ShodhKosh: Journal of Visual and Performing ArtsISSN (Online): 2582-7472

|

|

Blockchain and the Visual Arts Ecosystem: Disruptive Impacts on Digital Art Ownership, NFTs, and Creative Economies

Dr. Sandip Sane 1![]()

![]() , Dr. Diksha Tripathi 2

, Dr. Diksha Tripathi 2![]()

![]() , Dr. Anagha Bhope 3

, Dr. Anagha Bhope 3![]()

![]() , Aditee Huparikar Shah 4

, Aditee Huparikar Shah 4![]()

![]() , Dr. Rashmi Dongre 5

, Dr. Rashmi Dongre 5![]() , Dr. Harshal Raje 6

, Dr. Harshal Raje 6![]()

![]() , Dr. Sudesh N S 7

, Dr. Sudesh N S 7![]()

![]()

1 Director,

ASM’s Institute of Business Management and Research, Savitribai Phule Pune

University, Pune, India

2 Assistant

Professor, Symbiosis Skills and Professional University, Pune, India

3 Associate Professor, Symbiosis Skills and Professional University,

Pune, India

4 Assistant Professor, Indira College of Engineering and Management,

Pune, India

5 Assistant Professor, Tilak Maharashtra Vidyapeeth, Pune, India

6 Associate Professor, Global Business School and Research Centre, Dr.

D.Y. Patil Vidyapeeth, Pimpri, Pune, India

7 Assistant Professor, Department of Finance and Accounting, ICFAI

Business School (IBS), ICFAI University, Hyderabad, India

|

|

ABSTRACT |

||

|

One of the ways in which blockchain technology is

transforming the visual arts ecosystem is by providing decentralized,

transparent, and verifiable systems of ownership, distribution, and value

exchange of digital art. This paper analyzes how blockchain has been

disruptive to visual arts in modern times, specifically in non-fungible

tokens (NFTs), creative economies, and artist-collector relationships.

Historically, the digital artworks were associated with the issues with

provenance, copyright protection, scarcity, and justifiable monetization.

Blockchain overcomes these weaknesses by providing immutable registries,

smart contracts, and tokenization to allow artists to have verifiable

ownership, determine authenticity, and earn automatic royalties on transactions

in the secondary market. The study takes a conceptual and analytical

structure by synthesising the extant literature, platform case studies and

new blockchain-based art markets to assess the worth of NFTs in redefining

artistic value, authorship and market forces. The results suggest that

blockchain makes global art markets more democratic by decreasing the use of

intermediaries including galleries and auction houses, which are central, and

thus giving power to independent and new artists. Simultaneously, it

cultivates new creative economies in which digital scramble, community

contribution and speculative finance overlap. Nevertheless, the paper also

singles out some fundamental challenges such as environmental sustainability

issues, market unpredictability, regulatory ambiguity and the issues of

artistic legitimacy and cultural value. The article presents the argument

that although blockchain does not substitute the traditional art

institutions, it supports them by providing hybrid ecosystems through

integrations of physical and digital practices. All in all, the study

suggests blockchain as a revolutionary infrastructure to the visual arts,

reinventing ownership, trust, and economic frameworks and proposing a

sustainable, ethical, and inclusive future to enable the long-term

development of digital art ecosystems. |

|||

|

Received 11 May 2025 Accepted 14 September 2025 Published 25 December 2025 Corresponding Author Dr.

Sandip Sane, dr.sandipsane@gmail.com DOI 10.29121/shodhkosh.v6.i4s.2025.6969 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2025 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Blockchain Technology, Visual Arts Ecosystem;

Digital Art Ownership, Non-Fungible Tokens (Nfts), Creative Economies,

Decentralized Art Markets |

|||

1. INTRODUCTION

The blockchain technology has become a basic digital infrastructure that transforms various spheres of modern society, including finance, government and cultural production. In digital culture, blockchain presents decentralized designs that are transparent, tamper-resistant and trustless, without the use of centralized authorities. These traits have far-reaching consequences on the creative sectors, especially the visual art where the issues of authorship, ownership, and value have been debated extensively in the digital space. With the increased functionality of digital platforms as an artistic creation, circulation, and consumption mode, blockchain has become a technological solution to structural constraints of traditional digital systems Spyrou et al. (2025), Sidorova (2025). Having allowed the creation of an immutable set of records and a programmable smart contract, blockchain reinvents the concept of authenticating, trading, and monetizing cultural assets in networked societies Pineda et al. (2024).

