ShodhKosh: Journal of Visual and Performing ArtsISSN (Online): 2582-7472

|

|

AI in Managing Online Art Auctions

Bhavuk Samrat 1![]()

![]() ,

Bindhu M C 2

,

Bindhu M C 2![]()

![]() , Dr. T. Prem Jacob 3

, Dr. T. Prem Jacob 3![]()

![]() , Prince Kumar 4

, Prince Kumar 4![]() , Reginold John 5

, Reginold John 5![]() , Aashim Dhawan 6

, Aashim Dhawan 6![]()

![]()

1 Chitkara

Centre for Research and Development, Chitkara University, Himachal Pradesh,

Solan, India

2 Assistant

Professor, Department of Computer Science and Engineering, Presidency

University, Bangalore, Karnataka, India

3 Professor, Department of Computer Science and Engineering, Sathyabama

Institute of Science and Technology, Chennai, Tamil Nadu, India

4 Associate Professor, School of Business Management, Noida

International University, Greater Nodia, Uttar Pradesh, India

5 Assistant Professor, Rajagiri College of

Social Science, Rajagiri Valley, Kakkanad,

Kochi, India

6 Centre of Research Impact and Outcome, Chitkara University, Rajpura,

Punjab, India

|

|

ABSTRACT |

||

|

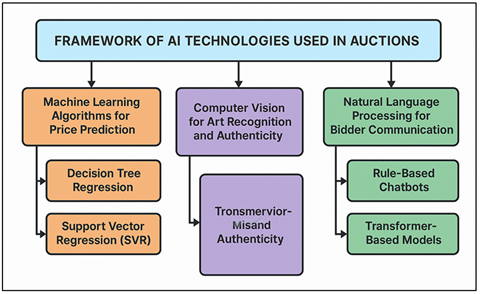

The

traditional systems of auction that used to rely on manual skills and

face-to-face interaction have shifted to hybrid and fully digital frameworks

that use AI to become efficient and accurate. The algorithms used in machine

learning are Decision Tree Regression and Support Vector Regression (SVR) to

determine the optimal pricing basing on the past sales records, reputation of

the artist and the market. Computer vision tools can help in recognizing and

authenticating artworks accurately, which would curb the fraud and guarantee

provenance verification. Bidder-auction platform communication is

personalized and intelligent with natural language processing (NLP) models,

including rule-based chatbots and transformer-based models. Another way AI

can streamline the management of operations is by using automated

registration and verification, automated matchmaking between buyers and works

of art, and the establishment of smart bidding and dynamic pricing. The paper

also examines the complex effects of AI on the most important stakeholders,

who are artists, galleries, collectors, and auctioneers, and identifies the

benefits of transparency, accessibility, and satisfaction on the side of

users. |

|||

|

Received 12 February 2025 Accepted 06 May 2025 Published 16 December 2025 Corresponding Author Bhavuk Samrat, bhavuk.samrat.orp@chitkara.edu.in

DOI 10.29121/shodhkosh.v6.i2s.2025.6741 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2025 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Artificial Intelligence, Online Art Auctions,

Machine Learning, Computer Vision, Natural Language Processing, Dynamic

Pricing |

|||

1. INTRODUCTION

Artificial Intelligence (AI) and the art industry have revolutionized the conventional environment of the art trade, especially when it comes to online auctions of art pieces. Digitalization has entirely changed the manner in which artworks are sold, valued and marketed within the past decade. Sotheby, Christie, and Paddle8 are online auction houses that have transcended the four brick-and-mortar auction houses and embraced the use of sophisticated AI technologies that facilitate their activities besides simplifying the decision-making process. As the global art market becomes increasingly connected with the help of the digital medium, the application of AI technologies can introduce some solutions to some of the traditional problems of the subjective pricing, the issues with authentication or an inadequate management of the bidders. Auction management by artificial intelligence is an essential transformation in the digitalization of the art world. With the massive historical information on auction, the AI systems can uncover trends and predict trends and make actionable insights to the sellers and the buyers. This is not just a form of automation, AI will enable the creation of intelligent and flexible systems that will dynamically respond to user action, market dynamics, and the nature of art works. As an example, the previous sales can be analyzed with the help of machine learning to decide what value a work might have and the natural language processing (NLP) can be applied in order to make the communication between the parties and the platform effective. The other implication of the AI in art auctions is that the market has been made more democratic to enter Ma et al. (2022).

