ShodhKosh: Journal of Visual and Performing ArtsISSN (Online): 2582-7472

|

|

The Role of Data Analytics in Contemporary Art Market

Saniya Khurana 1![]()

![]() ,

Sourav Rampal 2

,

Sourav Rampal 2![]()

![]() , Dr. Pastor R. Arguelles Jr 3

, Dr. Pastor R. Arguelles Jr 3![]() , S. Simonthomas 4

, S. Simonthomas 4![]()

![]() , Dr. Afroz Pasha 5

, Dr. Afroz Pasha 5![]()

![]() , Mona Devi 6

, Mona Devi 6![]()

![]()

1 Centre

of Research Impact and Outcome, Chitkara University, Rajpura, Punjab, India

2 Chitkara

Centre for Research and Development, Chitkara University, Himachal Pradesh,

Solan, India

3 Director, Research and Publication

Office, University of Batangas Lipa City, Philippines

4 Department of Computer Science and

Engineering Aarupadai Veedu Institute of Technology, Vinayaka Mission’s

Research Foundation (DU), Tamil Nadu, India

5 Assistant Professor, Department of

Computer Science and Engineering, Presidency University, Bangalore, Karnataka,

India

6 Assistant Professor, Department of Computer Science and Engineering (DS),

Noida Institute of Engineering and Technology, Greater Noida, Uttar Pradesh,

India

|

|

ABSTRACT |

||

|

Data analytics

implementation into the modern art market has changed the way the

stakeholders analyze, invest, and interact with art pieces. The art market,

traditionally opaque and subjectively valued, is currently adopting

data-driven approaches to increase transparency and efficacy, as well as,

decision-making. This essay examines the primary importance of the data

analytics in transforming the art ecosystem with an emphasis on its uses,

advantages, and difficulties. It starts with defining the key elements and

classes of analytics: descriptive, predictive, and prescriptive and the

technological tools used: artificial intelligence, big data platforms,

machine learning algorithms. The tools are then placed in the framework of

the art market and discussed on how they can solve the inefficiencies of

pricing, valuation, and demand forecasting. Case study examples show how

analytics can be used to identify the rising artists, identify the market

trends, and prevent fraud risks and manipulation. Alongside these benefits,

the paper also mentions such limitations as the lack of data, ethical

concerns, and algorithmic bias. Lastly, it also looks into the future

opportunities which include blockchain integration, value of digital art and

analytics of non-fungible tokens (NFTs). In general, this paper highlights

the fact that data analytics is not just democratizing the art investment,

but also reshaping cultural and economic value in the ever more digital

marketplace. |

|||

|

Received 15 February 2025 Accepted 09 May 2025 Published 16 December 2025 Corresponding Author Saniya

Khurana, saniya.khurana.orp@chitkara.edu.in

DOI 10.29121/shodhkosh.v6.i2s.2025.6735 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2025 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Data Analytics, Art Market, Big Data, Predictive

Modeling, Artificial Intelligence, Blockchain |

|||

1. INTRODUCTION

The art market has traditionally been viewed as a place that is fuelled by subjectivity, intuition, and exclusivity and not by empirical evidence. Assessments of artworks, judgments of purchases, and estimates of market movements have long been based on the experience and judgment of curators, critics and collectors, and this has frequently become an ecosystem characterized by opaqueness and speculation. Nevertheless, due to the swift technological development and the spread of digital data, this balance is changing radically. Initially restricted to the financial, business, and scientific studies, data analytics has become a potent instrument that can transform the mechanisms of the modern art market. Analytics offer more market behavior insights, artist performance, and investment potential than ever available before due to its systematic collection, processing, and interpretation of large amounts of data. Quantifiable information on the art world has been generated in large volumes by the globalization and digitalization of the art world. The result of online auctions, gallery databases, museum archives, and social media platforms creates the data that can be utilized to analyze the trends of art consumption and cultural impact. Examples of platforms that incorporate the use of data analytics in the process of tracking sales, predicting changes in value, and finding new trends include Artnet, Artprice, and MutualArt Giannakoulopoulos et al. (2022). These analysis tools help players, both as collectors and investors, and as institutions and policymakers to make evidence-based decisions and not base them on intuition or insider knowledge.

