within localities, rates may differ based on the property type, location, and size of the plot, and various other factors. These rates are an indicator of the likely prices of properties in various areas. A property must be registered either on the actual transaction value or the Annual Statement Rate set by the government, whichever is higher Sharma (2020). The IGR Office registers all types of property deals, including sale and purchase of land, properties, rent and lease agreements. Stamp Duty is a tax levied on any kind of transaction that takes place and is registered. The Stamp Duty is based on Annual Statement Rate and Registration Charges are added taxes on the Stamp Duty. It came into existence after the passing of the Indian Stamp Act in 1899. After the Stamp Duty is paid, these documents become legally valid, and have evidentiary value in a court of law Understanding Stamp Duty (2016). Market Rate of property is the rate at which there is a willing buyer and a seller agreeing to transfer the property in present market conditions. Month-wise registrations of documents and revenue collections pertaining to properties from 2014-15 to 2018-19 with Office of the IGR and Controller of Stamps, Pune are presented in following Table 1 and Table 2 respectively. Annual Statement Rates and Market Rates of housing properties for identified localities in Pune City have been collected from 99 Acres, Magic Bricks and Prop Tiger from 2013-14 to 2018-19 are presented in following Table 3 and Table 4. ASRs are available in sq. mt. unit; same have been converted to sq. ft. unit for the purpose of uniformity and comparison. Yearly trend analysis of registrations of documents verses revenue collections is presented in following Figure 2 and yearly trend analysis of average of 99 Acres, Magic Bricks, Prop Tiger and AS rates of housing properties for identified localities are presented in following Figure 3 and Figure 4.

Table 1

|

Table 1 Registrations of Documents of Properties in Office of the IGR |

|||||||

|

S. No. |

Months |

Financial Year |

Total Registrations of

Documents |

||||

|

2014-15 |

2015-16 |

2016-17 |

2017-18 |

2018-19 |

|||

|

1 |

April |

1,81,475 |

1,96,708 |

1,78,408 |

1,95,631 |

1,80,713 |

9,32,935 |

|

2 |

May |

2,15,999 |

1,97,642 |

2,12,099 |

1,97,329 |

1,95,386 |

10,18,455 |

|

3 |

June |

2,07,905 |

2,06,585 |

2,16,911 |

2,29,851 |

2,01,464 |

10,62,716 |

|

4 |

July |

1,94,182 |

1,99,379 |

1,80,452 |

1,96,105 |

1,84,193 |

9,54,311 |

|

5 |

August |

1,69,068 |

1,75,780 |

1,77,045 |

1,60,207 |

1,85,515 |

8,67,615 |

|

6 |

September |

1,73,425 |

1,68,879 |

1,47,998 |

1,57,793 |

2,18,151 |

8,66,246 |

|

7 |

October |

1,40,590 |

1,64,110 |

1,75,614 |

1,49,249 |

2,38,779 |

8,68,342 |

|

8 |

November |

1,80,347 |

1,52,405 |

1,20,022 |

1,26,182 |

1,14,396 |

6,93,352 |

|

9 |

December |

2,25,176 |

2,25,307 |

1,56,797 |

1,97,148 |

1,79,443 |

9,83,871 |

|

10 |

January |

2,18,233 |

1,96,068 |

1,69,173 |

1,83,541 |

2,18,431 |

9,85,446 |

|

11 |

February |

1,77,224 |

1,97,607 |

1,46,495 |

1,79,813 |

1,99,165 |

9,00,304 |

|

12 |

March |

2,14,305 |

2,28,339 |

2,35,588 |

2,20,000 |

2,20,000 |

11,18,232 |

|

Total Registrations of

Documents |

22,97,929 |

23,08,809 |

21,22,591 |

21,93,149 |

23,35,636 |

||

|

Source Office of the Inspector General of

Registration and Controller of Stamps, Pune, 2019 |

|||||||

Table 2

|

Table 2 Revenue Collections from Property Registrations in Office of the IGR (All numbers are in ₹ crore) |