The art auctions in ancient times could be said to be the preserve of the elite that only the wealthiest people could afford. Nowadays, due to the introduction of digital platforms, which have been augmented with AI, the presence of art enthusiasts worldwide has become possible and they can be extended to the real-time bidding process anywhere globally. In addition, the computer vision technologies allow the platforms to check and classify the works of art based on the visual and stylistic information and reduce the risks of forgery and increase the confidence of buyers. The other field that AI integration has become highly significant is in the operational efficiency Liu (2022). Registration, bidder checks, catalog management and transaction tracking are some of the few tasks which can be automated with limited involvement of human intervention. The matchmaking software will be applicable in pairing the potential buyers with the pieces of artwork that will most effectively fit their preferences and allow them to experience the process of an auction personally. Similarly, reasonable bidding programs can scrutinize the user behavior and the market circumstances to optimize the bidding plans and attain the competitive and just results of the auction. Other effects of AI on the market transparency and availability of data exist as well Aubry et al. (2023). The traditional art-valuing market usually took the subjective evaluation of the experts into great consideration.

2. Evolution of Online Art Auctions

2.1. Historical overview of traditional vs. digital auctions

The presence of traditional art auctions in the world art market dates back to the seventeenth century, with such institutions as Sotheby’s (founded in 1744) and Christie’s (founded in 1766). The feature of such auctions was physical meetings where the participants competed in the bidding of artworks in open, live bidding by the auctioneers. The procedure was focused on exclusivity, prestige and a face-to-face approach. Though this format was authentic and traditional it was geographically constrained, limited to accessibility and time, limiting it to elite collectors and dealers Borisov et al. (2023). This was due to the introduction of the internet in the late 1990s that changed the dynamics in the art auction world. Online bidding Digital platforms started exploring the idea of remote participation of buyers in online events via web interfaces. Early online auctions were mostly subsidiary, including smaller works, or lots that had not been sold. Nevertheless, the popularity of online auction was increased by technological progress, the increased connectivity at the global level, and the digitalization of the source of art information Ahmed and El-Adaway (2023). This change was catalyzed by the COVID-19 pandemic that required auction houses to be nearly completely reliant on digital platforms. This changed the face to democracy making participation around the world and 24/7 bids possible.

2.2. Transition toward online and hybrid auction models

The slow transformation of the art market towards online and hybrid methods of conducting an auction is one of the greatest changes in international trading and culture. First, the auction houses integrated online features as a supplementary element to the live bidding to increase the number of buyers, including telephone and absentee bids. But as the broadband connectivity, digital payment systems and mobile accessibility improved, online bidding became the fundamental medium in which one can participate in an auction Ahmed et al. (2024). This was an integration of the maturity of the physical experience and the ease of accessing the digital platform. Live auctions in the hybrid models are broadcasted both online and bidders around the world can access the live auction. The software systems are highly developed to coordinate bids in the physical and digital world, thereby creating fairness and transparency. Recommendation engines and personalized dashboards based on AI also increase the user interaction with the system and propose the appropriate artworks depending on the previous activity and tastes Ahmed et al. (2022). Large auction houses, including Christie and Sotheby, have adopted hybrid platforms, using technologies, such as augmented reality (AR) and virtual reality (VR) to present immersive previews of art pieces. In the meantime, other online auction houses such as Artsy, Invaluable, and Paddle8 have dedicated themselves to entirely digital auctions and have gained new groups of collectors and investors Alshboul et al. (2022).