Consequently, data analytics is making art market information more democratic, making art markets accessible to even non-experts in an industry previously dominated by a small group of professionals. In addition, data analytics can be applied in a wider range. It helps comprehend sociocultural dynamics of art production and reception by measuring the number of people interested in the art, patterns of exhibitions, as well as reactions to it. Using descriptive analytics, the stakeholders will be able to evaluate the trend in history; using predictive analytics, they will be able to estimate the movement and price change in the future, and using prescriptive analytics, they will be able to receive recommendations on the best decision-making Pergantis et al. (2023). Figure 1 presents data analytics structure used in the current art market. This tendency to use data in practice brings the art market closer to other areas of the world economy that are based on evidence-driven models.

Figure 1

Figure 1 Framework of Data Analytics in the Contemporary Art

Market

Regardless of such efforts, the process of data analytics integration into the art market is not free of difficulties. Algorithms are difficult to be accurate because of the limited number of trustworthy and standardized data, as well as because of subjective aspects of valuing art. Moreover, privacy, ownership of digital data and algorithm bias raised some ethical issues on the issue of fairness and transparency Nicolaou et al. (2024). The fact that the art world is resistant to full transparency, and that in many cases, it is associated with the luxury products market and the need to keep clients information confidential, complicates the common use of data-driven models even further.

2. Understanding Data Analytics

2.1. Definition and key components of data analytics

The term data analytics is described as the methodical procedure of analyzing raw data to find useful patterns, trends, and insights that can be used to make knowledgeable decisions. Simply put, it converts unstructured or complicated data into actionable intelligence by use of statistical, computation and visualization tools. In the art market, data analytics fills the void between subjective aesthetic perception and objective market analysis to enable the stakeholders to quantify elements of artistic value, demand and performance. Data analytics involve the important stages of data collection, data cleaning, data processing, data analysis, and data interpretation. Data collection will entail the process of retrieving data through various sources including auction data, gallery databases, social media, and online art websites Jaillant (2022). Preprocessing and cleaning will ensure the data is accurate, consistent and do not contain duplication or error. Data are then analyzed using analytical methods, which can be statistical modeling-based methods or machine learning-based methods and subsequently presented visually and interpreted to make meaningful conclusions. These elements in the context of the art market make it easier to comprehend consumer preferences, reputation of the artist and the risk of investment. Data analytics can turn the art valuation into a data-powered task by measuring the past performance of art and identifying the new trends Burton and Toh (2023). As a result, it enables investors, curators and collectors to make evidence-based rational choices that redefine the traditional aspects of the art business that relies on intuition and exclusiveness.

2.2. Types of data analytics: descriptive, predictive, and prescriptive

There are three major types of data analytics, including descriptive, predictive, and prescriptive analytics which serve different roles in the interpretation and use of data insights. Descriptive analytics aim at making summaries and visualizations about past data with an aim of understanding what has been occurring over the years. It gives an idea of what has been auctioned out in the past, the frequency of sales, price movement, and popularity of artists in the art market. This baseline phase would help the stakeholders to understand the market dynamics and recognise the common trends or exceptions. Predictive analytics is another step further because it predicts future outcomes using statistical algorithms and machine learning Saah et al. (2023). In art market, it will be able to anticipate the possible value of a piece of art, forecast future demand of given artists, or determine market cycles. Predictive models can be based on huge amounts of data, such as the presence of social media, past sale prices, and exhibition history, to project new opportunities and threats. The most advanced form of analytics, prescriptive analytics, provides suggestions about what one should do to get some desired outcomes. It uses optimization algorithms and simulation methods to recommend pricing strategies, investment timing or portfolio diversification in art collections Dovey (2023).