The development of digital art has been directly related to the development of imaging technologies, computer applications, and web distribution network. Although such developments have brought about democratization of artistic production and world presence, it has also brought its fair share of challenges on issues to do with ownership, provenance and economic sustainability. Digital art in contrast to the physical work is endlessly reproducible and it is hard to create scarcity, originality and value in the long run. There can be a lack of control over the works created by artists after their publication in the Internet, followed by unauthorized replication, loss of attribution, and inability to participate in the profitability of secondary markets Tapscott and Tapscott (2016), Illanes et al. (2018) in particular. The conventional intellectual property models and single gateways have failed to deal with these issues, as they appear to build on the notion of intermediaries that consider platform value over the equity of artists. As a result, digital art ecosystems have traditionally prioritized the exposure over the reward, weakening the fair pay and trust Sigley and Powell (2023).

It is on this context that blockchain-enabled mechanisms, especially non-fungible tokens (NFTs) have come to disrupt the digital art markets by reestablishing ownership and value in these markets. NFTs enable the tokenisation of digital artwork as a unique asset in a blockchain and add metadata such as authorship, provenance and the history of transactions. This change has triggered the emergence of new economies of creativity where artists can sell their creations directly to collectors, they can collect automatic royalties, and they can be part of decentralized markets Viriyasitavat et al. (2019). The quick commercialization of blockchain within the visual arts has not been without critical discussion, however, on the subject of market speculation, the sustainability of the environment, regulatory vagueness, and the legitimacy of culture Porras (2023). The key research question of the presented study is about the idea in which blockchain technologies are changing the visual arts ecosystem and whether these changes can be considered sustainable, equitable, and culturally significant innovations. The aims of this study are three-fold, to investigate the role of blockchain in the re-definition of digital art ownership and provenance, to analyze the effect of NFTs on creative economies and the relationships between artists and collectors, and finally, to analyze the opportunities and challenges of blockchain-based art ecosystems in a critical manner. This study is important because of its interdisciplinary approach that cuts across technology, economics, and the visual culture to add to the new academic literature on decentralized creativity and the future of digital art Brynjolfsson and McAfee (2014).

2. Conceptual Foundations

2.1. Fundamentals of Blockchain, Decentralization, and Smart Contracts

Blockchain is a distributed registry technology, aimed at logging transactions over a network of nodes in a safe, transparent and unalterable form. On one hand, blockchain is decentralized, unlike a centralized database that is controlled by one party, in which the data validation and consensus are jointly established by the network participants. Such a decentralized design eliminates the use of intermediaries, single-point failure, and improves trust in users who have no direct interaction or may not trust one another Brynjolfsson and McAfee (2014). Decentralization is especially relevant in digital cultural ecosystems, which question the conventional gatekeepers of access, valuation, and legitimacy platforms, galleries, and auction houses, which historically had a major influence on these aspects.

The central aspect of blockchain operation is the consensus mechanisms, i.e. Proof of Work or Proof of Stake, that guarantee that the transactions are confirmed and permanently attached to the ledger in an unsecure and tamperproof way. This means that once data has been recorded it is impossible to change without the consensus of the entire network making data immutable a fundamental concept Huang et al. (2019). Smart contracts also build on the functionality of blockchain by supporting self-executable contracts enshrined directly into the registry. These programmable contracts enforce automatically pre-defined rules e.g. royalty payout, licensing terms, or resale rights Aponte et al. (2021)without the intervention of a third party.

Applied to visual arts, smart contracts allow the artists to incorporate economic logic into their digital artworks, which can guarantee transparency, automation, and active involvement in the creation of value over the long term. Blockchain, decentralization, and smart contracts are creating a technology system that transforms trust, governance, and economic agency in the digital creative space and are the basis of new forms of ownership and exchange in the visual arts ecosystem Li et al. (2021).

2.2. Digital Scarcity, Provenance and Trust Mechanisms

This is because the digital media fundamentally questions the traditional scarce ideas of resources, where digital files can be copied, shared and reproduced without any degradation. This lack of perceived scarcity has traditionally weakened the economic value of digital art with original and imitation being hard to tell and no foreseeable permanence in market worth. The introduction of blockchain is a paradigm shift in that it provides artificial but verifiable digital scarcity, which is made possible by cryptographic uniqueness and tokenization Ponder (2024). By connecting a digital work of art with a unique blockchain transaction, they enable the artist to identify a particular case of the work as the genuine one, even though the copies of the same work may persist.