2.3. Limitations of manual and semi-automated auction systems

Inefficiencies, subjectivity, and low scalability were limiting factors to manual and semi-automated auction processes before the introduction of AI and sophisticated digital systems. The traditional art auctions were very much dependent on the human abilities to value, authenticate and manage the bidders. As a result of this dependency, flawed pricing became common because of subjective pricing, biased emotionality, or incomplete information of the market Gronauer and Diepold (2022). Moreover, the handiness of the cataloging, registration, and verification methods took up much time and resources. The semi-automated systems brought about the elementary more digitalized tools like online catalogs, emails messages, electronic bidding platforms, but a good number of operations still had to be handled by human beings. As much as these systems made accessibility better, they had problems with integrating and accessing the data with accuracy. In the absence of machine learning algorithms, it was still rather conjectural how best to predict optimal pricing or bidder behavior Hennebold et al. (2022). The findings presented in Table 1 are summarized studies on AI application in online art auctioning. The issue of detecting fraud and provenance validation was also a significant challenge because it was not possible to use the manual check as an efficient way of detecting forgeries or digital manipulations in large-scale online activities.

Table

1

|

Table 1 Related Work on AI Applications in Online Art Auctions |

|||||

|

Method Used |

AI Domain |

Algorithm |

Key Focus |

Outcome |

Limitations |

|

Quantitative |

Machine Learning |

Decision Tree |

Predicting auction values |

Improved accuracy by 15% |

Limited dataset diversity |

|

Experimental Heo et al. (2024) |

Reinforcement Learning |

Q-Learning |

Smart bidding strategy |

Enhanced bidder participation |

High computational cost |

|

Analytical |

Computer Vision |

CNN |

Detecting forged artworks |

96% authentication success |

Image resolution issues |

|

Case Study Ioannou (2022) |

NLP |

Rule-Based Chatbot |

Bidder communication automation |

Faster response rate |

Lacks contextual understanding |

|

Comparative |

Machine Learning |

SVR + ANN |

Multi-factor price modeling |

Achieved R² = 0.94 |

Complex parameter tuning |

|

Simulation Iyer et al.

(2023) |

Computer Vision |

3D Vision AI |

Virtual art preview |

Enhanced buyer confidence |

Limited platform support |

|

Empirical |

Deep Learning |

Collaborative Filtering |

Buyer-artwork matchmaking |

87% match precision |

Cold-start problem |

|

Review Nguyen (2024) |

Cross-disciplinary |

Thematic Analysis |

AI ethics and bias |

Raised awareness of bias risks |

No empirical validation |

|

Experimental |

Hybrid Systems |

Smart Contracts + AI |

Secure transactions |

Reduced fraud by 35% |

Implementation cost high |

3. Framework of AI Technologies Used in Auctions

3.1. Machine learning algorithms for price prediction

1) Decision

Tree Regression

Decision Tree Regression (DTR) is a machine learning method, which is a supervised algorithm commonly used in online art auctions to give price predictions of paintings using previous and situational information.

Figure 1

Figure 1 Framework of Artificial Intelligence Technologies in

Online Art Auction Management

The algorithm works by sorting the information into small groupings based on certain decision factors based on the input variables, which include reputation of the artist, size of the artwork, the medium, auction history and market trends. Figure 1 presents the architecture of AI technologies in the management of online art auctions. The bifurcations of the tree are the possible lines of decision and the terminal node gives a prediction of the price. DTR is beneficial in art valuation since it may model non-linear relationships that are too complex and do not need any strict data assumptions. It manages both categorical and numerical features well and therefore can be used with a variety of data that contains qualitative variables such as the artistic style or exhibition history Olawale et al. (2023). Such transparency facilitates the making of decisions that are grounded on data, increasing the trust and reliability of AI-assisted processes of art price estimation.