2.3. Tools and technologies used in art market analytics

The successful use of data analytics in the art market depends on the value of a set of superior tools, technologies, and platforms that will support data processing, visualization, and predictive modeling. Of them, the use of data management systems like SQL databases and cloud-based repositories (e.g., Google BigQuery, Amazon Redshift) is a key part of the storage and organization of large art-related data, like auction outcomes and gallery holdings. Python, R, Tableau, Power BI, and other analytical and visualization tools are used to conduct statistical analysis and interactive dashboards that help users to understand market dynamics in real time Abdul-Jabbar and Farhan (2022). More advanced prediction is done by using machine learning tools such as TensorFlow and Scikit-learn to create predictive models that evaluate pricing dynamics and performance of artists. Besides, specialized art market databases like Artnet, Artprice and MutualArt may be used to provide overall analytics on price trends, artists rankings and activity among collectors, using historical sales data. New technologies such as artificial intelligence (AI) and natural language processing (NLP) improve the process of pattern recognition and sentiment analysis, whereas blockchain securities provenance verification and transparent transactions Hawkins (2022). In Table 1, the methodologies and technologies and contributions and recognized research gaps are summarized. All these combined technologies empower the analytical base of the art market and help it better value the art and become more transparent and accessible. With the development of data ecosystems, such tools keep transforming the manner in which art is analyzed, bought and valued in a digitally networked worldwide marketplace.

Table 1

|

Table 1 Summary of Related Work |

|||

|

Methodology / Approach |

Technologies Used |

Contributions |

Gaps Identified |

|

Market data analysis |

Artnet, Artprice |

Provided global market

insights using sales data |

Lacked predictive modeling |

|

Econometric analysis |

Regression models |

Demonstrated financial potential of art assets |

Limited dataset scope |

|

Quantitative analysis Doing et al. (2023) |

Hedonic pricing models |

Identified long-term art

return trends |

Ignored digital art

influence |

|

Predictive modeling |

Random Forest, SVM |

Improved price forecasting accuracy |

Required larger datasets |

|

AI data mining |

TensorFlow, Python |

Linked AI to valuation and

fraud detection |

Ethical data use concerns |

|

Comparative market study Xu (2022) |

Network analysis |

Mapped international gallery influence |

Minimal quantitative backing |

|

Case study |

Tableau, SQL |

Highlighted role of

analytics in pricing transparency |

Did not include blockchain

impact |

|

Mixed-method study Liang et al. (2021) |

Data visualization tools |

Emphasized art investment analytics |

Limited NFT consideration |

|

Deep learning |

Convolutional Neural

Networks |

Modeled creativity

recognition in visual art |

Subjectivity in

interpretation |

|

Technical analysis |

Ethereum, Smart Contracts |

Demonstrated use of blockchain for provenance |

Adoption challenges remain |

|

Quantitative data mining Philippopoulos et al. (2024) |

Blockchain analytics,

DappRadar |

Examined volatility and

investor behavior |

Market immaturity and hype |

|

Predictive analytics |

Time-series forecasting |

Identified cyclical price trends |

Ignored cultural variables |

|

Sentiment and social

analytics |

NLP, Twitter API |

Linked audience sentiment to

market performance |

Data noise and inconsistency |

|

Experimental modelling Schellnack-Kelly and Modiba

(2024) |

Reinforcement learning |

Enhanced risk mitigation strategies |

Limited real-world validation |

3. The Contemporary Art Market Landscape

3.1. Structure and stakeholders of the art market

The modern art market is a complex ecosystem, a set of interdependent actors that mutually influence the creation, distribution, and evaluation of art, as well as its consumption of art objects. By definition, the market is performed in terms of primary and secondary markets. The first sale of an income artwork is the main industry, and is usually aided by galleries, dealers, or artists themselves. The secondary market on the other hand includes the resales of the artworks by auction houses, single collectors and the art investment funds Rosen (2024). Artists, galleries and dealers, auction houses like Christie and Sotheby, collectors and investors are key players in the art industry because they define the price level, demand, and liquidity. Also, curators, art critics, museums, art fairs, and websites have significant influences in the visibility and culture value. This network has been widened by the emergence of digital platforms, encompassing data providers, analytics companies, and NFT markets since today they form a hybrid ecosystem that combines art, finance, and technology Wen and Ma (2024). Both cultural and economic capital are made through the contributions of each participant, albeit with different goals, which can be aesthetic appreciation and profit making.