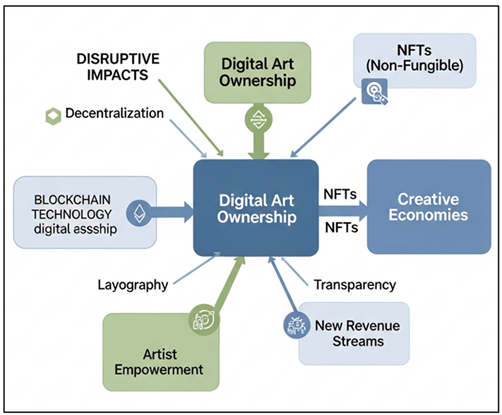

Figure 1

Figure 1 Conceptual Framework of Blockchain-Driven Digital

Art Ownership and Creative Economies

The other important aspect in creating trust and value in art markets is provenance that is the history of ownership and transactions. With classical art systems, provenance documentation is usually disjointed, a black box or open to abuse. Blockchain can overcome these shortcomings by ensuring a transparent, avalanching ledger that documents all the transactions that have occurred with a digital asset since its creation, through resale Ochoa et al. (2019). This provenance, which is continuously verifiable in public, builds trust between artists, collectors, and institutions and decreases the levels of the former. The Figure 1 demonstrates that decentralized ownership of digital art via NFTs is made possible by blockchain technology, which connects authenticity, transparency, and new sources of revenue. It emphasizes how blockchain is disruptive to the visual arts system by highlighting how traditional asset control systems shift to artist empowerment and creative economies. The trust mechanisms that are built within blockchain systems are not based on the authority of the institution but on cryptographic verification and network consensus. This change in belief in intermediaries to trust in code shifts the nature of credibility formation in the realms of digital art significantly. Consequently, scarcity systems, provenance systems, and similar systems based on blockchain generate novel ideas of confidence, responsibility, and legitimacy and transform the valuing, exchanging, and preserving of digital artworks in a decentralized creative economy Condon et al. (2023).

2.3. Overview of NFTs and Tokenized Art Assets

Non-fungible tokens (NFTs) are a rather specialized usage of blockchain technology that is used to authenticate the ownership of unique digital assets. When applied in the visual arts setting, NFTs can be interpreted as digital ownership certificates referring to an artwork and keeping metadata on blockchain authorship, date of creation, and purchase history Brynjolfsson and McAfee (2014). This technicality allows the digital works of art to be handled as collectible objects and not continuously reproduced files.

The asset of tokenized art establishes a new model of value allocation and transfer in the online marketplace. The NFTs allow artists to deposit their artworks directly on the blockchain platforms bypassing the traditional intermediaries and reaching an international audience. Automated payment of royalties by Smart contracts in NFTs enables creators to receive secondary market sales, which is widely unavailable in traditional art systems Huang et al. (2019), Aponte et al. (2021). Also, NFTs enable new forms of art, such as generative art, interactive media, community-based projects, and the development of which occurs over time.

NFTs are also associated with problematic cultural and economic issues despite their potential to transform. Hypothetical trading, market fluctuations, and environmental aspects that are linked to blockchain infrastructure have caused a lot of controversy. Moreover, there is no clear legal and conceptual differentiation between the ownership of a token and the control over the underlying intellectual property Li et al. (2021), Ochoa et al. (2019). However, NFTs are an underlying mechanism in tokenized creative economies, which indicate a wider re-setting of ownership, value and engagement in the modern visual arts ecosystem Condon et al. (2023).

3. Blockchain and Digital Art Ownership

3.1. Provenance Verification and Authenticity Assurance

The issues of provenance verification and authenticity assurance become the key problems in the ownership of digital art because digital files can be reproduced indefinitely and the quality remains just as high. The solution to this is the blockchain, which is a transparent and inalterable, time-stamped record of the entire lifecycle of a digital artwork. Once an artist has minted a work on a blockchain, a cryptographic identifier is created that is irrevocably attached to the work of art. This identifier is usually stored in a non-fungible token (NFT) and stores important information like the wallet address of the creator, the time of creation and the receipt of transactions. This information cannot be debriefed afterwards, thus providing long-term integrity of provenance information.

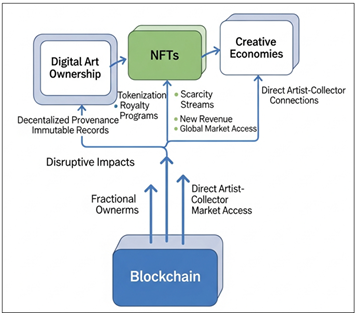

Figure 2

Figure 2 Blockchain–NFT Integration Framework for Digital Art

Ownership and Creative Economies

The Figure 2 illustrates blockchain as the base layer that makes it possible to tokenize digital artworks with the help of NFT. It emphasizes Tokens It shows how NFTs connect the ownership of digital artworks with creative economies through giving them scarcity, accessing a global market, and facilitating direct artist to collector relationships, in decentralized creative economies and ecosystems. Its mechanism of operation is based on distributed consensus, wherein several nodes verify every transaction and only after that, it is inserted into the blockchain. This decentralized verification is free of reliance on central authorities to do the authentication to minimize the risks of forgery, manipulation, or contested ownership. Every change of ownership is recorded publicly, and allows collectors, curators and institutions to understand both the history of an artwork, as well as its owner. This leads to the development of authenticity by cryptographic evidence instead of institutional approval.