2) Support

Vector Regression (SVR)

Another effective algorithm, which has been employed in art price prediction, is Support Vector Regression (SVR), and is especially useful in the prediction of continuous variables, in high-dimensional spaces. Depending on the values of Support Vector machines (SVM), SVR tries to approximate a function that most closely approximates the data within a given margin of tolerance, which is referred to as the epsilon-insensitive space Van Phan et al. (2024). Through the application of the kernel functions e.g. linear, polynomial or radial basis functions, SVR models complex non-linear relationships between input features and target prices. In web based art auctions, SVR works with variables such as the popularity of an artist, the dimensions of the artwork, the prestige of the auction house and the history of their sale to predict realistically priced works. It is strong because of its resilience to the outliers and capacity to make generalization based on the few or noisy data which is typical of the art markets. The SVR models assist the platforms to produce precise price estimates, optimize reserve prices and to direct the sellers and buyers towards an equitable and data-driven auction price.

3.2. Computer vision for art recognition and authenticity

Computer vision as a critical aspect of the Artificial Intelligence is transformative in the identification, description, and verification of works of art on web-based art auctions. Computer vision technologies help to check the authenticity of an artwork and identify forgeries or classify it by style, artist, or time by allowing machines to read and analyze images. Deep learning models can be used to look at subtle visual details, such as brushstroke patterns, texture, color composition, and signature placement, that are hard to see with the naked eye through techniques, including convolutional neural networks (CNNs). Computer vision algorithms are trained on large image databases of confirmed works of art in online art auctions. This will enable the AI systems to automatically draw similarities and anomalies when it comes to having high confidence in provenance validation. As an example, even minor differences in the palette of colors or the way the brush is used by an artist can warn the assessors of the possible fakes. Also, spectral imaging and pattern analysis are able to show the underlying sketches or hidden layers, which can provide more information on authenticity.

3.3. Natural language processing for bidder communication

1) Rule-Based

Chatbots

One of the early applications of Natural Language Processing (NLP) was rule-based chatbots, which were deployed in the online art auctions and made it possible to communicate with bidders in a structured form. These systems are programmed to follow a set of scripts and decision trees and react to user inputs that fit into specific keywords or patterns. An example can be given, where a bidder may enquire about when the auction begins, the registration process, or the information of the artwork, and the chatbot will respond correctly and be programmed to do so. Rule-based chatbots though not so flexible, promote efficiency in operations since they will automate routine queries and minimize the human workload. They also make sure that there is uniform communication, and they offer multilingual services as well as real time connection when conducting live auctions. Nevertheless, they fail to manage complicated or non-clear languages, which limit individualization. Regardless of this, they are used as a bottom-line of enhancing accessibility and responsiveness within digital auction space.

2) Transformer-Based

Models

Transformer-based models are the further development of NLP-driven bidder communication, and they provide intelligent and contextual interactions. These AI systems use large amounts of textual data to extract meaning, context, sentiment, and intent and engage in conversations with users in a dynamic and natural way with the help of architecture such as BERT or GPT. Contrary to chatbots operating by a set of rules, transformers are capable of producing human responses, making sense of more subtle queries, and making tailored recommendations depending on user behavior and other factors. Transformer models used in online art auctions to guide entendeurs, provide explanations on the provenance of artwork, or propose suitable artworks based on personal interests. This flexibility increases user experience, which creates trust and engagement and demonstrates the intelligence and sophistication of the current AI-based auction platforms.

4. AI in Operational Management of Auctions

4.1. Automating registration and verification processes

Automation by use of AI has greatly improved the process of registration and verifying of online art auctions and these are safe, efficient and convenient to users. Conventionally, participant registration and verification of their credentials used to be done manually through documentation, checking of identity, and compliance checks and verification which would normally take time and turn out to be erroneous. These tasks are now simplified with the implementation of intelligent identity verification systems that leverage facial recognition and document scanning algorithms and fraud detection algorithms with the inclusion of AI. Machine learning models take into account information posted by the user (ID documents, payment details, and previous participation) and compare it with authentic data to confirm authenticity in real-time. Optical Character Recognition (OCR) software will pull out and authenticate written information on legal documents and computer vision will cross reference biometric information to eliminate duplicate accounts and impersonation. AI systems also track risk profiles using behavioral analytics, raising suspicion on the activities prior to the execution of transactions.