3.2. Traditional methods of valuation and investment

The artworks have traditionally been based on subjective judgment and expert opinion as opposed to objective financial modeling to value them. Predominantly, aesthetic quality, provenance, historical importance and artist reputation have been used by art appraisers, curators and dealers as the most important determinants of value. Perceived value has been formed by factors like history of shows, critical praise and rarity, which has frequently been guided by the status of the circle of friends or gallery affiliation. Art has historically been a non-liquid and alternative asset, only available to wealthy collectors and institutions in terms of investment. It was based on connoisseurship and insider information in making investment decisions where there was little empirical information to aid in risk assessment and price forecasting Derda (2024). Though public, auction results tended to represent selective information not including the private sales and this was incomplete in the market analysis. The conventional method cultivated exclusivity and conjecture, and not much transparency in pricing processes. Art does not have the standardized valuation models, which are found in conventional assets like stocks or bonds and therefore, portfolio diversification and measurement of performance is not easily achieved.

3.3. Challenges in transparency and market inefficiency

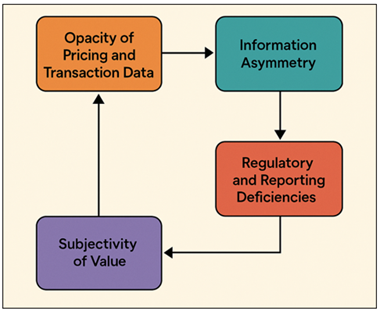

Although it is culturally prestigious and economically important, the art market can be considered to be one of the least transparent world businesses. One of these difficulties is the obscurity of the pricing and transaction data. Numerous transactions are made behind closed doors, and there is no information regarding the buyers, sellers and prices. Such a secret favours exclusivity and impedes proper valuation and healthy competition. Consequently, participants tend to use disjointed or anecdotal information which causes inefficiencies and manipulation. Figure 2 indicates the major difficulties of transparency and market inefficiency.

Figure 2

Figure 2 Key Challenges in Transparency and Market

Inefficiency within the Art Market

The other important problem is information asymmetry wherein a small number of insiders, dealers or auctioneers or elite collectors have privileged access to information about the market at the disadvantage of new entrants and small investors. This asymmetry continues to stimulate speculation, price inflation, and volatility, especially to the works of the present and the artists of tomorrow.

4. Application of Data Analytics in the Art Market

4.1. Pricing and valuation models using big data

Historically, intuition, professional judgement and market feeling have been used to value artworks, creating unequal or inaccessible prices. Nevertheless, the big data analytics have also brought a revolutionary method that combines large volumes of data to determine objective and data-driven valuation models. By combining records of auctions, gallery, and exhibition history and artist career trajectories the analytics systems have the potential to determine quantifiable influences on price, including size, medium, provenance, and market timing. Through the use of regression analysis, hedonic pricing models, and machine learning algorithms, analysts will be able to separate the statistical significance of these variables resulting in more precise and transparent pricing structures. Price indexes and the ability to forecast demand in genres, artists, and regions are the outputs of the models used in platforms such as Artprice, Artnet, and Art Market Research. Another way big data can be used is in real-time monitoring of the market where investors and collectors can use the information to make informed acquisition or divestment decisions. In addition, blockchain technology adds value to these models since provenance and transaction records can be verified, eliminating fraud and duplication.