|||||||

|

S. No. |

Month |

Financial Year |

Total Revenue

Collections |

||||

|

2014-15 |

2015-16 |

2016-17 |

2017-18 |

2018-19 |

|||

|

1 |

April |

1,81,475 |

1614.4 |

1477.3 |

1603.2 |

2052 |

1,88,222 |

|

2 |

May |

2,15,999 |

1589.7 |

1665.4 |

1776.8 |

2305 |

2,23,336 |

|

3 |

June |

2,07,905 |

1635.1 |

1771.7 |

2612.7 |

2358.8 |

2,16,283 |

|

4 |

July |

1,94,182 |

1825.8 |

1685.9 |

1898.5 |

2292.3 |

2,01,885 |

|

5 |

August |

1,69,068 |

1702.6 |

1746.7 |

1856.6 |

2381.5 |

1,76,755 |

|

6 |

September |

1,73,425 |

1666.2 |

1605.5 |

2170.5 |

2226.2 |

1,81,093 |

|

7 |

October |

1,40,590 |

1647.7 |

1901.7 |

1948.5 |

2280.8 |

1,48,369 |

|

8 |

November |

1,80,347 |

1468.43 |

1297.97 |

2161.22 |

1998.43 |

1,87,273 |

|

9 |

December |

2,25,176 |

2637.8 |

1769.4 |

2414.9 |

2773.8 |

2,34,772 |

|

10 |

January |

2,18,233 |

1539.9 |

1426 |

2203.9 |

2331.7 |

2,25,735 |

|

11 |

February |

1,77,224 |

1602.6 |

1343.4 |

2366.2 |

2343.1 |

1,84,879 |

|

12 |

March |

2,14,305 |

2839.7 |

3361.6 |

3457.8 |

3438.1 |

2,27,402 |

|

Total Revenue

Collections |

19,959.64 |

21,767.01 |

21,052.65 |

26,470.81 |

28,781.64 |

||

|

Source Office of the Inspector General of

Registration and Controller of Stamps, Pune, 2019 |

|||||||

Demonetization of high value bank notes has resulted in elimination of black money in the Real Estate Sector in the city of Pune. This has further resulted in a reduction in unearned income and corruption affecting the circulation of unaccounted cash flows in the Real Estate Market. This has directly impacted registrations of documents with Office of the IGR and Controller of Stamps, Pune. The number of documents registered in 2015-16 was 23,08,809 and the same came down to 21,22,591 in 2016-17 showing around 8 per cent decrease in registrations of documents. However, registrations of documents have shown increasing trends in subsequent financial years. Revenue collections in 2015-16 was ₹ 21,767.01 crore and the same came down to ₹ 21,052.65 crore in 2016-17. Similar to registrations of documents, revenue collections have shown increasing trends in subsequent financial years. The announcement of demonetization in 2016 and implementation of RERA in 2017 have resulted in considerable fall in registrations of documents and revenue collections in 2016-17. The elimination of black money and reduction in unaccounted cash flows in the Real Estate Sector have resulted in higher Market Rates while registrations of documents. This has been observed from a higher increase in revenue collections than increase in registrations of documents from 2016-17 onwards. Thus, the increase in revenue collections does not mean proportionate recovery in the number of registrations of documents. Increase in revenue collections is also resulted due to control of Stamp Duty evasion after implementation of RERA. From the trend analysis of registrations of documents verses revenue collections, it is further concluded that volatility resulted in the market in 2016-17, stabilized over subsequent financial years. This is mainly due to implementation of RERA which has made Real Estate (Regulation and Development) and accountable by increasing the confidence of the buyers.

Table 3

|

Table 3 Housing Property Rates Comparisons Across Identified Localities (₹/Sq. Ft.) |