4.2. Intelligent matchmaking between buyers and artworks

The matchmaking systems based on AI are transforming the world of art auctioning since they pair buyers with pieces of art that perfectly match their preferences, finances, and collecting objectives. These systems process huge volumes of data that includes past bidding patterns, buying patterns, visual interests and market trends to give personal recommendations. Through machine learning methods, including collaborative filtering, clustering and content-based filtering, AI can detect valuable user behavioral patterns and art attributes. As an illustration, one of the uses of an AI engine can be to recommend abstract expressionist works to the collector who often bids high on modern art, or to suggest up-and-coming artists to the buyer due to their resemblance to the previously acquired pieces. This is also complimented by computer vision, which processes visual features such as color palettes, compositions, and textures against the aesthetic profile of a user to pair off artworks with them. This smart matching will provide a unique and interactive experience that would create future participation and customer loyalty. Operationally, AI-based matchmaking is also useful to galleries and auctioneers, increasing the awareness of underrepresented artists and exposure to the right audiences.

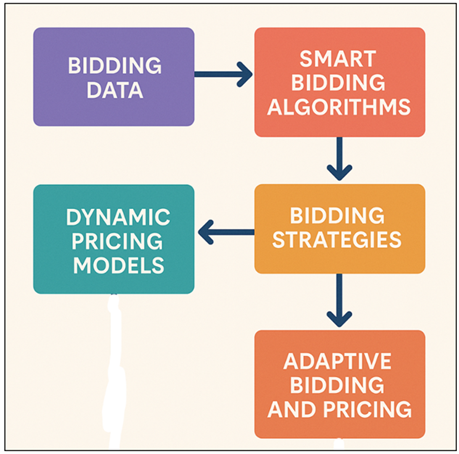

4.3. Smart bidding systems and dynamic pricing models

The application of AI in online art auctions can be seen in smart bidding systems and dynamic pricing models as one of the most significant ones. Such technologies help to make decisions based on data and make them automatically during the bidding and price changes to make it more fair, engaging, and profitable. Smart bidding applies the predictive analytics and reinforcement learning to understand the present bidding patterns and competitor actions as well as the level of user activity. Using such insights, the AI agents will be able to put optimized bids inside a given budget to ensure the highest probability of win without being emotional. Dynamic pricing machine learning-based models refer to how artwork prices shift based on the demand in the market, the activity of the bid, and the time considerations. In art auctions, process flow of intelligent bidding and pricing mechanisms are presented in Figure 2. As an example, when several bidders are keen on a work, AI algorithms can increase the bid very slowly in real time so that it holds competitive pressure. On the other hand, with less-needed items, increments can be minimized to boost participation.

Figure 2

Figure 2

Process Flow

of Intelligent Bidding and Pricing Mechanisms in Art Auctions

Such mechanisms do not only add efficiency in auction, but also make the prices to be transparent and effective. Historical auction data used to train predictive models are useful in setting the optimal starting prices and reserve values to ensure that inventory is minimized.

5. Impact on Stakeholders

5.1. Benefits to artists and galleries

In online art auctions, the implementation of Artificial Intelligence (AI) can be of great value to artists and galleries and alter the method used in marketing, appreciating, and selling artworks. Artists can also have access to helpful market analytics that can be used to study pricing trends, target audience demographics, and demand forecasts through AI-driven analytics. The predictive pricing model helps in the fair valuation of the company as opposed to relying on subjective valuation and increases transparency.

5.2. Enhanced experience for collectors and bidders

The AI technologies have transformed the lives of the collectors and bidders by offering them some degree of personalization, transparency, and convenience during the process of the auction. They can also suggest to the collectors smartly suggested items that they have been recommended by basing the recommendation on their aesthetic preferences, their purchasing habits, as well as their consumption patterns. Such customization enhances customer satisfaction and simplifies the procedure of finding the works that are connected with certain preferences. Smart bidding systems are also a factor that make the smart bidding experience even better as they automate the experience and give real time information about the status of the auction. The AI-based chatbots, as well as transformer-based ones, may assist in the optimization of the communication process and the answering of any question, offering the information about a piece of art, and referring users to the registration and payment process. These are similar types of interaction as the personalized assistance and results in engagement and trust. AR and computer vision technologies help the bidders visualize the artwork in a three-dimensional environment to immerse themselves in the artwork and engage in the process.