4.2. Market trend analysis and predictive modelling

Current market trend analysis and predictive modeling has become a critical aspect of comprehending and forecasting changes in the modern art environment. By studying longitudinal data in the form of auctions, exhibitions, and selling of digital art, researchers can determine how buyer behavior, taste and investment trends change over time. These analyses are based on the time-series modeling, sentiment analysis, as well as clustering algorithms to identify the correlations between macroeconomic indicators, cultural events, and performance of the art market. In particular, predictive modeling applies machine learning algorithms, including decision trees, random forests and neural networks, to predict future demand and price patterns. Nevertheless, predictive systems may evaluate possible appreciation in the market value of an artist by examining such variables as the frequency of artist exhibitions, critical reception, and social media activity. To give an example, surges in online search or mentions may indicate the growing popularity far before that is reflected in sales data. Moreover, predictive analytics allows optimizing a portfolio of collectors and investors by proposing which pieces of art or artists will produce the most significant profit over certain time. This can improve the process of making decisions, not to mention that the speculative buying risks will be reduced.

4.3. Tracking artist performance and artwork demand

Monitoring artist activity and the demand of artworks is one of the most critical uses of data analysis, which allows galleries, collectors, and investors to objectively evaluate artistic career. By using the systematic gathering of data on the outcomes of the auction, gallery representation, museum acquisition, and media exposure, analytics websites build the full profiles that indicate the presence of an artist in the market and their potential to grow. The measures of performance can be comprised of variables like average prices of sales, frequency of exhibitions, critical coverage, social media exposure, and involvement of collectors. These indicators are processed with advanced analytics algorithms to produce artist rankings, momentum scores, and demand indices to create a real-time picture of the reputation change of an artist. The patterns in the correlation between artistic output and market response can also be identified by the machine learning algorithms and are predictable in terms of which artists will be likely to enjoy a price increase in the future. This assists investors recognize upcoming talents prior to their business breakthrough, giving possibilities to pre-acquisition and diversification in their portfolio.

5. Benefits of Data Analytics for Art Market Participants

5.1. Enhanced transparency and informed decision-making

The increase of transparency and well-informed decision-making is one of the greatest additions of the contemporary art market that data analytics made. Traditionally, the art market has been blamed due to its lack of transparency with regards to the price information, provenance and identity of the buyers usually being secreted. The solution to this problem is data analytics in which it consolidates and evaluates enormous datasets of auctions, galleries, and online platforms, hence democratizing market intelligence vitality. The collectors, dealers and investors are now able to monitor real time market trends, price histories and performance metrics across the artists and artworks through data visualization and analytical dashboards. This openness enables the stakeholders to make well informed decisions and not necessarily rely on gut feeling or insider knowledge. In addition, it enhances accountability and trust, which minimizes misinformation or speculative pricing. Better transparency is also an added advantage to institutions and regulators because data analytics help to verify provenance and authenticity by integrating blockchains and digital records. Analytics increases the credibility of the marketplace ecosystem through the provision of empirical data and standardized reporting.

5.2. Identification of emerging artists and investment opportunities

Data analytics has transformed the way the stakeholders can recognize an emerging artist and opportunities that could be valuable to invest in the art industry. Historically, the process of identifying new talent was based on heavily on the decision-making of the curators, critics, and dealers with exclusive connections. Nowadays, analytics processes combine the information on exhibitions, auction history, social media, and online sales to discern the trends of growth and interest that indicate artistic potential. Data models can evaluate early signs including mentions that increase in media, gallery representation or expansion of the digital audience by using machine learning and sentiment analysis. Figure 3 depicts the process of determining new artists and investment opportunities. These numerical understandings allow collectors and investors to identify underrepresented or undervalued artists prior to their market worth soaring so that they can have strategic points of investment.

Figure 3

Figure 3 Process of Identifying Emerging Artists and Art

Investment Opportunities

Moreover, predictive analytics is able to assess the potential of performance over the long term by comparing the performance of the artist to the historic market performance and macroeconomic trends. These tools can also be used by galleries and institutions to organize exhibitions to represent an emerging movement and enhance cultural and financial relevance. This information-driven methodology makes the discovery of arts more democratic, and more people can be involved in discovering talent outside of the elite. It is the balance of intuition and facts and enhances inclusivity and innovativeness. Measurement of creative power and market traction transforms the identification of creative artists into an ordered and strategic undertaking through data analytics - fusing the artistic value with investment value forecasting.