3.2. Copyright Management and Implication of Intellectual Property

Blockchain presents unexplored opportunities and challenges to copyright management and intellectual property (IP) in digital art. Historically, the protection of copyright in the online world has been challenging because of unlawful copying, loss of attribution and jurisdictional constraints. Blockchain enhances copyright signaling, whereby artists can publicly acid-test authorship and creation signatures, creating a great deal of evidence of originality. This unchanging document can be used to prove legal assertions by proving an earlier ownership and authorship in a dispute.

Nevertheless, blockchain is not the one that transfers and enforces the copyright per se. The possession of a tokenized art does not always imply the rights to copy, edit, and commercially abuse the work behind it. This difference carries far reaching legal consequences since collectors can take greater rights than those conferred upon them. To solve this, authors are more inclined toward metadata and license terms within tokens to specify the permission of use.

3.3. Smart-Contract–Based Royalty and Resale Models

Smart contracts are transformative and revolutionary in the redefinition of model royalty and resale in digital art markets. These self-executing programs are automatic in nature and automatically apply certain predefined conditions in case certain events happen, like resale of an artwork. In the traditional art markets, artists have been the least beneficiaries of the secondary sales because resale gains are mainly enjoyed by the collectors and middlemen. Smart contracts are a disruption to this model because they add royalty clauses into digital artworks when they are minted.

In the resale of a tokenized artwork, the smart contract will automatically pay a percent of the transfer value to the original creator so that they remain involved in the economic lifecycle of the artwork. This process is transparent and galleries, auction houses, and manual enforcement are not necessary. This leads to revenue streams and increased economic security of the artists in the long term, especially in speculative markets or fast-appreciating markets.

4. NFTs as a Disruptive Innovation in Visual Arts

4.1. NFT Marketplaces and Platform Ecosystems

NFT markets are the key infrastructural layer where tokenized works of art have been minted, displayed, traded, and priced. The platforms combine blockchain networks, digital wallets, smart contracts, and user interfaces to form digital art transaction end-to-end ecosystems. NFT marketplaces are accessible worldwide and around-the-clock, compared to traditional art markets that utilize physical gallery, curator and auction houses so that artists can reach audiences across the globe with no geographic or institutional restrictions. Platforms normally provide minting, pricing, auctioning and resales functionality of artworks together with verification of creators and presentation of provenance information.

Network effects, platform governance and technical standards are the determinants of ecosystem dynamics of NFT platforms. The environments of royalty structures, supported blockchains, and content moderation policies tend to take the form of market places that affect the way value flows within the system. Although it is a fundamental ideological concept, most platforms are semi-centralized intermediaries that trade off user experience with blockchain transparency. This hybrid model has expedited adoption at the expense of creating platform power and fee harvesting issues and long-term sustainability.

4.2. Redefinition of Artistic Value and Authorship

NFT has a fundamental effect on the artistic value of shifting the focus to the verifiable originality, context, and story instead of focusing on materiality. Traditional systems of art have tended to assign value based on physical distinctiveness, institutionalization, and historic distinction. Consequently, value is highly linked to the artist, the conceptual meaning of the piece of art, and its traceable on-chain provenance as opposed to its physical manifestation. Public and permanent associations between creators and their works by blockchain help to strengthen authorship within digital space, where it has historically been weak. In addition, NFTs create new collaborative and generative authorships, in which works of art are built using algorithms, community feedback, or an iterative process of minting. Authorship is also shared in these situations instead of being individual, and it disrupts traditional ideas of artistic property and creative authority.

4.3. Collector Behavior, Speculation, and Community Formation

NFTs have greatly changed the behavior of collectors by combining art patronage and investing in digital assets. The collectors are ceasing to be passive consumers, but active practitioners in the market places, communities and structures of governance. The availability of easy resale, and price transparency have enhanced the processes of speculation, and artwork is most frequently estimated on its appreciation prospects than on aesthetical value. This conjecture has given rise to rapid price volatility and market cycles, media hype and is leading to concerns on sustainability and artistic integrity.