||||||||

|

S. No. |

Locality |

Agency |

Financial Year |

|||||

|

2013-14 |

2014-15 |

2015-16 |

2016-17 |

2017-18 |

2018-19 |

|||

|

1 |

Aundh |

99 Acres |

7267 |

8075 |

8840 |

8627 |

8500 |

8712 |

|

Magic Bricks |

7495 |

8413 |

8909 |

8595 |

8892 |

9194 |

||

|

Prop -Tiger |

8099 |

8428 |

8637 |

8606 |

8422 |

8609 |

||

|

ASR |

7860 |

9039 |

9357 |

9638 |

9638 |

9638 |

||

|

2 |

Balewadi |

99 Acres |

5652 |

5907 |

6120 |

5822 |

6375 |

6672 |

|

Magic Bricks |

6689 |

6767 |

6951 |

6766 |

6835 |

7288 |

||

|

Prop -Tiger |

5992 |

6290 |

6460 |

6247 |

7267 |

7777 |

||

|

ASR |

5008 |

5759 |

5759 |

5976 |

5976 |

5976 |

||

|

3 |

Baner |

99 Acres |

5397 |

6035 |

6800 |

6460 |

6842 |

7437 |

|

Magic Bricks |

6695 |

7038 |

7673 |

7377 |

7443 |

7693 |

||

|

Prop -Tiger |

6353 |

6612 |

6989 |

6882 |

7071 |

7176 |

||

|

ASR |

6288 |

7232 |

7232 |

7340 |

7340 |

7340 |

||

|

4 |

Hadapsar |

99 Acres |

5652 |

5185 |

5822 |

4972 |

5355 |

5950 |

|

Magic Bricks |

6928 |

7412 |

7832 |

7216 |

7792 |

8168 |

||

|

Prop -Tiger |

5574 |

5621 |

5875 |

5665 |

5536 |

5784 |

||

|

ASR |

6215 |

6215 |

6527 |

6527 |

6527 |

6527 |

||

|

5 |

Kharadi |

99 Acres |

4632 |

5227 |

5992 |

5695 |

6120 |

6630 |

|

Magic Bricks |

6052 |

6363 |

6417 |

6216 |

6684 |

7066 |

||

|

Prop -Tiger |

5322 |

5576 |

5671 |

5553 |

5661 |

5732 |

||

|

ASR |

5807 |

5672 |

5672 |

5757 |

5757 |

5757 |

||

|

6 |

Kothrud |

99 Acres |

7055 |

7607 |

8287 |

7990 |

8415 |

9010 |

|

Magic Bricks |

8846 |

9129 |

9593 |

8880 |

9197 |

9677 |

||

|

Prop -Tiger |

9006 |

9208 |

9661 |

9388 |

9797 |

10251 |

||

|

ASR |

8046 |

8850 |

9162 |

9643 |

9643 |

9643 |

||

|

7 |

Lohegaon |

99 Acres |

3740 |

4037 |

4292 |

4080 |

4547 |

4717 |

|

Magic Bricks |

4293 |

4556 |

4721 |

4563 |

4898 |

5250 |

||

|

Prop -Tiger |

4013 |

4185 |

4402 |

4343 |

4256 |

4384 |

||

|

ASR |

5198 |

5198 |

5718 |

6190 |

6190 |

6190 |

||

|

8 |

Manjari |

99 Acres |

4122 |

4420 |

4972 |

4547 |

5015 |

5312 |

|

Magic Bricks |

4381 |

4681 |

5125 |

4870 |

5065 |

5257 |

||

|

Prop -Tiger |

4115 |

4406 |

4578 |

4460 |

4727 |

4843 |

||

|

ASR |

3941 |

3941 |

3941 |

4104 |

4104 |

4104 |

||

|

9 |

Mundhawa |

99 Acres |

4802 |

5780 |

5397 |

5100 |

5822 |

6120 |

|

Magic Bricks |

5213 |

5439 |

5720 |

5538 |

5903 |

6135 |

||

|

Prop -Tiger |

5036 |

5113 |

5214 |

5038 |

5412 |

5807 |

||

|

ASR |

5937 |

6649 |

6649 |

7248 |

7248 |

7248 |

||

|

10 |

Wadgaon Sheri |

99 Acres |

5440 |

5907 |

5992 |

5610 |

7012 |

7692 |

|

Magic Bricks |

5992 |

6254 |

6414 |

6124 |

6543 |

6812 |

||

|

Prop -Tiger |

6139 |

6613 |

7075 |

6769 |

6574 |

6308 |

||

|

ASR |

5718 |

6291 |

6512 |

6831 |

6831 |

6812 |

||

|

Source 99acres.com, magicbricks.com,

proptiger.com, Office of the IGR, 2019 |

||||||||

Table 4

|

Table 4 Housing Property Rates Comparisons Across Identified Localities (₹/Sq. Ft.) |