5.3. Reduction of risk and price manipulation

Price manipulation, forgery, and speculative risk have always been common in the art market where there is no regulation and transparency. Data analytics helps to address these challenges through the introduction of mechanisms that enhance verification, consistency as well as accountability. Analytics can identify artificial inflation or collusion, however, through complex tracking programs, and algorithm-based modeling, abnormal pricing trends or suspicious transactions can be recognized. The data systems can identify discrepancies between the estimated and actual prices by comparing large volumes of data across various sales platforms to identify the presence of manipulations or fraud. Furthermore, blockchain technology maximizes provenance, as it offers unalterable digital ownership of information, minimizes forgery and generates open transaction history. In the case of investors, analytics-driven risk evaluation instruments are used to determine the volatility, liquidity and diversification prospects of art portfolios. Predictive models are represented in the form of simulating the market situation and enable stakeholders to predict the recessions and maximize the allocation of assets. This piece of evidence-based vision makes the speculative environment less uncertain.

6. Challenges and Limitations

6.1. Data availability and accuracy issues

The limited availability and the questionable accuracy of data is one of the major problems of implementing data analytics in the art market. The art market is characterised by relatively unregulated private dealings, unlike financial markets, which are regulated by uniform reporting and regulatory controls, and where there is minimal disclosure of prices, purchasers and sellers. The result of this intransparency is that datasets are broken and incomplete, and it is hard to analyze them comprehensively. In addition, the records of auction, which is usually the major source of art information available to the public, is only part of the overall sales of art, not considering the sales conducted through the individual galleries and those conducted directly with the artists. Consequently, the datasets applied in modeling might be inadequate to encompass the entire market activity. Also, variation in data accuracy through inconsistent catalogue entries, lack of provenance records and use of varied currency also complicate data accuracy. Digital platforms and social media have increased the sources of data, which, however, have weaknesses in reliability, including fake accounts, distorted levels of engagement, or unverified facts. Normalization and data cleaning processes are trying to eliminate these imperfections, but the input or interpretation may always be faulty to skew the results of analysis.

6.2. Ethical considerations and privacy concerns

With the growing adoption of data analytics in the art industry, the problem of ethical and privacy has become a major challenge. Cammers and processing of sensitive data including the financial account of those who collect, personal data of artists, and confidential sale information, are posing a question of consent, ownership, and security. The art market is transacted privately and the participants usually desire secrecy. Nevertheless, art information is going to be digitized, which presents a risk of unauthorized access, surveillance and information misuse. Ethical issues are also raised by analytics platforms, which collect data by aggregating information on online sources and social media, in terms of data scraping and intellectual property rights. Artists, in turn, can be analyzed or monetized without their express consent, and the distinction between their exposure and privacy is not clearly distinguished. In addition, artificial intelligence in valuation and trend forecasting also contests the issue of accountability and transparency in algorithmic decision-making. In circumstances when the proprietary models are used to decide the market, the inexplainability may generate suspicion and continue to provide unfair benefits to the data owners. The art market would therefore need transparency in data conception, anonymity and transparency of algorithms.

6.3. Potential bias in algorithmic valuation

Although it brings objectivity and accuracy, data analytics is not free of algorithmic bias, which is a critical drawback in the process of art valuation. Algorithms rely on the data that the algorithm is trained on and when datasets bias or mirror historical inequalities or biases, the models that are generated may unconsciously reproduce them. To give an example, when using historical auctions data which is biased in favor of Western male artists, predictive models can be biased against women, minority or emergent artists, further strengthening the existing market inequities. Furthermore, the variables to be used and weightings, including critical reviews, repeatedly exhibited, or media coverage, may contain some human bias in model design. The cultural and aesthetical aspects of art that are usually immeasurable, are especially susceptible to reductionist interpretation when algorithmically processed. The second issue is that proprietary algorithms of large art analytics companies are not transparent. The users cannot ensure the way in which the valuations are created or the biases that can affect them because the methodologies are not publically disclosed. Such a veil poses the threat of diminishing the trust in the data-driven decision-making.