Simultaneously, NFT ecosystems contribute to the establishment of powerful community of artists, collections and platforms. The possession can usually allow entrance to special groups, occasions or joint initiatives and make collecting social and participatory. These societies are networks of joint identity and cultural belonging, in which value is created through a collective attention and participation. Therefore, NFTs heighten speculative processes and also foster kinds of cultural belonging to create new social structures within the contemporary visual arts ecosystem.

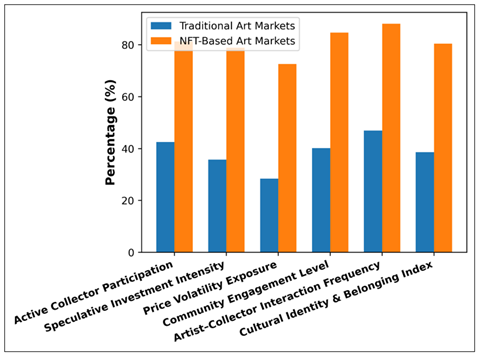

Table 1

|

Table 1 Analysis of Collector Behavior, Speculation, and Community Formation In NFT Ecosystems |

|||

|

Parameter |

Traditional Art Markets (%) |

NFT-Based Art Markets (%) |

Change / Impact (%) |

|

Active Collector

Participation |

42.5 |

81.3 |

+38.8 |

|

Speculative Investment

Intensity |

35.7 |

78.9 |

+43.2 |

|

Price Volatility Exposure |

28.4 |

72.6 |

+44.2 |

|

Community Engagement Level |

40.2 |

84.7 |

+44.5 |

|

Artist–Collector Interaction

Frequency |

46.9 |

88.1 |

+41.2 |

|

Cultural Identity and

Belonging Index |

38.6 |

80.4 |

+41.8 |

Table 1 shows that the traditional and NFT-based art markets differ significantly in terms of their behavioral changes. NFT ecosystems have significantly increased active participation by collectors and engagement between artists and collectors, and have interactive and engaged models of ownership. The values of speculative investment and market volatility are considerably high, which implies market dynamism and risks of sustainability. At the same time, higher scores on community engagement and cultural belonging indicate that NFTs can create participatory art communities based on identity and the integration of economic speculation with social and cultural value generation.

Figure 3

Figure 3 Comparative Analysis of Collector Behavior in

Traditional and NFT-Based Art Markets

The Figure 3 compares traditional and NFT-based art markets based on the major behavioral indicators. The presence of NFT markets demonstrates significantly more collector activity, speculative activity, community activity, and the relationship of artists and collectors. Although the higher level of volatility indicates the speculative processes, the greater cultural belonging and involvement elaborates the role of NFTs in developing participatory, communitative art ecosystems.

5. Impact on Creative Economies

5.1. Disintermediation of Galleries and Traditional Art Institutions

The systems of blockchain and NFT have brought in a high degree of disintermediation to creative economies by disincentivizing the use of old art institutions, particularly galleries, auction houses, and agents. These mediators once had a monopoly of access to markets, artistic visibility and shaped valuation using institutional power. As much as they brought legitimacy and infrastructure, they also offered high commissions and gate keeping practices which suppressed the emergent and marginalized artists. Blockchain-based systems enable artists to produce, display and sell artworks directly to buyers bypassing most of these filters.

With this change, the power dynamics in the art ecosystem are altered enabling artists to have an increased freedom in pricing, distribution, and interacting with the audience. The digital market places substitute the physical exhibition places, which offers constant and transnational transactions and minimizes the operational barriers. Nonetheless, disintermediation does not mean that institutions are washed out altogether. Instead, it triggers their roles to be reconfigured to curation, education, and physical-digital experiences. Although some critics say that platforms themselves emerge as new intermediaries, blockchain still decentralizes power by making visibility, access to the market, spread more widely throughout the creative economy.

5.2. Artists and creators New Revenue Models

Blockchain creates innovative revenue generation approaches that are not limited to one point of sale, which provides lasting economic precarity in creative industries. With NFTs and smart contracts, artists have the ability to directly sell digital work and program in the royalty payments to be automatically generated as the work is purchased on the secondary market. This guarantees continued financial involvement since pieces of art are in circulation and they are gaining more and more value- something never seen in the traditional art markets.

Also, creators have the opportunity to test fractional ownership, limited editions, paid access, and token-gated content, and move income streams in more directions. Community-based models in which the collectors become patrons and promoters contribute to the sustainability even more. These processes make artistic practice a constant economic process, not the one time transaction, but congruent with the long-range value creation of the creative labor. Although market volatility is still an issue, blockchain-driven revenue models are providing artists with more control, visibility and strength in changing creative economies.