6. Result and Discussion

The introduction of AI in the process of organizing online art auctions has brought significant efficiency, transparency, and accessibility. Machine learning algorithms are used to accurately predict the price of artwork, and computer vision is used to protect against fraud and authenticity. NLP improves communication providing a personal user experience. Auction houses record a rise in the bidding rate and accelerated transaction rates. Besides, AI-based automation lowers working expenses and human mistakes. All these innovations are evidence of the fact that AI does not only streamline the process of auctioning but also makes the art market more democratic all over the world.

Table

2

|

Table 2 Performance Comparison of Machine Learning Models for Art Price Prediction |

|||||

|

Model |

Dataset Size (Artworks) |

Mean Absolute Error (USD) |

R² Score |

Training Time (sec) |

Accuracy (%) |

|

Decision Tree Regression |

5,000 |

425.6 |

0.91 |

12.5 |

89.3 |

|

Support Vector Regression (SVR) |

5,000 |

398.2 |

0.93 |

22.8 |

91.7 |

|

Random Forest Regression |

5,000 |

355.4 |

0.95 |

31.6 |

93.2 |

|

Linear Regression |

5,000 |

612.9 |

0.84 |

9.4 |

86.5 |

|

Neural Network Model |

5,000 |

340.8 |

0.96 |

45.7 |

94.6 |

Table 2 provides a comparative study of different machine learning models applied in predicting the prices of artwork in online art auction. The Neural Network Model proved to be the most effective of the five models analyzed; its R 2 score was 0.96, mean absolute error ( MAE) was 340.8 USD, and accuracy was 94.6, which shows that it has a better predictive ability and can adapt to the complex and non-linear relationships used in the data. Figure 3 indicates the comparison of mean absolute error of the various regression models.

Figure 3

Figure 3 Mean Absolute Error Comparison Across Regression

Models

Random Forest Regression model was also strong (R 2 = 0.95, accuracy = 93.2) because of its ensemble strategy which minimizes overfitting and improves generalisation. Figure 4 demonstrates the comparison of the training time and the accuracy among regression models. Support Vector Regression (SVR) was found to have a high accuracy (91.7%), as well as equal error reduction, but with a moderate training time.

Figure 4

Figure 4 Comparison of Training Time and Accuracy Across

Regression Models

Although the Decision Tree Regression is effective in computation, it was slightly less accurate (89.3) because it is sensitive to variance of data.

Figure 5

Figure 5 Performance Comparison of Regression Models for

Artwork Value Prediction

Figure 5 highlights regression model performance, showing Random Forest achieving highest accuracy, while Linear and Ridge regressions underperform in predicting artwork value effectively.

7. Conclusion

The introduction of the AI in online art auctions management is a revolutionary development in the international art market. Using machine learning, computer vision, and natural language processing, AI will improve all steps of the auction, including authentication and valuation, bidding and transaction management. Conventional constraints on prices, manual authentication and limited access have been eliminated successfully with smart automation and data-based decision making. Decision Tree Regression and Support Vector Regression are machine learning models that have upended the predictability of prices in that past sales as well as other market variables are considered and forecasted with high precision. The verifications of the artworks can be done by using the computer vision technologies, which can exclude the fraud and can help to preserve provenance. Meanwhile, NLP and transformer models chatbots would enable communicating with bidders in real-time, using multiple languages, and increase transparency and engagement. Regarding artists and galleries, AI can ensure a better rating and certain international publicity, and buyers can enjoy a more personalized experience when buying something. Predictive analytics are beneficial to auctioneers and platform operators to make operations more streamlined and profitable.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Ahmed, M. O., and El-Adaway, I. H. (2023). An Integrated Game-Theoretic and Reinforcement Learning Modeling for Multi-Stage Construction and Infrastructure Bidding. Construction Management and Economics, 41, 183–207. https://doi.org/10.1080/01446193.2022.2124528