||||||||

|

S. No. |

Locality |

Agency |

Financial Year |

|||||

|

|

|

|

2013-14 |

2014-15 |

2015-16 |

2016-17 |

2017-18 |

2018-19 |

|

11 |

Ambegaon Bk |

99 Acres |

4420 |

4845 |

5227 |

4632 |

5057 |

5397 |

|

|

|

Magic Bricks |

5036 |

5317 |

5422 |

4876 |

5227 |

4976 |

|

|

|

Prop -Tiger |

4554 |

4615 |

4650 |

4568 |

4838 |

4766 |

|

|

|

ASR |

4078 |

4108 |

4252 |

4263 |

4263 |

4263 |

|

12 |

Bibewadi |

99 Acres |

6502 |

6630 |

7437 |

6800 |

7395 |

7480 |

|

|

|

Magic Bricks |

6532 |

7217 |

7547 |

7307 |

7699 |

7850 |

|

|

|

Prop -Tiger |

7403 |

7931 |

9009 |

8835 |

9003 |

9108 |

|

|

|

ASR |

7107 |

6316 |

8460 |

8841 |

8841 |

8841 |

|

13 |

Dhankawadi |

99 Acres |

4082 |

5440 |

5525 |

5227 |

5100 |

5312 |

|

|

|

Magic Bricks |

5445 |

5513 |

6713 |

6231 |

6320 |

6563 |

|

|

|

Prop -Tiger |

5127 |

5210 |

5445 |

5309 |

5661 |

5847 |

|

|

|

ASR |

5379 |

6336 |

6336 |

6733 |

6733 |

6733 |

|

14 |

Dhayari |

99 Acres |

4505 |

5142 |

5720 |

4675 |

5355 |

5695 |

|

|

|

Magic Bricks |

4502 |

5063 |

5455 |

5178 |

5209 |

5310 |

|

|

|

Prop -Tiger |

4532 |

4817 |

4896 |

4763 |

4616 |

4606 |

|

|

|

ASR |

4088 |

4497 |

4542 |

4679 |

4679 |

4679 |

|

15 |

Katraj |

99 Acres |

4845 |

4802 |

5185 |

5397 |

5312 |

5440 |

|

|

|

Magic Bricks |

5119 |

5336 |

5539 |

5227 |

5075 |

5514 |

|

|

|

Prop -Tiger |

5193 |

5383 |

5461 |

5266 |

4968 |

5125 |

|

|

|

ASR |

4643 |

5108 |

5159 |

5288 |

5288 |

5288 |

|

16 |

Kondhawa |

99 Acres |

4377 |

5397 |

5482 |

4802 |

5397 |

6715 |

|

|

|

Magic Bricks |

4964 |

5258 |

5681 |

5181 |

5572 |

5829 |

|

|

|

Prop -Tiger |

4648 |

4759 |

4864 |

4814 |

4950 |

4902 |

|

|

|

ASR |

4878 |

4876 |

5048 |

5199 |

5199 |

5199 |

|

17 |

Narhe |

99 Acres |

4037 |

4335 |

4632 |

4292 |

4547 |

4717 |

|

|

|

Magic Bricks |

4708 |

4949 |

5001 |

4766 |

4786 |

4831 |

|

|

|

Prop -Tiger |

4070 |

3896 |

3636 |

3499 |

3339 |

4131 |

|

|

|

ASR |

4083 |

4083 |

4083 |

4124 |

4124 |

4124 |

|

18 |

Pisoli |

99 Acres |

3697 |

3952 |

4122 |

3782 |

4292 |

4377 |

|

|

|

Magic Bricks |

4115 |

4442 |

4881 |

4314 |

4438 |

4583 |

|

|

|

Prop -Tiger |

4534 |

4777 |

5014 |

4838 |

5005 |

4925 |

|

|

|

ASR |

3484 |

3832 |

3871 |

4133 |

4133 |

4133 |

|

19 |

Undri |

99 Acres |

3995 |

4420 |

4675 |

4165 |

4887 |

4802 |

|

|

|

Magic Bricks |

4635 |

4873 |

5018 |

4708 |

4873 |

5009 |

|

|

|

Prop -Tiger |

4186 |

4299 |

4368 |

4136 |

4346 |

4402 |

|

|

|

ASR |

4039 |

4644 |

4691 |

5043 |

5043 |

5043 |

|

20 |

Warje |

99 Acres |

4845 |

5950 |

6460 |

6162 |

6375 |

6715 |

|

|

|

Magic Bricks |

6381 |

6563 |

6860 |

6563 |

6647 |

6891 |

|

|

|

Prop -Tiger |

5581 |

5869 |

6084 |

5816 |

6006 |

5858 |

|

|

|

ASR |

5481 |

5481 |

5560 |

5895 |

5895 |

5895 |

|

Source 99acres.com, magicbricks.com,

proptiger.com, Office of the IGR, 2019 |

||||||||

Figure 2

|

Figure 2 Trend Analysis of Registrations of Documents Verses Revenue Collections Source Office