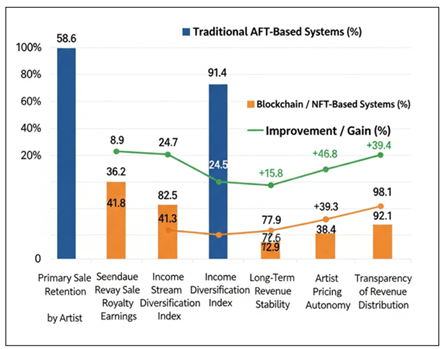

Table 2

|

Table 2 Numeric Analysis of New Blockchain-Based Revenue Models for Artists |

|||

|

Revenue Model / Metric |

Traditional Art Systems (%) |

Blockchain / NFT-Based

Systems (%) |

Improvement / Gain (%) |

|

Primary Sale Revenue

Retention by Artist |

58.6 |

91.4 |

+32.8 |

|

Secondary Sale Royalty

Earnings |

8.9 |

24.7 |

+15.8 |

|

Income Stream

Diversification Index |

36.2 |

82.5 |

+46.3 |

|

Long-Term Revenue Stability |

41.8 |

77.9 |

+36.1 |

|

Artist Pricing Autonomy |

49.3 |

88.6 |

+39.3 |

|

Transparency of Revenue

Distribution |

52.7 |

92.1 |

+39.4 |

Table 2 illustrates the important economic benefits brought about by revenue models powered by blockchains to artists. Artists earn a significantly larger percentage of primary sales and receive significant royalty fees in secondary markets, which have been long-term gaps in monetization, as compared to traditional systems. The income diversification and pricing freedom has increased dramatically, an indicator of increased creative and financial control. Increased transparency, revenue stability in the long term also demonstrate the fact that smart contracts and decentralized platforms help decrease the reliance on intermediaries. All of these benefits point to blockchain creating more resilient, equitable, and stable creative economies, even though there are still concerns involving market volatility and barriers to adoption.

Figure 4 juxtaposes both the traditional and blockchain-based revenue systems in the main economic indicators to artists. It shows that revenue retention, income diversification, pricing autonomy, and transparency can be seen to be significantly improved under NFT-enabled systems. The superimposed gain curve demonstrates that smart contracts and decentralized platforms contribute greatly to the financial stability in the long term and fair value distribution in creative economies.

Figure 4

Figure 4 Comparative Evaluation of Artist Revenue Models in Traditional

and Blockchain-Based Art Systems

5.3. Global Access, Inclusivity, and Democratization of Art Markets

Among the greatest effects of blockchain on creative economies, the spread of world access and inclusivity can be noted. The digital platforms eliminate geographical, institutional and socio-economic obstacles that have limited people to engage in art markets. Artists not in the privileged regions will be able to access global audiences without gallery representation or exhibition space. On the same note, collectors are able to learn about and purchase works of art in various cultural backgrounds with little resistance.

Pluralistic visual cultures are promoted through this democratization of the art world, and hierarchical structures in the art world are questioned. The transparent infrastructure of blockchain offers opportunities of visibility through merit instigated by the involvement of the community as opposed to elite accolade. Nonetheless, inclusivity cannot be expressed entirely without constraints, though technical literacy, platform charges, and exposure to computer technology infrastructure can remain an obstacle. Nonetheless, blockchain is also marked by tremendous expansion of participation and redistribution of opportunities, which have further led to more open, diverse, and globally connected creative economies.

6. Challenges and Critical Perspectives

6.1. Environmental and Energy-Consumption Concerns

The most popular issue related to the implementation of blockchain technology in the visual arts sector is its environmental impact, especially its energy consumption. Old blockchain networks overburdened consensus mechanisms that consumed a lot of energy prompting concerns on carbon emission and environmental sustainability. Creating and trading digital artworks, particularly when the practice was very active in the market, intensified the public attention to the practice, through its association of practices with the infrastructures that cause environmental harm. This association has created ethical dilemmas and opposition to artists and institutions that are socially and ecologically responsible.

In reaction, the blockchain industry has also been seeking more power-saving solutions, including proof-of-stake and layer-two solutions, which demand much fewer resources in terms of energy. In spite of these developments, the issue of the environment is still a very sensitive factor that affects societal perception, institutionalisation and sustainability. To fulfill the sustainability issue, technical innovation is not enough, but also open reporting, accountable platform management, and mindful involvement of artists and collectors in digital art ecosystem are needed.