7. Future Prospects and Innovations

7.1. Integration of AI, machine learning, and blockchain

The use of artificial intelligence (AI), machine learning (ML) and blockchain technologies signifies a breakthrough in the development of the art market. All these innovations contribute to the increased transparency levels, automation of the valuation, as well as increased verification of authenticity. An enormous amount of auction, social media, and art institution data can be analyzed by AI and ML algorithms and patterns identified, price fluctuations anticipated, artistic tendencies evaluated more accurately than ever before. Machine learning, specifically, provides adaptive architecture, which personalizes valuation models as time progresses considering changes in taste and cultural relevance. Blockchain technology is an addition to these advancements that provide irrevocable histories of ownership, provenance, and history of transactions. Every piece of art (physical or digital) can be tokenized and traced on decentralized registers, minimizing cases of fraud and providing a verifiable authenticity. Smart contracts also facilitate art transactions through automation of payments, royalties and copyright management making them effective and more trustworthy among market members. Combined, these technologies create a data-based ecosystem that combines creative and financial spheres. Besides enhancing the transparency of operations, they also make the art investment more democratic, making it possible to have fractional ownership and safe digital transactions.

7.2. Evolution of digital art and NFTs analytics

Digital art and non-fungible tokens (NFTs) have changed the art market paradigms and presented a whole new way of creating, owning, and valuing art. In comparison to classic works of art, NFTs are stored on blockchain networks, and each artwork is given a distinct digital signature, which authenticates it and provenance. Data analytics is essential to this new area as it will cover the market trends, transactions, and investor moods on NFT platforms.

Figure 4

Figure 4 Evolution of Digital Art and NFT Analytics Framework

By providing real-time data aggregation, analysts are able to discover price movements, collector base data, and platform health, providing insight into new genres and market trends. Figure 4 displays the development of digital art and analytics framework of NFT. Predictive analytics evaluates sustainability of the long-run value by comparing the engagement measures, which are trading volume, social media mentions, and artist collaboration frequency, with market appreciation. In addition, NFT analytics platforms, such as NonFungible.com and DappRadar, provide the opportunity to create transparency in trading operations and evaluate risk and authenticity by the collector. Machine learning models are also used to differentiate true value creation and hypothetical hype as they allow identifying anomalies in trading patterns. With the digital art market still in its maturity stage, data analytics will be a necessary tool to help confirm the credibility, optimize portfolio management, and improve regulatory oversight. Integrity of blockchains and analytical intelligence are colliding to guarantee that the development of NFTs is not just a technological advancement but also a data-driven phenomenon, a more responsible and analytical digital art system.

8. Conclusion

Data analytics as an infiltration into the modern art market is a significant change in the paradigm of decision-making that relies on intuition to a more transpire-based, open, and data-driven approach. The art industry, which used to be controlled by subjectivity, exclusivity, and clouded practices of valuation, has become more dependent on quantitative methodologies to explain complex market trends and forecast future trends. Using big data, artificial intelligence, and machine learning, stakeholders have a higher degree of precision and confidence when it comes to assessing works of art, artists, and investments. Data analytics not only improves the precision of pricing and the transparency of the market, but it also has the democratization of information access, allowing a greater number of participants, such as collectors, investors, curators, and policymakers, to participate in the art economy in a valuable way. The capacity to trace the artist performance, follow the demand and predict the trends has changed how art is appreciated and exchanged and the disconnect between art creation and commercialization. Moreover, other innovations, including blockchain and NFT analytics, have applied those to the online market to guarantee authenticity, provenance, and secure ownership in online markets. Nevertheless, the issues remain, such as the lack of information, privacy, and bias in the algorithm, which requires further ethical and regulatory control. There is always a need to balance the technological progress with the sensitivity to the culture to ensure that art as a financial asset and as a human expression is not being compromised.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Abdul-Jabbar, S. S., and Farhan, A. K. (2022). Data Analytics and Techniques: A Review. ARO – The Scientific Journal of Koya University, 10, 45–55. https://doi.org/10.14500/aro.10975