of the Inspector General of Registration and Controller of Stamps, Pune, 2019 |

Figure 3

|

Figure 3 Trend Analysis of

Housing Property Rates Across Identified Localities Source

99acres.com, magicbricks.com, proptiger.com, Office of the IGR, 2019 |

Figure 4

|

Figure 4 Trend Analysis of

Housing Property Rates Across Identified Localities Source

99acres.com, magicbricks.com, proptiger.com, Office of the IGR, 2019 |

Analysis of Market Rates of housing properties across twenty identified localities in the city of Pune from financial year 2013-14 to 2018-19 has been carried out. Average of Market Rates collected from 99 Acres, Magic Bricks, and Prop Tiger and ASRs is obtained to avoid any kind of biasness in assessment of impact of demonetization and RERA. Combined analysis of registrations of documents, revenue collections, and average Market Rates has helped us to understand intricacies and interdependency among these parameters. It is observed that Market Rates of housing properties across all identified localities in Pune City received major setback during financial year 2016-17 due to demonetization and implementation of RERA. Variations in setbacks in Market Rates across identified localities have been observed due to locational perspective. Further, increasing trends in Market Rates of housing properties across all identified localities in Pune City is observed in subsequent financial years. Increasing trends in Market Rates is resulting due to elimination of black money and unaccounted cash flows, fall in launching of new projects, speedy completion of ongoing projects, holding on of recently launched projects, availability of financing at cheaper interest rates, changes in payment terms and options, etc. Further, implementation of RERA has helped to create a more transparent environment for property buyers by increasing the accountability of developers and regulating the Real Estate Sector. Launching of housing projects considerably reduced as developers’ focus shifted towards completing ongoing projects. Developers have tried to adhere to compliances, to avoid litigation due to implementation of RERA. Change in buyer’s preference towards ready-to-move-in properties has resulted in bringing down unsold inventory and vacancy rate considerably in Pune City.

4.2. Assessment of Impact of Demonetization and RERA by Indirect Approach

Analysis of questionnaire survey

conducted to understand perspectives of experts, developers and buyers

pertaining to impact of demonetization and RERA on Real Estate Sector under

Indirect Approach has been carried out, and presented in following subsequent

paras:

1) Perspectives

of Experts Pertaining to Impact of Demonetization and RERA

Most of the experts expressed that demonetization and RERA would impact negatively on property pricing, new launches, demand for property, resale market, rental market, land banking, foreign direct investment, rate of interest, market liquidly, etc. Further, most of the experts expressed that demonetization and RERA would impact positively on transparency, speedy complaint redressal, buyer’s confidence, regulation and accountability, obligations / bindings on developers, etc. According to experts, implementation of RERA would change procedural aspects of the Real Estate Sector and it would work in the interest of buyers as well as developers, if taken in the right spirit by them. According to them, demonetization would affect both buyers and developers to similar extents. Cumulative effect of both the phenomena would affect both smaller and bigger developers, however in a different way.

2) Perspectives

of Developers Pertaining to Impact of Demonetization and RERA

Most of the developers expressed that demonetization and RERA would impact negatively on property pricing, demand for property, new launches, frequency of launches, cash flows, markets liquidity, availability of funding, cash transactions, payment of installments, completion of project, land banking, inventory of stocks, foreign direct investment, etc. Further, most of the developers expressed that demonetization and RERA would impact positively on unsold inventory, cost escalation, transparency, regulation and accountability, obligations / bindings, etc. According to developers, implementation of RERA would affect cash flows in real estate market adversely and functioning of it would become more complicated. According to them, demonetization would affect property pricing negatively for the short term and however, it would affect positively in longer term. New project launching would be delayed as developers are unable to launch without obtaining approvals. Cumulative effect of both the phenomena would affect both developers and buyers, however in a different way.

3) Perspectives

of Buyers Pertaining to Impact of Demonetization and RERA

Most of the buyers expressed that demonetization and RERA would impact negatively on investment in property, land pricing, liquidity crunch, cash flows, payment of taxes / charges, supply in market, cash transactions, payment terms and options, completion of project, etc. Further, most of the buyers expressed that demonetization and RERA would impact positively on property pricing, transparency, speedy complaint redressal, buyer’s confidence, regulation and accountability, obligations / bindings, etc. According to buyers, implementation of RERA would eliminate anomalies prevalent in the Real Estate Market and would result in transparency, accountability, and standardization in the market. According to them, demonetization would affect cash transactions and ultimately result in property price appreciation. The cumulative effect of both the phenomena would affect buyer’s preferences towards ready-to-move-in properties and for some towards rental properties.