6.2. Market Volatility, Speculation and Sustainability risks

NFTs have become so popular that their rapid growth has been coupled by extreme volatility and hype in the market, which has cast doubts on the economic sustainability. The prices of tokenized art works are usually very volatile as they are tied more to hype, the social media, and the short-term investment plans instead of being based on their artistic quality or cultural importance. This speculative culture may corrupt production values where resource is used to create work based on market tastes and not on long term artistic discovery.

This volatility is a source of risk to both artists and collectors since the market crashes may leave assets worthless and trust is broken quickly. Moreover, the excessive supply of works of low quality or derivatives will threaten to fill the market, reducing trust in NFT ecosystems. Speculative cycles can undermine the integrity and sustainability of blockchain-based art markets without their valuation structures and curation, in which they could be an effective creative economy in the future.

6.3. Legal, Regulatory and Ethical

The ownership of artwork is based on blockchain networks, which are decentralized and borderless networks, and which conflict with current legal and regulatory frameworks. Enforcement of intellectual property rights, consumer protection and taxation are made difficult by jurisdictional ambiguity. Not every participant understands what is legally different between possessing a digital token and having copyright, which makes the possibility of misunderstanding and conflict higher.

Morally, there is the issue of plagiarism, copyright in artistic work and unfair allocation of technological tools. Anonymity of blockchain can be misused, and uncertainty in the regulation will expose artists and collectors to financial and legal risks. To counter these issues, it is necessary to implement the coordinated actions of the policymakers, law scholars, platforms, and cultural institutions to create the ethical standards, clear governance, and flexible regulatory patterns that can facilitate innovation and safeguard the creative rights and trust of the population.

7. Hybrid and Emerging Art Ecosystems

7.1. Embodiment of the Physical and Digital Art Practices

Blockchain technologies are leading to the emergence of hybrid art ecosystems as a result of both physical and digital art practices. Innovative artists have begun to integrate physical art with a digital version, including NFTs which are a new representation of ownership, authenticity, or the foundation of an extended story connected to the real work. This intersection enables the physical artworks to be overlaid with digital gloss and could be in the form of interactive media, virtual exhibition or changing generative elements. Blockchain is the network linkage factor keeping both the physical presence and the digital verification in sync, which ensures provenance and ownership in both realms. This means that artists are able to increase creative expression more than material constraints and still maintain the cultural value of physical art. To collectors, hybrid practices offer a greater experience of participation as they allow participation in both the physical and digital exhibition space and consequently alter the production, experience and dissemination of art.

7.2. Institutional Adoption and Curatorial Transformations

Museums, galleries, and auction houses are just starting to implement blockchain technologies, which have brought about major changes in curatorial activities and their operations. Instead of acting as custodians of physical collections only, the institutions are trying digital acquisitions, blockchain-based registries, and NFT exhibitions. The curators are more involved with the issues of online authenticity, conservation, and self-service and extend the sphere of curatorial activity into the virtual and decentralized environment. Blockchain has additionally made it possible to have clear management of the collection, provenance, and responsibility of the donor, as institutional practices align to the digital trust models. Although questions of market speculation and technological complexity remain, institutional adoption is an indicator of an increasing validity of blockchain-based art and creates new forms of curation between traditional authority and decentralized cultural participation.

7.3. Future use of Blockchain in Cultural Heritage and Archives

Blockchain is likely to become a decisive factor in the saving of cultural background and digital libraries in the future. Long-term preservation and research into cultural artifacts can be supported by using immutable ledgers to record the provenance and provenance of cultural artifacts, and their provenance and restoration history. To digital heritage, blockchain offers continuity of access and authenticity in the swift change in technology. The community-based stewardship models could also be made possible with the help of tokenization models, in which cultural assets are not under the control of institutions but shared among the community members. But to capitalize on this potential, sustainable infrastructures, ethical governance and cooperation between technologists, cultural institutions and policymakers are needed to make sure that blockchain can be used in sustaining inclusive, responsible and sustainable cultural memory systems.

8. Conclusion

This paper has discussed how blockchain technology is changing the visual arts ecosystem, especially the ownership of digital art and NFTs, as well as creative economies. The analysis has shown that blockchain is a kind of provenance that can be verified, ownership that is decentralized and revenue models that are based on smart contracts that can solve longstanding issues of authenticity, transparency and fair compensation in digital art markets. NFTs become a disruptive technology that changes the definition of art and authorship, as well as allows new types of collector involvement and cultural engagement by communities. All of this points to the role of blockchain in more democratic, artist-focused and globally connected creative economies. Policy and practice wise, the paper also highlights the importance of the adaptive regulatory frameworks that can define intellectual property rights, consumer protection and taxation in the decentralized art markets. The use of sustainable blockchain infrastructure, ethical rulemaking, and advocacy of environmentally-friendly technologies should be embraced in cultural institutions and platforms to reduce ecological issues. It is recommended that practitioners consider introducing hybrid physical-digital models that are neither too innovative nor too culturally legitimate, and that encourage transparency and trust over the long term between artists, collectors, and institutions.