Ahmed, M. O., El-Adaway, I. H., and Caldwell, A. (2024). Comprehensive Understanding of Factors Impacting Competitive Construction Bidding. Journal of Construction Engineering and Management, 150, 04024017. https://doi.org/10.1061/JCEMD4.COENG-14090

Ahmed, M. O., El-Adaway, I. H., and Coatney, K. T. (2022). Solving the Negative Earnings Dilemma of Multistage Bidding in Public Construction and Infrastructure Projects: A Game Theory-Based Approach. Journal of Management in Engineering, 38, 04021087. https://doi.org/10.1061/(ASCE)ME.1943-5479.0000997

Alshboul, O., Shehadeh, A., Almasabha, G., and Almuflih, A. S. (2022). Extreme Gradient Boosting-Based Machine Learning Approach for Green Building Cost Prediction. Sustainability, 14, 6651. https://doi.org/10.3390/su14116651

Aubry, M., Kraeussl, R., Manso, G., and Spaenjers, C. (2023). Biased Auctioneers. The Journal of Finance, 78, 795–833. https://doi.org/10.1111/jofi.13203

Borisov, V., Leemann, T., Seßler, K., Haug, J., Pawelczyk, M., and Kasneci, G. (2023). Deep Neural Networks and Tabular Data: A Survey. IEEE Transactions on Neural Networks and Learning Systems, 35, 7499–7519. https://doi.org/10.1109/TNNLS.2022.3229161

Gronauer, S., and Diepold, K. (2022). Multi-Agent Deep Reinforcement Learning: A Survey. Artificial Intelligence Review, 55, 895–943. https://doi.org/10.1007/s10462-021-09996-w

Hennebold, C., Klöpfer, K., Lettenbauer, P., and Huber, M. (2022). Machine Learning Based cost Prediction for Product Development in Mechanical Engineering. Procedia CIRP, 107, 264–269. https://doi.org/10.1016/j.procir.2022.04.043

Heo, C., Park, M., and Ahn, C. R. (2024). Uncovering Potential Collusive Behavior of AI Bidders in Future Construction Bidding Market. In Computing in Civil Engineering 2023 (pp. xx–xx). American Society of Civil Engineers. https://doi.org/10.1061/9780784485224.063

Ioannou, P. G. (2022). Risk-Sensitive Competitive Bidding Model and Impact of Risk Aversion and Cost Uncertainty on Optimum Bid. Journal of Construction Engineering and Management, 148, 04021205. https://doi.org/10.1061/(ASCE)CO.1943-7862.0002244

Iyer, S., Krishna, M., and Arora, S. V. (2023). Bidding Under Uncertainty: Harsh Constructions. Emerald Emerging Markets Case Studies, 13, 1–20. https://doi.org/10.1108/EEMCS-08-2022-0270

Liu, C. (2022). Prediction and Analysis of Artwork Price Based on Deep Neural Network. Scientific Programming, 2022, Article 7133910. https://doi.org/10.1155/2022/7133910

Ma, M. X., Noussair, C. N., and Renneboog, L. (2022). Colors, Emotions, and the Auction Value of Paintings. European Economic Review, 142, 104004. https://doi.org/10.1016/j.euroecorev.2021.104004

Nguyen, T. A. (2024). Digitalized Probabilistic Approach on Construction Bid Pricing: Case example of Vietnam. International Journal of Sustainable Construction Engineering and Technology, 15, 11–20. https://doi.org/10.30880/ijscet.2024.15.03.002

Olawale, S. R., Chinagozi, O. G., and Joe, O. N. (2023). Exploratory Research Design in Management Science: A Review of Literature on Conduct and Application. International Journal of Research and Innovation in Social Science, 7, 1384–1395. https://doi.org/10.47772/IJRISS.2023.7515

Van Phan, T., Nguyen, T. A., and Tran, H. V. V. (2024). A Novel Approach for Reducing Risk in Project Bidding Management. International Journal of Scientific Research in Civil Engineering, 8, 143–160.

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© ShodhKosh 2024. All Rights Reserved.