5. Conclusion

Announcement of demonetization on 8th November 2016 and implementation of RERA, 2016 with effect from 1st May 2017 had severally affected Real Estate Sector in the city of Pune. Demonetization has impacted financial aspects of Real Estate Sector by way of elimination of black money, unearned income, and unaccounted cash flows. At the same time, implementation of RERA has impacted procedural aspects of the Real Estate Sector by bringing more transparency, accountability, and standardization. Subsequent enactment of both these phenomena adversely impacted the Real Estate Market by resulting in sluggish demand, controlled supply, and property pricing. However, this scenario in the market changed in subsequent financial years, and observed price appreciation, regulated supply of properties, and change in buyer’s perspectives. It has largely impacted payment terms and options and resulted in buyers adopting virtual wallets with the penetration of alternative forms of cashless payment. Though, the impact on the Real Estate Sector was for short term; however, it has made long term changes in functioning of real estate market. These changes include an increase in Market Rates of properties while registrations of documents, increase in Stamp Duty and registration charges, decrease in land pricing and land banking, decrease in unsold inventory and vacancy rate, etc. Impact has also resulted in restrictions on speculative activities in the real estate market by elimination of black money, unaccounted cash flows and regulating money received from property buyers in a particular project. Impact has further resulted in elimination of many non-serious and marginal developers from the Real Estate Sector and bankruptcy of some developers operating on large scale.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Bhandari, M. (2013). The End Game of Speculation in Indian Real Estate has Begun. Retrieved from 2015, May 30 Vallum Capital Advisors Pvt Ltd, 1-14.

Brave New World for India Real Estate (2011). FICCI, 19-20.

Choudhary, A. (2018). Rera : A Reform to Support Real Estate Sector. Inspira-Journal of Commerce, Economics and Computer Science, 4(1), 208-210.

Fatima, A. M. (2017, March 3). Effects of Demonetization in India. International Journal of Economics and Management Studies, 4(3),51-54.

Jha, A. (2017, Jan 25). Pune’S Commercial Real Estate Challenges.

Kadam, A. V., Jangam, R. R., Pawar, R. R., Sagavekar, A. A., Parulekar, G. D. & Patil, S. S. (2018). Detailed Study and Analysis of RERA Act. International Research Journal of Engineering and Technology (IRJET), 5(4) ,3030-3032.

Kapoor, R. (2017, April 29). Need for Rera in Indian Real Estate. Retrieved from 2020, June 9 RERA Filing.

Kushwah, H., Kumar, A. & Abbas, Z. (2018). Impact of Demonetisation on Indian Economy : A Critical Study. International Journal of Management Studies, 5-2(7) 1-7.

Pratap, R. (2018, March 22). Mumbai, NCR Most Affected by Real Estate Slowdown.

Realty Plus (2018, Jan 22). Pune Realty Growth Analysis.

Real Estate (Regulation and Development) Act (RERA) (2016).

Sharma, A. K. (2020, April 29). What is Ready Reckoner and Circle Rate, and What Purpose Does it Serve ? Retrieved from 2020, June 9 Live Mint.

Singh, S. K. (2017, June 11). A Study of Impact of Demonetisation on Real-Estate. 3 International Conference on Imerging Trends in Engineering, Technology, Science and Management 2. Delhi : Institution of Electronics and Telecommunications Egineers, 7(3) 33-239.

Sonar, S. G., & Patil, S. (2023). Assessment of Speculation in Real Estate Sector in Pune City. International Journal for Research in Applied Science & Engineering Technology (IJRASET), 11(2), 1178-1186.

Sridevi, T., & Sarangi, P. P. (2017, July). Demonetisation Policy : Its Impact on the Real Estate Sector. International Journal of Latest Technology in Engineering, Management and Applied Science, 6(7), 120-124.

Thakur, U. (2017, April). Demonetization in India : Impact on Employment and Job Market. International Journal of Multidisciplinary Research and Development, 4(4), 188-190.

Tripathi, V. (2013). Pune-The Leading Real Estate Destination-2012-13. Retrieved from 2020, June 8, 1-78.

Understanding Stamp Duty and Registration Charges. (2016, October 12). Retrieved from 2020, June 8 Paisa Bazaar.

Welankar, P. (2019, May 4). Maharashtra Leads Nation in Implementation of Rera. Retrieved from 2020, June 8 Hindustan Times.

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© IJETMR 2014-2023. All Rights Reserved.