The research in the future must embrace interdisciplinary ways of research that incorporate the views of visual culture, economics, law, computer science and sustainability studies. There is a specific need in empirical study of long-term stability of the market, environmental effect, and community control. Moreover, the application of blockchain in cultural heritage and archives and participatory formula in ownership can be examined as the means of expanding the applicability of the technology even to non-commercial art markets. This research will be critical towards creating responsible, fair, and sustainable blockchain-driven visual art systems.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Aponte, F., Gutierrez, L., Pineda, M., Merino, I., Salazar, A., and Wightman, P. (2021). Cluster-Based Classification of Blockchain Consensus Algorithms. IEEE Latin America Transactions, 19, 688–696. https://doi.org/10.1109/TLA.2021.9448552

Brynjolfsson, E., and McAfee, A. (2014). The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies. W. W. Norton and Company.

Condon, F., Franco, P., Martínez, J. M., Eltamaly, A. M., Kim, Y. C., and Ahmed, M. A. (2023). EnergyAuction: Iot-Blockchain Architecture for Local Peer-To-Peer Energy Trading in a Microgrid. Sustainability, 15, 13203. https://doi.org/10.3390/su151713203

Huang, J., Lei, K., Du, M., Zhao, H., Liu, H., Liu, J., and Qi, Z. (2019). Survey on Blockchain Incentive Mechanism. In Data Science: 5th International Conference of Pioneering Computer Scientists, Engineers and Educators (ICPCSEE 2019) (386–395). Springer. https://doi.org/10.1007/978-981-15-0118-0_30

Illanes, P., Lund, S., Mourshed, M., Rutherford, S., and Tyreman, M. (2018). Retraining and Reskilling Workers in the Age of Automation. McKinsey Global Institute.

Li, X., Zheng, Z., and Dai, H. N. (2021). When Services Computing Meets Blockchain: Challenges and Opportunities. Journal of Parallel and Distributed Computing, 150, 1–14. https://doi.org/10.1016/j.jpdc.2020.12.003

Ochoa, I. S., de Mello, G., Silva, L. A., Gomes, A. J., Fernandes, A. M., and Leithardt, V. R. (2019). Fakechain: A Blockchain Architecture to Ensure Trust in Social Media Networks. In Proceedings of the International Conference on the Quality of Information and Communications Technology (QUATIC 2019) (105–118). Springer. https://doi.org/10.1007/978-3-030-29238-6_8

Pineda, M., Jabba, D., and Nieto-Bernal, W. (2024). Blockchain Architectures for the Digital Economy: Trends and Opportunities. Sustainability, 16, 442. https://doi.org/10.3390/su16010442

Ponder, N. (2024). Integrating NFTs into Feminist Art Practices: Actualizing the Disruptive Potential of Decentralized Technology. Arts, 13, 124. https://doi.org/10.3390/arts13040124

Porras,

E. R. (2023).

Intellectual Property and the Blockchain Sector: A World of Potential Economic

Growth and Conflict. IntechOpen.

Sidorova, E. (2025). NFTs, Blockchain, Cryptocurrency, Metaverse: The Web3 Revolution that has Transformed the Art Market. Arts, 14, 12. https://doi.org/10.3390/arts14010012

Sigley, G., and Powell, W. (2023). Governing the Digital Economy: An Exploration of Blockchains with Chinese Characteristics. Journal of Contemporary Asia, 53, 648–667. https://doi.org/10.1080/00472336.2022.2093774

Spyrou, O., Hurst, W., and Krampe, C. (2025). Minting the Future of Art: A Comprehensive Overview of Non-Fungible Tokens in the Art Metaverse. Arts and the Market, 15(2–3), 109–127. https://doi.org/10.1108/AAM-08-2024-0058

Tapscott, D., and Tapscott, A. (2016). Blockchain Revolution: How the Technology Behind Bitcoin is Changing Money, Business, and the World. Penguin Random House.

Viriyasitavat, W., Xu, L. D., Bi, Z., and Pungpapong, V. (2019). Blockchain and Internet of Things for Modern Business Process in Digital Economy—The State of the Art. IEEE Transactions on Computational Social Systems, 6, 1420–1432. https://doi.org/10.1109/TCSS.2019.2919325

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© ShodhKosh 2024. All Rights Reserved.