Burton, O., and Toh, D. J. (2023). Digital Dominance and Social Media Platforms: Are Competition Authorities up to the Task? International Review of Intellectual Property and Competition Law, 54, 527–572. https://doi.org/10.1007/s40319-023-01302-1

Derda, I. (2024). Museum Exhibition Co-Creation in the Age of Data: Emerging Design Strategy for Enhanced Visitor Engagement. Convergence, 30, 1596–1609. https://doi.org/10.1177/13548565231174597

Donig, S., Eckl, M., Gassner, S., and Rehbein, M. (2023). Web Archive Analytics: Blind Spots and Silences in Distant Readings of the Archived Web. Digital Scholarship in the Humanities, 38, 1033–1048. https://doi.org/10.1093/llc/fqad014

Dovey, L. (2023). Intermediality in Academia: Creative Research Through Film. Arts, 12(4), 169. https://doi.org/10.3390/arts12040169

Giannakoulopoulos, A., Pergantis, M., Konstantinou, N., Kouretsis, A., Lamprogeorgos, A., and Varlamis, I. (2022). Estimation on the Importance of Semantic Web Integration for Art and Culture Related Online Media Outlets. Future Internet, 14(2), 36. https://doi.org/10.3390/fi14020036

Hawkins, A. (2022). Archives Linked Data and the Digital Humanities: Increasing Access to Digitised and Born-Digital Archives Via the Semantic Web. Archival Science, 22, 319–344. https://doi.org/10.1007/s10502-021-09381-0

Jaillant, L. (2022). How Can we Make Born-Digital and Digitised Archives More Accessible? Identifying Obstacles and Solutions. Archival Science, 22, 417–436. https://doi.org/10.1007/s10502-022-09390-7

Liang, S., McCarthy, P., and Van Stry, M. (2021). DATA: Digital Archiving and Transformed Analytics. Intelligent Information Management, 13, 70. https://doi.org/10.4236/iim.2021.131004

Nicolaou, C., Matsiola, M., Dimoulas, C. A., and Kalliris, G. (2024). Discovering the Radio and Music Preferences of Generation Z: An Empirical Greek Case from and Through the Internet. Journal of Media, 5, 814–845. https://doi.org/10.3390/journalmedia5030053

Pergantis, M., Varlamis, I., Kanellopoulos, N. G., and Giannakoulopoulos, A. (2023). Searching Online for Art and Culture: User Behavior Analysis. Future Internet, 15(6), 211. https://doi.org/10.3390/fi15060211

Philippopoulos, P. I., Drivas, I. C., Tselikas, N. D., Koutrakis, K. N., Melidi, E., and Kouis, D. (2024). A Holistic Approach for Enhancing Museum Performance and Visitor Experience. Sensors, 24(3), 966. https://doi.org/10.3390/s24030966

Rosen, I. (2024). Advanced Visitor Profiling for Personalized Museum Experiences Using Telemetry-Driven Smart Badges. Electronics, 13(20), 3977. https://doi.org/10.3390/electronics13203977

Saah, R., Abban, S., and White, E. (2023). Use of Social Media in Public Archives: Perspectives about Ghana’s Readiness and Perceived Challenges. Journal of Contemporary Archival Studies, 10, Article 20.

Schellnack-Kelly, I., and Modiba, M. (2024). Developing Smart Archives in Society 5.0: Leveraging Artificial Intelligence for Managing Audiovisual Archives in Africa. Information Development. https://doi.org/10.25159/UnisaRxiv/000072.v1

Wen, J., and Ma, B. (2024). Enhancing Museum Experience Through Deep Learning and Multimedia Technology. Heliyon, 10, e32706. https://doi.org/10.1016/j.heliyon.2024.e32706

Xu, D. (2022). An Analysis of Archive Digitization in the Context of Big Data. Mobile Information Systems, 2022, Article 1517824. https://doi.org/10.1155/2022/1517824

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© ShodhKosh 2024. All Rights Reserved.